⚡️DeFi Summer is Just Getting Started (ETH, LDO, LINK)

Inside look at Chainlink's LINK Reserve, Lido's buyback proposal and trillions in retirement accounts coming for crypto

Read Time: ~5 minutes

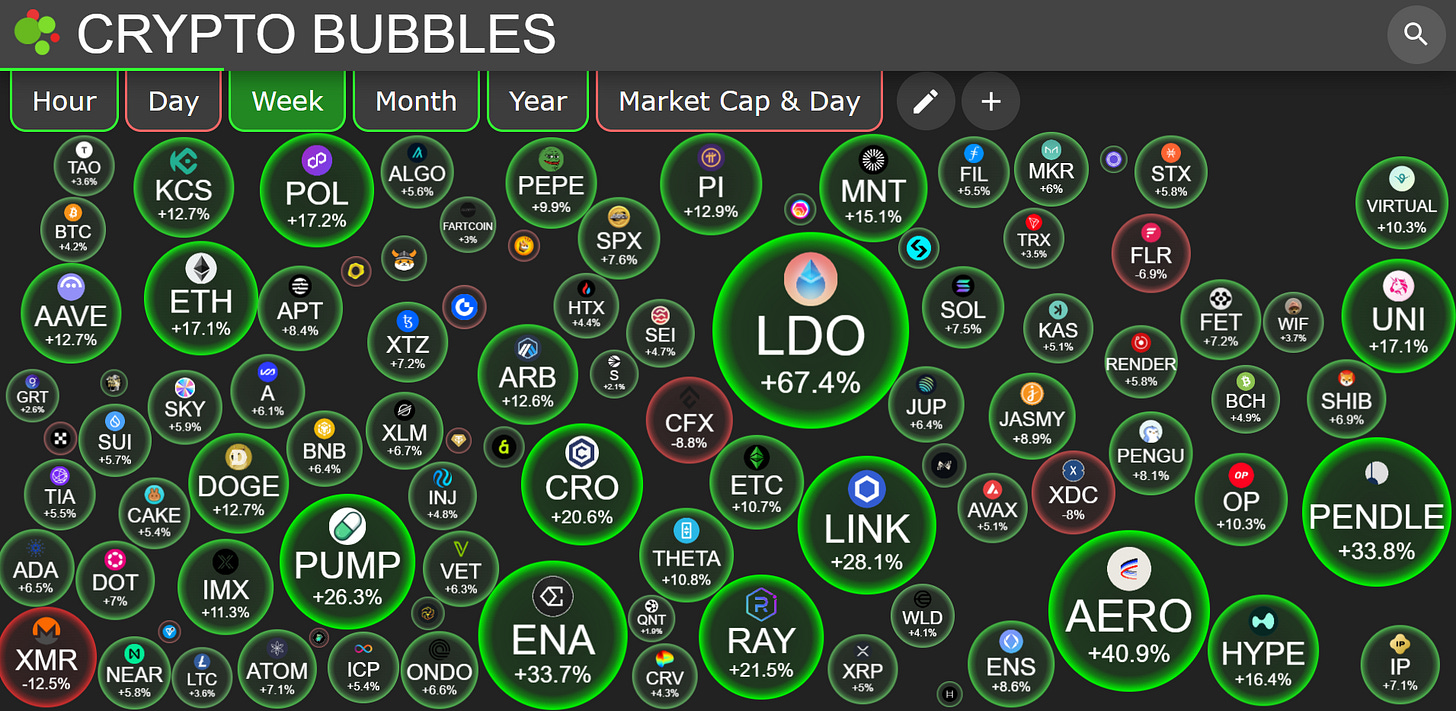

DeFi Summer is back. Don’t believe us? Look at top performers this week: Ethereum, Lido, Chainlink, Aerodrome, Pendle, Ethena… Scroll down for the full list.

We’re taking this newsletter to the next level and building a way for you to become a better investor in digital assets. You can help shape what we build. Can you spare 30 seconds to fill out this form and help us serve you better?

⚡In This Edition

Market Metrics at a Glance

What to know this week in crypto

Onchain Analysis

Farm of the Week

Macro events, new launches and token unlocks this week

DeFi tools & our favorite resources

⚡Metrics Snapshot

Top Performers this Week

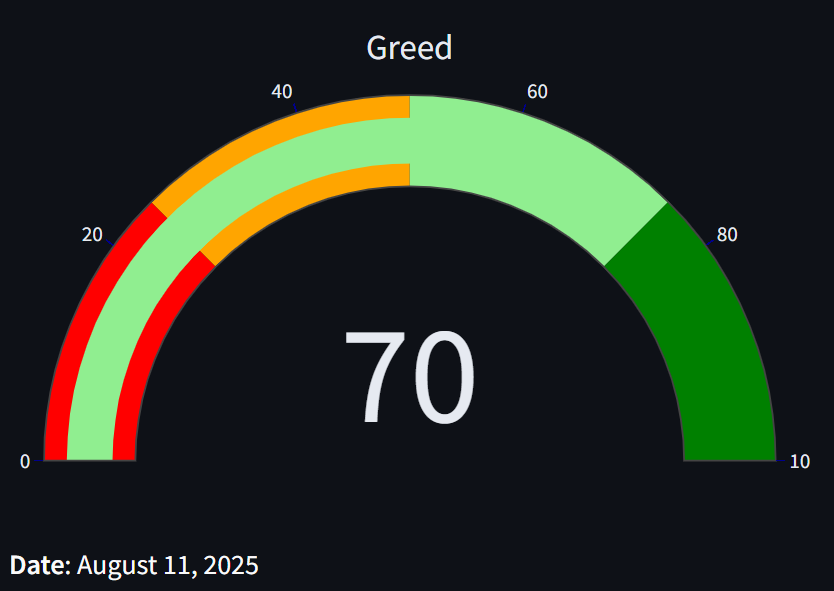

Fear & Greed Index: 64 (Greed)

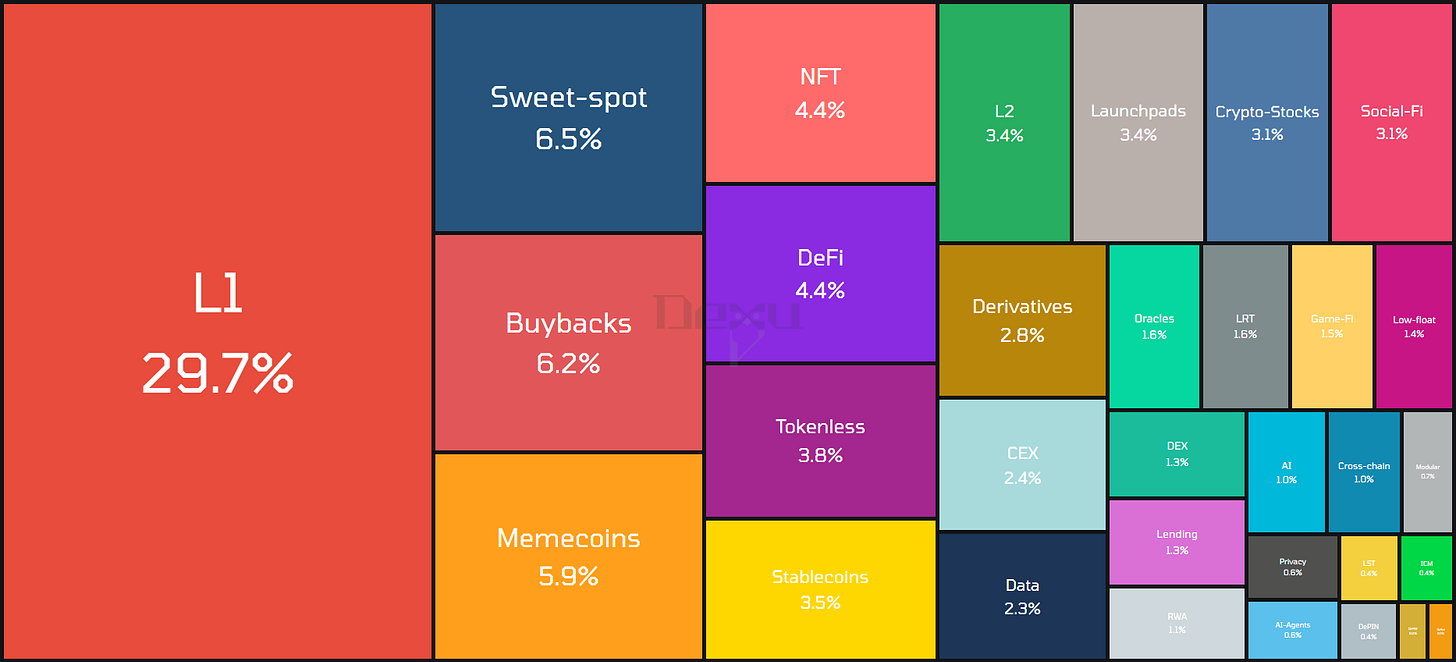

Narrative Mindshare (7d)

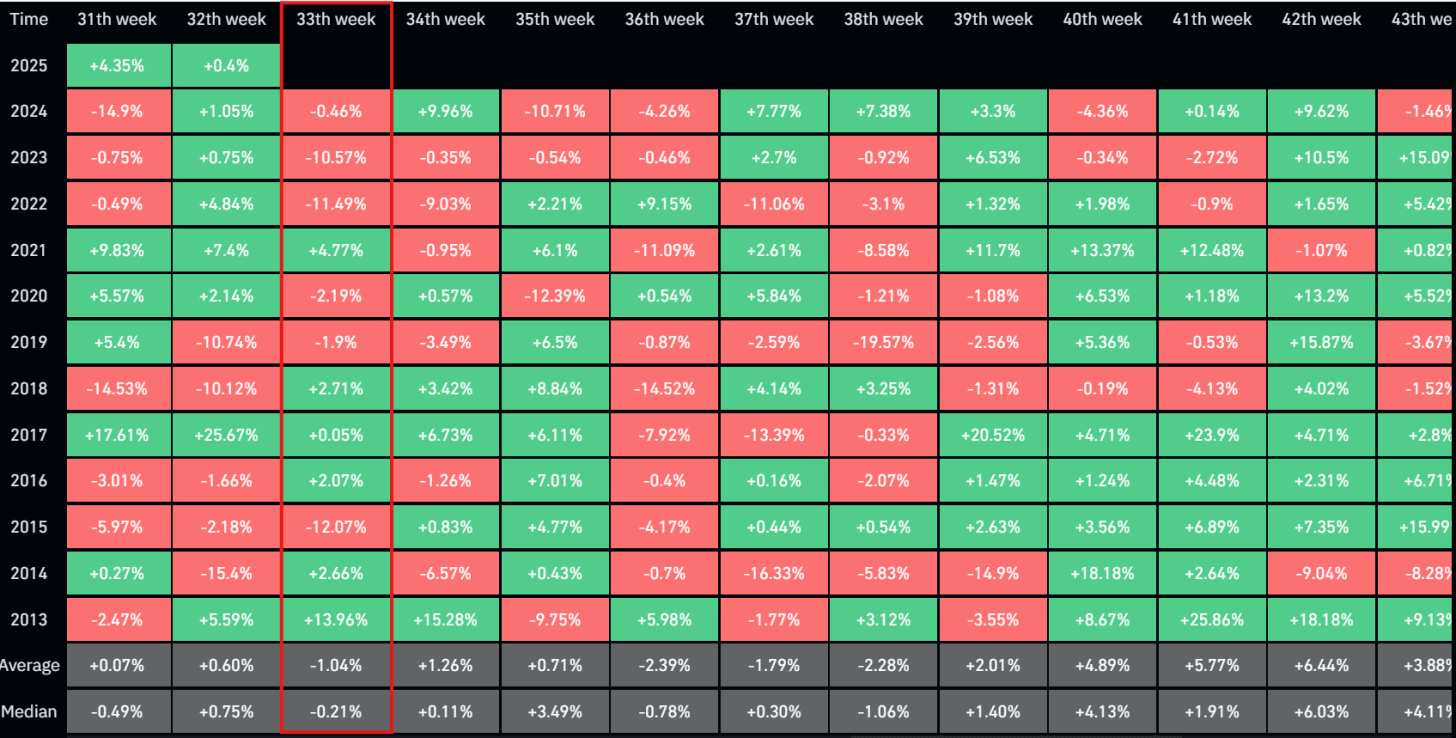

Historical Bitcoin Performance This Week

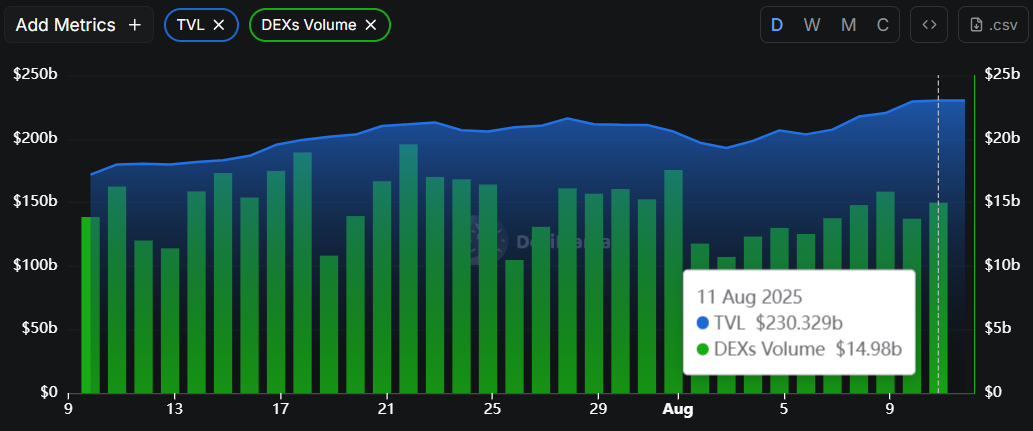

DeFi Market Metrics: Global TVL & DEX Volume

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. Trump Signs Executive Order Allowing 401(k) Access to Crypto

We covered this in our latest post: Trillions of liquidity is unlocked. A new executive order directs the Labor Department to redefine 401(k) investment rules, allowing Americans to allocate retirement funds into alternative assets like crypto and private equity.

What This Means: This could eventually unlock trillions in new demand for crypto. While implementation will take time, there is clear institutional acceptance of digital assets and this may shake up how Americans invest for retirement.

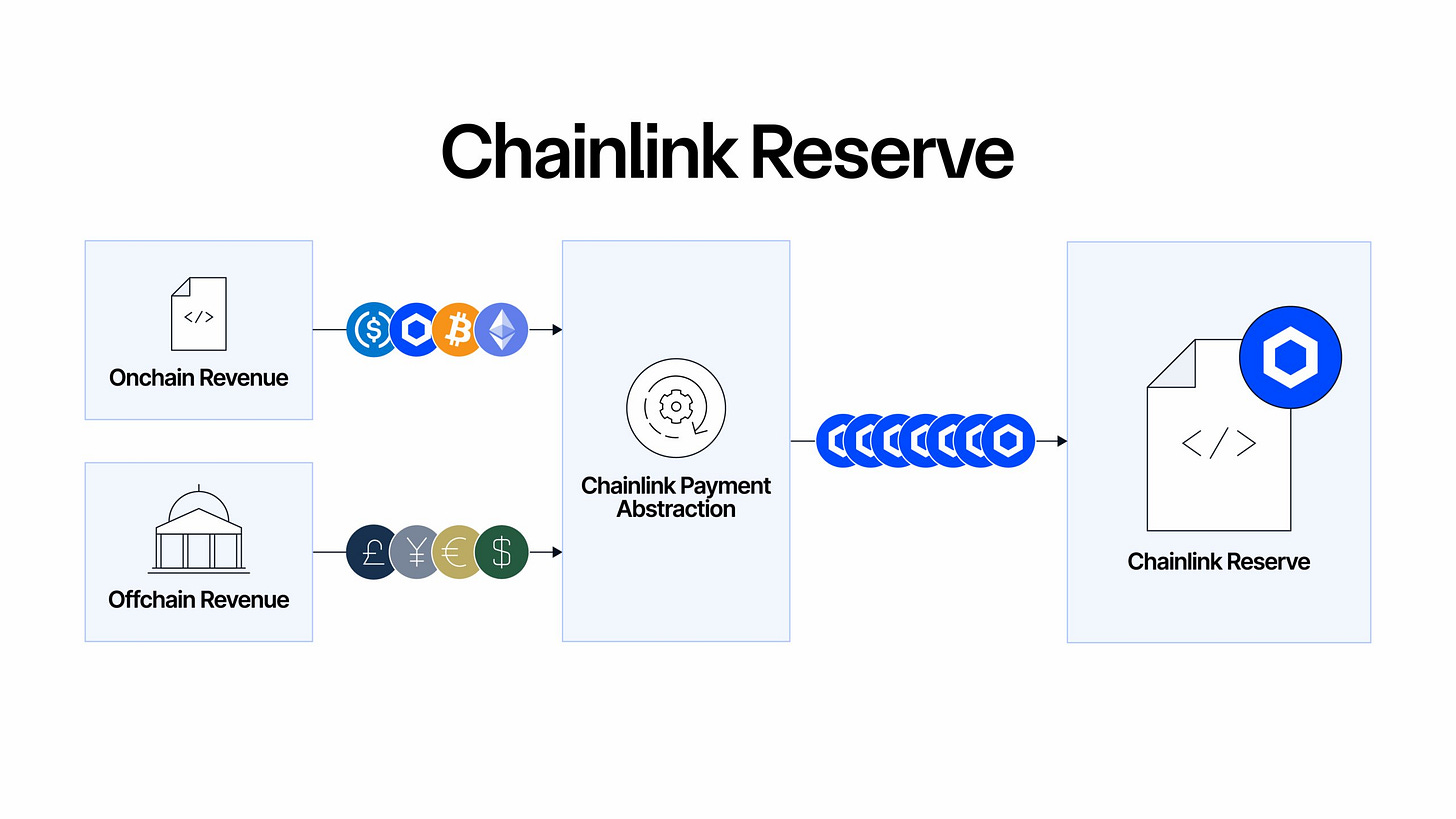

2. Chainlink Announces LINK Reserve Powered by Revenue

Payment Abstraction will convert offchain & onchain revenue into LINK. Over $1 million has already been accumulated through this system.

Even revenue from institutions that don’t pay onchain still accrues to the LINK reserve.

What This Means: Chainlink is building long-term demand for LINK. More institutions adopting the platform and paying for services creates structural buying pressure and reinforces Chainlink’s position in both DeFi and traditional finance.

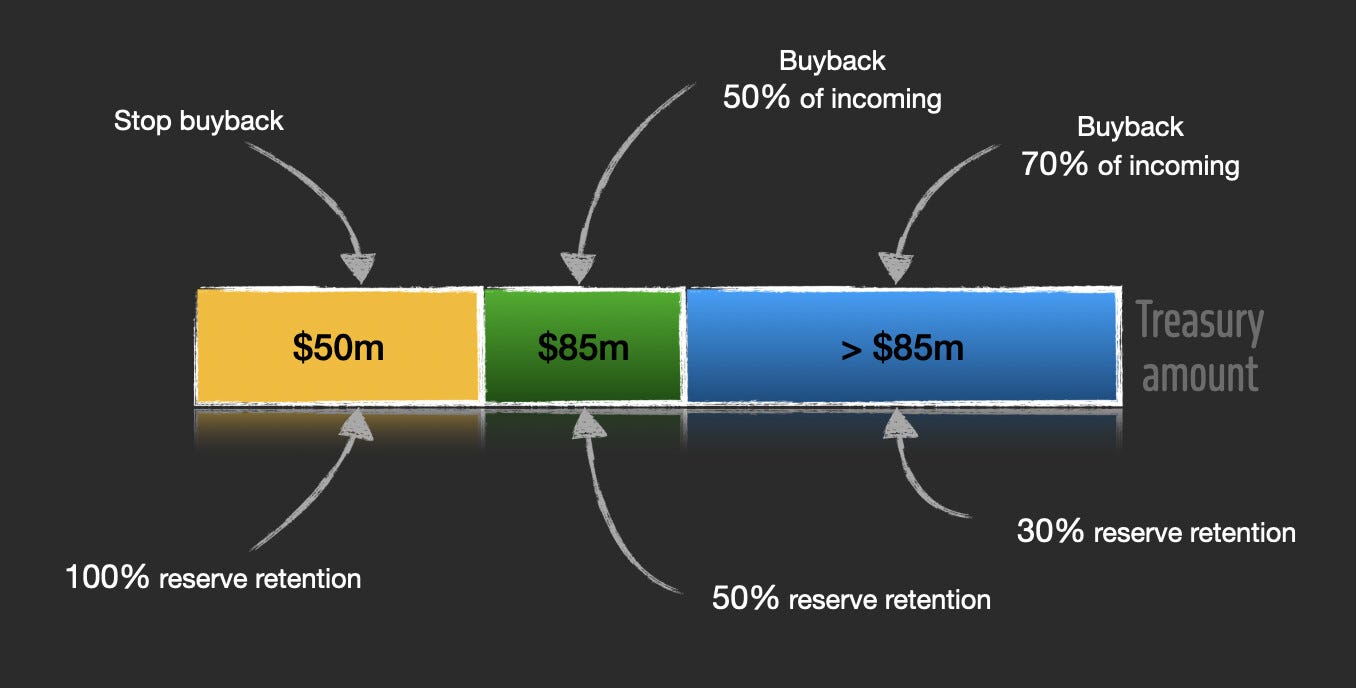

3. Proposal for Lido to Initiate Dynamic LDO Buyback Program

A new proposal would allocate up to 70 percent of incoming liquid assets in Lido’s treasury to buy back LDO.

The program would dynamically adjust based on treasury levels, with safeguards to pause buybacks if reserves fall too low.

What This Means: If this proposal is taken seriously, this could mark a turning point in LDO’s utility from pure governance token to yield-aligned asset.

Given the regulatory confirmation that staked assets are not securities, the time could be right for Lido.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡Trump is Unlocking Trillions in Liquidity for Crypto

The executive order is signed, what happens next?

How to avoid the confirmation trap in trading

⚡5 ways to use GPT-5 to change the way you invest in crypto

How savvy crypto users are harnessing GPT-5

Learn advanced yield strategies and how to find DeFi opportunities

⚡LayerZero announces acquisition of Stargate

LayerZero Foundation proposes $110m acquisition of Stargate token STG

⚡Get Ahead in DeFi: This Thursday

Below is the agenda for this month’s Zoom call, where I go live with dedicated research covering the most important market topics that DeFi users need to know.

The presentation delivers institutional-grade insights, and includes my thoughts on where we are in the market and what could be coming next.

Click the image to join Pro and RSVP for Thursday’s live call.

Thursday at 5:30pm EDT. Recording is available for Pro Members.

Sovereign Members, submit your questions here for dedicated research slides

🔢Onchain Analysis

Ethereum & the Rising Tide

The ETH token is a top performer over the last week and the last month.

But the real story lives within the metrics:

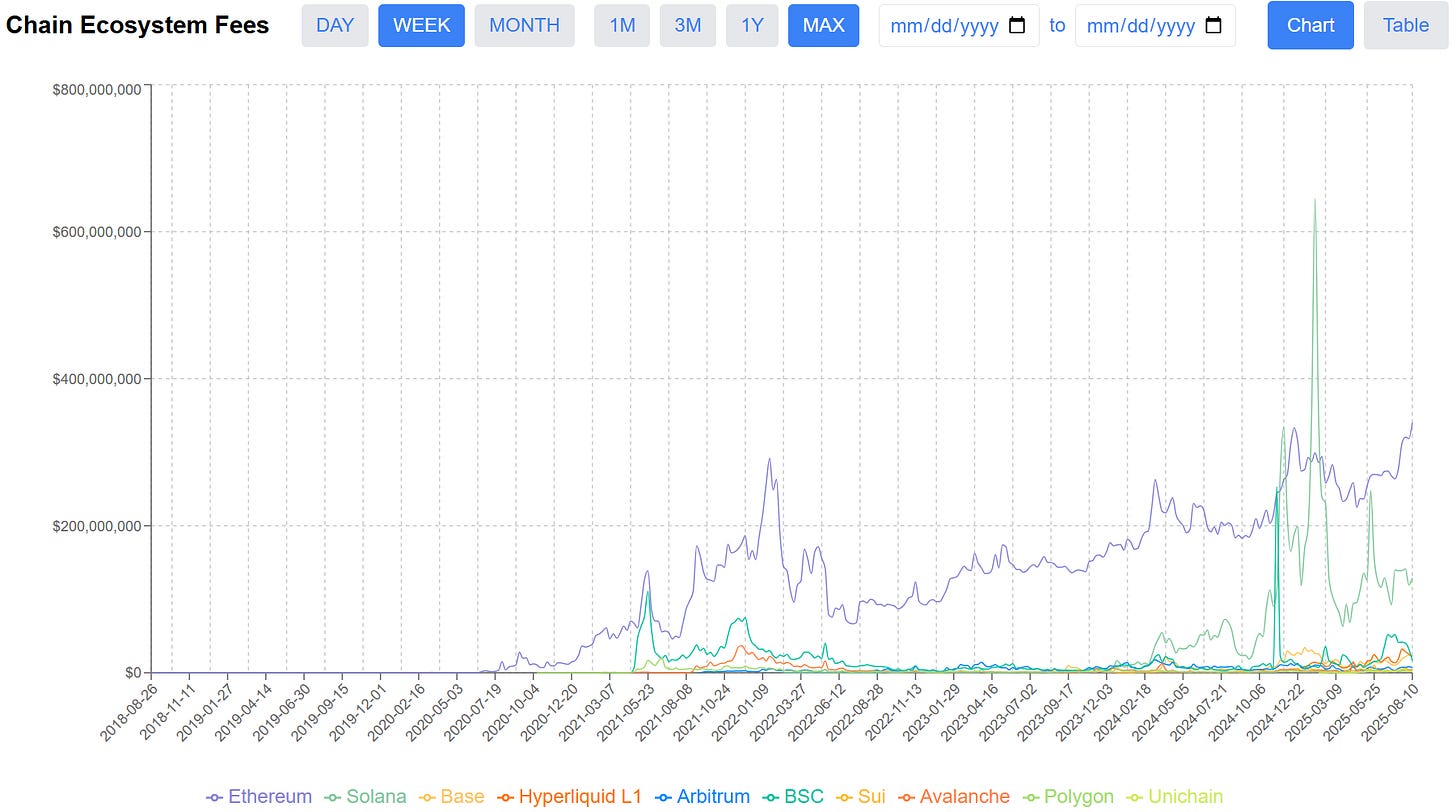

Chain Ecosystem Fees, a metric I developed that looks at real onchain activity through fees collected by apps on a chain, hit an all-time record high on Ethereum.

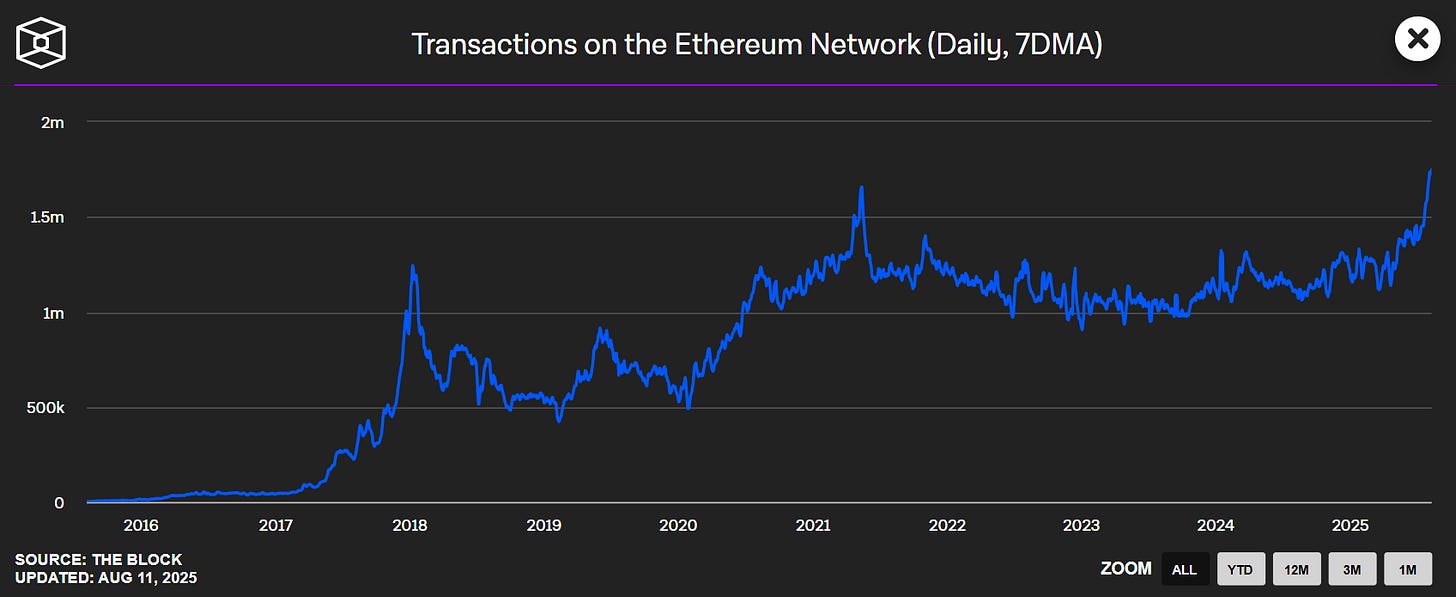

Active addresses & transactions are at their highest point in four years.

Ethereum’s increased activity and token price performance is representative of the narrative shift and renewed optimism toward DeFi.

The success of the chain is a rising tide that lifts DeFi boats. While Ethereum has its moment:

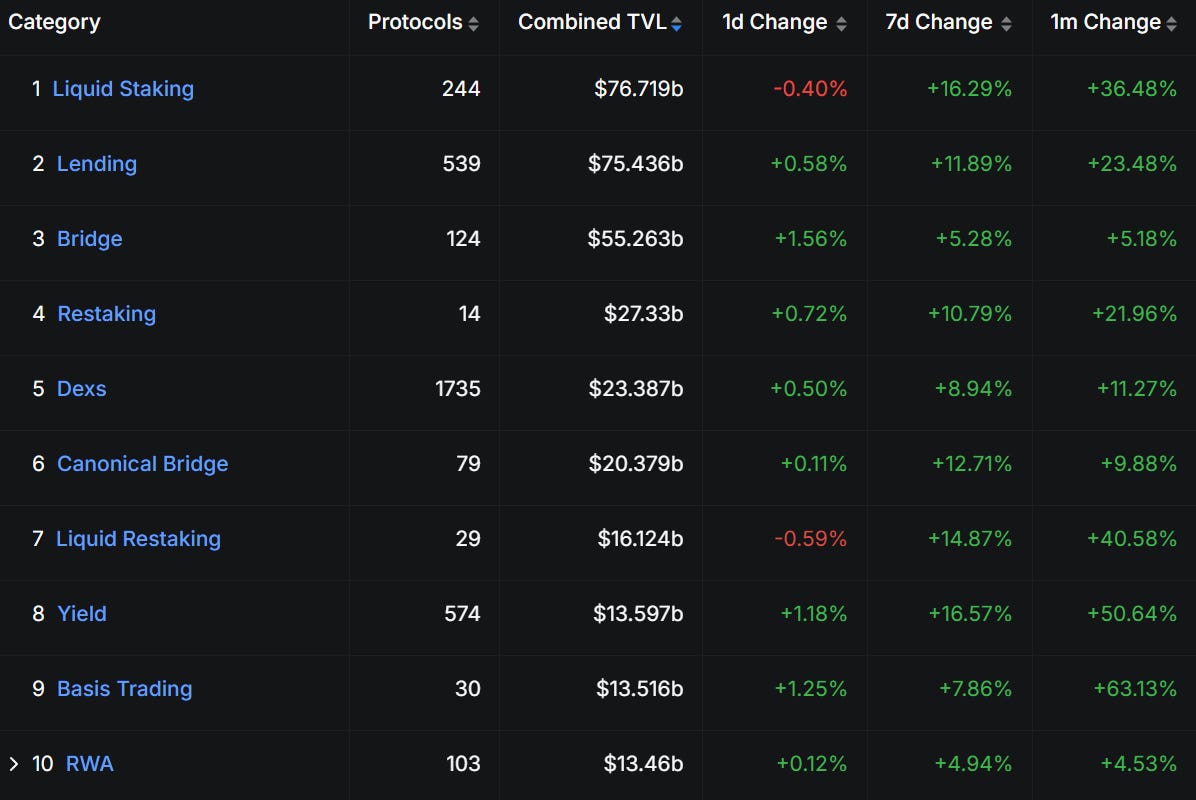

Total DeFi TVL adds nearly $50b in a month

Ethena’s USDe adds $5b in market cap

Digital Asset Treasuries show renewed interest in altcoins

Aave & other major DeFi platforms hit ATHs in TVL - most categories saw double-digit TVL gains over the last week, which is significant given these categories already have tens of billions in TVL

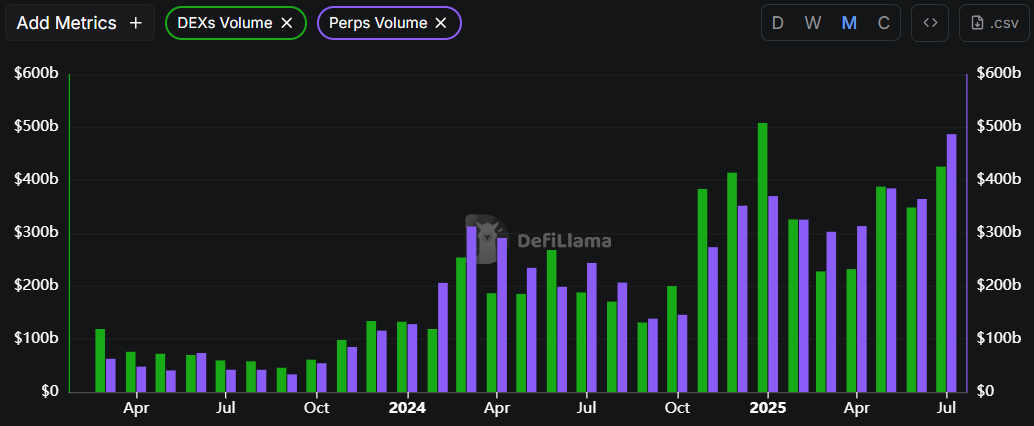

DEX volume hits $425b in July, second highest month ever (record month for onchain perp volume)

Trillions of liquidity will be unlocked in relatively short order. DeFi stands to be one of the largest beneficiaries. ETH’s dominance will change over time, but for now, as long as the network is thriving, the rest of DeFi stands a much better chance of increased usage and utility.

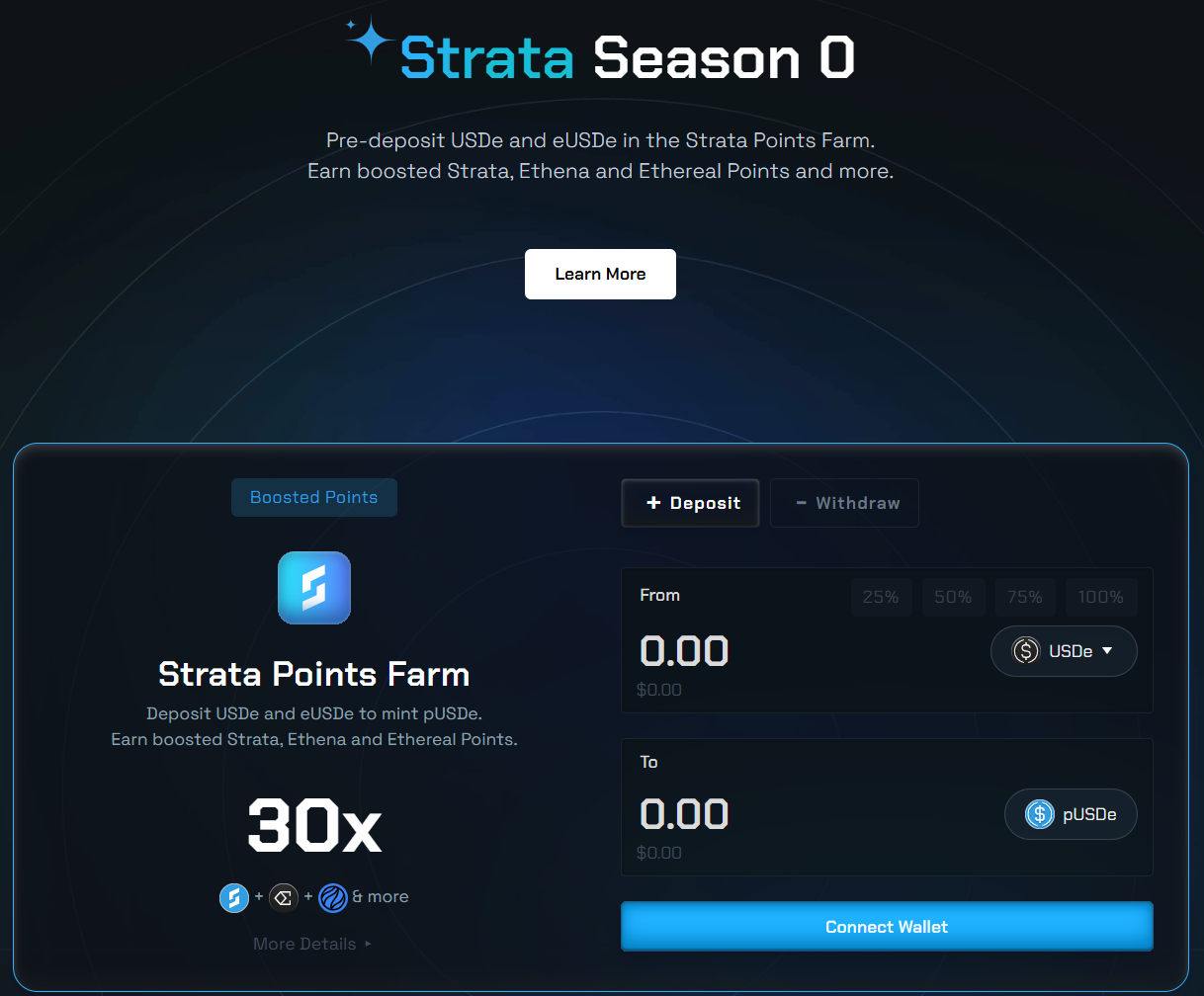

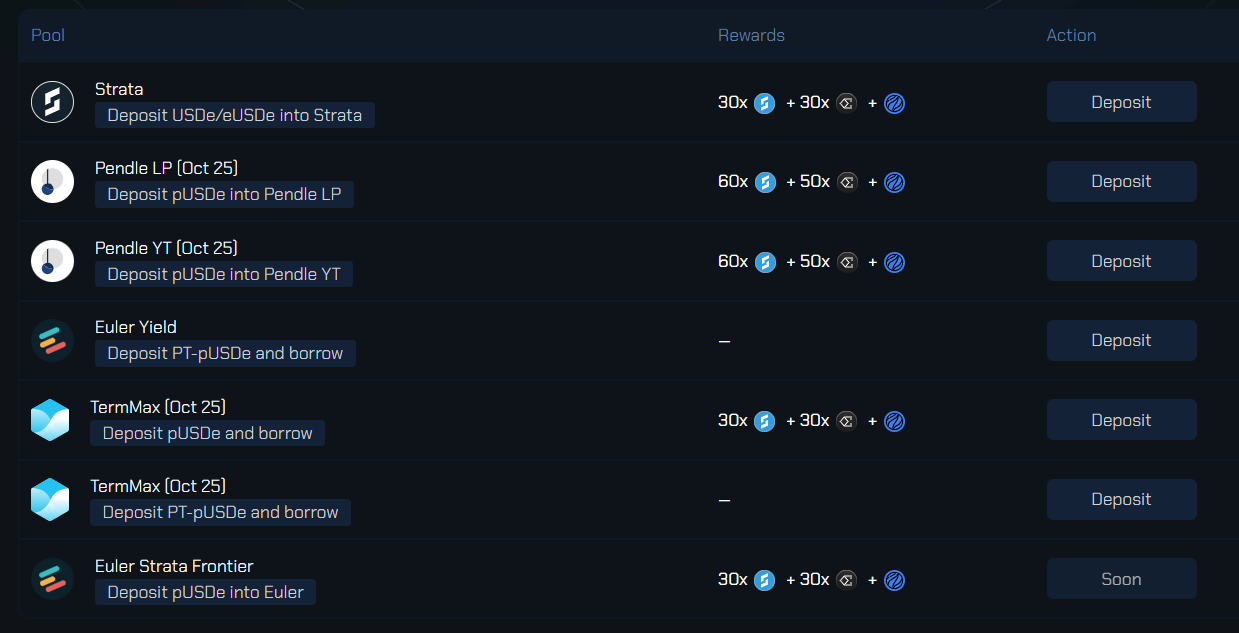

🚜Farm of the Week

Strata Points Farm

Strata facilitates structured yield products. It’s built on Ethena and recently began a Season Zero points farm. It’s still fairly early as Strata has not yet crossed $75m TVL.

How it Works

Head to Strata’s pre-deposit page and deposit USDe.

You’ll receive pUSDe in return, along with Strata, Ethena & Ethereal points. You can use your pUSDe in Ethena DeFi to earn additional points.

Risk Level: Low

Risks

Smart Contract risk

Protocol Layer risk

⚡Hyperliquid: Elite Fundaments or All Hype?

🛠️Tool Spotlight

Track Real World Assets on rwa.xyz

rwa.xyz has helpful dashboards to track everything RWA: news, participants & entities, metrics and more.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 OPEC Monthly Report - August 12th

📊 July CPI Inflation data - August 12th

📊 July PPI Inflation data - August 12th

📊 July Retail Sales data - August 15th

📊 Total of 5 Fed speaker events this week

Token Unlocks: $245m Unlocking This Week

🔓LAYER (9.51%) - August 11th

🔓BB (97.4%) - August 11th

🔓APT (2.20%) - August 12th

🔓CRV (9.91%) - August 13th

🔓CYBER (11.81%) - August 14th

🔓SEI (1.21%) - August 15th

🔓VANA (8.65%) - August 15th

🔓PSP (1.07%) - August 15th

🔓STRK (5.98%) - August 16th

🔓ARB (2.04%) - August 16th

🔓APE (1.72%) - August 17th

🔓ZK (3.61%) - August 17th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Lombard BTC yield accrual commences - August 11th (Source)

🚀 VertigoDex Launch - August 11th (Source)

🚀 Delysium cross chain solution agent release - August 12th (Source)

🚀 Stellar testnet reset - August 14th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi