⚡Dynamo DeFi Portfolio Update - October 2025

Plus our framework for picking investments

Warren Buffett doesn’t pick stocks.

But that wasn’t always the case. When he was young, he learned technical analysis. He focused on whether stocks would go up or down rather than on whether the companies they represented ownership in were fundamentally sound.

Crypto investors are following that same evolution today. In the past, analaysis of “tokens” dominated crypto analysis. Technical analysis. Whale purchases. Exchange flows. This was because it was one of the only ways to assess where tokens would move.

When there are no fundamentals, you can’t invest based on them. If you were looking for investable onchain businesses, you would have kept looking forever.

That’s no longer the case.

DeFi apps are now generating millions of dollars a month in revenue.

And, in many ways, DeFi is even better suited to fundamental analysis than TradFi:

In TradFi, you only receive earnings quarterly.

In DeFi, you get real-time data on app usage, revenue, and deposits.

The Dynamo DeFi Approach to Digital Asset Investing

In past Bitcoin cycles, I was guilty of trading too many short-term narratives. This time around, I believe we’re at the start of a long-term secular adoption curve. Rather than catching the “runner” of the day, my approach is to focus on a few assets that I am comfortable holding for the long term.

The goal is to invest in the Apples and Amazons of digital asset adoption and to find assets that will produce consistent returns over a multi-year horizon.

JLP

The Jupiter Liquidity Pool (JLP) token is a liquidity pool on Jupiter’s perp DEX that exists as a counterparty to perp traders. When a levered position is opened, the leverage comes from the Jupiter Liquidity Pool.

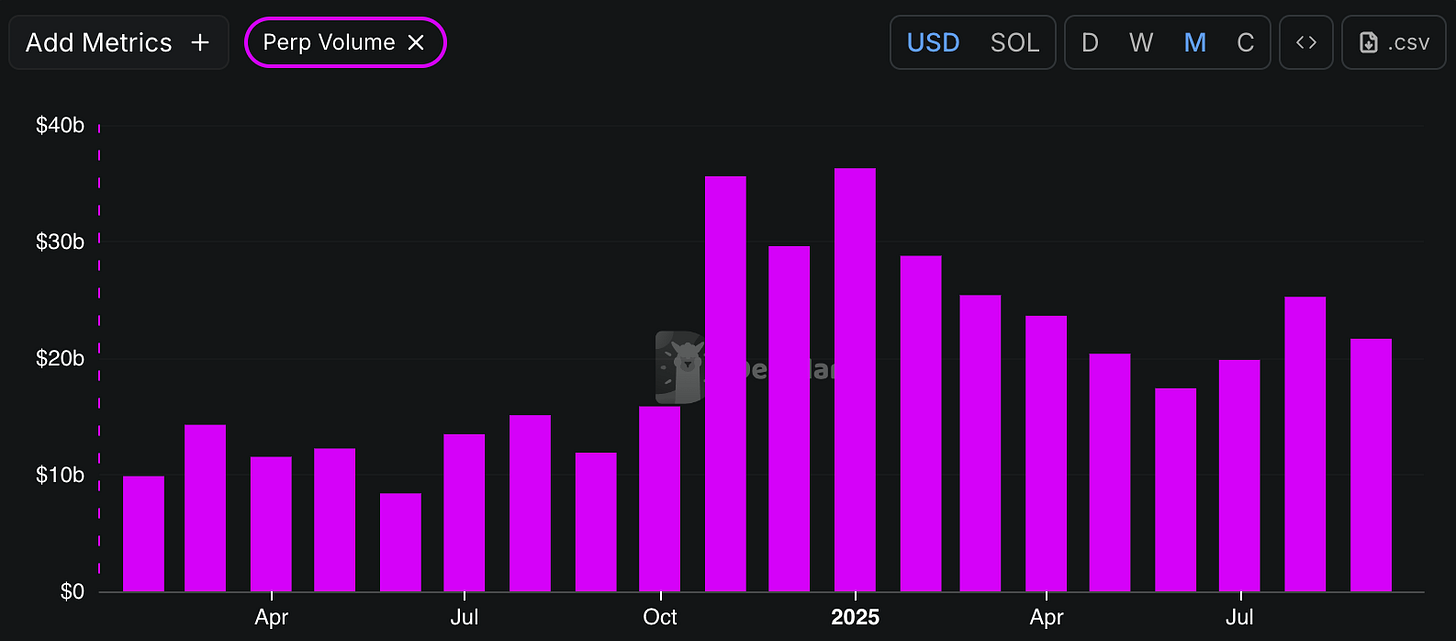

Jupiter perps have processed at least $15b per month in volume for a year now.

While not a investing in a specific dapp like the other tokens on this list, JLP checks a lot of boxes for the portion of my portfolio dedicated to “majors".

First, it’s essentially an index. The JLP token consists of SOL, ETH, WBTC and USDC.

Second, it’s income-producing. The yield varies, but trading fees and PnL go directly to the JLP pool.

It’s one of the most pure form “own the casino” options available.

Here’s what JLP looks like over the last two years:

Denominating in USD doesn’t tell the full story. We want to benchmark against easier, less risky exposure to the crypto market: Bitcoin.