⚡Perfect Timing: US Crypto Reserve & DeFi 101 Launch

Inside: Trump's strategic reserve announcement, extreme BTC volatility explained, and Jupiter's 44% APY →

Read Time: ~6 minutes

⚡Snapshot

Trump announces strategic crypto reserve - Crypto Summit this Friday

Breaking down recent volatility onchain

Follow me on LinkedIn for more stats & stories about running a business in crypto

📖 Recommended Reads

⚡President Trump announces a U.S. Crypto Reserve

A reserve is coming that includes BTC, ETH, XRP, SOL and ADA. More news coming at the Crypto Summit on March 7th

⚡A simple framework for buying and saving Bitcoin long-term

A way to stack your long-term BTC bag without relying on cycles

⚡Part 1 of the DeFi 101 course is live

A completely free course designed to get anyone onchain - complete with videos, visuals and guides

⚡SEC drops case against Kraken Exchange

This marks the 6th SEC case dropped in less than two weeks

⚡Record week of outflows for digital asset investment products

$2.9B in total outflows, Sui & XRP saw minor inflows

⚡Finding Edge Has Never Been Harder

The crypto landscape is more complex than ever - data overload, endless narratives, and institutional competition.

That’s why so many DeFi users (both serious traders and beginners) use Dynamo DeFi Pro.

Exclusive market research and analysis

Custom data dashboards and metrics found nowhere else

Monthly live strategy calls with complete market analysis and early access to emerging trends

Active Discord community for real-time insights

Start making data-driven decisions →

🔢Onchain Analysis

Major Volatility Ahead of Crypto Summit

It’s been a volatile week. Bitcoin went from above $90k to below $80k to back above $90k and then back to $86k. Let’s try to find consistent growth among this wasteland of liquidated leverage traders chop.

Starting with Chain Ecosystem Fees, a metric I developed (originally called Chain GDP). It’s the measure of total fees collected by apps on each chain - as close to a true representation of activity as is possible in DeFi.

Nearly all chains in the top 10 have seen a drop in ecosystem fees over the last 30 days. The exceptions are BSC and Sonic.

We’ve mentioned Sonic quite a few times in the last month, the chain’s ecosystem 30d fees increased by 450%. This past week, however, was a large drop.

Interestingly enough, BSC had the second largest weekly drop, but it’s still positive on the month.

Hyperliquid leads the way in 7d growth, followed by Bitcoin. The Bitcoin DeFi ecosystem is really starting to heat up.

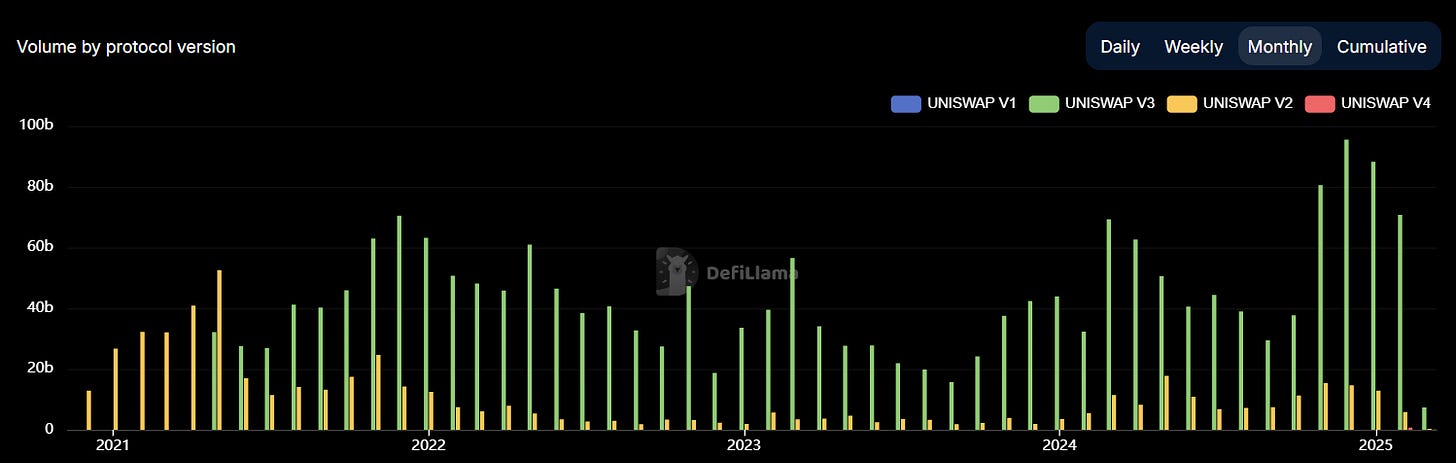

Hyperliquid did $1.6B in volume over the last 7 days, but the real 7d day volume story is Uniswap, which did $22B.

February was one of Uniswap’s largest volume months ever. In fact, the last four months have all been record-setting for the behemoth DEX in terms of volume.

Total stablecoin market cap isn’t spared from recent volatility.

This week saw a drop in stablecoin market cap of ~$2B, less than a percent of total market cap but a drop nonetheless. We saw a dip like this during the last week of December.

Stablecoin market cap is still positive within the last 30 days, up $7B.

Speaking of billions, Berachain crossed $5B in TVL this week.

Despite the (mostly justified) overall negative sentiment, the fact remains that crypto is on a path toward adoption.

Stablecoins continue to grow

Blackrock added its Bitcoin ETF to a model portfolio for the first time

Uniswap is working with institutions to make off-ramping easier

🚜Farm of the Week

Jupiter Liquidity Provider Token (JLP) on Solana

JLP’s basket of blue chip tokens (Solana, Ethereum & Bitcoin) combined with yield from perp trader losses and 75% of perp trading fees make it a compelling token to hold.

30% of the basket of holdings is in battle-tested stablecoins, meaning JLP also has muted volatility, making big down days less impactful.

How it Works

Head to Jupiter’s app and simply swap any token to acquire JLP tokens. There’s no complicated dual-sided liquidity provision here, simply click the Buy JLP button and swap any token for JLP. You’ll begin earning yield and have an index fund of Bitcoin, Ethereum, Solana and stablecoins.

JLP is currently offering 44% APY. This is updated weekly.

Risks

Perpetual trade risk - when traders profit, it comes at the expense of the JLP pool

DeFi 101: If you’ve been wanting to get onchain, watch this

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

Lulo Finds the Best Stablecoin Yields on Solana

Lulo is a yield aggregator on Solana, routing deposits to the the best lending rates across major Solana DEXs. The yield comes from supplying stablecoins to lending protocols.

Lulo uses rate-maximized yield - every 60 minutes, deposits on Lulo can be re-routed to the best possible lending rates, constantly maximizing yields.

To limit risk, you can limit your max exposure to a single source of yield, making sure you’re constantly diversified, hands-free.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 February ISM Manufacturing PMI data - March 3rd

📊 ADP Nonfarm Employment data - March 5th

📊 Initial Jobless Claims data - March 6th

📊 February Jobs Report - March 7th

📊 White House to host first ever Crypto Summit - March 7th

📊 9 Fed Speaker Events This Week

Token Unlocks: $1.57B Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓CETUS (0.83%) - March 3rd

🔓KAS (0.63%) - March 7th

🔓IMX (0.69%) - March 7th

🔓BERA (9.27%) - March 8th

🔓GMT (1.44%) - March 8th

🔓MOVE (2.08%) - March 9th

🔓ENS (0.94%) - March 9th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Onyx Goliath mainnet - March 3rd (Source)

🚀USH launch on mainnet - March 3rd (Source)

🚀 RejuveAi Airdrop - March 3rd (Source)

🚀 LTO network RWA airdrop launch - March 3rd (Source)

🚀 Hedera testnet upgrade - March 4th (Source)

🚀 Legend of Elumia game pass release - March 4th (Source)

🚀 Portal bridge launch - March 4th (Source)

🚀 Atlas fleet rental launch - March 5th (Source)

🚀 ShadeX launch - March 5th (Source)

🚀 MegaETH public testnet - March 5th (Source)

🚀 Pectra testnet on sepolia - March 5th (Source)

🚀 Cryptify AI MVP launch - March 7th (Source)

🚀 Swellchain Upgrade - March7th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi