⚡️DeFi Momentum is Strong, but Something's Off

Plus: Stripe & Circle announce blockchain projects, the protocols seeing the most growth, and the best DeFi opportunities of August

Read Time: ~5 minutes

DeFi has serious momentum, but conflicting signals are everywhere. Is this simply a pullback, or is a bigger slowdown taking place?

⚡In This Edition

Market Metrics at a Glance

What to know this week in crypto

Onchain Analysis

Farm of the Week

Macro events, new launches and token unlocks this week

DeFi tools & our favorite resources

⚡Metrics Snapshot

Top Performers this Week

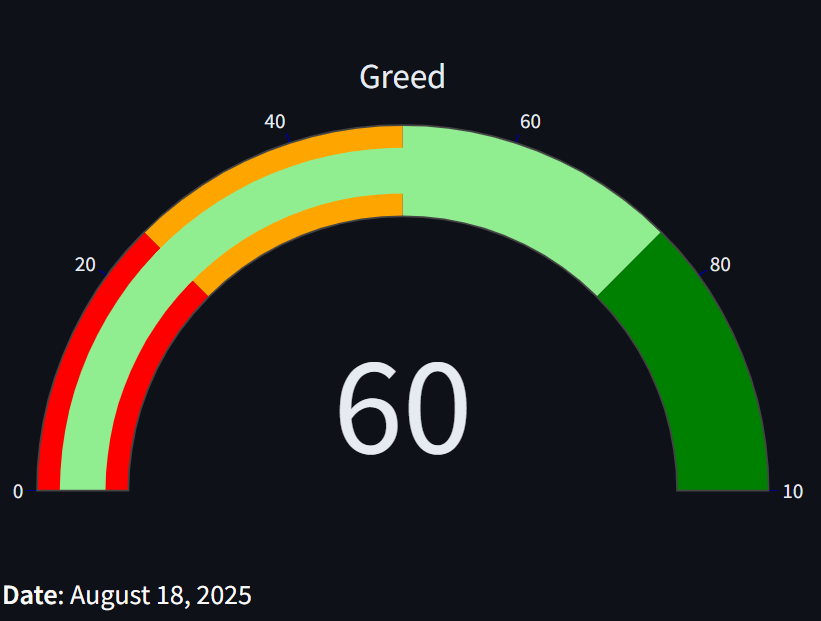

Fear & Greed Index: 64 (Greed)

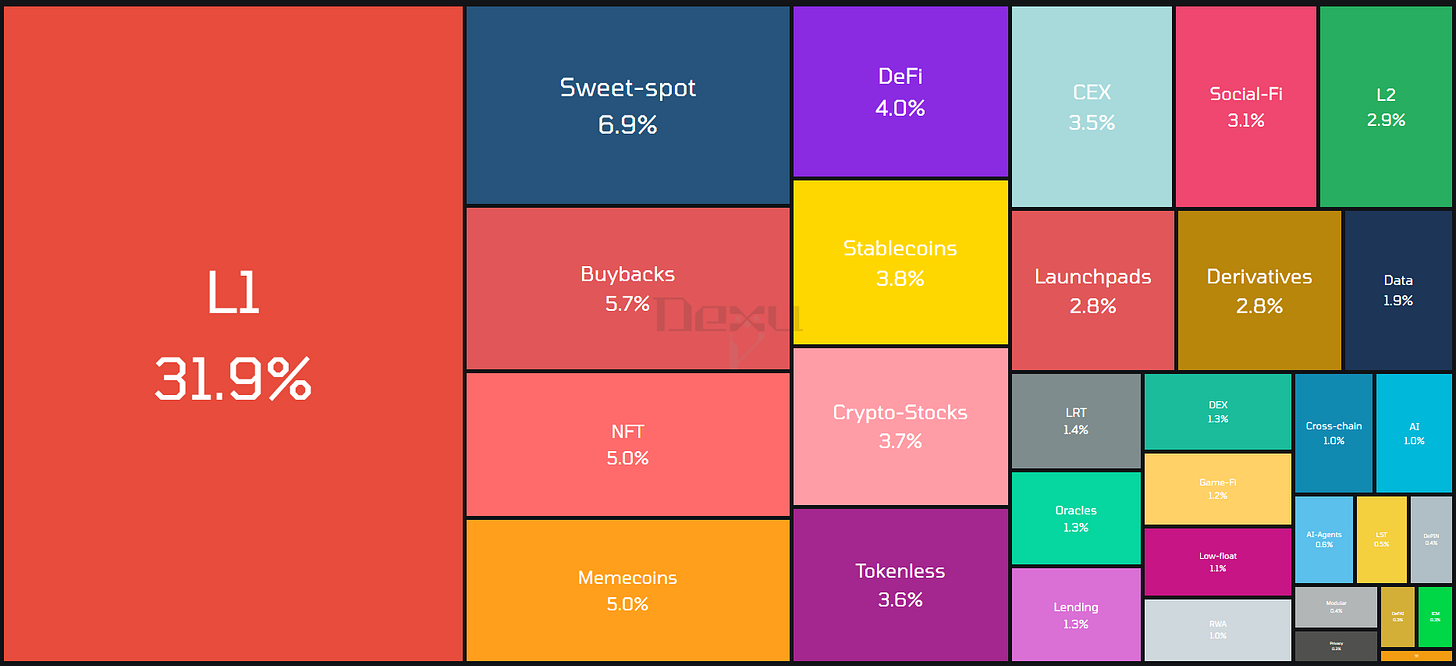

Narrative Mindshare (7d)

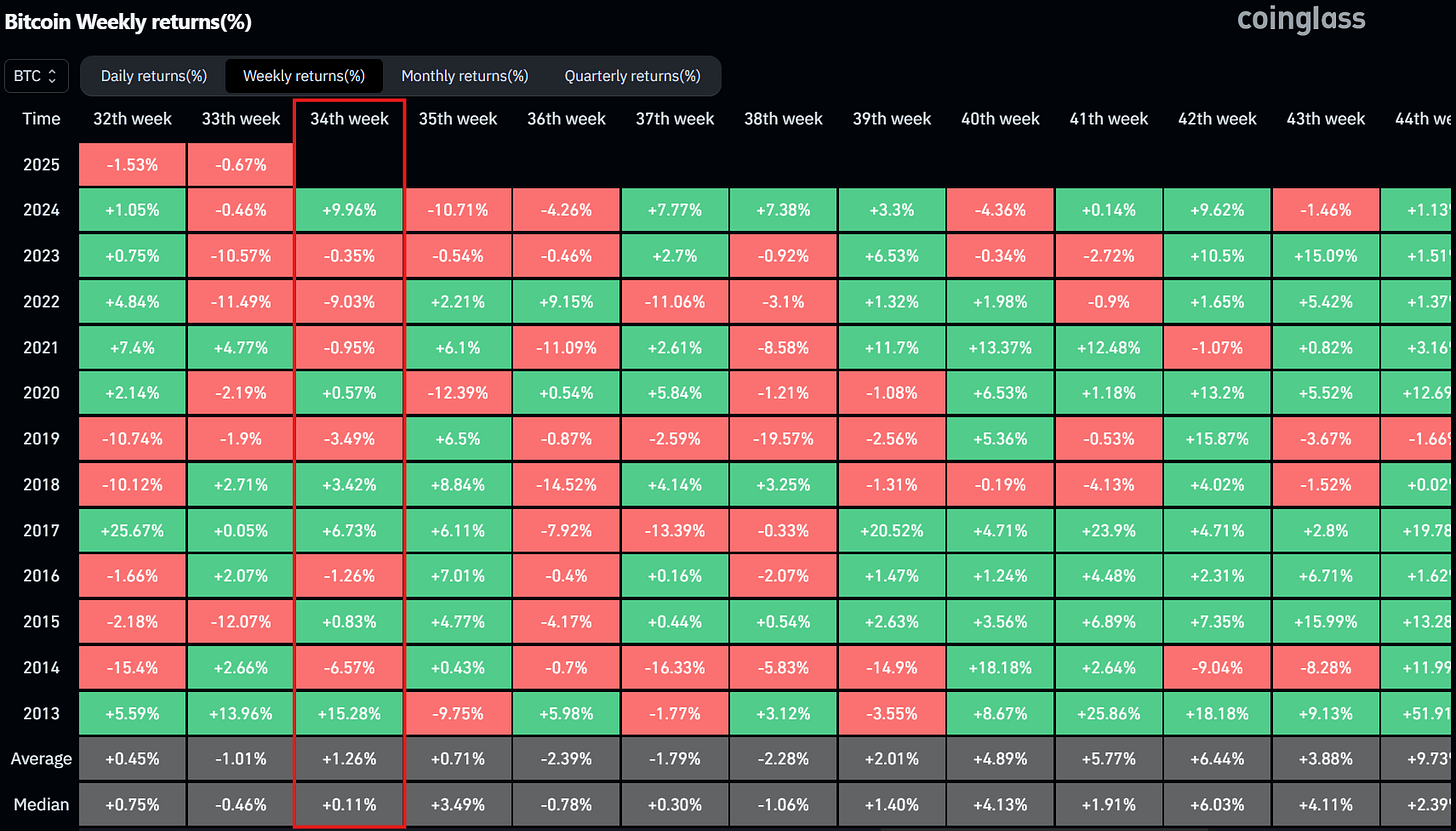

Historical Bitcoin Performance This Week

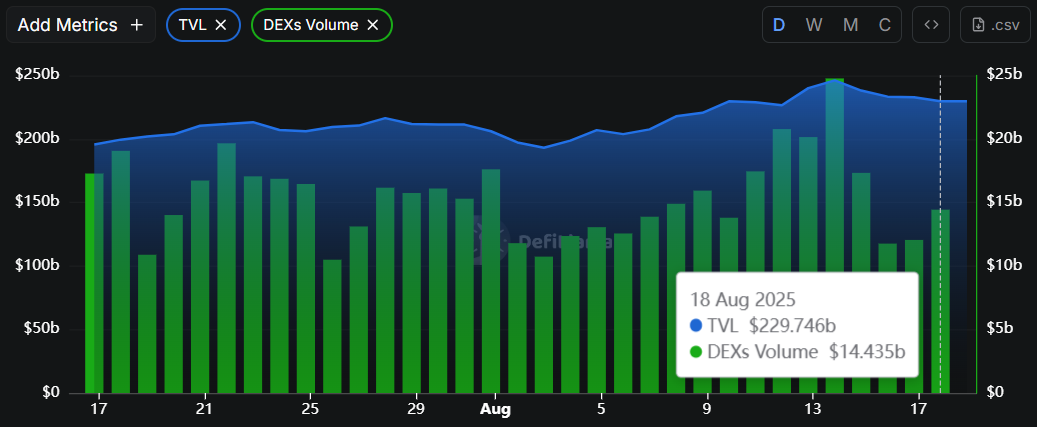

DeFi Market Metrics: Global TVL & DEX Volume

TVL MoM growth: +15%

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. Bitcoin Breaks All-Time High, Followed by Sharp Correction

BTC pushed for a new all-time high on Wednesday but pulled back about 6%. Large-cap altcoins like Mantle, Cardano, Chainlink and Arbitrum outperformed Bitcoin over the last week.

What This Means

Bitcon’s ATH break came with mixed signals: institutional buying is driving demand and altcoins are outperforming, but retail interest is nonexistent and the economy looks weak.

2. Stripe & Circle Announce Blockchain Projects

Stripe announced Tempo, an L1 built with Paradigm.

Circle announced Arc, an L1 optimized for stablecoins.

Stripe’s millions of merchants and $90b in payments stand to benefit from Stripe’s unique payments-focused chain, and Arc is designed to provide an enterprise-grade foundation for payments, FX, and capital markets.

What This Means

Purpose-built blockchains continue to see real-world adoption. The current meta is payment infrastructure.

3. Coinbase is Building the Full Stack

Coinbase acquired Deribit, the world’s largest crypto options exchange.

What This Means

Coinbase’s Base integration and Deribit acquisition are part of a larger strategy to offer their 120 million monthly users a full suite of products. Coinbase’s vision to be the everything app for crypto takes another step.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡Bitcoin’s all-time high was short-lived. Why?

Theories on why BTC price action hasn’t drawn attention like it usually does

⚡The Best DeFi Opportunities of August

Pro Monthly Call covers major ecosystems and trends to capitalize on

⚡State of BTCfi and what comes next

There’s demand for BTC as a store of value, but what about a yield-generating asset?

Learn advanced yield strategies and how to find DeFi opportunities

⚡Gemini Exchange Files for IPO

The US exchange is looking to IPO while the market is hot

⚡Custom Metrics Delivered to You, Every Week

The Dynamo DeFi Pro newsletter dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value behind different tokens. We’ve revamped this recently to include a wide variety of custom metrics, such as:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

Read last week’s newsletter here (first few sections free):

To get these insights delivered to you each week, become a Pro member.

🔢Onchain Analysis

TradFi-Friendly Trend

Having a business model that traditional finance can recognize & embrace has proven to be beneficial over the last month.

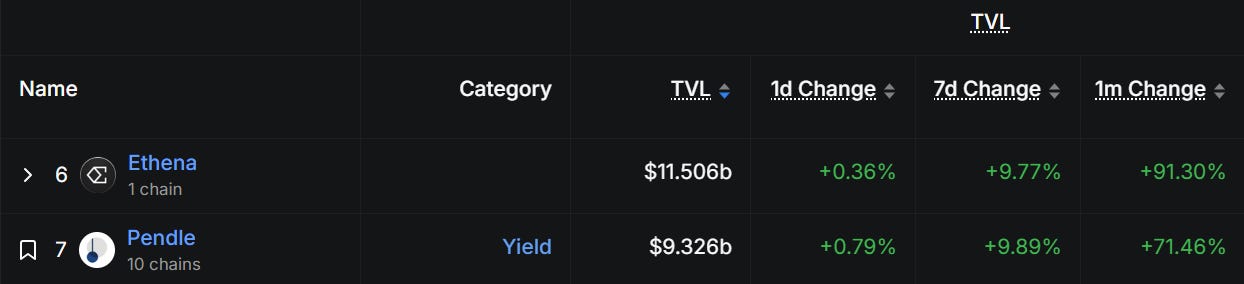

Ethena and Pendle are prime examples. Both experienced large TVL increases on 7d & 30d time frames.

11 days ago, S&P Global gave Ethena’s stablecoin a 1,250% risk weighting. Basically the S&P believes USDe is a high-risk asset.

This sounds bad at first, but consider this: the S&P simply recognizing USDe as a legitimate (albeit risk) asset is a huge step.

Despite Ethena’s risks, it’s clear that adoption for their products is accelerating: Ethena’s USDe market cap outgrew both USDT & USDC over the last 30 days, and is on track to post its highest monthly revenue to date.

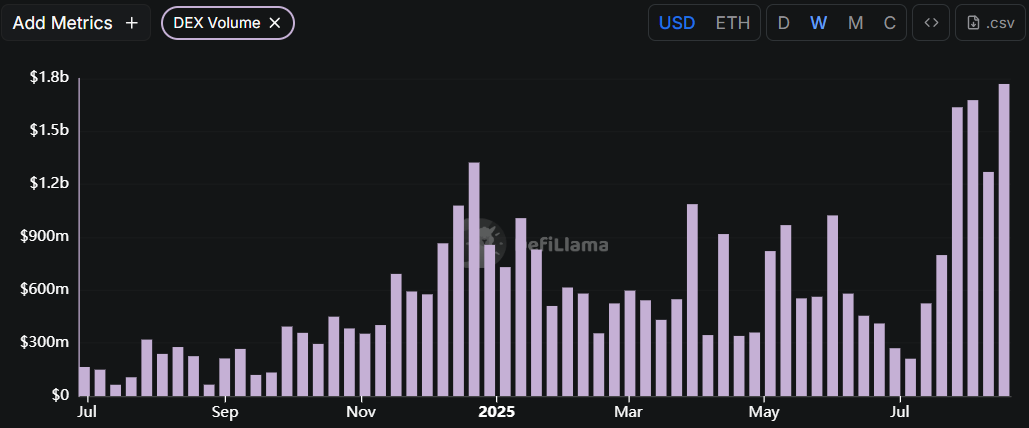

Pendle’s surge in TVL was accompanied by a surge in DEX volume. 3 of the last 4 weeks have seen record DEX volume facilitated by Pendle.

Pendle is a protocol for structured yield products onchain. It’s AMM allows yield to be tokenized and traded. If there’s one thing tradfi loves, it’s yield.

Both Ethena and Pendle’s TVL was capped in a range until now. Now, they’re both at all-time highs. Ethereum’s resurgence played a role in this as the value of deposited ETH & other assets rose, but friendly regulation is changing the landscape for onchain businesses.

Protocols that cement themselves as category leaders are primed for continued adoption by tradfi behemoths as they come onchain.

🚜Farm of the Week

Stablecoin Yields on Kamino

Kamino is Solana’s largest DeFi platform. The team recently launched Season 4 incentives. Instead of points, the rewards are KMNO tokens.

Lending APY + KMNO rewards + additional incentives currently provides double-digit stablecoin yields on Solana.

How it Works

Head to Kamino’s Earn dashboard, connect your wallet and select a stablecoin vault.

Here’s the rewards breakdown:

USDC Prime receives the highest KMNO rewards, at 4m weekly.

The Allez USDC vault earns 1m KMNO weekly plus additional ADX rewards.

The Steakhouse USDG vault earns 500k KMNO weekly plus syrupUSDC rewards.

Risk Level: Low

Risks

Smart Contract risk

Protocol Layer risk

Lending risk

⚡DeFi is Back: Top 6 DeFi Tokens for Bull Market Gains

🛠️Tool Spotlight

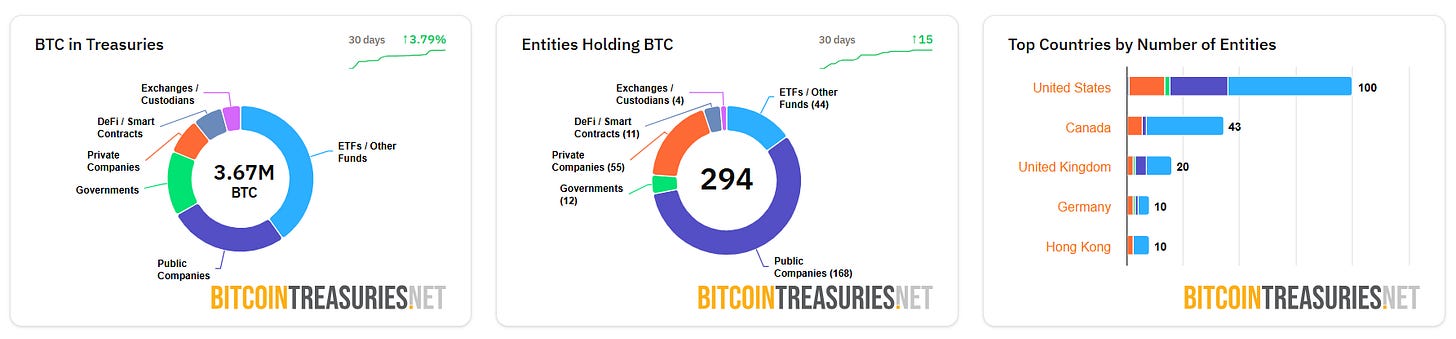

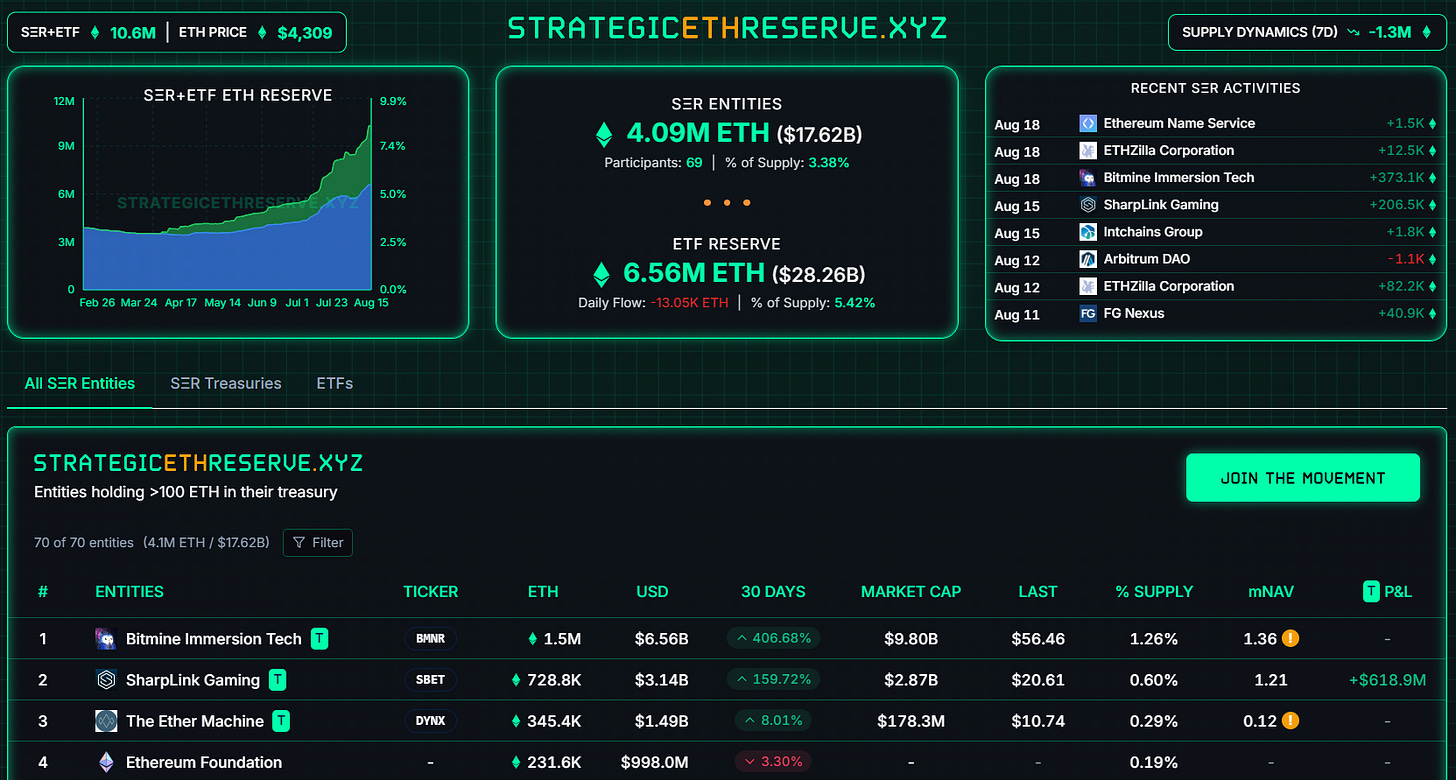

Track Digital Asset Treasuries

Bitcointreasuries.net and strategicethreserve.xyz are great resources to track institutional accumulation of Bitcoin and Ethereum.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Zelensky’s meeting with Trump - August 18th

📊 July Fed meeting minutes - August 20th

📊 August S&P Manufacturing PMI data - August 21st

📊 August S&P Composite PMI data - August 21st

📊 July Existing Home Sales data - August 21st

📊 Fed chair Powell speaks - August 22nd

Token Unlocks: $270m Unlocking This Week

🔓FTN (2.08%) - August 18th

🔓ZETA (4.57%) - August 18th

🔓MELANIA (3.26%) - August 20th

🔓KAITO (10.87%) - August 20th

🔓ZRO (21.88%) - August 20th

🔓HYPHEN (0.77%) - August 23rd

🔓REZ (12.25%) - August 24th

🔓TORN (2.4%) - August 24th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Cap launch on Ethereum - August 18th (Source)

🚀 Delysium AI insurance claims agent launch - August 19th (Source)

🚀 Deribit USDC-settled linear launch - August 19th (Source)

🚀 Hedera mainnet upgrade - August 20th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi

![⚡Records Everywhere, Attention Nowhere [Dynamo DeFi Pro Report]](https://substackcdn.com/image/fetch/$s_!M6Qj!,w_280,h_280,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc2ec7214-79bc-4689-9797-0640ab809c32_2336x1390.png)