⚡️The Day of Reckoning for Tokens & Stonkification of DeFi

Tokens are either pseudo-equity or memecoins

The day of reckoning is here for crypto.

For the past 5 years, tokens have enjoyed what I like to politely call “speculative demand in excess of fundamentals.” Less politely, they’ve been way overvalued.

The reason why is straightforward: there haven’t been that many liquid assets in the crypto industry with good fundamentals. So investors have been reduced to getting exposure via the only assets they can, which tend to be Bitcoin or altcoins. Add to this retail traders who heard stories about Bitcoin millionaires and wanted to throw money at replicating those returns on newer, smaller coins.

This created a demand for purchasing altcoins which far outstripped the supply of altcoins with actually solid fundamentals.

The first order effect? You could buy anything when sentiment hit a low and a few years later you’d make incredible returns.

The second order effect? Most industry business models, if you can call them that, revolved around selling their own tokens rather than actual revenue streams tied to their product.

Three things happened in the past 2 years which were cataclysmic for the altcoin market:

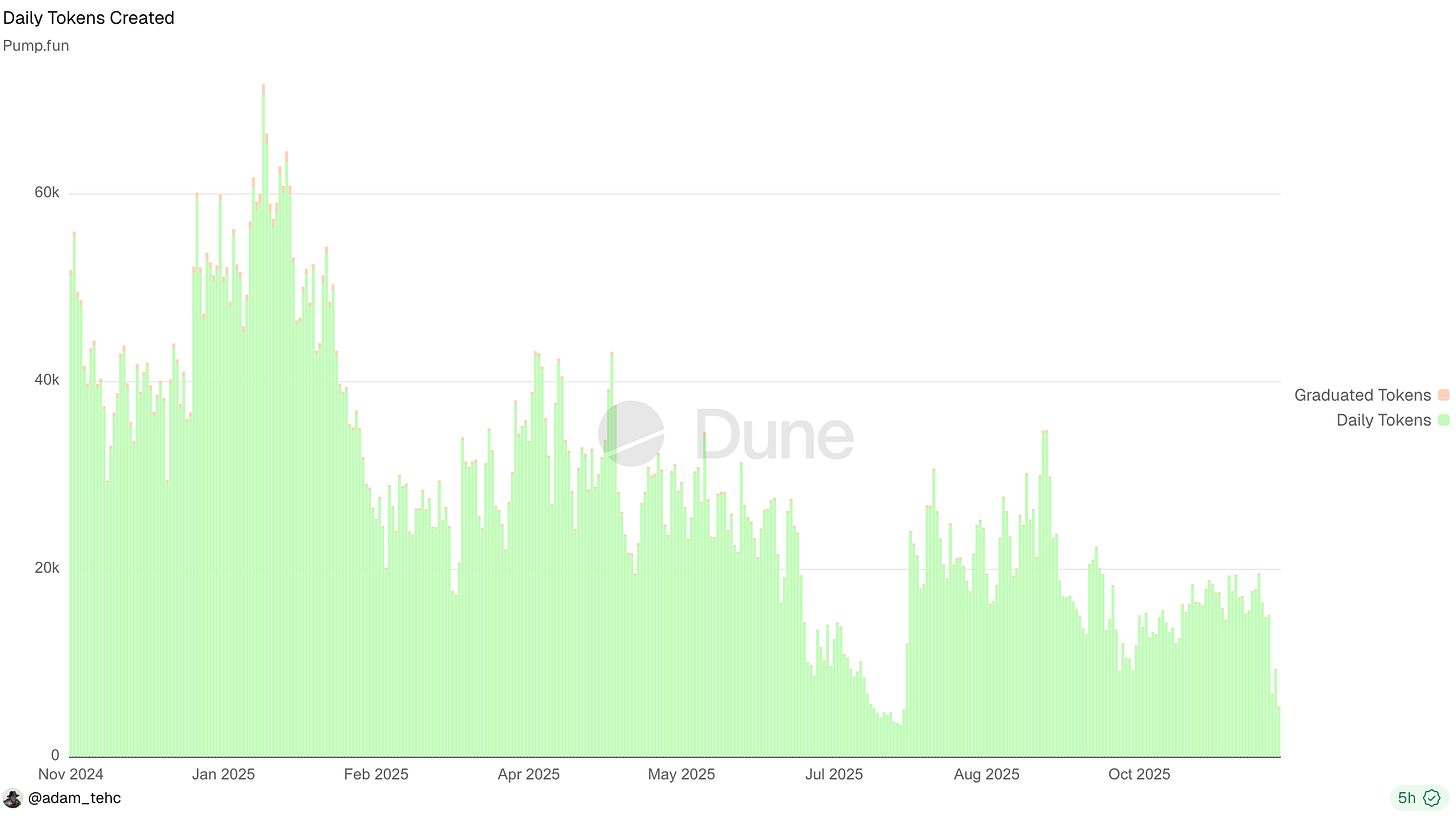

Pump fun and other launchpads commoditized the launch of new tokens. This spread attention across millions of assets, prevented the top few thousand tokens from receiving the concentrated money flows that they usually do, and disrupted the usual wealth effect that Bitcoin halvings create.

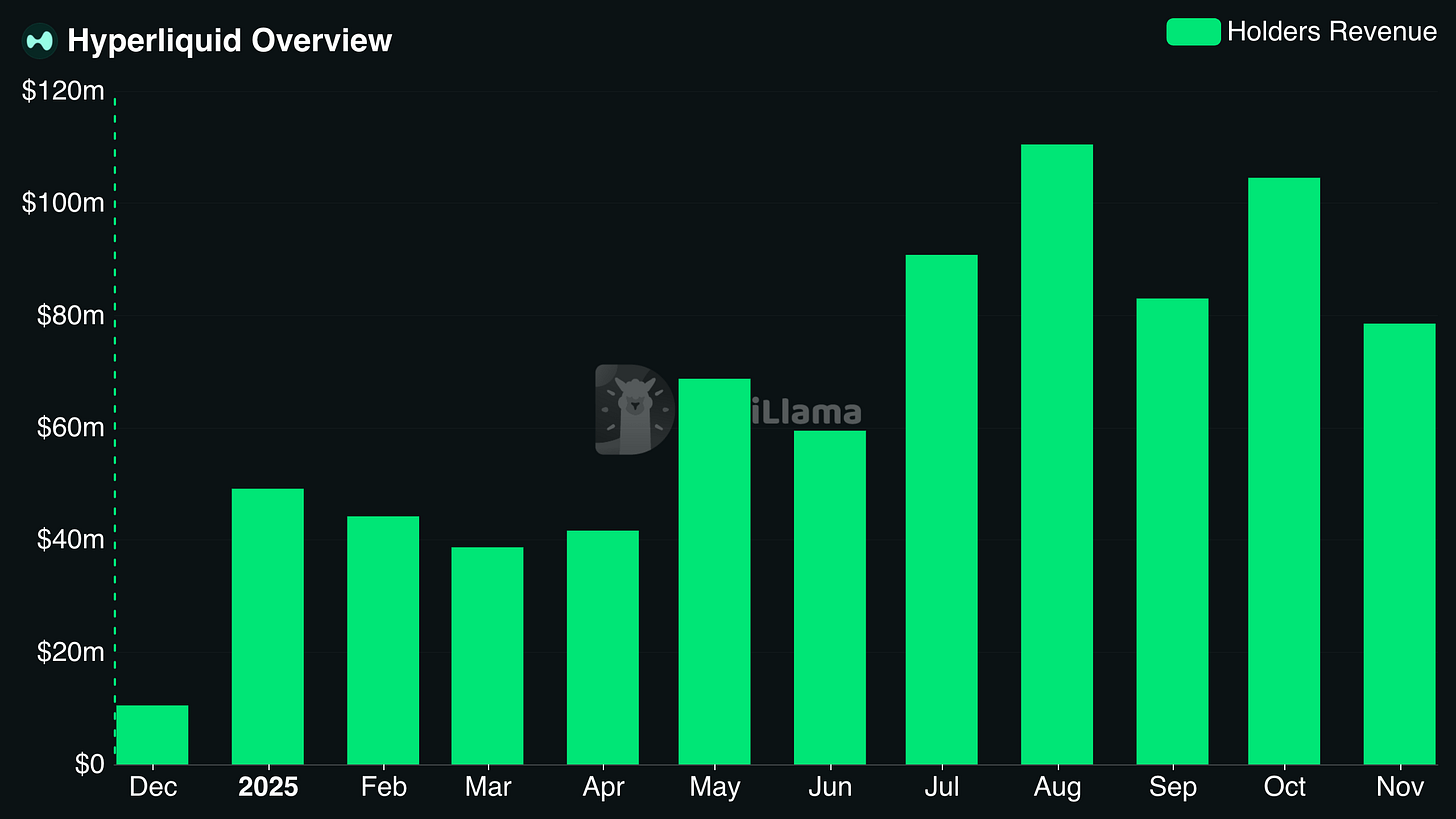

Select crypto assets developed real fundamentals. These include both tokens like HYPE and new IPOs like CRCL. It becomes difficult to bet on whitepapers when you have other assets backed by fundamentals.

Tech equities outperformed crypto. In many cases, equities linked to AI, robotics, biotech, and quantum computing have outperformed the crypto market. Retail investors may be left wondering why they’d risk their capital on altcoins when “real” companies offer better returns for seemingly less risk. Even the NASDAQ has outperformed both Bitcoin and altcoins YTD.

The result of all of this is a graveyard of underperforming altcoins, teams competing over an increasingly scarce pool of capital, and seasoned crypto investors running around like headless chickens, unsure how to invest in this new regime.

At the end of the day, tokens either provide a stake in a business or are valueless. They aren’t some magical new thing that receives value just from existing.

Things become much clearer if you stop viewing tokens as indecipherable and start treating them as an asset that represents future cash flows from a business.

“But Dynamo” you might protest, “Some tokens don’t give you the right to future cash flows. Some tokens are U-T-I-L-I-T-Y tokens. Some protocols have both a token and equity.” That’s where you’re wrong. Those tokens still do represent future cash flows; the cash flows associated with them just happen to be $0.

At the end of the day, tokens either provide a stake in a business or are valueless. They aren’t some magical new thing that receives value just from existing or from a “community” as many people like to say. Caveat: this doesn’t apply to network coins like BTC, which share many characteristics of commodities; I’m talking about protocol tokens here.

In the near future, the only DeFi tokens that have any meaningful value will be those that act as pseudo-equity with (1) claims to protocol income, (2) the protocol income to make that an attractive value proposition.

Retail is Done with Crypto (for now)

Leading KOLs talk about “crime is legal” and then act surprised when people don’t want to be a victim of said crime.

Retail is done with the vast majority of tokens for the foreseeable future.

In addition to the reasons I outlined above, a large part of this is that people are simply sick of losing money:

1. Tokens became overinflated on promises that failed to materialize

2. The number of tokens became oversaturated due to memecoin launchpads

3. Extractive tokenomics and industry toleration of absolute trash means that retail correctly thinks they’re set up to lose

The result? People that would have previously bought crypto find another outlet for their gambling addiction: sports betting, prediction markets, stock market options. None of these are necessarily good ideas, but then again, neither is buying most altcoins.

And can you really blame people?

Leading KOLs talk about “crime is legal” and then act surprised when people don’t want to be a victim of said crime.

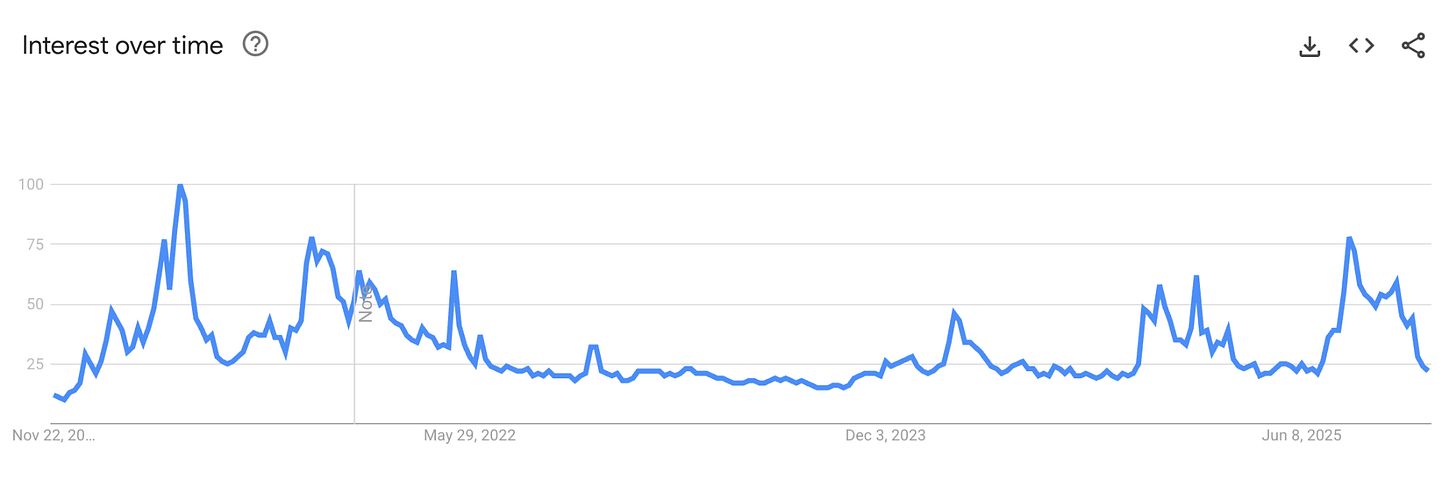

This apathy amongst the public to crypto is reflected in interest in the space. The enthusiasm of this year never reached the heights of 2021, despite fundamentals being better than ever and regulatory risk being lower than ever.

