⚡The War for Hyperliquid

The race to build Hyperliquid's stablecoin is on, plus a yield optimizer with a points program

Read Time: ~5 minutes

⚡In This Edition

Oracle Total Value Secured is growing rapidly

$1.65b Solana Treasury company announced

The war for Hyperliquid’s new stablecoin

While Bitcoin ranges, here are the top airdrops to qualify for in September.

⚡Metrics Snapshot

Top 100 Coins at a Glance

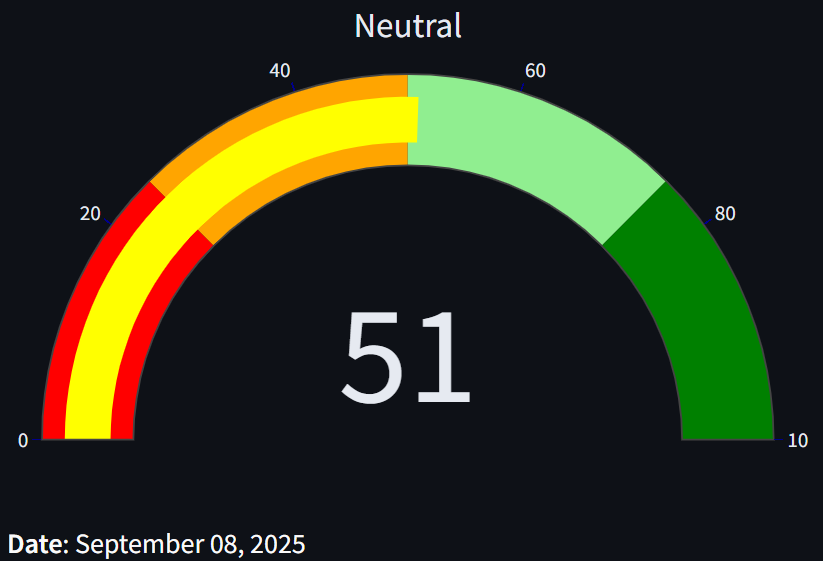

Fear & Greed Index: 51 (Neutral)

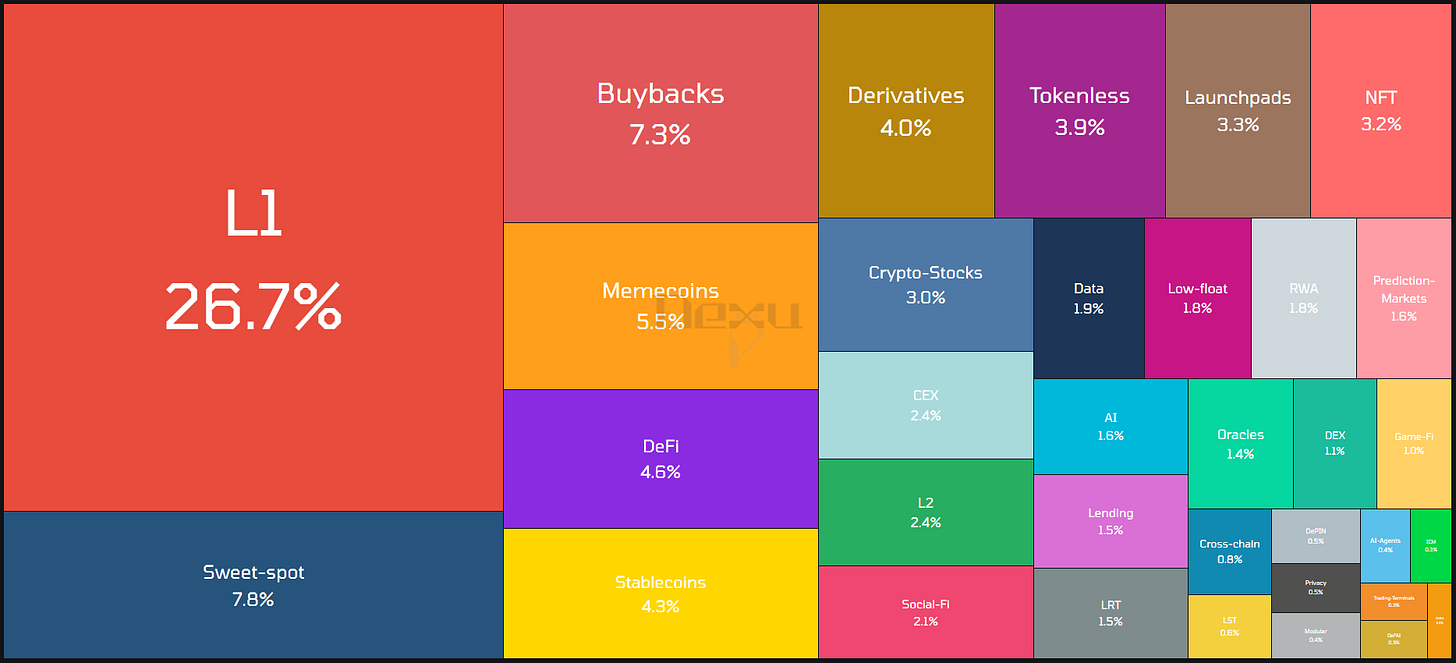

Narrative Mindshare (7d)

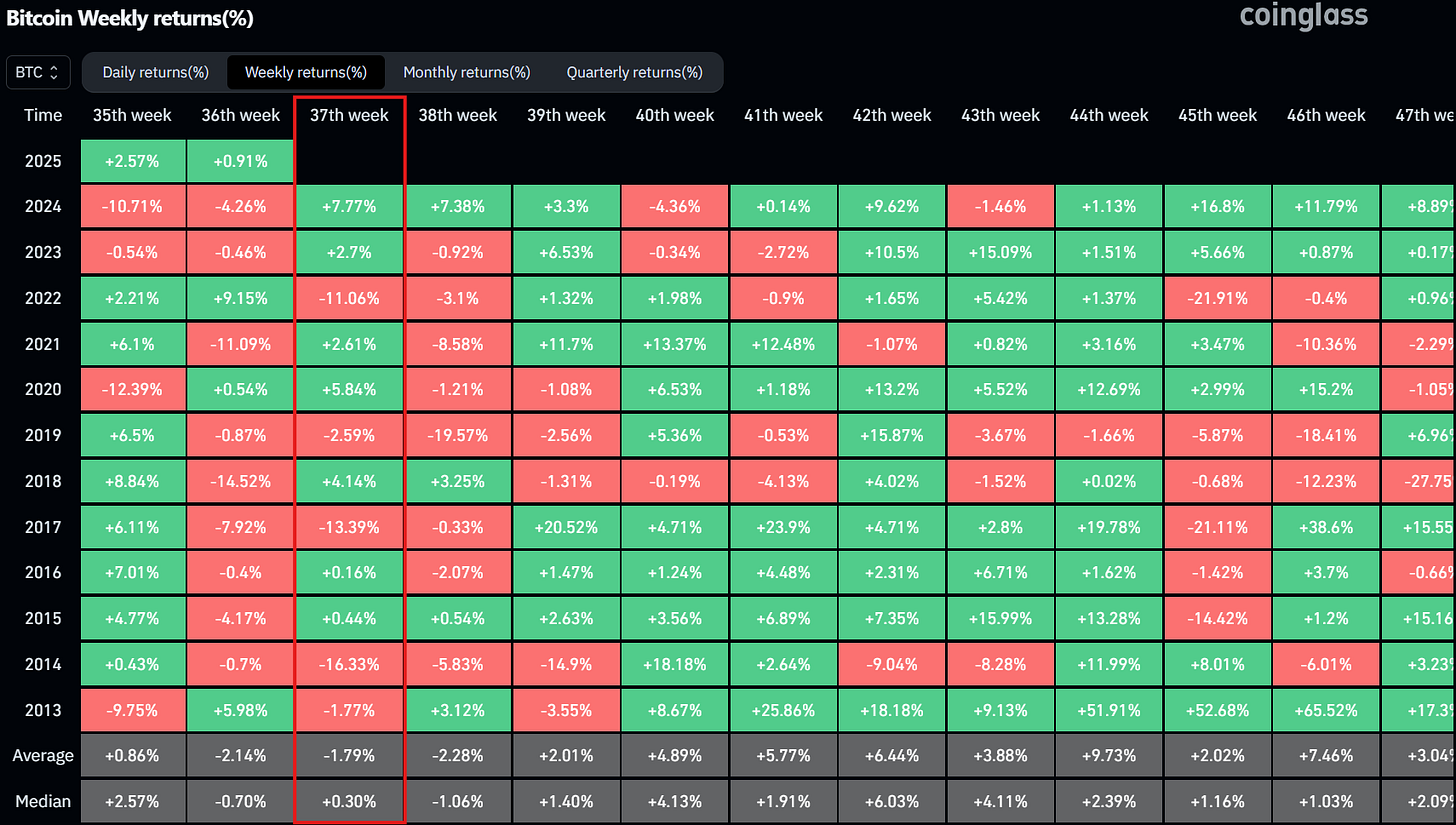

Historical Bitcoin Performance This Week

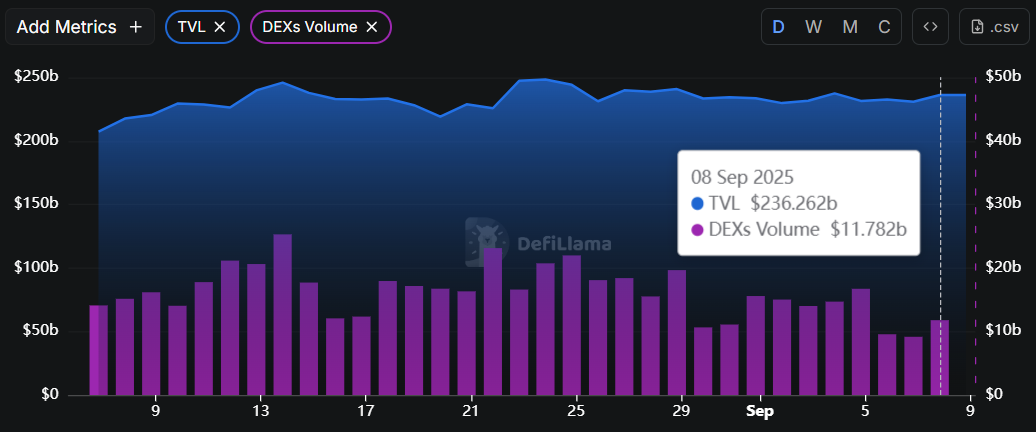

DeFi Market Metrics: Global TVL & DEX Volume

TVL is up slightly MoM, DEX volume has been trending down over the last two weeks.

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. $1.6b Solana Treasury Company Announced

Jump, Multicoin and Galaxy announced a Nasdaq-listed treasury company called Forward Industries with $1.65b in cash ready to purchase Solana. It’ll be the largest SOL treasury to date, although a portion of the tokens acquired could be locked token transfers, not open market purchases.

What This Means

Forward plans to generate onchain returns and participate in the Solana ecosystem. Some speculate that this is a hunt for exit liquidity for locked token holders. Either way, an additional $1b+ of funds potentially coming to the Solana ecosystem is a good thing.

2. The Hyperliquid Stablecoin Race is On

The Hyperliquid team announced it wants to create a “Hyperliquid-first” compliant stablecoin. The ticker would be USDH.

Everyone wants to be the USDH issuer: Stripe (via Bridge), Paxos, Moonpay, Circle and many others.

What This Means

Ruthless competition to be the stablecoin issuer on Hyperliquid is a nod to its powerful ecosystem and bright future. Ideally Hyperliquid selects the stablecoin issuer that brings the most value, which would be a win for projects and users.

For example, Native Markets proposed to contribute “a meaningful share of its reserve proceeds” to the Hyperliquid Assistance Fund treasury, which buys back HYPE tokens.

3. Nasdaq is Ready for Tokenized Stocks

Nasdaq filed a request with the SEC asking for a rule change that would allow tokenized stock listings.

What This Means

Nasdaq’s ask is not trivial. On the table for amendments is the definition of a security. Given the size and influence of the Nasdaq, however, it’s likely they’ll get what they’re asking for. But it could take some time.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡DeFi just found another $20b use case

Collectible Capital Markets

⚡September 2025 Airdrop Checklist

Use these to potentially qualify for the biggest airdrops this year

⚡Ethena Announces Follow-On Treasury Raise

Ethena’s DAT StablecoinX raises 14% of ENA’s market cap

Learn advanced yield strategies and how to find DeFi opportunities

⚡Custom DefiLlama dashboards to track narratives & ecosystems

Hyperliquid, Solana, stablecoins, revenue heavy-hitters and more

⚡Become a DeFi Menace

The Dynamo DeFi Pro newsletter helps you understand the intrinsic value behind different tokens. We dive deeper into the fundamentals behind digital assets with unique visuals, and revamped this recently to include a wide variety of custom metrics, such as:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

To get these insights delivered to you each week, become a Pro member.

🔢Onchain Analysis

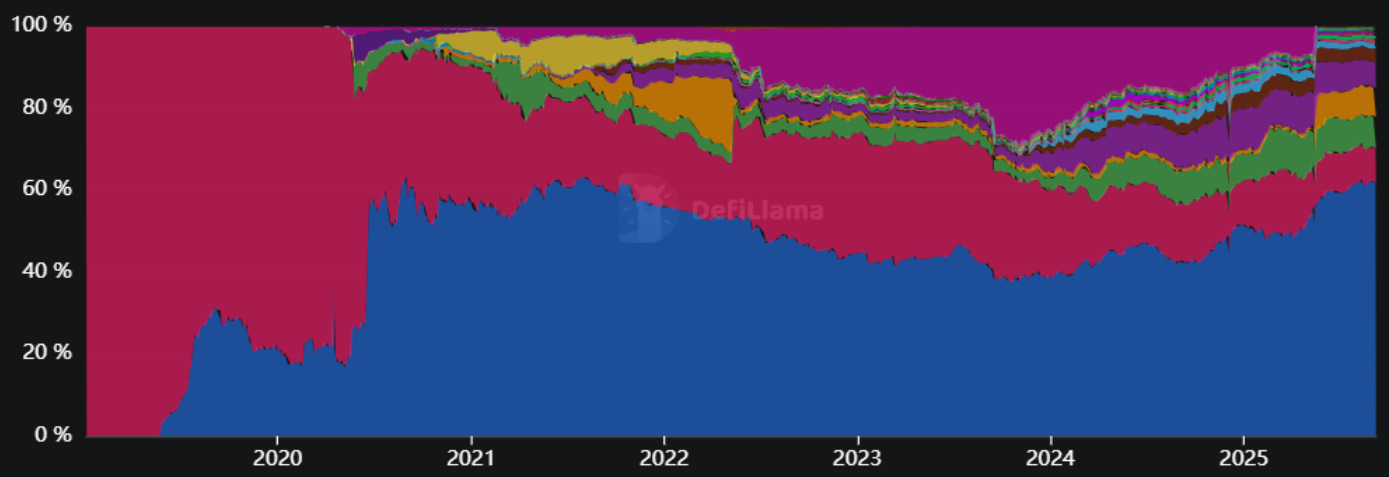

Oracle Value Secured at All-Time Highs

Onchain critical infrastructure is being utilized more than ever.

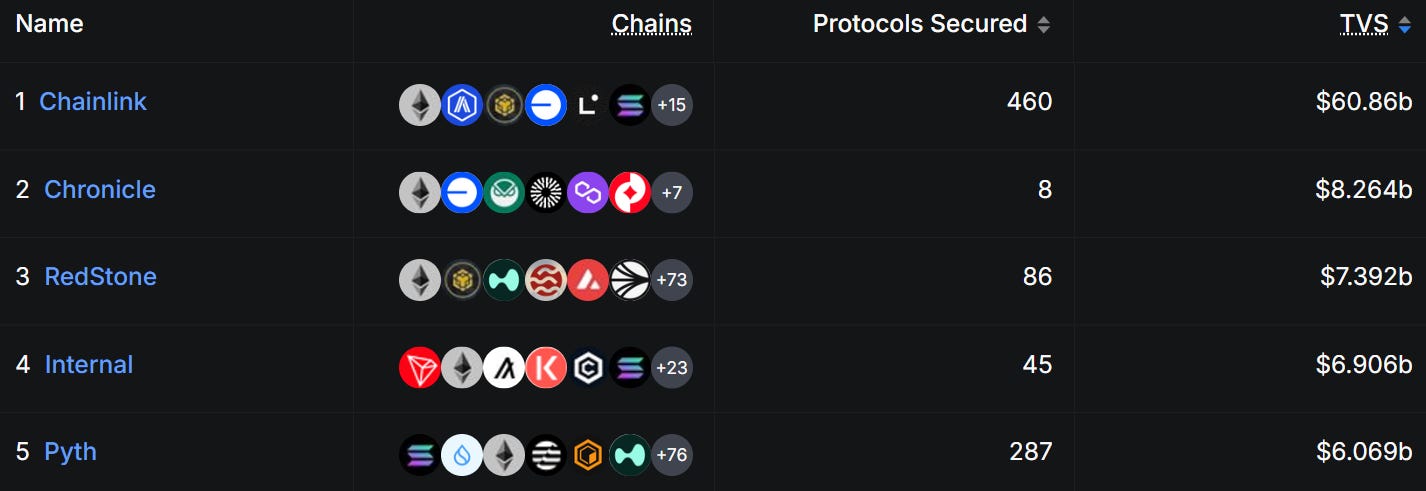

The top 5 oracles secure 886 protocols worth nearly $90b in value.

Chainlink dominates, securing 60% of all onchain value. In 2023, Chainlink only secured about 37% of onchain value. Since then Chainlink has clawed back market share.

Given Chainlink’s longstanding performance, reliability, reputation and connections, it’s poised to continue dominating.

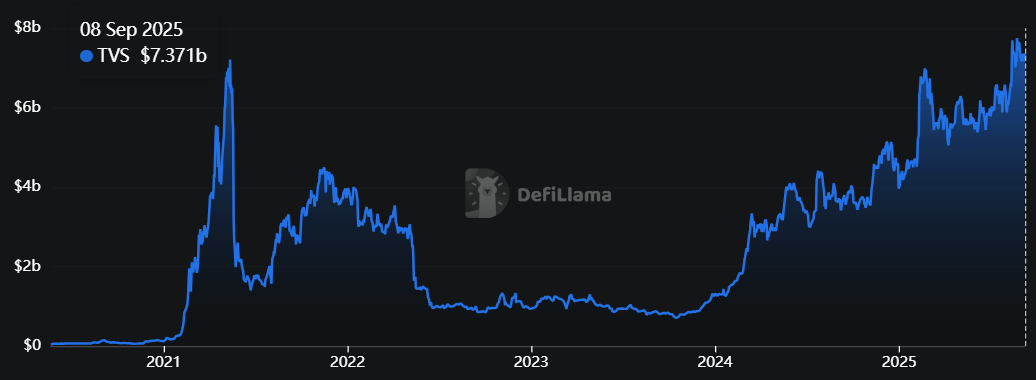

RedStone Total Value Secured (TVS) is also at all-time highs. RedStone secures major protocols like Venus, SparkLend and major Hyperliquid protocols like HyperLend, Hyperbeat, Felix and others.

The oracle will continue to be critical infrastructure. As oracles strengthen business models, they should become investible assets to own.

Chainlink is working to make this possible with their LINK reserve program, passing on revenue to token holders.

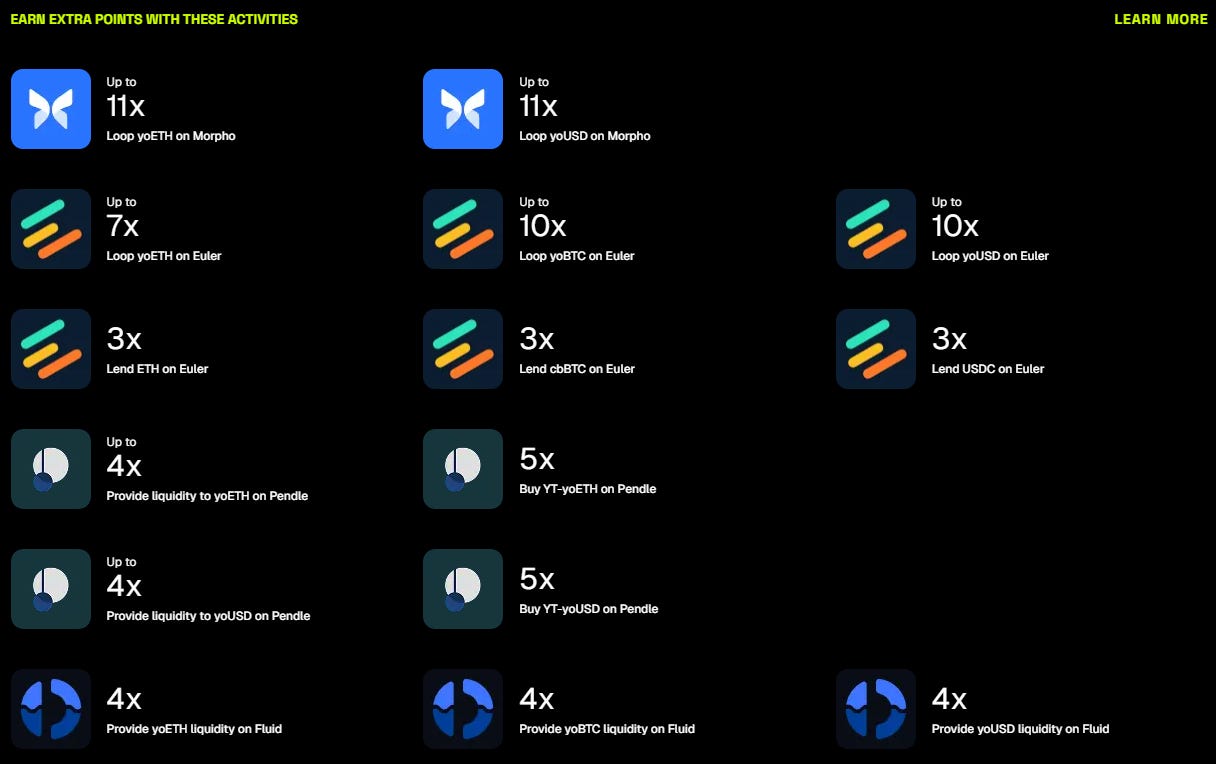

🚜Farm of the Week

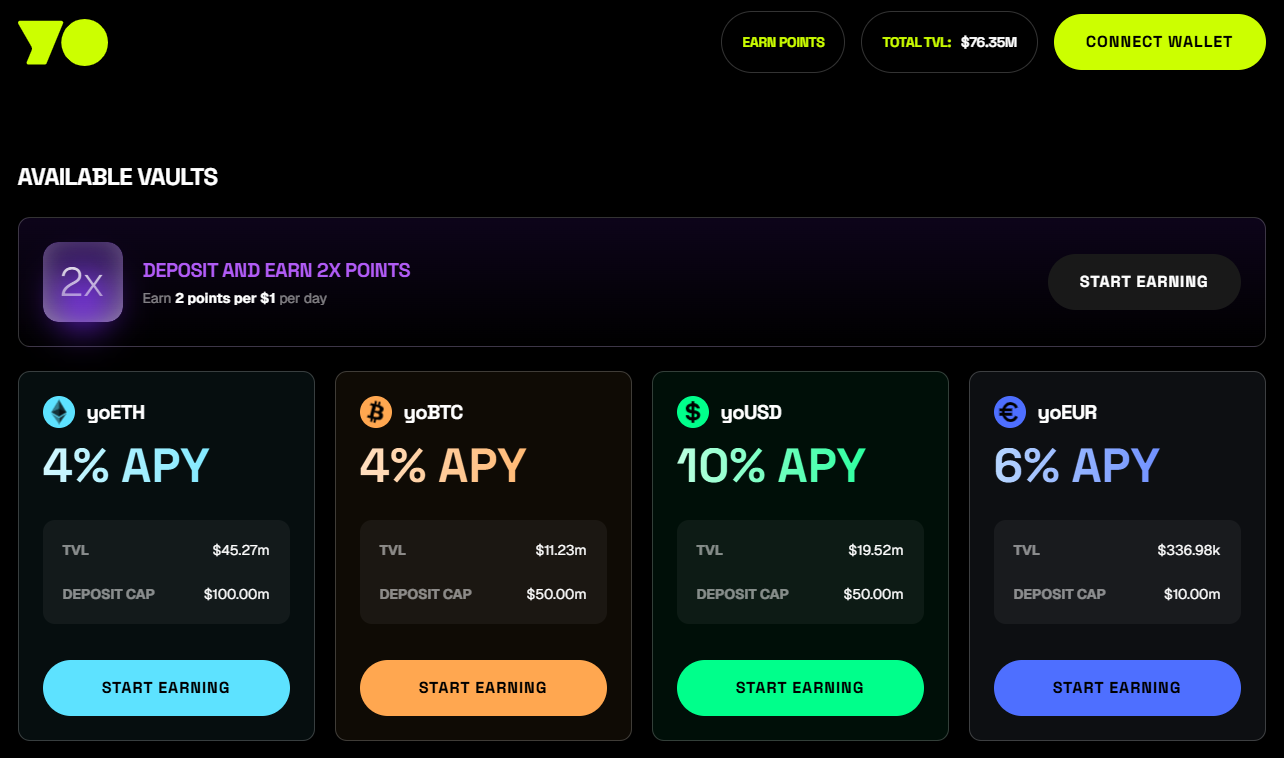

YO - Yield Optimizer and Points Program

YO is a multi-chain yield optimizer that continuously rebalances to deliver top risk-adjusted yields in DeFi. The protocol has accumulated $75m in TVL.

How it Works

Head to YO’s dashboard, connect your wallet and select which asset you’d like to deposit. Use my link for a 10% points boost.

Both the yoBTC and yoUSD yields are quite good. You can deposit these assets through Base, Ethereum, Arbitrum, Optimism, Avalanche or Gnosis.

You can also boost your points by using the receipt tokens throughout DeFi. Keep in mind this carries additional risks.

Risk Level: Low

Risks

Smart Contract risk

Protocol Layer risk

⚡Why Hyperliquid is Leading the Crypto Market

🛠️Tool Spotlight

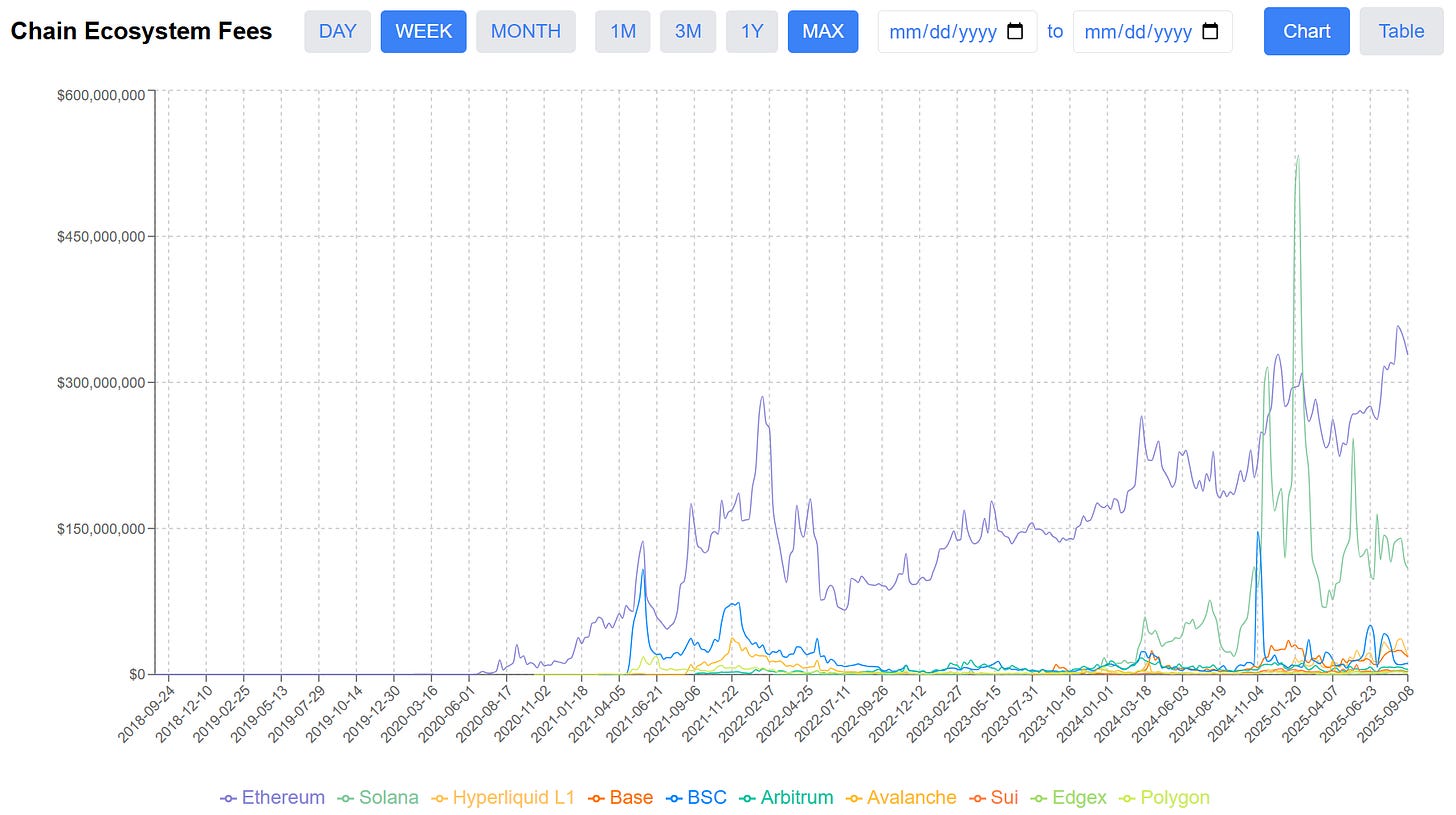

Chain Ecosystem Fees Dashboard

I built the Chain Ecosystem Fees dashboard to measure real activity onchain.

It’s free and can be used to track which chains are receiving more fees from ecosystem applications, so you can see where real users are going.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 August PPI Inflation data - September 9th

📊 OPEC Monthly Report - September 10th

📊 August CPI Inflation data - September 11th

📊 MI Consumer Sentiment data - September 12th

📊 MI Inflation Expectations data - September 12th

Token Unlocks: $160m Unlocking This Week

🔓FLR (1.8%) - September 9th

🔓AGI (2.26%) - September 9th

🔓BB (1.9%) - September 11th

🔓APTOS (1.13%) - September 11th

🔓$CYBER (0.89%) - September 13th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 $DYDX affiliate booster program launch - September 8th (Source)

🚀 DoubleUp marble racing launch - September 9th (Source)

🚀 Celo hardfork on mainnet - September 10th (Source)

🚀 Collaterize V2 - September 10th (Source)

🚀 Ethervista launch on SOL - September 12th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi

Thx for your work ! Enjoy reading it