⚡️You couldn't ask for a better crypto environment than this

Plus what the White House and SEC are doing to make crypto go mainstream

Read Time: ~6 minutes

Two major pieces with serious pro-crypto language came from the SEC and the White House last week. Read on for a brief rundown of exactly what happened and what it means moving forward.

We’ve added new charts and news summaries to help you understand the market at a glance.

We’ve rolled out new formats for this newsletter and our weekly metrics newsletter.

All of the analysis you’re used to is still there.

Below you’ll find numbers-driven market context, news summaries, onchain insights, yield farms, airdrop farms and tools we use every day.

We think you’ll love it. Give it a read, and reply with any feedback!

⚡In This Edition

Market Metrics at a Glance

What to know this week in crypto

Onchain Analysis: insights giving you the most important things happening onchain

Farm of the Week: Understand exactly how to capitalize on yields or airdrop opportunities onchain

Macro events, new launches and token unlocks for the week

DeFi tools and our favorite resources

⚡Metrics Snapshot

Top Performers this Week

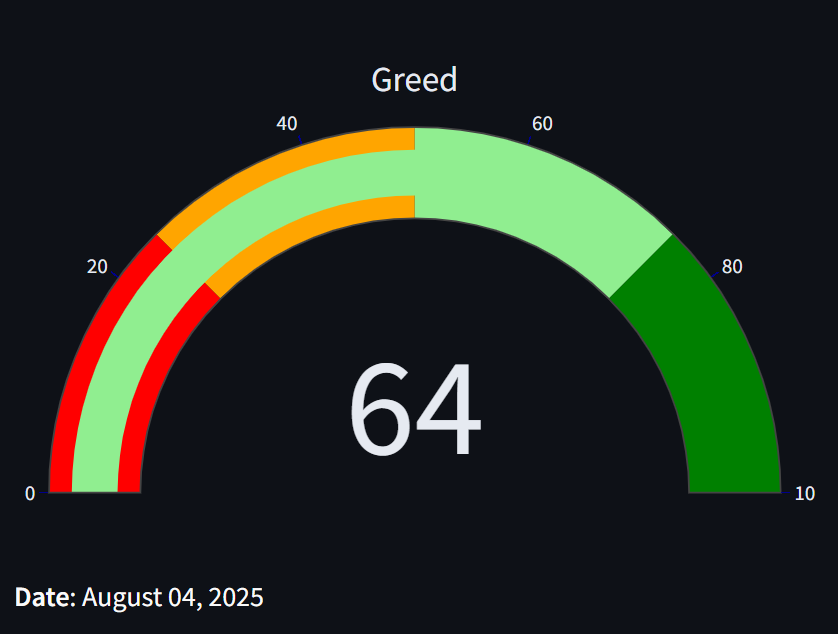

Fear & Greed Index: 64 (Greed)

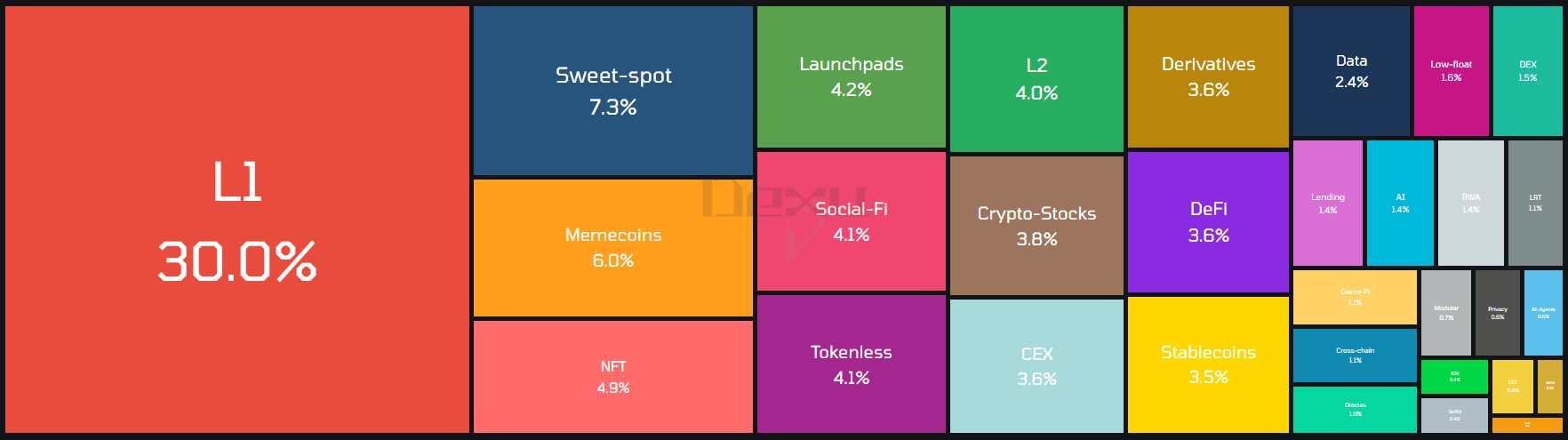

Narrative Mindshare (7d)

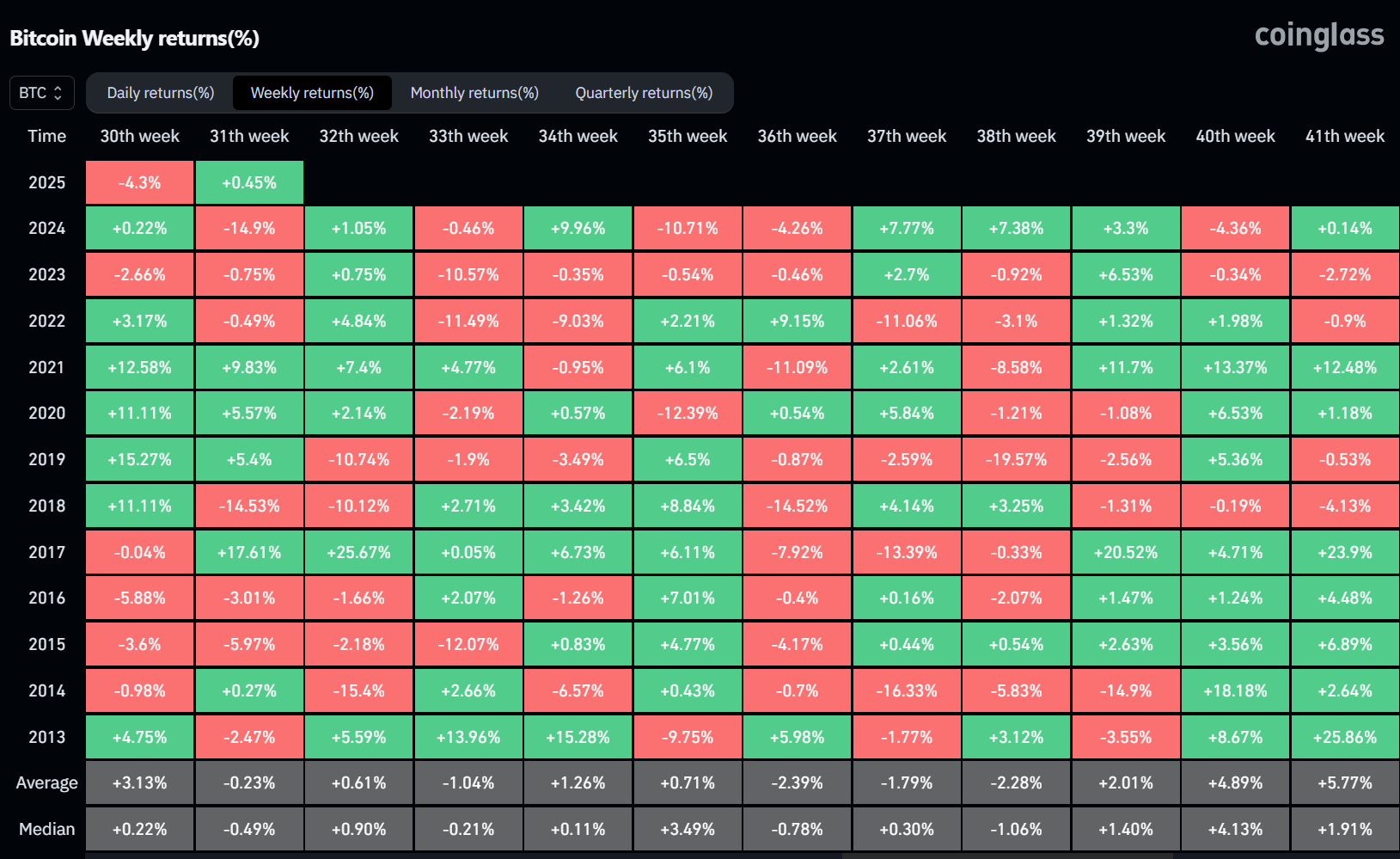

Historical Bitcoin Performance This Week

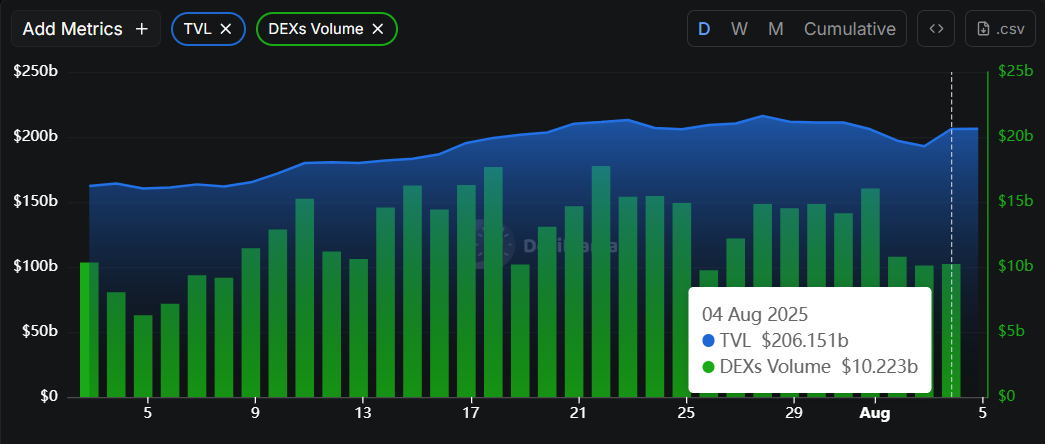

DeFi Market Metrics: Global TVL & DEX Volume

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. White House Releases Landmark Digital Assets Report

The White House published a detailed Digital Assets PDF report outlining its vision for making the U.S. the global leader in digital assets. The framework highlights stablecoin legislation, market structure clarity, and an explicit rejection of CBDCs.

What This Means: Crypto now has unprecedented government backing, a reversal from the hostile stance of just two years ago. Expect more institutional adoption and U.S.-based innovation as policy clarity improves.

2. SEC Launches “Project Crypto”

SEC Chairman Paul Atkins announced Project Crypto, calling it the agency’s “north star” for supporting the Trump Administration’s push to make America the crypto capital of the world. The initiative emphasizes transparent rules, market accessibility, and fostering blockchain innovation.

What This Means: With both Congress and the SEC aligned, U.S. regulators are transitioning from obstruction to acceleration. This could mark the start of a secular bull market fueled by domestic policy tailwinds and rising liquidity. The onchain economy is like a coiled spring.

3. First Digital Asset Outflows in 15 Weeks

After $883m in early-week inflows, digital asset funds swung to $223m in net outflows, breaking a 15-week streak. Bitcoin led with $404m out, while Ethereum marked its 15th consecutive week of inflows at $133m.

What This Means: It was likely a buildup of leverage followed by disappointing macro news that drove the reversal. Despite the pullback, sustained ETH inflows suggest investors remain confident in altcoin momentum even as BTC reacts to macro headwinds.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡The Onchain Economy is Like a Coiled Spring

Projects with strong onchain businesses stand out - but will ETF's limit the rotation?

90 accounts to follow for DeFi strategies, airdrops, and macro & market insights

⚡Ethena is aiming to scale to $30-50b USDe

Summary of Ethena founder’s podcast appearance: goals, revenue & future plans

Learn advanced yield strategies and how to find DeFi opportunities

⚡What the F*ck Happened to Crypto x AI?

What needs to change for a project to get PMF

⚡Complete Metrics Package: Level Up Your DeFi

The Dynamo DeFi Pro newsletter dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value behind different tokens. We’ve revamped this recently to include a wide variety of metrics, such as:

Onchain highlights

Financial analysis

DeFi metrics

Sentiment analysis

Open interest rates

ETF Flows

Read last week’s newsletter here (first few sections free):

Among the metrics, 3 custom visuals are included:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

To get these insights delivered to you each week, become a Pro member.

🔢Onchain Analysis

Bitcoin Pulls Back After Record Month

July was a hot month for digital assets.

Bitcoin had its highest monthly close ever

ETH ETFs saw record inflows and 1.2m ETH were acquired by DATs

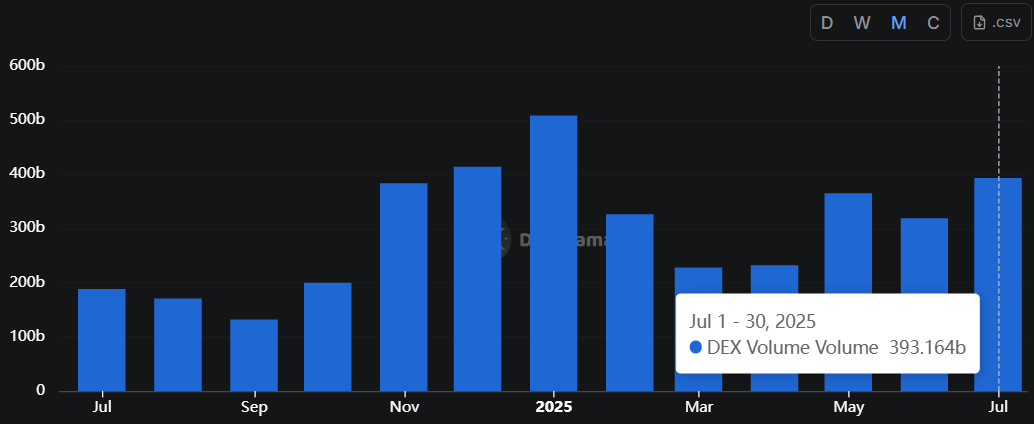

Onchain DEX volume totaled $393b, the third highest monthly volume on record

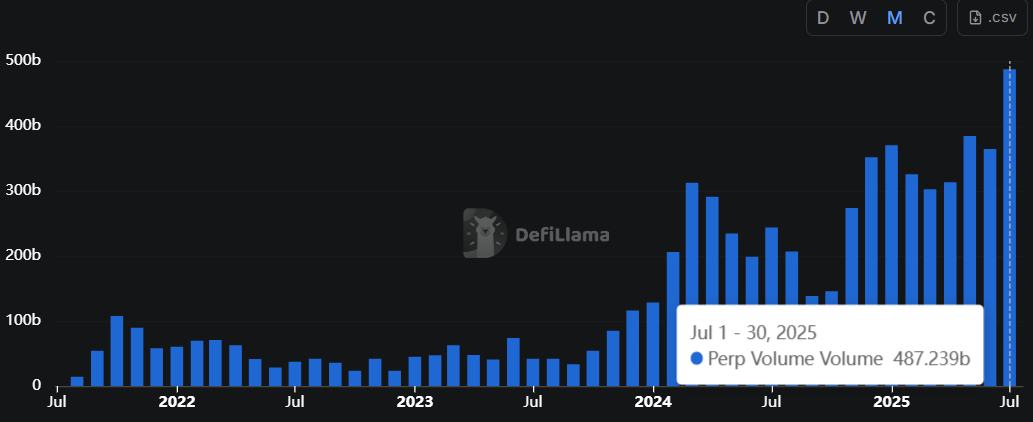

Onchain perp volume had a record-shattering $480b month, led by Hyperliquid

However, last Thursday, BTC fell from $118k all the way to $112k on Saturday.

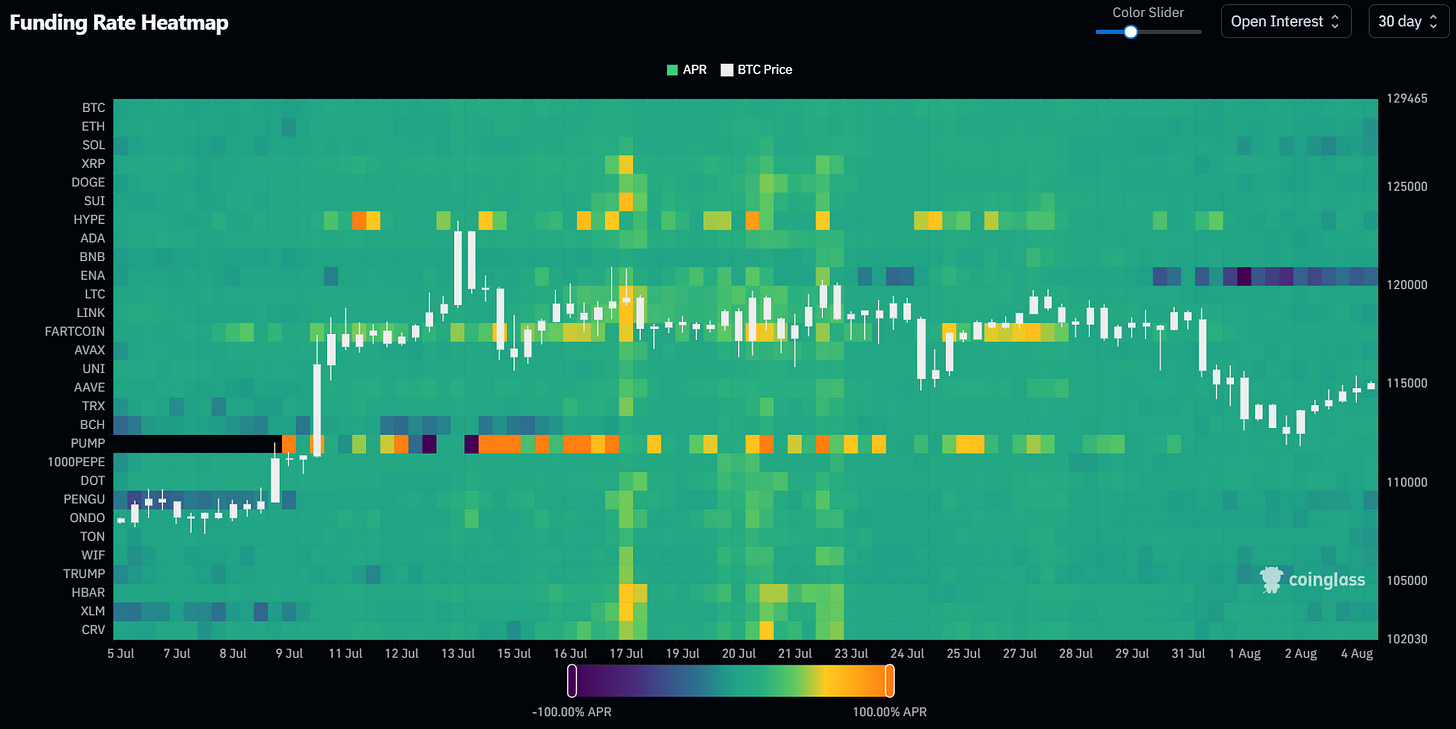

Whether this is an extended break below BTC’s range or just a blip on the radar, funding rates are trending negative across the board, indicating larger short positions and broader neutral positioning for traders. This is after over $1b in long positions were liquidated last Thursday & Friday.

Looking at the 30-day funding rate heatmap, we can see that the market was running a little too hot.

We highlighted this in last week’s Pro newsletter. For the first time in over three weeks, ETH funding is negative, representing a more balanced perps market.

Given the news we had last week from the White House & SEC, and fundamentally strong onchain projects seeing a surge of usage in July, our conviction in the bright future for the onchain economy continues to be validated.

While leverage traders battle for the next move, we’re laser-focused on finding protocols & onchain businesses that will be at the forefront of adoption over the next few years.

To join the community of DeFi heavy hitters finding these protocols, become a Pro member.

🚜Farm of the Week

Project X on HyperEVM: Yield + Points

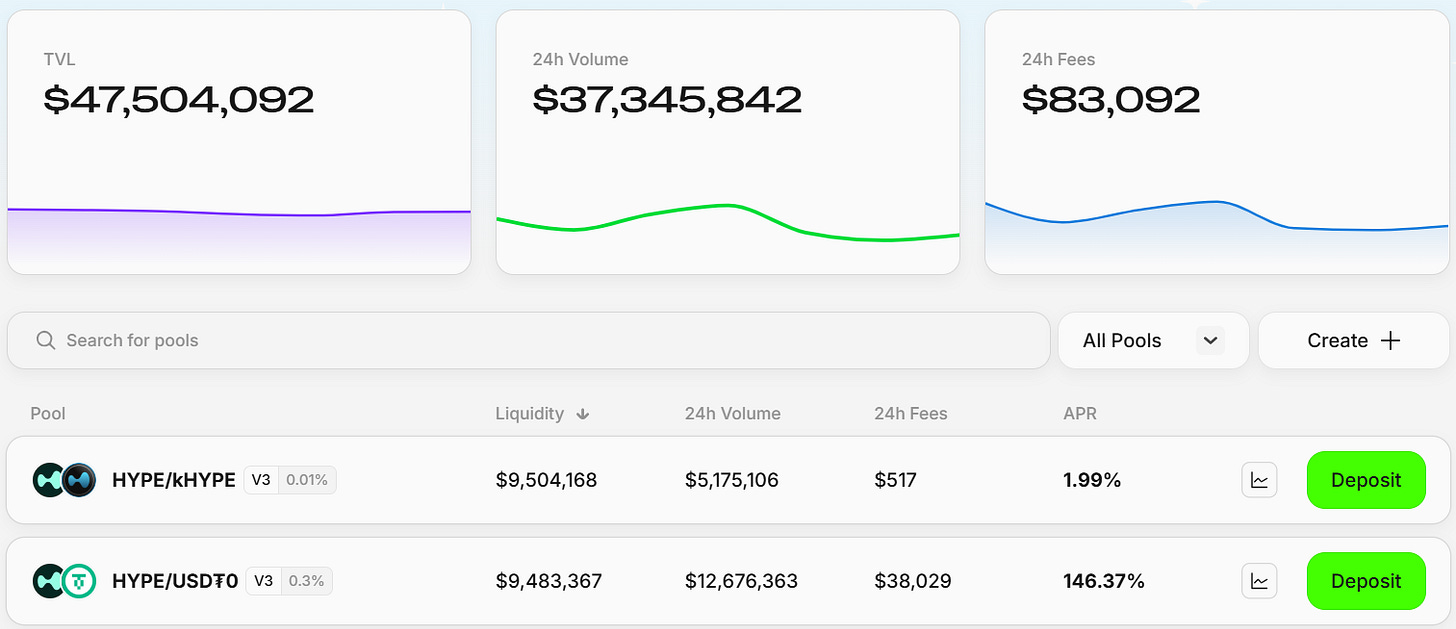

Project X is a DEX that launched recently on HyperEVM. The DEX recently crossed $50m in TVL and has a points system: providing liquidity on Project X is a great way to earn yield and protocol points.

Most of the points are going toward liquidity providers.

How it Works

Head to Project X’s website and connect your wallet. You’ll need HYPE as your gas token (for our full guide on how to get airdrops on Hyperliquid, click here).

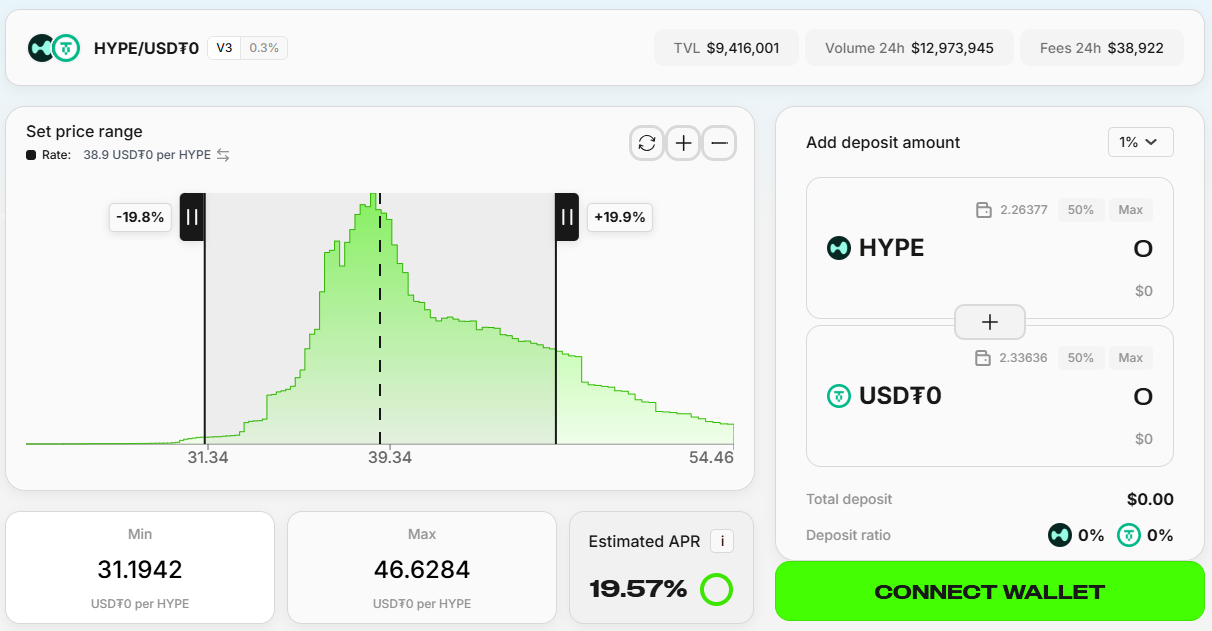

The HYPE/USDT0 pool is earning lots of fees at this moment. That can and will change, but for now, the APR is solid.

You can swap for USDT0 on Project X’s Swap page.

Click deposit, select a range (given recent volatility, a 20% range on either side should minimize your probability of impermanent loss), add your deposit amounts and hit the big green button.

Your position will begin earning yield and points.

Risks

Smart Contract risk

Impermanent loss risk

Risk level: Medium

⚡Why the SEC is Going All In on Crypto

🛠️Tool Spotlight

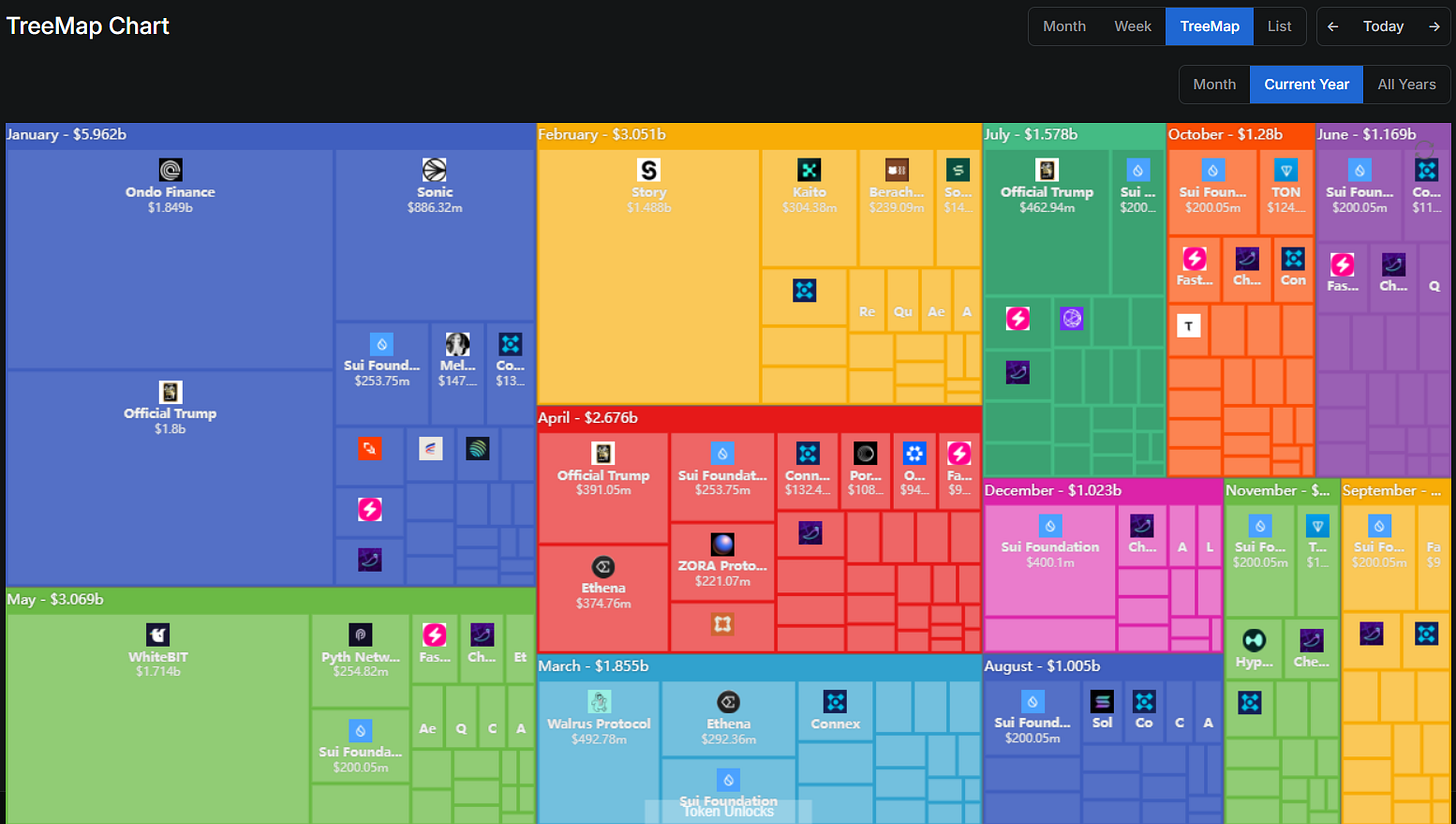

DefiLlama Token Unlocks

DefiLlama’s Token Unlocks dashboard tracks & displays upcoming unlocks, and can be sorted by unlock date, market cap, percentage unlocked and more.

There’s also a helpful calendar that breaks down all upcoming unlocks with multiple views & time frames.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 July S&P Global Services PMI data - August 4th

📊 10-Year Note Auction - August 6th

📊 Initial Jobless Claims data - August 7th

📊 Total of 5 Fed speaker events this week

📊 ~20% of S&P 500 companies report earnings

Token Unlocks: $90m Unlocking This Week

🔓SD (1.17%) - August 4th

🔓GMT (2.26%) - August 7th

🔓IMX (1.31%) - August 8th

🔓ENS (2.83%) - August 8th

🔓FLR (2.85%) - August 9th

🔓AGI (3.6%) - August 10th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Bucket protocol new deBUT model launch - August 4th (Source)

🚀 Seeker (Sol mobile) ships - August 4th (Source)

🚀 Baby social airdrop - August 4th (Source)

🚀 Rice AI launch on TokenFi - August 5th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi