⚡Is This the Dip You Don't Want to Buy? [Dynamo DeFi Pro Report]

Yeezy Token aftermath, a Fed rate cut might be coming

💡Dynamo’s Thoughts

In retrospect, it was obvious…

The year is 2026, crypto has finally bottomed, or so you hope.

The jubilation of friendly crypto regulation and institutional money pouring in through ETFs and Digital Asset Treasuries has long since waned.

You think back to summer 2025, only a year prior, and wonder how you could have missed so many obvious top signals.

Now, back to the present day.

Let’s review where the market is at today and the dangerous number of top signals around. While signs of adoption are indistinguishable from top signals, here are the more alarming recent occurences:

Out of the top 200 insider trades over the last week, zero were buy orders.

Rapper Big Sean telling his audience to buy crypto during a show

Not only does he say it’s about to go up, but he says it’s a “quick flip”. Historically celebrities getting publicly vocal about crypto is a sign that the top is near or even passed.

YZY token crashed and burned

Kanye announced the Yeezy Token last Thursday and the market cap went to $3b in less than an hour. Most of the token supply was held by insider wallets.

Predictably, a lot of people got rinsed.

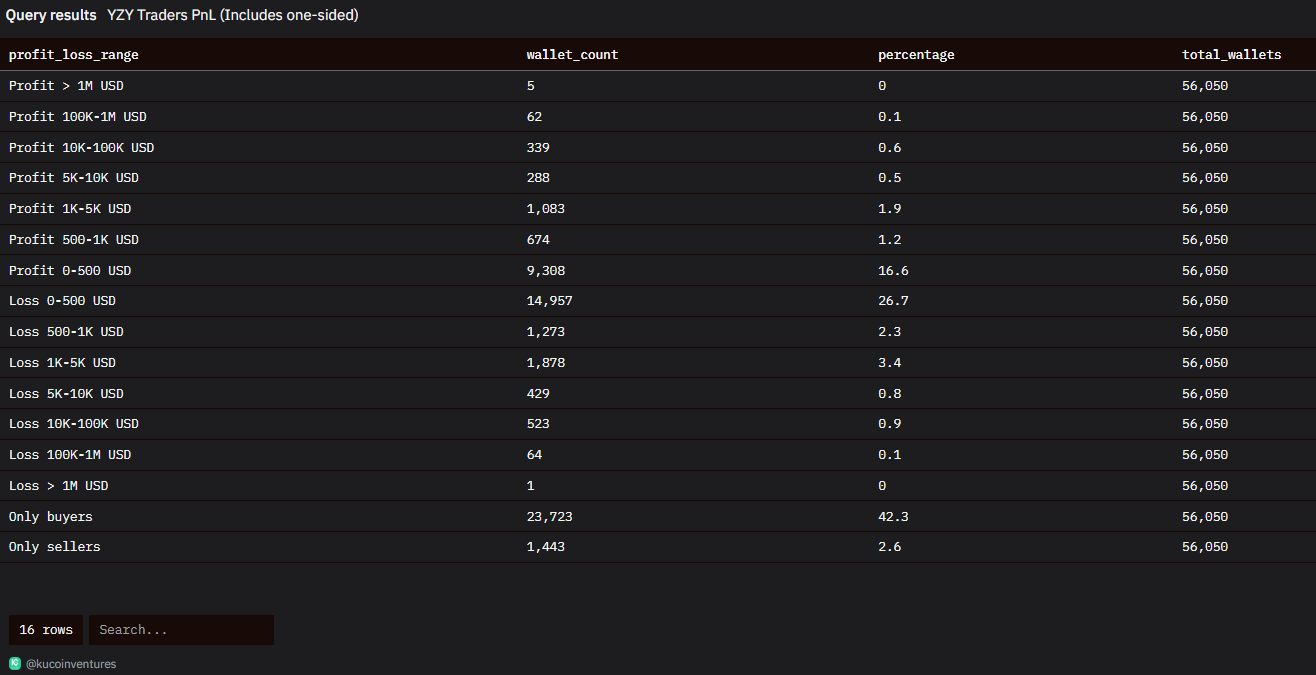

15,000 wallets lost $500. 2,800 wallets lost between $1k-$100k. One wallet even lost over $1m.

About 38% of wallets that bought & sold realized profits.

It’s improbable that the majority will make money with any token (most people buy the top, while the few that bought early sell at the top), but these sorts of insider-heavy wallets result in a large majority losing money.

I suspect, this is part of the reason why crypto has been unable to generate the same buzz as previous cycles. The marginal retail buyer already lost their money, or heard about a friend that lost money.

The result of this is that demand for altcoins in excess of their fundamental value is dramatically lower.

This game has become too efficient: extraction happens within hours instead of years. In this case, participants had less than an hour to ride the token up before the token would drop 70% over the next two hours.

Who wants to play this game?

Going back to our original scenario, if the market were to crash from here, you would probably feel like you should have been able to tell it was a top. That isn’t to say that every top signal has been hit or that it’s a sure thing, but, even though we all want to make it quickly, prudence is warranted. People in crypto tend to be overly optimistic at the top and overly pessimistic at the bottom. And if everyone’s getting angry that you’re selling, it’s probably a sign the top is near.

There are, however, reasons to be hopeful, Reasons to think, dare I say, “this time is different.”

This time around we have ETFs providing a passive bid, DATs (at least at the moment. Buying has slowed down for now. Let’s hope that doesn’t become an existential risk), and retirement accounts opening up to alternative assets like crypto.

Because of this, I don’t believe that the tops of previous cycles will look like the top of this cycle. It feels like we’re close, but it’s more likely that we see mini rallies fueled by liquidity cycles, followed by pullbacks that are more shallow than previous -80% drawdowns, but perhaps more frequent.

If the market hadn’t received a complete institutional embrace and widespread regulatory acceptance, it’s hard to imagine how deep into the shadowlands we’d be.

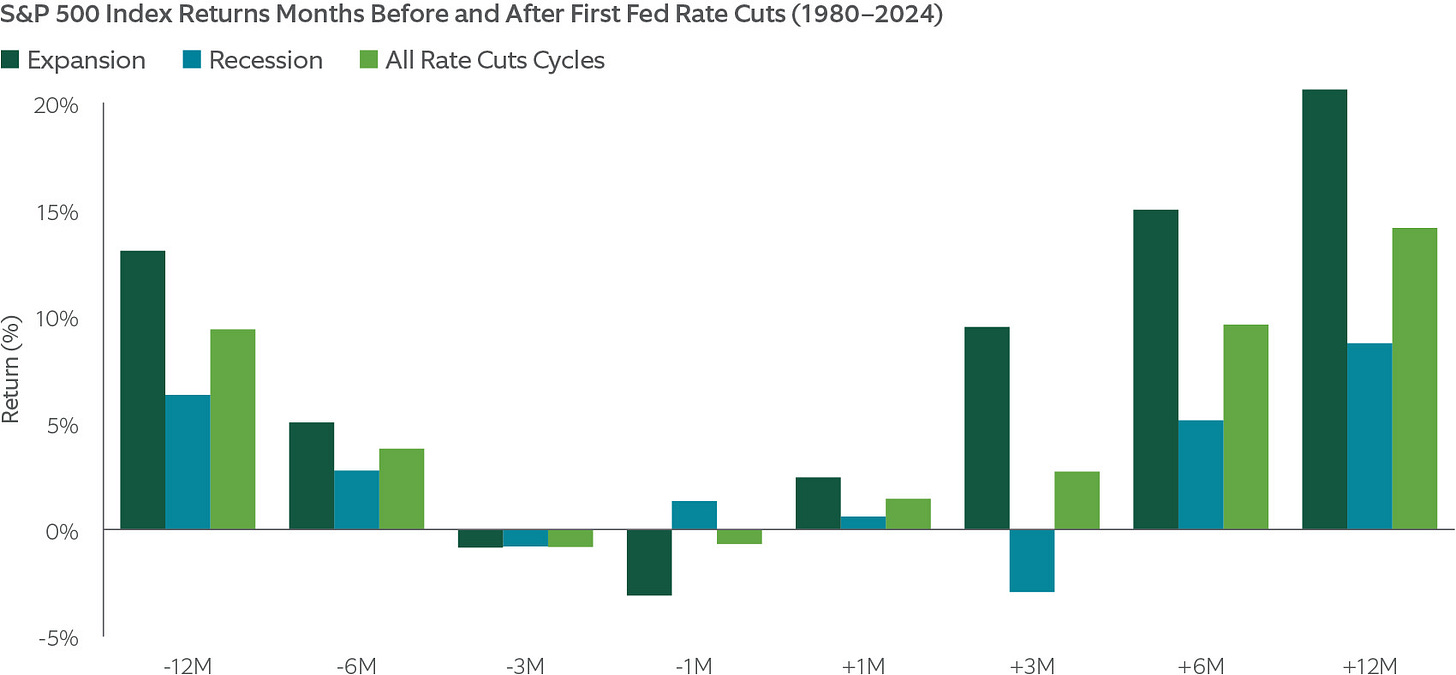

Right now, all eyes are on the upcoming September Fed meeting, where the expectation is that Powell will start cutting rates.

A quote from Powell from last week made clear what many already suspected: a rate cut is likely coming.

Typically, markets respond well to rate cuts (although in the age of prediction markets, with odds of future events more transparent they are inreasingly priced in).

While we wait for the market’s next move, I published a video with a framework for value investing in crypto.

Value investing and crypto typically aren’t said in the same sentence, but DeFi’s maturation means real onchain businesses are reaching escape velocity. These projects are battle-tested, have less supply overhang, and are actually making money. The bigger ones often even use revenue for buybacks. You can treat them more like growth equities than traditional crypto tokens.

To bring things back to our original premise, we were overdue for a pullback. Valuations have gotten too inflated and too much junk has accumulated. Fortunately, unlike in previous cycles, there are real companies using these rails and real, profitable, growth startups build onchain. If you’re invested in a few core tokens that you believe in as a successful enterprise (not just an idea), I predict you’ll be just fine.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

Before I start, if you’re looking for a more comprehensive overview of trends driving the market, check out our monthly Zoom call from this week:

Dynamo DeFi Pro Group Call - August 2025

Each month, I conduct a group Zoom call with premium Dynamo DeFi subscribers to discuss the trends driving the crypto market.

🔭Market Outlook

Before we start with the metrics section of this newsletter, a quick poll to help us make this section more useful:

Market Health

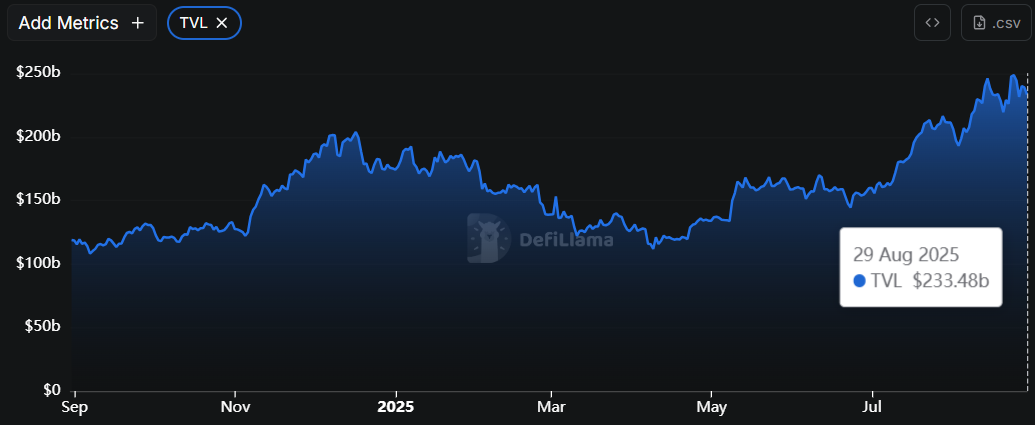

Total DeFi TVL

Pulled back from the $248b high earlier this week.

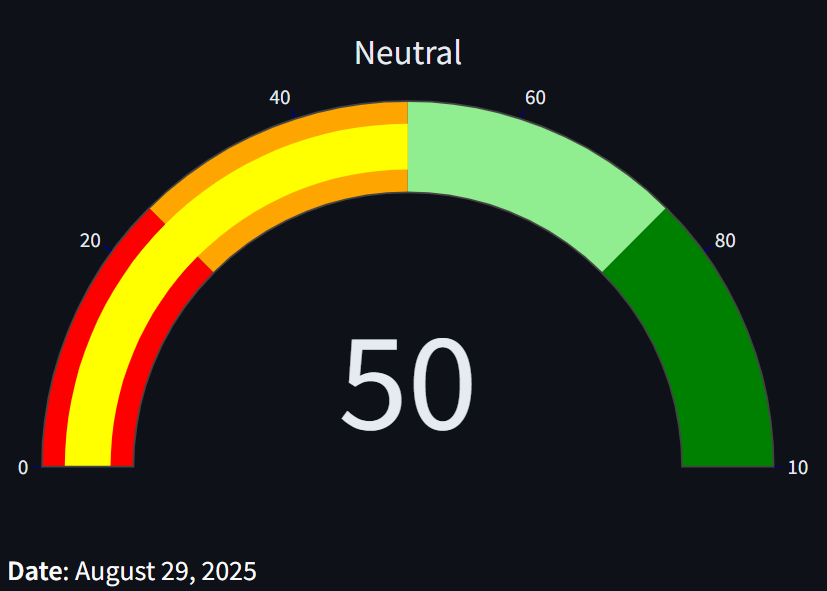

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here.

Today’s index is the same as last week’s: Neutral.

Stablecoin Market Cap

New record for stablecoin market cap, crossing $280b and adding $17b in the last 30 days. USDC led 30d growth, adding $6.8b in market cap.

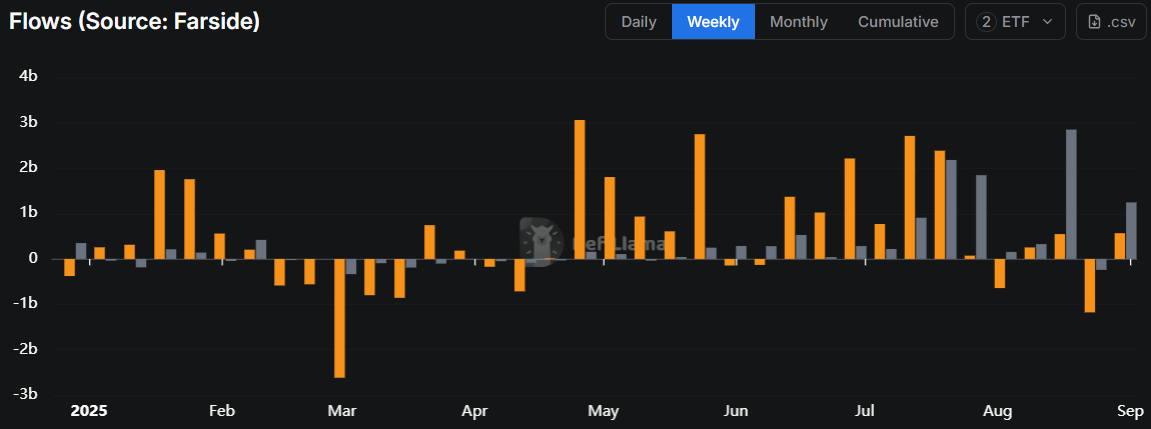

ETF Flows

After last week’s outflows, both BTC & ETH ETFs saw inflows this week. This is the 6th consecutive week that ETH flows have outpaced BTC.

It’s likely that BTC will end the month with net outflows, something that hasn’t happened since March.

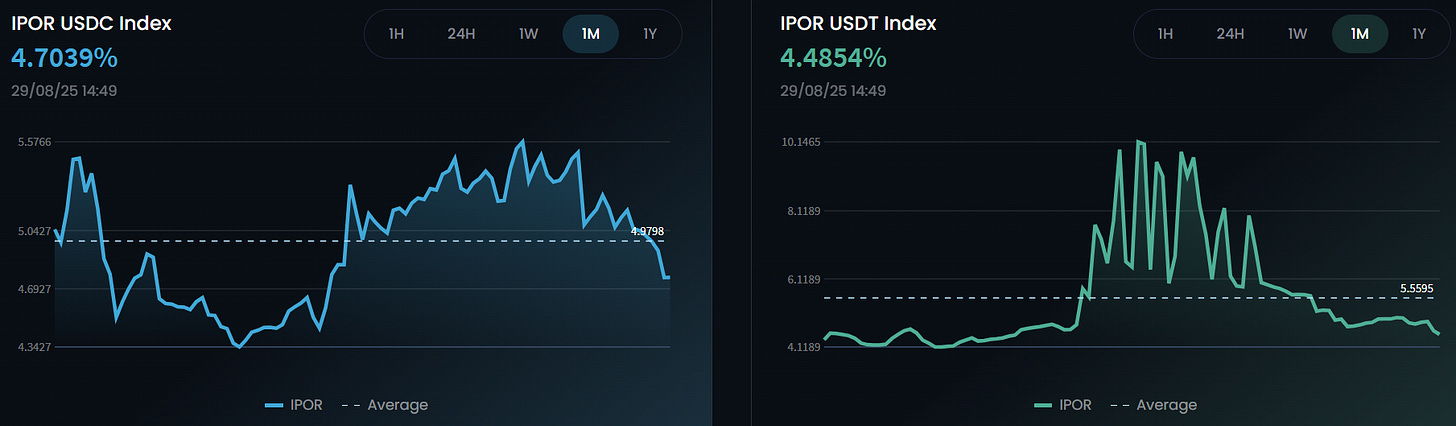

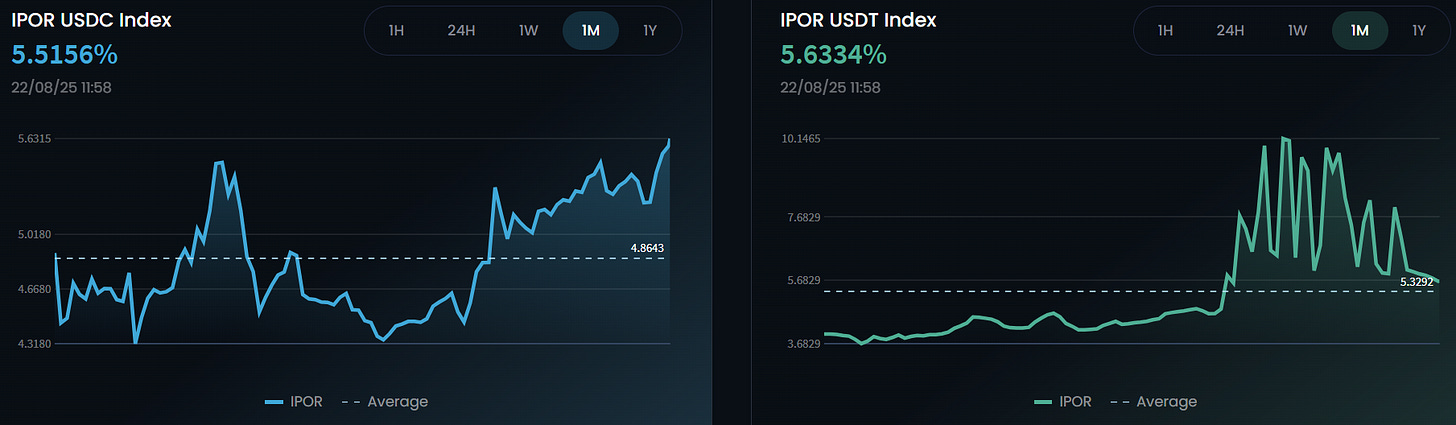

IPOR Stablecoin Indices

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

Rates have fallen back below monthly averages after rising to their highest levels in months.

For reference, here are last week’s numbers:

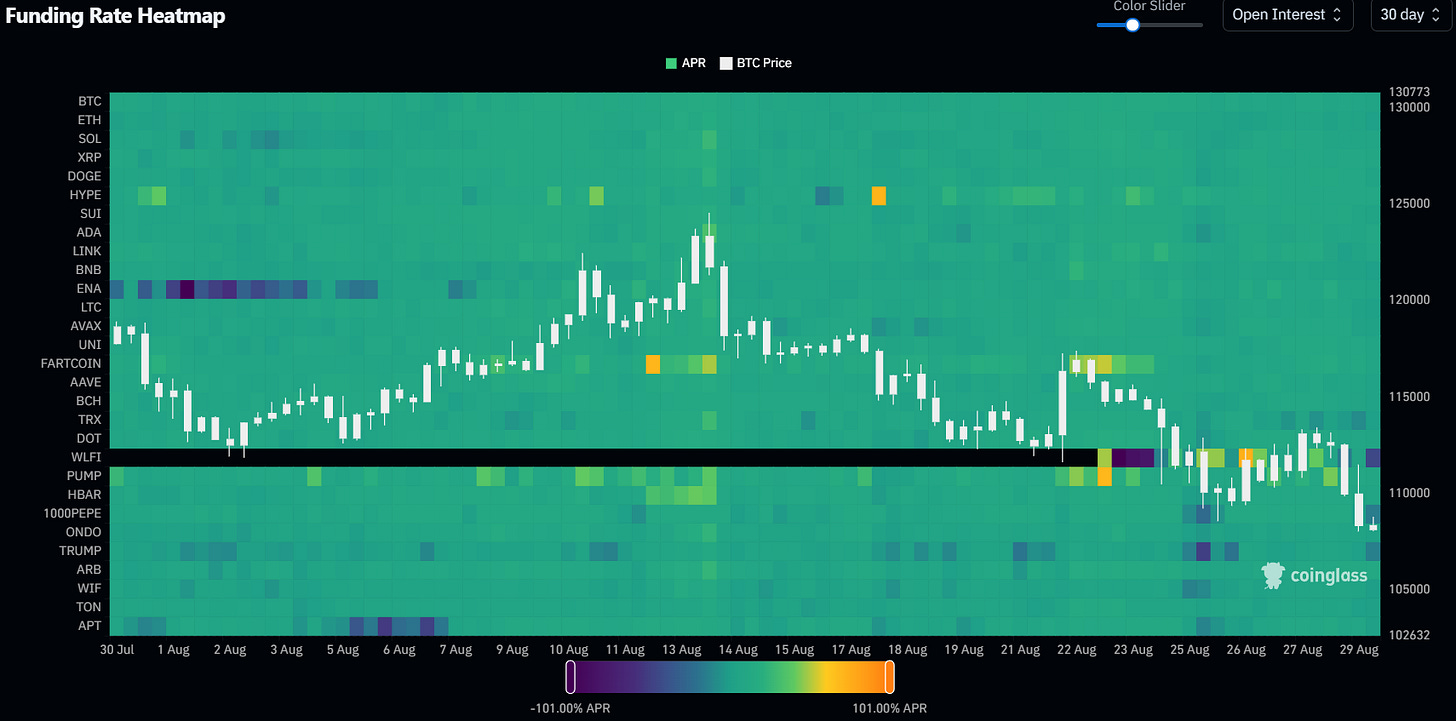

Funding Rate Heatmap

The Funding Rate Heatmap from Coinglass displays funding rates across some of the largest crypto assets.

Brighter colors indicate elevated funding rates for longs, and darker colors indicate low or negative funding rates (indicates large short positions).

Funding rates have begun to turn negative for some of the higher beta perps.

Coins like TRUMP & PEPE have negative funding, and ETH funding is slightly negative.

ARB is one of the more expensive perps to long right now at 11% annualized funding.

Category and Chain Trends

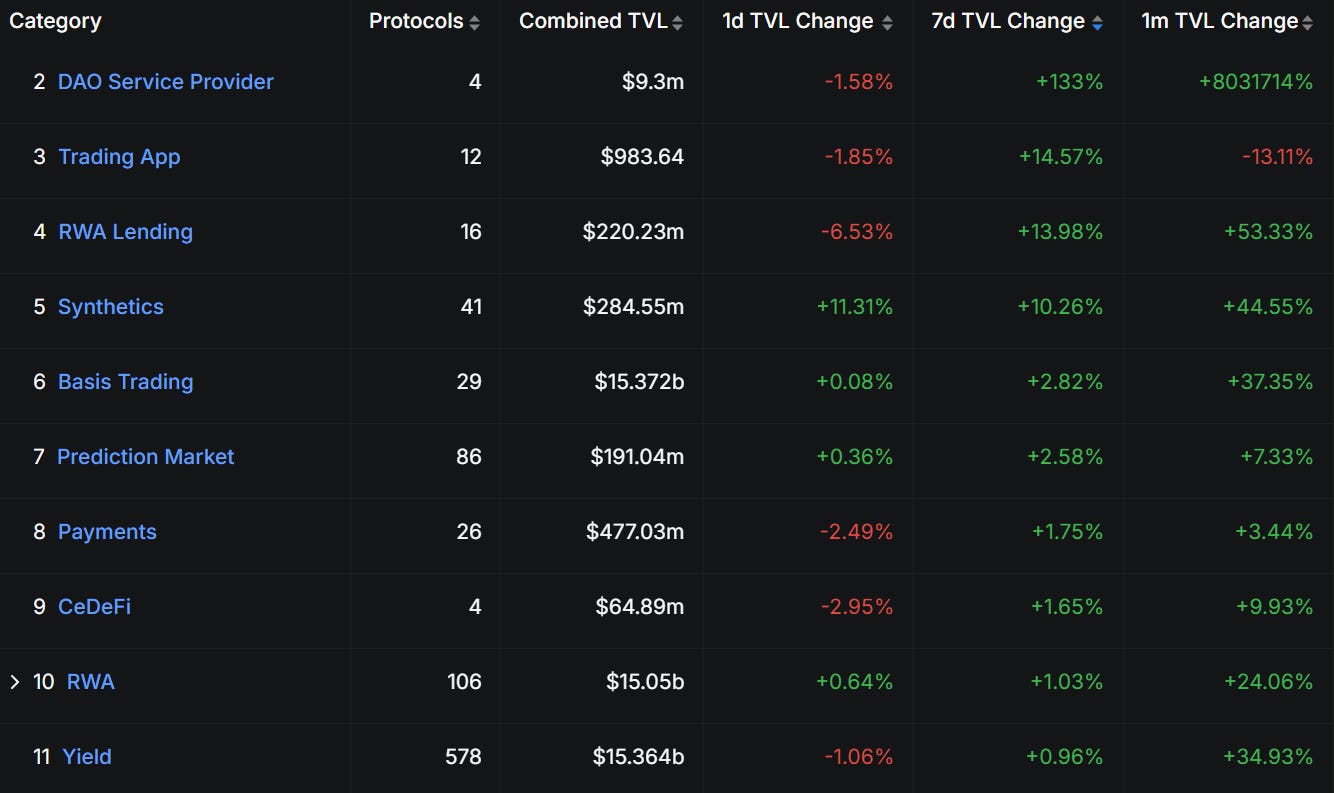

Category TVL Changes

RWA Lending continues its month of strong growth, crossing $220m in combined TVL. Synthetics are also up 44% over the last 30d. Prediction markets have gained some attention recently and TVL has been steadily rising.

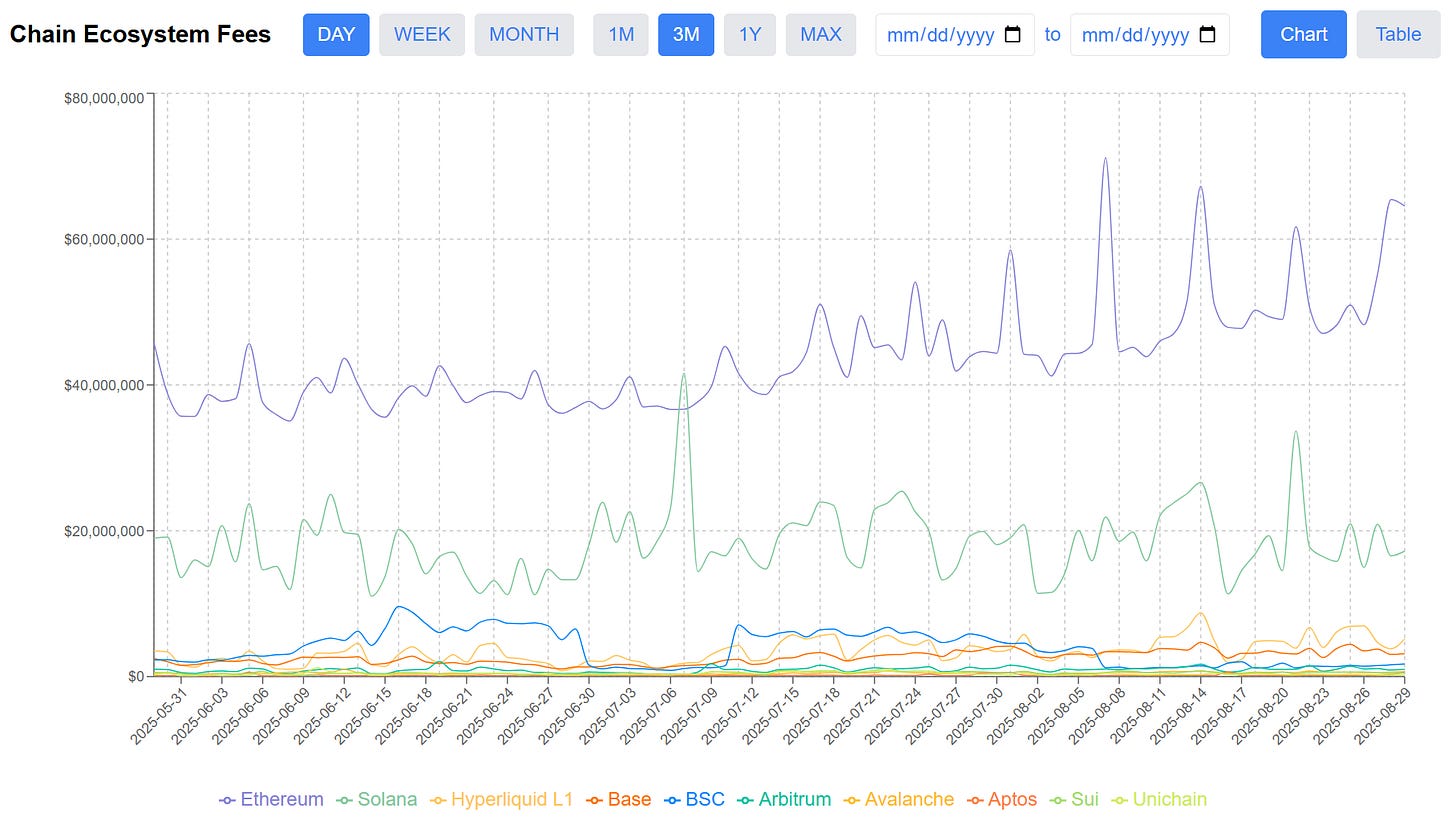

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

CEF on Ethereum remain strong. Solana’s CEF are steady, and Hyperliquid has cemented itself as the 3rd highest ranked fee generator.

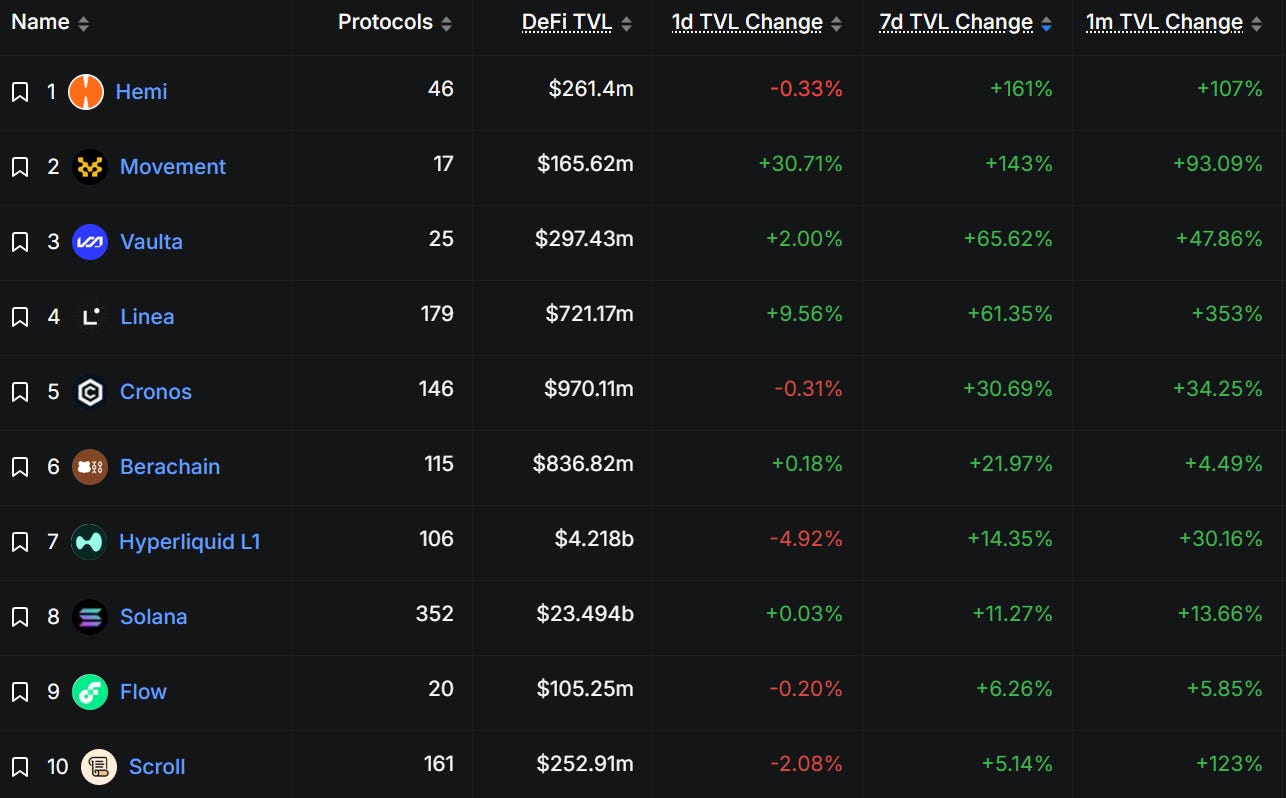

Fastest Growing Chains ($100M+ TVL)

Hemi continues to gain momentum as a Bitcoin scaling network. Linea TVL grew another 60% this week, and Hyperliquid & Solana both grew double-digits.

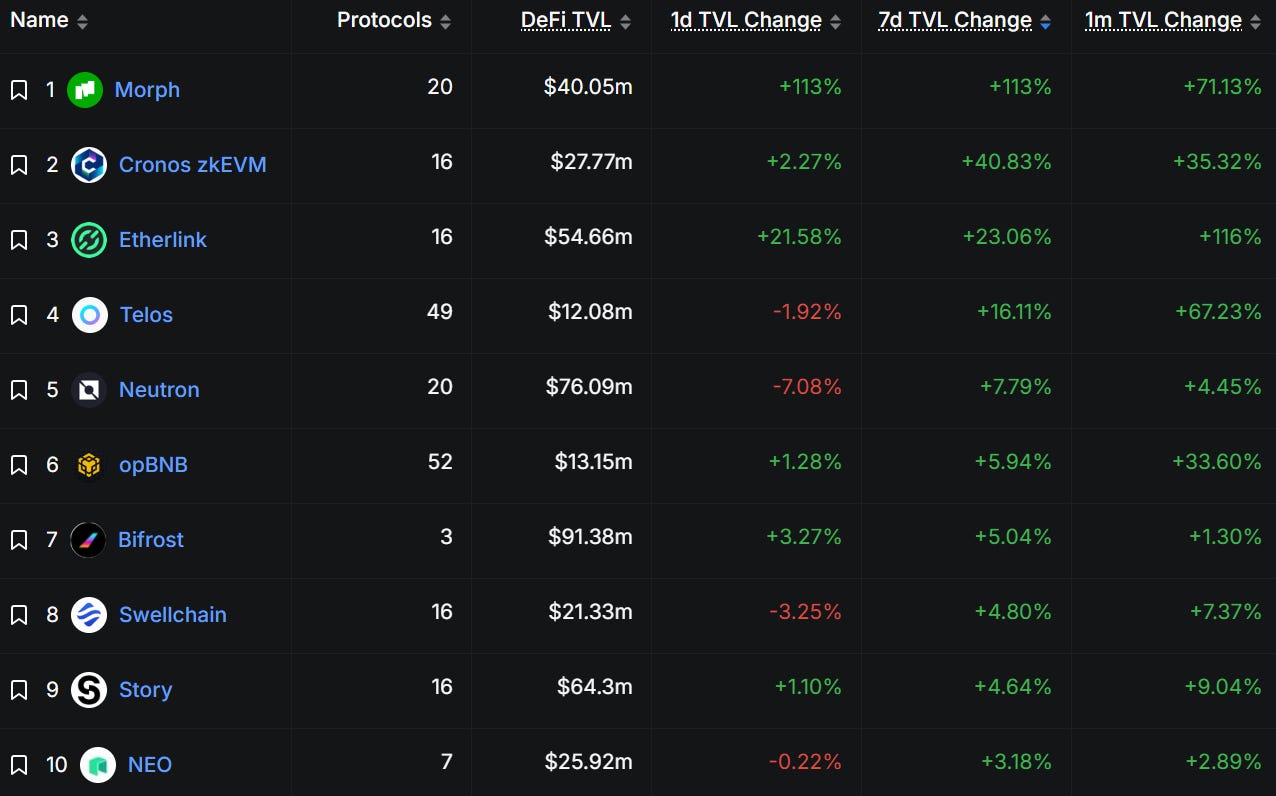

Fastest Growing Chains ($10M-$100M TVL)

📊Onchain Metrics

Digital Asset Fundamentals

We’re building out this section, where we dive deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens.

Below you’ll find 3 visuals:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.