⚡️Fed Decisions, Hyperliquid Rally & Hot Yields

All eyes on the Fed, Trump <> Xi meeting, and a 65% APY stable vault

Read Time: ~5 minutes

⚡In This Edition

Hyperliquid’s ecosystem bounces back

65% APY stablecoin farm

⚡Metrics Snapshot

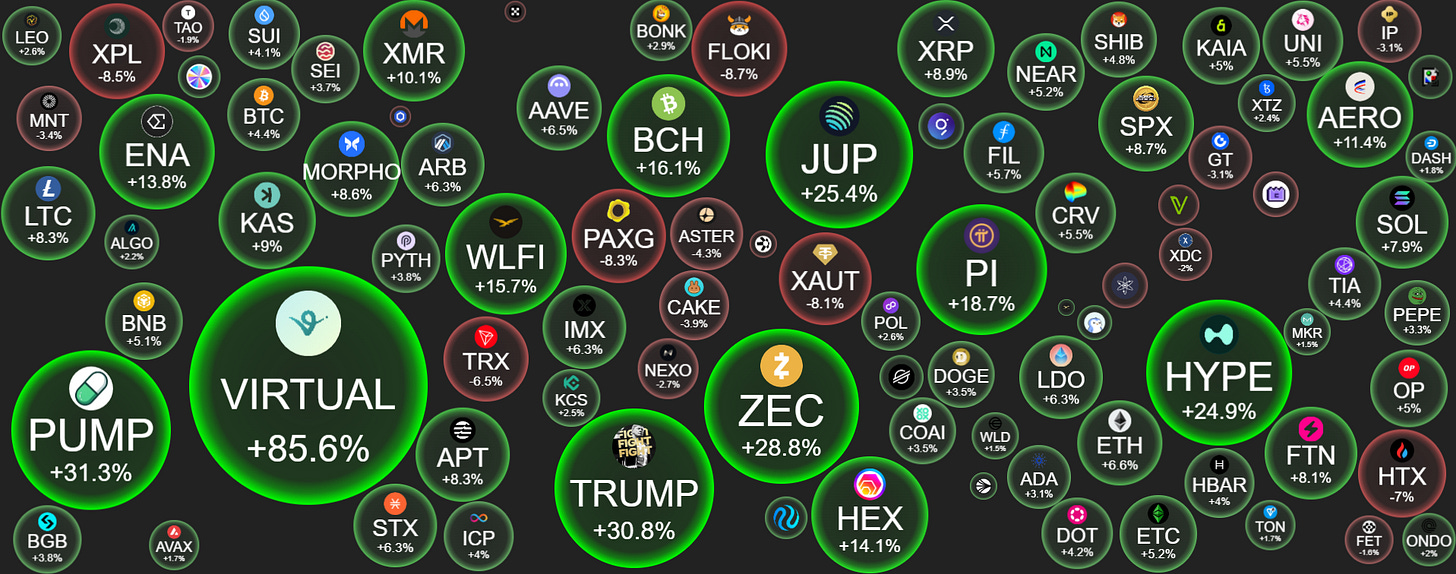

Top 100 Coins at a Glance (7d)

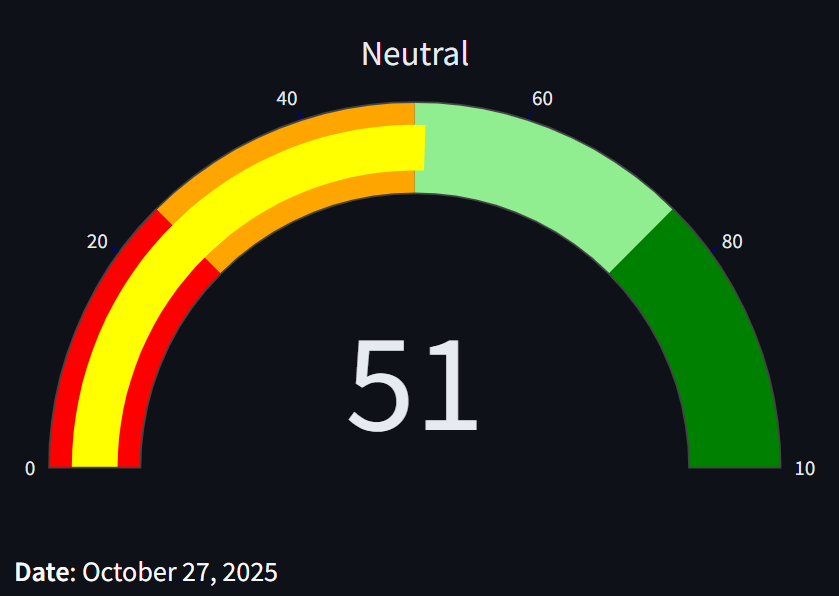

Fear & Greed Index: 51 (Neutral)

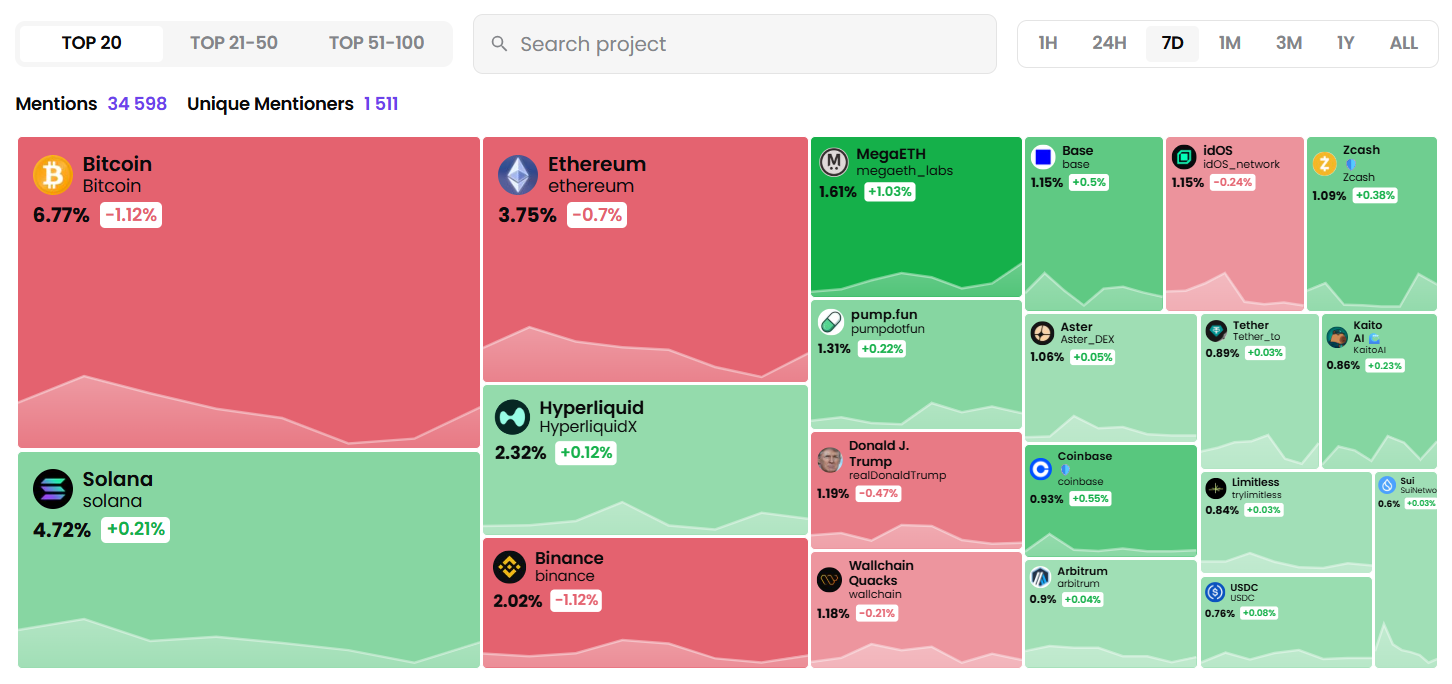

Project Mindshare (7d)

Historical Bitcoin Performance This Week (Week 44)

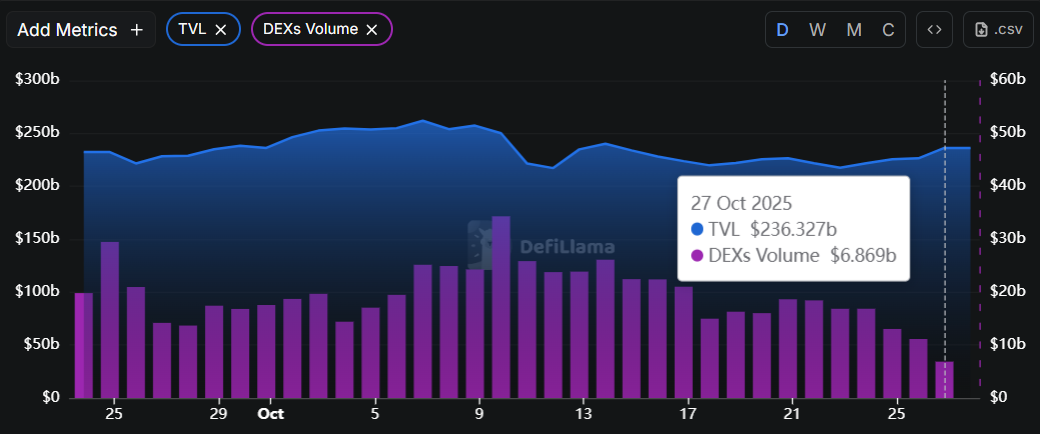

DeFi Market Metrics: Global TVL & DEX Volume

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. Fed: Rate Cuts and QT Wind-Down

Markets are focused this week on the FOMC decision set for October 29. A 25bps rate cut is widely expected, marking the second cut of the year.

The Fed could potentially announce the end of Quantitative Tightening (QT after shedding over $2.2 trillion from its balance sheet. With inflation softening and the labor market cooling, liquidity is poised to return.

What This Means

If QT ends, the drain on liquidity does too. And markets may feel it fast. Expect a more supportive environment for crypto, gold, and risk assets heading into 2026. Rate cuts may be priced in, but QT relief is a fresh tailwind.

2. Trump’s Asia Tour Sets the Stage for U.S. & China Reset

Trump’s return to the global stage included a ceasefire deal between Thailand and Cambodia, new trade pacts with ASEAN nations, and a key upcoming meeting with Xi Jinping at the APEC summit in Busan.

The White House is pitching the trip as a bid to lock in U.S. influence across Asia.

What This Means

Markets are rallying on de-escalation hopes. If Trump and Xi seal the proposed “framework” agreement, it could unlock hundreds of billions in trade flows and pause further tariffs.

It’s a bullish backdrop, but still fragile. Don’t underestimate how fast rhetoric can flip.

3. IBM Launches Institutional Digital Asset Platform

IBM just unveiled Digital Asset Haven, a full-stack blockchain platform for governments, banks, and corporates. The platform, built with Dfns (a wallet infra provider), offers custody, compliance, cold storage, and programmable governance across 40+ blockchains.

What This Means

Another blue-chip giant is going deep into digital assets. While this doesn’t move token prices directly, it signals where things are headed: tokenization, compliance-first custody, and regulated platforms designed for the real world at scale.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡a16z State of Crypto 2025 Report

The year crypto matured

⚡Dynamo DeFi framework for picking investments

Current holdings & the goal of investments

⚡TVL is a terrible metric for lending

DeFi’s scoreboard is broken

⚡What you can learn from a 30yo Charlie Munger

If you’re feeling like you’ve wasted time, read this

⚡Everything you need to know about x402

The internet finally found its payment layer

⚡Get More Crypto Edge

Each week Patrick sends out a comprehensive DeFi report that includes:

Custom metrics & fundamentals of the strongest projects

Protocol revenue analysis & aggregated cross-industry analysis

Market thoughts & onchain insights

Some of the Pro Report is free. Give it a read right here.

To get the complete reports sent to your inbox each week (and much more), join Dynamo DeFi Pro.

🔢Onchain Analysis

Hyperliquid Leads Chain Growth

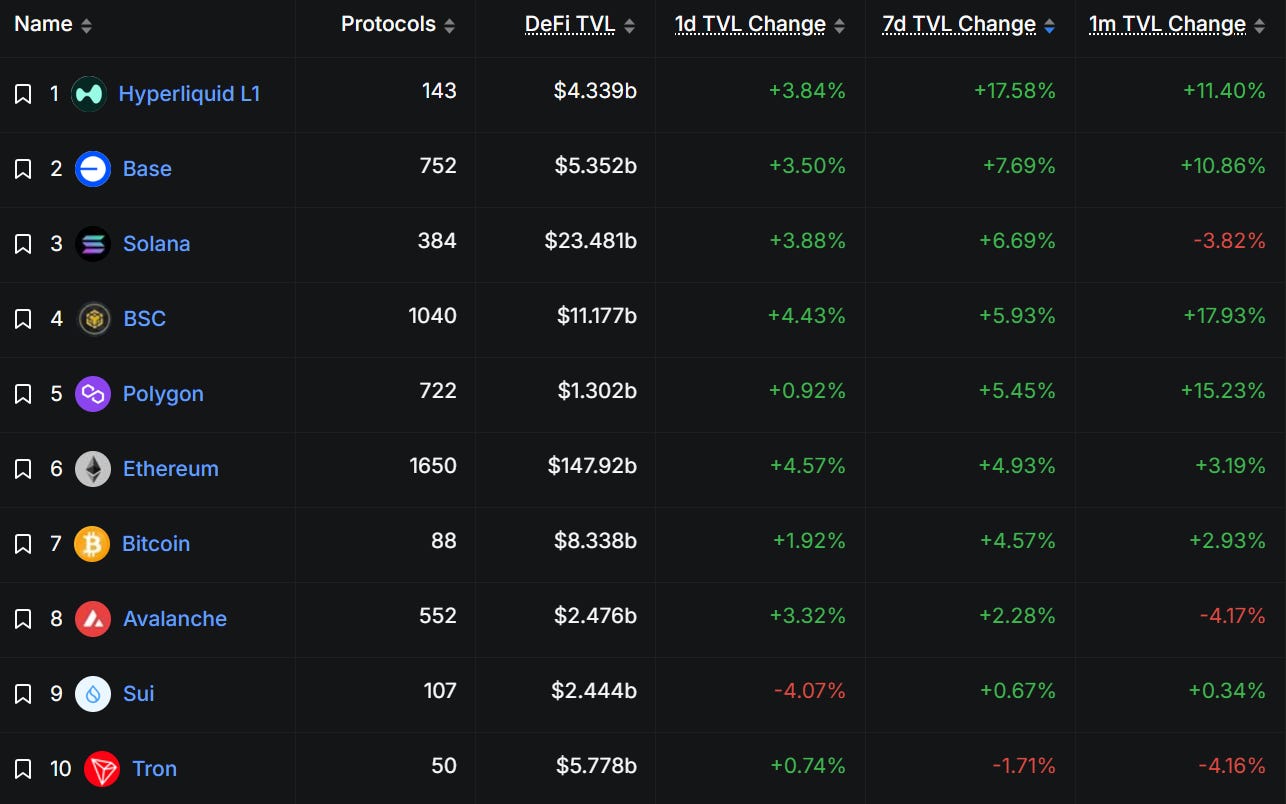

There are 13 chains with over $1b in TVL. 9 of them have seen positive growth over the last 7 days.

Hyperliquid L1 takes the cake with a nearly 18% boost in 7d TVL.

TVL peaked at over $5b in mid-September. When Aster launched, Hyperliquid TVL proceeded to drop 28%.

As TVL climbed back to $4.6b, the 10/10 crash sparked another TVL outflow. This time, the drop was more visible in Hyperliquid’s onchain stablecoin market cap, with stablecoin market cap dropping over $1b in less than a week.

For the first time since 10/10, Hyperliquid’s stablecoin market cap has flipped upward and appears to be growing again.

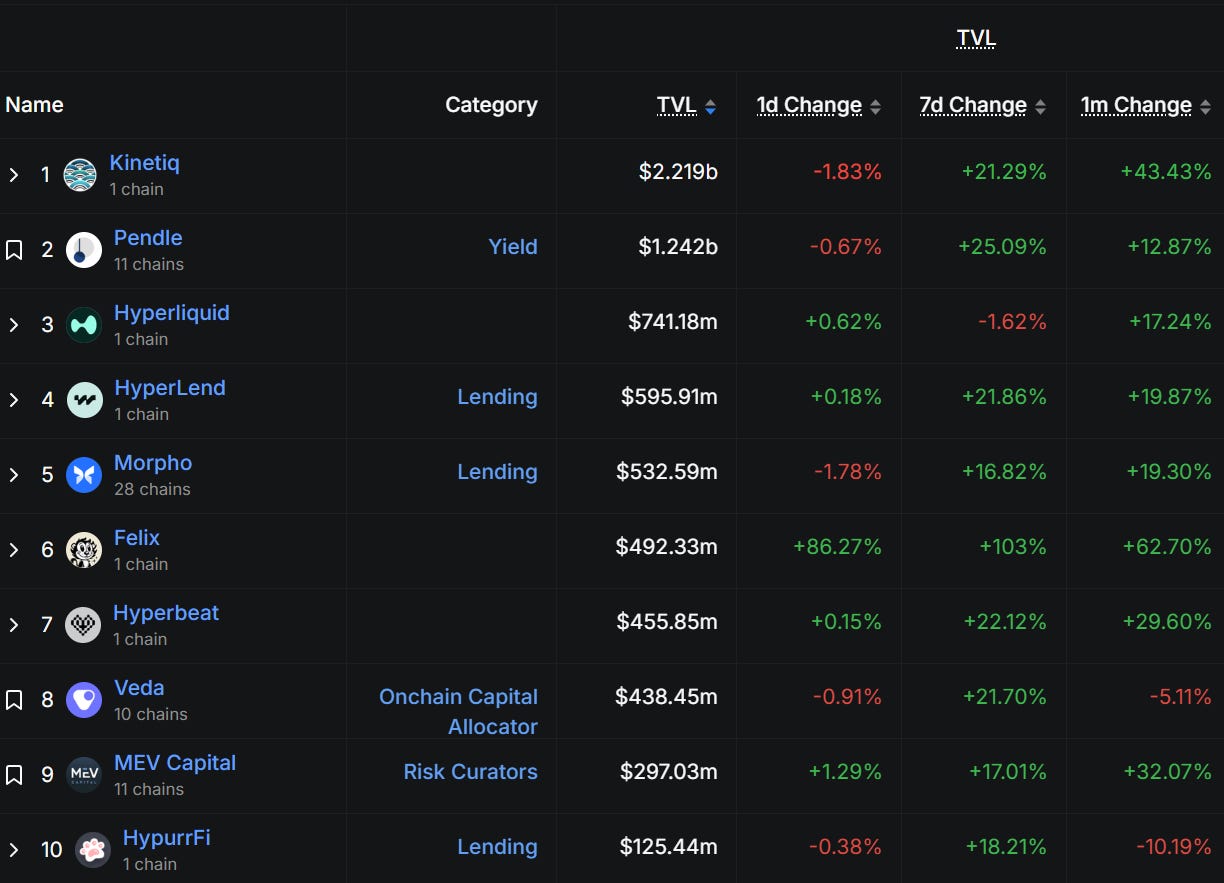

Taking a closer look at Hyperliquid protocols, many are up 20%+ in 7d TVL.

TVL growth can typically be directly attributed to the rise in HYPE token price. For every HYPE token put to work in the ecosystem, as the tokens increase in value, so does TVL.

In this case, many Hyperliquid protocols are at TVL ATHs denominated in HYPE, which shows this surge isn’t just because of HYPE’s token price.