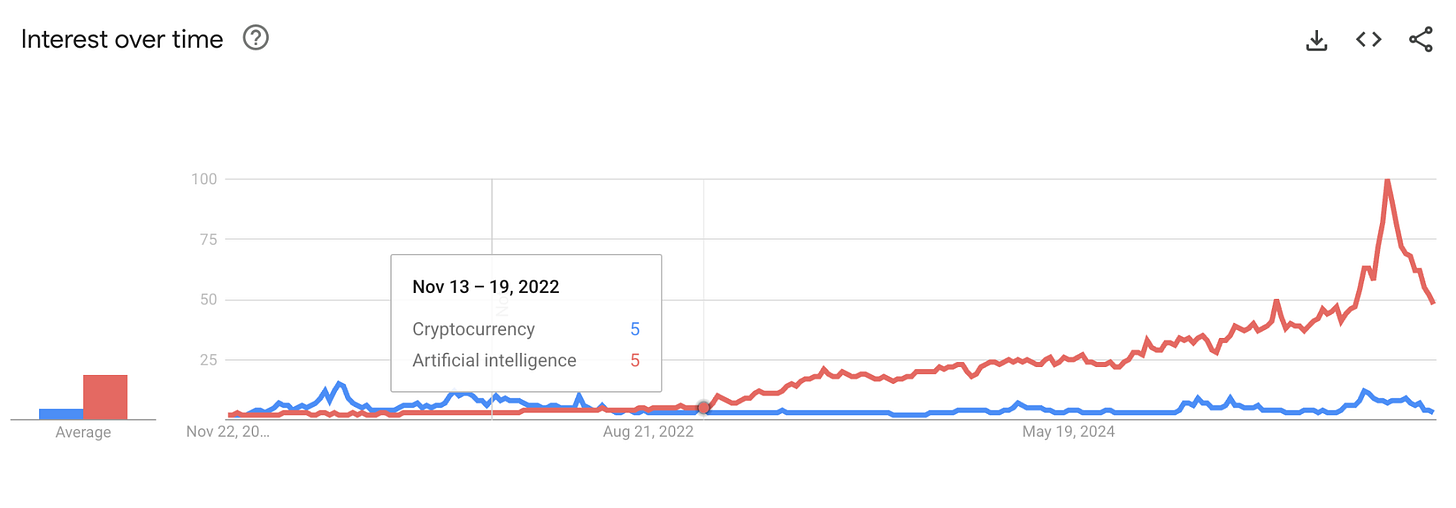

I’d also argue that ChatGPT and the ensuing AI boom have dampened the enthusiasm for crypto by showing a new generation what a true killer product looks like. For a decade enthusiasts have been talking about crypto being a new “Dot-Com Moment.” It’s tougher to convince people of this when they’re seeing AI reshape their world everyday in much more visible, obvious ways.

Compare the interest in crypto and AI on search engines. The last time crypto had more interest on Google was during the FTX collapse:

Could anything bring retail back?

Yes.

Arguably they are being back to prediction markets today, but they’re buying binary options on when the government shutdown will end, not altcoins. To get them to buy altcoins in large numbers again, they’ll need to feel they have a reasonable chance to make it.

All Token Value Accrual Comes from Protocol Income

In a world where tokens can’t count on a never-ending stream of buyers based on speculation, they actually have to stand on their own value.

After 5 years of experimentation, it’s become painfully clear that there’s basically one meaningful form of token value accrual: claims to protocol income (past, present, and/or future).

All of these various forms of real value accrual come down to claims on protocol income or assets:

Dividends

Buybacks

Fee burns

Treasury control

This doesn’t mean that to be valuable, protocols necessarily need to do one of these things today. In the past, I’ve received much criticism for saying that I wish protocols I believed in would reinvest rather than do buybacks. But they need to have a switch to turn on this value accrual in the future, ideally based on a governance vote or clear criteria being met. Ambiguous promises are no longer enough.

Fortunately for savvy investors, these fundamentals are readily available for thousands of protocols on platforms like DefiLlama.

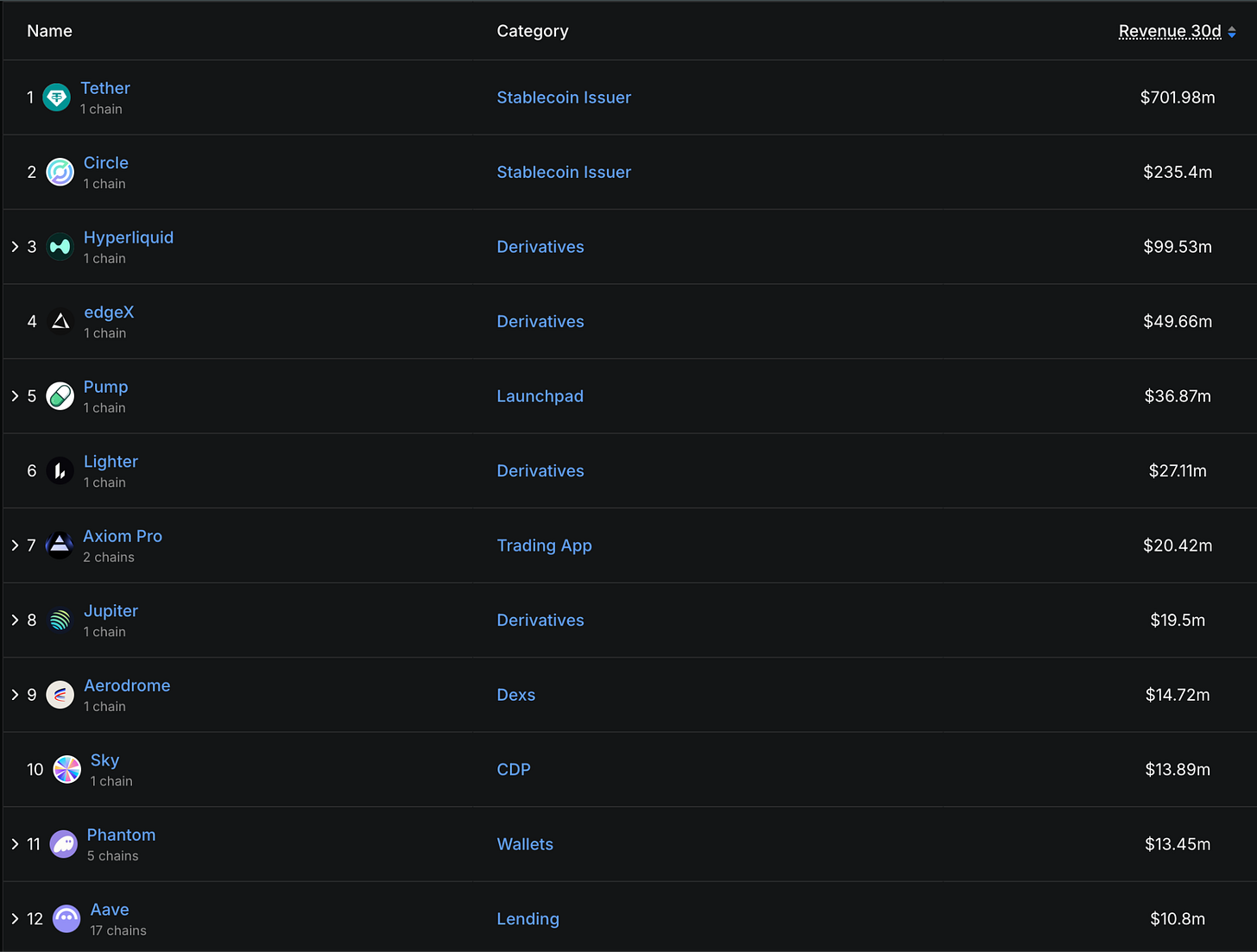

A quick look at the top protocols by 30d revenue shows a clear pattern: Stablecoin Issuers and Derivatives dominate, while Launchpads, Trading Apps, CDPs, Wallets, DEXs, and Lending are also represented.

A few takeaways from this:

Stablecoins and Perps are the two most profitable businesses in crypto today

Trading, more generally, is a very profitable business to support. In my view, there is significant risk to revenue in trading-related activities if the market enters a prolonged bear, unless protocols can pivot to trading RWAs, as Hyperliquid is attempting to.

Controlling distribution is as important as building the underlying primitives. I suspect there’s a strong contingent of hardcore DeFi users who would have argued vehemently that a Trading App or Wallet would never be among the top revenue generators because users could save money by using protocols directly. Meanwhile, in the real world, Axiom and Phantom are hugely profitable.

More generally, what I want you to take away from this is that some crypto apps are generating tens of millions in revenue a month. If your protocol of choice isn’t there yet, that’s okay. I know very well that it takes time to build a product the market is willing to pay for as I run revenue for DefiLlama. But there needs to be a path to profitability. Playtime is over.

Investment Frameworks for the Value-Based Crypto World

When looking for tokens to invest in over the next few years, strong performers will meet these criteria:

1. Claims to protocol income or a clear, transparent path to claims on protocol income

2. Consistent and growing revenue and earnings

3. Market caps at reasonable multiples to past revenues

Rather than ramble about what this means theoretically, here are a few concrete examples:

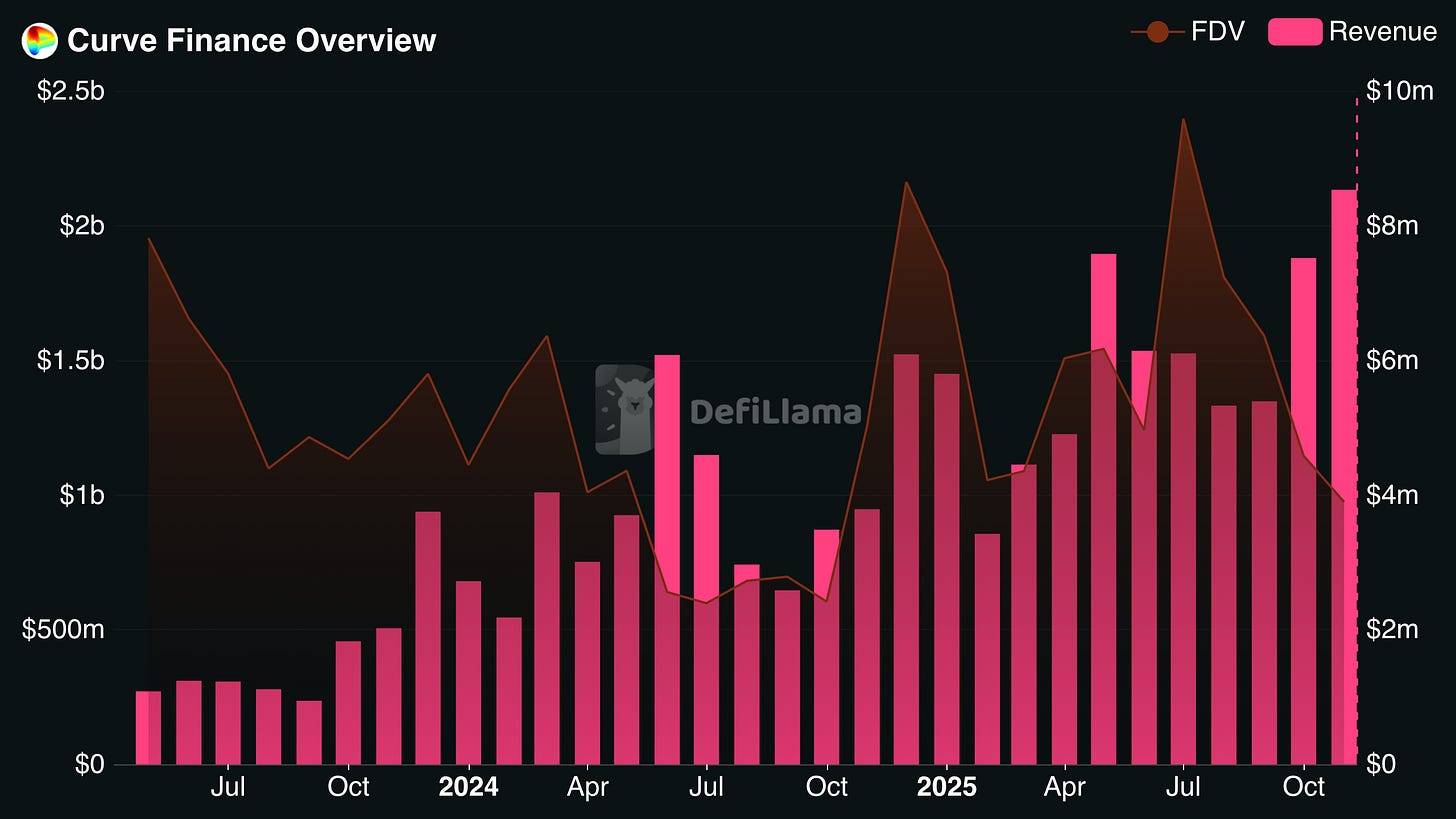

Curve Finance

Curve has accomplished steady, consistent revenue growth over the past 3 years, even as FDV has dropped. The result is an FDV which is less than 8X Curve’s annualized revenue from the past month. Due to bribes for locked Curve stakers and a long period for token releases, token’s actual yield is much higher. Watch to see whether Curve maintains its revenue in the coming months.

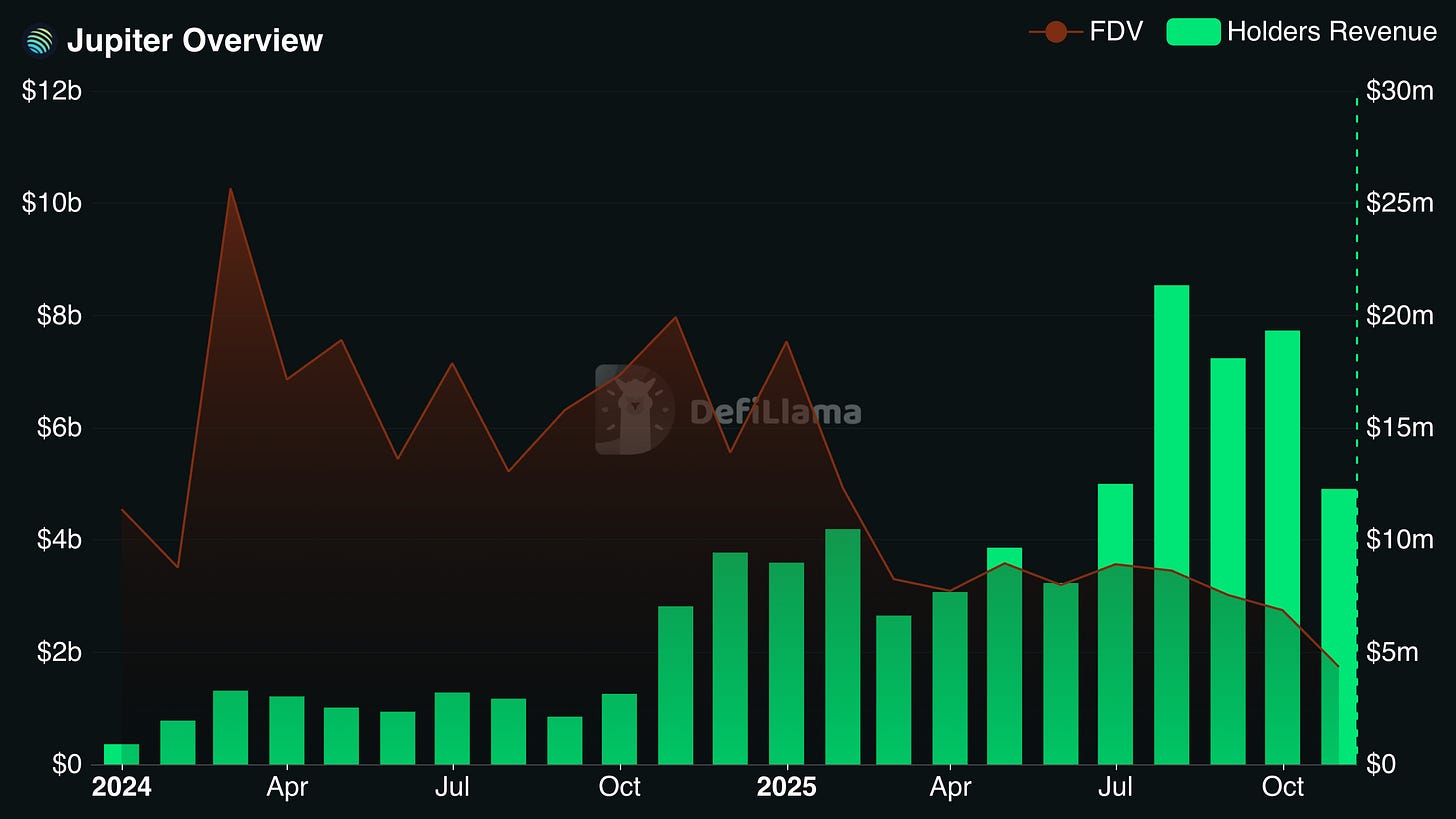

Jupiter

Jupiter has cemented itself as one of the main beneficiaries of the Solana ecosystem boom. They’re the most used DEX aggregator and perp DEX on that chain. They’ve also made numerous strategic acquisitions, which allow them to use their distribution to expand to other onchain markets. Their annualized revenue that goes to token holders is actually quite high at nearly 25% of circulating market cap and over 10% of FDV.

NOTE: I hold positions in neither of these protocols and there are other considerations, like the team and competitive landscape, before making an investment.

Other protocols which fit these criteria are Hyperliquid, Sky, Aerodrome, and Pendle.

The White Pill

Good news is that teams which care about their own survival are realizing this quickly. I expect that in the coming years, the pressure of not being able to endlessly dump tokens will push more DeFi projects towards developing revenue streams and connecting their tokens to those streams. The future is bright if you know where to look.