⚡️The Skeleton in Crypto's Closet

Who really controls crypto? Plus tokenization wars, why we're still all-in DeFi & BNB's onchain airdrop

Read Time: ~5 minutes

⚡In This Edition

four.meme activity & BNB Chain’s attempt to keep the party going

150% APY LP farm on Base

⚡Metrics Snapshot

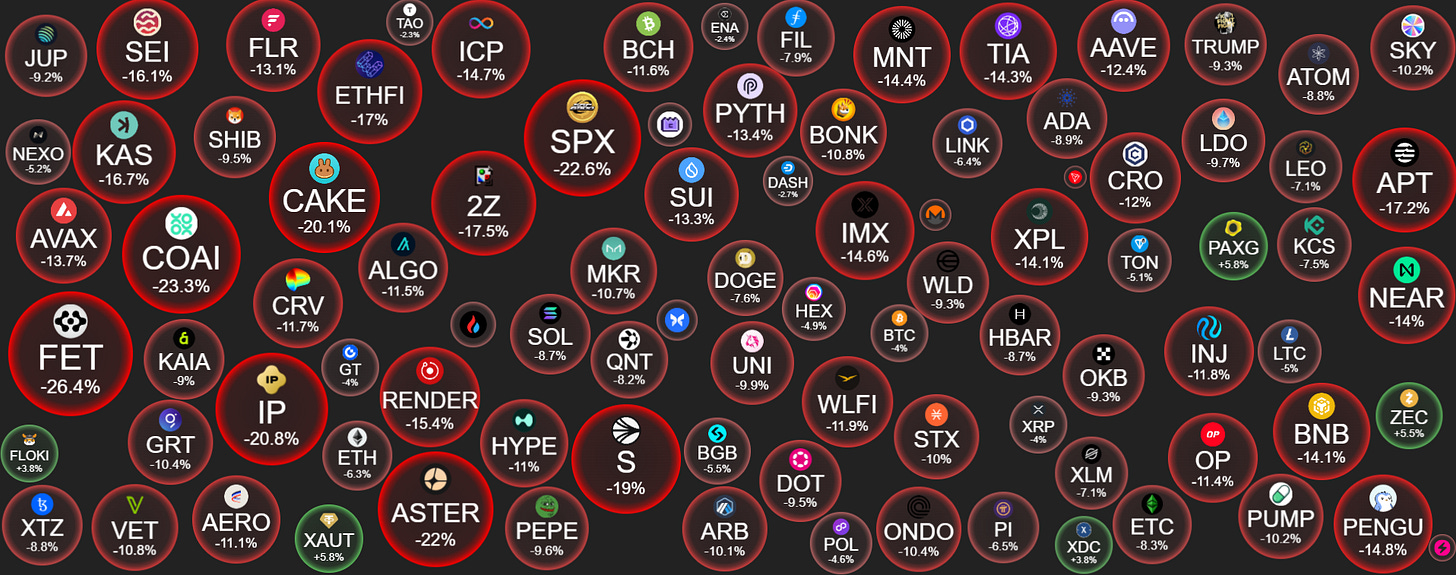

Top 100 Coins at a Glance (7d)

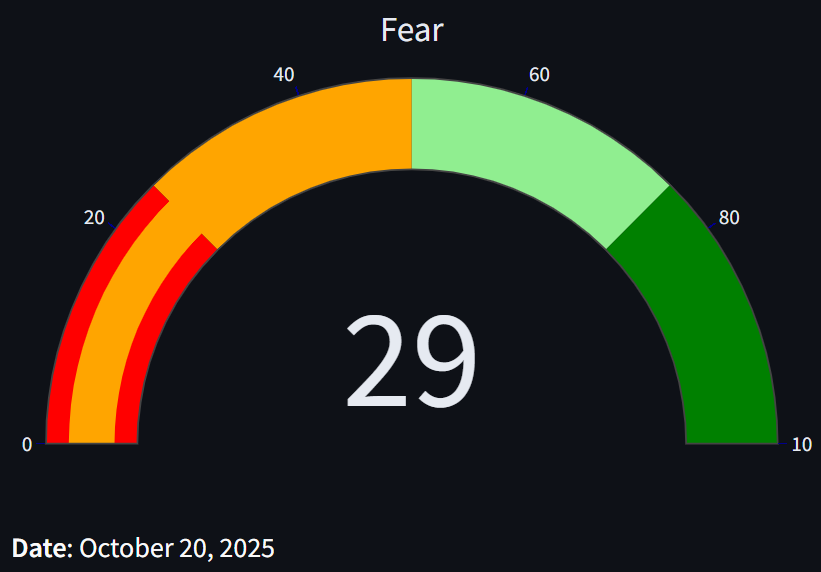

Fear & Greed Index: 29 (Fear)

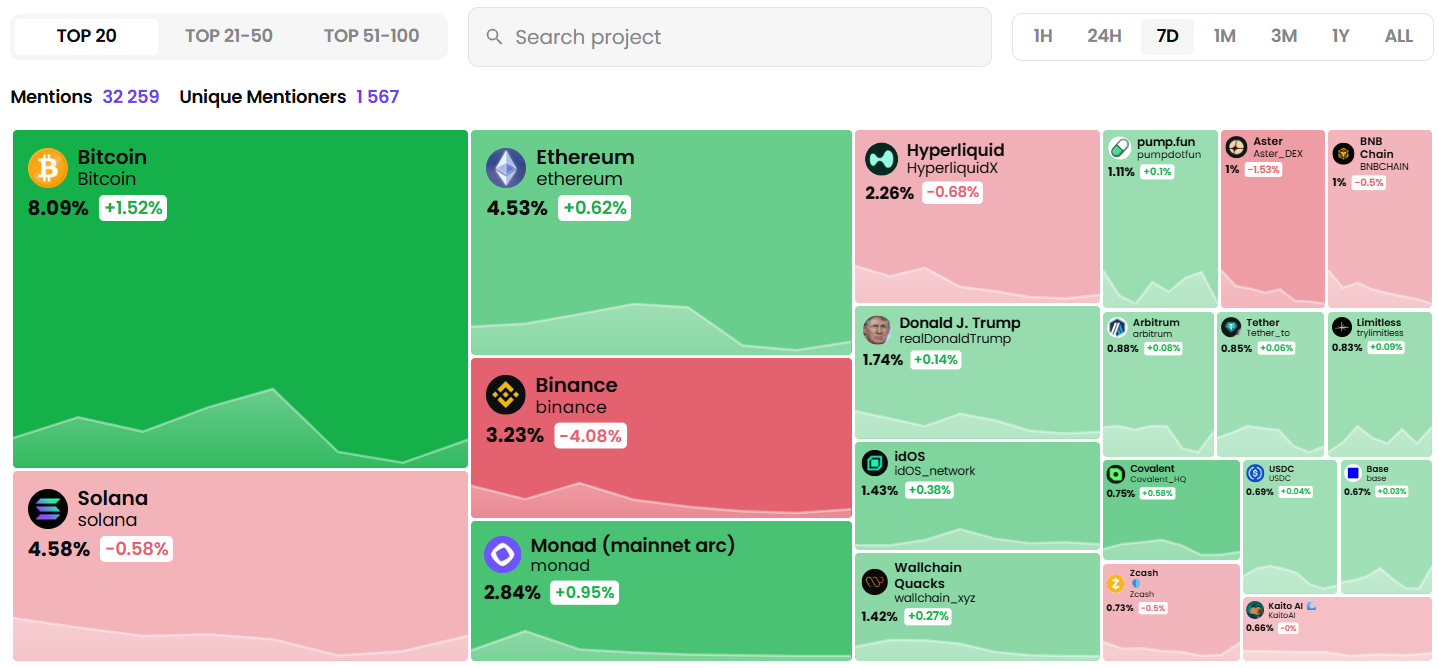

Project Mindshare (7d)

Historical Bitcoin Performance This Week (Week 43)

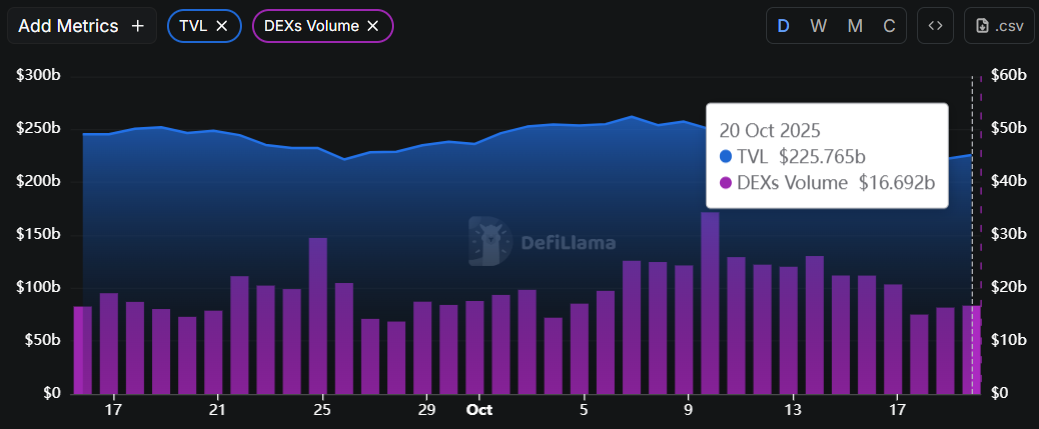

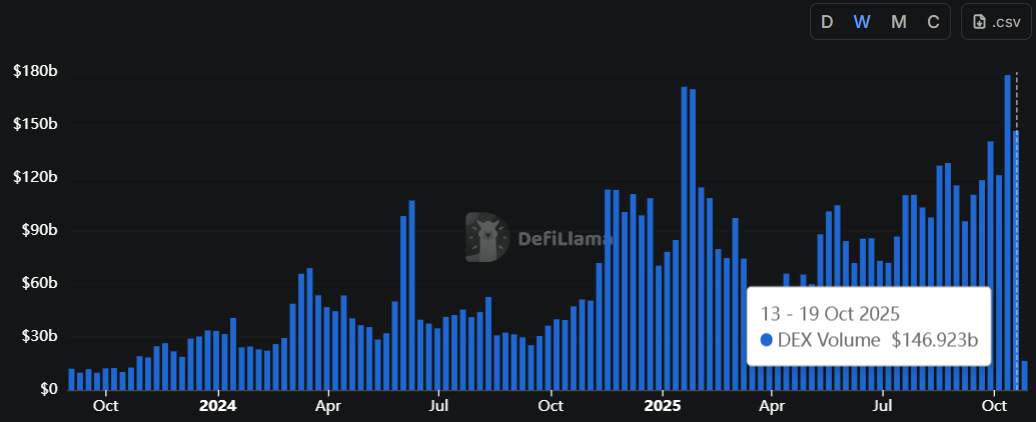

DeFi Market Metrics: Global TVL & DEX Volume

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. AWS Outage Crashes Base, Coinbase, and More

Amazon Web Services went down Monday morning, breaking transaction capacity on Base (only for about an hour) and caused outages across Coinbase, Robinhood, Infura, and several other services.

Even stablecoin bridging and RPC endpoints were hit, grinding parts of crypto to a halt.

What This Means

The industry still leans heavily on centralized web2 infrastructure. Until decentralized infra becomes standard, outages like this will continue to reveal what’s really running things are under the hood.

2. Ondo Finance Challenges Nasdaq’s Tokenization Plans

Ondo Finance published an open letter urging the SEC to delay Nasdaq’s tokenized securities rollout. Their concern is a lack of transparency from Nasdaq’s Depository Trust Company (DTC), which could give incumbents an unfair edge.

Others argue that delaying could halt tokenization progress altogether.

What This Means

This is the first real public disagreement over how tokenization happens in the US. The outcome may define whether onchain finance mirrors Wall Street or truly decentralizes it.

3. Stripe-Backed Tempo Raises $500 Million for Payments Blockchain

Stripe and Paradigm’s new blockchain, Tempo, raised $500 million at a $5 billion valuation Series A round.

The project is focused on stablecoin payments and has recruited Ethereum researcher Dankrad Feist to help build it.

What This Means

Tempo is already shaping up to be a major contender in the stablecoin infrastructure wars. With big backers and OG crypto talent, it’s another reminder that the future of payments is being rebuilt from the ground up.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

We’ve crossed the chasm

⚡Dynamo DeFi framework for picking investments

Current holdings & the goal of investments

ICO launches & a mechanism to save DAOs

Re-evaluating Hyperliquid from the ground up

⚡The Healthy Competition Between Kalshi & Polymarket

Markets don’t just price assets, they price truth

⚡What Happens to the Crypto Market Next?

What happened during the 10/10 crash & what does it mean moving forward?

Who are the privacy coin leaders and what are their strengths?

What are Ownership Coins and why are MetaDAO ICOs doing so well?

Patrick covered all of this and more in the latest Pro Live Stream.

Get the full recording and research slides right here.

Pro Members received the research slides and can watch the full presentation anytime

🔢Onchain Analysis

Four.meme Activity Surges

We mentioned in last week’s newsletter that we were watching volume trends after an explosive week of DEX volume to see if the trend would sustain itself.

For now, it has. DEX volume had another very strong week last week. A good sign.

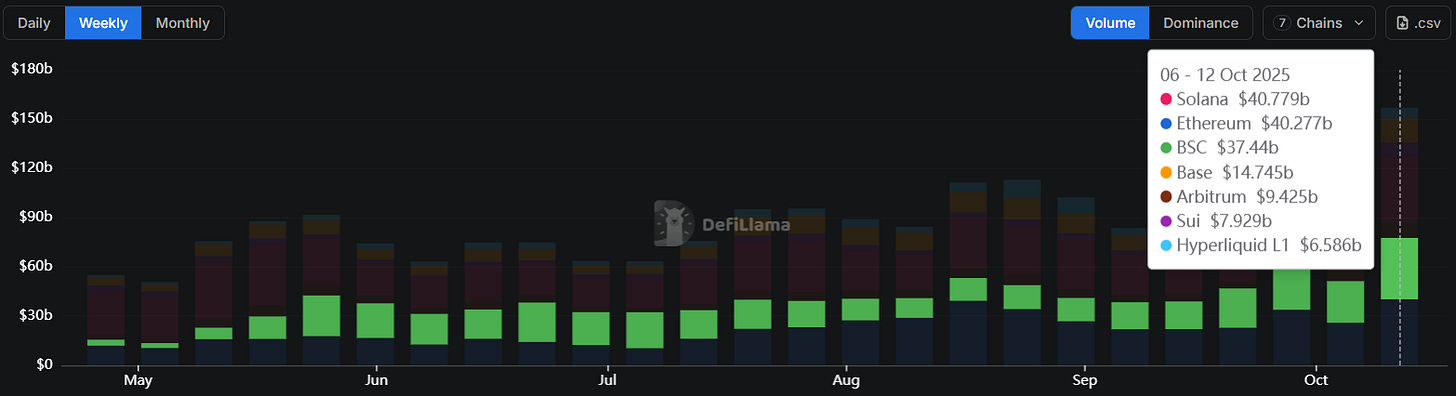

This time last year, BNB Chain was only transacting a fraction of total DEX volume.

Over the past several months, Ethereum, Solana & BNB Chain have facilitated near equal amounts of volume.

BNB Chain experienced a meme season recently, and four.meme was at the epicenter.

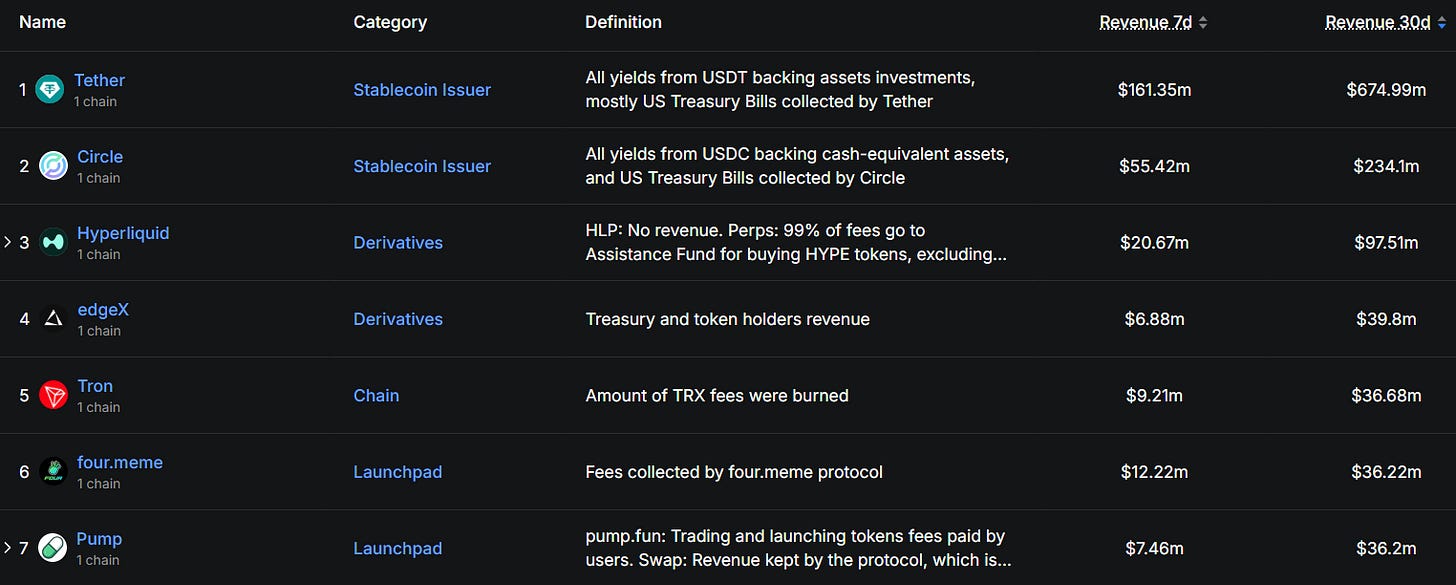

Four.meme is a memecoin launchpad platform only on BNB Chain. The platform saw $3.5b in 30d volume and is ranked 6th in 30d revenue.

Last week the meme season began to lose steam and BNB Chain & Four.meme teamed up to launch a $45m Reload airdrop directly to 160k+ BNB Chain wallets.

It’s a valiant effort, but it remains to be seen if the initiative will have the desired onchain wealth effect to keep the party going.

While four.meme volume has fallen from its peak, it’s still 7-10x higher than it was a month ago.

🚜Farm of the Week

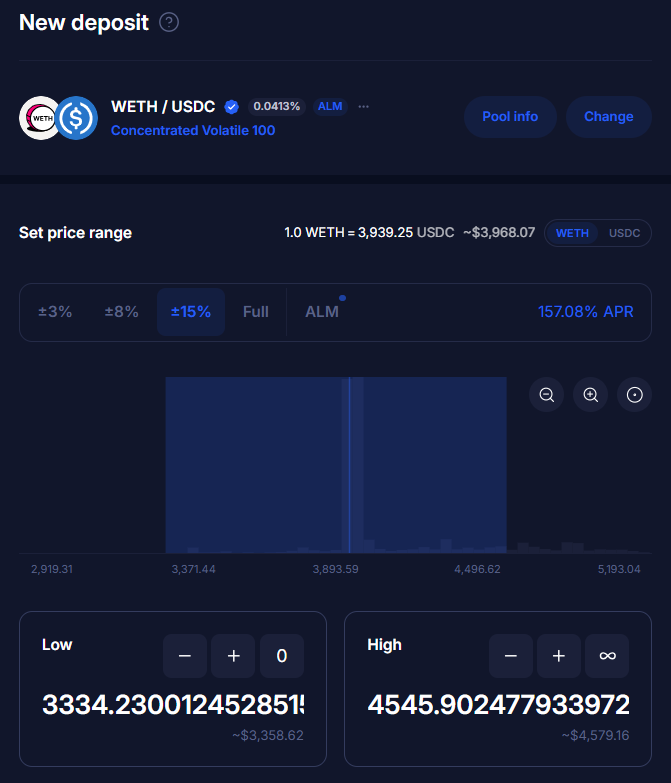

WETH / USDC on Aerodrome

Aerodrome powers DEX volume and liquidity on Base.

Given recent volatility and elevated DEX volume, there are opportunities to earn yield by providing liquidity.

This pool is currently earning over 150% APY with the ability to earn fees on a 30% ETH price range.

A widened price range minimizes the possibility that ETH price rises or falls outside the range, meaning LPers earn fees on broader price action.

How it Works

Head to the pool’s page on Aerodrome.

Select your desired price range - 15% has a good yield and captures more volatility, while 3% & 8% ranges have higher yield (capturing less volatility.

You’ll just need ETH and USDC. If you don’t have either, you can swap for them here.

Connect your wallet, select your range and deposit amount, then deposit.

Risk Level: Medium

Risks

Smart Contract Risk

Impermanent Loss Risk (although minimized)

⚡Why I’m Still All-In on Crypto (Despite the Market)

🛠️Tool Spotlight

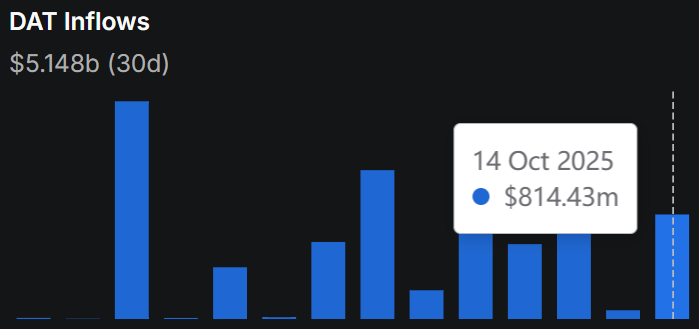

Track DAT Inflows

Track inflows and outflows to Digital Asset Treasury companies using DefiLlama’s dashboard.

The dashboard displays each company’s total holdings value, their stock price, mNAV and cost basis.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 US Crude Oil Inventory data - October 23rd

📊 September Existing Home Sales data - October 24th

📊 September CPI Inflation data - October 25th

📊 October Services PMI data - October 25th

📊 October MI Consumer Sentiment data - October 25th

📊 ~10% of S&P 500 Companies Report Earnings

Token Unlocks: $185m Unlocking This Week

🔓FTN (4.61%) - October 20th

🔓KAITO (3.47%) - October 21st

🔓MBG (11.97%) - October 22nd

🔓TON (1.45%) - October 23rd

🔓TORN (2.41%) - October 23rd

🔓MANTRA (9.11%) - October 23rd

🔓INIT (2.89%) - October 23rd

🔓AVAIL (7.13%) - October 23rd

🔓REZ (12.09%) - October 23rd

🔓NEWT (1.92%) - October 24th

🔓NIL (4.16%) - October 24th

🔓H (3.01%) - October 24th

🔓VENOM (33.19%) - October 25th

🔓XPL (4.97%) - October 25th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Axie infinity codex launch - October 20th (Source)

🚀 Ethereal mainnet alpha - October 20th (Source)

🚀 EleveX mainnet launch - October 22nd (Source)

🚀 Forte mainnet launch - October 22nd (Source)

🚀 Zilliqa 2.0 mainnet - October 22nd (Source)

🚀 TradingView agent launch on Delysium - October 22nd (Source)

🚀 Meteora MET TGE - October 23rd (Source)

🚀 Bitmart DEX launch - October 23rd (Source)

🚀 Flux fork - October 25th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi