⚡AI Agents Lead the Market

Breaking down Sui's growth, optimal strategies by portfolio size, and more

Read Time: ~6 minutes

⚡Snapshot

A guide to crypto with levels for each portfolio size

What’s behind Sui’s monster run up?

The four categories of AI agents

New Dynamo Defi website and metrics dashboard (in beta) are live!

📖 Recommended Reads

⚡Most AI agents fall into 4 categories

Surprising similarities to DeFi

⚡Complete guide to AI agents in crypto

Video breakdown of the hottest crypto narrative for 2025

Essentials to sharpen your skills & a leveling guide on portfolio size

“Lowering Your IQ” isn’t as simple as you think

⚡2025 is the year for deep institutional liquidity flowing onchain

Have the stars aligned?

⚡Opportunities within emerging trends

Ecosystem ideas & potential plays in the agentic metaverse

⚡No-fluff toolkit for serious onchain traders

I built the Onchain Academy to be the resource I wish I had.

In less than 3 hours, you’ll be able to:

Track smart money flows before they trend

Spot undervalued gems using on-chain metrics

Find the next big airdrops using real data

Analyze protocols like a professional

Skip the expensive lessons. Get instant access to my complete framework →

🔢Onchain Analysis

Is Sui Worth Your Attention?

With AI Agents taking off, it’s easy to forget the high-performance chain’s token is up over 200% in the last 100 days. For reference, Solana’s SOL is up ~40% in the same time frame and Bitcoin is up ~50%.

Sui is outperforming most blue chip tokens (and SUI is sitting near ATHs while other majors have pulled back). The question is: will this continue?

And what’s worth paying attention to in the ecosystem?

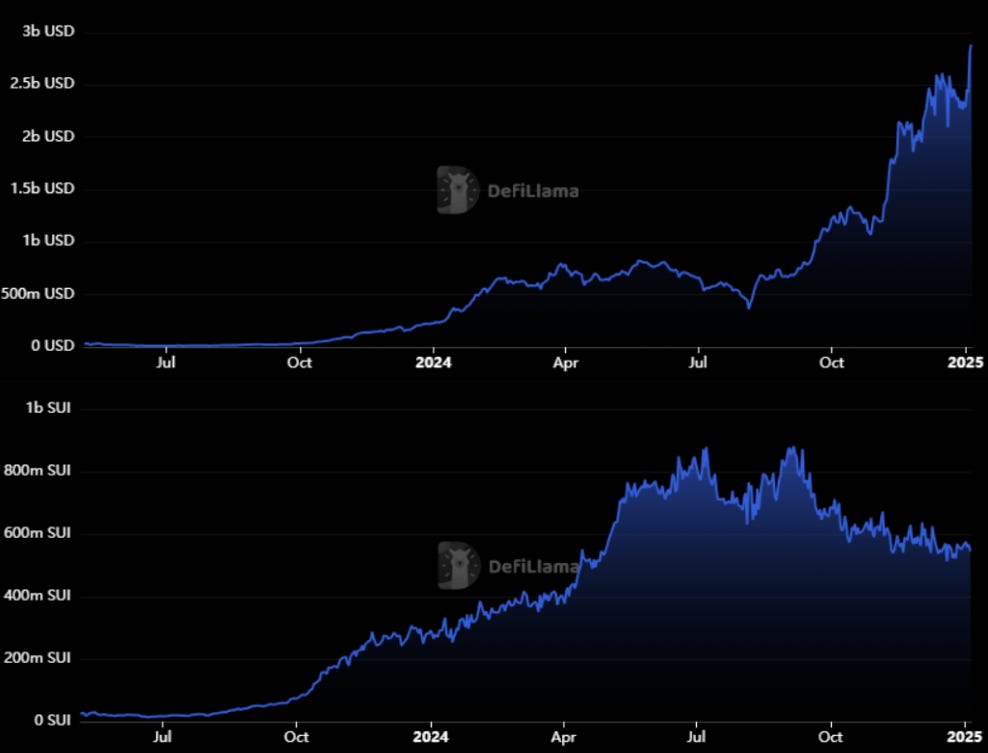

Initial analysis tells a similar story to what we’ve previously discussed - Sui’s TVL growth is mostly due to the SUI token going up. While Sui had healthy TVL growth a year ago, TVL denominated in SUI tokens is down after peaking in September.

The story so far: Sui’s explosive TVL growth isn’t all sunshine and rainbows under the hood.

Let’s dig further.

Ecosystem

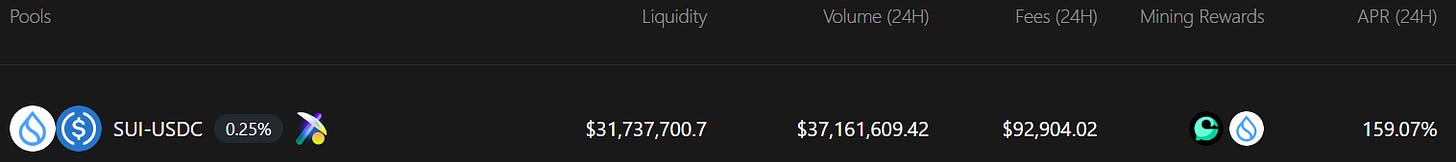

Sui had its best month ever in DEX volume, 50% of which was through Cetus, Sui’s leading DEX. Cetus has triple-digit yields on liquidity pools for SUI token pairs. It’s a great yield destination if you’re hodling SUI or Sui ecosystem tokens.

A good portion of Sui’s December volume was through Bluefin, a high-performance perp DEX on Sui backed by big firms like Polychain. They want to become the NYSE equivalent of DeFi. They’ve facilitated over $43B in cumulative volume with 50k users. The recently-launched BLUE token is less than $100M market cap, but at this time it’s purely a governance token. In the future, Bluefin Foundation plans to introduce more utility for the token through onchain governance.

It’s not just DEXs on Sui - Sui AI is a launchpad for AI Agents (like Virtuals on Base). The token 10x’ed it’s market cap in 6 days, sitting at $50M currently. Agent creators on Sui AI can create and connect agents to their existing tokens, and can mint NFTs. The Sui AI team says more features are coming.

What about token unlocks?

Sui survived a massive token unlock in May. Now each month ~2% of the SUI token supply unlocks, currently equivalent to over $300M.

Sui’s alleged 297,000 transactions per second, unique & secure MOVE development framework and heavy-hitter partnerships are no joke. SUI holders are doing well and we expect they’ll migrate further into the ecosystem overtime.

The upcoming Phantom <> Sui integration will be a friction-reducing catalyst for growth. Expect more onchain activity post-integration. Finding undervalued protocols with heavy usage in the Sui ecosystem is a good strategy. Many protocols on Sui are well-funded - for a breakdown of Sui eco opportunities and yields, click here.

🚜Farm of the Week

SUI-USDC on Cetus

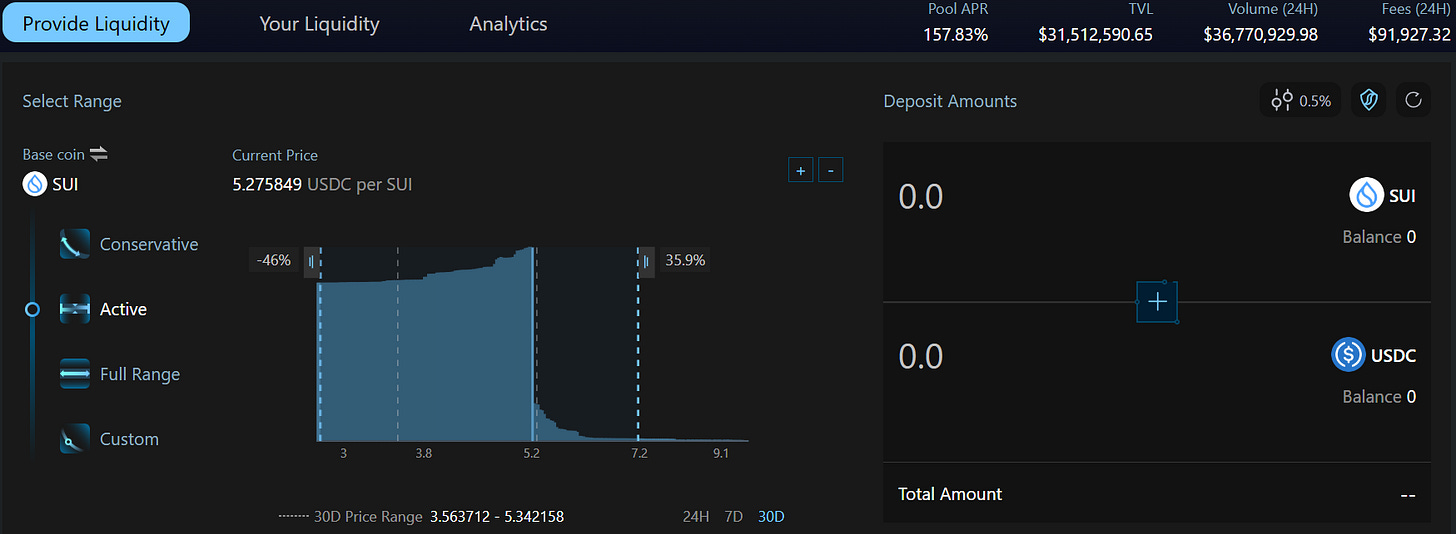

If you’re holding SUI, you can get over 150% APR providing liquidity.

SUI-USDC liquidity providers earn both SUI and CETUS tokens as rewards.

How it Works

If you haven’t used Sui yet, you can create a Sui wallet using Suiet. Phantom is also integrating Sui into their wallet soon.

With high trading volume comes high fees & APYs for liquidity providers. To begin providing liquidity, connect your wallet to Cetus and select a liquidity provision range. The ‘Active’ range should do just fine. If SUI price rockets upward or collapses, you’ll need to readjust your parameters, but it only takes a few clicks.

Enter how much SUI-USDC you’d like to provide, and confirm - you’ll receive a prompt to confirm in your wallet. Once approved, you’re good to go.

You’ll earn fees when swaps are made within your liquidity provision range.

Risks

If price moves out of your liquidity range, you won’t earn fees. Keep an eye on prices and adjust if necessary.

The ONE Thing that Determines if Crypto Goes Up

No, it’s not hopium. Essential supply & demand data.

The Ultimate Guide to AI Agents in Crypto

⚡AI Agents: What’s Next?

In last month’s Pro Call, we highlighted major AI Agents:

AI16Z at $700M market cap (2.5x since)

AIXBT at $220M market cap (1.6x since)

What is the Dynamo DeFi Pro Call? It’s comprehensive research report that I present live to Pro Members.

On Wednesday we have our January Pro call. It’s available to all Pro members.

Join Dynamo DeFi Pro and get an access link to the Zoom call on Wednesday.

Growth for the Pro Call is exploding. It costs $11/month to be a Pro member, and the Pro Call alone delivers value on that cost (not to mention getting weekly custom research from me, a private Discord with community calls and member-only market videos).

Sovereign Members can ask questions ahead of time and get personalized research & slides after the call.

For those who want access but can’t make the 5:30pm EST call, it’ll be recorded and immediately posted to watch anytime.

🛠️Tool Spotlight

Track ETF Flows Using DeFiLlama

Track daily, weekly & monthly ETF flows for Bitcoin and Ethereum with DeFiLlama’s ETF dashboard.

Each ETF ticker is a direct link to the issuer’s fund details page.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 December ADP Nonfarm Employment data - January 8th

📊 Fed Meeting Minutes - January 8th

📊 December Jobs Report - January 10th

📊 8 Fed Speaker Events

Token Unlocks: $240M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓KAS (0.72%) - January 6th

🔓MOVE (2.22%) - January 9th

🔓APT (2.03%) - January 11th

🔓IO (2.50%) - January 11th

🔓AXS (0.52%) - January 12th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 GenesysGo shdwOperators staking launch - January 6th (Source)

🚀 Strawberry AI twitter autonomous agent launch - January 6th (Source)

🚀 CronosZkEVM mainnet upgrade - January 9th (Source)

🚀 Digibyte core v8.22 launch - January 10th (Source)

🚀 Fusionist closed beta test - January 12th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi

Thanks for the update Patrick