⚡️Ethereum is so back: How DeFi is Poised to Explode

Plus our new newsletter format helps you understand the crypto market in 5 minutes

Read Time: ~5 minutes

Welcome back to exciting times in the crypto market. Much of the market is up, and everyday is bringing a new piece of news that would have sparked weeks of discussion a few years ago. How are you supposed to keep up?

Our brand new format is designed to get you up to speed on the most important market updates, and prepare you for the week ahead.

It includes numbers-driven market context, news summaries, onchain insights, yield farms, airdrop farms and tools we use every day.

We think you’ll love it. Give it a read, and let us know at the end if it’s a helpful update.

⚡In This Edition

Market Metrics at a Glance

What to know this week in crypto

Onchain Analysis: Onchain insights giving you the most important things happening onchain

Farm of the Week: We explain exactly how to capitalize on yields or airdrop opportunities onchain

Macro events, new launches and token unlocks for the week

DeFi tools and our favorite resources

⚡Metrics Snapshot

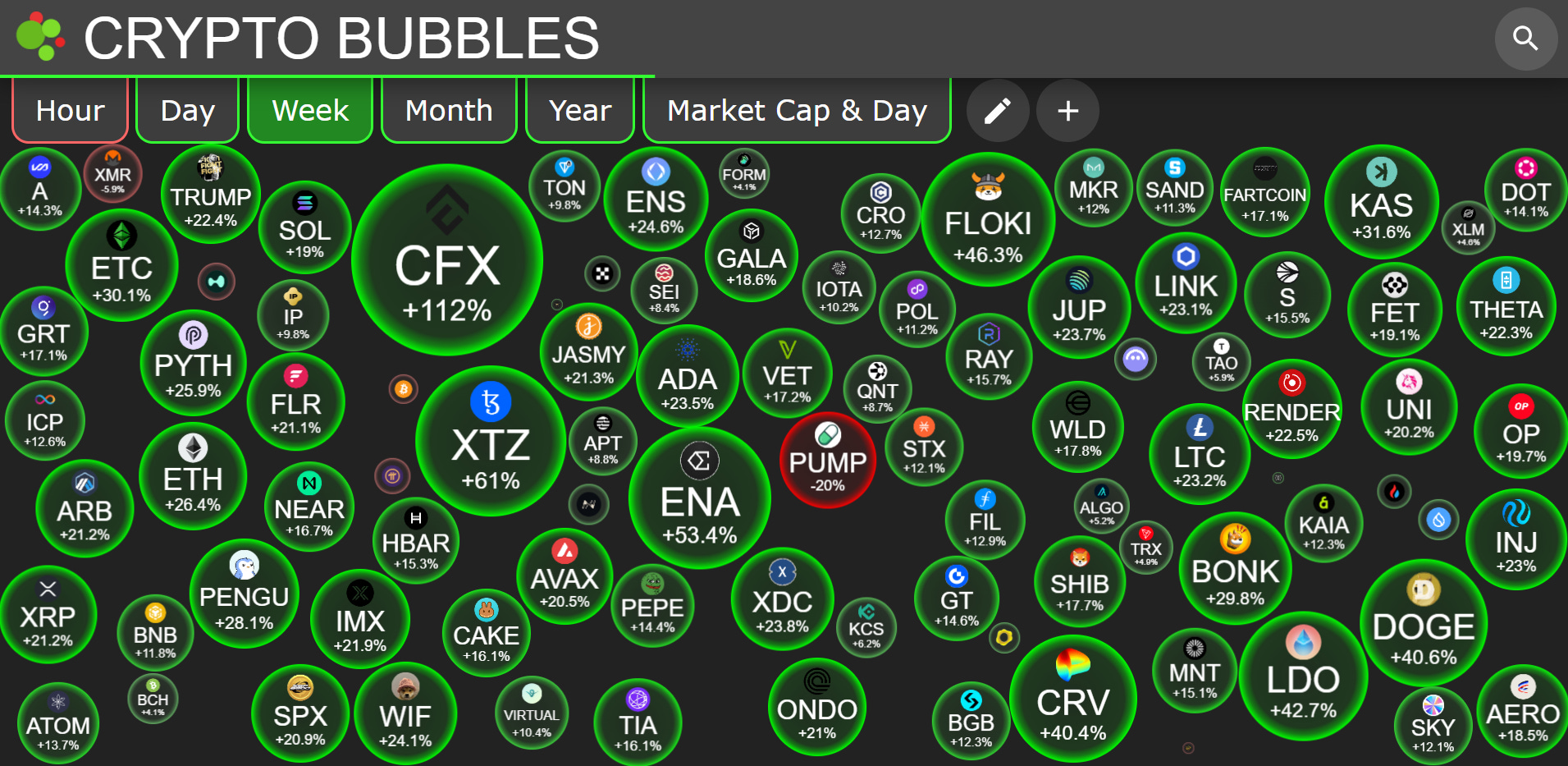

Top Performers this Week

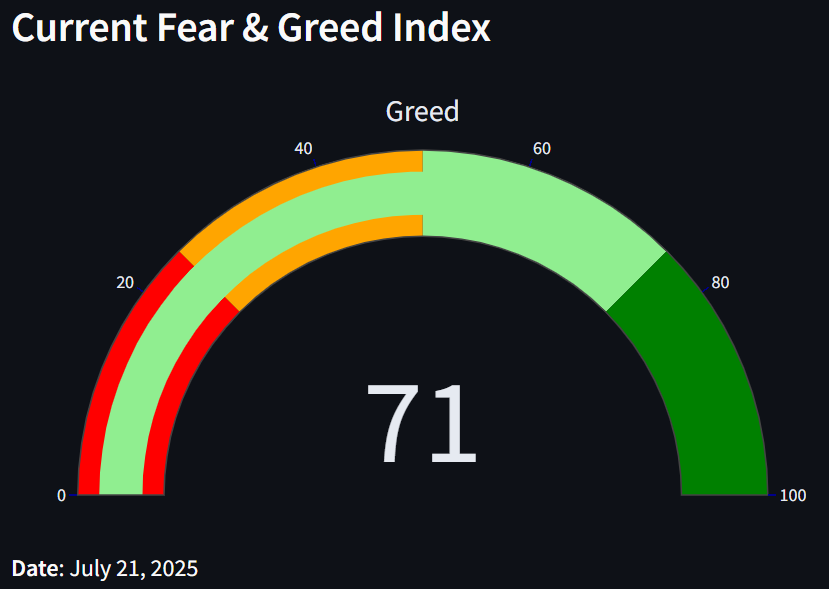

Fear & Greed Index: 71 (Greed)

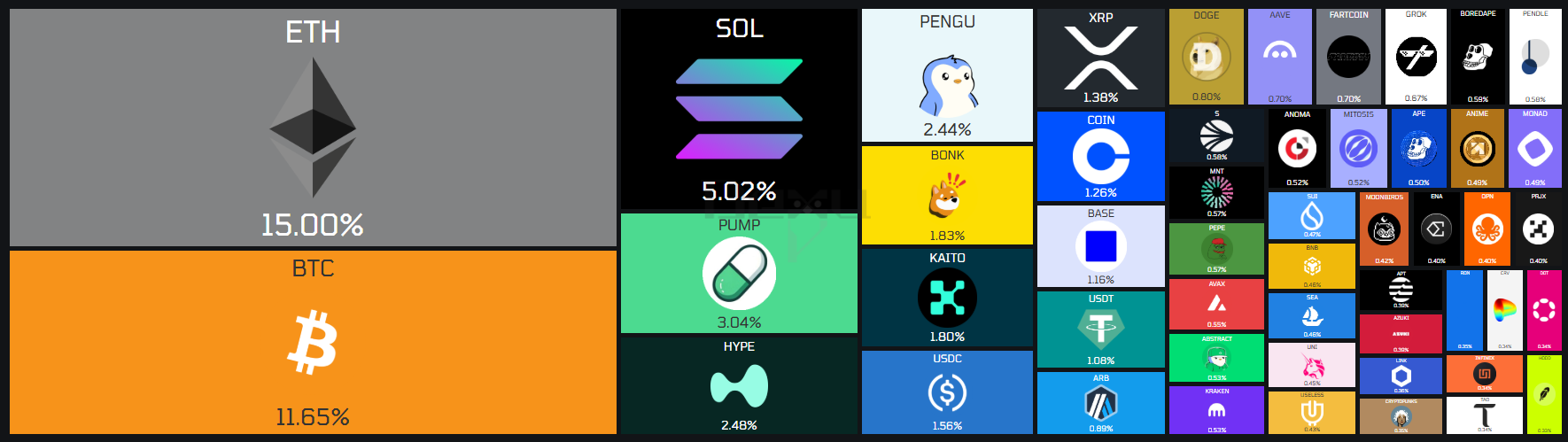

Project Mindshare (7d)

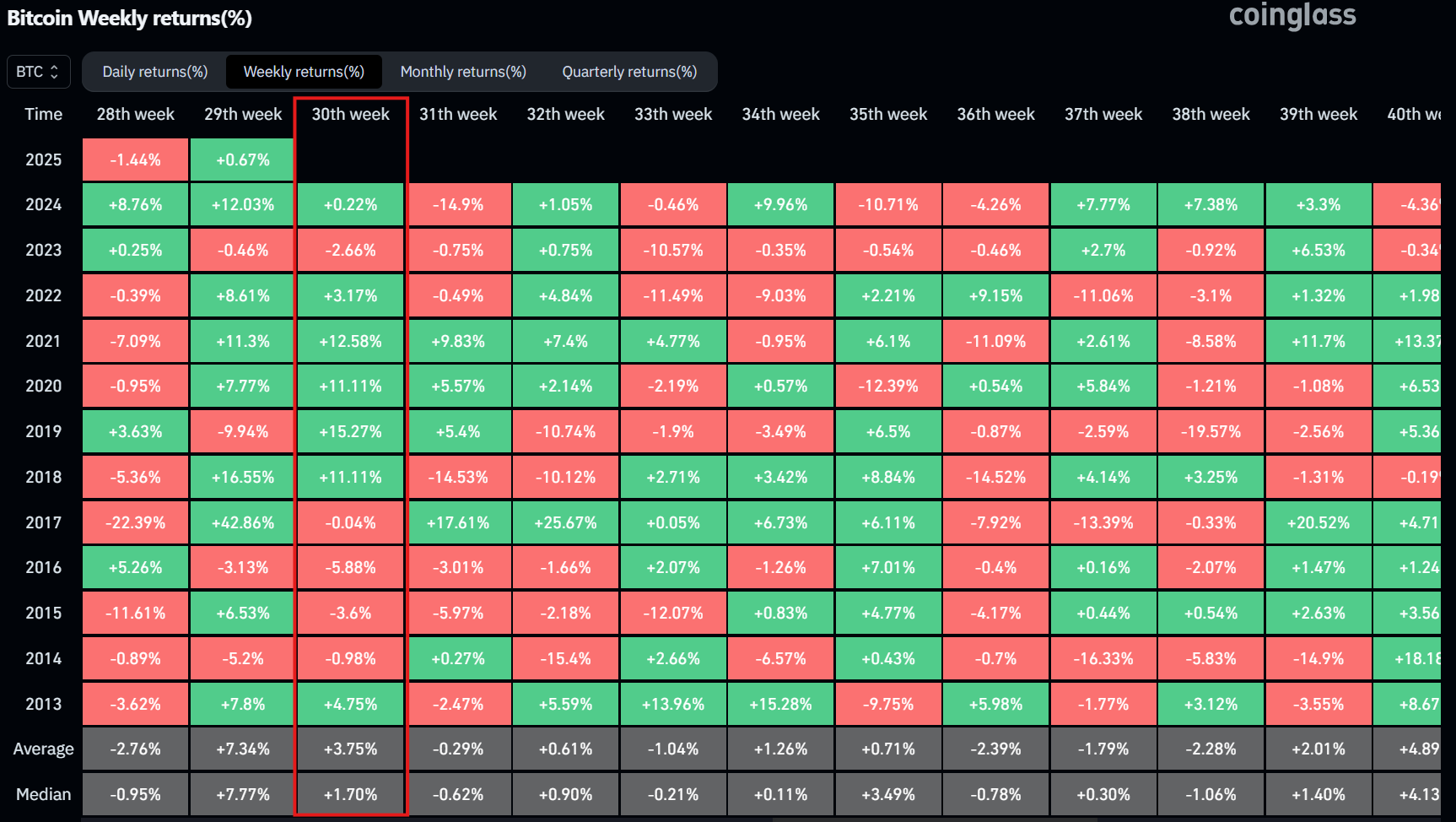

Historical Bitcoin Performance This Week

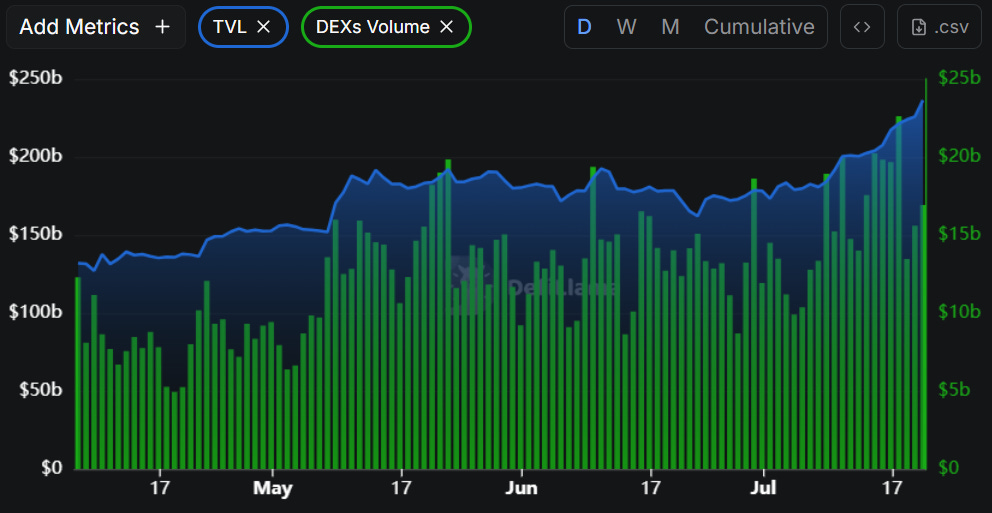

DeFi Market Metrics: Global TVL, DEX Volume

What to Know this Week

The biggest headlines moving the market and what it means for you

1. Trump Media Goes All-In on Bitcoin

Trump Media has converted $2B of its $3B treasury into Bitcoin, citing financial freedom and future token plans.

What This Means: Bitcoin is no longer viewed as solely a hedge. It’s becoming the reserve asset of large brands & companies.

2. Ethena Orchestrates $260M in ENA Buy Pressure

StableCoinX raised $360M to buy ENA and will list under “USDE” on Nasdaq, with $5M/day set for ENA purchases over 6 weeks.

What This Means: A TradFi loop has now been created to funnel public capital into ENA. More DeFi tokens may follow this playbook.

3. Solana Lands $200M Corporate Treasury Deal

Nasdaq-listed Mercurity Fintech will build a $200M SOL treasury with staking, DeFi yield, and direct ecosystem investments, backed by Solana Ventures.

What This Means: Solana is now a corporate treasury asset. Not just for price exposure, but for active participation and yield.

📖 Recommended Reads

⚡Key Onchain Metrics Surge to New Highs

The US government is becoming one of the most pro-crypto institutions in the world

⚡One of the Best Weeks Ever for ETH

The future looks bright

Learn advanced yield strategies and how to find DeFi opportunities

How to stop the pattern that destroys most market participants

⚡Ether Machine raised $1.5b to buy 400,000 ETH

The Pantera-backed company is aiming to use half the raise to acquire ETH

⚡Our Revamped Weekly Metrics Newsletter

The Dynamo DeFi Pro newsletter dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value behind different tokens. We’ve revamped this recently to include a wide variety of metrics, such as:

Onchain highlights

Financial analysis

DeFi metrics

Sentiment analysis

Open interest rates

ETF Flows

Read last week’s newsletter here (first few sections free):

Among the metrics, 3 custom visuals are included:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

To get these insights delivered to you each week, become a Pro member.

🔢Onchain Analysis

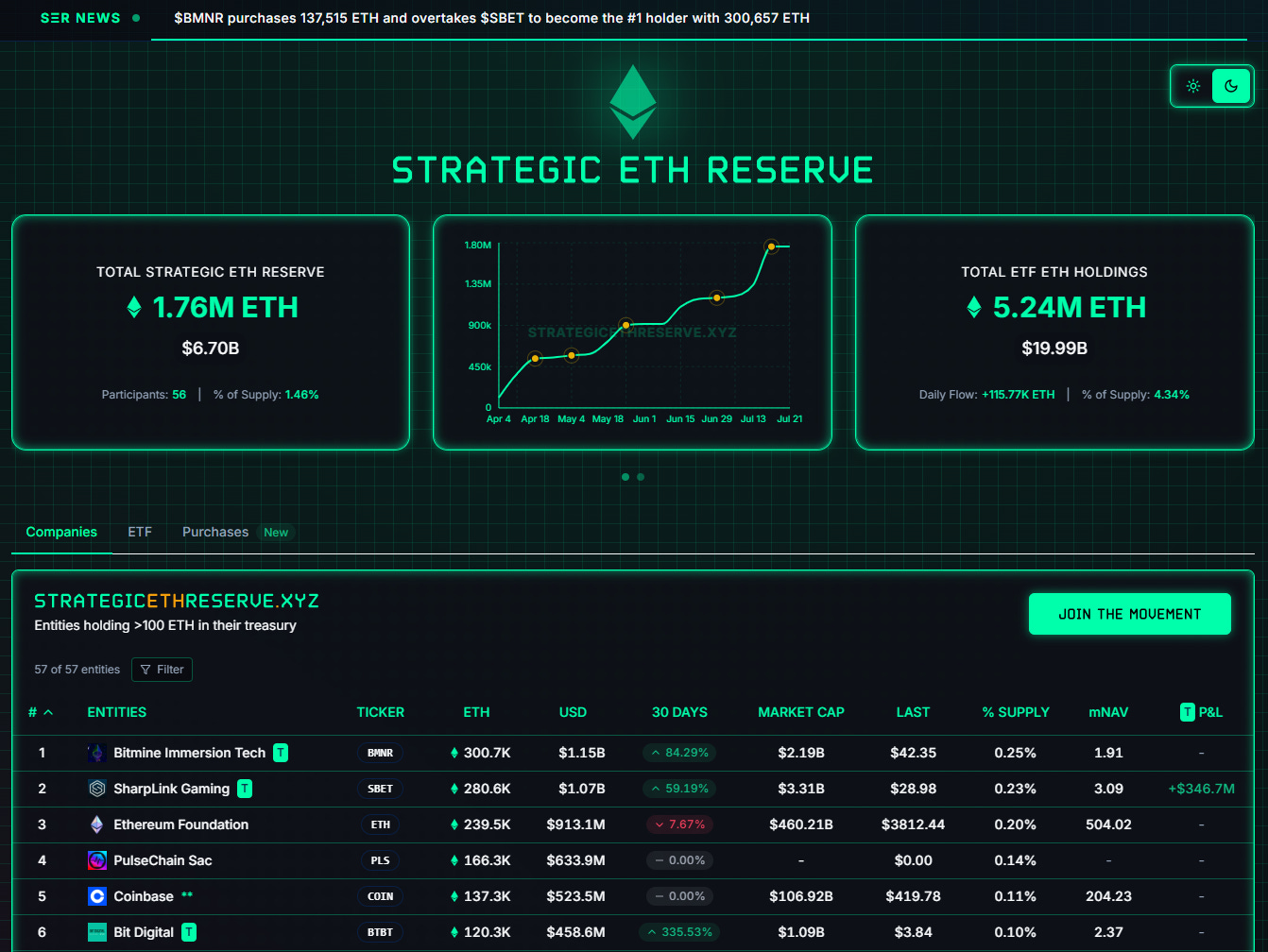

Ethereum is So Back

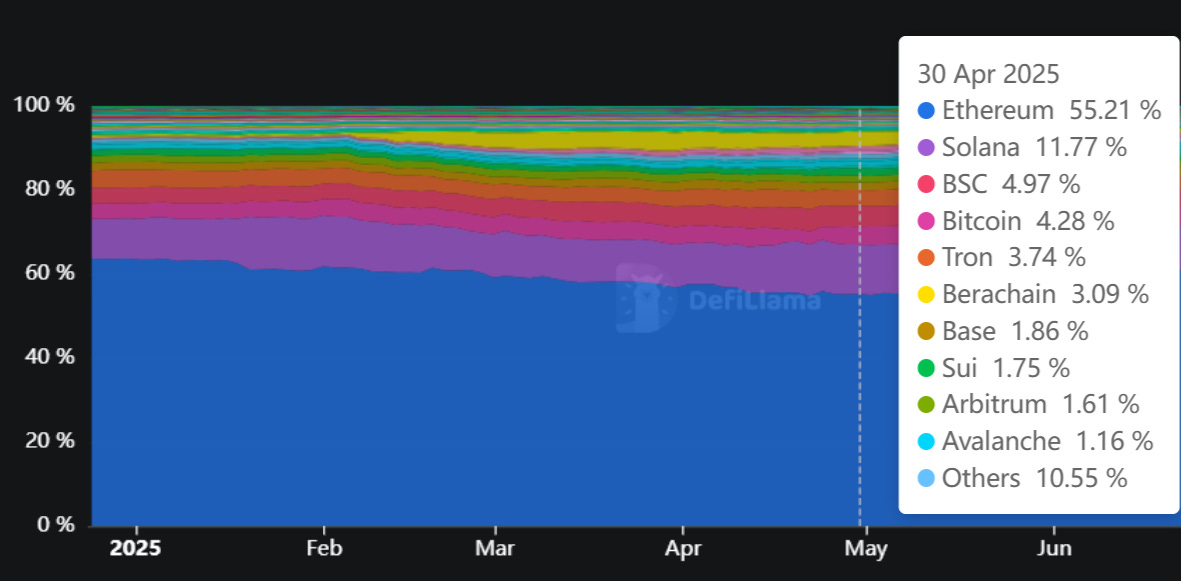

90 days ago, Ethereum sentiment was at all-time lows. The chain went from holding 65% of all TVL in crypto down to 55%.

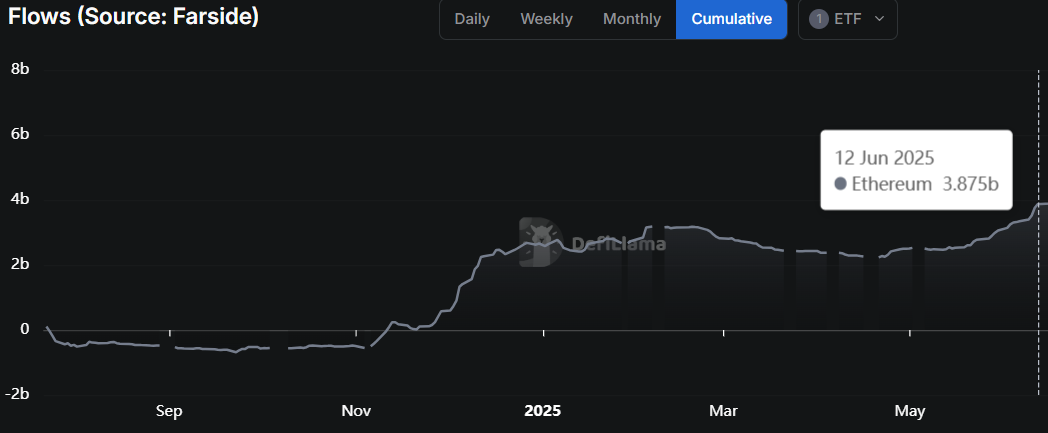

Then, ETF flows start picking up. Total ETF flows rise 50% in a single month.

Corporations begin purchasing massive amounts of ETH. Bitmine & Sharplink acquire almost 600,000 ETH tokens before you can say ‘MicroStrategy’.

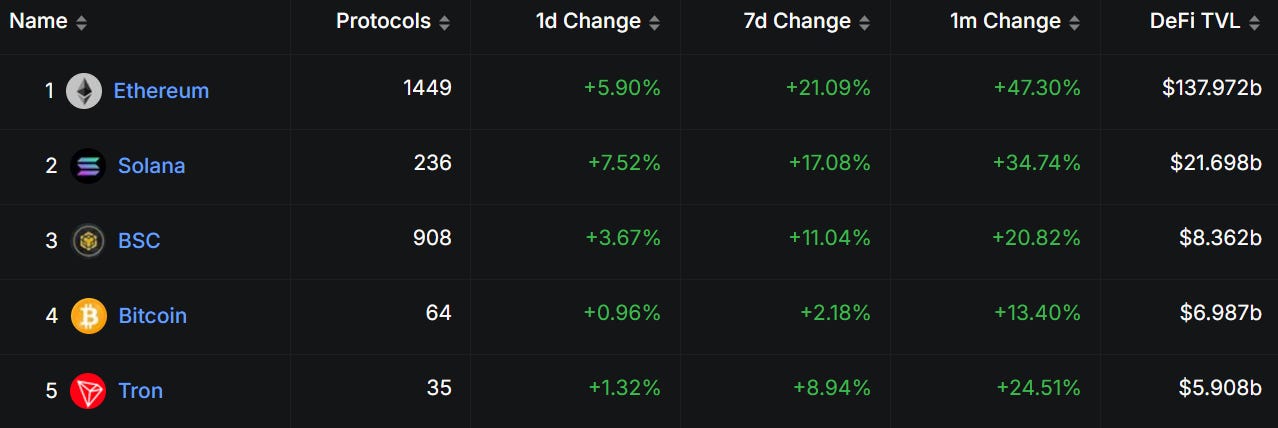

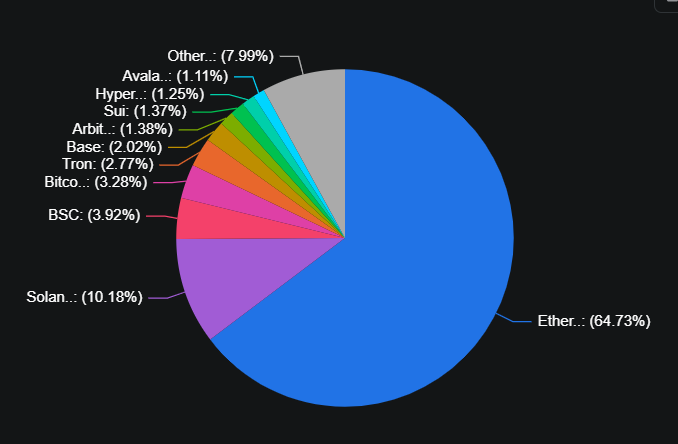

Now? Ethereum TVL leads 30d growth among major chains. TVL dominance charged all the way back: Ethereum holds 65% of all crypto’s TVL, higher than the start of the year and the strongest TVL dominance since September.

Ethereum’s rising tide is lifting the DeFi space higher: TVL on nearly all chains is up, Chain Ecosystem Fees are going up (signaling increased usage), and sentiment is overwhelmingly positive for ETH. Over the last week, ETH overtook BTC for the #1 mindshare spot in the industry.

As long as this trend continues, the growth opportunity for DeFi is real.

To get more in-depth metrics each week, become a Pro member.

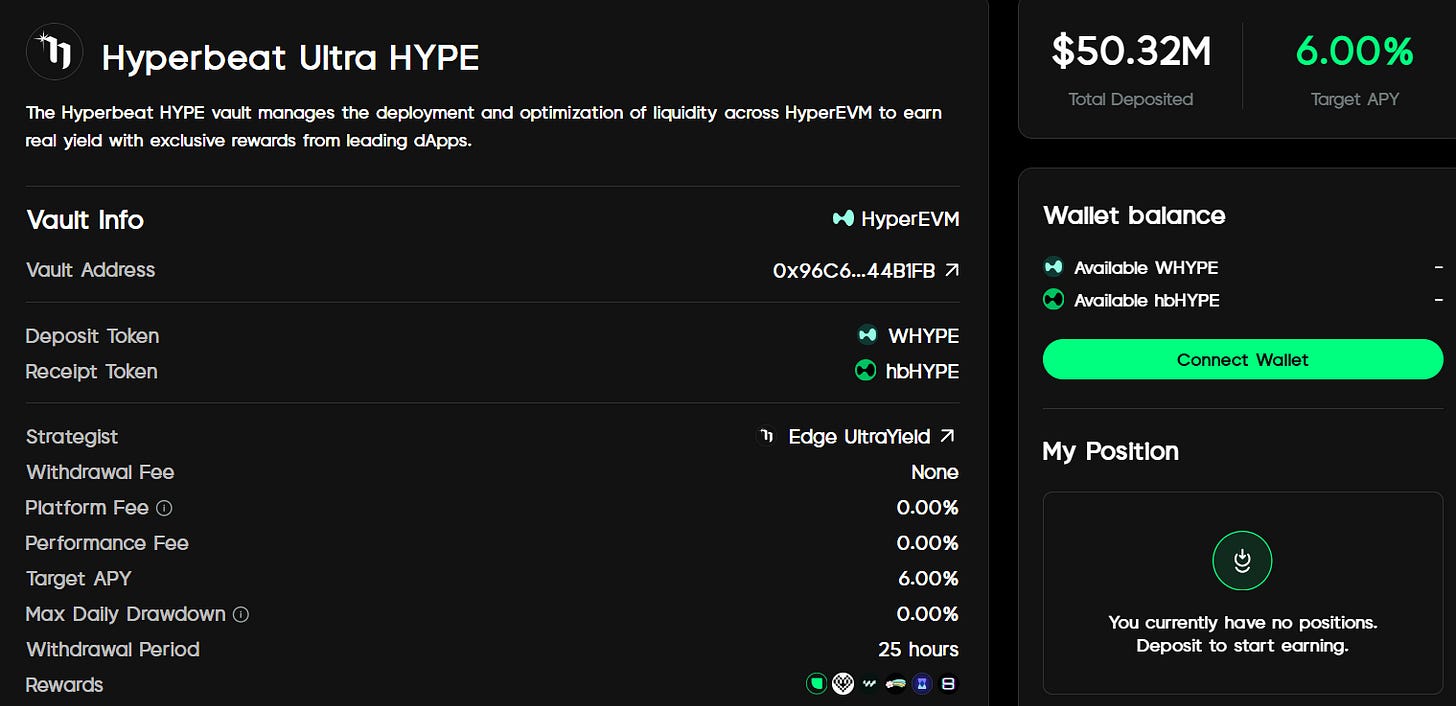

🚜Farm of the Week

Earn Points from 6 Protocols with Upshift

Upshift is a yield vault platform that recently crossed $400m in TVL.

Their Hyperbeat Ultra HYPE vault earns yield and points across 6 protocols, including Upshift and several Hyperliquid ecosystem points.

In short, it’s a great way to earn yield on HYPE and potentially qualify for airdrops in just a few clicks.

How it Works

Head to Upshift, connect your wallet and deposit WHYPE. If you don’t have WHYPE you can swap for it on Hyperswap.

Once you deposit, you’ll start earning yield and protocol points.

Risks

Smart Contract risk

Protocol Layer risk

Risk level: Low

⚡Why Crypto is Just Getting Started

🛠️Tool Spotlight

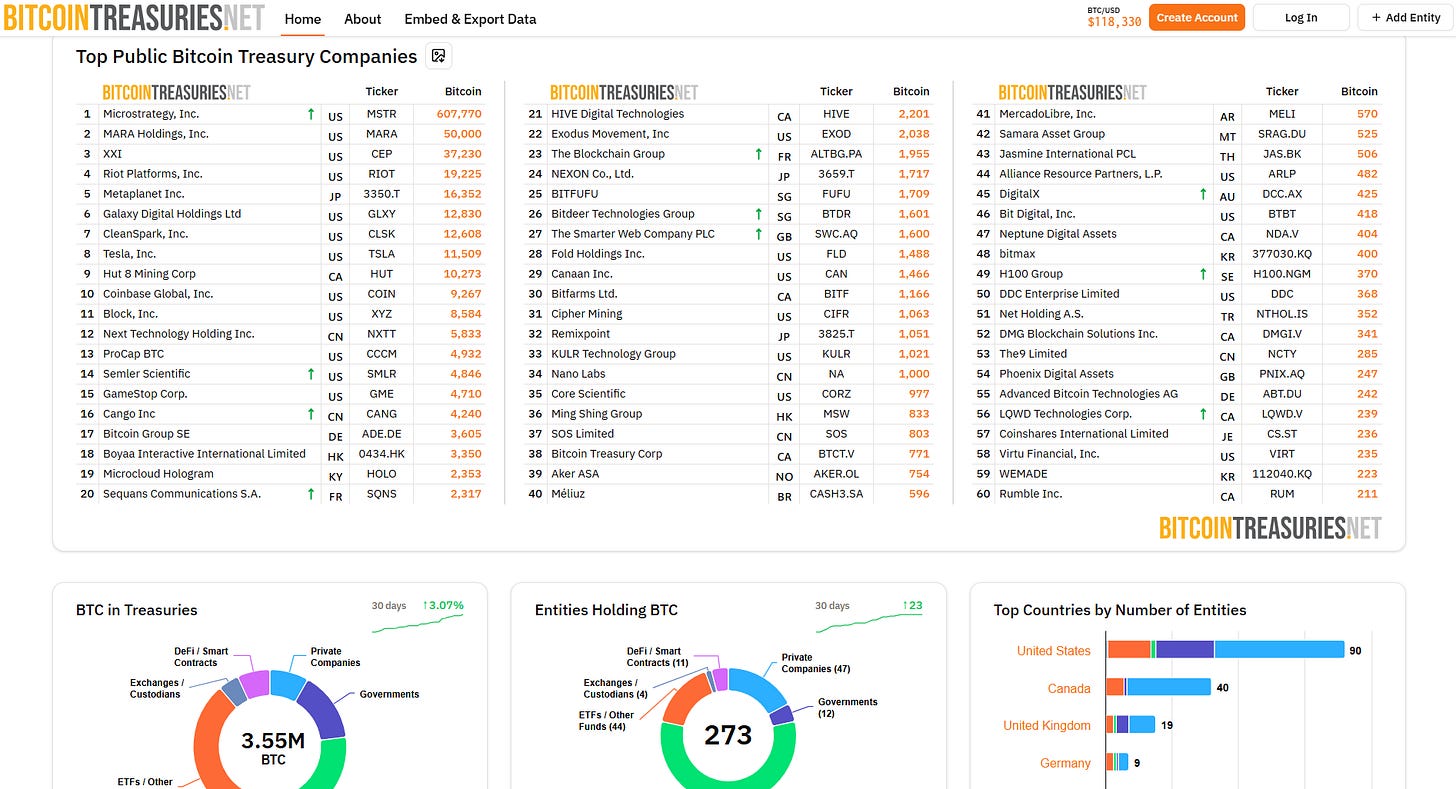

Track Digital Asset Reserves

We use DeFiLlama’s ETF dashboard to track flows, but what about entities accumulating digital assets?

BitcoinTreasuries.net tracks the top Bitcoin treasuries, and strategicethreserve.xyz tracks Ethereum treasuries.

Both sites have charts and tools to track treasury growth.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Fed chair Powell speaks - July 22nd

📊 June Existing Home Sales data - July 23rd

📊 July S&P Global Manufacturing PMI data - July 24th

📊 June New Home Sales data - July 24th

📊 15% of S&P 500 companies report earnings

Token Unlocks: $160m Unlocking This Week

🔓FTN (4.63%) - July 21st

🔓KAITO (3.43%) - July 22nd

🔓PLUME (81.58%) - July 22nd

🔓AVAIL (38.23%) - July 23rd

🔓BICO (0.77%) - July 24th

🔓REZ (11.93%) - July 24th

🔓VENOM (2.84%) - July 25th

🔓 TORN (2.42%) - July 25th

🔓AXL (1.55%) - July 27th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Coinbase perpetual futures launch - July 21st (Source)

🚀 Sahara AI data service platform beta launch - July 22nd (Source)

🚀 Bodega v3.0 launch - July 22nd (Source)

🚀 Yield-bearing LBTC launch - July 22nd (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi

![⚡Key Onchain Metrics Surge to New Heights [Dynamo DeFi Pro Report]](https://substackcdn.com/image/fetch/$s_!31iQ!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff4e28eda-0abd-458c-887e-fa35f852f7be_1165x441.png)