⚡Key Onchain Metrics Surge to New Heights [Dynamo DeFi Pro Report]

Plus new crypto fundamentals visualizations, open interest rises, and ETH ETF inflows break records

💡Dynamo’s Thoughts

Slowly, then all at once.

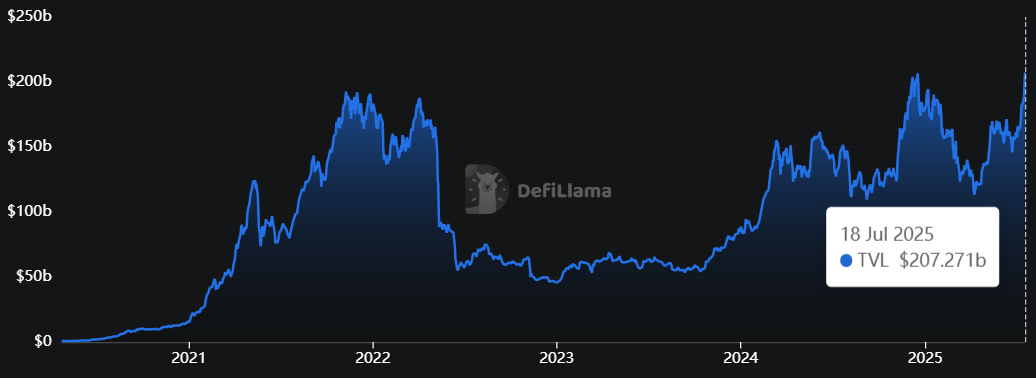

We knew the all at once part would arrive someday, but rarely do inflection points appear exactly as expected. In the case of DeFi, simultaneous skyrocketing in TVL, stablecoin supply, and DEX volume is coinciding with the US government becoming one of the most pro-crypto institutions in the world.

Imagine going back in time two years, when friends were losing bank accounts, fighting SEC suits or even facing criminal charges over their involvement in the crypto industry and showing them this video of the US Treasury Secretary pledging to make the US the global leader in digital assets, even as the President signs into a pro-crypto regulatory framework. Fan fiction would have been more believable.

Three major pieces of crypto legislation passed this week.

The GENIUS Act, which focuses on stablecoin legislation.

The CLARITY Act, providing framework for digital asset market structure.

The Anti-CBDC Act

Crypto-friendly legislation and ETF flows are only part of the positive picture this week.

President Trump is reportedly planning to open up US retirement accounts to crypto, gold, private equity and other alternative assets.

Additionally, the Ethereum narrative is hot, with crypto treasury companies like Sharpink Gaming, Bitmine and others stacking billions in ETH. Both companies own ~300,000 Ethereum, acquiring those ETH tokens in a relatively short time period.

Of course, not everyone is on board.

Onchain rails have been laid for transactions and payments in the next century. Institutions, seeing the change, are now racing to catch up, adopt, and profit from the marginal benefits of stablecoin transactions.

Cross-border payments, prediction markets, perps trading, overcollateralized loans, transparent financial data: all places where crypto has found PMF and is growing.

One of the places crypto has lagged is in consumer applications and in building network effects outside a few examples. The announcement of the Base app this week is indicative of where the future is heading.

The Base app combines payments, social media & group chats, trading and mini apps into a single hub on Base.

While there’s a hint of euphoria in the air, it’s wise to not get too euphoric yourself. There will be plenty of dips along the way, but the culmination of this news is creating a much better looking market than we’ve seen so far this year.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

🔭Market Outlook

Market Health

Total DeFi TVL

Total DeFi TVL (including liquid staking) officially hits an all-time high. 🎉

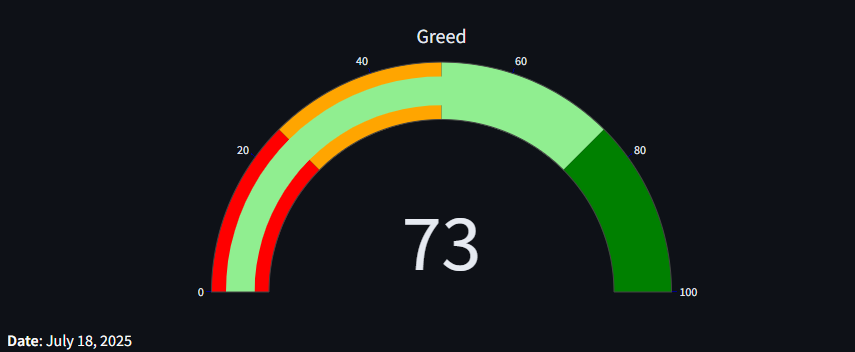

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here. Today’s value is 73. Given how the market has performed over the last two weeks, it’s a healthy sign to see this indicator in Greed territory and not Extreme Greed. That said, we’re only a few points away from Extreme Greed.

Stablecoin Market Cap

The most relentless trend in crypto continues. Stablecoin market cap added almost $9b in the last 30 days - half of that came from USDT. USDC market cap grew $3b.

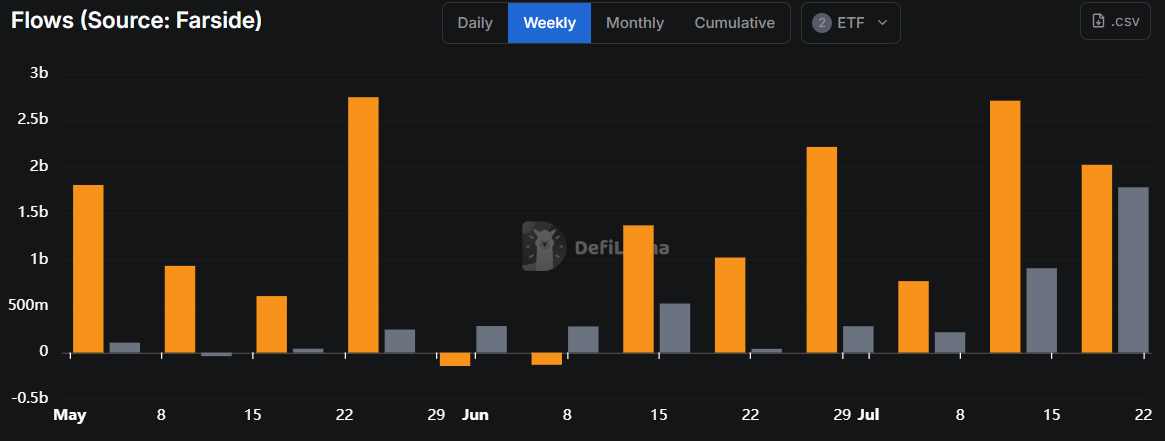

ETF Flows

ETF flows have been huge across the board. Ethereum is on an 11-week inflow streak, and depending on how flows end up after market close today, ETH could surpass BTC in inflows this week.

We’re only halfway through the month and Ethereum is already having it’s largest monthly inflow ever (by far). Bitcoin is on track to have its best month ever as well.

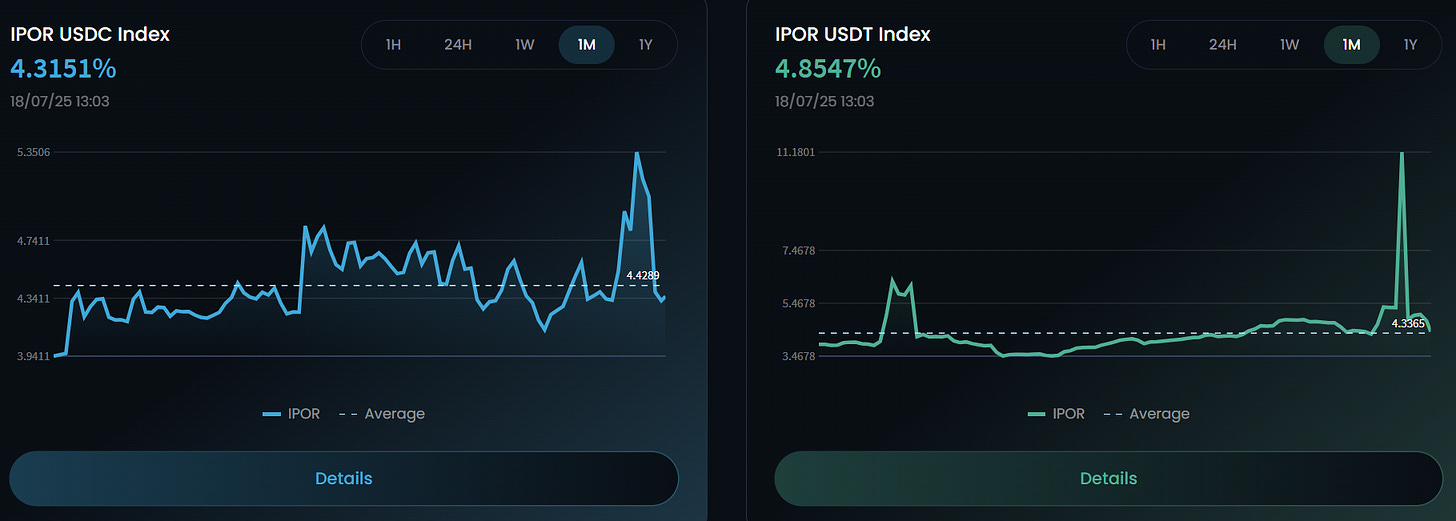

IPOR Stablecoin Indeces

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

Rates for both USDT & USDC are trending up over the last month. They’re still well below the baseline for this year, but the upward trend and spike yesterday show demand for onchain borrowing is increasing.

