⚡Sonic volume just doubled (again)

Breaking down: The massive ETH transfer gone wrong, SEC's major defeats, and which DEXs are still growing

Read Time: ~5 minutes

⚡Snapshot

What happened to Bybit?

Wins for Coinbase & Robinhood vs SEC

Key metric still going up

Follow me on LinkedIn for more stats & stories about running a business in crypto

📖 Recommended Reads

⚡$1.5B gone - what happened to Bybit?

From a routine transfer to losing $1.5B in ETH

⚡SEC drops Coinbase suit, closes Robinhood investigation

Key victories for institutional crypto players

⚡Complete guide to sBTC: unlocking Bitcoin’s DeFi potential

Yield & DeFi opportunities on Stacks using sBTC

⚡Total Stablecoin supply is still rising

Stablecoin supply is still up $10B in the last 30 days

⚡Digital asset investment products see another week of outflows

XRP sees inflows, Bitcoin sees outflows

⚡Get Exclusive Pro Research

Our Pro research breaks down everything you need to know about current market movements:

ETF trends & implications

Deep dives into Solana, Hyperliquid & Sonic

AI narratives gaining traction

High-conviction farming strategies

Get instant access to all research →

🔢Onchain Analysis

DEX Volume Holds On

It’s been over a month since the launch of the Trump memecoin. The DEX activity that followed set all-time high records for volume.

In the last four weeks, DEX volume has sharply trended downward, but still remains elevated.

The Solana frenzy has markedly cooled down - PancakeSwap and Uniswap overtook the largest Solana DEXs to top weekly volume.

Curve Finance volume doubled this week. Fluid, a protocol on Ethereum that promises to utilize liquidity consolidation to catalyze DeFi, sits firmly in the top 10 protocols for DEX volume this week.

Weekly volume is up from $500M in November to $2.6B this week.

Last week we covered Sonic DEX volume - the chart was up and to the right.

Since then DEX volume on Sonic doubled, reaching almost $900M for the week, dwarfing previous volume weeks.

The last few months have been mostly Solana in terms of activity. Now activity is beginning to shift, and the race for the Sonic airdrop is on.

🚜Farm of the Week

Earn Points & Yield on Sonic

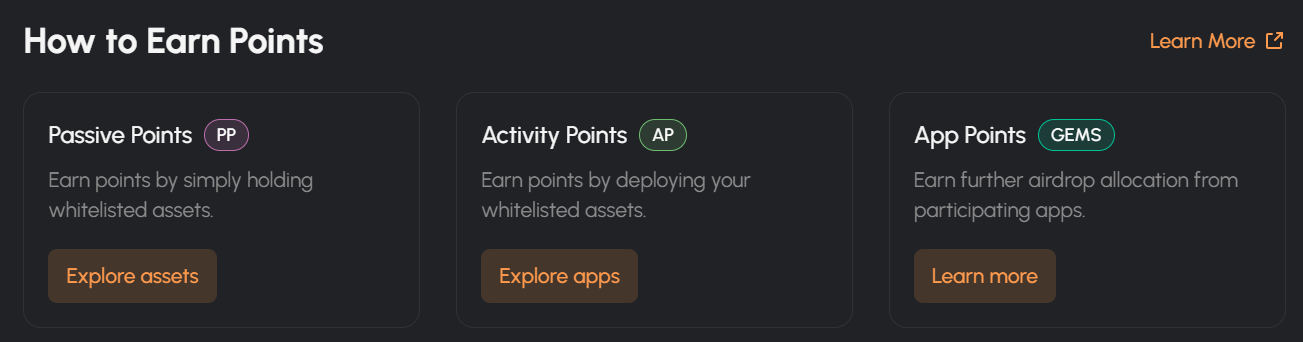

There are three types of points on Sonic.

This allows for different strategies depending on a user’s trading style - it appeals to holders, traders and DeFi power users.

For information on how to qualify for the Sonic airdrop, check out this blog post or watch my video.

How it Works

For those interested in simplicity, who don’t want to actively trade: simply mint scUSD on Sonic. It’s similar to holding USD, but on Sonic.

This action earns boosted 6x Passive and Activity Points, extra rewards from Rings and VEDA, and a Sonic Gem.

Utilizing Sonic LSTs also comes with nice benefits, similar to scUSD rewards.

For a more active strategy: lend S (Sonic’s token) or USDC on Silo Finance for up to 10x Sonic Activity Points and 1 Silo point per dollar lent / borrowed per day on top of regular deposit yield.

How to capitalize: Head to the Sonic Points page and use my referral code HQBA3B.

Risks

DeFi metrics predicted Sonic’s rise - here’s how to use them to find the next big thing

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

Find Token Unlocks Early with DeFiLlama’s Token Unlocks

DeFiLlama’s Token Unlocks dashboard displays upcoming unlocks ordered by date, with data such as unlock size, current token price & market cap, and percent unlocked.

It’s helpful to get a quick view of upcoming unlocks - use the Search function to find protocols that aren’t near the top of the list.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 CB Consumer Confidence data - February 25th

📊 New home sales - February 26th

📊 US Q4 2024 GDP Data - February 27th

📊 January PCE inflation data - February 28th

📊 10 Fed Speaker Events This Week

Token Unlocks: $630M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓TORN (0.92%) - February 25th

🔓AXL (1.39%) - February 25th

🔓OP (1.93%) - February 28th

🔓MAV (1.19%) - February 28th

🔓ZETA (6.48%) - March 1st

🔓SUI (0.74%) - March 1st

🔓DYDX (1.14%) - March 1st

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀Foxy NFT mint on Linea - February 24th (Source)

🚀 Kaidro beta version release - February 24th (Source)

🚀 Reactive mainnet launch - February 25th (Source)

🚀 L1X wallet profiler launch - February 25th (Source)

🚀 Sonic SVM mainnet launch - February 27th (Source)

🚀 HumansAI public version launch - March 1st (Source)

🚀 IOST 3.0 launch - March2nd (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi