⚡Trillions of liquidity is unlocked [Dynamo DeFi Pro Report]

Plus crypto fundamentals visualizations, notable onchain developments, and how retirement funds provide trillions in capital to crypto

💡Dynamo’s Thoughts

Last week we talked about the upcoming notable changes from the US government, the stablecoin market growing to trillions of dollars, and what that looks like for the market.

Stablecoin growth is a key metric for the onchain economy, but, insofar as prices are concerned, what really matters is liquidity. Stablecoins are traditionally a good measure of onchain liquidity, since most money first enters the crypto ecosystem as a stablecoin.

But recently that’s started to change:

Investors are buying Bitcoin and Ethereum through ETFs

Digital Asset Treasuries are accumulating tokens

And now, $12T in 401(k)s is being opened up to crypto (and other alternative investments)

On August 7, President Trump signed an executive order aimed at expanding investment options for 401(k) retirement plans to include alternative assets such as cryptocurrencies, private equity, and real estate.

The goal behind the order, is to offer Americans better returns & investment diversification in their retirement plans by allowing exposure to a greater variety of asset classes. Crypto, or “digital assets” as they’re being called in polite company nowadays, is one of those asset classes.

Setting aside concerns over whether the average investor is prepared to invest in these types of alternative investments without getting scammed (there are also plenty of penny stocks they can get scammed on), this represents a huge (one of the biggest) opportunity for a marginal buyer with size.

To be clear, there are no immediate changes to 401(k) plans. Federal agencies must first revise rules and regulations, a process expected to take months.

But the order directs the SEC to ‘facilitate’ access to alternative assets, so it’s likely that the retirement market will indeed open up to these alternative vehicles.

The crypto market stands to benefit to a large degree. Institutions were the additional set of flows that began in 2024. Now, the next set of flows could be from individuals retirement funds. If even 1% of the $12T in retirement accounts entered digital assets, that would twice the total inflows to ETFs since their inception. Over $100 billion.

It won’t happen overnight. And that’s a good thing. Instead of a short-term speculative bubble that ends in a vicious crash, it’s more likely that retirement funds will provide steady inflows overtime. Like ETFs, this could mute future drawdowns

Expect indexes of onchain assets to be created to accommodate for the new flows—most investors won’t (and shouldn’t) try to pick tokens themsleves. The types of assets in these indexes - aside from the “Big Four” (BTC/ETH/SOL/XRP) - will be made up of tokens that:

Are tied to projects with proven product-market fit

Have survived drawdowns previously

Are well-positioned within the onchain ecosystem to benefit from network effects.

Our upcoming Digital Asset Fundamentals series will help provide guidance.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

🔭Market Outlook

Market Health

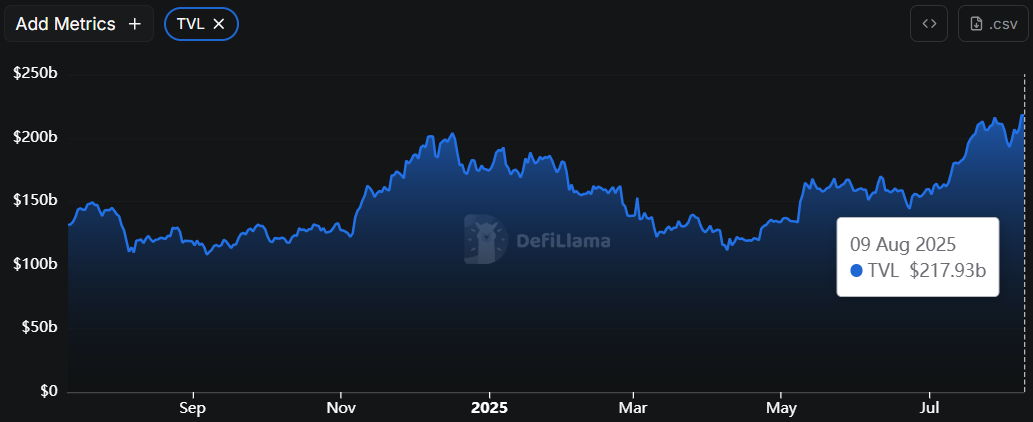

Total DeFi TVL

🚨New record high, currently $217.9b.

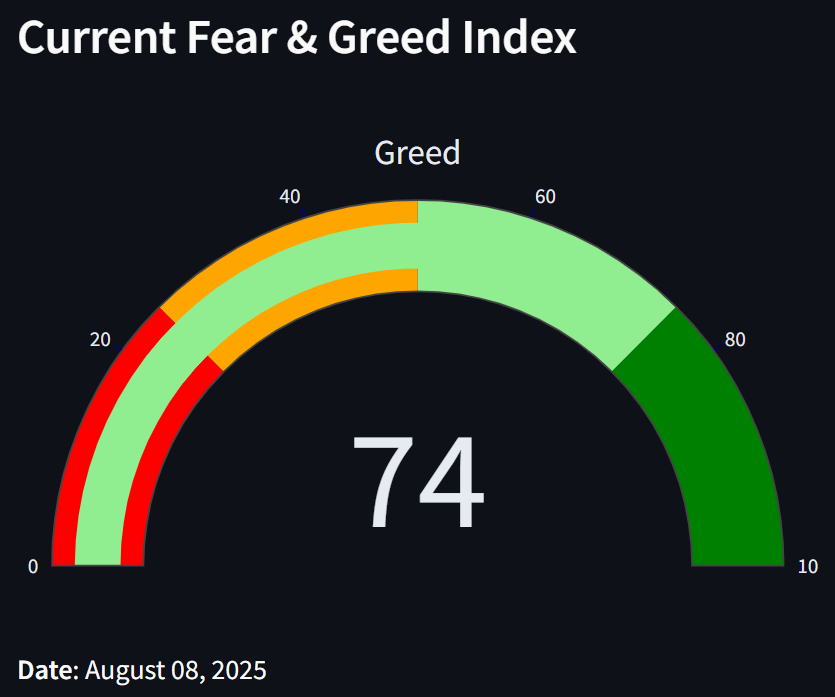

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here.

The index is up to 74 today, the highest possible mark within Greed. This is up from a value of 54 just two days ago.

The index has spent 78 of the last 90 days in Greed.

Stablecoin Market Cap

Stablecoin market cap added over $14b in the last 30 days. Ethena’s USDe market cap is up 80% over that time, adding nearly $4.5b.

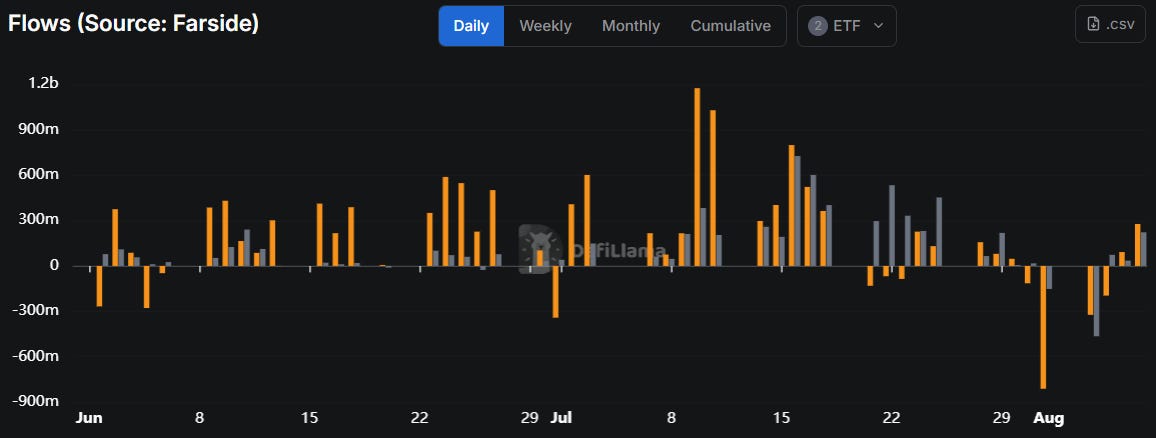

ETF Flows

Ethereum’s incredible 20-day inflow streak came to an end, seeing two consecutive outflow days.

Weekly flows are slightly negative as cumulative holdings pull back from the highs.

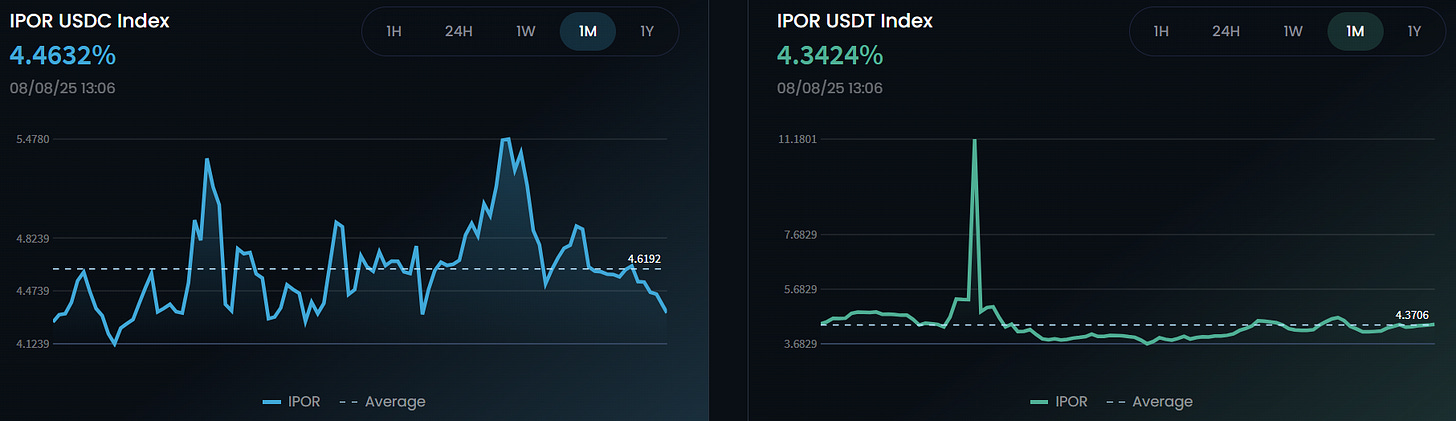

IPOR Stablecoin Indices

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

Last week we noted the rise of onchain USDC rates to 5.5%, the highest point since February. Rates have since fallen back to below the monthly average rate. USDT rates are down slightly.

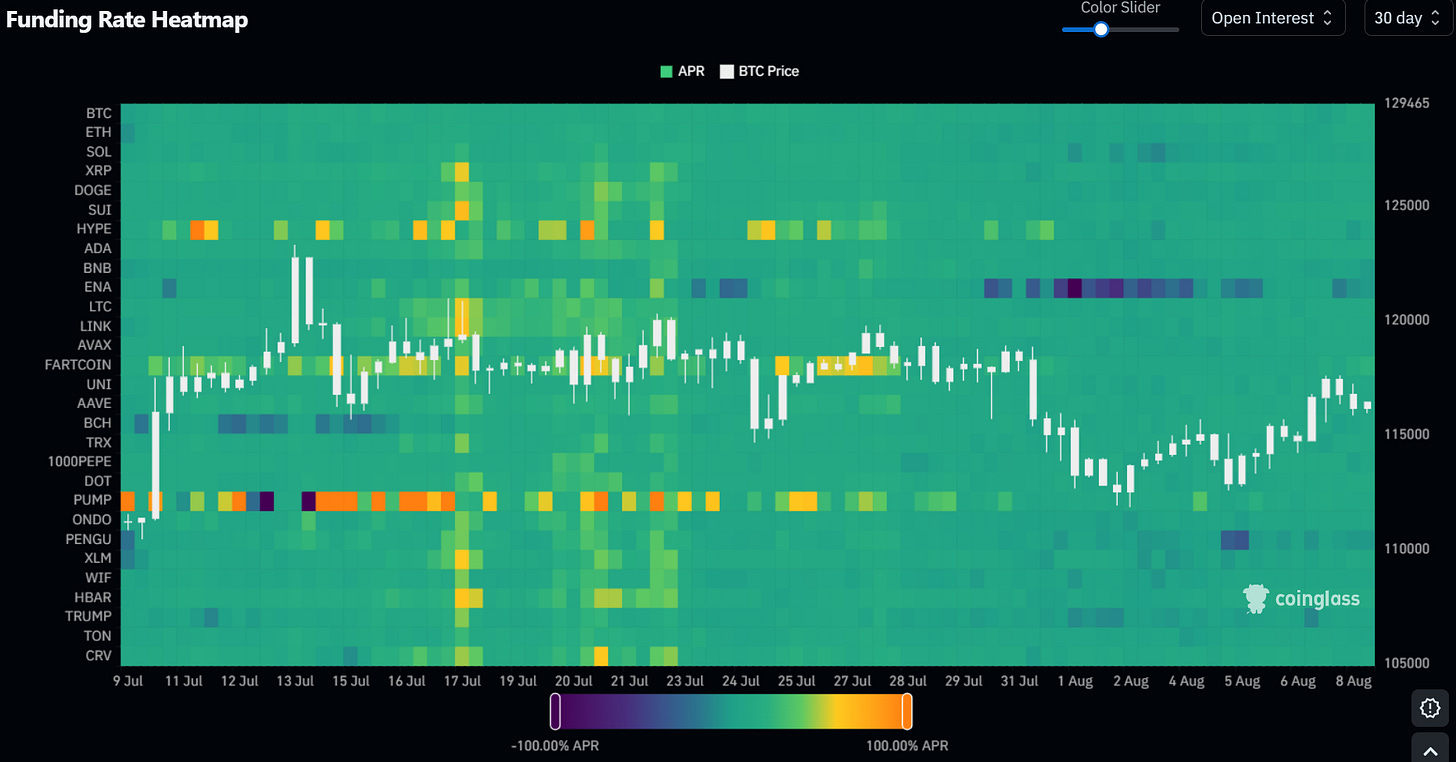

Funding Rate Heatmap

The Funding Rate Heatmap from Coinglass displays funding rates across some of the largest crypto assets.

Brighter colors indicate elevated funding rates for longs, and darker colors indicate low or negative funding rates (indicates large short positions).

Last week we highlighted the funding rates for ENA going deeply negative, with shorts paying longs 50% annualized. That has since corrected and is only slightly negative.

Only ENA, BNB and PENGU have negative funding rates. Fartcoin has the highest funding rate at this time, with longs paying shorts 20% APY.

Funding looks balanced across the board.

Category and Chain Trends

Category TVL Changes

The Yield & Basis Trading categories are the largest to experience double-digit growth over the last 7 days. Ethena leads in Basis Trading and Pendle leads in the Yield category. Yield TVL hit its highest point in over three years.

Farms & Leveraged Farms are up this week, Ethereal Season Zero crossed $1.3b in TVL for the first time.

The Options category growth is led by GammaSwap tripling its TVL this week.

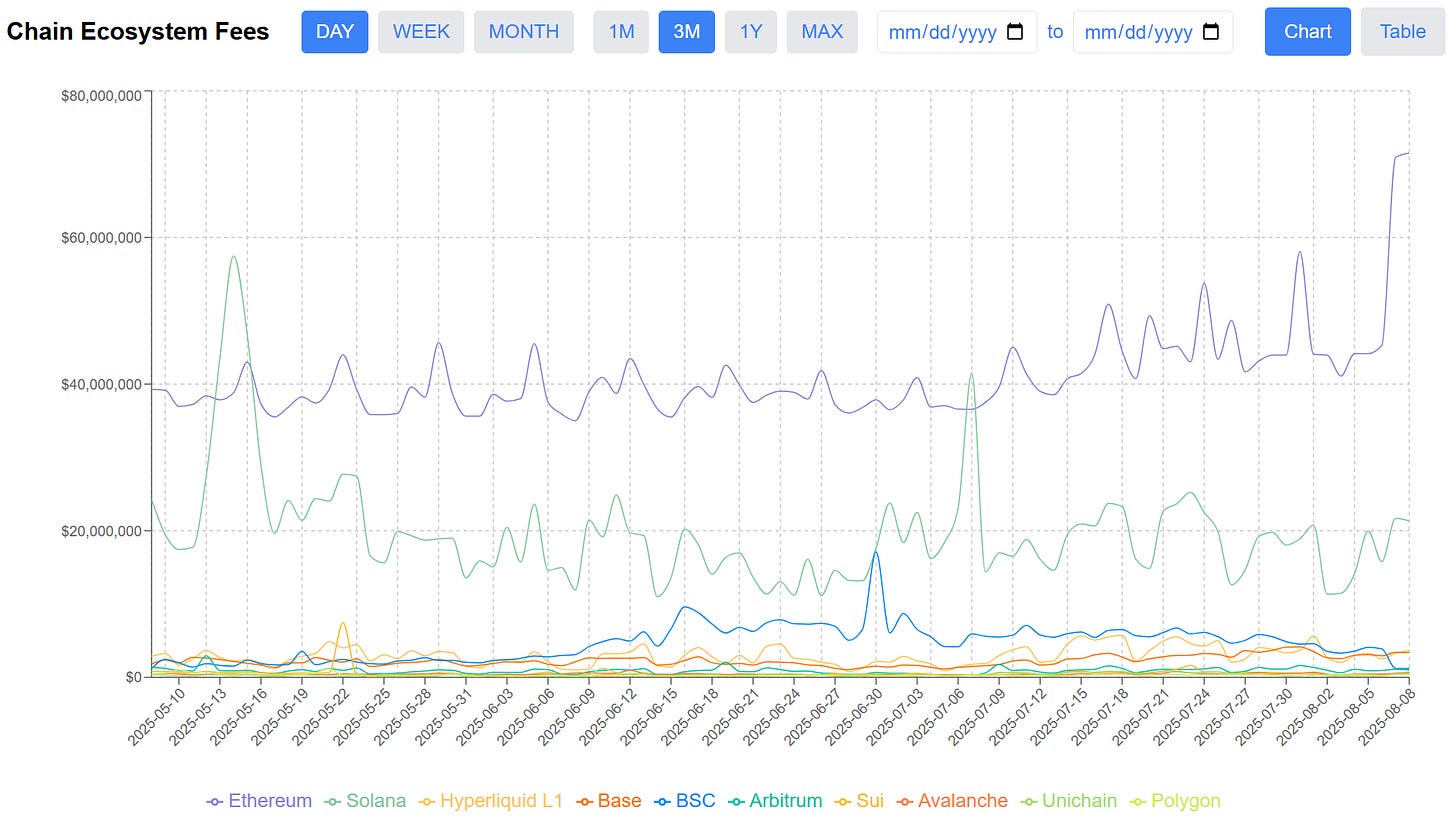

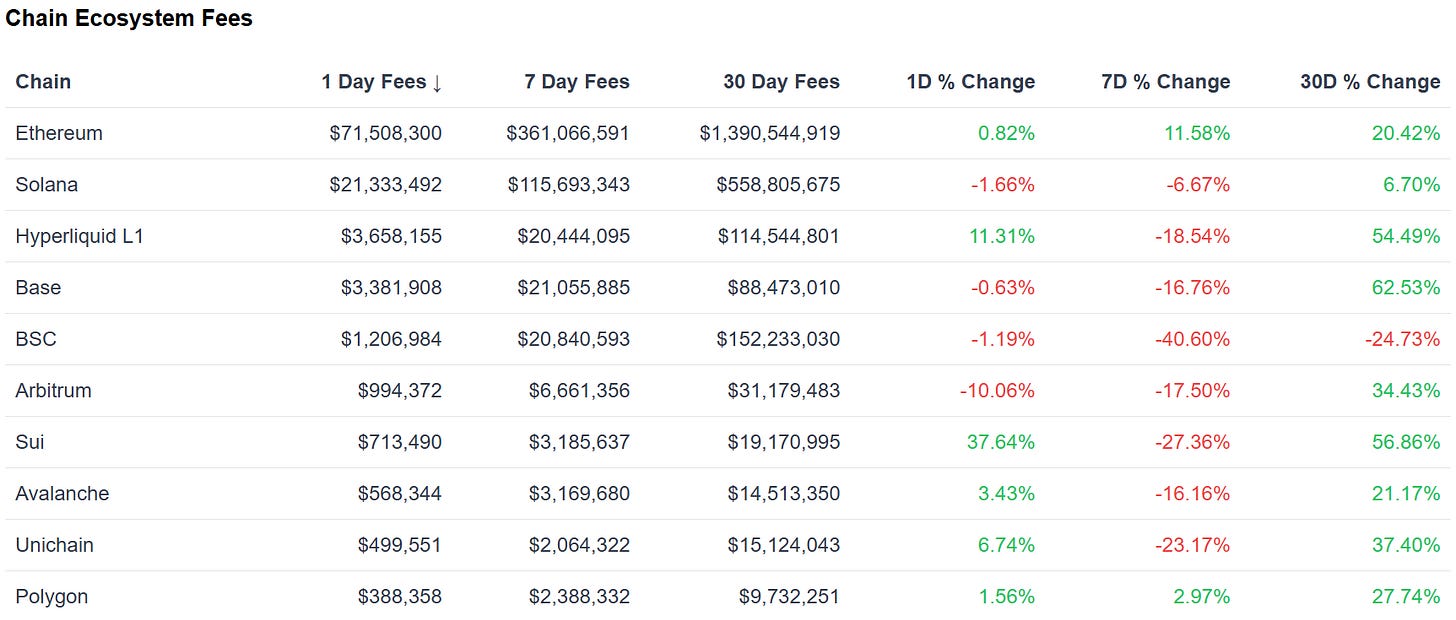

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard myself to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

Ethereum is shining brightly: Chain Ecosystem Fees just hit a record, registering $71m in one day, $360m in one week, and $1.3b in a month. Record highs across all time frames.

This is especially notable given nearly every other major chain’s CEF are down on the week.

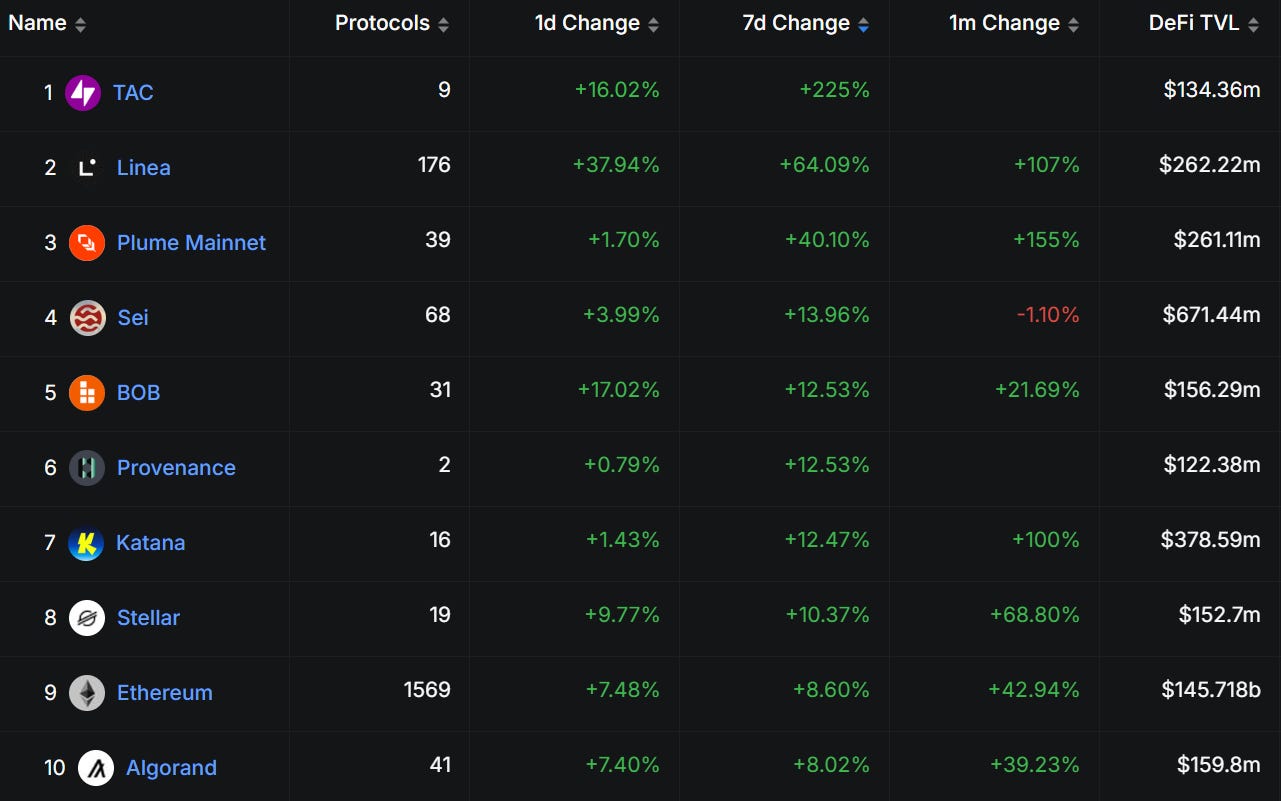

Fastest Growing Chains ($100M+ TVL)

Linea announced the LINEA token, an announcement airdrop farmers have been waiting for. Linea TVL is up 64% as farmers return to the chain.

Plume added another $50m in TVL from last week.

Ethereum is in the top 10 largest TVL gainers this week, gaining a considerable amount of TVL (largely due to ETH price increasing).

Fastest Growing Chains ($10M-$100M TVL)

ZetaChain & Etherlink are top TVL gainers for the second week in a row.

Story added another $10m in TVL.

📊Onchain Metrics

Digital Asset Fundamentals

We’re building out this section, where we dive deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens.

Below you’ll find 3 visuals:

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.