⚡When Fundamentals Become a Narrative [Dynamo DeFi Pro Report]

On-chain insights and DeFi strategies

💡Dynamo’s Thoughts

When Fundamentals Become a Narrative

We’ve been talking about a “return to fundamentals” for months.

Two piece of news this week crystallized the degree to which this shift has taken hold:

Mike Novogratz went on CNBC and talked Hyperliquid’s revenue, buybacks, and the transparency thereof through onchain data.

The Believe App going viral by promising to tie tokens to real apps with real usage.

Let’s talk about each of these individually first.

Hyperliquid Revenue

Mike Novogratz went on CNBC to talk crypto this week and mentioned Hyperliquid.

He talked about Hyperliquid as being like a “decentralized Nasdaq”, but what I want to call out are two things he mentioned:

Hyperliquid’s strong revenue and the fact that they’re using that revenue for buybacks

The fact that Hyperliquid’s revenue is transparent and available daily

Both of these things, as he notes, make this an investment with appeal to traditional equities investors.

The point of this isn’t to shill Hyperliquid.

The point is that (1) some DeFi protocols now have real revenue, and (2) that revenue is verifiable onchain in close to realtime.

Platforms like DefiLlama provide revenue, deposits and other metrics for hundreds of protocols. In DeFi we take it for granted that we can get those metrics daily, hourly or even in real-time. But to the rest of the world that’s groundbreaking innovation in-and-of itself. TradFi investors are used to waiting for quarterly reports in order to get financials.

Quarterly —> Hourly

That’s the difference that DeFi data makes.

As more and more business starts to move onchain, I expect that investors, especially younger investors that are used to investing in crypto, will become accustomed to having more frequent data.

Over time, this will result in a preference for assets which provide that more transparent, more regular data. In turn, this will push more business to move onchain.

Return to fundamentals isn’t just about investing in crypto dApps with real revenue. It’s about a new paradigm where onchain data ushers in an era of increased financial transparency.

Internet Capital Markets

To recap, Believe is a platform for launching more traditional Web2 apps, but with an associated token. These include everything from games to generative AI.

Imagine a mobile game where the in-game currency is a tradable token:

Early players can cash in big for being early

The in-game economy merges with the real-world economy

Developers receive a new income stream early on in their apps development

Naturally, many of the first tokens to launch through this new narrative have turned out to be extractive and have quickly run up and crashed. And it isn’t entirely clear whether these tokens will ever actually be a proxy for the apps value (in fact, Believe’s terms and conditions expressly forbid this). However, underneath the hype is a truth: crypto investors are hungry for apps with real-world use, where tokens are tied to real businesses.

Check out the article we published earlier this week going through this narrative in more depth.

The Commonality

The commonality between these two stories is that crypto investors are beginning to evaluate tokens less as financialized attention and more as businesses.

Hyperliquid is more explicitly a successful business, since it makes revenue and uses that revenue to buyback its HYPE token.

Some of these Believe apps may in turn establish themselves as successful businesses.

Either way, tracking token revenue and other financial metrics is likely to be more important than ever for digital asset investors in the future.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

🔭Market Outlook

Market Health

Total DeFi TVL

Up 28% YoY and at the highest level since late February.

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here. Today’s value is 70, on the high end of the Greed category.

A month ago today, F&G index marked 29. April and this first half of May have seen sentiment go from near-rock bottom to bordering extreme greed.

Sentiment distribution tells us that Greed is where the plurality of time is spent (29% of all tracked history is in Greed) - the market can be greedy for quite some time. Extreme Greed, however, is the category where the least amount of time is spent (13%).

Stablecoin Market Cap

Another all-time high, officially crossing $240b. Stablecoin market cap added almost $9b in the last 30 days - most of that came from USDT.

ETF Flows

Flows have been strong. Over $5b in BTC inflows over the last 45 days. 10 of the last 13 trading days have been inflows for Bitcoin, and total cumulative inflows are an all-time high of $41b.

ETH ETF flows have been mixed, and cumulative holdings are down from the February highs. However with Ethereum’s price performance over the last two weeks, that may begin to pick up. Cumulative ETH ETF flows: $2.5b.

IPOR Stablecoin Indeces

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity. The benchmark stablecoin rates bottomed about three weeks ago. Rates went from 3.24% to 4.24% - which may not seem like a big jump, but is a 30% increase.

Still, not overheated rates by any means. Healthy.

Category and Chain Trends

Category TVL Changes

Ethereum’s resurgence means large protocol TVLs are going up - including CDP Managers, Staking Pools, and Liquid Restaking. Anchor BTC added $400m in total TVL, and is at an all-time high. Privacy TVLs (Tornado Cash, Railgun) are up, and AI Agents have seen a resurgence over the last month.

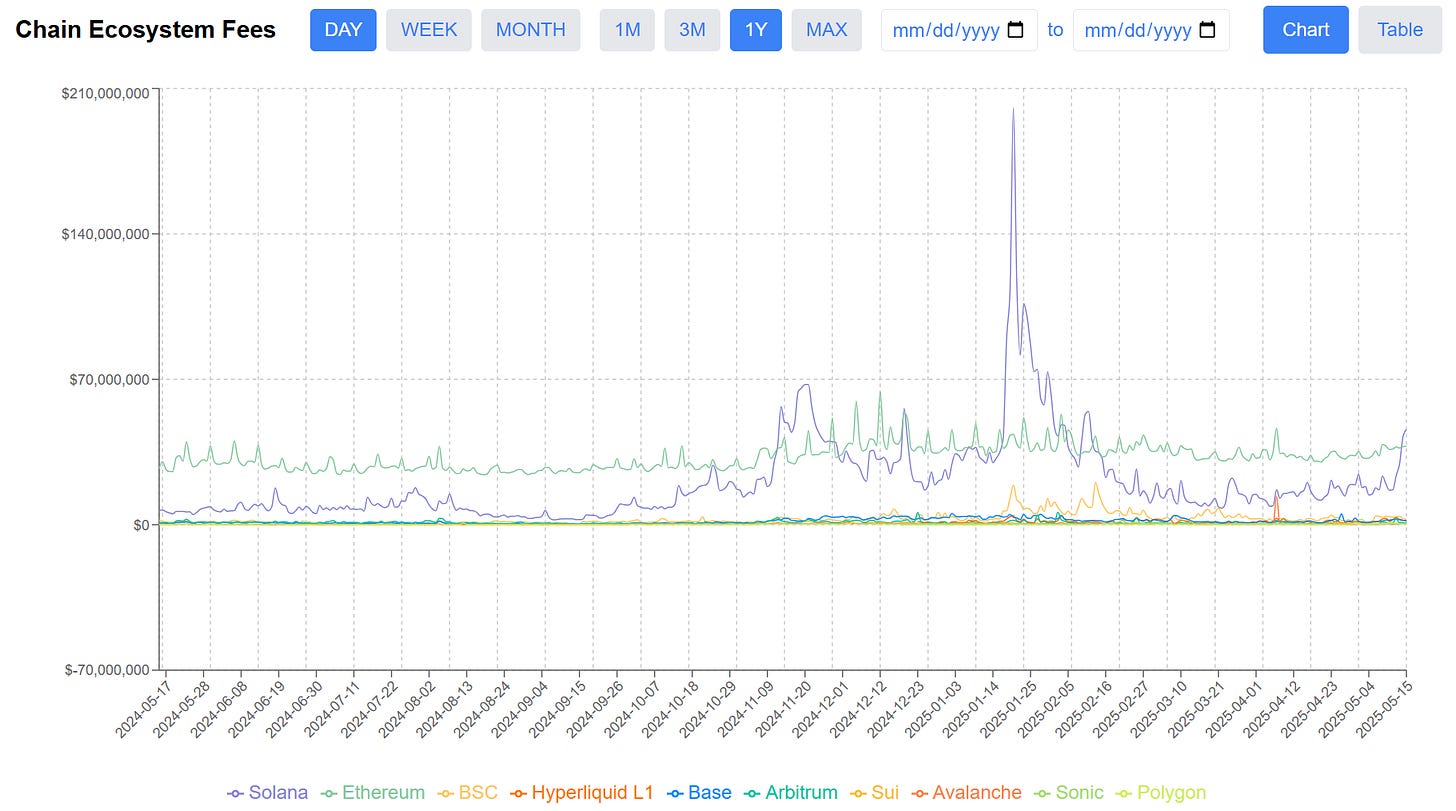

Chain GDP / Chain Ecosystem Fees

Chain GDP, which I’m now calling Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

Since this has been a custom metric up to this point, I built a dashboard myself to show this over time by chain: https://dashboard.dynamodefi.com/

Solana’s ecosystem fees have risen over 50% WoW - surpassing ETH in 1d fees for the first time in 90 days.

Notably, Arbitrum & Polygon’s CEF doubled in the last week.

Fastest Growing Chains ($100M+ TVL)

Tron, Ethereum and Solana standout for their growth because their TVLs are already so large (meaning the $ amount of TVL they gained was massive). PulseChain’s TVL is up 60% this week (but down 72% from December).

Said it before and will say it again: when ETH does well, everything tends to do well.

Fastest Growing Chains ($10M-100M TVL)

Initia (an ecosystem of rollups, harnessing an Interwoven STack framework to easily build rollups & applications) TVL went up 150% this week. NEO, Saga, World Chain, and Abstract all saw strong growth this week. The common denominator of these chains: focus on simple UI and chain abstraction to enhance user experience.

📊Onchain Metrics

Onchain Highlights

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.