Onchain users want exposure to the Hyperliquid ecosystem - over 5 of the top 10 protocols have points systems but haven’t launched tokens yet. The race for airdrops is back on.

🚜Farm of the Week

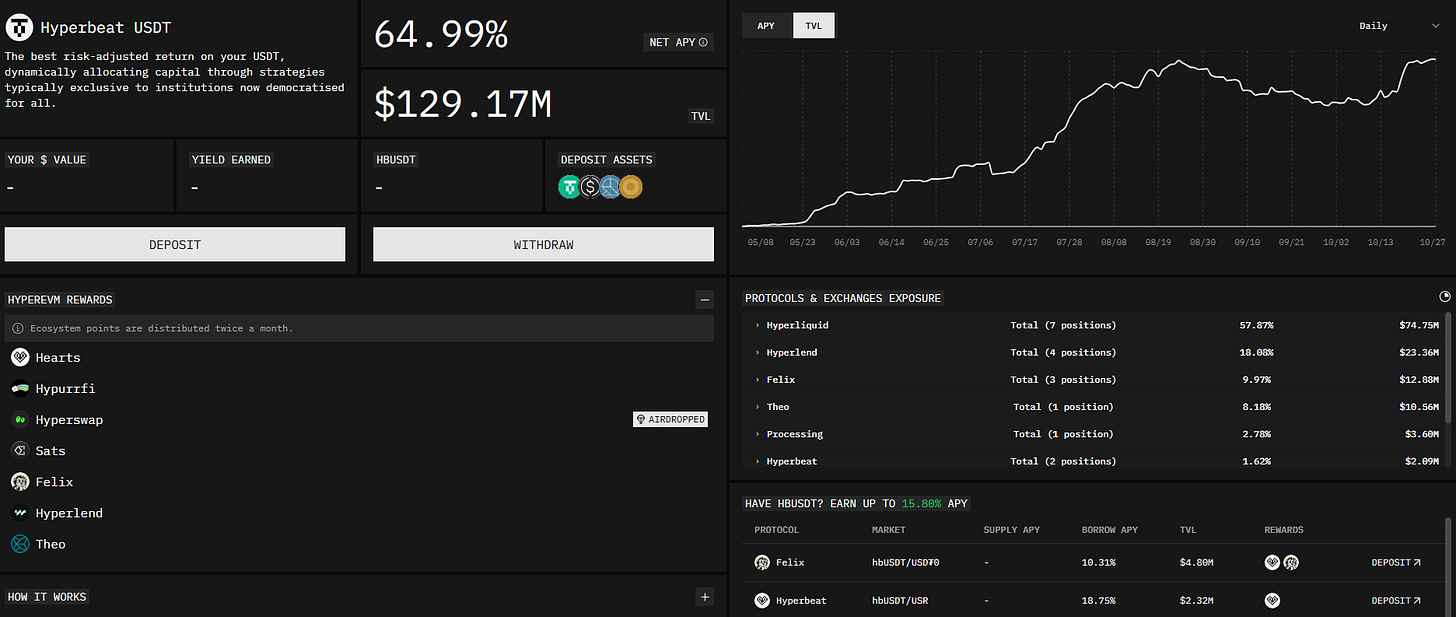

Hyperbeat USDT

Hyperbeat’s USDT vault offers 65% APY on USDT0 deposits.

If you don’t have USDT0, you can swap for it on Hyperbeat’s MasterSwap page.

This vault is attractive because:

Yield is high

TVL is high, lowering risk

Points are earned from 7 protocols

The vault is hands-off; no adjusting or LPing necessary

How it Works

Head to Hyperbeat, acquire USDT0 and hit Deposit. You’ll begin earning yield and ecosystem points.

Risk Level: Medium

Risks

Smart Contract Risk

Protocol Layer Risk

⚡Onchain Metrics Masterclass: How to Spot Trends & Track Fundamentals

🛠️Tool Spotlight

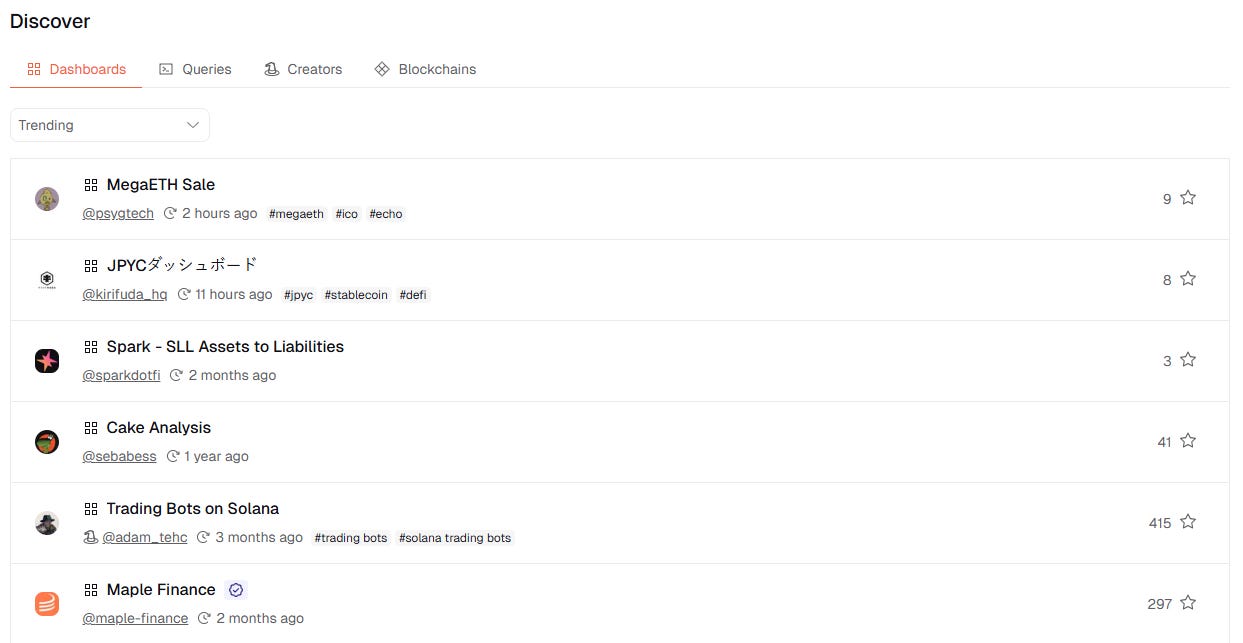

Dune Analytics: Community-Built Custom Dashboards

Dune makes querying blockchain data easy, allowing anyone with a bit of SQL knowledge to create in-depth dashboards.

Two helpful tools here:

List of trending blockchains that are seeing lots of activity

Trending dashboards, usually created to capture current events (like data on the MegaETH token sale)

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Fed Interest Rate Decision - October 29th

📊 Fed Chair Powell Press Conference - October 29th

📊 President Trump Meets President Xi - October 30th

📊 October MI Consumer Sentiment data - October 25th

📊 ~20% of S&P 500 Companies Report Earnings (including Microsoft, Alphabet, Mea, Apple & Amazon)

Token Unlocks: $400m Unlocking This Week

🔓YCG (1.25%) - October 27th

🔓SIGN (21.48%) - October 28th

🔓SOPH (1.53%) - October 28th

🔓GRASS (73.44%) - October 28th

🔓AURO (0.51%) - October 29th

🔓TREE (6.12%) - October 29th

🔓ZORA (4.55%) - October 30th

🔓REZ (8.79%) - October 30th

🔓KMNO (5.99%) - October 30th

🔓GUN (7.25%) - October 30th

🔓IMX (1.24%) - October 30th

🔓OP (1.71%) - October 31st

🔓W (1.26%) - October 31st

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Legend of YMIR launch - October 28th (Source)

🚀 MegaETH sonar ICO goes live - October 27th (Source)

🚀 Hong Kong first $SOL ETF launch - October 27th (Source)

🚀 Monad early airdrop reveal - October 28th (Source)

🚀 $INJ token burn commences - October 29th (Source)

🚀 Neo legacy network shutdown - October 31st (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi