⚡️Don't shrug off this onchain trend

Plus liquidations, portfolio update and Pro call on Wednesday

Read Time: ~6 minutes

⚡In This Edition

One of the largest liquidations in crypto’s history & what it means

Record DEX volume & what to watch for

⚡Metrics Snapshot

Top 100 Coins at a Glance (7d)

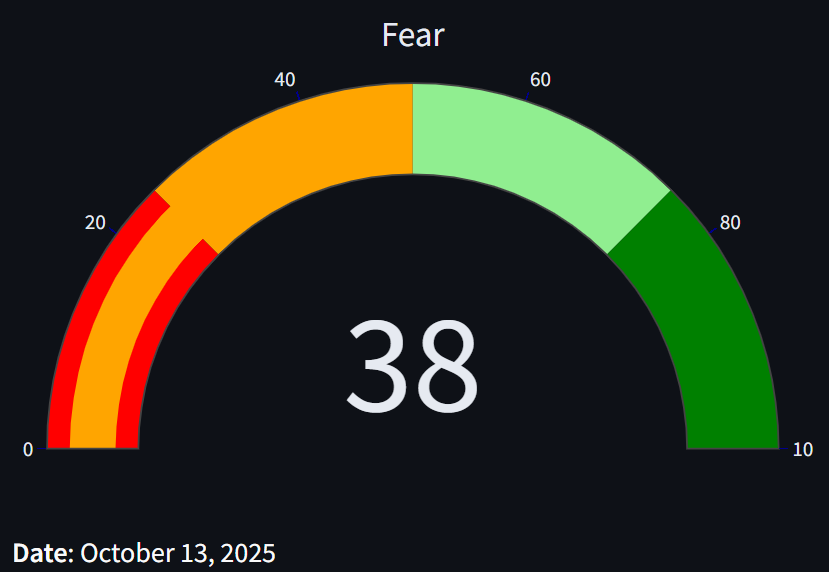

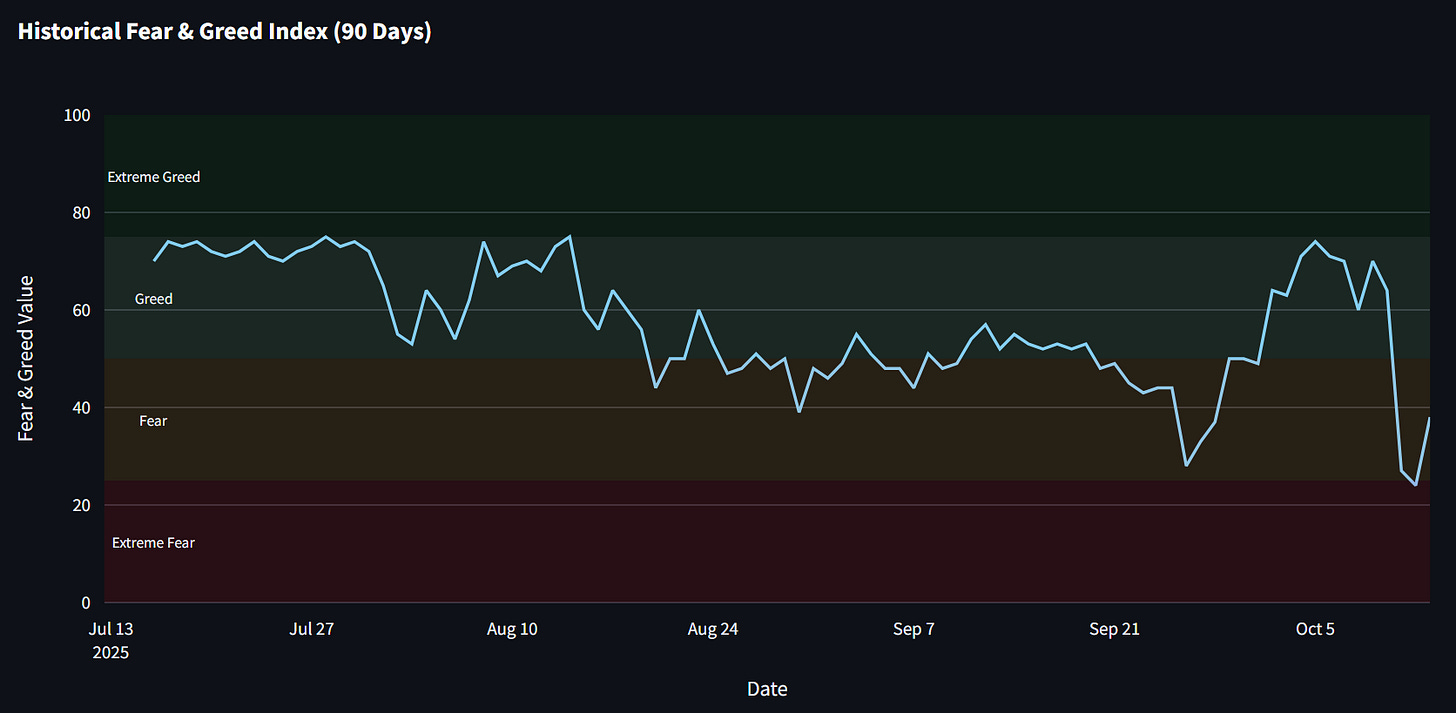

Fear & Greed Index: 38 (Fear)

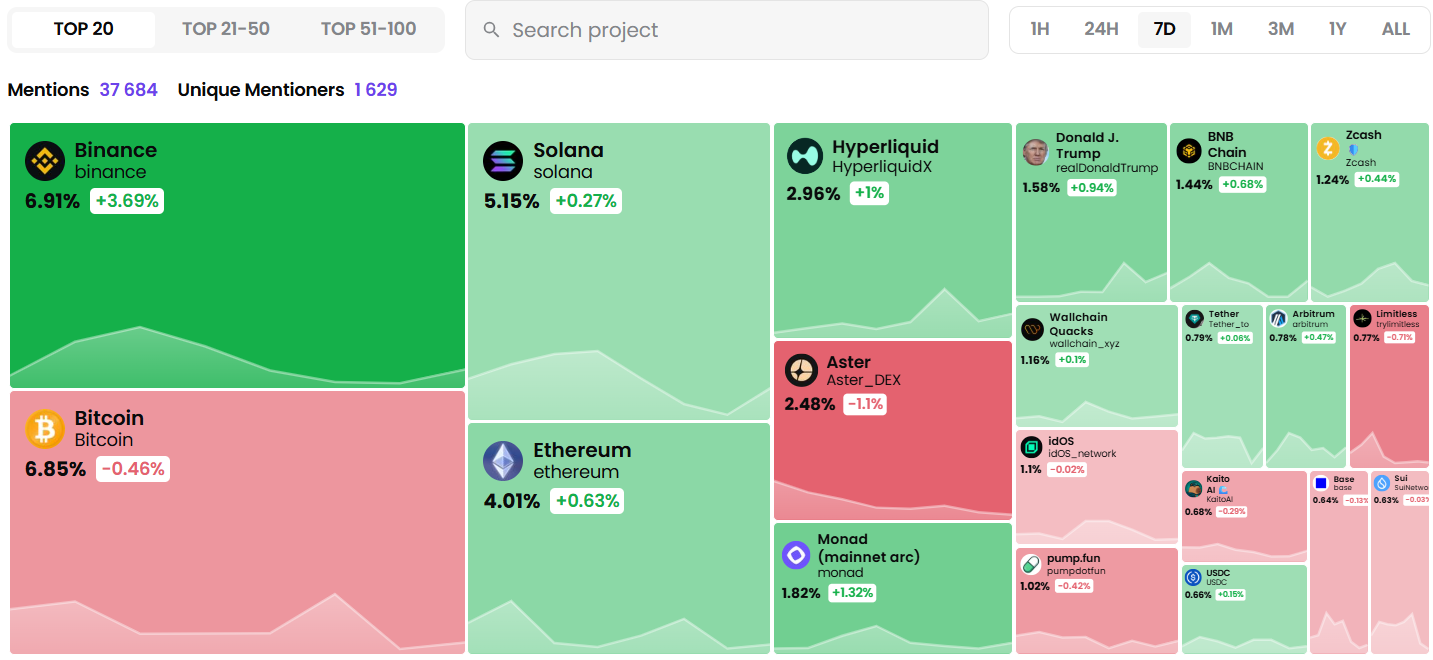

Project Mindshare (7d)

Historical Bitcoin Performance This Week (Week 42)

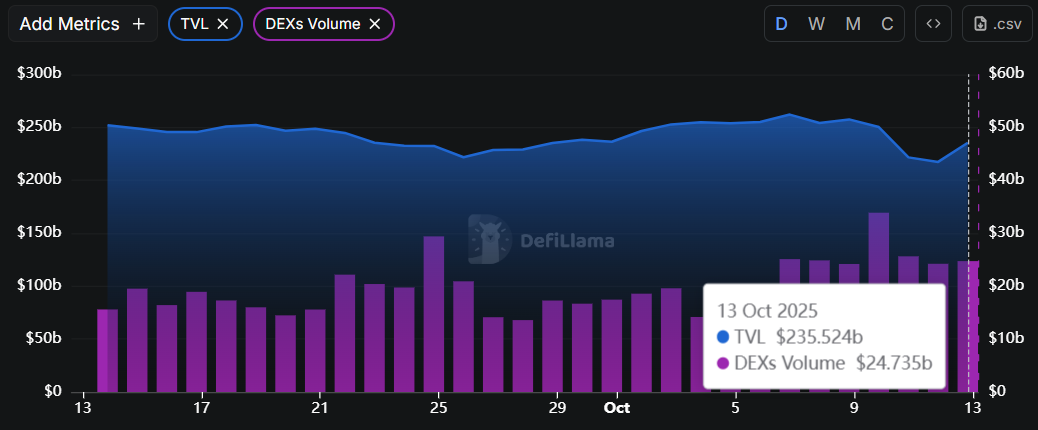

DeFi Market Metrics: Global TVL & DEX Volume

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. One of the Largest Liquidation Events in Crypto History

After a week of massive inflows, a massive selloff triggered by renewed US–China trade tensions led to $16+ billion in liquidations across crypto markets.

Perp DEX open interest fell nearly 50 percent. Some assets temporarily crashed to zero. Even seasoned traders were wiped out.

There’s reason to believe one or more major players may have been liquidated.

Meanwhile, fear metrics spiked, but so far, ETF and stablecoin outflows remain minimal.

What This Means

Flash crashes are part of the game, but this one was fast, violent, and likely systemic.

Watch for signs of contagion in the coming weeks, and expect volatility to remain elevated. Investors should focus on protocols with real cash flow or growing network effects, not speculative assets with weak foundations.

2. Institutional Inflows Continue Despite the Crash

Digital asset investment products saw $3.17 billion in inflows last week, even as prices dropped.

This brings year-to-date inflows to a record $48.7 billion. Friday alone saw all-time high ETP trading volume at $15.3 billion.

Bitcoin led inflows at $2.67 billion. Ethereum drew in $338 million, despite being the most sold on Friday. Solana and XRP flows slowed compared to previous weeks.

What This Means

Despite short-term turbulence, institutions are still allocating. That suggests confidence in the long-term thesis.

Perma-DCA bids from TradFi offer a steady counterweight to retail volatility and reinforce the trend of structural adoption.

3. Prediction Markets Go Global

Kalshi raised $300 million at a $5 billion valuation and expanded to 140 countries.

Polymarket disclosed $205 million in prior funding ahead of its $2 billion deal with NYSE parent ICE, which valued the firm at $9 billion post-money.

Kalshi now commands over 60 percent of global market share, and prediction markets are gaining traction with major platforms like Robinhood and Webull integrating them.

What This Means

Backed by top-tier VCs and major exchanges, prediction markets are becoming a core part of financial infrastructure.

Expect wider distribution, new use cases, and a wave of tokenized prediction products entering mainstream investing. Especially if Tom Brady is going to keep shouting out Polymarket during nationally televised football games.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

Building edge and developing skills

⚡Dynamo DeFi framework for picking investments

Current holdings and the goal of investments

What happened, where we go from here, what to watch

⚡BNB Chain announces $45m ‘Reload’ airdrop to onchain users

160k+ addresses are set to receive the airdrop. Keep an eye out for scams

Monad, Flying Tulip, HIP-3 and more

⚡Are You Missing an Edge?

We’re going live Wednesday to present market research & answer your looming questions surrounding digital assets.

Wednesday at 5:30PM EDT ae’ll cover:

Fundamentals of the strongest projects

Hottest ecosystems

Aggregated cross-industry metrics

Market thoughts & onchain insights

Here’s a sample of September’s presentation. Watch it. If you think the presentation would be helpful, we’d love to see you on Wednesday.

To receive an RSVP for the live presentation, join Dynamo DeFi Pro.

Pro Members receive the research slides and can watch the full presentation anytime.

🔢Onchain Analysis

Record DEX Volume Breakdown

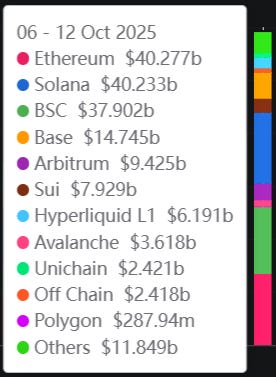

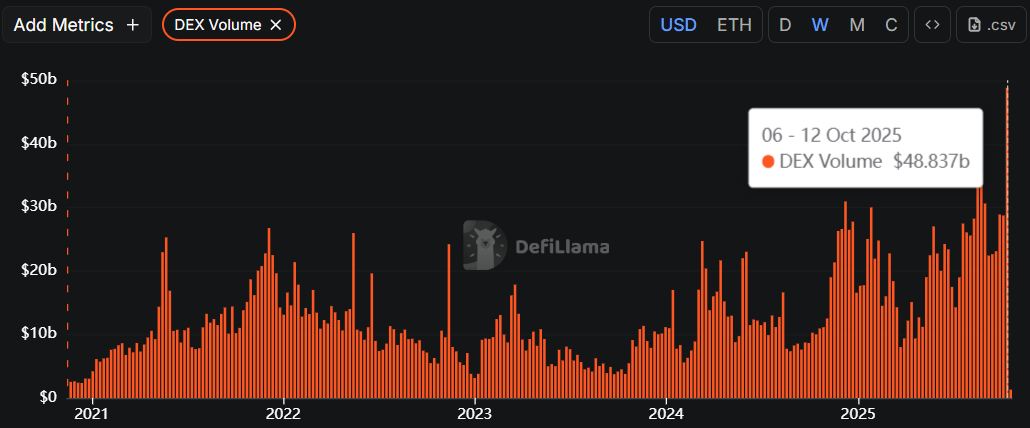

Last week was a record for DEX volume: $177b in total.

Previous record volume weeks were typically dominated by a single chain, like the TRUMP memecoin launch in January hurling Solana volume to all-time highs.

This time, volume was evenly split across Solana, Ethereum & BNB Chain.

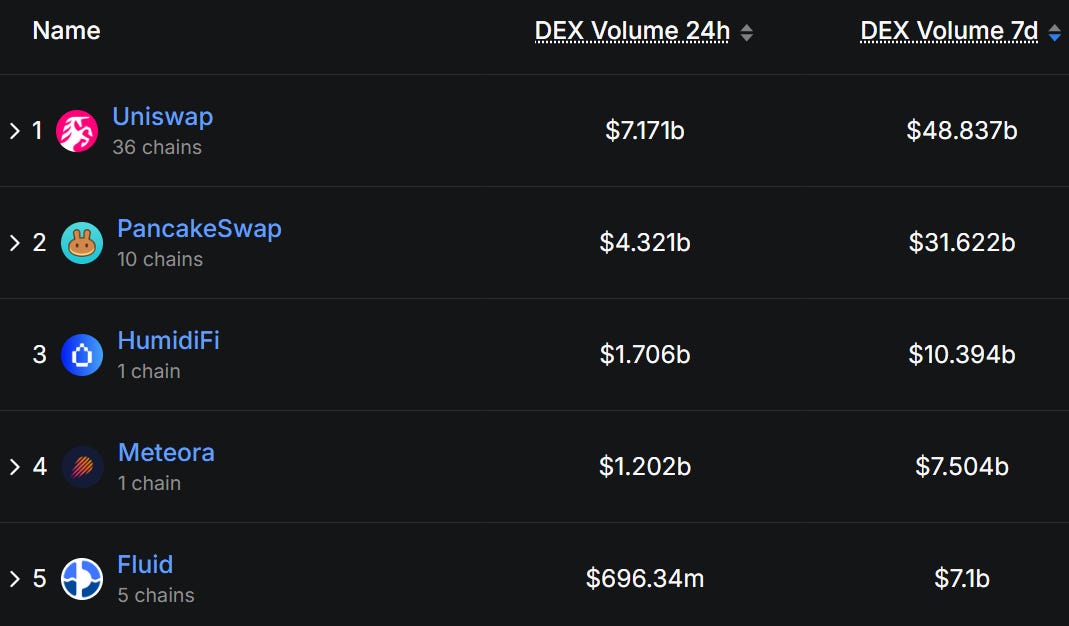

Zooming in to individual protocols, Uniswap had its first $10b volume day and nearly a $50b week, which has never happened before.

Uniswap and HumidiFi are the only DEXs in the top five to have record weeks, although PancakeSwap had its largest week of DEX volume since May of ‘21.

Momentum, a ve(3,3) DEX on Sui broke into the top 10 DEXs last week, facilitating $5b in weekly volume.

It’s encouraging to see an onchain spike in activity, although it’s unfortunate that it was accompanied by such heavy liquidations. There’s likely a cohort of onchain users that tried their hand at perps trading and are heading back to the onchain domain.

DEX volume has been steadily trending up since April. What we don’t want to see is a directional change of that trend after an explosive week. That could signal onchain users packing up and leaving, at least for now.

We’ll be watching DEX activity closely for volume trends and to see which new or existing DEXs are seeing outsized activity.

🚜Farm of the Week

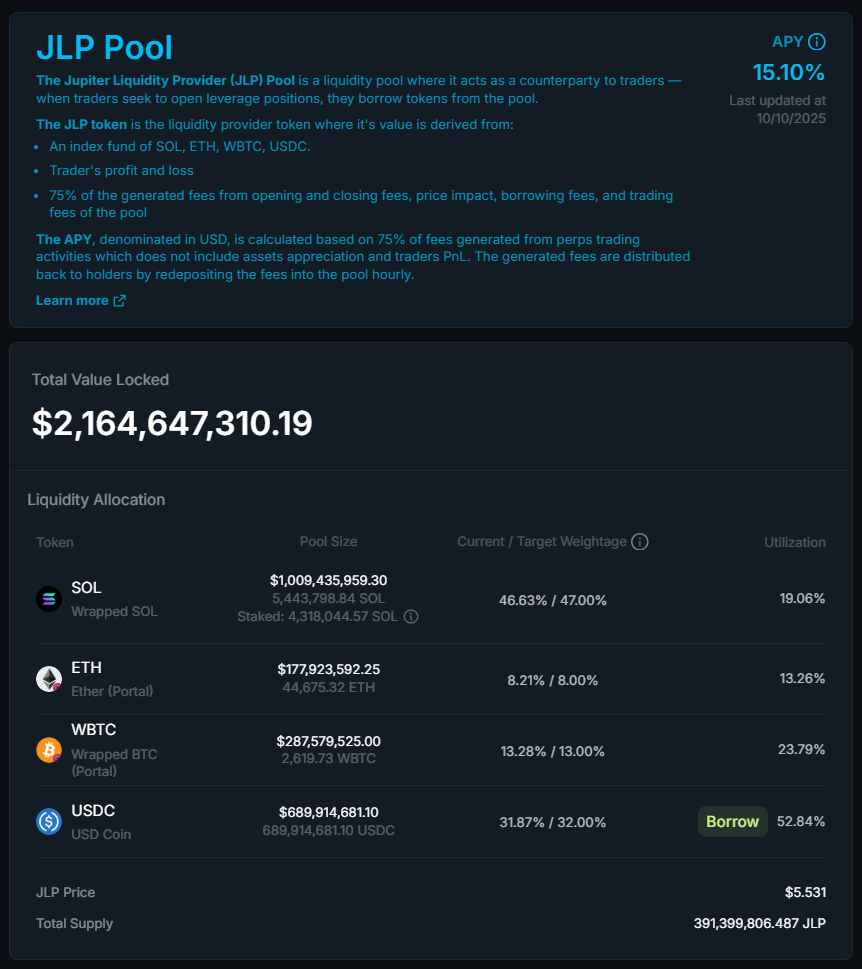

Own the House: JLP

We mention JLP often because it’s been a great asset to own for over a year now.

JLP is made up of a basket of Solana, Ethereum, Bitcoin and USDC.

It earns yield from trading fees and PnL on Jupiter Perps.

Given last week’s volatility and liquidations, it’s likely that the 15% APY shown here (updated weekly) will jump, at least in the short term.

How it Works

Head to Jupiter Perps Earn page and deposit USDC, SOL, ETH or WBTC to swap for JLP. Yield begins accruing immediately and you’ll retain exposure to the underlying tokens.

Risk Level: Medium

Risks

Smart Contract Risk

PnL Risk - if traders win big, JLP loses

⚡Aster vs Hyperliquid: Which Perp DEX has the Best Fundamentals?

🛠️Tool Spotlight

Crypto Fear & Greed Index

I created a website to track the Fear & Greed Index, which analyzes market volatility, momentum, sentiment & search trends.

The index can be used to inform decisions: if investors are too worried, there could be a buying opportunity. If investors are too greedy, there may be a correction coming soon.

Use the time series & distribution charts to track F&G value overtime.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 OPEC Monthly Report - October 13th

📊 Fed Chair Powell Speaks - October 14th

📊 NY Fed Manufacturing Index - October 15th

📊 Philly Fed Manufacturing Index - October 16th

📊 NAHB Housing Market Index - October 16th

📊 ~10% of S&P 500 Companies Report Earnings

Token Unlocks: $250m Unlocking This Week

🔓DEEP (114.5%) - October 14th

🔓STRK (5.64%) - October 15th

🔓XCN (0.82%) - October 15th

🔓SEI (1.15%) - October 15th

🔓ARB (1.99%) - October 16th

🔓TRIBL (1.28%) - October 17th

🔓ZK (3.49%) - October 17th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Alvara’s BSKT launch - October 14th (Source)

🚀 Snake8 hardfork - October 14th (Source)

🚀 $MON airdrop claim portal opens - October 14th (Source)

🚀 OpenxAI public release - October 16th (Source)

🚀 Governance Advisor launch on Delysium - October 16th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi