The Future of Dynamo DeFi

The DeFi industry is evolving. And it’s time for Dynamo DeFi to evolve with it.

How we got here

I first created this Substack to provide a source of reliable information on the crypto market: the most interesting articles, onchain insights, upcoming events, and tools.

Later, I added the paid substack to provider deeper onchain insights and add a source of signal amidst the noise that is the crypto market. The idea was to focus on which narratives were forming and driving the market, based on the onchain metrics.

And I couldn’t be more grateful for everyone that’s supported this publication over the years. I mean that from the bottom of my heart.

More recently, a few things have changed:

First, crypto went much more mainstream. When I started this newsletter almost 3 years ago, the idea that major payment processors and banks would be betting the farm on the digital asset industry seemed far-fetched. Now, billion dollar acquisitions in the industry barely make the news.

Second, the crypto industry diverged more sharply into institutions and hyper speculation.

The old meta of trading new narratives or chains has largely been solved or abandoned. As a result, hype cycles tend to burn out in hours, if they exist at all. Think about how many new L1s have raised at huge valuations pre-launch and then bled out post-launch.

Simultaneously, numerous other opportunities have arisen for altcoin traders to earn outsized returns. Prediction markets for one. Equities for another: certain sectors like quantum computing and batteries have posted altcoin-level returns, but without the perception that there’s nothing underlying their value.

The end result of all of this is that, despite digital asset adoption doing better than ever, Dynamo DeFi has not benefited from that growth. Something has to change.

What next?

As a result of this, I’m making a few major changes to this newsletter:

Dynamo DeFi will no longer be producing regular weekly newsletters

Instead, I will focus on original, unique analysis and evergreen resources

My plan for these new posts is a healthy mix of video and articles. The overarching theme of them will be to provide maximum value and to help you navigate the digital asset space whether you are a beginner or expert.

These premium posts will focus on targeted onchain analysis. Answering questions like:

How do I see this industry evolving based on concrete evidence?

Do airdrops lead to long-term user growth?

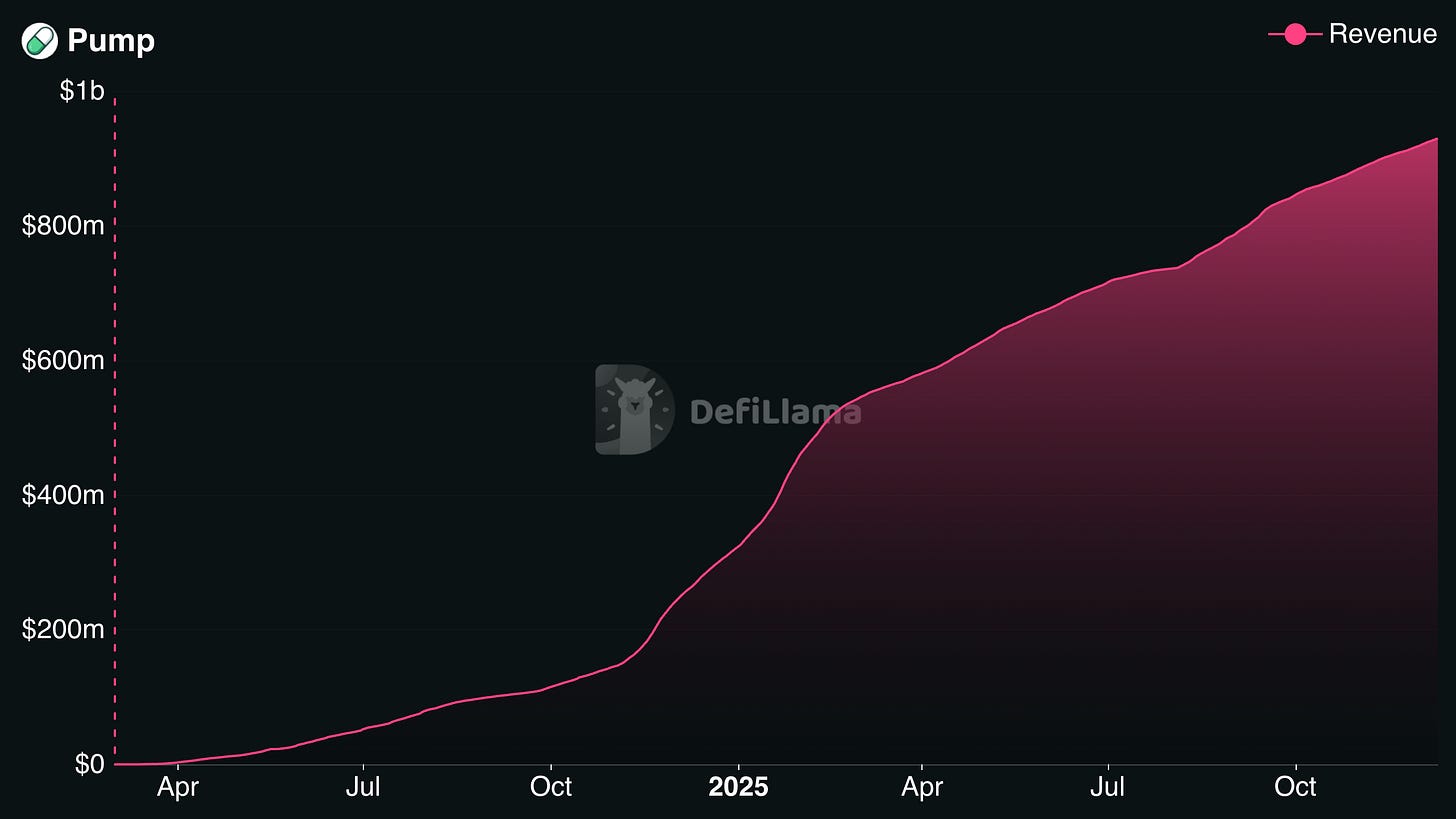

Which DeFi categories capture the most revenue?

You can find an example of the type of content I’ll be putting out in the future here:

I’m also planning to do Q&As every Friday. This will be a chance for paid subscribers to ask questions about anything related to crypto, finance or business that I’ll answer quickly:

I’m also planning to create more free evergreen resources like this prediction market tools list:

Prediction Markets Tool Directory

This is a directory of over 70 tools related to trading on prediction markets. Please note that the vast majority of these are untested and unverified. Use any, especially bots, at your own risk and with your own discretion.

In addition to ending this publication’s weekly newsletter, I am also deprecating the Dynamo DeFi Discord. Unfortunately, as a one-man operation, I no longer have the resources to moderate it and, with altcoin trading and DeFi farming slowing down significantly, activity has plummeted anyways. The Telegram group for people on Sovereign Member plans will remain unaffected; however, I’ve disabled renewals of this plan.

I also generally want to bring more things onto Substack itself since this platform is growing rapidly and adding new features. So I’ve activated the subscriber chat for paid subscribers to chat about DeFi, digital assets, and investing strategies there. My hope is that this chat, the Q&As, and possibly more will be able to do an even better job of helping subscribers to navigate the digital assets market.

What about YouTube?

Long-time subscribers probably know that I have more subscribers on YouTube than here. Significantly more in fact:

I’m planning to keep my YouTube active and will experiment with different topics. Most of those will focus on DeFi, but I may venture into adjacent topics as well.

With AI poised to decimate white collar work as we know it, the US Dollar slowly rolling towards a crisis, and a world after fiat looking like a reality in our lifetimes, we’re in the midst of one of the biggest economic transitions in recent memory. I’ll focus my content on helping people to navigate and understand that change.

I’m also always open to suggestions. Feel free to comment here with what sort of videos you’d like to see.

Final Thoughts

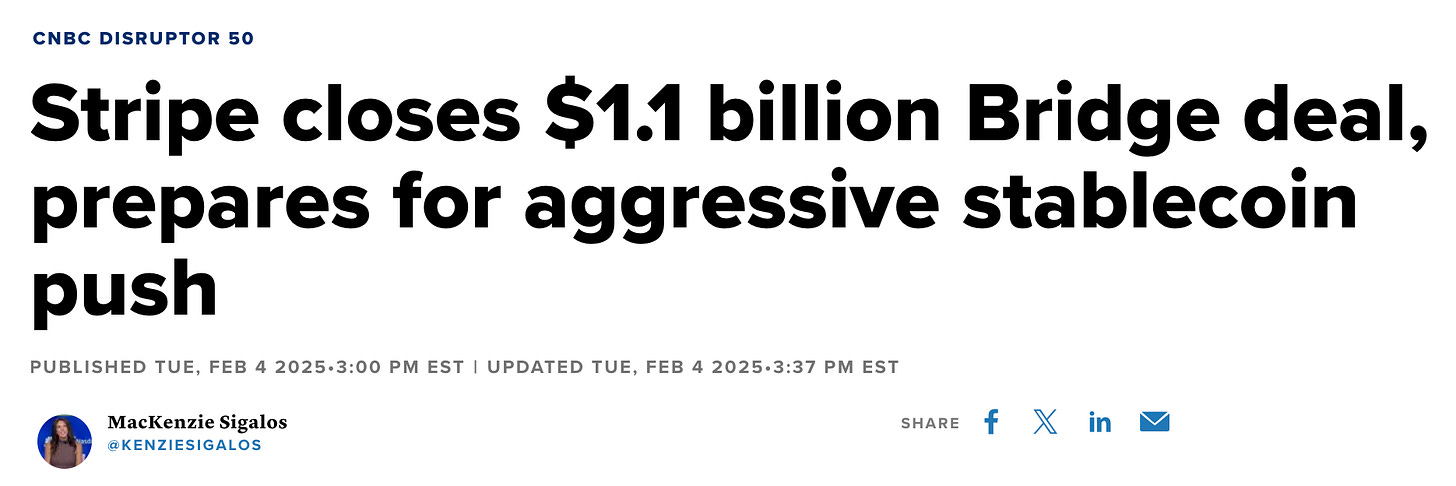

I don’t want you to take away from this post that my long term conviction in this industry and asset class has changed. In fact, recent news, like Stripe going deeper into stablecoins, only confirms my thesis that huge portions of financial activity will move onchain.

The future of finance is onchain, everything is going digital, and the economy is shifting in unprecedented ways. I plan on publishing content to help people navigate this change for as long as I’m able to.

Until next time,

Patrick

Dynamo DeFi

Hey Patrick - just leaving a comment here to let you know that I appreciate the work you have produced over the years. Looking forward to this change and will continue to support!

Thanks!