⚡️The Most Investible Project in DeFi Right Now

Plus Ethereum’s Trillion Dollar Security plan, 200% SUI yields, and what whales are doing with Bitcoin.

Read Time: ~5 minutes

⚡Snapshot

The rise of Hyperliquid

Ethereum announces Trillion Dollar Security initiative

200% SUI APY

Coinbase added to S&P 500 this week

📖 Recommended Reads

⚡Bitcoin whales accumulated $122b in Bitcoin over last two months

Will history repeat itself?

⚡Ethereum announces Trillion Dollar Security (1TS) initiative

Ecosystem-wide effort to upgrade Ethereum’s security to help bring the world onchain

How Kaito Yapper leaderboards are changing project’s GTM strategies

⚡Bitcoin continues Acceleration Phase

What comes next?

⚡Digital Asset inflows fully recover from February-March outflows

YTD digital asset investment products total $7.5b

⚡The Strongest Crypto Project Right Now

Hyperliquid is a top-tier onchain trading experience:

No gas fees, no sign-up. Just connect and trade

Trade native spot assets like BTC & ETH with the lowest fees

L1 ecosystem with airdrop opportunities

🔢Onchain Analysis

Hyperliquid’s Rise

Hyperliquid, an L1 and perp DEX, is becoming the gold standard for a DeFi protocol.

The team built a product that people like to use, the protocol makes money, and the HYPE token accrues a portion of that value.

A large percentage of the Arbitrum inflows (Arbitrum leads inflows on all time frames: Day, Week, Month) are going into Hyperliquid, showing additional interest in depositing to the Hyperliquid ecosystem and perp DEX.

Of all large bridges, Hyperliquid is second in volume over the last 7 days only to LayerZero.

Mike Novogratz from Galaxy Digital went on CNBC and talked about Hyperliquid as an attractive investment for traditional equity managers, due to Hyperliquid’s strong revenue and data transparency. Read Dynamo’s Thoughts on that here.

Hyperliquid sits among giants in Chain Ecosystem Fees, earning $15m over the last 7 days - more than Base & Arbitrum.

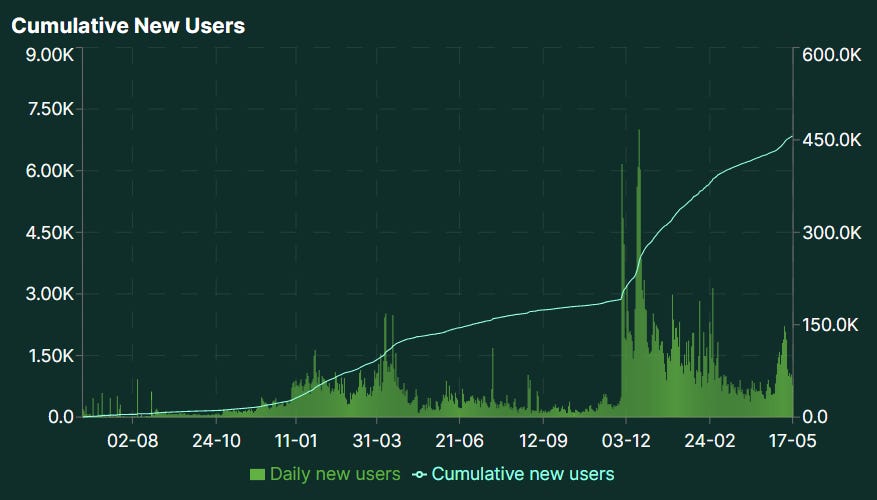

Hyperliquid sees thousands of new users each day. The protocol crossed 450k users after a spike earlier this month added 30k new users.

There are now several reasons to like Hyperliquid as a DeFi user:

A perp DEX is an excellent business

Hyperliquid enabled native spot trading of several assets, including Bitcoin & Ethereum - attracting more than just perp traders

The L1 ecosystem is starting to heat up - here are two of our favorite potential airdrop opportunities on the L1.

With the L1 recently crossing $1b in TVL, Hyperliquid is making a name for itself outside of just the Crypto Twitter sphere.

However, at a $25b FDV, HYPE is already the 11th most valuable token when sorted by FDV. Explosive upside is limited for now - but if the L1 becomes a hotbed for activity with a wealth effect (similar to Solana), and more institutional finance comes onchain, HYPE could enter a whole new category of valuations, up with SUI, BNB & SOL.

If you haven’t used Hyperliquid yet, you should give it a try. Here’s how you can get started in two minutes.

🚜Farm of the Week

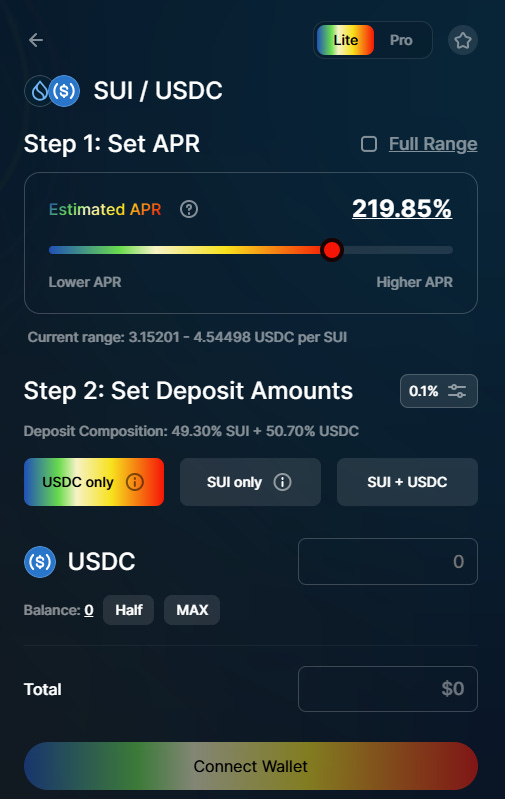

Earn 200% SUI-USDC Pools on Turbos Finance

Turbos is a DeFi protocol on Sui. Elevated trading volume means higher yields for those providing liquidity.

How it Works

Connect your wallet (you can use most major wallets) and deposit USDC, SUI, or both. If you choose deposit a single asset, the pool will automatically split the deposit for you.

The range is about 36%, meaning the price of SUI can drift ~18% in either direction and still earn fees. While this pool doesn’t require constant attention, if there’s volatility in the market, the pool parameters may need to be adjusted to accommodate SUI price changes.

Risks

Risk level: Medium

Impermanent loss - use the Impermanent Loss Calculator here

Interview with Jito Labs Founder Lucas

⚡Significant DEX Volume Increase for Solana

A notification went off in the Dynamo DeFi Discord: Solana’s DEX volume has increased across 3 crucial time frames.

This indicates a strong uptick & trend in activity.

Get the most important DeFi metrics & timely updates from the DeFi Alerts channel. The alerts come straight to you, so you can focus on execution.

Available only in the Dynamo DeFi Discord. Get immediate access →

🛠️Tool Spotlight

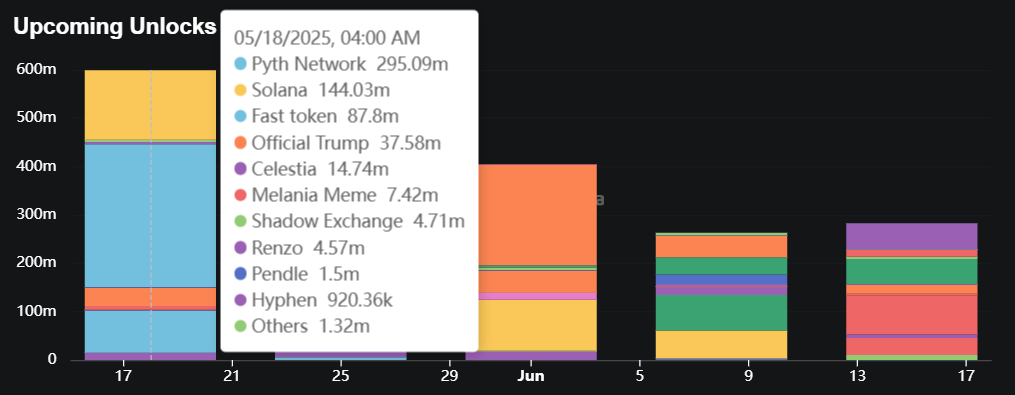

Track Token Unlocks with DeFiLlama

Use DeFiLlama’s Unlocks dashboard to track major token unlocks - PYTH’s big unlock is coming this week.

There are several ways to view total token unlocks, as well as get details on each individual unlock. May is the 3rd largest month of unlocks this year.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Inclusion of Coinbase in the S&P 500 - May 19th

📊 US Crude Oil Inventory data - May 21st

📊 S&P Global Manufacturing PMI data - May 22nd

📊 April Existing Home Sales data - May 22nd

📊 April New Home Sales data - May 23rd

📊 14 Fed speaker events this week

Token Unlocks: $600m Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓PYTH (58.62%) - May 19th

🔓ZKJ (5.30%) - May 19th

🔓ORDERLY (0.57%) - May 19th

🔓ZETA (5.4%) - May 19th

🔓MELANIA (5.79%) - May 20th

🔓SHADOW (20.72%) - May 21st

🔓FTN (4.66%) - May 21st

🔓BICO (0.8%) - May 24th

🔓REZ (12.33%) - May 24th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Liquity v2 relaunch - May 19th (Source)

🚀 Illuvium beyond wave4 alpha and extended sales launch - May 20th (Source)

🚀 Conquest.eth next release on fusionist - May 21st (Source)

🚀 Nockchain launch - May 21st (Source)

🚀 Aethir checker node buyback - May 22nd (Source)

🚀 Hydranet public alpha release - May 23rd (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi