⚡️Use This to Take Your DeFi Skills to the Next Level

A Completely Free Resource to Master DeFi on Solana

Read Time: ~5 minutes

⚡Snapshot

Take your DeFi skills to the next level with part 3 of the (free) DeFi 101 Course

The largest onchain category continues to grow

Earn Points on 7 Hyperliquid protocols at once

📖 Recommended Reads

⚡Robinhood Launches Stock Tokens, Reveals Layer 2 Blockchain

Robinhood’s “To Catch a Token” reveals a slew of updates, including staking in the US

⚡Bitcoin: An Onchain Ghost Town

Summary of Glassnode’s Bitcoin onchain data report

How to use concentrated liquidity, delta neutral farms and assess DeFi protocols

⚡The rotation to crypto equities is accelerating

Circle’s IPO, Robinhood’s announcements & Coinbase’s new features

⚡Another $2.7b of digital asset inflows last week

First half of 2025 saw $17.8b in inflows

Take Your DeFi Skills to the Next Level

Part 3 of the DeFi 101 Course is live! Here’s the full Course playlist.

🔢Onchain Analysis

The Largest Onchain Category Continues to Grow

Lending is the largest onchain sector, and it grew another 8% this week.

Current lending TVL sits just under $54b, near all-time highs and up 250% from two years ago.

The category is led by Aave, crypto’s largest protocol (by TVL). Aave holds nearly half the category’s total TVL.

There are 10 lending protocols with over $1b in deposits. While Aave has been around for years, newer protocols like Morpho, Spark, Kamino and Maple have seen strong growth and PMF.

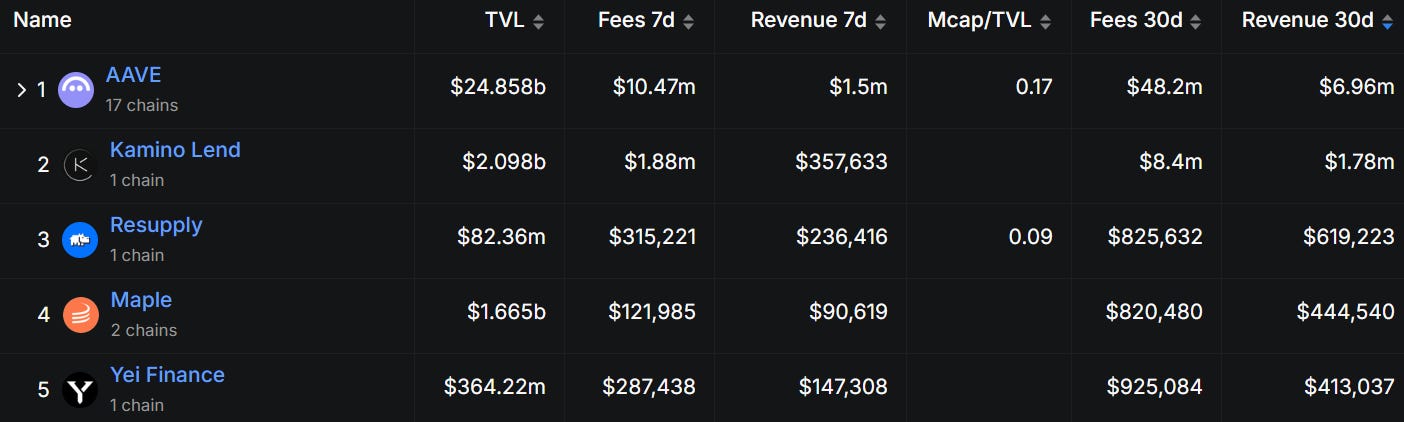

When sorting 30d revenue, we can get a better picture of lending platforms that are seeing heavy usage and growth.

AAVE leads the way. Kamino is Solana’s premiere DeFi hub and sees lots of activity; TVL doubled over the last year.

Maple Finance aims to be an onchain lending marketplace for institutions and is the highlight of the group, with TVL growing 1,600% YTD.

Yei Finance on Sei is at a TVL all-time high and June was a record month for revenue.

TVL isn’t always a reliable indicator for protocol success. But for lending protocols, it’s a representation of trust. Maple’s TVL growth specifically shows institutional interest in onchain lending.

Lending is a sector that will continue to expand rapidly as more large firms dip their toes into the onchain world.

🚜Farm of the Week

Earn Points on 7 Protocols at Once with Hyperbeat

Hyperbeat is a DeFi protocol on Hyperliquid, offering yield vaults, lending & borrowing and onchain leverage.

The Hyperbeat Ultra HYPE vault is an automated DeFi strategy vault that provides users a simple access point to use their HYPE in the HyperEVM ecosystem. Assets are deployed to generate real yield and earn points from Hyperbeat, Hyperlend, Upshift, Hypurrfi and several other protocols - all at once.

How it Works

Head to Hyperbeat and connect your wallet (most major wallet will do).

You’ll need some wrapped HYPE (WHYPE) tokens. You can buy HYPE and wrap the tokens from any network on Hyperbeat’s swap page.

Once you have your WHYPE tokens, head to Hyperbeat’s Ultra HYPE vault and click Deposit. There’s no complicated clicking here, just select the amount you’d like to deposit and click Deposit.

Now you’re earning 6% yield on your WHYPE and points across 7 protocols, maximizing chances for an airdrop.

Risks

Smart Contract risk

Protocol layer risk

Risk level: Medium

🛠️Tool Spotlight

DeFiLlama Revenue Dashboard

Revenue is a great metric to track for crypto protocols, as it signals how much real users are willing to pay for a project’s product or service.

The DeFiLlama Revenue Dashboard tracks top protocols and revenue over 24hr and 30d time frames.

The dashboard can be filtered by chain & category, and each protocol’s revenue source is explained.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Fed chair Powell speaks - July 1st

📊 June ISM Manufacturing PMI data - July 1st

📊 June Jobs Report - July 3rd

📊 US markets closed - July 4th

Token Unlocks: $300m Unlocking This Week

🔓ACX (22.60%) - June 30th

🔓STRK (1.06%) - June 30th

🔓MAV (3.11%) - June 30th

🔓OP (1.79%) - June 30th

🔓SUI (1.30%) - July 1st

🔓DYDX (0.58%) - July 1st

🔓TRIBE (7.1%) - July 1st

🔓ENA (0.67%) - July 2nd

🔓EIGEN (7.42%) - July 2nd

🔓CETUS (1.03%) - July 3rd

🔓SD (1.36%) - July 5th

🔓S (7.48%) - July 5th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Byreal launch on Solana - June 30th (Source)

🚀 Golem marketplace open beta - June 30th (Source)

🚀 Starknet v0.14.0 testnet - June 30th (Source)

🚀 Valhalla mainnet launch - June 30th (Source)

🚀 Polkadot first ever vote-escrowed dex release - July 1st (Source)

🚀 Bitget pro launch - July 1st (Source)

🚀 Vechain Galactica mainnet launch - July 1st (Source)

🚀 Darlania legend mainnet launch - July 1st (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Hyperliquid: the best onchain trading experience, and the blockchain to house all finance.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi

Hey Patrick, thanks for this market update and education, as always. The video on how to take your Defi game to the next level was well done. Can you please give some tips on your shooting and editing workflow? Or was it done with AI? If so, which tool did you use?

Best, Siegfried