⚡Ownership Coins are Coming [Dynamo DeFi Pro Report]

A mechanism to save DAOs, successful ICO launches and all the DeFi metrics you need to know

💡Dynamo’s Thoughts

Futarchy is a governance idea dreamed up by economist Robin Hanson in 2000.

It fuses democracy with betting: people vote on what they want (values, like “make the economy stronger” or “improve community welfare”), but then prediction markets decide how to get there (beliefs, like which policy will actually work best).

This turns governance into a market that rewards accurate predictions.

Instead of “should we do X?” polls, futarchy asks, “Will X actually boost this metric the DAO specifically asked for?”

Traders put real tokens on the line, so only those with skin in the game (and reasonable intel) shape the outcomes.

If you think this sounds like something well-suited to crypto, you’re right. Sometimes ideas need the right technology for their time to come:

DAOs are great for efficiently collecting votes, while historically struggling with decision-making due to a combination of indecision and special interests.

Small, niche betting markets are tough to spin up with traditional payment rails

Futarchy is basically tailor-made for crypto DAOs.

For DAOs, futarchy boosts engagement, leans on wisdom of the crowds, and forces DAOs to be crystal clear on their goals & outcomes.

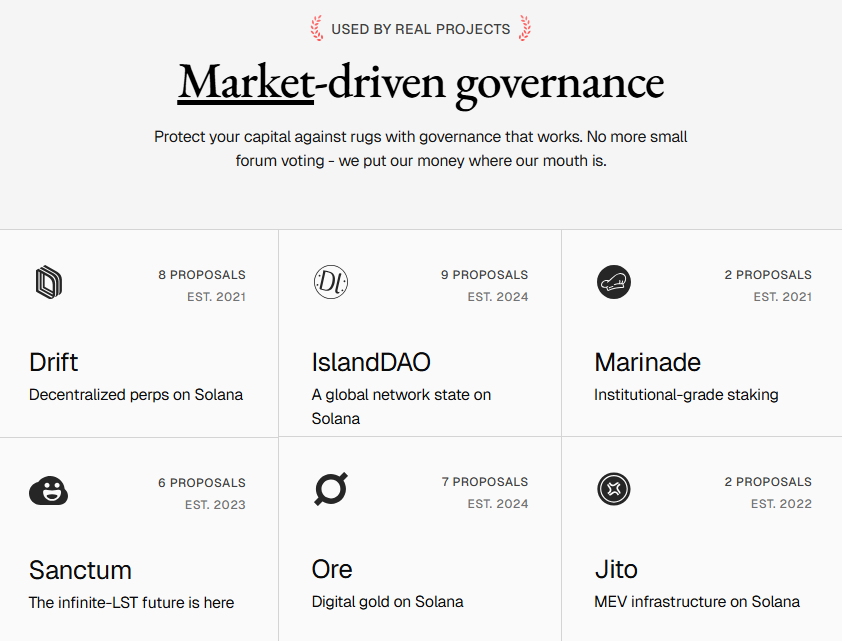

The leading example is MetaDAO on Solana. The platform helps tokens ICO with a promise to provide more transparency and improve outcomes for both token holders and founders.

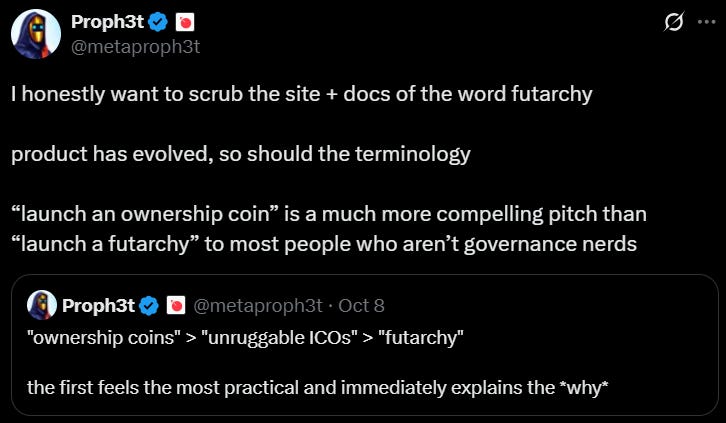

MetaDAO and Colosseum are also trying to rebrand futarchy to “Ownership Coins.”

Several high-profile Solana projects are testing MetaDAO’s Futarchy infrastructure.

Liquidity is still low on many markets.

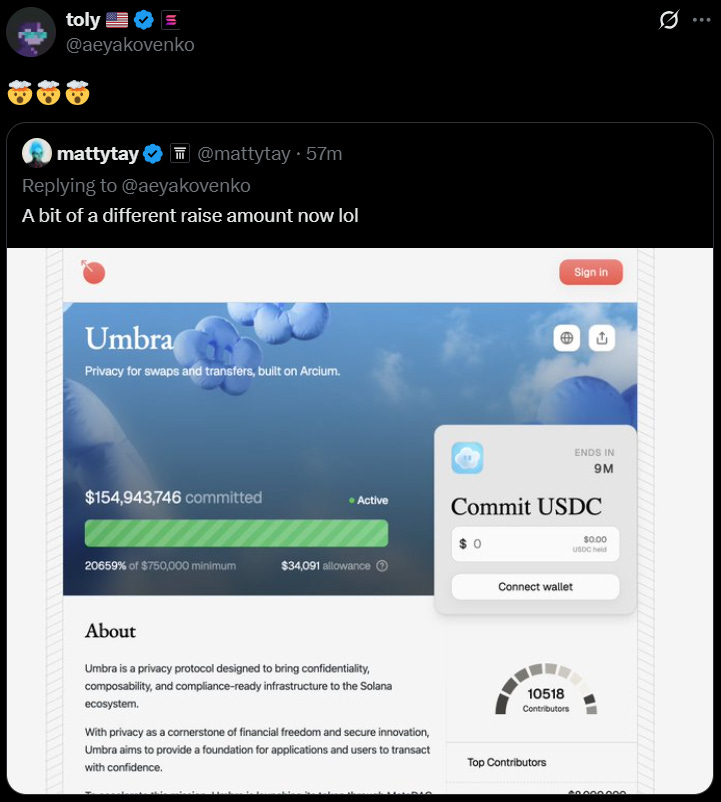

For projects raising through MetaDAO, however, attracting investment has not been an issue. Privacy protocol Umbra on Solana ICO’d and the project’s $750k fundraising goal was 20,000% oversubscribed. Total raise: $150m.

Important to note: this was just a raise, so no futarchy was involved yet (the eternal crypto user continues to be more interested in investing than actually using the technology). But each ICO is required to set aside funds for futarchy markets, so it’s likely we’ll see more markets in the near future.

The amount of contributed capital raised shows people are paying attention.

We’re in the early days of this implementation, which means things could go awry, but this is the most serious attempt to make DAOs work that I’ve seen recently.

It’s worth keeping an eye on this implementation. If it can meaningfully improve DAO decisions & outcomes, it could help DAOs scale into self-perpetuating, functional online organizations. There are a number of benefits to decentralized organizations, so if they can crack this nut, they could easily start to penetrate other realms, like politics as well.

For now, at least we know ICOs are back with strength.

MetaDAO launches have been quite successful, YieldBasis on Legion was successful, Echo & Sonar provided Plasma investors with 30x returns. MegaETH is up next.

The new round of ICOs is a notable improvement from those of previous cycles. More is required of investors through KYC & barriers to entry, and more is demanded of projects looking to ICO, but these elevated requirements have resulted in success for both participants and projects.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

If you’re looking for a more comprehensive overview of trends driving the market, check out our monthly Zoom call from this month:

🔭Market Outlook

We’ve heard your feedback from last week’s poll that you want more trending altcoins. We’ll be introducing several new newsletters each month:

Top 5 altcoins based on fundamentals that month. 3 will be free and 2 will be paywalled.

Portfolio updates. For paid subscribers, I’ll provide a monthly update on what I’m holding, based on fundamentals. Here’s our portfolio update for October.

Market Health

Total DeFi TVL

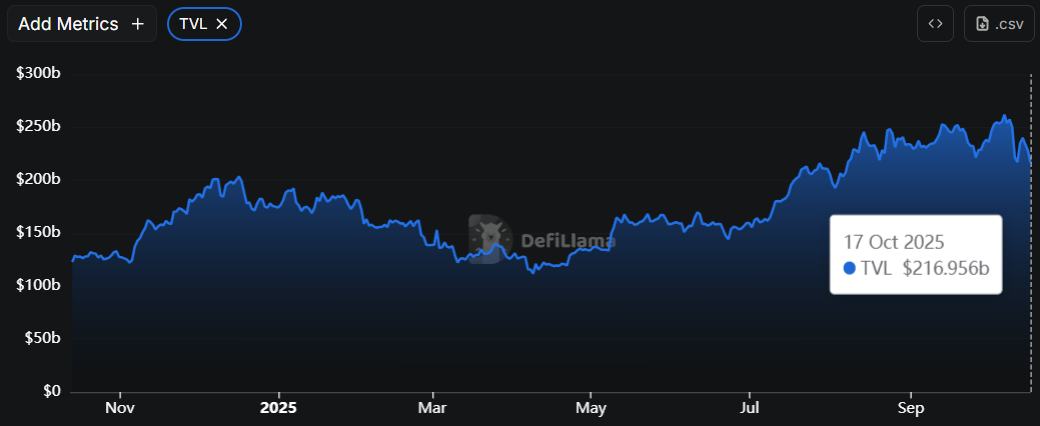

Less than two weeks off an ATH, total DeFi TVL has fallen back to $216b.

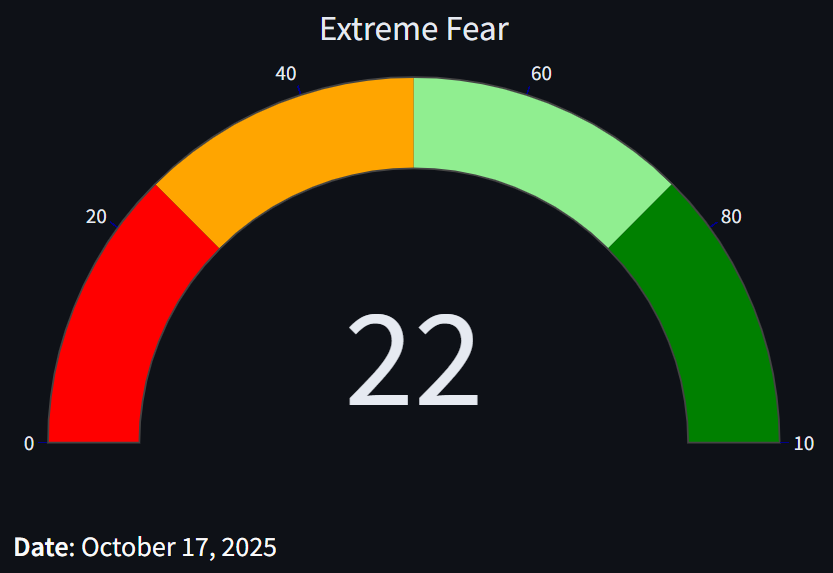

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here.

The index was steadily falling into the Fear category a few weeks ago, then pushed up to very high levels of Greed on October 6th.

From there, it’s been down only. Current reading: 22

Stablecoin Market Cap

Total market cap continues to climb, despite price action in the broader crypto market.

USDT saw a $3.4b increase in market cap this week.

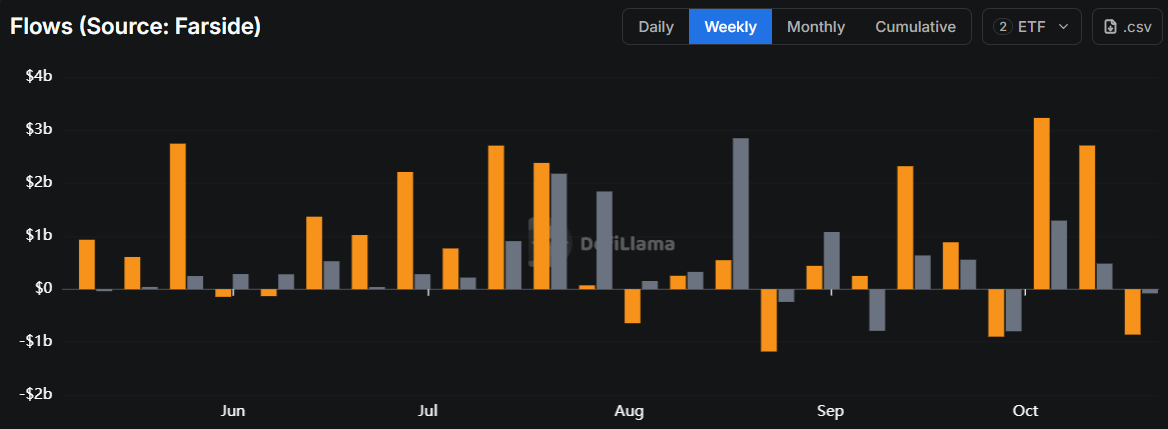

ETF Flows

After an early October surge in flows, weekly flows are negative.

-$800m BTC

-$80m ETH

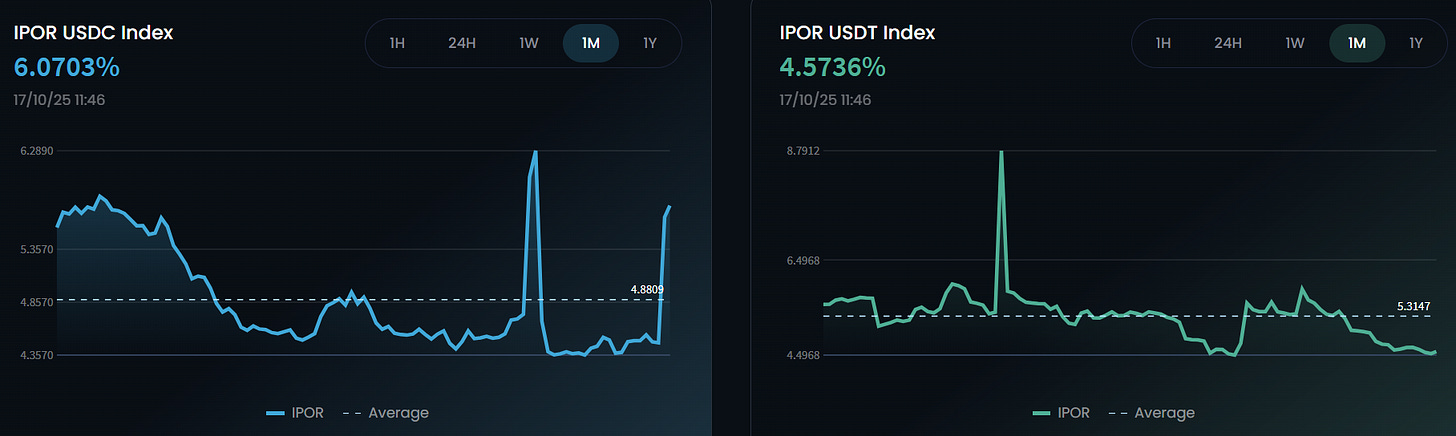

IPOR Stablecoin Indices

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

Rates for both USDC & USDT have seen spikes - USDC specifically saw the highest index rate since February.

The USDC rate is currently elevated, USDT is below its monthly average.

For reference, here are last week’s numbers:

Category and Chain Trends

Category TVL Changes

Treasury Mangers are up due to the category’s inclusion of kpk, a protocol that DefiLlama just started tracking.

OTC Marketplace growth comes from Figure Markets Exchange, which saw a spike in TVL several days ago.

Yield Basis has been added to Leveraged Farming and already has over $150m in TVL.

Polymarket TVL is climbing, setting new highs steadily, leading to a growth in the Prediction Markets Category.

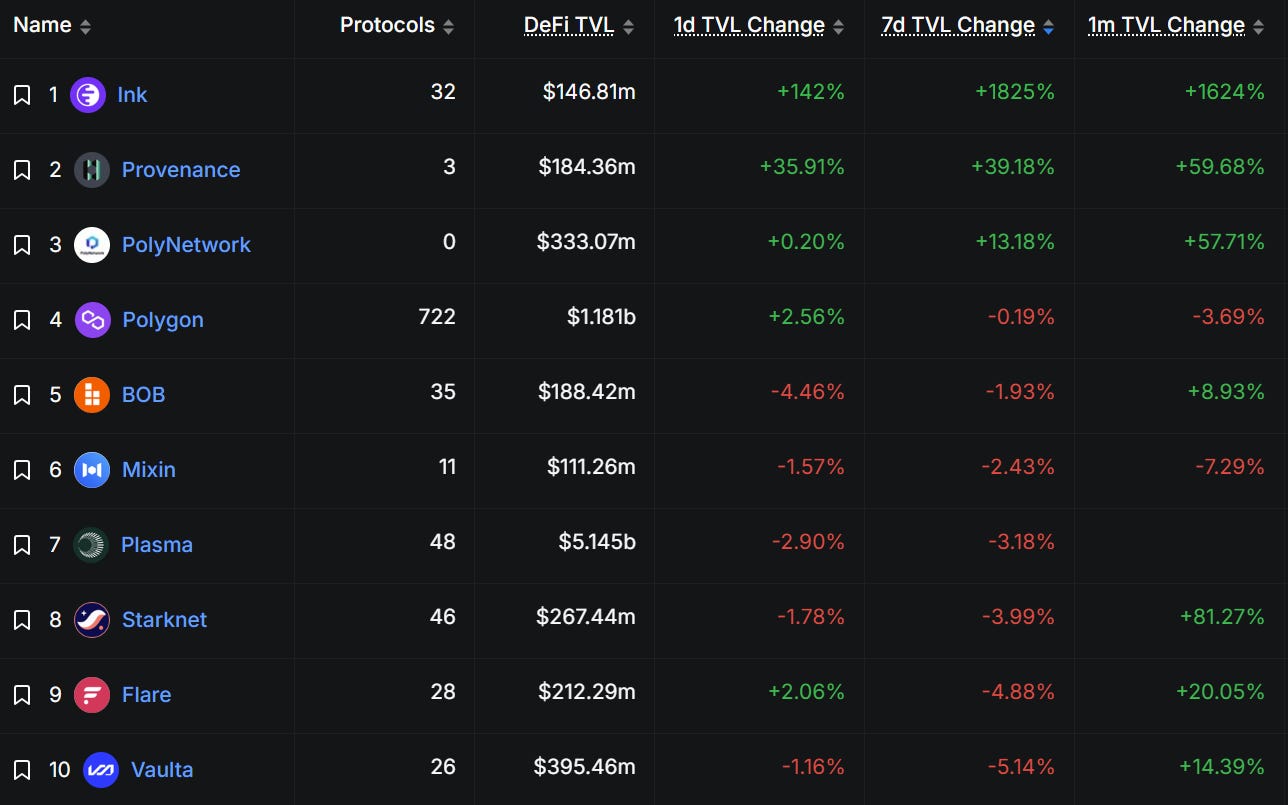

Fastest Growing Chains ($100M+ TVL)

Only three major chains saw positive 7d growth. Several more have experienced growth over the last 30d.

Kraken’s L2 Ink is up due to the launch of Tydro, a lending protocol powered by Aave.

Provenance’s growth comes from Figure Markets.

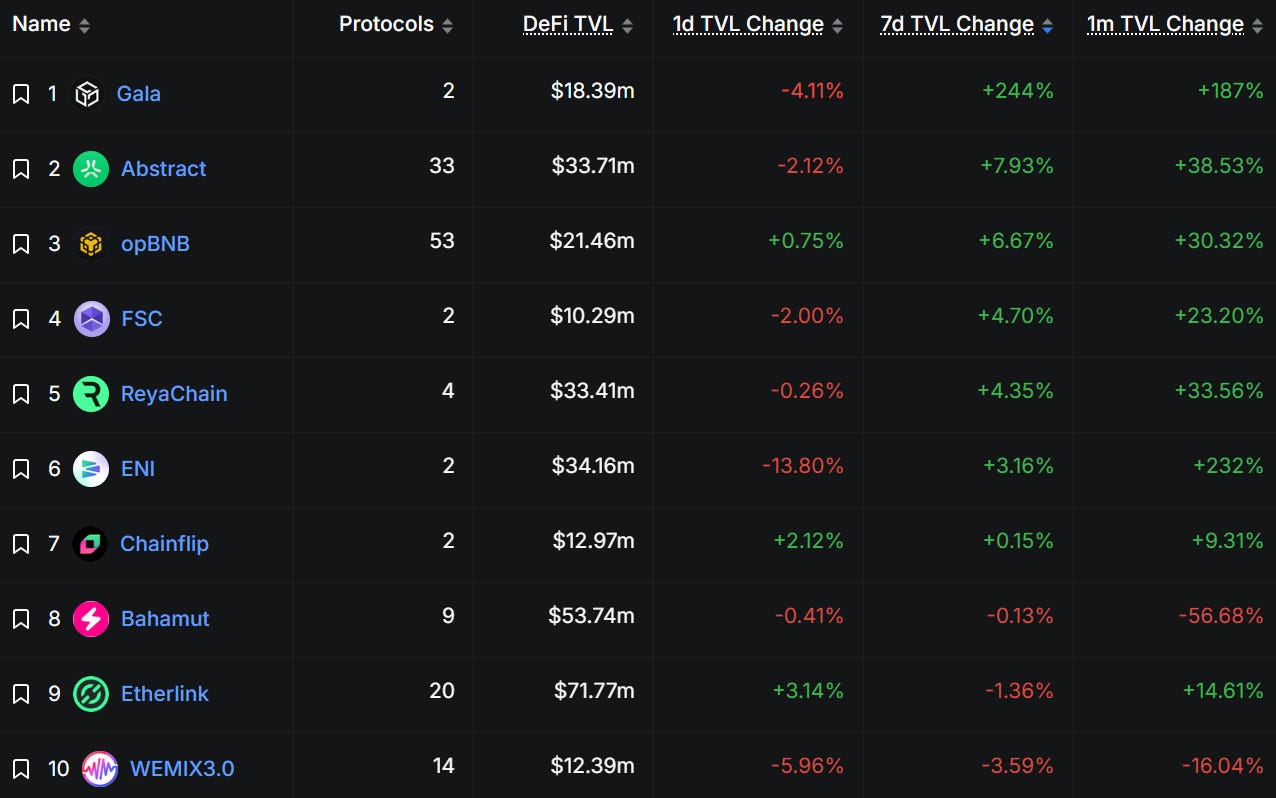

Fastest Growing Chains ($10M-$100M TVL)

Gala & Abstract lead this week, with ENI’s 200% 30d growth continuing.

📊Onchain Metrics

Digital Asset Fundamentals

This section dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens.

Below you’ll find 3 visuals:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.