⚡Records Everywhere, Attention Nowhere [Dynamo DeFi Pro Report]

Coinbase calls for Alt Season, BTC highs, and what we're watching

💡Dynamo’s Thoughts

It’s quieter than you’d expect.

Ethereum is up nearly 30% in 30 days, coming within a few percentage points of its first all-time high in 4 years.

Bitcoin broke an all-time high.

Total crypto market cap hit $4T for the first time ever.

The SEC declared that all divisions were mobilizing to make the US the “crypto capital of the world”

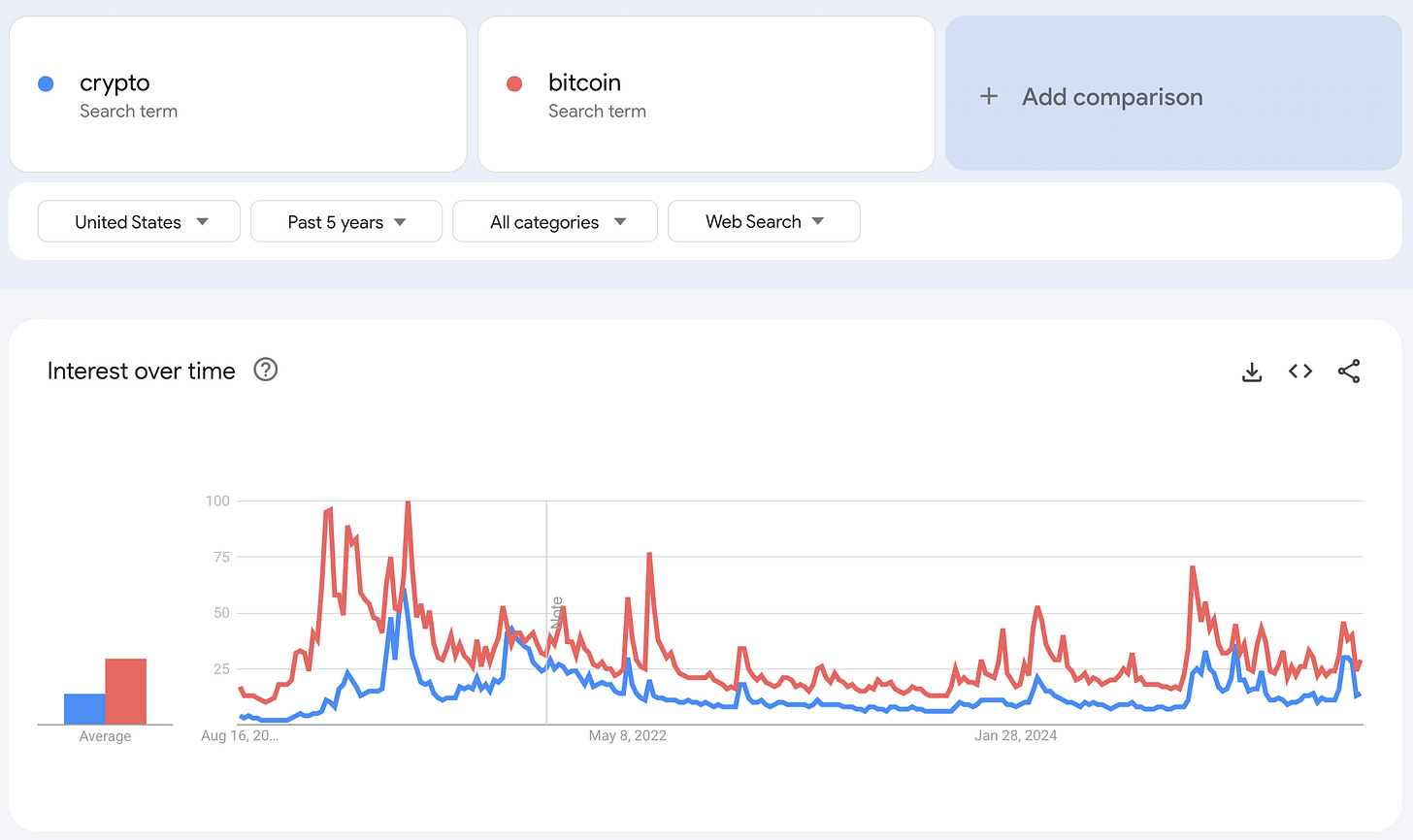

Yet there’s no breakout in interest in crypto and Bitcoin. The recent price increase and barely registers in search interest for “crypto” and “bitcoin” in the US. (Worldwide, it’s slightly more noticeable).

And, there was no breakout post-ATH for Bitcoin. The ATH sold off hours later. Before we get into recent news that drove a further sell-off in subsequent days, I have a few theories on why price action hasn’t drawn attention the way it usually does:

Bitcoin ATHs have become more frequent. Sustained inflows via ETFs and DATs mean that Bitcoin has become less volatile, posting less explosive ATHs more frequently. We’re only in August and this is already the 4th Bitcoin ATH YTD.

People are tired of crypto. Enough people have been burned badly enough by crypto over the years, that a critical mass of the usual audience for crypto is no longer interested in speculating on it. Sports betting and prediction markets give alternative outlets for gambling. And when new masses did start to arrive last December and January, they were quickly extracted.

This lack of attention interrupts the usual BTC > Large altcoin > Small altcoin rotation that usually occurs at ATHs. I’m not counting an “alt season” out entirely, but I’m not banking on one either.

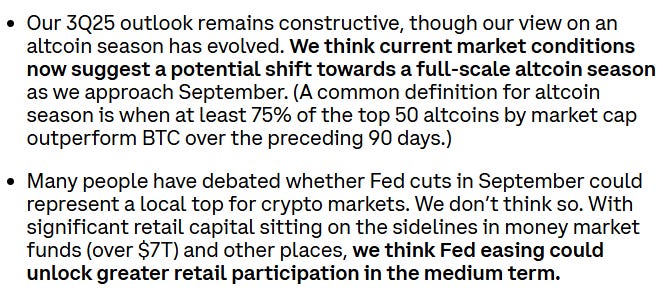

Coinbase Institutional apparently is..

The official Coinbase Institutional account posted an eyebrow-raising statement attached to their Q3 report:

Their reasoning is based on market conditions and trillions in capital sitting in money market funds, waiting for a Fed easing to get back into markets.

Negative news contributed to a (modest) sell-off.

Scott Bessent went on Fox Business and said the government will not be buying any Bitcoin. He then posted this; perhaps a softening of his tone.

To be honest, I thought this was already the assumption, but some people were apparently caught off guard. On the positive side of things, Bessent being asked about it repeatedly shows how much interest there is in the topic.

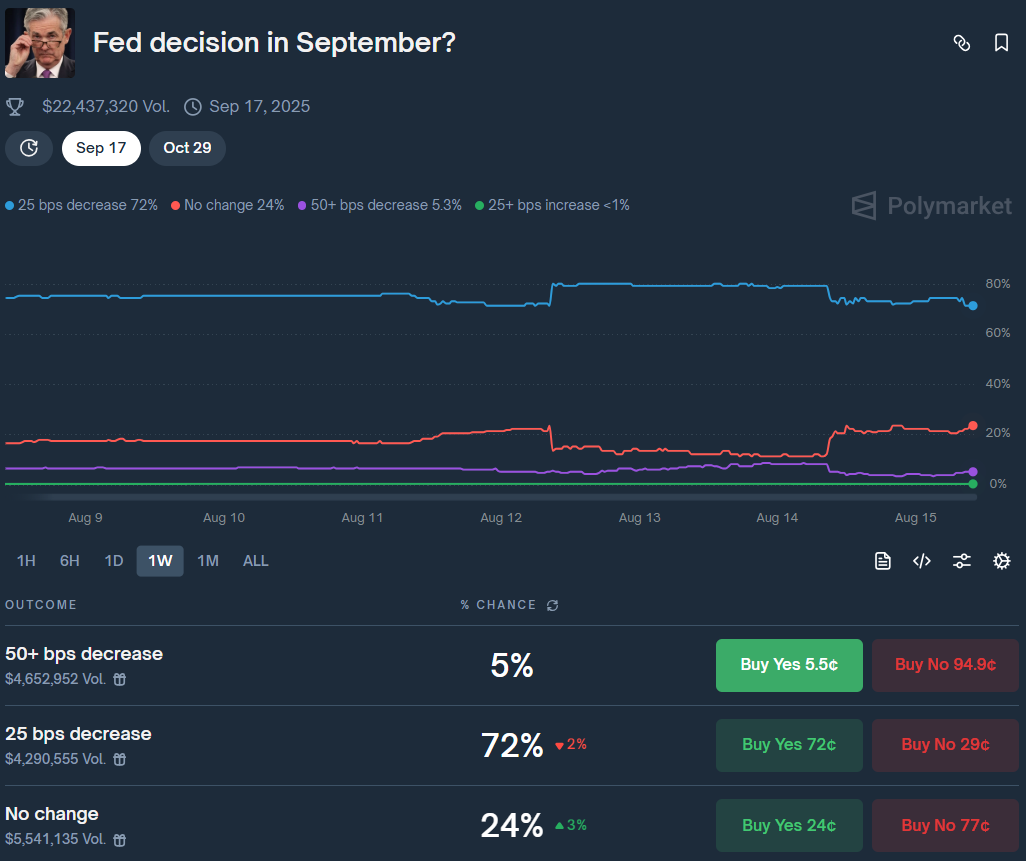

More significant to actual fundamentals, the PPI print on Thursday came in much higher than expectations. Higher inflation makes a Fed rate cut less likely.

Traders on Polymarket believe there’s a 72% chance of a small cut, and 24% chance of no change. The chances of no change in rates doubled after PPI data was released.

Other data points pointed to a not particularly strong economy.

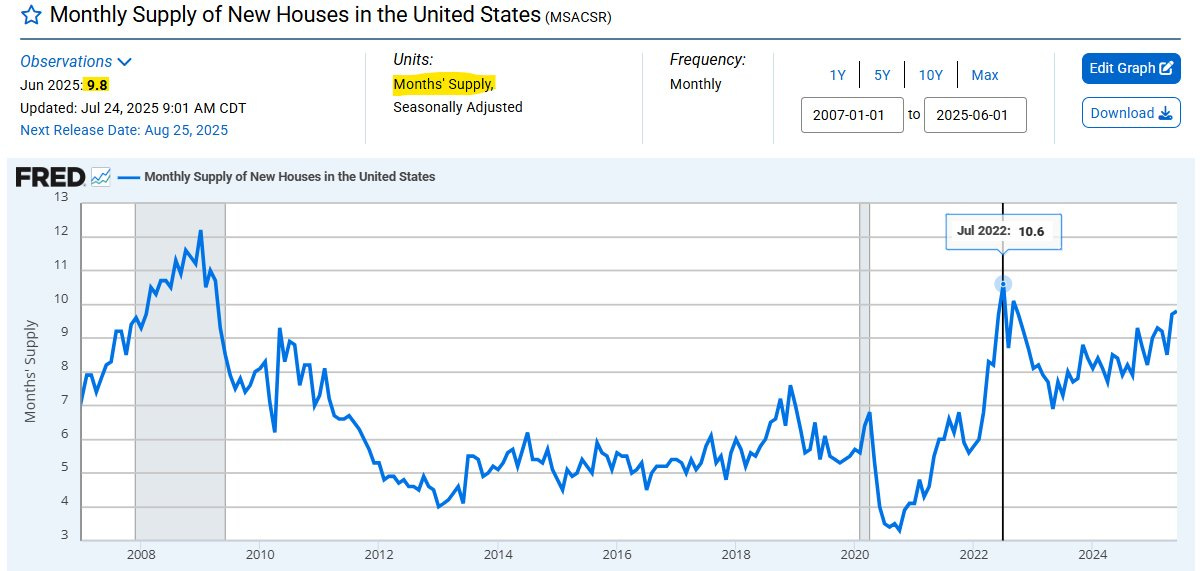

For example, there are 511,000 new homes for sale in the US, the highest inventory since 2007. Monthly supply of new houses in the US approached 10 months for the first time in 3 years.

Despite this, the stock market and crypto sit near all-time highs. Either fundamentals no longer matter in this Cantillon Effect world, the market is playing catch-up, or the negative economic datapoints we’ve seen miss something fundamental.

And bullish trends continue to drive the market:

Corporate adoption through payment integrations, balance sheet allocations or even speculative positioning (short term bullish)

Deregulation & embrace of the industry at large (mid term bullish)

As long as those remain, we’ll stay fundamentally bullish on digital, onchain finance.

Qualitative top signals abound, but those are just that: qualitative. To see through all the noise, we’re watching a few things:

Sustained flows through ETFs and DATs: clearest way to see TradFi allocating funds overtime

Onchain businesses: from traditional DeFi protocols to onchain perps, hardened teams building real products & generating revenue are having their moment. If revenue stays steady, any price dips on tokens with a claim on that revenue are a bargain.

Global liquidity: is the money printer on, or has it slowed down?

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

Before I start, if you’re looking for a more comprehensive overview of trends driving the market, check out our monthly Zoom call from this week:

Dynamo DeFi Pro Group Call - August 2025

Each month, I conduct a group Zoom call with premium Dynamo DeFi subscribers to discuss the trends driving the crypto market.

🔭Market Outlook

Market Health

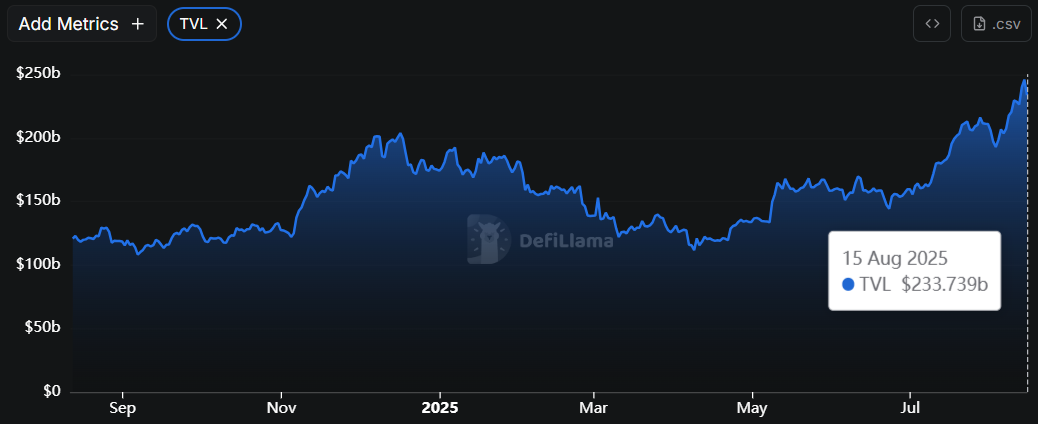

Total DeFi TVL

DeFi TVL continues to surge, hitting a peak of $245b before pulling back to $233b. DeFi TVL is up nearly 2x YoY.

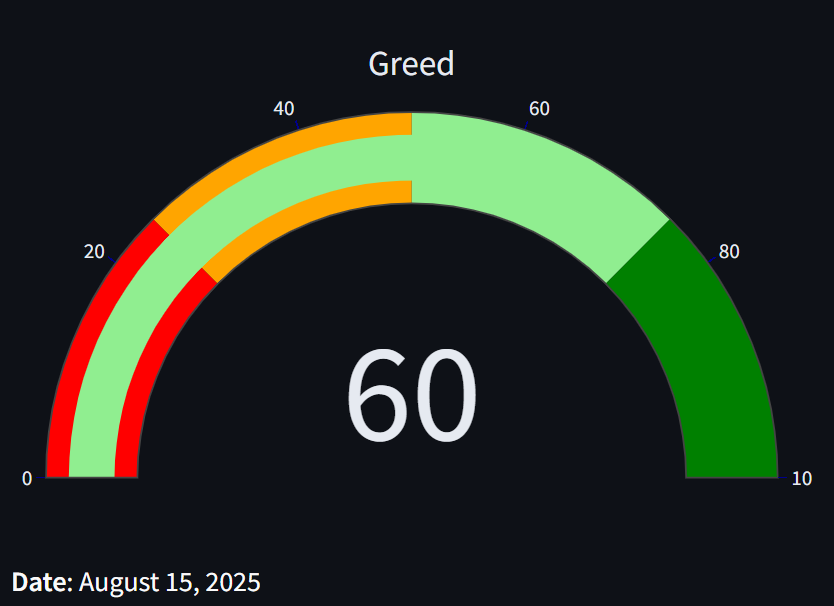

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here.

On Thursday, the index was at 75. Today, the index marks 60.

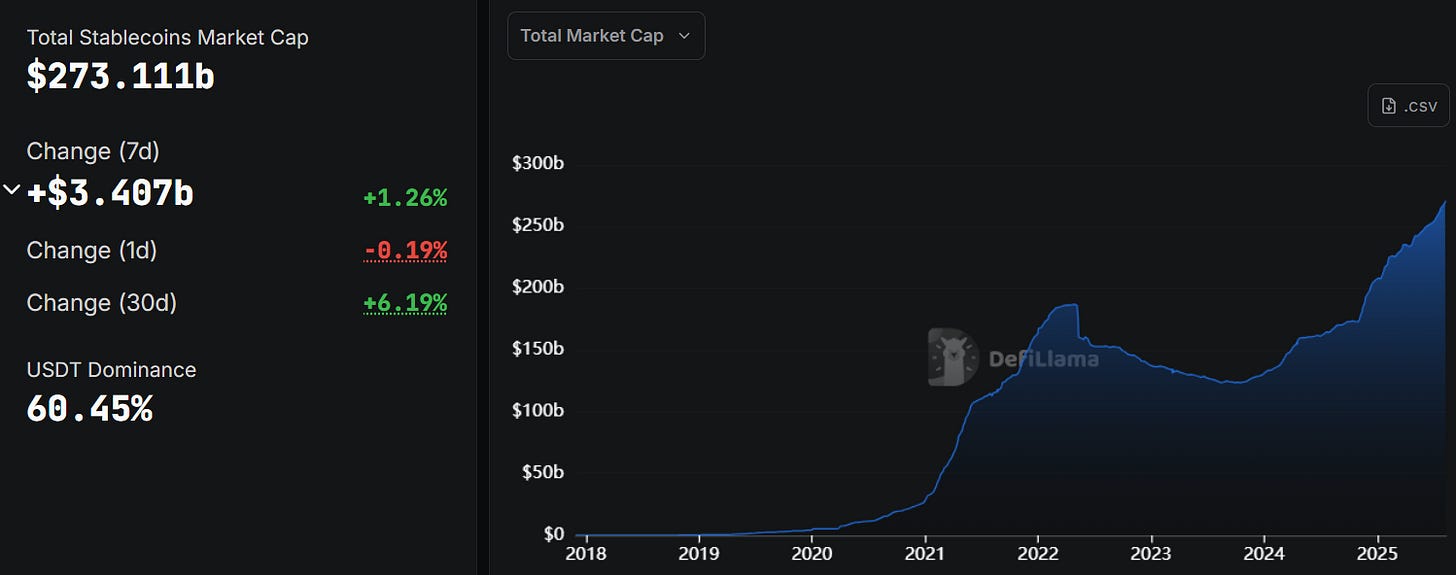

Stablecoin Market Cap

Stablecoin market cap added over $15 in the last 30 days. Growth was split mostly between the top three stablecoins: USDT, USDC and USDe.

Ethena’s USDe actually outgrew the top two stablecoins over the last month.

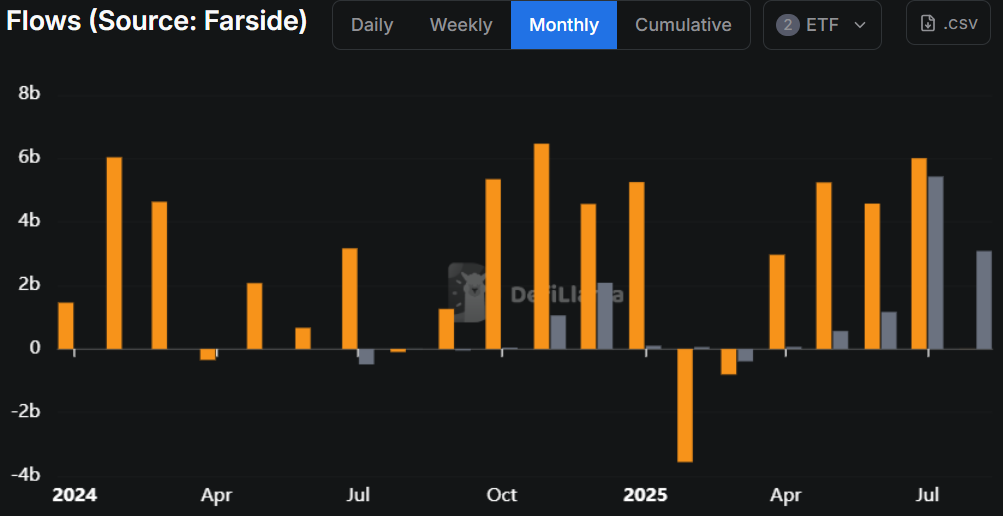

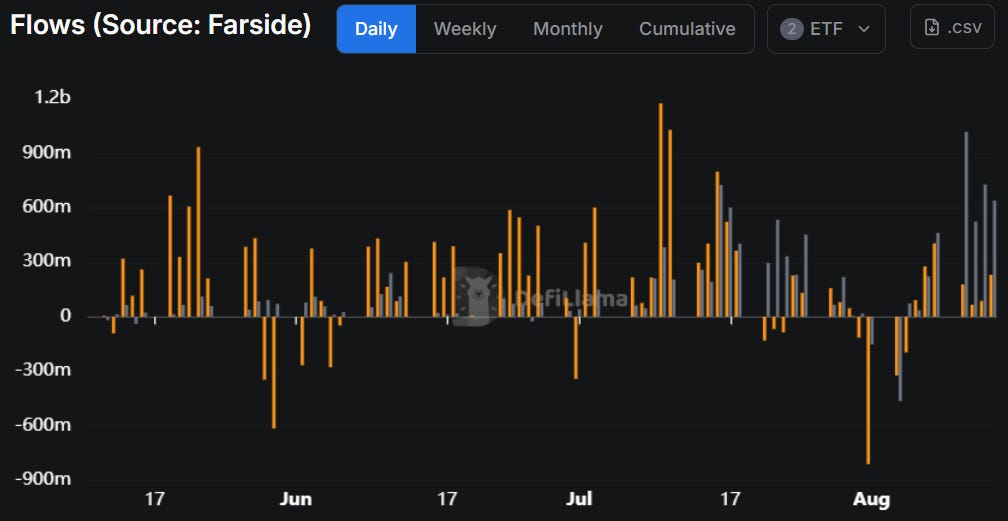

ETF Flows

Ethereum’s inflow domination continues. We’re halfway through the month and ETH has seen over $3b in inflows compared to BTC’s $2.6m.

ETH inflows outpaced BTC flows for the last 5 trading days.

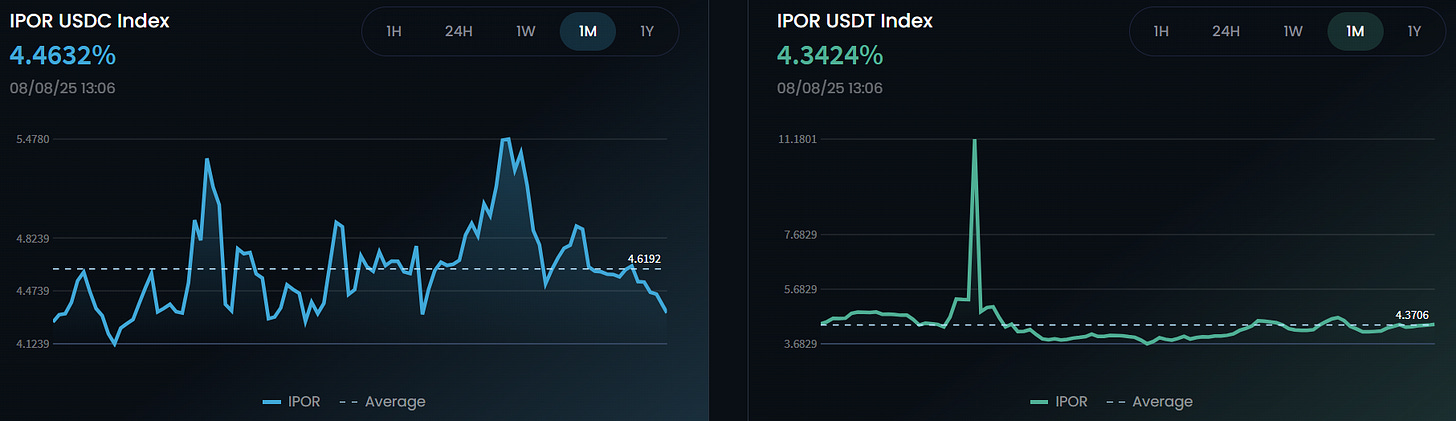

IPOR Stablecoin Indices

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

Rates are climbing again, indicating an increase in onchain leverage. Still, we would not consider these rates to be too hot or out of the ordinary.

For reference, here are last week’s numbers:

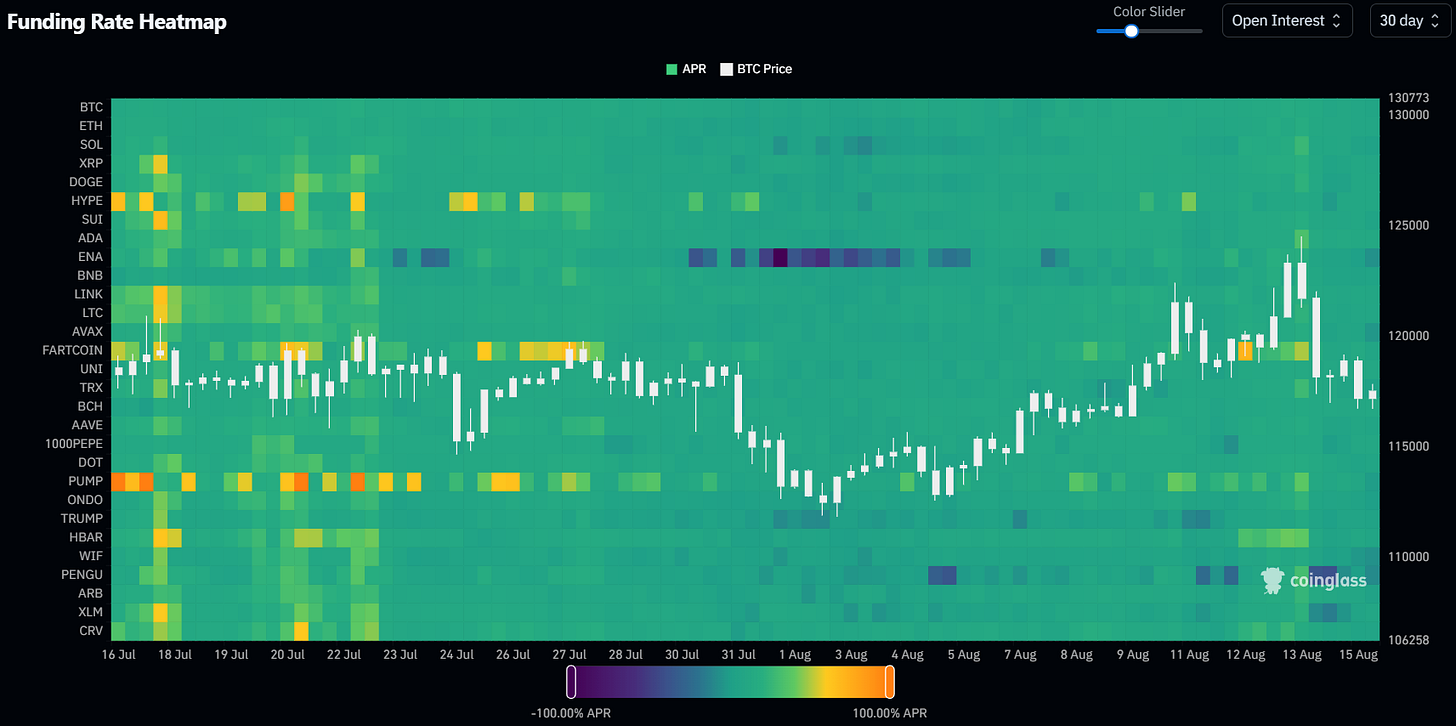

Funding Rate Heatmap

The Funding Rate Heatmap from Coinglass displays funding rates across some of the largest crypto assets.

Brighter colors indicate elevated funding rates for longs, and darker colors indicate low or negative funding rates (indicates large short positions).

Last week we highlighted the funding rates for ENA going deeply negative, with shorts paying longs 50% annualized. That has since corrected and is only slightly negative.

ENA, AVAX, PUMP, WIF and PENGU have negative funding rates. Cardano (ADA) has the highest funding rate at this time, with longs paying shorts 11% APY.

Funding still looks balanced.

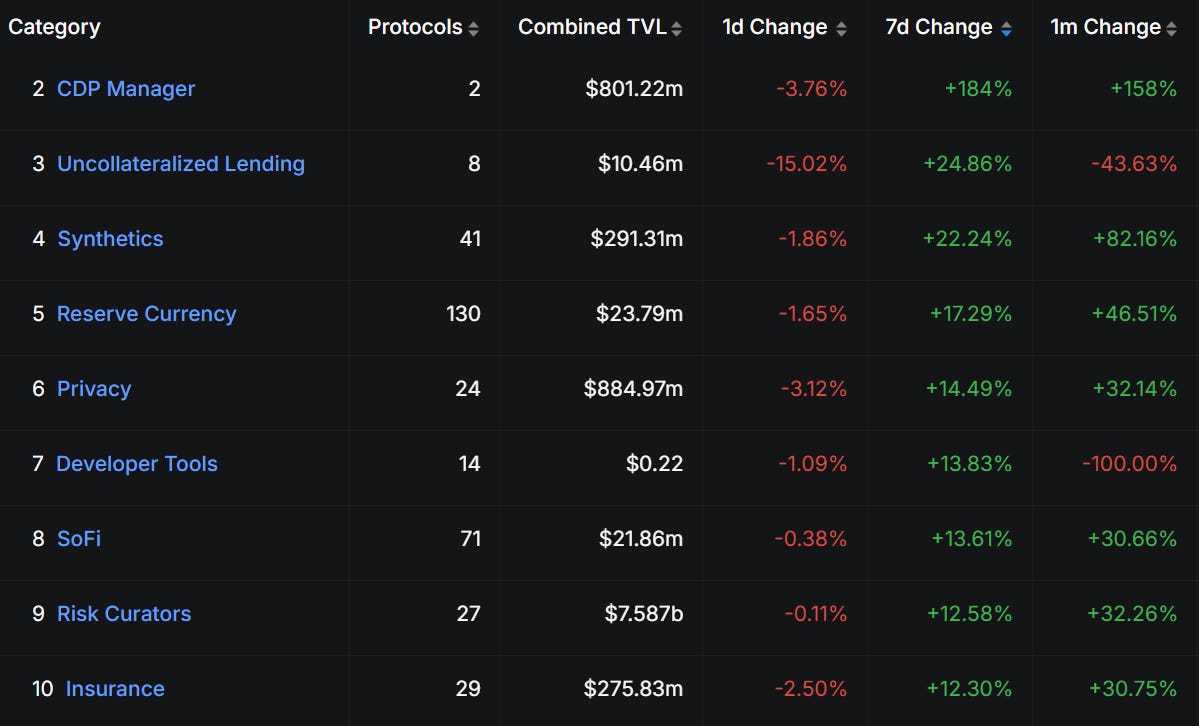

Category and Chain Trends

Category TVL Changes

The Risk Curators category (mostly made up of Euler, Gauntlet, MEV capital & Steakhouse) is at an all-time high of $7.5b, growing 12% this week.

The Privacy category led by Tornado Cash & Railgun is up 14% this week. Railgun hit a TVL ATH and Tornado Cash hit the highest TVL since December 2021.

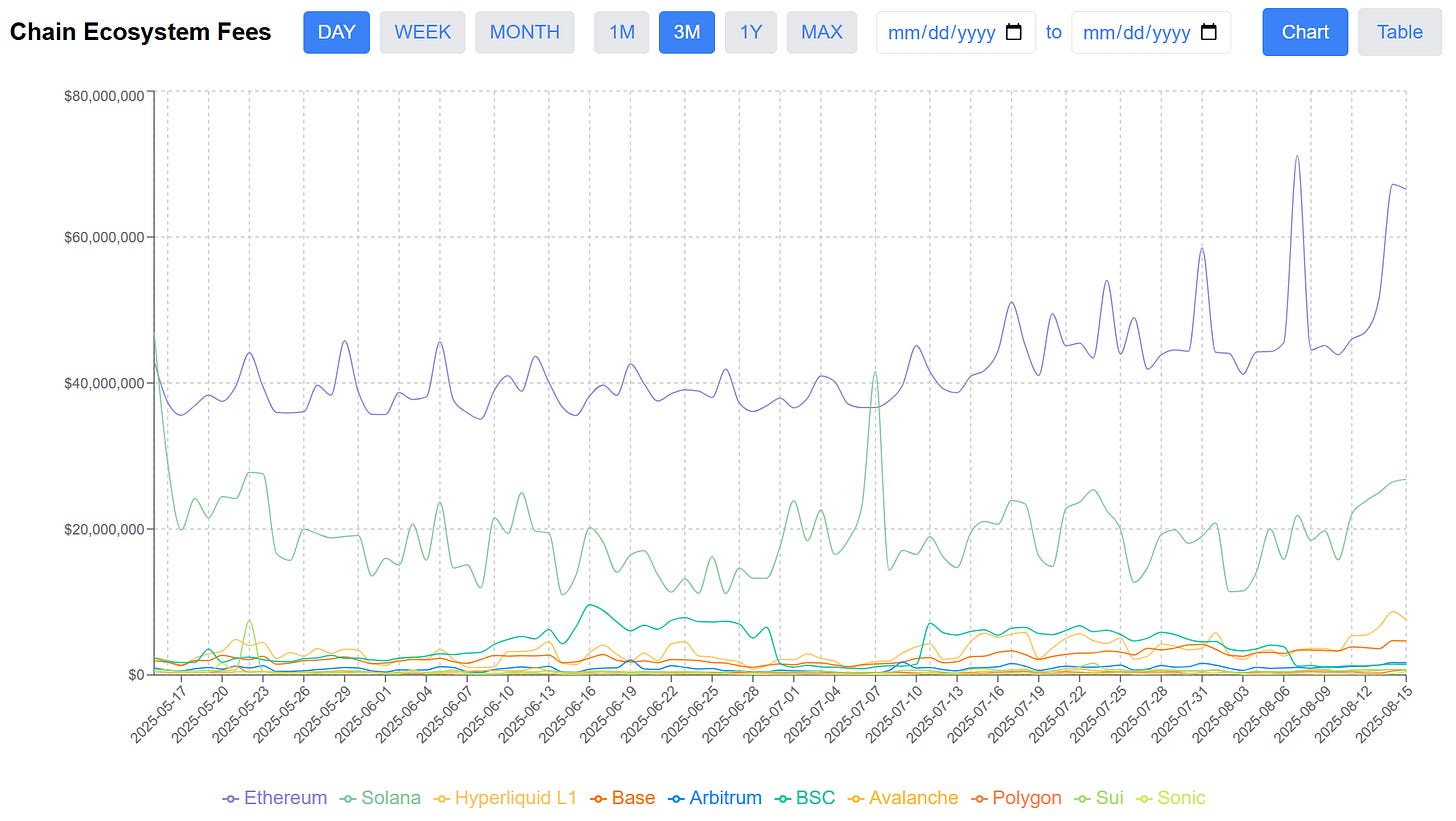

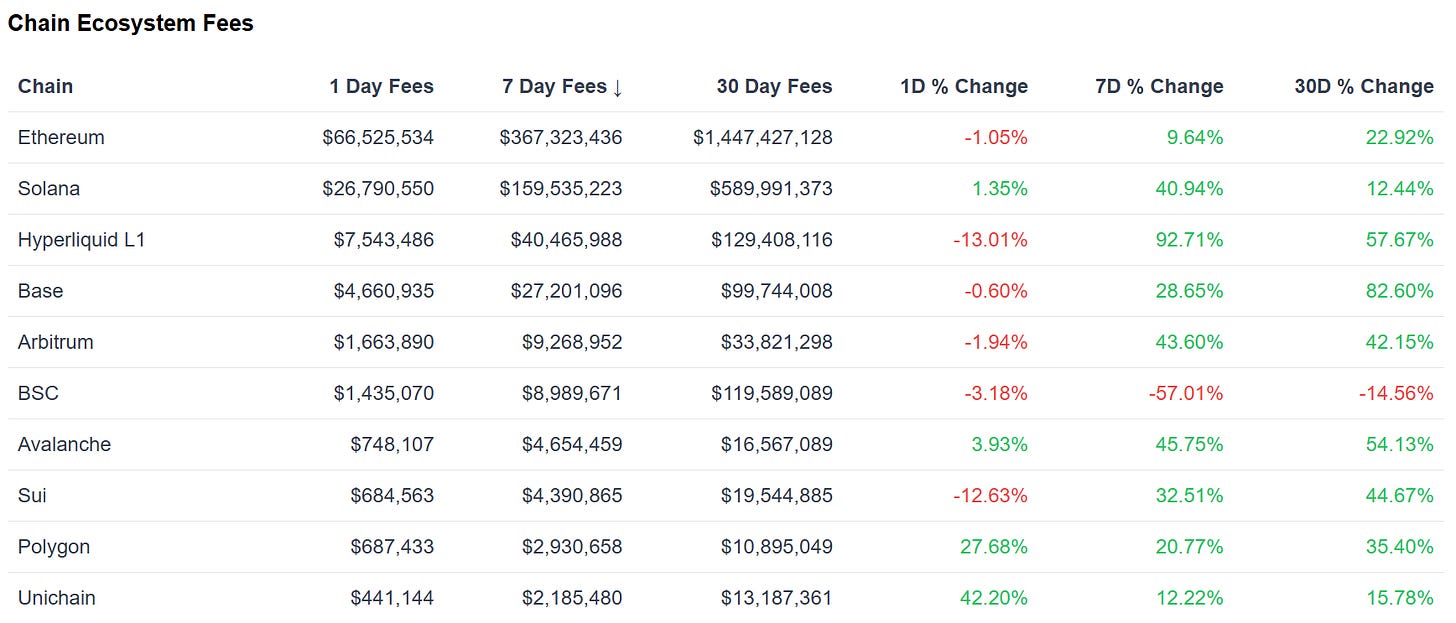

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard myself to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

Ethereum made new all-time highs last week and is making another push over the last few days. Solana is also seeing a sustained jump.

Hyperliquid Chain Ecosystem Fees are up nearly 2x this week, and Hyperliquid ranks 3rd on all time frames for CEF, a significant bump from previous weeks.

Fastest Growing Chains ($100M+ TVL)

Scroll led all large chains in growth this week, followed by TAC, Starknet & Linea.

Cardano & Bitcoin saw higher TVL growth than Hyperliquid, Base & Ethereum.

Fastest Growing Chains ($10M-$100M TVL)

Morph TVL is up 72% this week. Abstract TVL is up 40% over the last month, crossing $50m.

📊Onchain Metrics

Digital Asset Fundamentals

We’re building out this section, where we dive deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens.

Below you’ll find 3 visuals:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.