⚡Strong Fundamentals Win the Week [Dynamo DeFi Pro Report]

Plus crypto fundamentals visualizations, which protocols won this week, and ETH ETF inflows break records

💡Dynamo’s Thoughts

The “Big Four” closed the last week either down slightly or flat. XRP took a larger hit after wallets associated with Ripple co-founder Chris Larsen transferred ~$140m XRP to exchanges.

While prices are flat, onchain metrics are anything but.

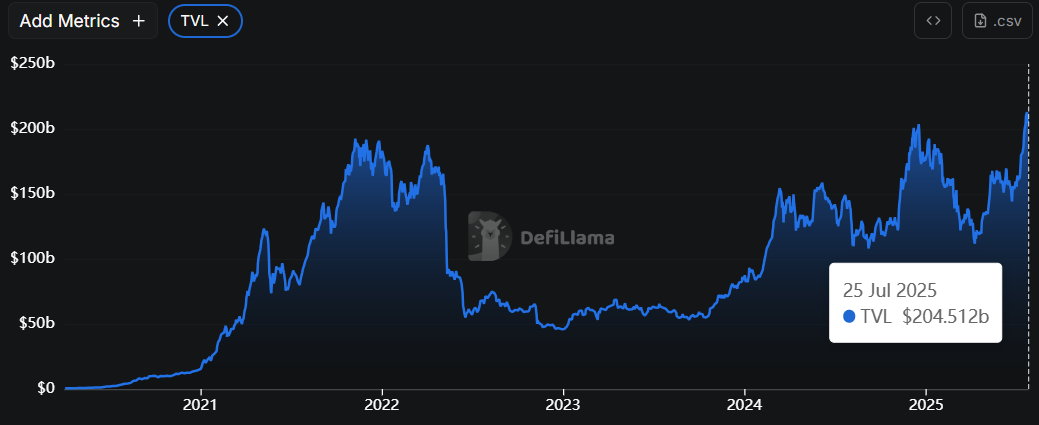

Total DeFi TVL (including liquid staking) crossed $200b for the first time since December, pushing to an all-time high of $213b.

Ethereum’s Big Week

Liquid Staking project TVL was a major beneficiary of the increase in TVL, largely due to ETH’s price running 50% over the last month. Ethereum is also the only member of the Big Four (as referred to by tradfi / news outlets) that’s up on the week.

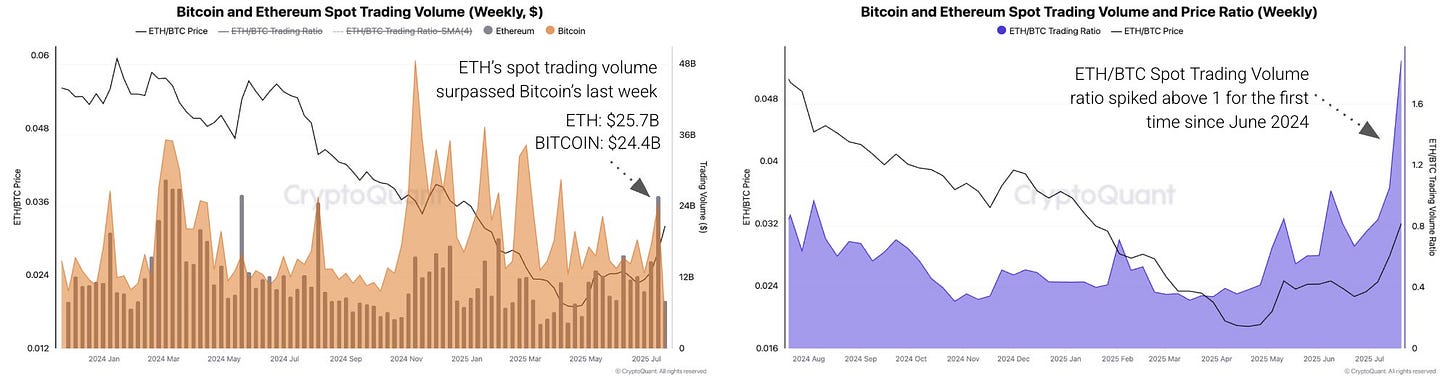

For the first time in over a year, ETH spot volume overtook BTC spot volume.

Top signal? The start of alt season? TradFi catching onto crypto’s use cases that extend beyond Bitcoin?

Probably a bit of all 3. Either way, it’s a sign that investors are moving down the risk curve from Bitcoin to alts.

There’s been a clear rotation to Ethereum. While this is encouraging for altcoins, this is the first crypto market cycle where ETFs are a factor and so far those are limited to BTC and ETH.

Alts Tied to Strong Onchain Businesses Stand Out

Amidst the slowdown in price action among majors, Ethena had a very strong week. The team announced their intention to become the first stablecoin developer fully compliant with the GENIUS Act through a partnership with Anchorage Digital.

Total market cap of their stablecoin USDe increased by 25% (about $1.4b) in just a week. sUSDe holders are earning 12% APY, which is a solid rate for a stablecoin with such a large market cap.

Ethena’s revenue sources (staked assets and perp funding) have the makings of a fundamentally sound business. While speculative demand for altcoins is lower than previous years, ENA doubling in a month shows the market has an appetite for projects with real fundamentals.

Ethena is also the latest beneficiary of the DAT (Digital Asset Treasury) trend, with StablecoinX announcing a $360m raise to purchase the ENA token.

At the time of the announcement, that amounted to about 8% of ENA circulating supply.

Guy (founder of Ethena) wrote an insightful post on the DAT trend and addressed key concerns related to the long-term sustainability of treasury capital structures.

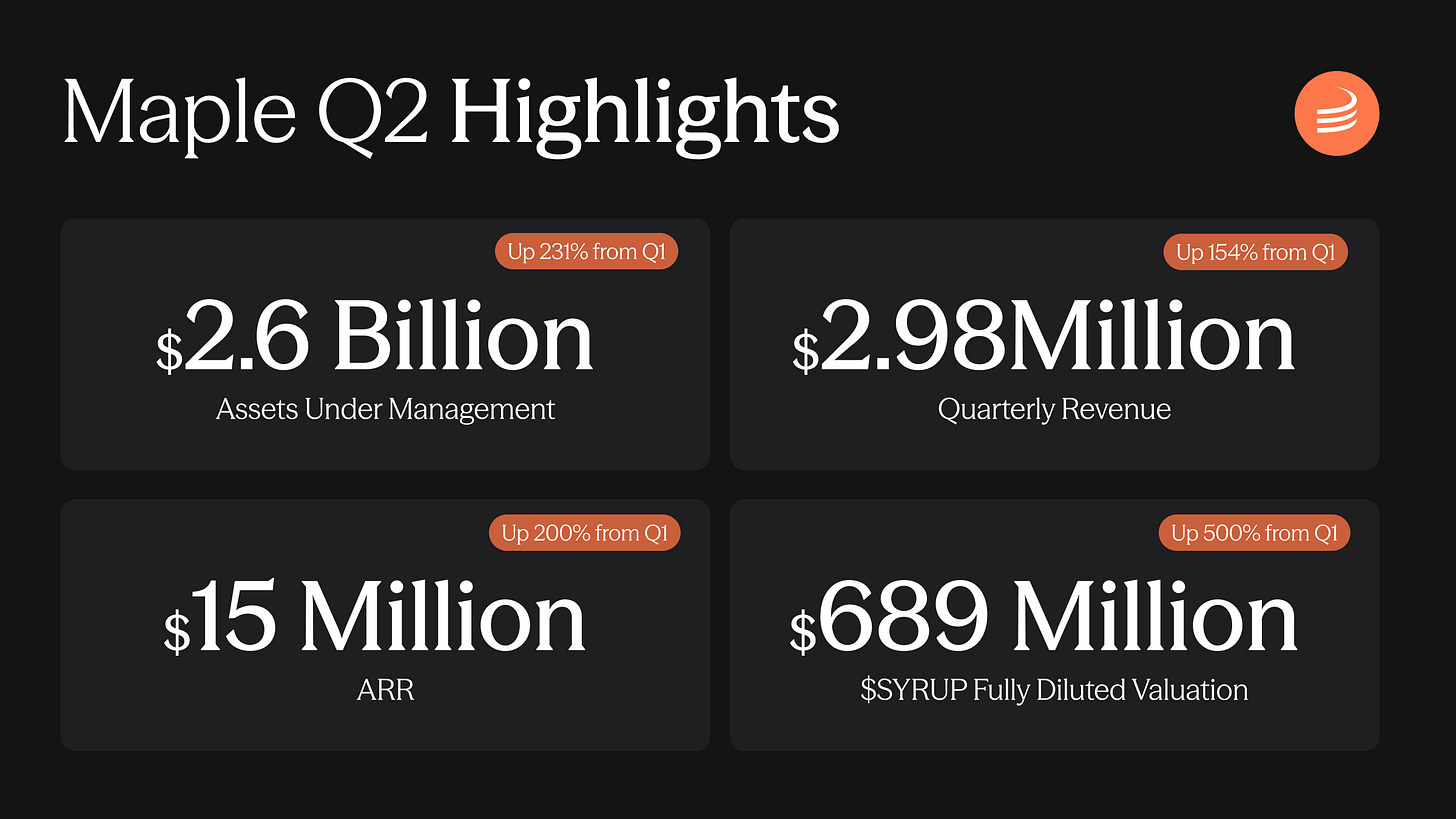

Maple Finance also crossed a significant milestone, passing BlackRock to be the largest onchain asset manager. syrupUSDC is the 3rd most widely adopted yield-bearing dollar asset in the industry.

Another project with strong fundamentals, Maple (SYRUP), is up 35% this week.

If you’ve been in the crypto space for awhile, you’ll notice the change in how narratives are formed.

The old pattern was price appreciation, then CT virality, then crypto-native users, then a spike in fundamentals, then wider virality (if a protocol was lucky). Now, fundamentals are leading the way. As more people conduct business onchain and hold crypto for the long-term, protocols are able to attract real users, not solely trend-chasers.

As more sophisticated investors enter the “digital assets” space, I expect this trend to accelerate.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

🔭Market Outlook

Market Health

Total DeFi TVL

Total DeFi TVL put in a new high at $213b before pulling back slightly to $204b.

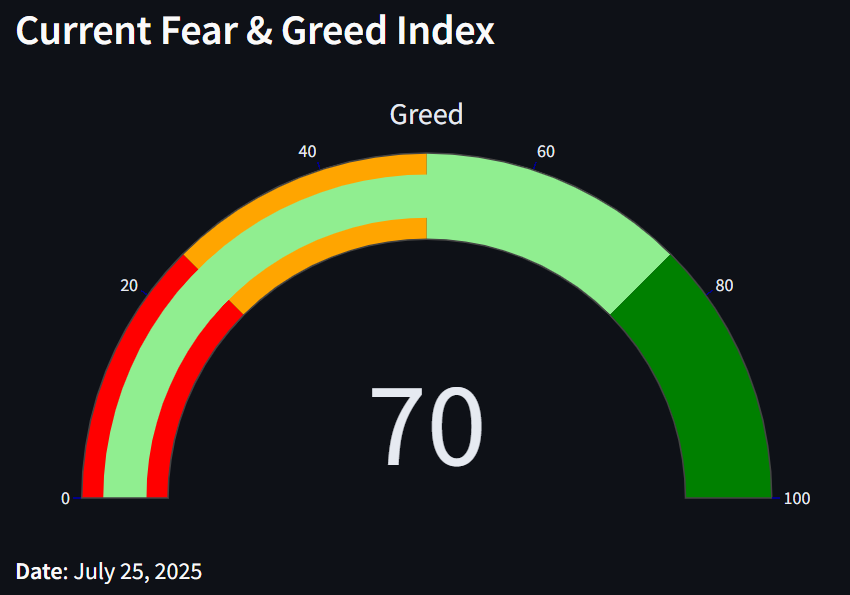

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here. The index is at 70 today, on the high end of Greed. Over the last 90 days, market sentiment has been in Greed 85% of the time.

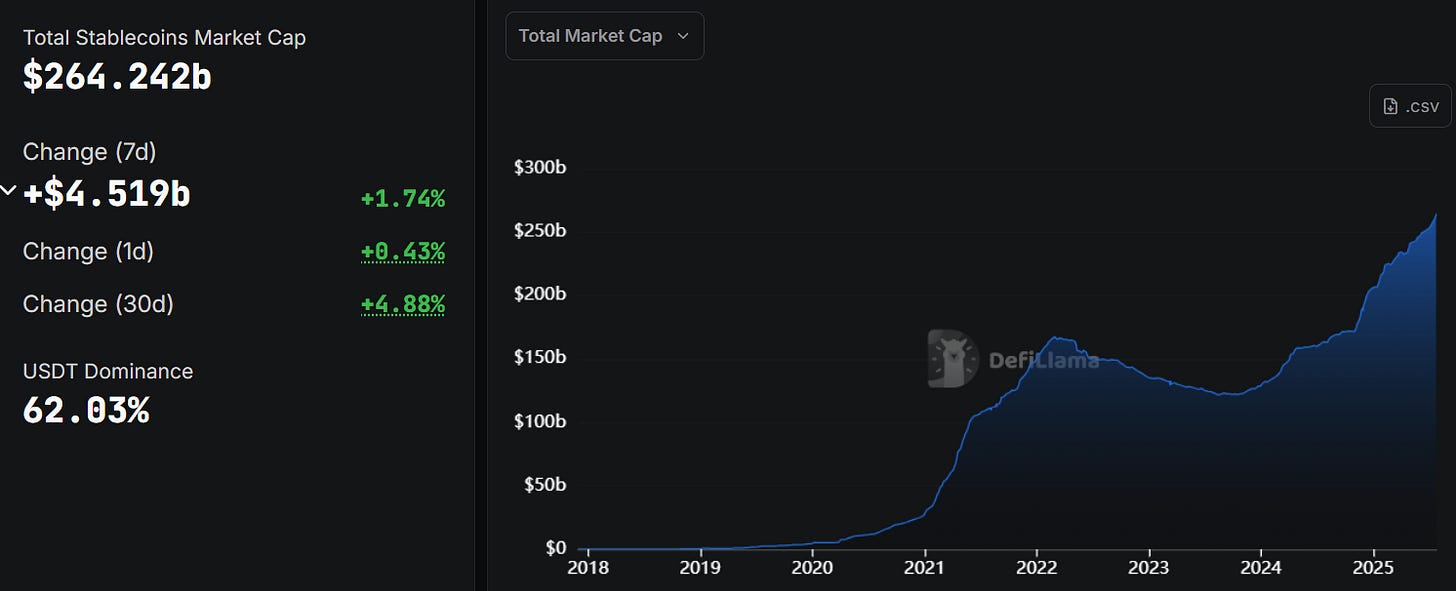

Stablecoin Market Cap

The most relentless trend in crypto continues. Stablecoin market cap added over $12b in the last 30 days - half of that came from USDT. USDC market cap grew $3b, and USDe grew $1.4b.

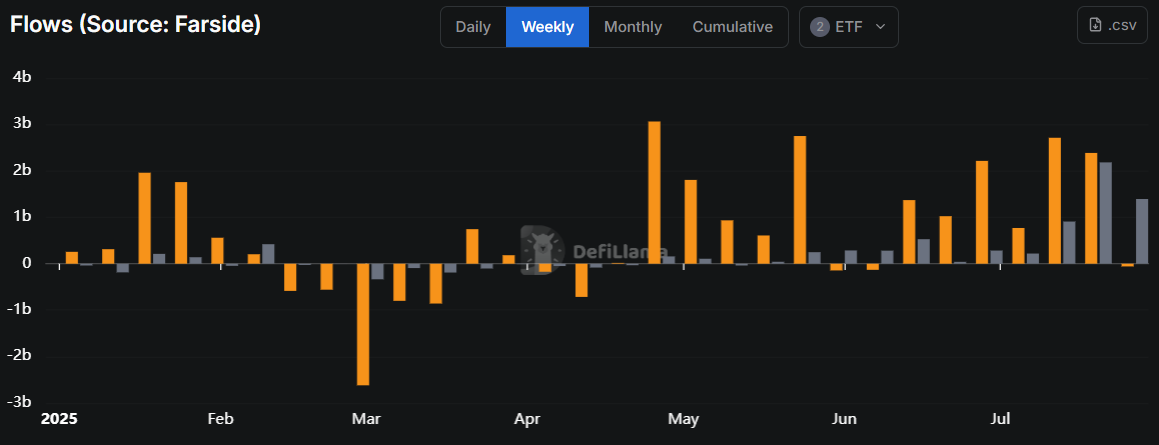

ETF Flows

After a record-setting run, BTC is on pace for its first weekly outflows in over a month. While outflows are looking miniscule, there’s still a $2b delta from last week.

Ethereum outpaced BTC in inflows over the last two weeks.

IPOR Stablecoin Indices

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

An interesting development in rates this week: USDC rates are higher and rising (vs 4.3% last week), and USDT rates or lower and falling (vs 4.8% last week)

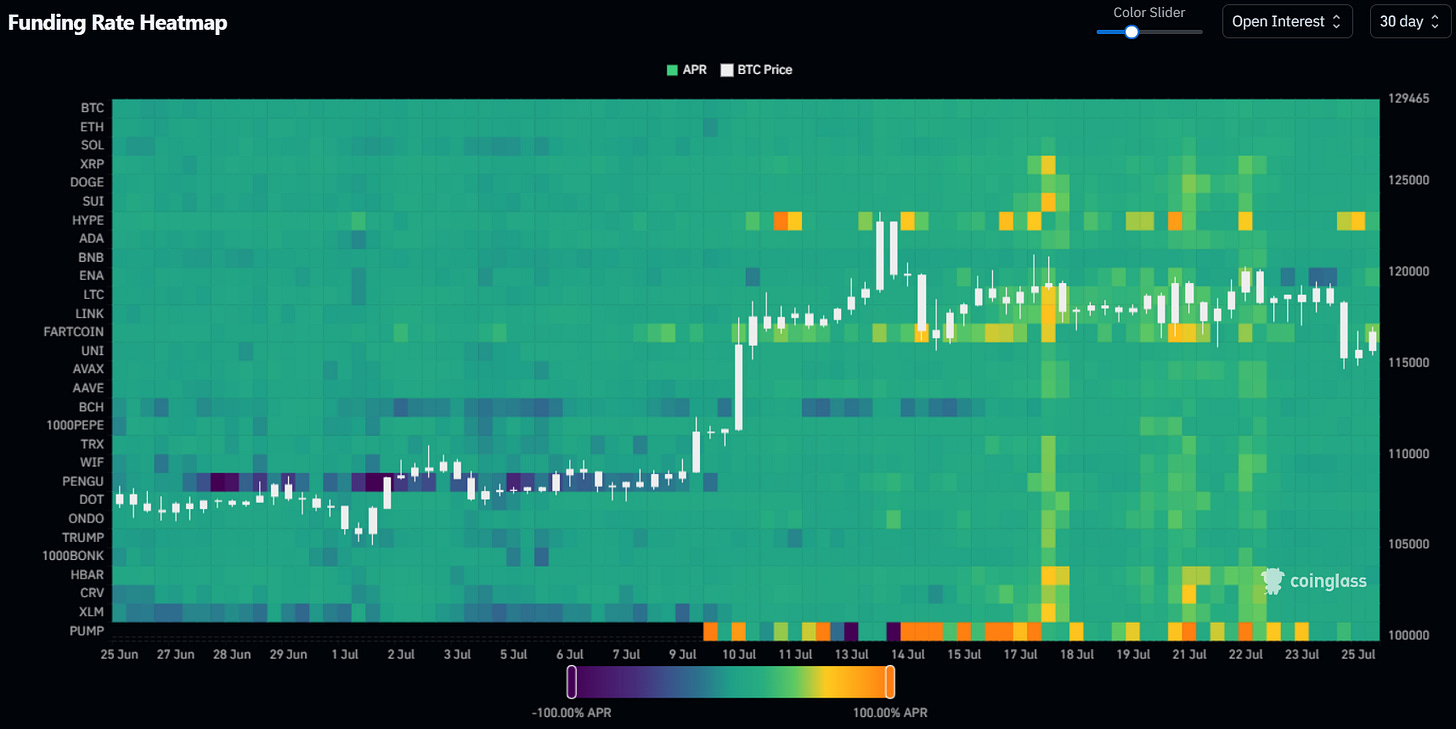

Funding Rate Heatmap

The Funding Rate Heatmap from Coinglass displays funding rates across some of the largest crypto assets.

Brighter colors indicate elevated funding rates for longs, and darker colors indicate low or negative funding rates (indicates large short positions).

Something to note this week: Pudgy Penguins PENGU had a high level of short interest right up until the PENGU token went up 150%.

Additionally PUMP positive funding has come down, indicating fewer levered longs.

Overall, not much mania in leverage at the moment; in fact, things have cooled off from last week.

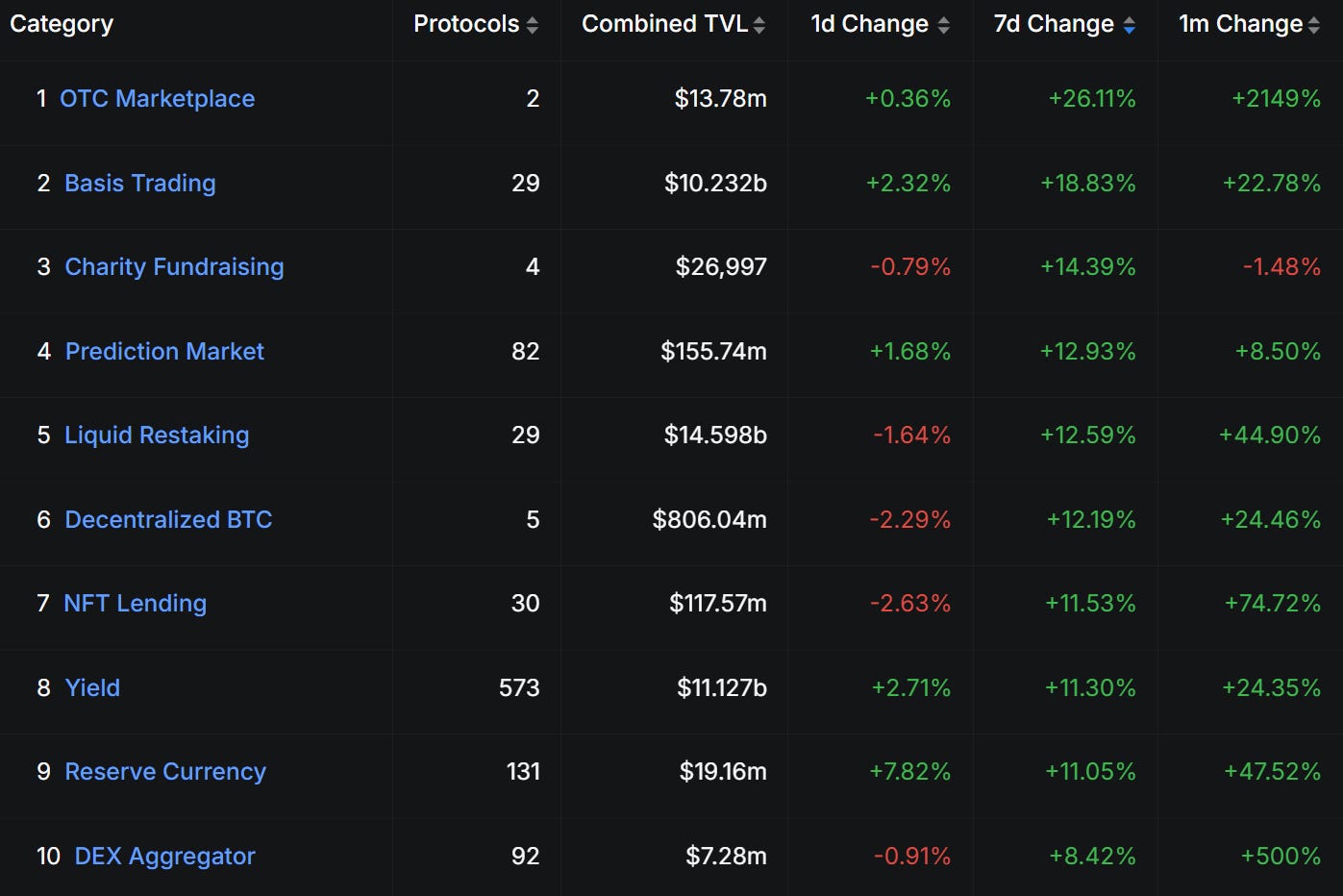

Category and Chain Trends

Category TVL Changes

Basis Trading grew 18% this week, due to Ethena’s USDe.

Prediction markets are positive on all time frames. Polymarket accounts for most of this TVL but there are nine other prediction markets with over $1m in TVL. Given relatively small category of $155m, 82 tracked protocols is a lot of competition. But so far none have come close to challenging Polymarket’s dominance.

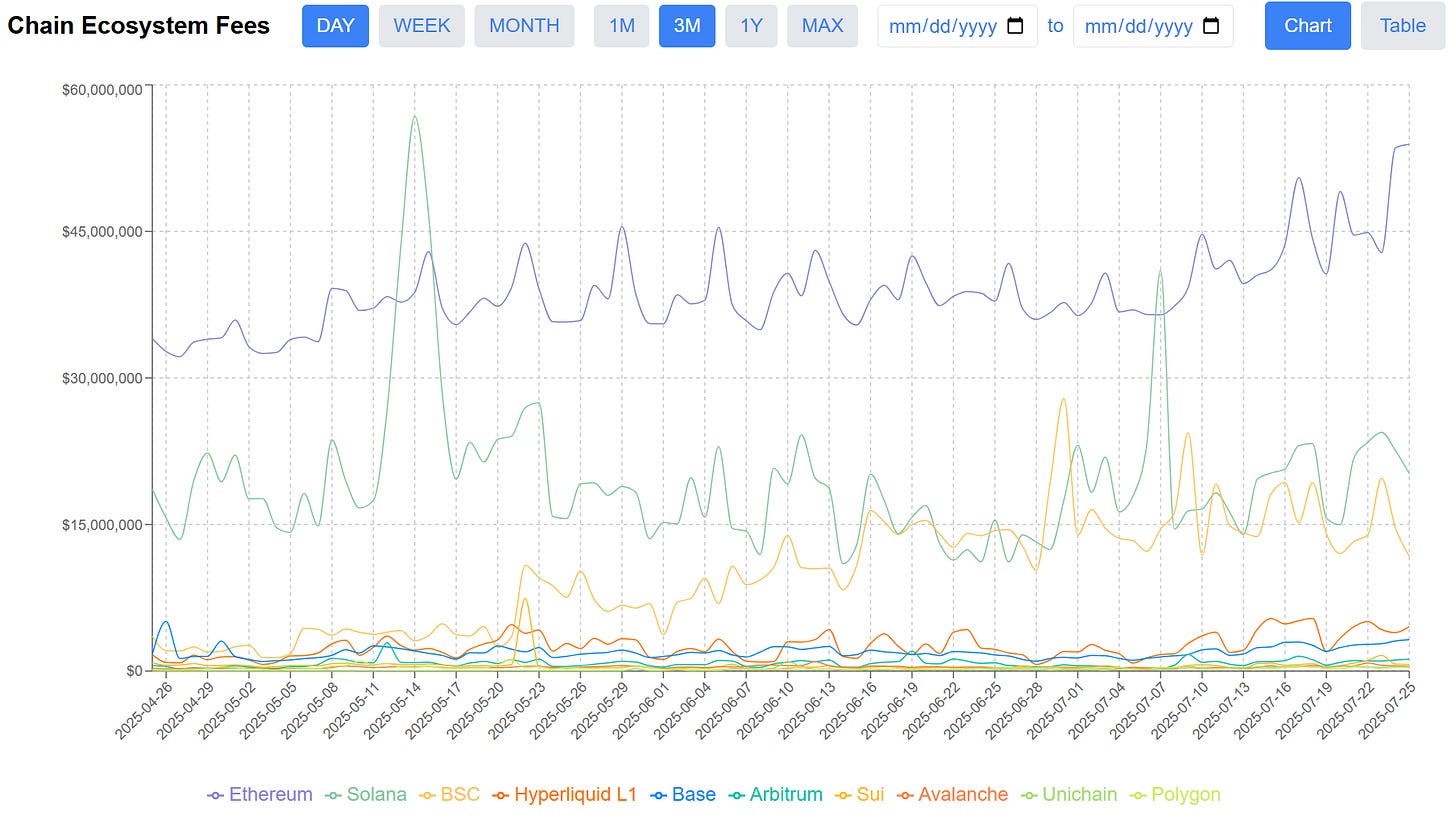

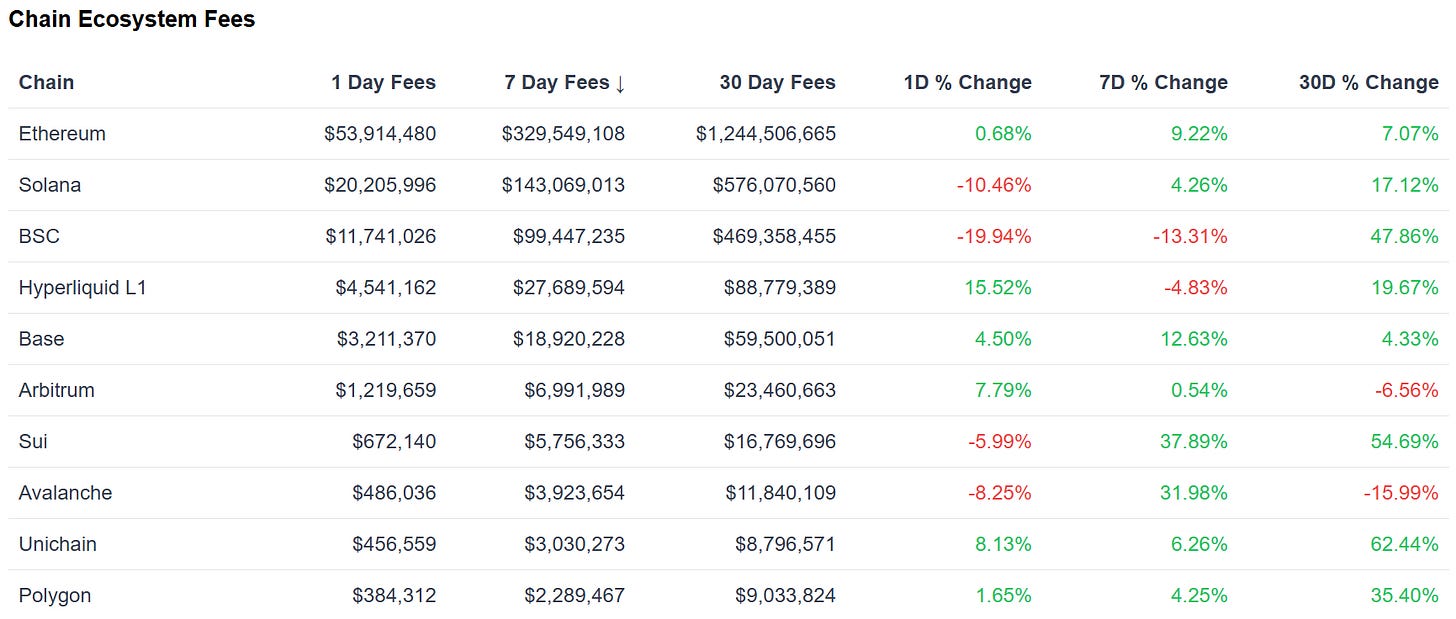

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard myself to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

Most major chains saw double-digit growth this past week.

Hyperliquid 7d fees grew 85%, partially due to a successful LST launch on Kinetiq. Hyperliquid open interest is also at an all-time high.

Other chains Base, Arbitrum and Unichain all saw over 40% growth in chain ecosystem fees over the last week.

Chain Ecosystem Fees on Ethereum have been steadily rising since the month began. The all-time monthly record for Chain Ecosystem fees on Ethereum were $1.4b in December 2024. Ethereum earning $1.2b over the past month signals onchain activity is close to a record high.

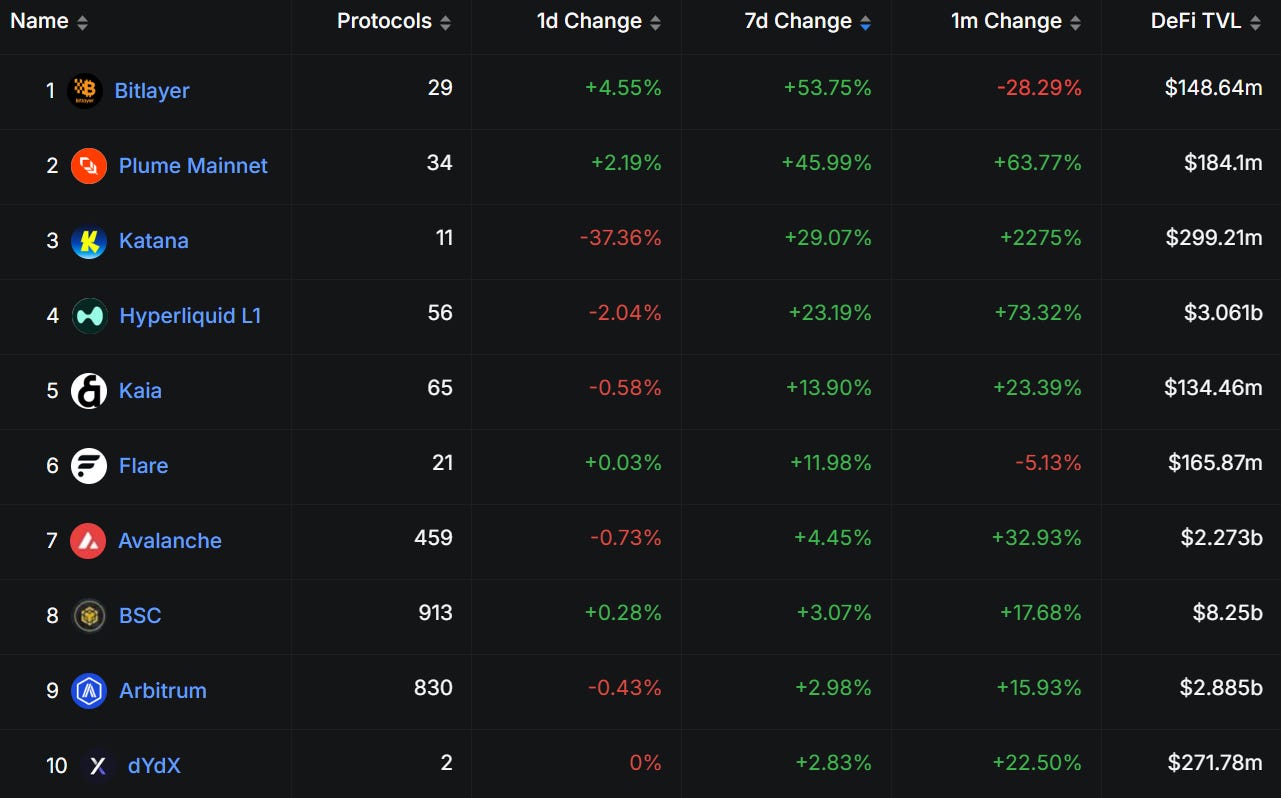

Fastest Growing Chains ($100M+ TVL)

Bitlayer leads TVL growth this week, but is still down on the month.

Plume continues growing - up 45% this week and over 60% over the last 30 days.

Katana TVL is up another 30% this week. Since their announcement to reward users with KAT tokens, onchain TVL went from $14m to $300m within 25 days.

Hyperliquid continues its impressive growth streak, up 73% in 30 days.

📊Onchain Metrics

Digital Asset Fundamentals

We’re building out this section, where we dive deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens.

Below you’ll find 3 visuals:

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.