⚡Crypto after the Crash [Dynamo DeFi Pro Report]

What happened, where do we go from here, what to watch for

💡Dynamo’s Thoughts

We had an entirely different newsletter created with a write-up on MetaDAO, Futarchy, and the usual onchain metrics that we share in this newsletter. We’ll still publish that at some point soon. But given the insane crash on Friday, I thought it was better to address that.

For those who missed it, this was one of the biggest (perhaps THE biggest in $ terms) crypto liquidation event in history. Some coins got liquidated down to literally zero:

The immediate cause was announcements about a new round of tariffs and export controls between the US and China. But the suddenness and severity of this crash caught even many experienced crypto investors off guard.

Some traders, such as “Bonk Guy”, who had successfully survived multiple downturns over the past few years, were wiped out.

Let’s put some numbers to the chaos.

Total Open Interest on Perp DEXs dropped by about 50%:

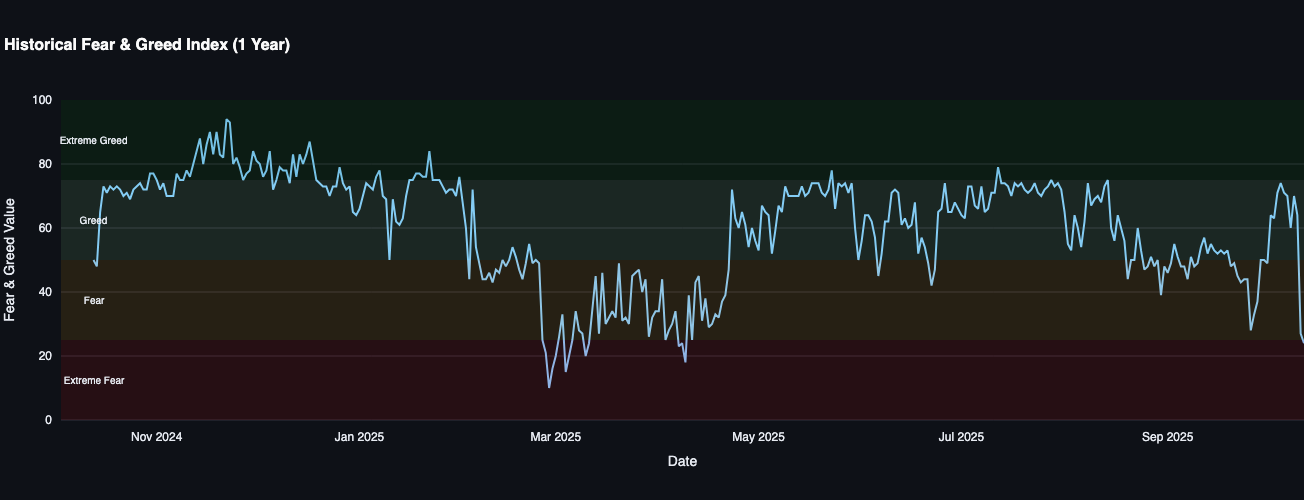

The Fear & Greed Index plummeted to Extreme Fear, its first time doing so since April:

Over $16b was liquidated (the real number may be even higher):

My initial impression is that this looks worse than it was. Many people have been farming Perp DEXs heavily with large nominal positions, but low principal (due to those exchanges allowing high leverage). The actual amount of money lost was far less than was reported.

That being said, the extreme severity of this crash leads me to think something more is going on. I wouldn’t be surprised to learn in the coming weeks that one or multiple major players were wiped out. Be on the lookout for that and play it cautious when rumors surface; oftentimes there is no downside to derisking based on rumors and being wrong, but heavy downside to not derisking.

Looking to the future, what can an intelligent crypto investor do to avoid being carried out on a stretcher in situations like this and to position themselves for the future:

Be smart about leverage - If you’re heavily levered, a flash crash can zero you out. Simple as that. And for many people it’s best to stick to spot; if you have to ask whether that’s you, it probably is. But also note that I said “be smart”, not avoid entirely. There is a place for modest leverage if done right. A smart way to use leverage, for example, is to hold assets with a multi-year timeframe and borrow against them as they go up in price.

Focus on cash flow or network effects - There are really only two types of cryptos that interest me at this point. The first are those that produce cash flow. These are the real businesses and liquidity pools. If you have cash flow, dips are exciting. If you have cash flow, dips mean buying more of your favorite tokens at a discount. If you don’t have cash flow, dips just mean that your assets are down. The second type of crypto I’m interested in are those that benefit from growing network effects. For example, Hyperliquid benefits from more dapps launching on HyperEVM, Zcash benefits from more ZEC moving into the shielded pool, Ethereum benefits from more RWAs coming onchain.

Cut losers - There’s no nice way to put it. Some charts look dead. If a coin is at a multi-year low even after this bounce and has no convincing catalyst, it’s worth considering whether it may be a weak horse that’s worth cutting.

Follow these rules and you’ll already be better off than most market participants.

And as far as what to watch for in the future, I’m laser-focused on whether liquidity continues to enter the space or begins to leave:

Total stablecoin market cap dipped ever so slightly by just under $1b today.

This is nothing to worry about yet. And coming on the heels over over $100b in inflows, it feels almost ridiculous to even comment on it. Watch in the coming days to see whether stablecoin outflows pick up or if inflows resume.

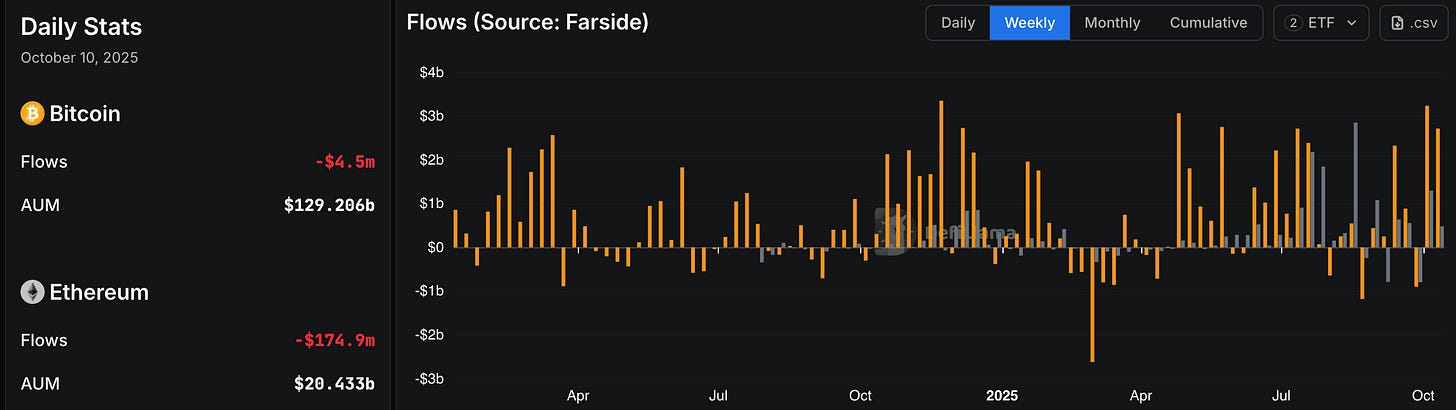

ETF flows are the other big liquidity movement to watch. On Friday, BTC and ETH ETFs saw very small outflows, but this was before the massive liquidation event.

The big number to watch in the coming days is whether capital outflows intensify and how long it takes for inflows to resume. In the past, outflows have rarely continued beyond a few weeks.

My theory on this is that many people are now permanently DCAing into Bitcoin and Ethereum ETFs, independent of price. This changes the nature of these markets and makes them less reflexive to price than they have been in past years. As a result, when a major event happens, you might have some initial selling, but as panic selling subsides, the perma-DCA takes control again and inflows resume.

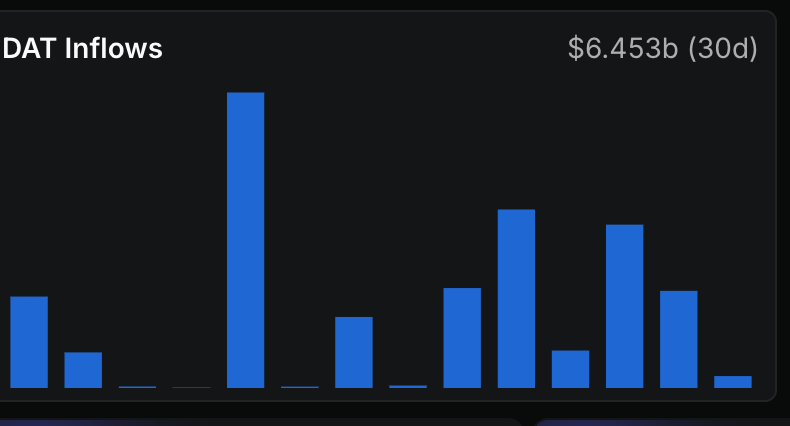

Finally, I’ll be keeping an eye on Digital Asset Treasury purchases. These have slowed down considerably in recent weeks.

Here I’m looking for two things:

Do capital inflows from DATs resume? These have been a huge driver of price this year.

Do any DATs start to liquidate assets? If this happens, it could spell bigger trouble.

While I still believe we’re in the mid-stages of a long-term secular adoption curve, I’m not ruling out the possibility that we’re near the end of a cyclical bull-run. If that’s the case, expect some near-term dips before fundamentals take over.

Announcements

A few quick announcements for our readers:

We’ve heard your feedback about wanting more trending altcoins. Last week, we published a portfolio update and we have a list of the top fundamentals altcoins coming soon:

This Wednesday at 5:30pm we’ll hold our monthly group Zoom. Find details to join here:

We’ll be back to our normal newsletter format soon. Hoping for fewer unexpected crashes ahead.

📊Onchain Metrics

Digital Asset Fundamentals

This section dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens. Note that these metrics were collected prior to this weekend’s crash, but most are still relevant.

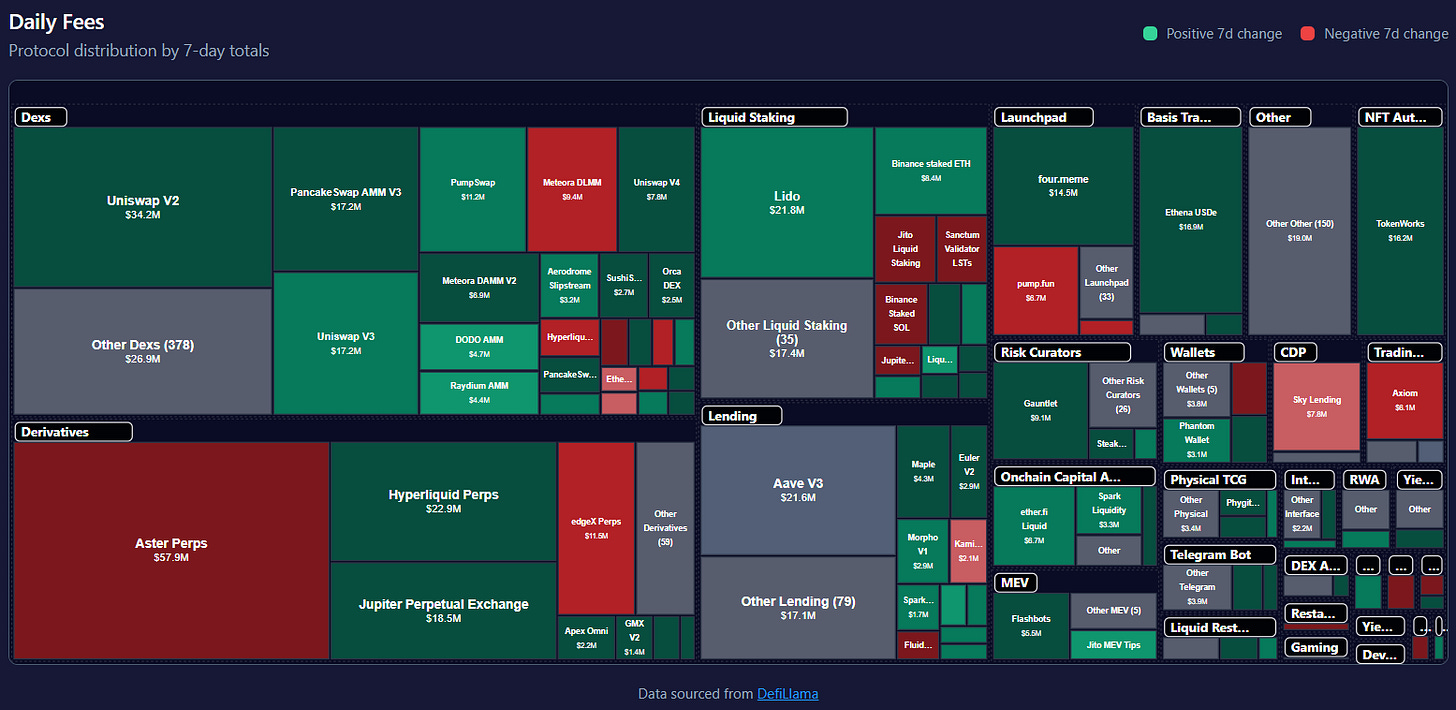

Fees & Revenue Treemaps

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.