⚡Hyperliquid and HyperEVM Airdrop Farming Guide

Strategies for future Hyperliquid airdrops and HyperEVM Project Drops

Hyperliquid has already rewritten the rules of what a decentralized exchange can be.

It’s become the runaway leader in onchain perps, in both volume and user experience. In fact, it’s expanded the entire perp DEX sector and is starting to threaten even centralized exchanges.

Now, Hyperliquid is building on its success in onchain perps to launch a Layer 1 ecosystem.

In an industry long dominated by centralized players, Hyperliquid is building a serious alternative: fast, permissionless (if you’re a US user, you’ll need a VPN. You can get one right here), and truly onchain.

The Genesis airdrop was a generational opportunity. But it may not be the last.

The Genesis event was 31% of the token supply.

Most crypto users didn’t accumulate points. And many that did failed to check a box “accepting” the initial Hyperliquid airdrop and missed out on tens (or hundreds) of thousands of dollars.

Hyperliquid has reserved over 38% of the token supply for future emissions and community rewards.

Are we getting a second chance at a Hyperliquid airdrop?

There are broadly two strategies related to airdrops on Hyperliquid:

Hyperliquid Community Fund Allocation

HyperEVM Ecosystem Airdrops (potentially more lucrative)

In this brief research piece, we’re highlighting the specific actions you can take to qualify for as many Hyperliquid points and L1 ecosystem project points as possible.

We’ve researched the most important metrics for Hyperliquid and explain exactly how to provide value to the DEX & ecosystem.

If you haven’t signed up for Hyperliquid yet, you can head there directly with my affiliate link. It takes two minutes and you’ll be ready to rock for some of the most important point-earning metrics.

The Genesis distribution was November 28th, 2024. The next scheduled unlock (a linear unlock for core contributors) is November 29th of this year.

No claims have been made about when a potential community reward allocation will be made (or if it’ll look like the last airdrop), but if they’re planning a drop around that time, we have 5 months to farm Hyperliquid points.

But it’s important to remember the snapshot will likely be well before the airdrop date for both Hyperliquid and HyperEVM protocols.

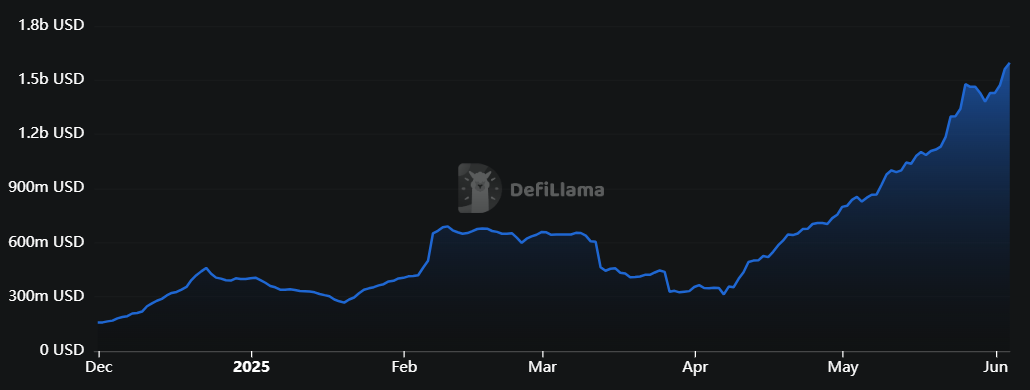

The ecosystem is growing like a weed, but the Hyperliquid L1 is still outside the top 10 chains for TVL.

The projects on the L1 could provide the biggest opportunity to earn an outside airdrop, and we have a list below of exactly what to do to capitalize on those point programs.

First, let’s talk about maximizing your chance of receiving an airdrop on Hyperliquid itself:

It’s important to put yourself in the shoes of the team that would be issuing an airdrop. Airdrops are a form of delayed incentives. The team is likely to want to incentivize 3 things:

Users that pay them fees

Users that contribute to the product

Users of their new products

Here are a few actions that may qualify you:

Trade Spot Markets

Hyperliquid integrated a spot order book. This market did not exist at the time of the first airdrop, and it’s likely an important market for Hyperliquid to grow, so users of the spot market should be rewarded.

Two ways to do this.

Buy spot assets on Hyperliquid

This gets you platform volume, using a new (important) feature

Bonus: buy spot HYPE and stake it.

Buy spot HYPE (not perps) and stake it here. We’re not staking for the APR, we want to qualify for the airdrop, and it’s reasonable to assume Hyperliquid team will reward HYPE stakers. Stakers are given governance rights, and in Hyperliquid’s decentralization push

Use Unit

Unit is the asset tokenization layer behind spot trading, allowing users to deposit & withdraw major native assets (BTC, ETH, SOL) without wrapping.

Unit already facilitated over $5b in volume.

To capitalize: use Unit to bridge in and out of hyperliquid, spot trade with Unit-supported assets, stake or LP Unit supported assets.

If you don’t want to take directional risk, you can use the perps DEX & spot order book at the same time. You’ll be putting more volume through the platform (key for potential point accumulation).

Here’s a link to the DEX to get started.

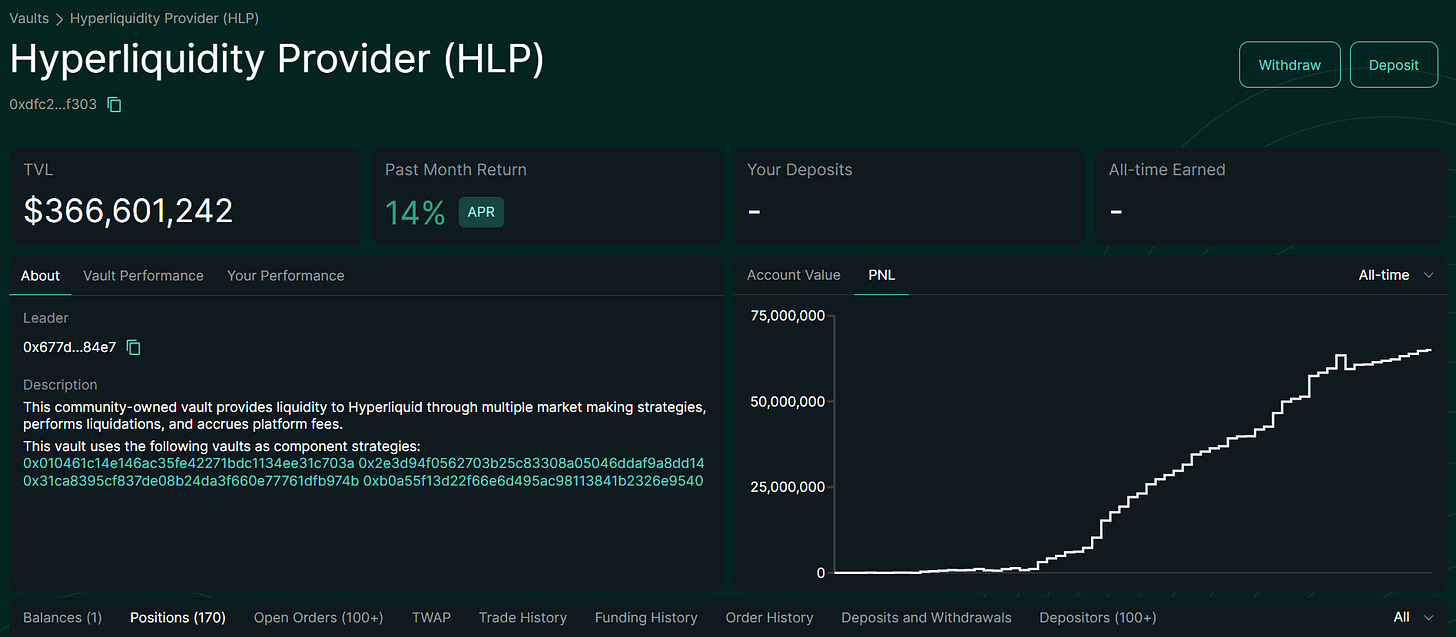

Hold HLP

Hyperliquidity Providers (users who deposited funds to HLP) received allocations in the first airdrop. With HLP being a critical component of Hyperliquid’s business, and the recent attempted manipulation attacks on HLP, it’s likely that Hyperliquid will reward those who continue to provide liquidity.

Currently HLP is offering 14% APR, and depositing is as easy as a click.

The Downside

You are competing with a large pool of users (some of them swinging lots of volume around) for the potential HYPE airdrop. Volume that’s traded will be diluted, especially given Hyperliquid’s dominance of perp volume.

That said, it’s still worth putting some volume through the Perps DEX and Spot order book, staking HYPE and depositing stables into HLP.

User HyperEVM

It’s also worth using Hyperliquid’s new HyperEVM. Hyperliquid is taking a big bet with their L1 and is likely to want to further incentivize its growth. Luckily if you participate in the many points programs on Hyperliquid, you’ll naturally wrack up a lot of HyperEVM usage. Which brings us to…

Hyperliquid Ecosystem Opportunities

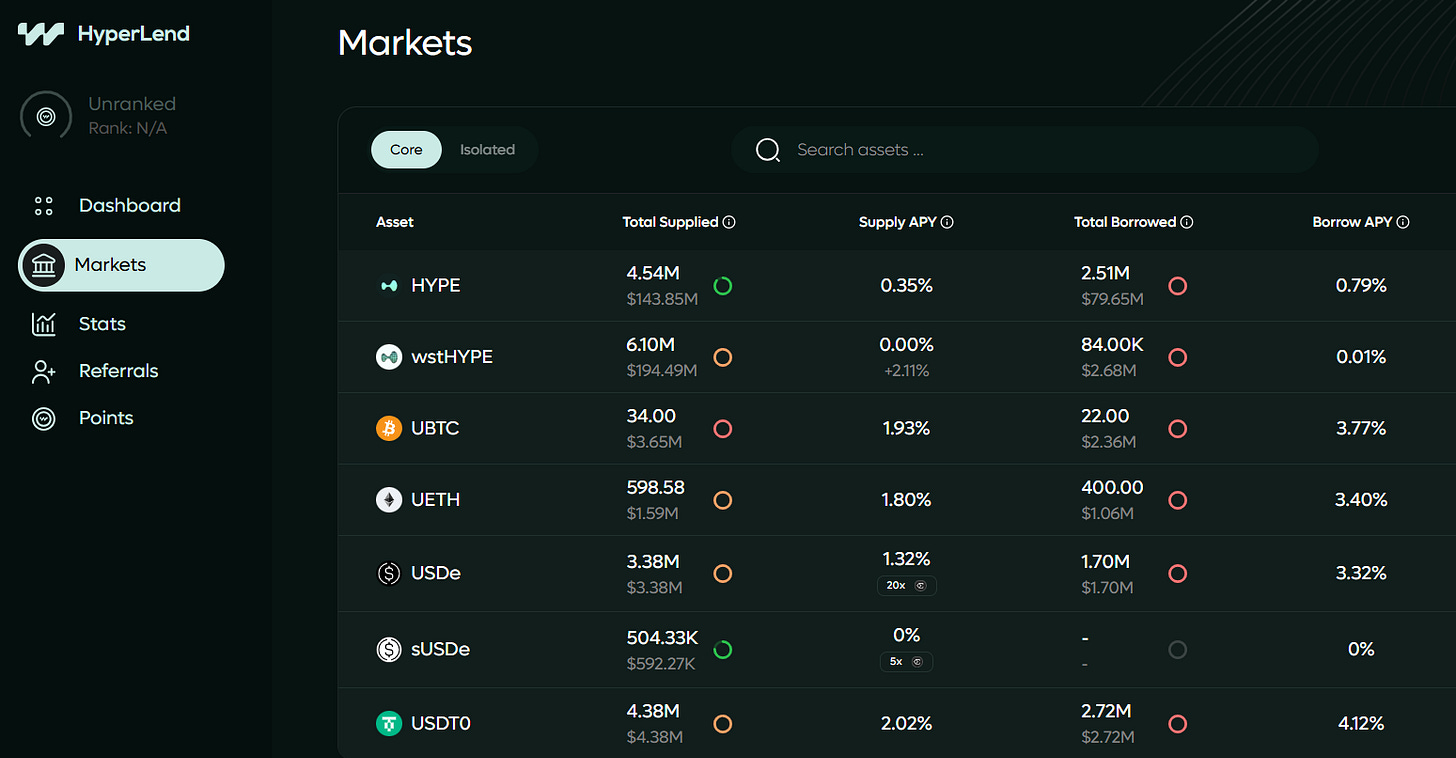

HyperLend

Hyperlend’s goal is to be the liquidity backbone of the Hyperliquid Ecosystem.

Currently there are over $350m in deposits on the platform.

The app is solid and useful for cheap borrowing of assets. Worth depositing & borrowing HYPE or stables (even looping them for more point accumulation).

At the time of writing there are about 14,000 wallets listed as active, a relatively modest amount of users. Not overfarmed.

The points system began in late March. Users holding Hypio NFTs and those who contributed during the testnet phase both get points multipliers.

HypurrFi

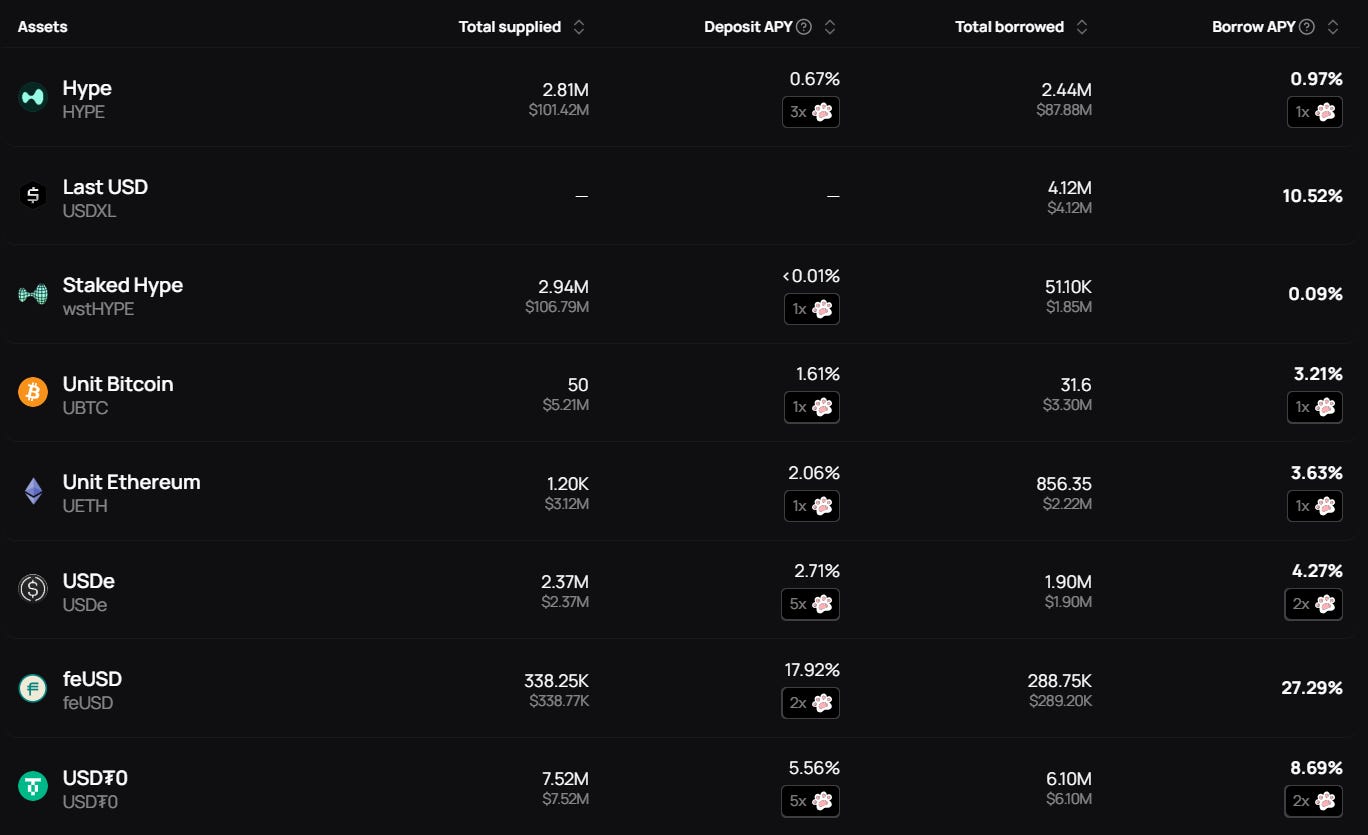

HypurrFi (a cute name for a very serious product) is a leveraged lending marketplace to create leveraged loops on Hyperliquid.

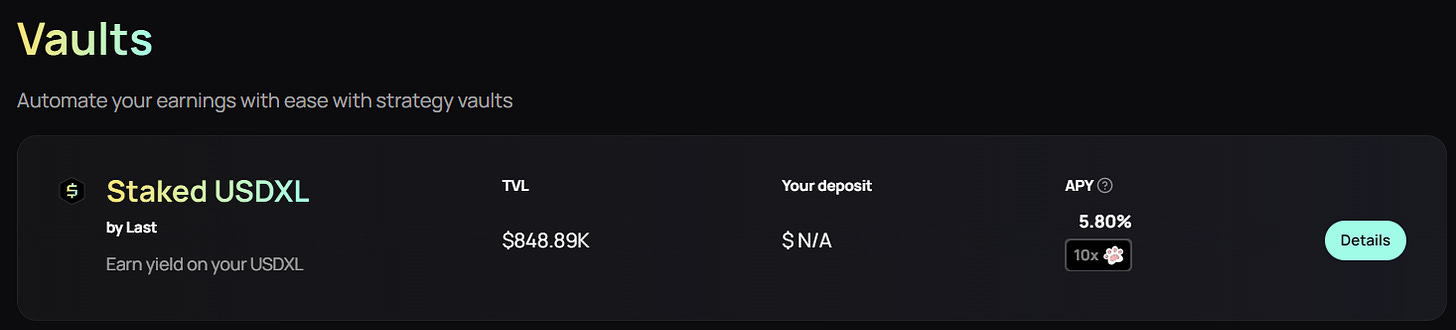

A core component of HypurrFi is USDXL, a hybrid-backed overcollateralized stablecoin. It’s backed by HypurrFi lending market deposits and will soon acquire a reserve of tokenized US Treasuries.

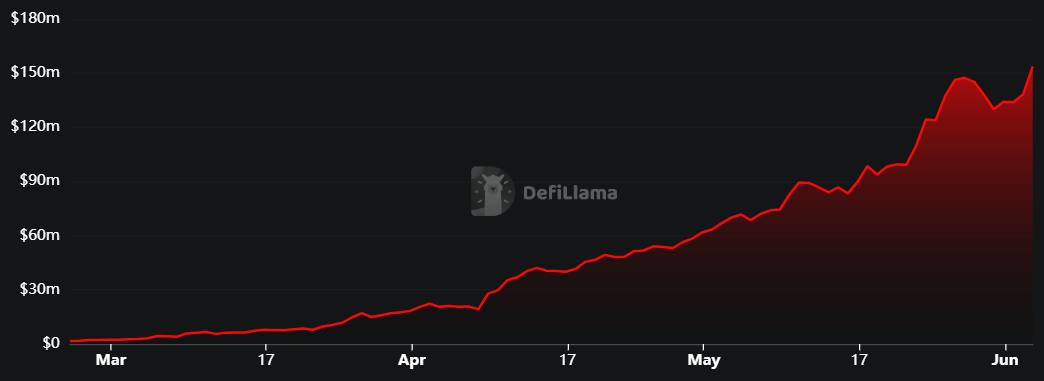

TVL on HypurrFi is growing, recently crossing $150m.

How to Capitalize

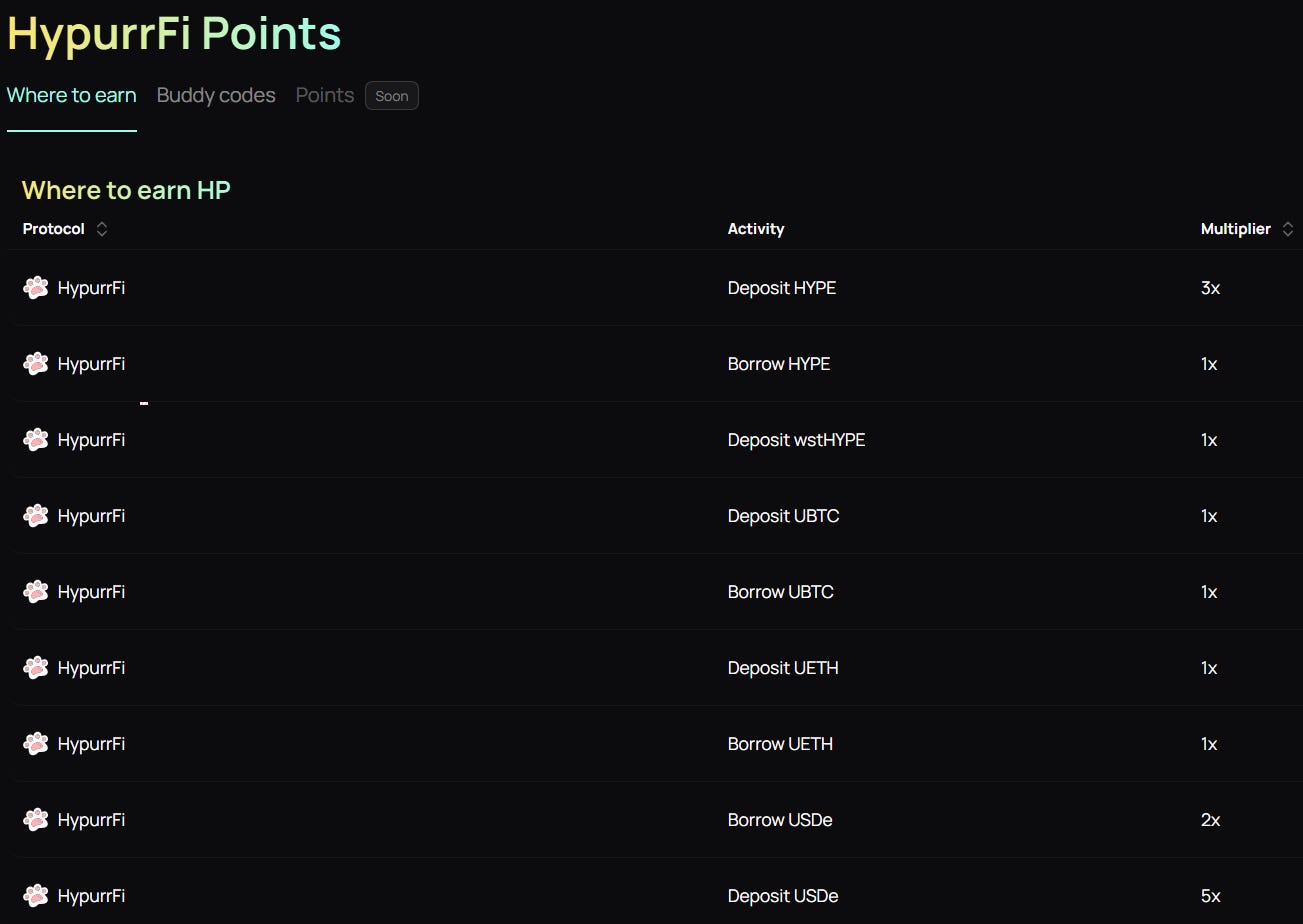

HypurrFi is running a points system (HP). Look for the pawprints for point multipliers.

Follow HypurrFi’s point guide

Deposit & borrow assets with point multipliers

Mint USDXL and stake for yield & 10x HP

TVL in this vault is small, so keep your deposit small.

