⚡️Winning Crypto This Summer: New Airdrops, Treasuries, and Milestones

Plus our new newsletter format helps you understand the crypto market in 5 minutes

Read Time: ~5 minutes

We’re wrapping up the last week of July. While summer is historically a slow time for crypto, that hasn’t exactly been the case this year. Bitcoin is near an all-time high. Ethereum is near $4K. DeFi is getting regulatory stamps of approval

How are you supposed to keep up?

We’ve rolled out new formats for this newsletter and our weekly metrics newsletter.

All of the analysis you’re used to is still there. But we’ve added new charts and news summaries to help you understand the market at a glance.

The new format includes numbers-driven market context, news summaries, onchain insights, yield farms, airdrop farms and tools we use every day.

We think you’ll love it. Give it a read, and reply with any feedback!

⚡In This Edition

Market Metrics at a Glance

What to know this week in crypto

Onchain Analysis: insights giving you the most important things happening onchain

Farm of the Week: Understand exactly how to capitalize on yields or airdrop opportunities onchain

Macro events, new launches and token unlocks for the week

DeFi tools and our favorite resources

⚡Metrics Snapshot

Top Performers this Week

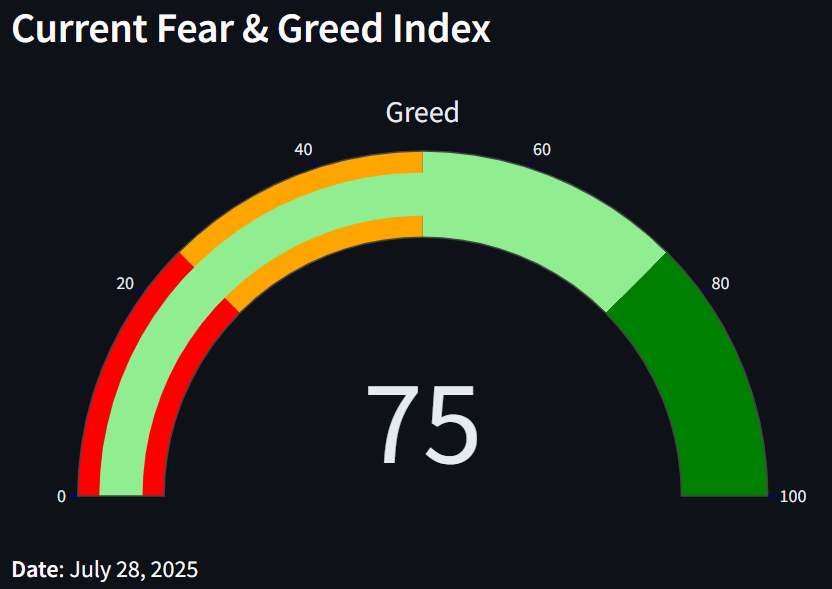

Fear & Greed Index: 75 (Greed)

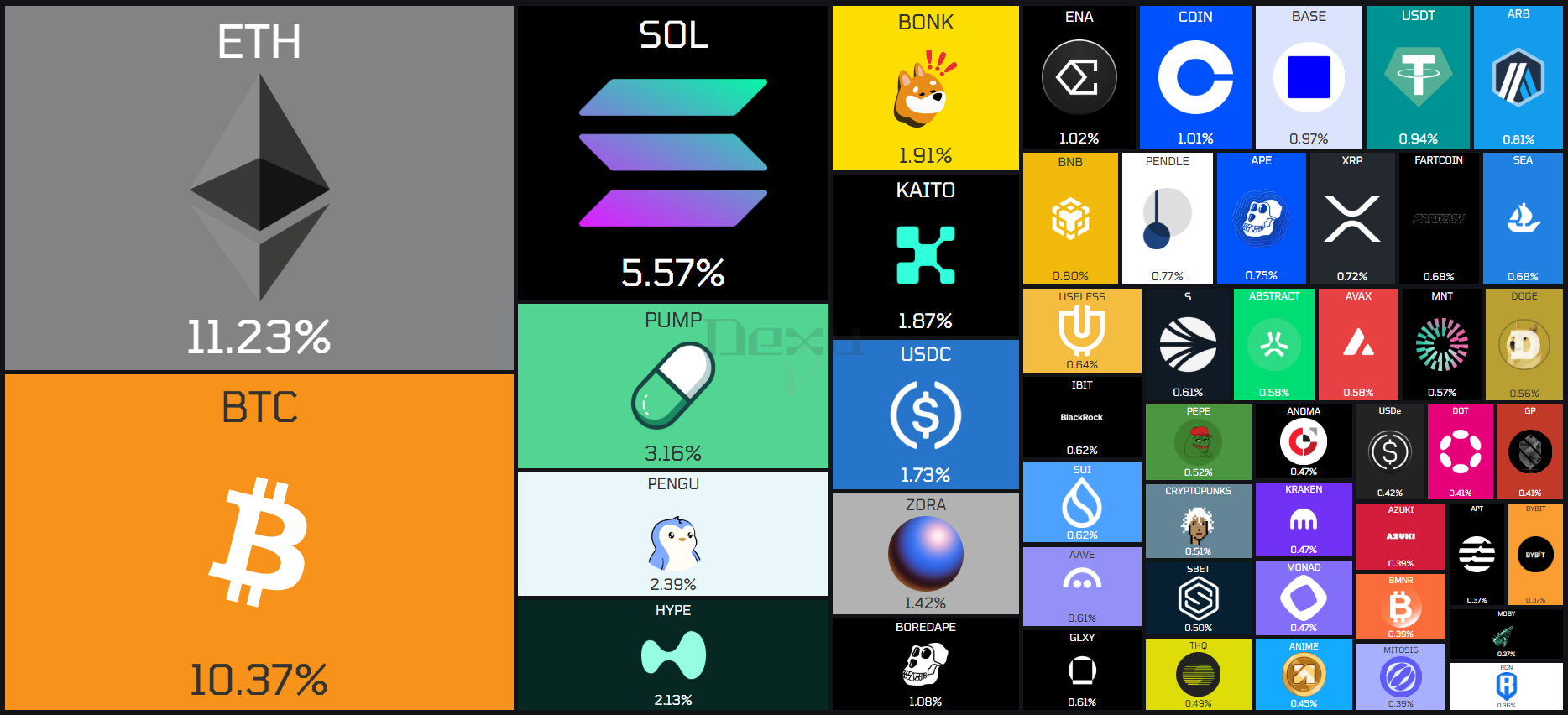

Project Mindshare (7d)

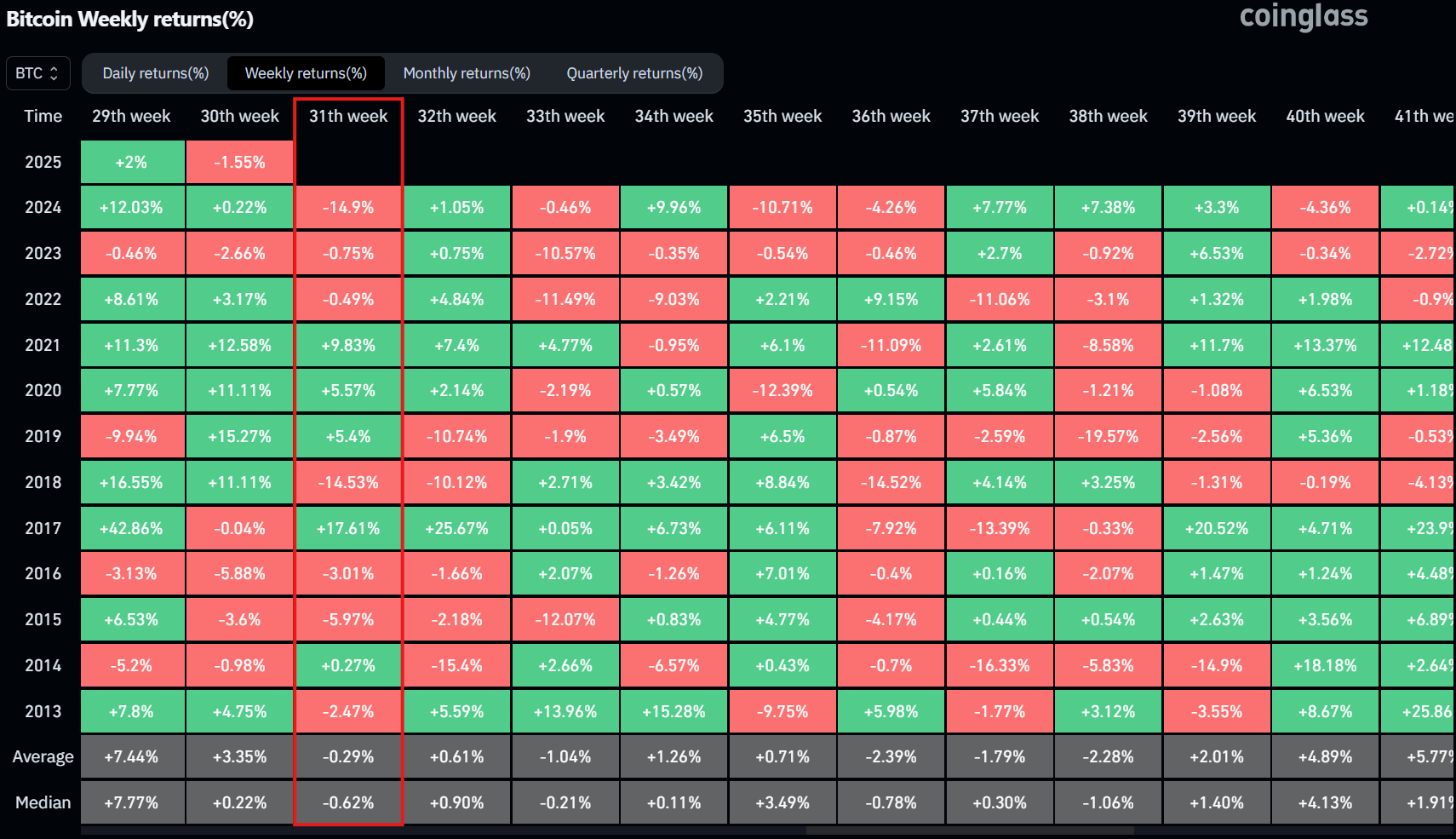

Historical Bitcoin Performance This Week

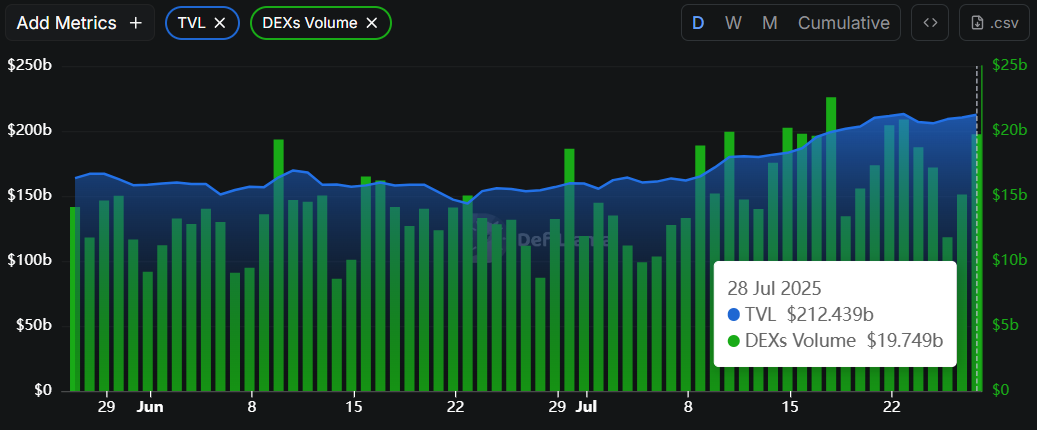

DeFi Market Metrics: Global TVL & DEX Volume

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. PayPal to Let Merchants Accept 100+ Cryptos

PayPal will now let U.S. businesses accept more than 100 cryptocurrencies, with fees slightly undercutting credit card rates and payments settling via its stablecoin PYUSD.

What This Means: While it’s unlikely that people start using Fartcoin to pay for goods, stablecoin rails for global commerce are being built faster than most expected.

2. Tron Files $1B Shelf Offering

Tron Inc. filed an SEC Form S-3 for up to $1B in securities, giving it flexibility to issue stock, debt, or warrants.

What This Means: While not officially tied to the Tron blockchain, the filing signals the brand is raising major capital, which could spill into its crypto ecosystem.

3. Mill City Ventures Pivots to a $441M SUI Treasury

Publicly traded Mill City Ventures will allocate nearly all of a $450M raise into SUI, making it the first U.S. public finance firm to bet its balance sheet on the Sui blockchain.

What This Means: SUI joins the growing Digital Asset Treasury (DAT) list.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡Strong Fundamentals Win the Week

Projects with strong onchain businesses stand out - but will ETF's limit the rotation?

⚡Why the Digital Asset Treasury (DAT) is a Worthwhile Pursuit

Ethena founder breaks down why DATs are necessary

Learn advanced yield strategies and how to find DeFi opportunities

⚡Jupiter: The Solana DeFi Superapp

Messari report on the largest DEX aggregator building the go-to DeFi app

⚡Meteora announces conclusion of Points System S1

Details on the updated LP Stimulus Plan

⚡Advanced Weekly Metrics Built Just for You

The Dynamo DeFi Pro newsletter dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value behind different tokens. We’ve revamped this recently to include a wide variety of metrics, such as:

Onchain highlights

Financial analysis

DeFi metrics

Sentiment analysis

Open interest rates

ETF Flows

Read last week’s newsletter here (first few sections free):

Among the metrics, 3 custom visuals are included:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

To get these insights delivered to you each week, become a Pro member.

🔢Onchain Analysis

DeFi TVL Rises as Majors Stay Flat

After a broad market rally, many of the larger crypto tokens are flat on the week.

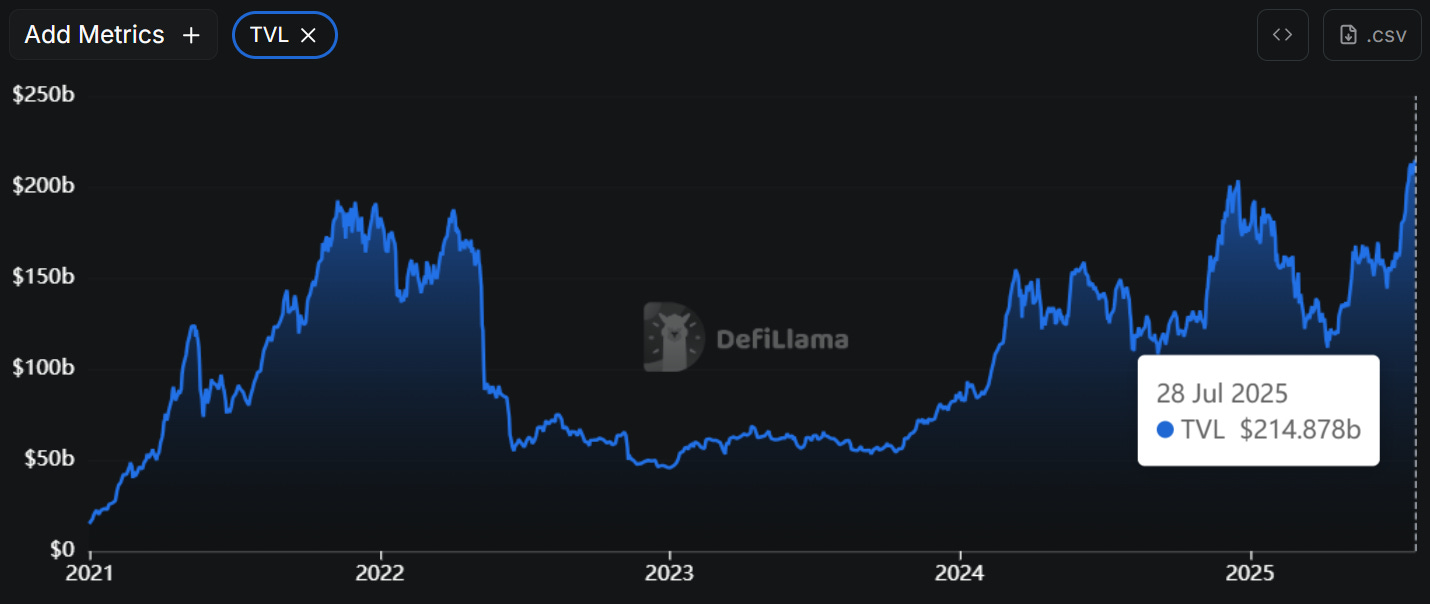

Despite this, total DeFi TVL (including liquid staking) is still rising, hitting another all-time high of $214b.

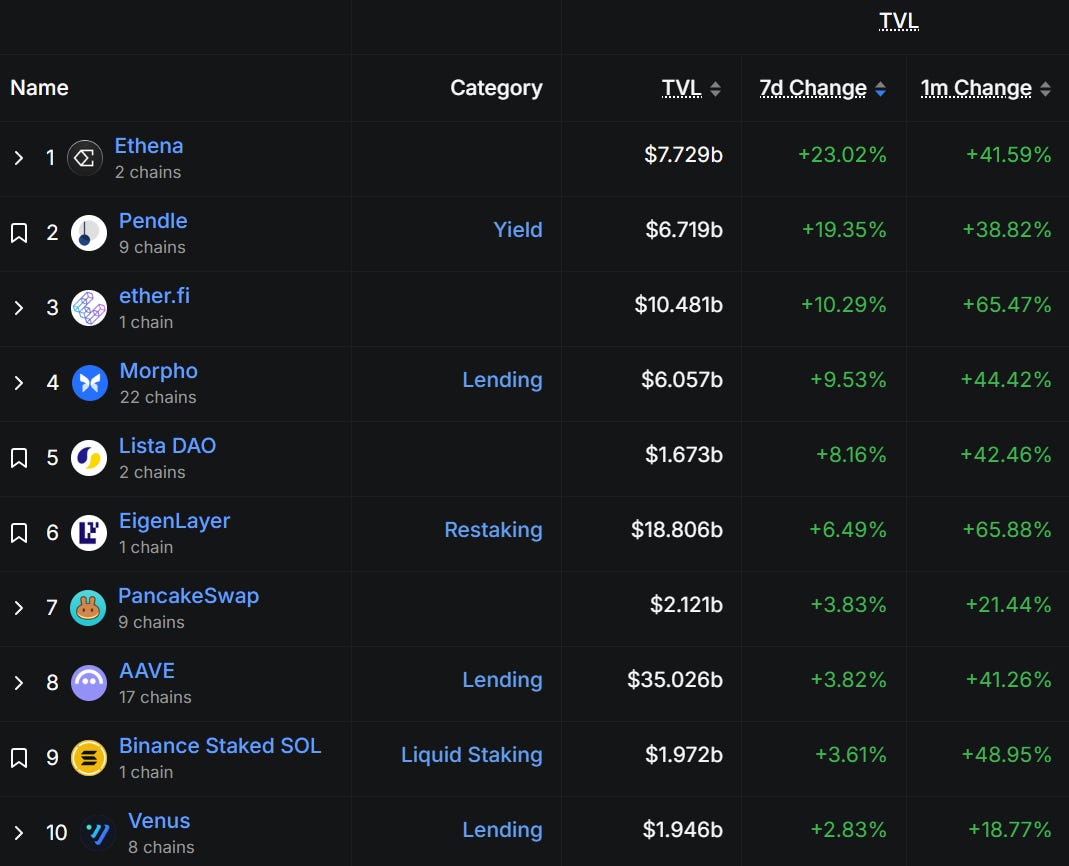

Protocols behind TVL growth this week include Ethena and Pendle - both had ~20% TVL growth and EtherFi TVL grew over 10%.

Some of this TVL growth can be attributed to the increase in the price of Ethereum over the last month, but onchain businesses with usage & PMF are distinguishing themselves as real products in the eyes of both their users and larger institutions.

3 of the top products allowed by blockchains are continuing to grow month over month: Stablecoins, onchain yield and decentralized lending.

To get more in-depth onchain metrics each week, become a Pro member.

🚜Farm of the Week

Strata Points Season 0 Begins

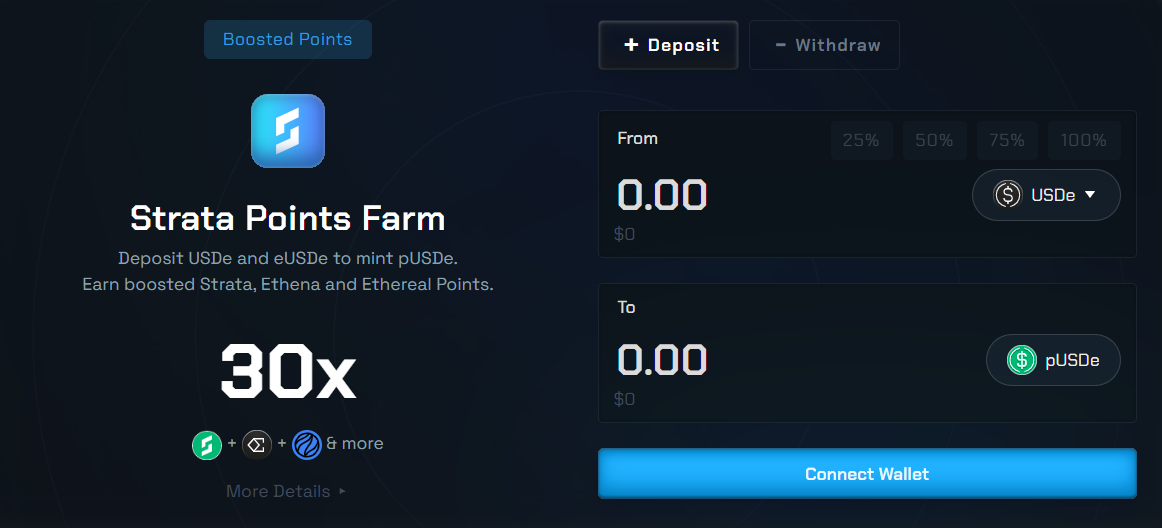

Strata is a risk tranching protocol built on Ethena and offers structured products on USDe (Ethena’s stablecoin), offering users yield.

How it Works

Despositing USDe earns 30x Ethena points, Strata points and Ethereal points, potentially qualifying for multiple airdrops with just a few clicks.

The pre-deposit campaign just began, so it’s still early. TVL is still under $30m at the time of writing.

To deposit, head to Strata’s deposit page. you’ll need USDe (you can swap for that just about anywhere). Simply connect your wallet and deposit to start earning points.

Risks

Smart Contract risk

Protocol Layer risk

Risk level: Low

⚡Ethereum is Back! What the Metrics Say

🛠️Tool Spotlight

Dexu AI: Social Analytics

Dexu AI uses social analytics to track narrative mindshare across time frames.

The mindshare dashboard is interactive - click any narrative to see a breakdown of the tokens within it: price performance, volume, and correlations.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 US Fed Meeting & Interest Rate Decision - July 30th

📊 Q2 2025 GDP data - July 30th

📊 US economy report - July 30th

📊 July Jobs Report - August 1st

Token Unlocks: $270m Unlocking This Week

🔓STRK (1%) - July 30th

🔓OP (1.79%) - July 31st

🔓HNT (8.26%) - July 31st

🔓 SUI (1.63%) - August 1st

🔓ENA (0.64%) - August 2nd

🔓CETUS (1.05%) - August 2nd

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 UNP testnet release - July 28th (Source)

🚀 Levva 2.0 beta launch - July 29th (Source)

🚀 Sparkdex TGE - July 29th (Source)

🚀 Resolv lab fee switch activation - July 31st (Source)

🚀 Lombard BTC-backed stablecoin BTCD launch - August 1st (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi