⚡Collectible Capital Markets [Dynamo DeFi Pro Report]

Why Trading Card Tokenization is a Textbook Use of DeFi

💡Dynamo’s Thoughts

Crypto traders finally managed to find another asset they want to hold: Pokémon cards…

Physical cards from Trading Card Games (TCGs) are trading at all-time highs.

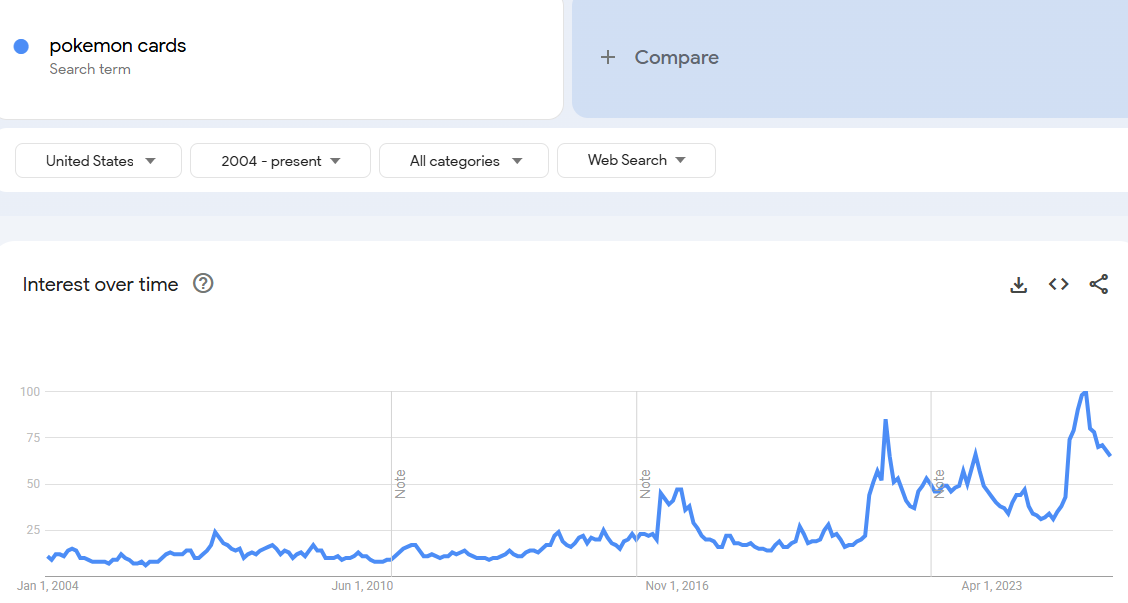

If you didn’t know already, Pokémon cards specifically have surged to record levels of interest this year. And high valuations have followed suit.

The reaction to the “Pokémon card crypto meta” has been mixed to say the least:

But, jokes aside, tokenized trading cards is actually a good use of DeFi. Tokenizing trading cards:

Makes a previously illiquid asset liquid

Enables cards to be used as collateral for loans

Allows for new speculative vehicles, like leveraged loops, to be built for trading cards

Plus, tokenization offers substantial benefits to the card trading experience.

Previously, buyers had to connect with a trusted seller, manage Ebay auctions, deal with shipping constraints, etc.

And who’s responsibility is it if the card is damaged along the way?

Tokenization means collectibles like Pokémon cards can be bought and sold instantly in a few clicks, easily transfer ownership, and have professional vault services that standardize the protection & shipping process.

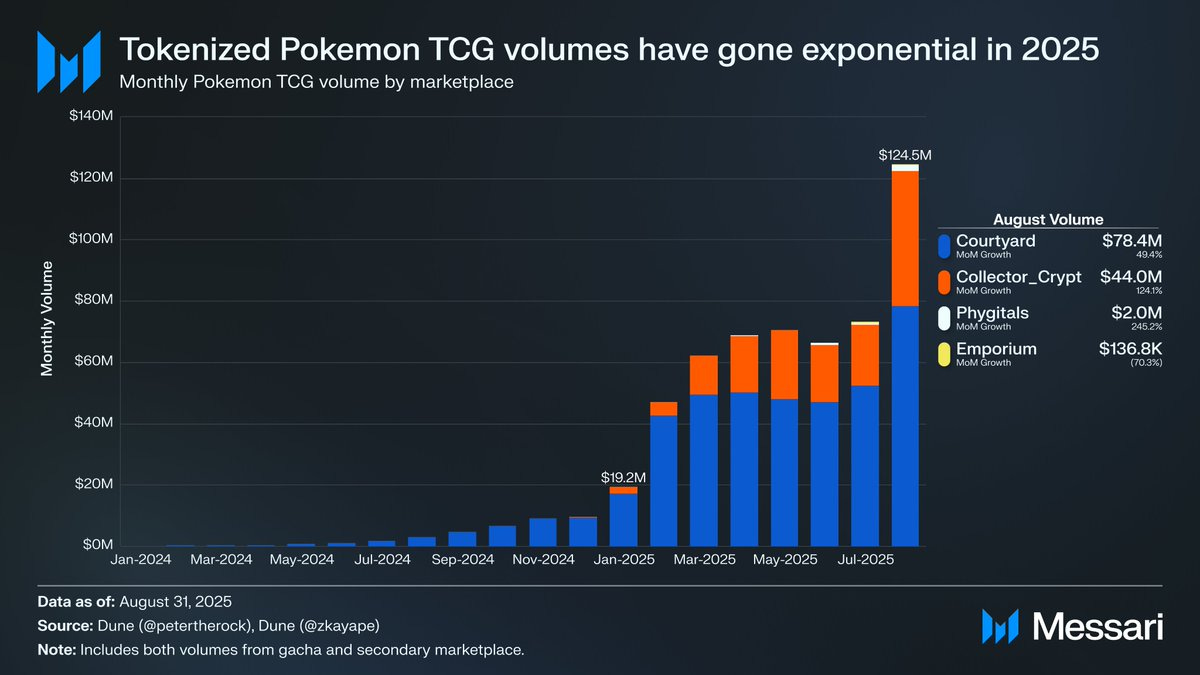

For those wishing to sell more of their cards, using a service like Courtyard or Collector Crypt means their cards are instantly liquid and verifiable using an authentication process.

Courtyard has been facilitating most of the volume thus far.

Collector Crypt managed a successful TGE utilizing the very first Metaplex Launch Pool. The token is up 10x since launch, recently crossing $100m market cap. Their breakout product is called Gacha, a fun +ev way to acquire new cards. It’s done over $5m in weekly volume for 6 consecutive weeks.

There’s also Phygitals, Emporium, Grailed, ToCa and others. Most of the collectible RWA markets are built on Solana.

The key here is that the value for these cards is exogenous to crypto: crypto merely provides a superior experience for trading, holding, and using them.

The popularity and staying power of tokenized Pokémon cards is encouraging for lasting onboarding: instead of coming onchain and getting extracted by memecoin traders and celebrities, new users now experience an improvement in a market they already enjoy.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

Before I start, if you’re looking for a more comprehensive overview of trends driving the market, check out our monthly Zoom call from this week:

Dynamo DeFi Pro Group Call - August 2025

Each month, I conduct a group Zoom call with premium Dynamo DeFi subscribers to discuss the trends driving the crypto market.

🔭Market Outlook

We’ve heard your feedback from last week’s poll that you want more trending altcoins. We’ll be introducing several new newsletters each month:

Top 5 altcoins based on fundamentals that month. 3 will be free and 2 will be paywalled.

Portfolio changes each month. For paid subscribers, I’ll provide a monthly update on what I’m holding, based on fundamentals.

Market Health

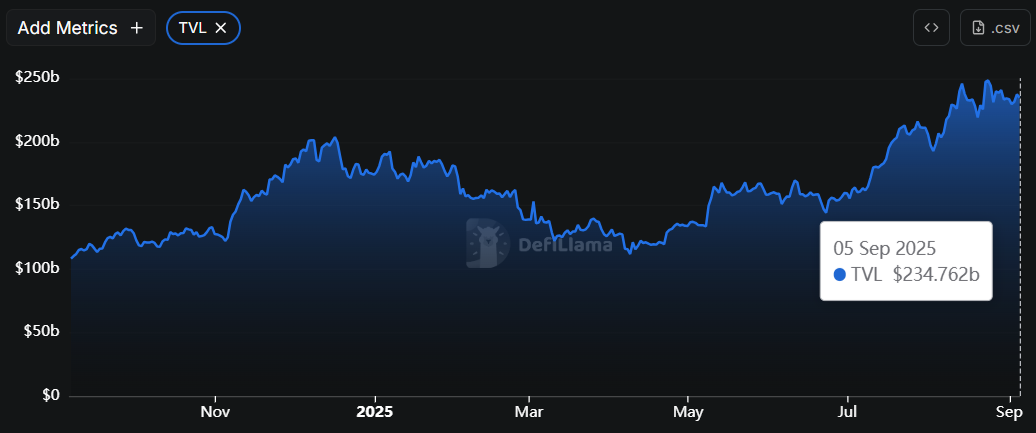

Total DeFi TVL

Total DeFi TVL is sitting comfortably after a decisive break above $200b in August. Currently $234b.

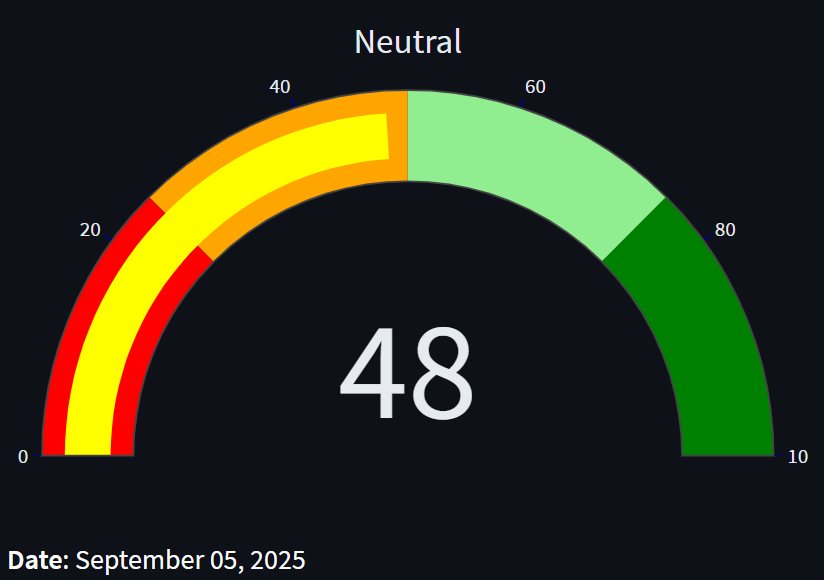

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here.

Today’s index is the same as last week’s: Neutral.

Stablecoin Market Cap

Another record for stablecoin market cap this week, rapidly approaching $300b. Nearly $20b was added over the last month. USDC growth outpaced all other stablecoins, and USDT dominance is below 60% for the first time in over two years.

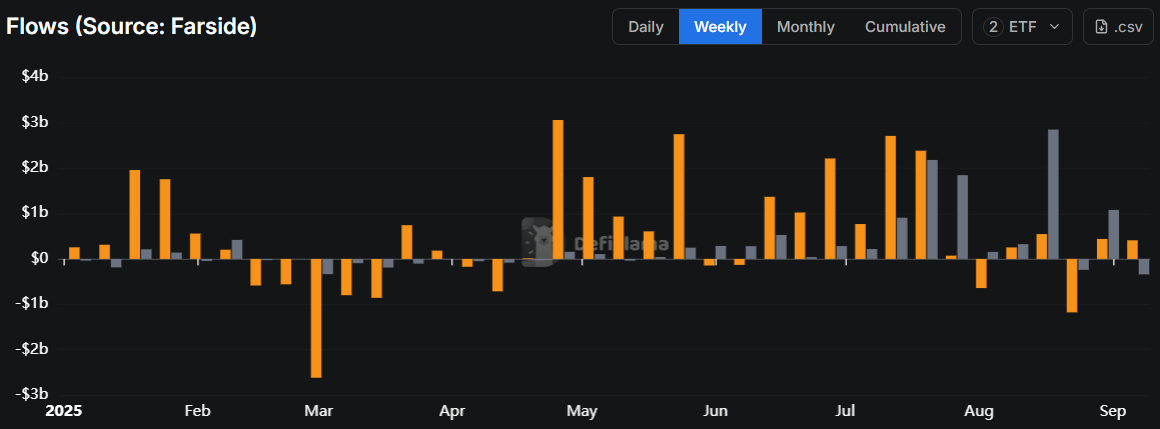

ETF Flows

ETF flows have been muted over the last several weeks. BTC ETFs saw their first month of net outflows since March, while August was Ethereum’s second highest month of inflows to date.

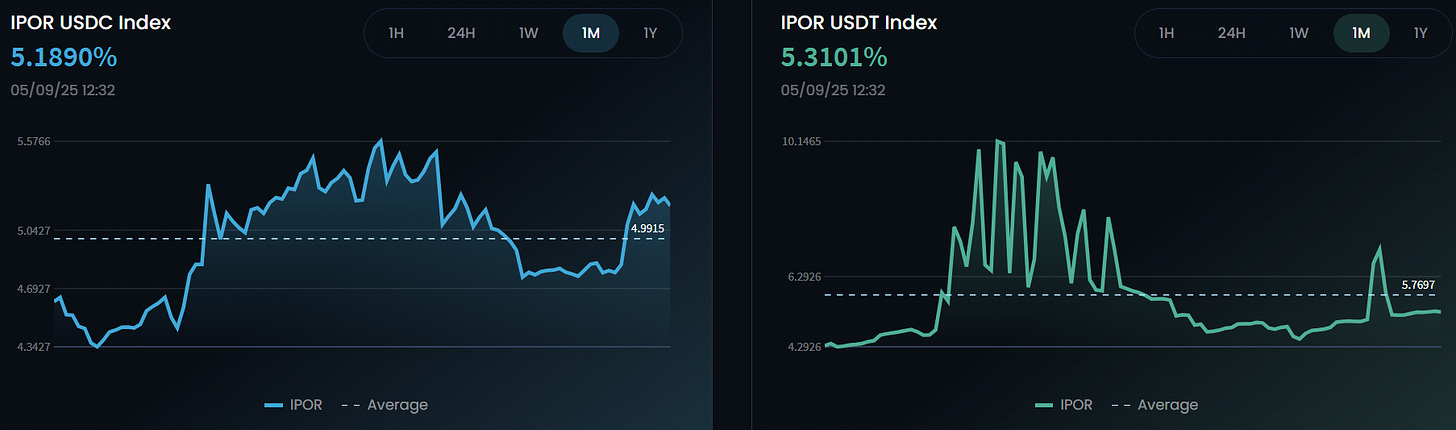

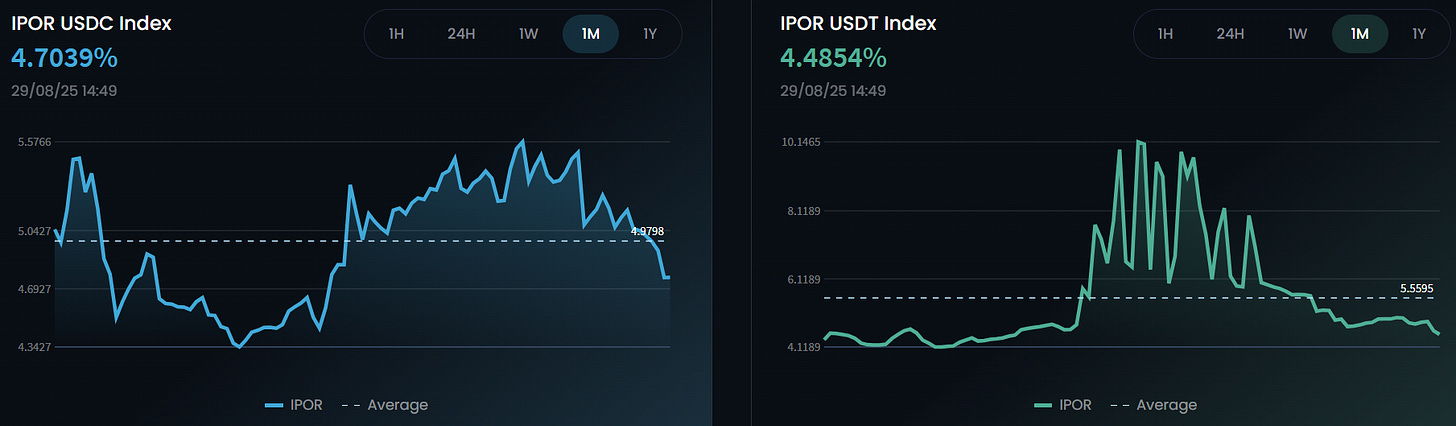

IPOR Stablecoin Indices

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

Rates for USDC & USDT are back above 5%. Rates have been steadily trending up since June, but besides a few spikes in USDT rates, nothing indicates a rate market that’s too hot.

For reference, here are last week’s numbers:

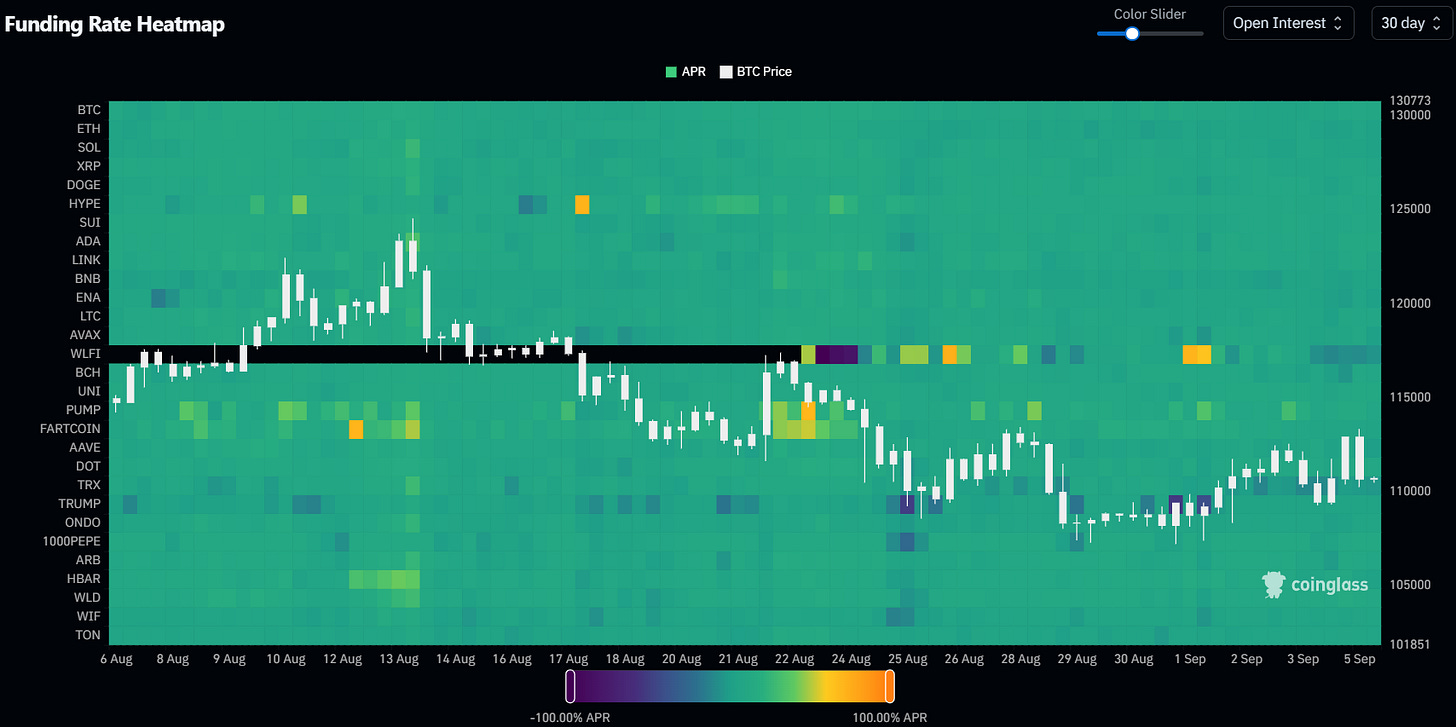

Funding Rate Heatmap

The Funding Rate Heatmap from Coinglass displays funding rates across some of the largest crypto assets.

Brighter colors indicate elevated funding rates for longs, and darker colors indicate low or negative funding rates (indicates large short positions).

Rates are balanced this week. The most expensive perp to long is ADA. PEPE & WLD are the most expensive perps to short.

Category and Chain Trends

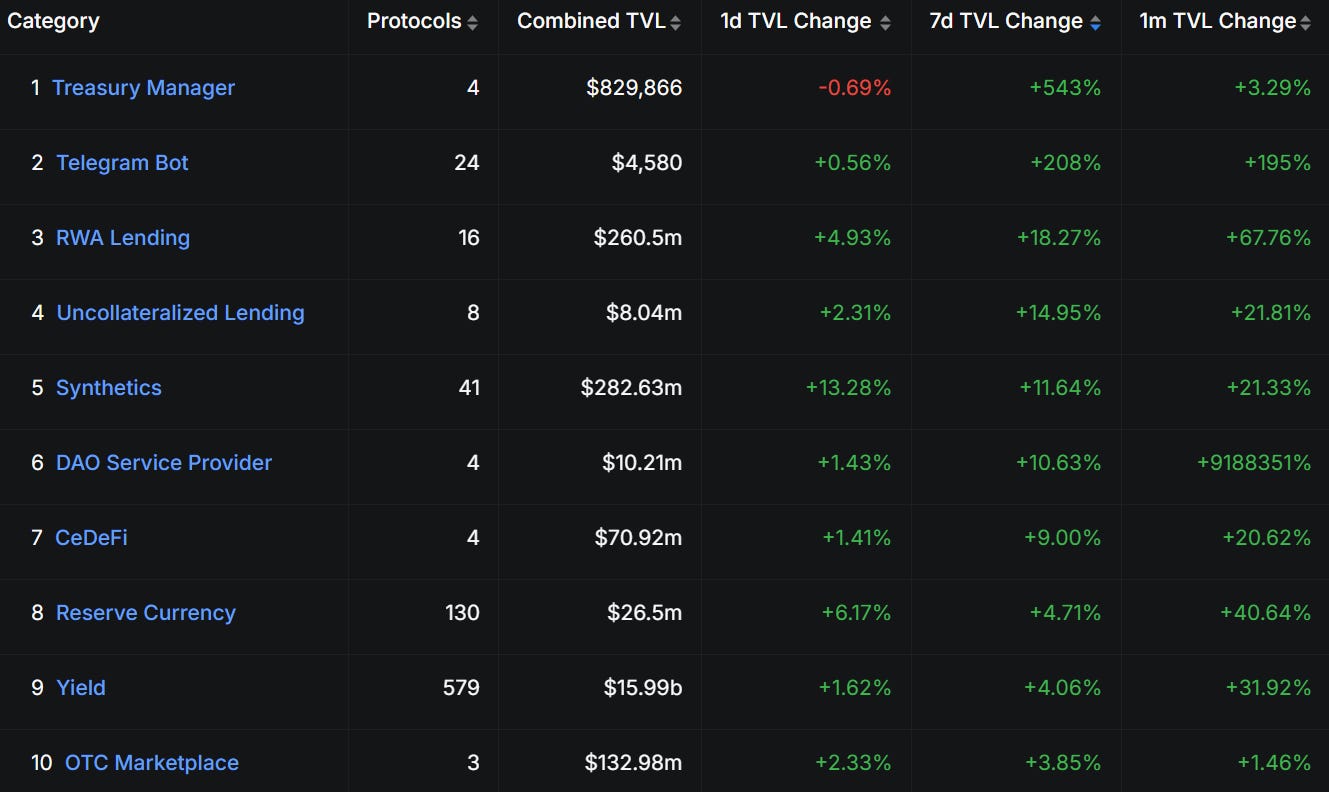

Category TVL Changes

Many smaller categories lead TVL growth this week. It’s typically best to focus on larger categories that are less affected by one depositor skewing TVL increases.

However, TVL isn’t a representable metric for categories like Telegram Bots. Bots are better measured by volume and revenue. When sorted by revenue, Telegram Bots are a top 10 category.

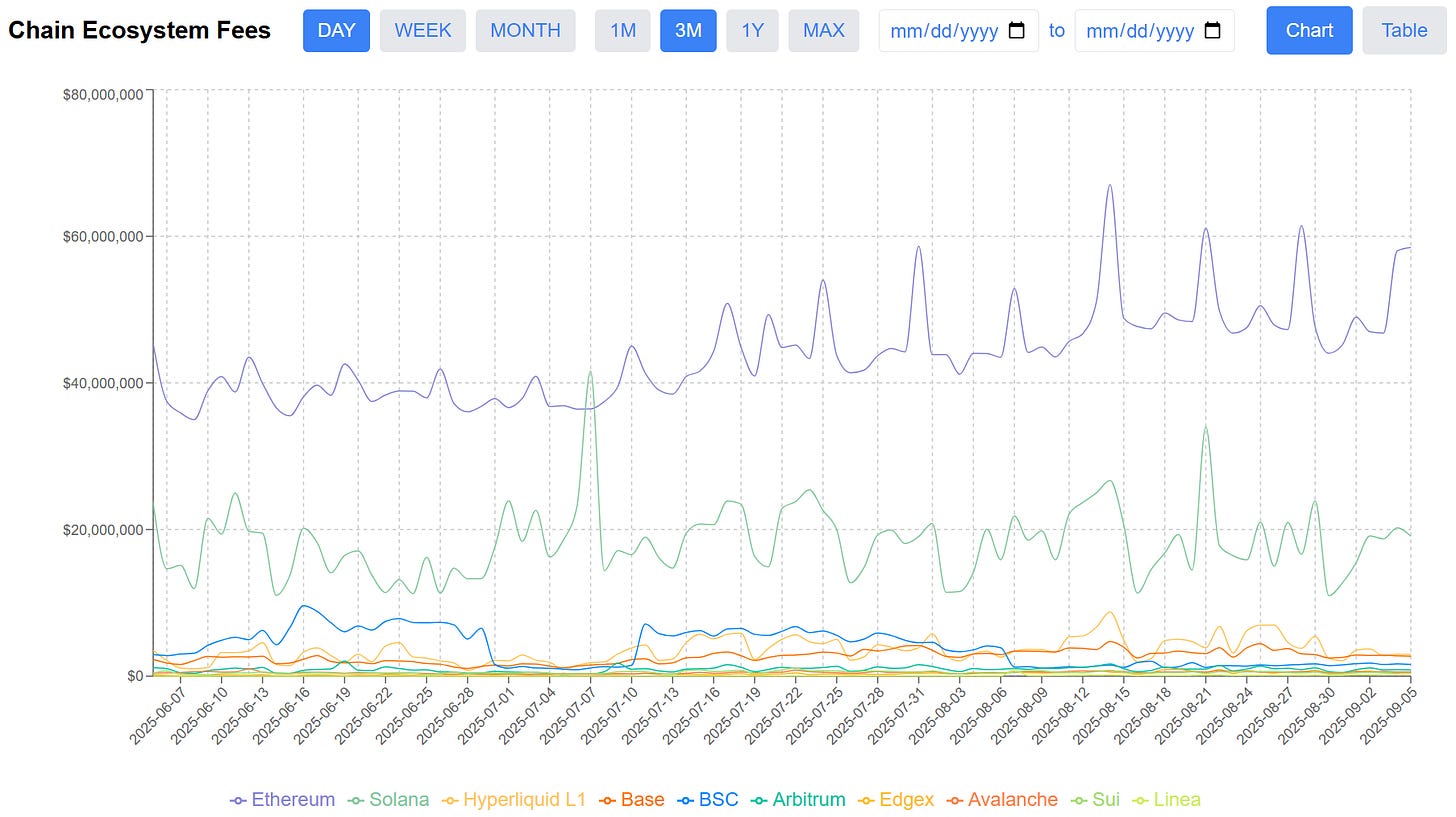

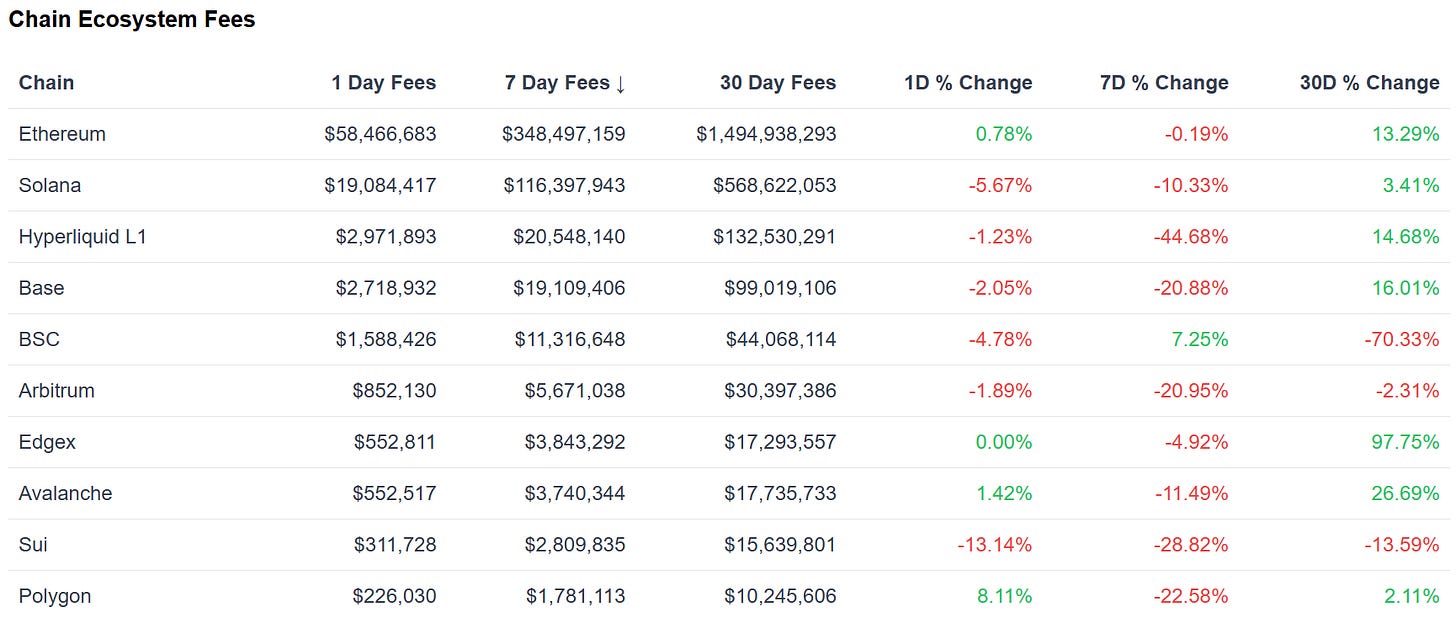

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

Many Chain Ecosystem Fees dropped this week, signaling a decrease in onchain activity. Hyperliquid stands out with a 44% decrease, but CEF are still up over 30d.

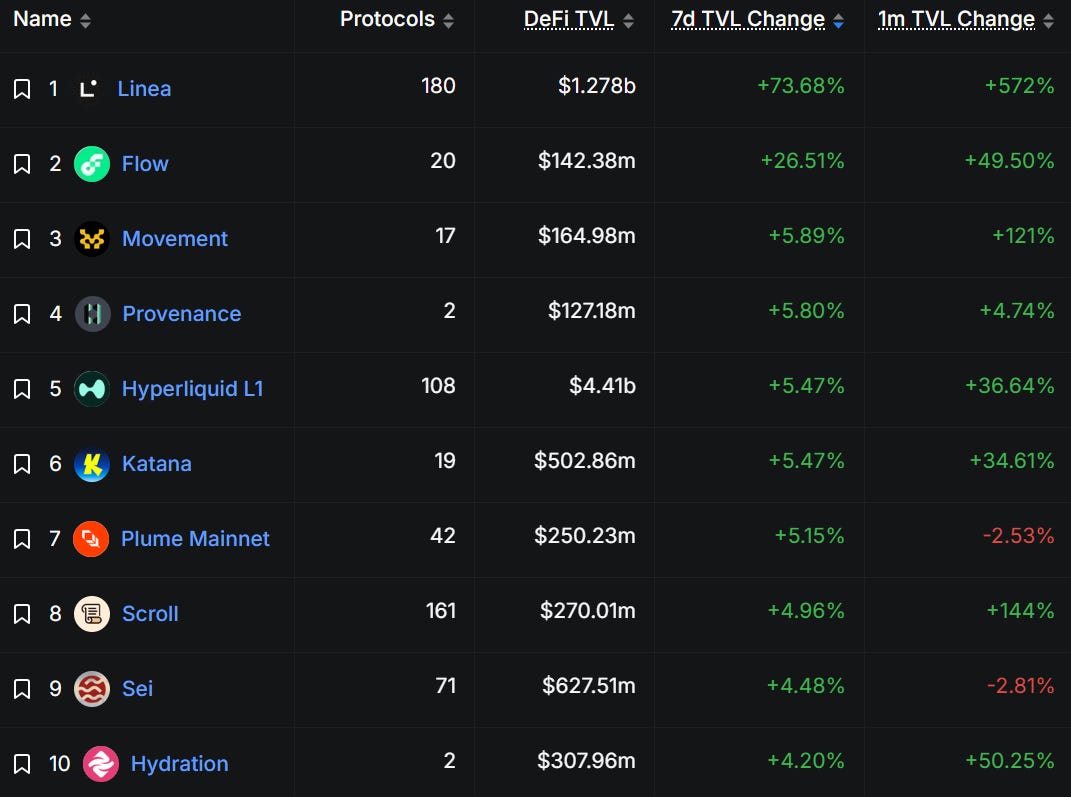

Fastest Growing Chains ($100M+ TVL)

Linea TVL is on a rampage, growing over 550% in 30 days. A month ago, Linea TVL was $170m. The top protocols on Linea are growing rapidly (Aave, Renzo, Etherex, Euler), and the team released an airdrop checker.

Hyperliquid L1 growth is in the top 5 this week, led by Pendle.

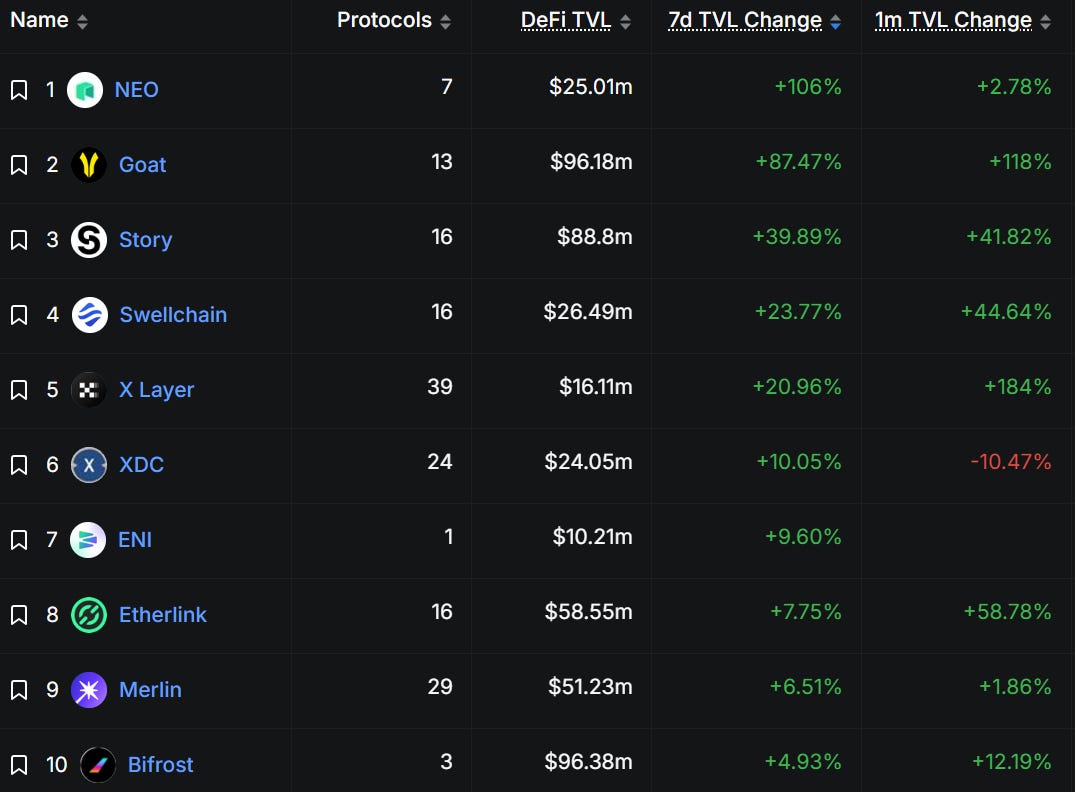

Fastest Growing Chains ($10M-$100M TVL)

Story hit a TVL ATH just a few days ago. Unleash Protocol’s TVL on Story is up 100% in 7 days.

📊Onchain Metrics

Digital Asset Fundamentals

This section dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens.

Below you’ll find 3 visuals:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.