⚡A Complete Guide to sBTC: Unlocking Bitcoin's DeFi Potential

Bitcoin DeFi just got real: Everything you need to know about putting your Bitcoin to work in DeFi

This post is a sponsored deep dive on sBTC.

Utilize your BTC in DeFi

Bitcoin's $2 trillion market cap represents enormous untapped potential for DeFi. While Bitcoin excels as a store of value, its programmability has been limited.

Until now. Enter sBTC, a groundbreaking innovation on the Stacks network that could unlock an incredible use case for Bitcoin: DeFi.

Quick refresher: Stacks is a leading Bitcoin Layer 2 solution that brings smart contracts and decentralized applications to Bitcoin without modifying its core protocol. Through its unique Proof of Transfer (PoX) consensus, Stacks anchors all transactions to Bitcoin's blockchain, inheriting BTC’s unmatched security while enabling faster transaction times.

When we last wrote about Stacks, the Nakamoto upgrade hadn’t yet gone live.

Now that the upgrade is live, Stacks achieves sub-minute block times and 100% Bitcoin finality, making it a powerful platform for Bitcoin DeFi. The upgrade makes Stacks faster AND more secure. It’s as secure as Bitcoin and is scalable.

Along with the upgrade, Stacks has now also launched sBTC, a serious innovation for Bitcoin DeFi.

Stacks thesis: There’s over $2T in latent BTC capital waiting to be activated.

Stacks goal: Activate the Bitcoin economy.

sBTC is Live - What is it?

sBTC is a 1:1 Bitcoin-backed asset that addresses the main bottleneck to unlocking BTC capital: A decentralized way to move BTC from Bitcoin L1 to L2s and back.

sBTC Key Features

100% Bitcoin finality and security

1:1 Bitcoin backing

Institutional-grade signer network

Transparent, open-source infrastructure

How sBTC Works

Users deposit BTC into a multisig protocol monitored by Stacks Signers.

If you’re wondering who these signers are, here are a few of them:

sBTC is minted 1:1 on Stacks

Users can now interact with DeFi applications

All transactions inherit Bitcoin's security through Stacks' Proof of Transfer mechanism

Earning Yield with sBTC

Simply holding sBTC earns you approximately 5% APY in Bitcoin rewards, distributed every two weeks. This is made possible through Stacks' unique consensus mechanism where STX stakers contribute their Bitcoin rewards to the sBTC reward pool.

How to get sBTC

Here are five simple steps to turn your BTC into sBTC.

Go to app.stacks.co

Connect your wallet - here are your wallet options:

XVerse

A self-custodial, open source browser extension wallet. Xverse has built-in Ledger hardware wallet support and, through an Asigna integration, supports multi-sig transactions. Xverse already has a mobile app available on Apple’s App Store and the Google Play Store.

Leather

Leather is also a self-custodial open source browser extension wallet with built-in Ledger support. The browser extension covers nearly everything in the BTC DeFi ecosystem (Ordinals, BRC-20, Runes, Stacks, etc). The mobile app is coming soon - you can join the mobile waitlist here.

Choose BTC amount to convert - the first deposit cap of 1000 sBTC went live in December, and on February 25th a second cap will enable an additional 2000 sBTC in deposits

Enter receiving Stacks address

Confirm transaction and enable sBTC token

For more details (and pictures for assistance) click here.

sBTC DeFi Opportunities

There’s already lots of ways to put your BTC to work using sBTC.

🪂 Bitflow Finance

Bitflow is a DEX aggregator and Runes AMM. There’s an ongoing points system.

Swap: Each trade earns Bitflow points with bonuses daily.

Liquidity Pools: Deposit sBTC into Bitflow’s liquidity pools, facilitating trades and earning a share of transaction fees.

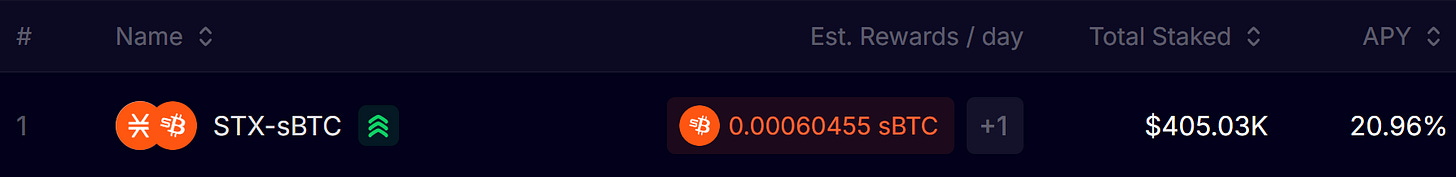

At the time of writing, the sBTC/STX liquidity pair has an estimated APY of over 20%

Yield Farming: Liquidity providers can stake their LP (liquidity provider) tokens in yield farming programs to earn additional rewards, typically from trading activity or platform incentives.

Runes: Stacks and sBTC are helping to scale Runes thanks to the Runes AMM, which is providing more liquidity and more insights into metrics. Runes holders can also now provide liquidity to Runes pairs.

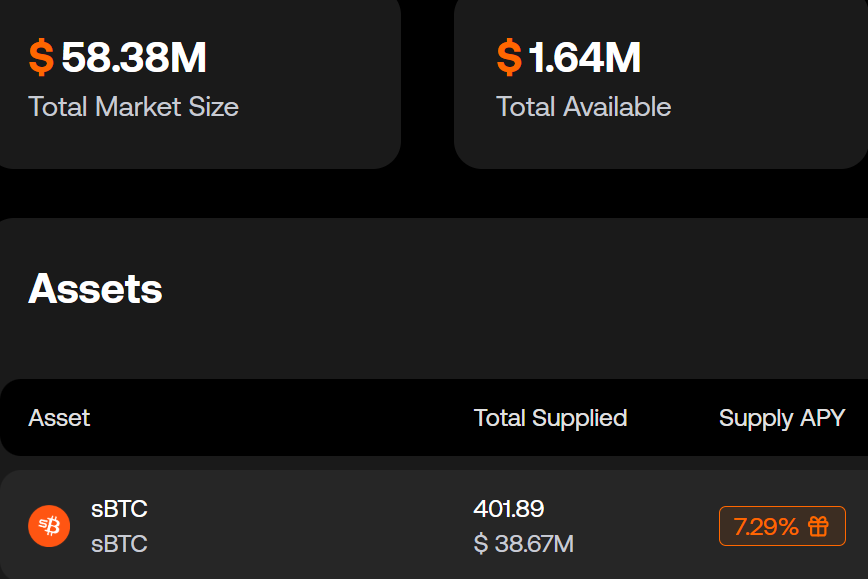

🪂 Zest Protocol

Backed by Binance Labs and Tim Draper, Zest is a lending market on Stacks. The protocol has over $50M in TVL.

Over 400 sBTC are already supplied. sBTC suppliers are earning over 7% APY and points for Zest’s point program.

On Zest, users can also:

Borrow USDh stablecoin against BTC or other stablecoins

Stake USDh on Hermetica to earn up to 25% APY on USDh

Refresher: Hermetica’s DeFi protocol offers USDh, the first Bitcoin-backed, yield-bearing stablecoin. The yield is sustainably generated through perp funding rates payments on centralized exchanges and paid out daily.

Velar

Velar is a DeFi liquidity protocol and the first perp DEX on Bitcoin. Here’s how you can take advantage:

Liquidity Provision: Supply sBTC to Velar's liquidity pools, facilitating trades and earning fees generated by the platform.

Yield Farming: Stake their liquidity provider (LP) tokens from providing sBTC liquidity to earn additional rewards in the form of Velar's native tokens or other incentives. The STX-sBTC pair is currently earning over 20% APY.

Velar has its own incentive program, rewarding users in Velar’s native token VELAR for deploying sBTC in one of their DEX pools.

ALEX Lab

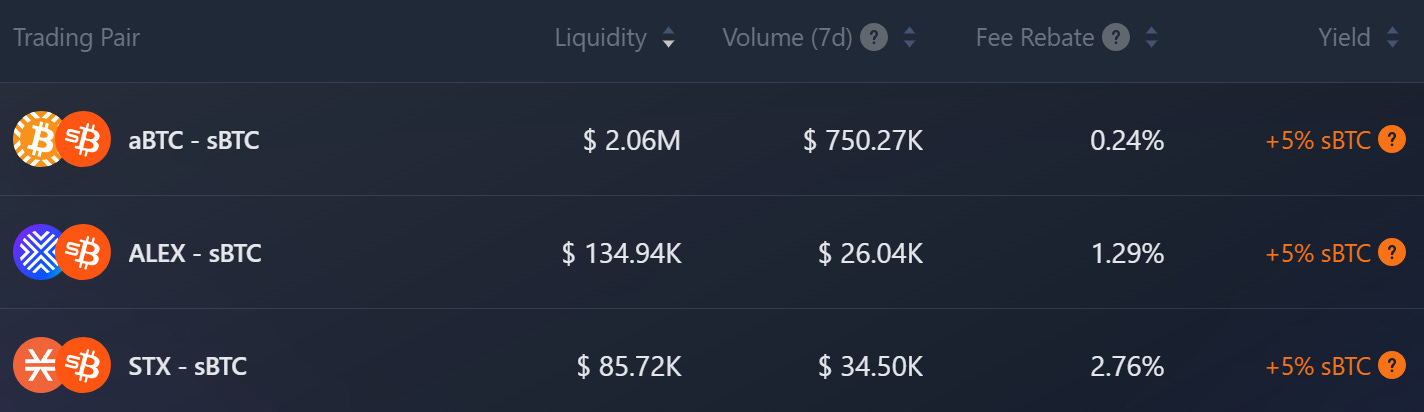

Users can deposit sBTC into liquidity pools on ALEX, pairing it with assets like STX or stablecoins. Depositors facilitate trading on the platform and earn a share of the trading fees generated by the pool.

ALEX liquidity pool yields involving sBTC all receive a bonus 5% sBTC yield.

ALEX Surge Campaign

ALEX will have bonus yield in the form of their native token ALEX via the Surge Campaign. This means beyond the baseline 5% APY sBTC, additional yield can be earned from pooling sBTC, as well as extra ALEX token rewards.

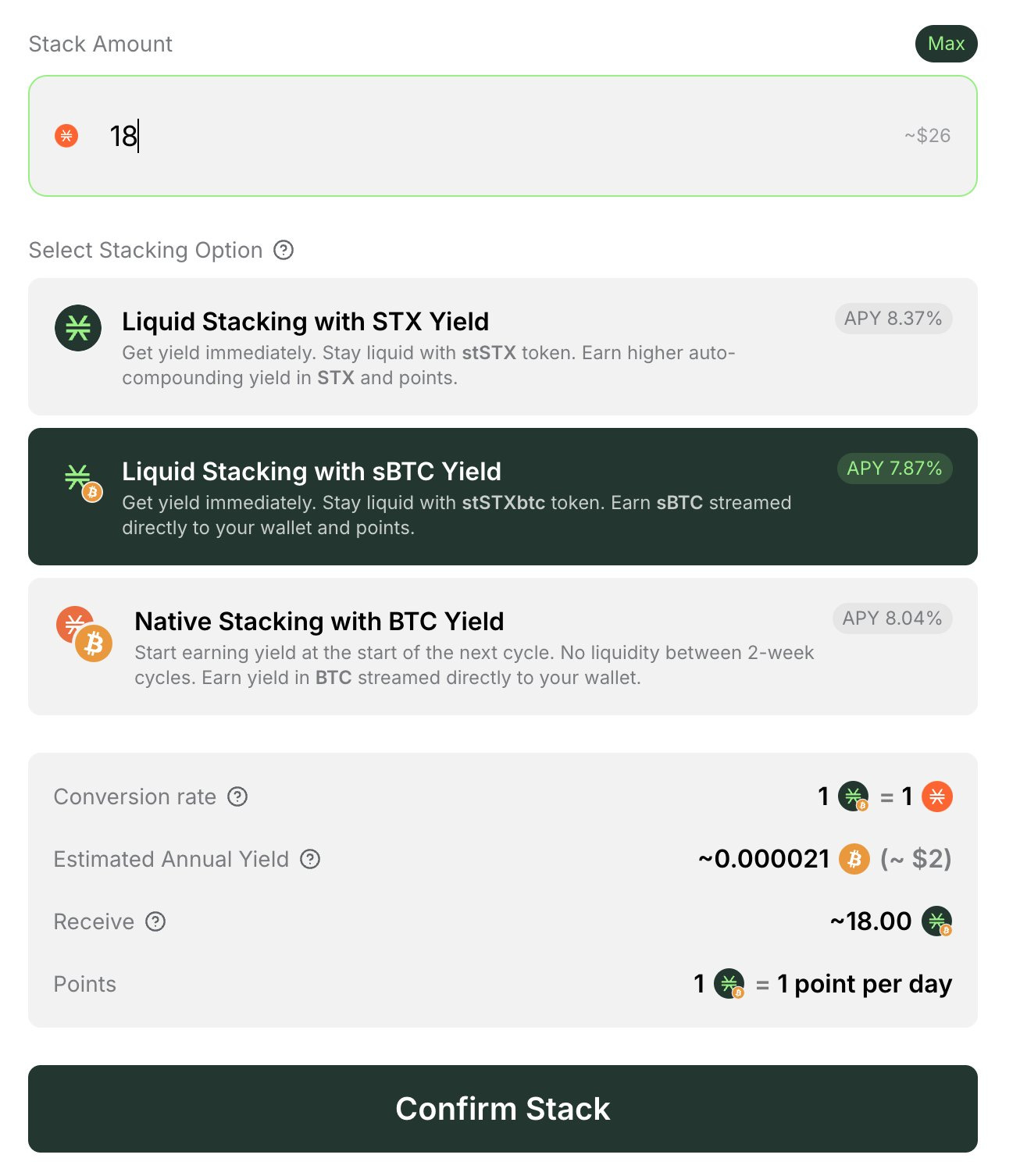

🪂 Stacking DAO

Stacking DAO launched a new stacking product called stSTXbtc, which is audited and live. stSTXbtc is a liquid stacking token backed 1:1 with STX. By holding the token, holders earn up to 10% APY in stacking rewards, paid in sBTC directly to your wallet.

How to capitalize

Head to Stacking DAO

Select stSTXbtc as the Stacking option

Choose the STX amount you’d like to deposit

Hit “Confirm Stack”

Now you’re earning 10% APY, paid in sBTC, directly to your wallet.

Additionally, thanks to the sBTC rewards program, that sBTC yield earns 5% APY as it streams to your wallet.

Learn more about stSTXbtc and its benefits here.

Granite (coming soon)

Granite is a new lending protocol, with no rehypothecation of collateralized funds and soft liquidations.

Borrowers can obtain stablecoin loans by collateralizing their Bitcoin, while liquidity providers earn yield by supplying stablecoins to the protocol

Borrowing: Users can deposit sBTC as collateral to borrow stablecoins, which can then be deployed in various DeFi strategies to earn yield.

Liquidation Participation: Users can act as liquidators, repaying portions of undercollateralized loans in exchange for collateral plus a reward, thereby earning yield through the liquidation process.

Join the waitlist to be among the first users.

What’s Next?

Deposit cap is expanding by 2,000 sBTC on February 25th

Full withdrawal functionality expected in March

Evolution toward permissionless signer network

Potential use of sBTC as gas token

Risk Considerations

Initial phase limitations (deposit-only, caps)

Smart contract risks

Signer network reliance

sBTC stands at the forefront of Bitcoin's transformation from a pure store of value to an active participant in DeFi. sBTC combines Bitcoin's legendary security with Stacks' programmability and opens up a new world of possibilities for BTC holders.

Whether you're interested in the straightforward 5% base yield or exploring more advanced DeFi strategies across lending, liquidity provision, and yield farming, sBTC provides the foundation for putting your Bitcoin to work. As the ecosystem matures and more protocols integrate sBTC, we're likely witnessing the early stages of Bitcoin's next evolution in financial innovation.

Thanks for reading,

Dynamo DeFi

Disclaimer: This article is for informational purposes only. Always conduct your own research and understand the risks before participating in any DeFi activities.