Felix

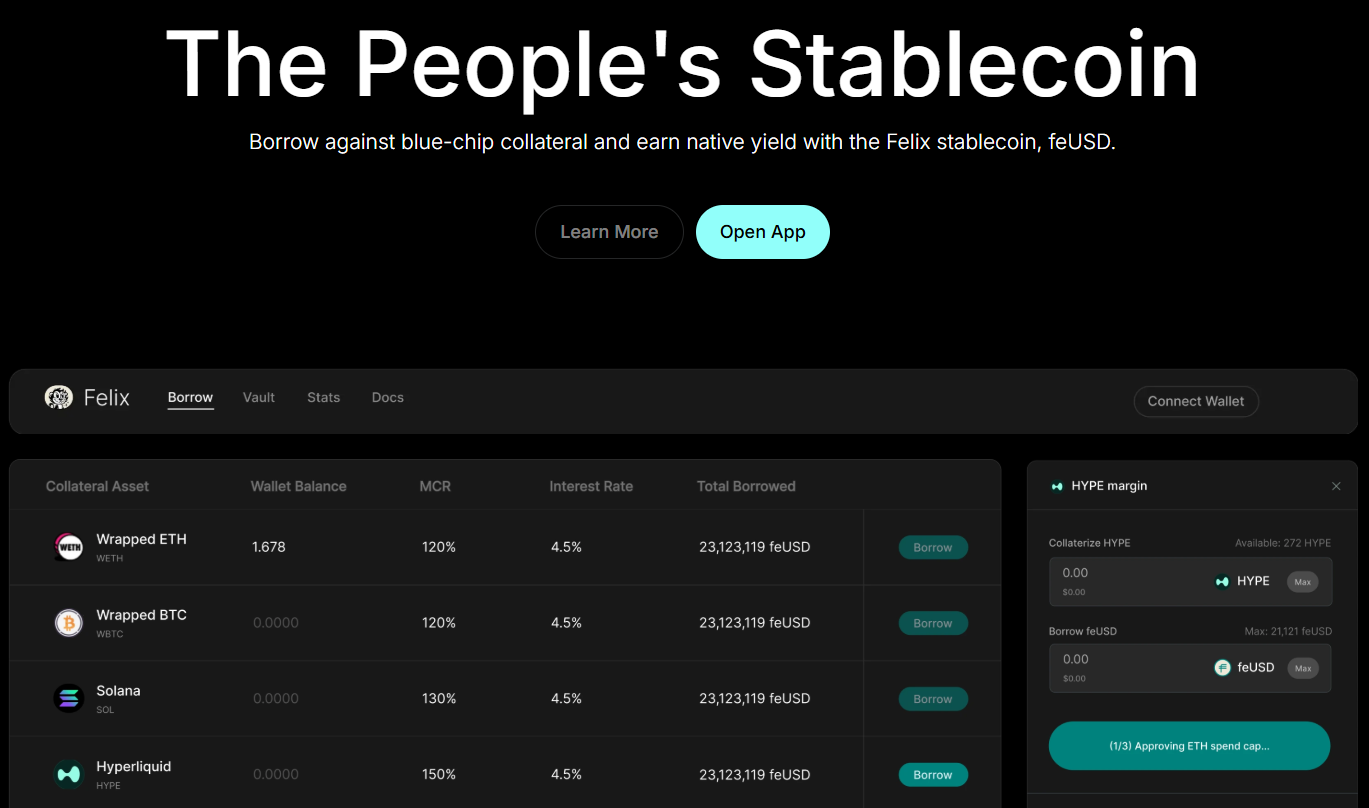

Felix is a CDP & lending protocol with the Felix stablecoin feUSD.

Felix allows Hyperliquid L1 users to do a variety of things:

Margin Trade

HLP Carry Trade

Spot Trades

Leverage Looping

Stable Yield

DEX LPing

There is no official recommendations on how to earn points, but there is a points program. Be curious and use different mechanisms on the platform, and you’ll likely accumulate points for a potential airdrop.

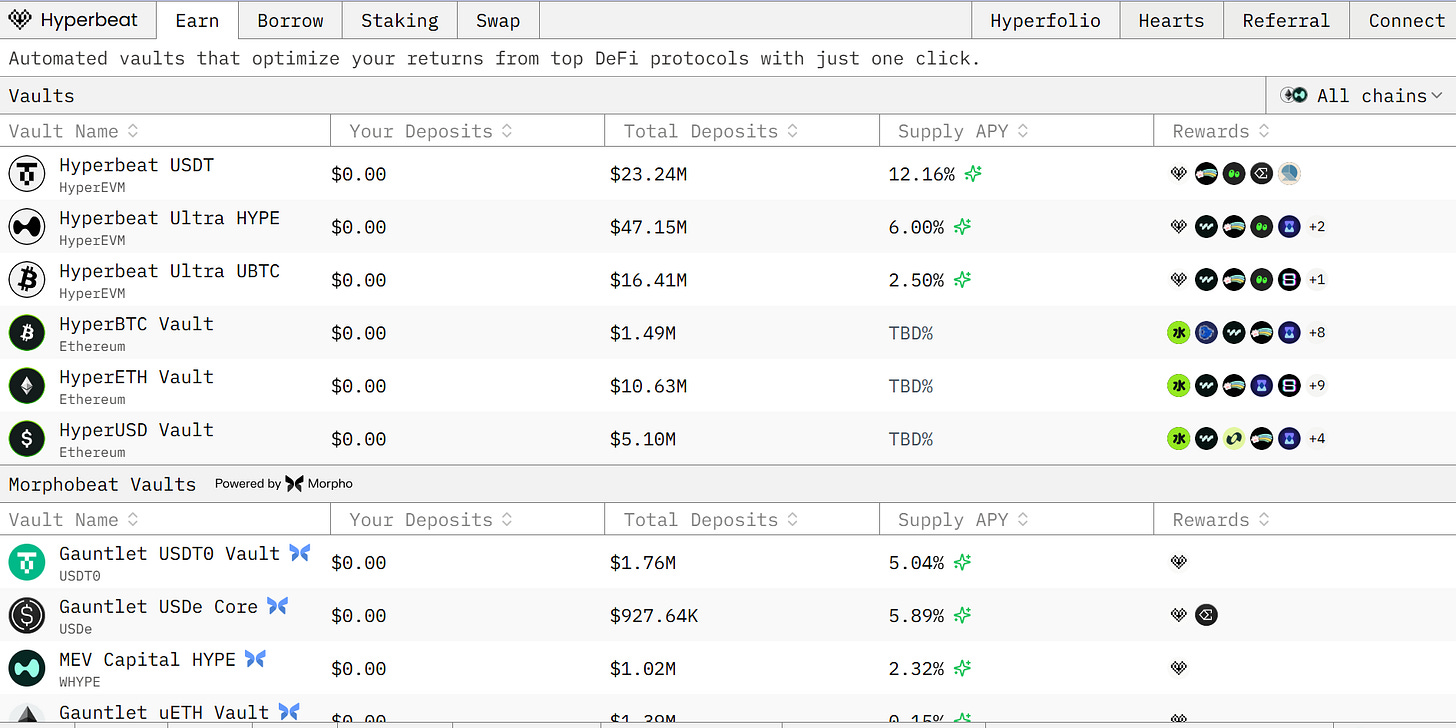

Hyperbeat

Hyperbeat is a liquidity engine for HyperEVM. The project is entirely self-funded, and the platform recently crossed the $100m in TVL.

Hyperbeat vaults are designed to unlock yield opportunities on HyperEVM.

Their dashboard allows you to easily see what you’re earning; the vaults provide rewards in both yield APY and points from other protocols.

Hyperbeat is running a points system. The points are called Hearts and there are 51m of them, distributed weekly.

Users earn Hearts for using the platform: depositing to vaults, borrowing funds, referring friends. Sybil activity will be detected & penalized, according to the team.

Resources

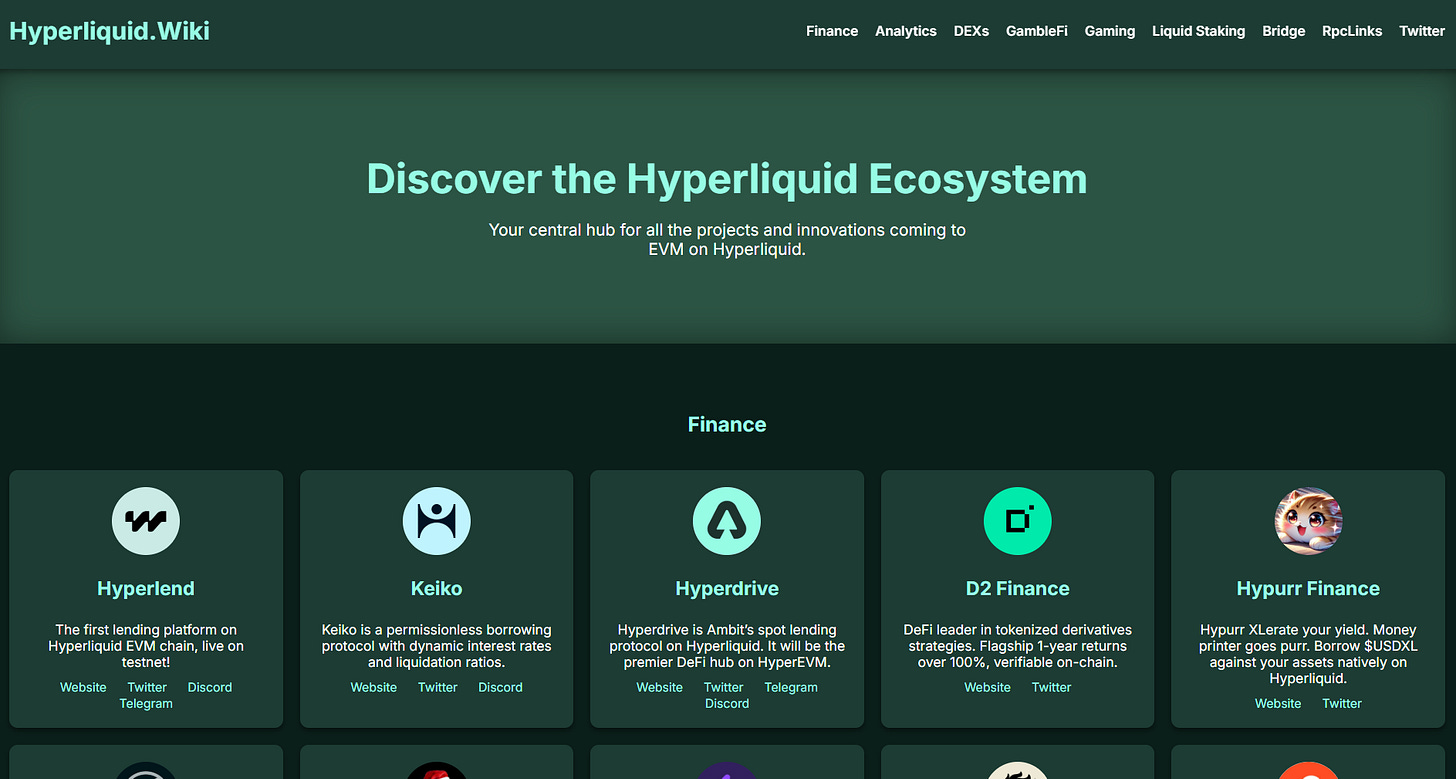

Find the full list of Hyperliquid projects here. There will be more protocol gems in this list, so familiarize yourself with it. We want to find Hyperliquid-native apps.

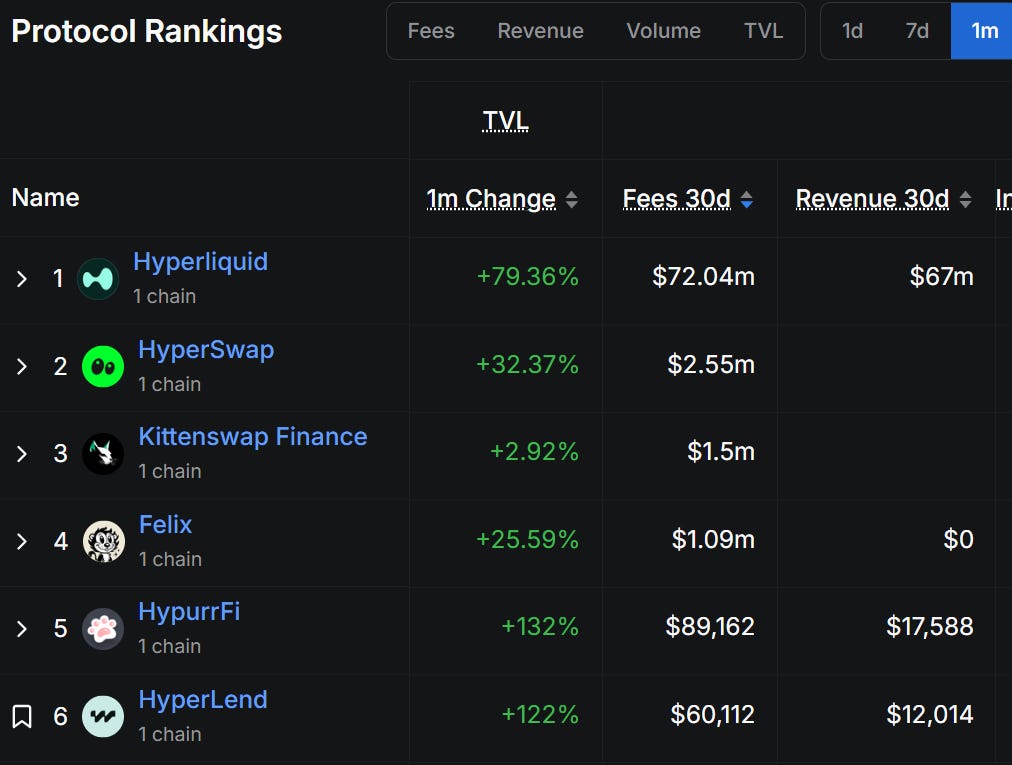

Use DeFiLlama to track HyperEVM protocols. We want to see protocols that are growing. Whether it’s TVL, fees, revenue, volume, etc.

Full Farming Guide

Conclusion

Hyperliquid is the latest crypto innovation that’s pushing the entire industry forward.

In a market once owned by centralized giants, Hyperliquid has managed to deliver low-latency, onchain derivatives to anyone, anywhere. And it as a rapidly growing spot DEX and Layer 1, too.

This is a protocol that didn’t just airdrop a token. It facilitated one of the largest wealth creation events in crypto history, and still reserved more than 38% of supply for future contributors.

This is only possible because they created a good product with real users.

With new features rolling out, ecosystem projects launching weekly, and a chain culture of rewarding users, the opportunity here could be massive.

Whether or not a second wave of airdrops will match Genesis, users of the protocol and its L1 ecosystem are likely to be rewarded.

The guide above gives you a focused strategy to take action. The rest is up to you.

Thanks for reading,

Dynamo DeFi