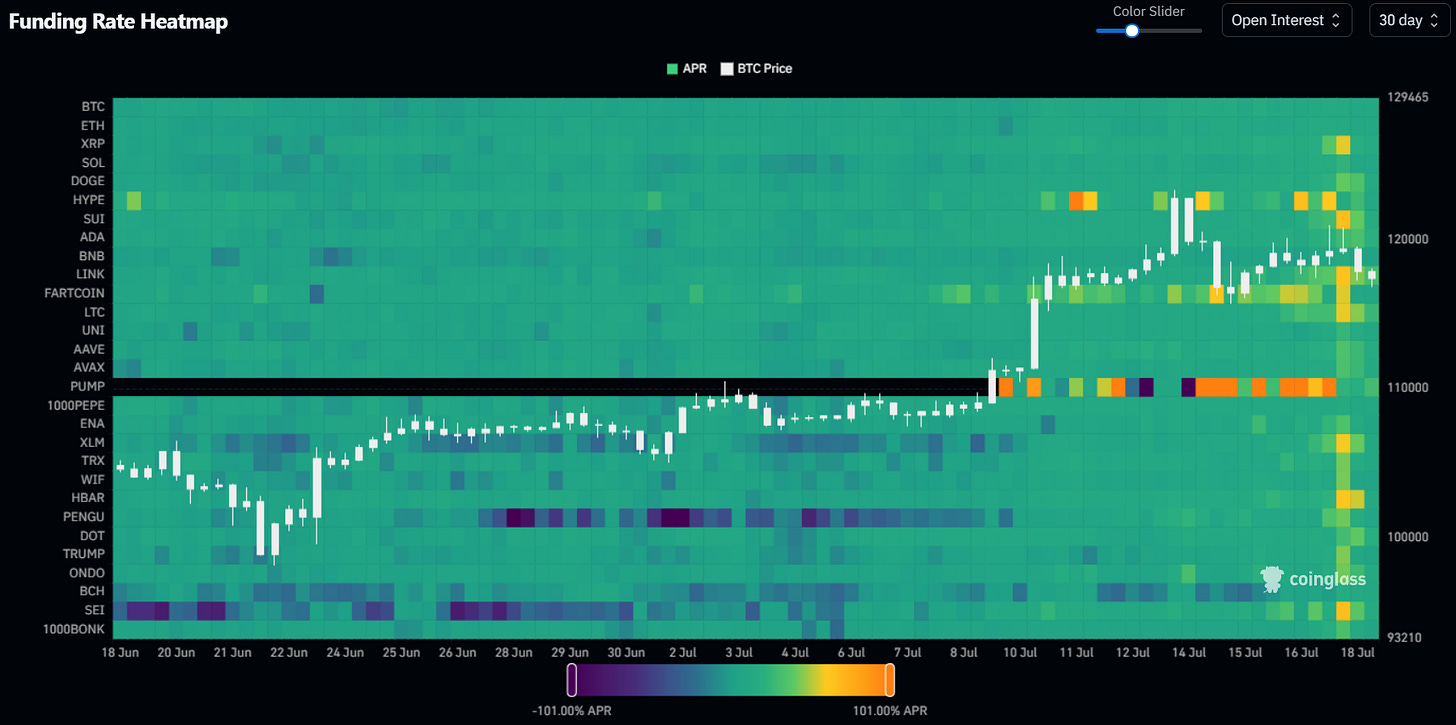

Funding Rate Heatmap

A new addition this week is the Funding Rate Heatmap from Coinglass. It displays funding rates across some of the largest crypto assets.

Brighter colors indicate elevated funding rates for longs, and darker colors indicate low or negative funding rates (indicates large short positions).

Use this to track broad sentiment and compare asset positioning over time. Blow off tops tend to coincide with surges in open interest.

This week, we can see the PUMP token launch brings a high annualized funding rate.

Additionally, on the 17th, many assets experienced a rise in funding rates, indicating larger long positioning across the board. Not high enough yet to be a glaring top signal, but it is something to monitor.

Category and Chain Trends

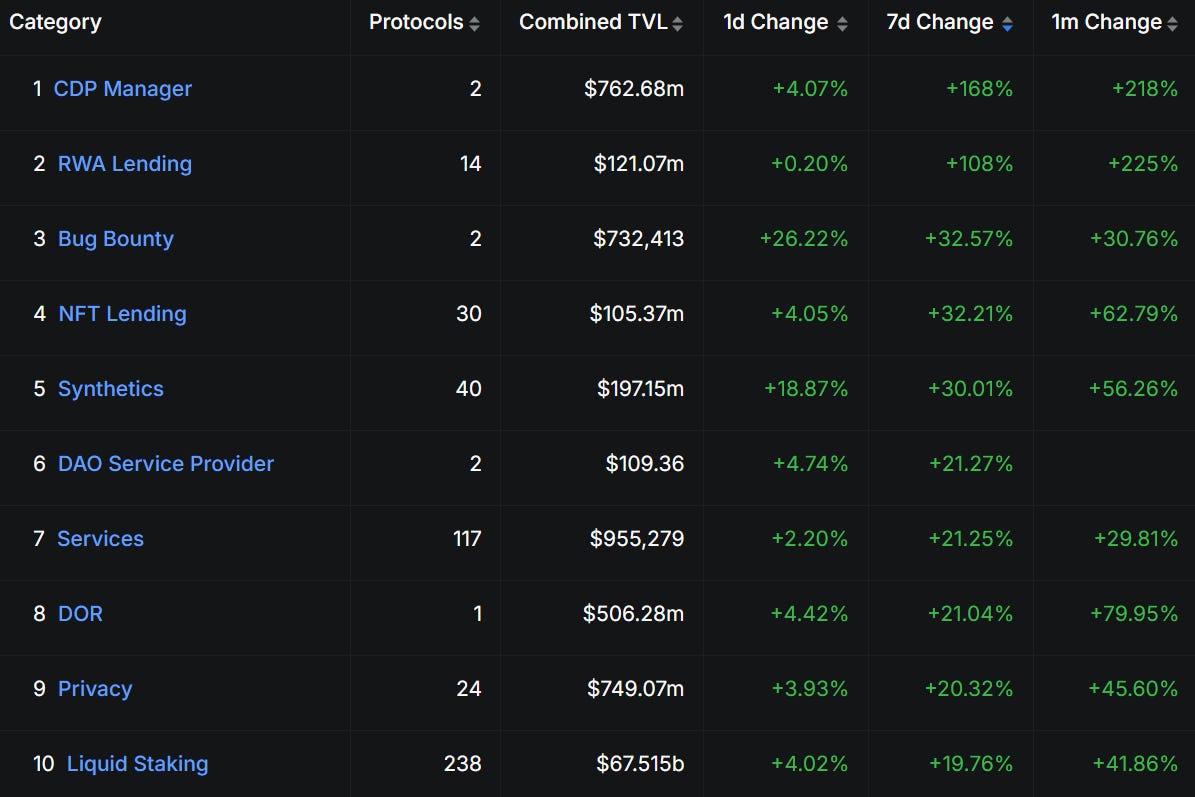

Category TVL Changes

CDP managers are seeing the most growth in TVL for the 2nd week in a row. RWA lending, part of the larger RWA narrative getting some time in the spotlight, saw TVL double this week.

The largest onchain category Liquid Staking is also in the top 10 this week. This is significant: TVL grew over $10b in seven days.

The price of the assets in liquid staking is a large driver of Liquid Staking TVL growth. While most LSTs don’t actually have increased deposits in native assets, LSTs like Binance staked ETH and Sanctum LSTs have more deposited than ever before.

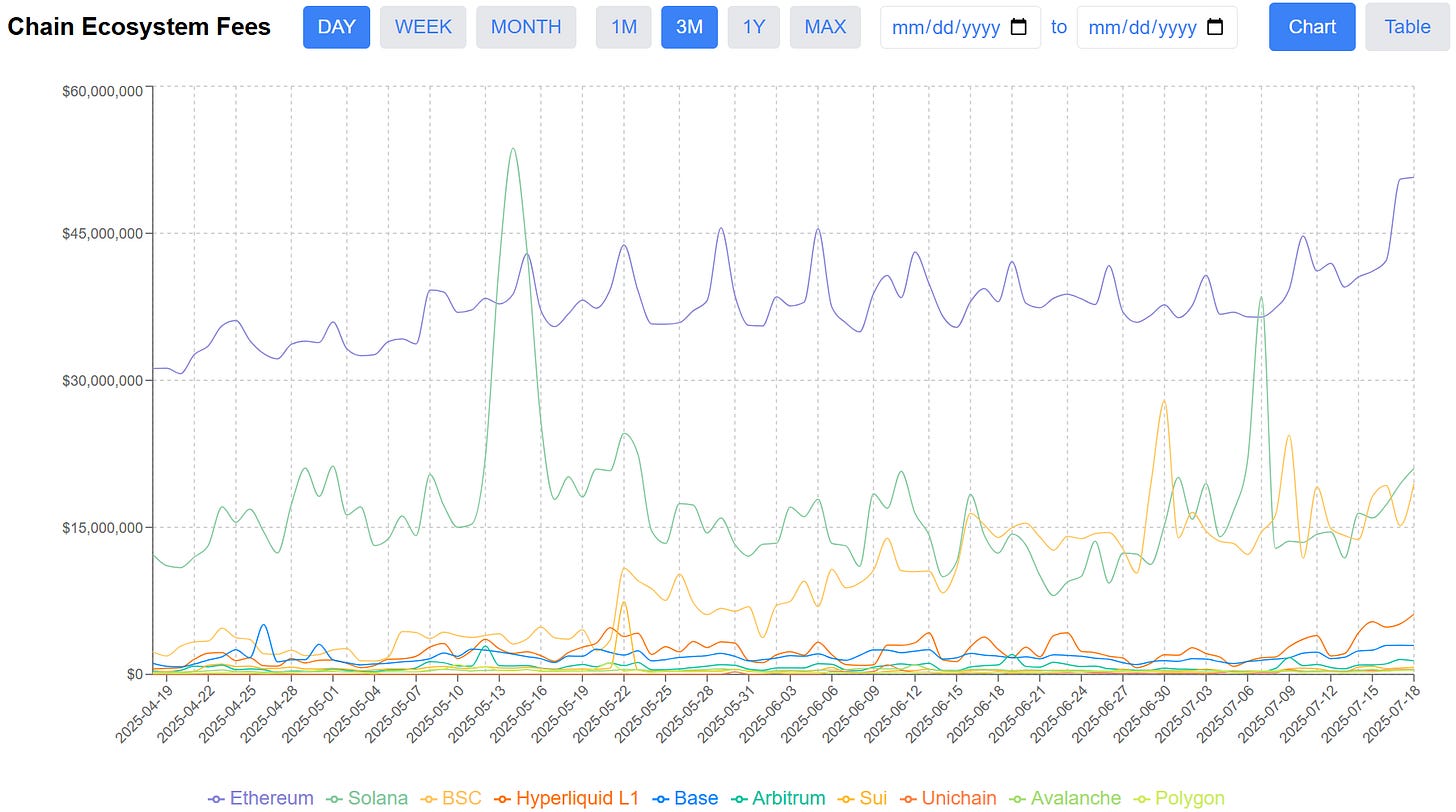

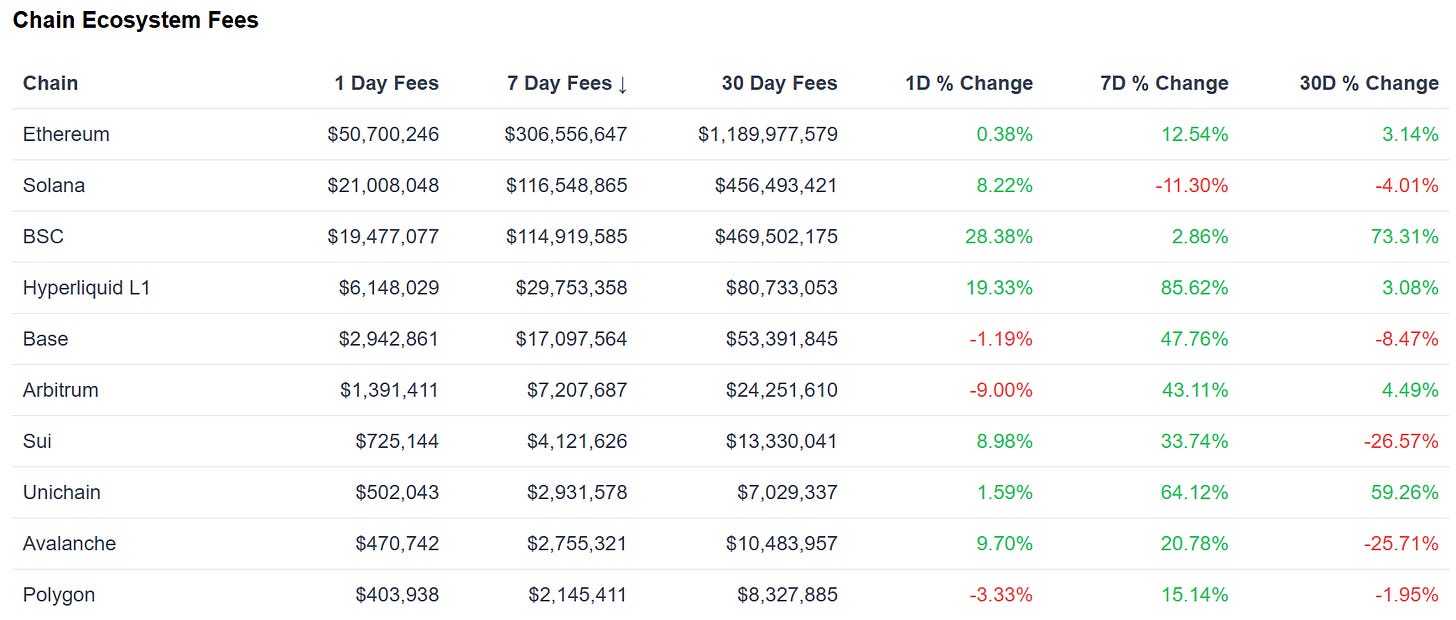

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard myself to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

Most major chains saw double-digit growth this past week.

Hyperliquid 7d fees grew 85%, partially due to a successful LST launch on Kinetiq. Hyperliquid open interest is also at an all-time high.

Other chains Base, Arbitrum and Unichain all saw over 40% growth in chain ecosystem fees over the last week.

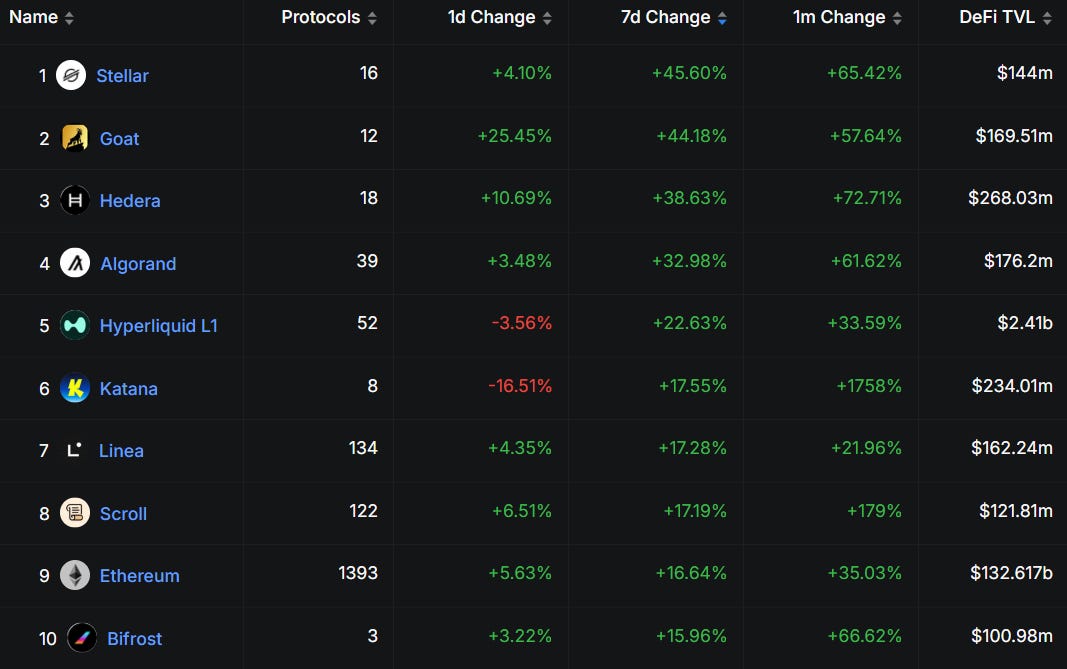

Fastest Growing Chains ($100M+ TVL)

Stellar leads TVL growth this week. Goat, Hedera, and Algorand are all seeing growth across all timeframes.

Linea, Scroll and Ethereum are seeing a lot of TVL growth as well. To see Ethereum in the top 10 when it’s 100x bigger than some of these chains is impressive.

Fastest Growing Chains ($10M-100M TVL)

Story & Abstract see another strong week of growth and Ronin crossed $75m in TVL.

📊Onchain Metrics

Digital Asset Fundamentals

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.