⚡3 Strong Protocols Buying Back Tokens

The best signal this week isn’t price action, it’s protocol behavior. These protocols are soaking up their own supply

Read Time: ~5 minutes

⚡In This Edition

The market is still seeing institutional inflows, but they’re slowing down

Strong onchain businesses are thriving

Solana just passed a vote for a major consensus overhaul that could make it orders of magnitude faster

While we await a potential interest rate cut, here are the top airdrops to qualify for in September.

⚡Metrics Snapshot

Top 100 Coins at a Glance

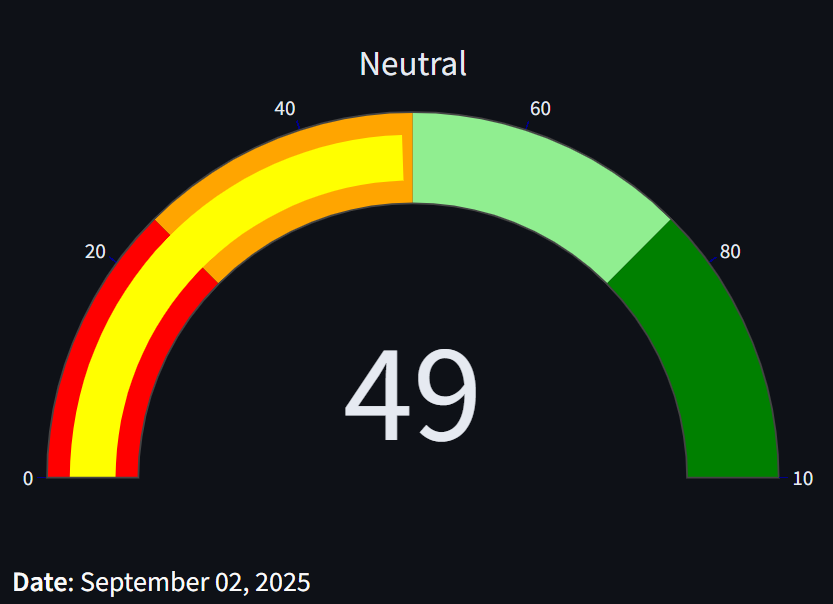

Fear & Greed Index: 49 (Neutral)

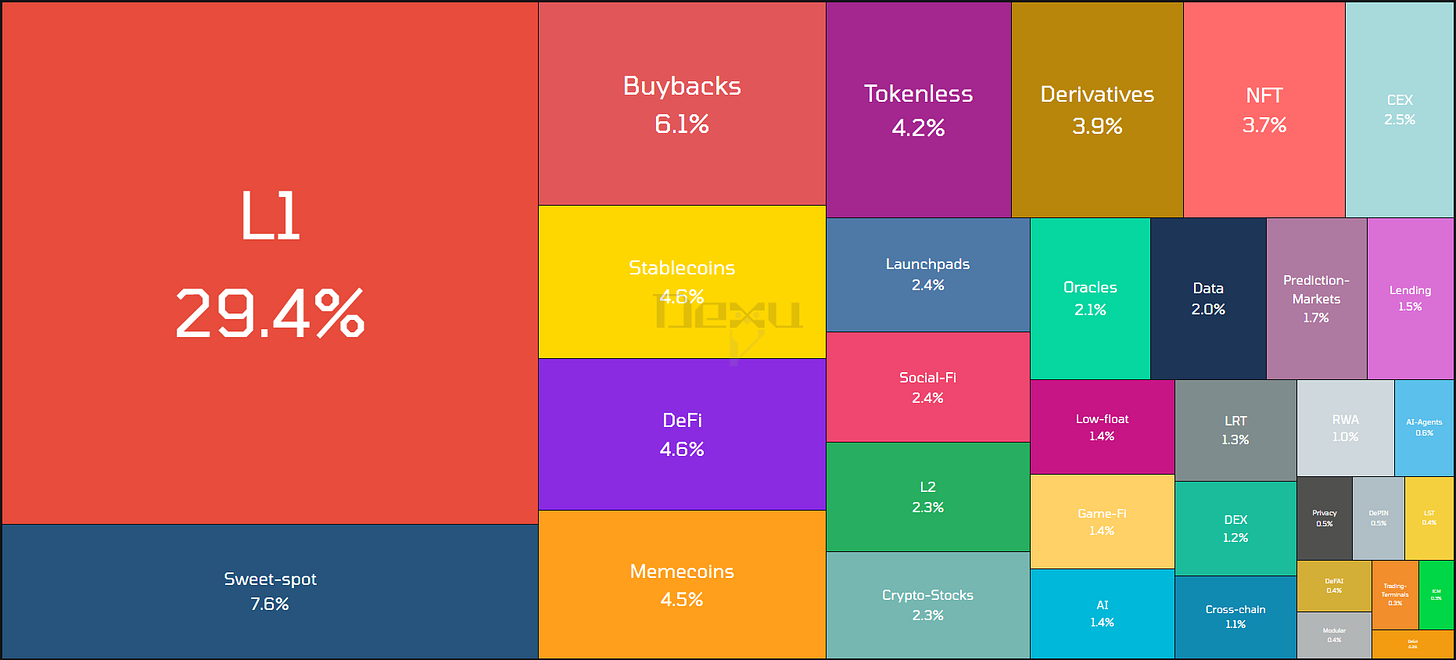

Narrative Mindshare (7d)

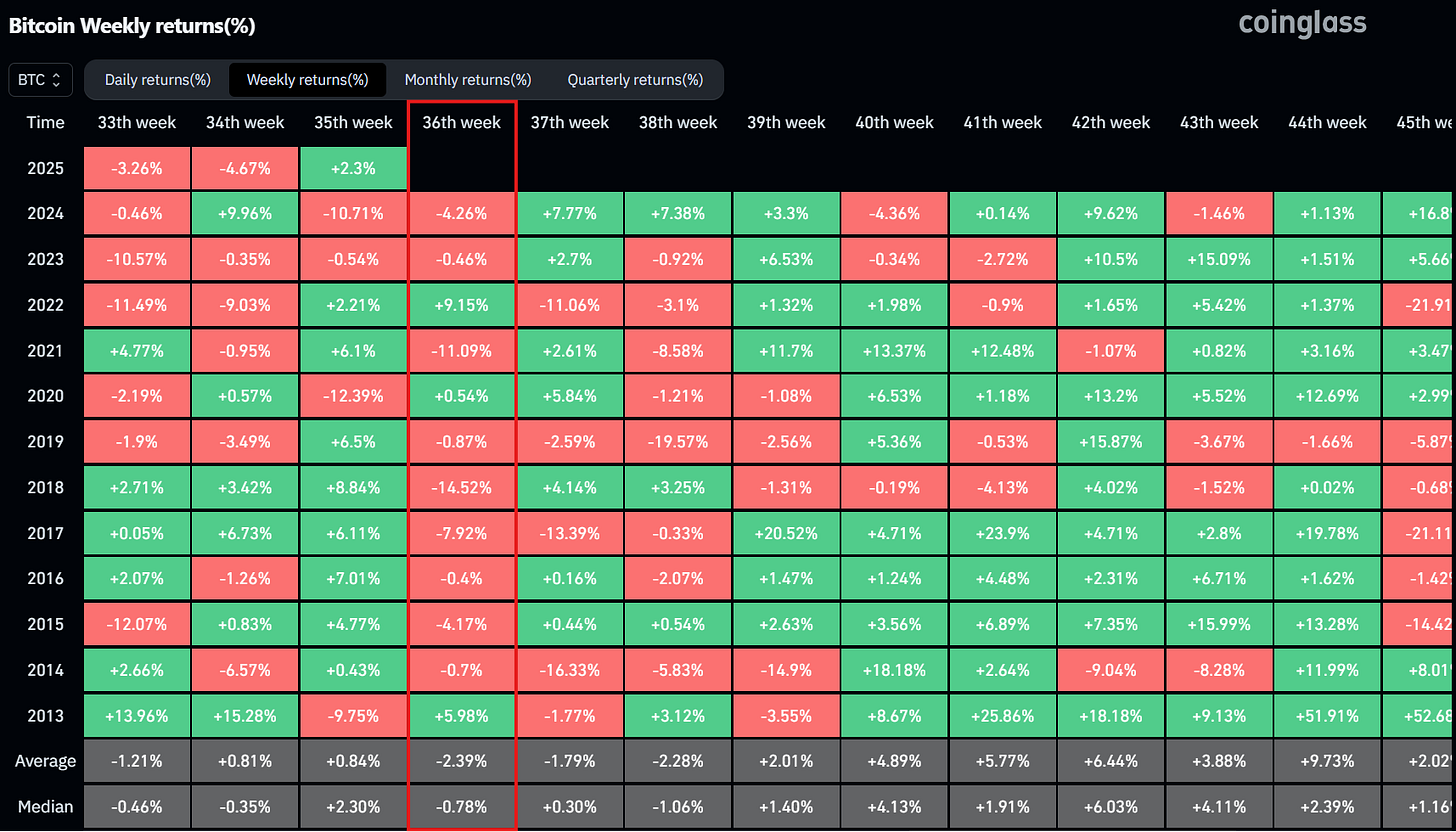

Historical Bitcoin Performance This Week

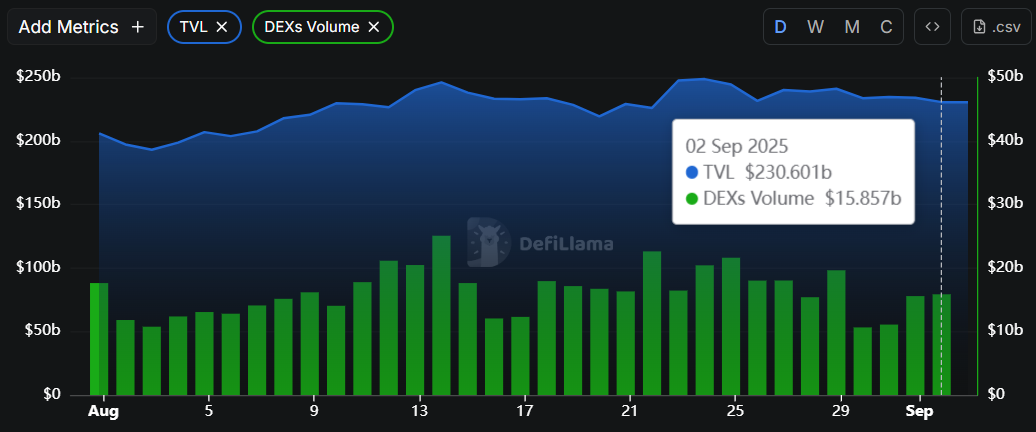

DeFi Market Metrics: Global TVL & DEX Volume

TVL MoM growth: +16%

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. World Liberty Financial Token Begins Trading

WLFI is a finance platform offering the stablecoin USD1 (currently the 6th largest stablecoin by market cap), and will soon offer lending & borrowing and a WLFI app. The Trump family token debuted across major exchanges, launching at a $7b+ valuation but dropping shortly after launch.

What This Means

Crypto is now a significant portion of the Trump family’s net worth. The Trump administration is doing more than simply talking about pro-crypto policy. This is a signal to founders & institutions that regulatory risk for building onchain in the US is all-clear.

2. Institutional Flows Update

Saylor acquired another 4k of BTC last week, worth about $450m. Metaplanet bought ~$112m in BTC.

Sharplink Gaming added 39k of ETH, worth about $170m. Sharplink has another $70m in outstanding cash to purchase more ETH.

ETFs had a positive week for both BTC & ETH, and ETH outpaced BTC in flows for the 6th consecutive week.

What This Means

Inflows remain positive (albeit slowed from July’s momentum) and DATs are proving they can continue to drum up buying power. The crypto market has pulled back, but continued inflows can buoy the market until the next set of flows make their way in.

3. Alpenglow: Major Solana Upgrade in Approval

Solana’s Alpenglow proposal, which seeks to slash the blockchain’s transaction finality to around 150 milliseconds, just passed. 99% voted in support.

What This Means

Solana’s meta-goal is to “Increase Bandwidth, Reduce Latency”. Alpenglow, a major consensus upgrade would do just that. It’s a 100x reduction in finality, simplifies consensus, and becomes more competitive with web2 applications for real-time transactions. Alpenglow is expected on mainnet early next year.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡Is this the dip you don’t want to buy?

Collection of top signals and if this time is actually different

⚡September 2025 Airdrop Checklist

Use these to potentially qualify for the biggest airdrops this year

⚡Put your money to work on Kamino

Yields, Season 4 airdrop and upcoming integrations

Learn advanced yield strategies and how to find DeFi opportunities

⚡Custom DefiLlama dashboards to track narratives & ecosystems

Hyperliquid, Solana, stablecoins, revenue heavy-hitters and more

⚡How to Value Tokens

The Dynamo DeFi Pro newsletter helps you explore the intrinsic value behind different tokens. We dive deeper into the fundamentals behind digital assets with unique visuals, and revamped this recently to include a wide variety of custom metrics, such as:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

To get these insights delivered to you each week, become a Pro member.

🔢Onchain Analysis

August: Record Month for Holder’s Revenue

August was a record month for Holder’s Revenue, a metric that measures protocol fees that are burned or turned into token buybacks.

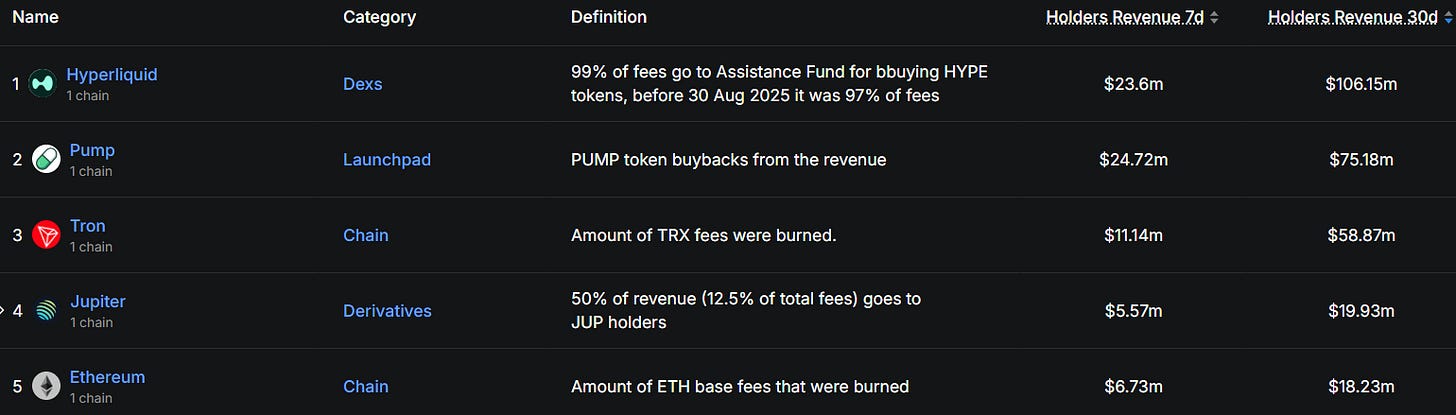

Hyperliquid led holder’s revenue over the last 30 days, followed by Pump, Tron, Jupiter & Ethereum.

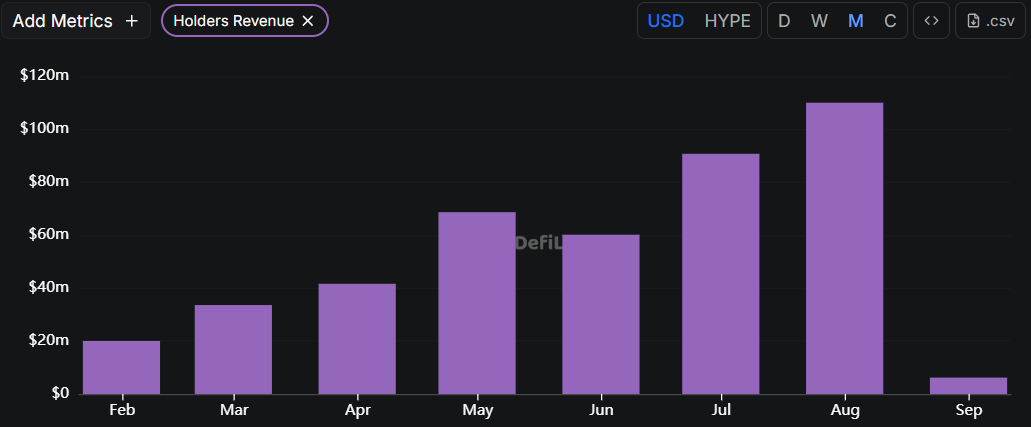

Hyperliquid Holder’s Revenue is up and to the right. After a record month of OI & spot DEX trading, $110m was passed to token holders in August.

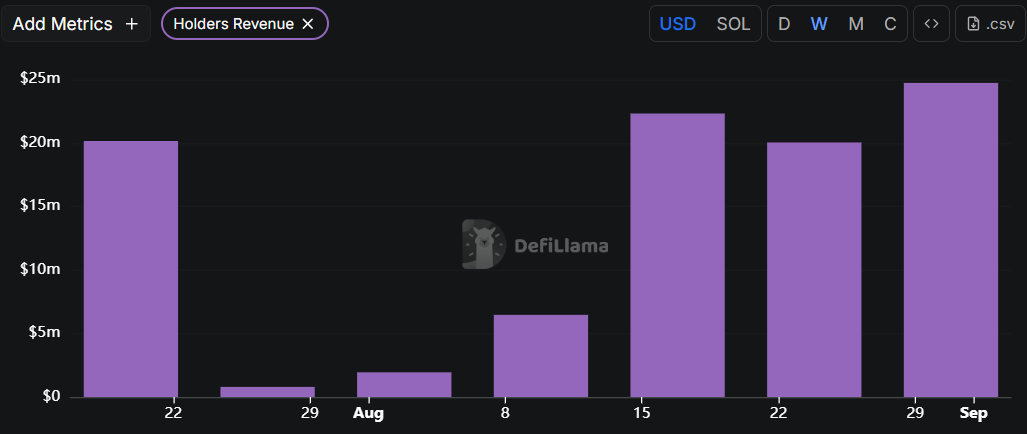

Pump has now purchased back 5% of the circulating PUMP supply and 4% just in the last month. If revenue stays high, PUMP buybacks should continue. Holder’s Revenue was over $20m each week for the last 3 weeks.

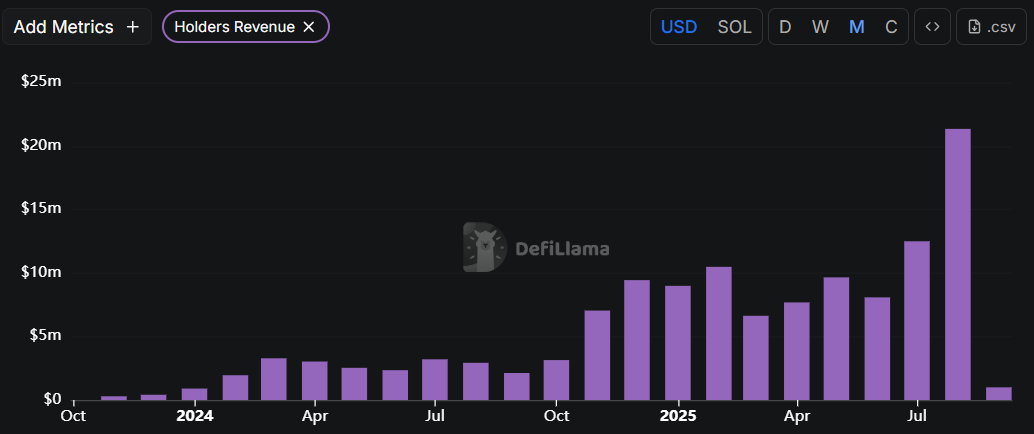

Finally, Jupiter Holder’s Revenue crossed $20m in August, nearly double the previous month. 12.5% of perp fees and fees from some of Jupiter’s myriad products (Aggregator, Staked SOL, DCA, Studio, etc) also go back to token holders.

The meta that Hyperliquid championed by using revenue to buyback or burn tokens isn’t new, but seeing it across protocols and chains is great for holders. While it may not pump the token price to the moon, a structural buyer is put in place and depending on the setup, buys more when the protocol earns more.

🚜Farm of the Week

JLP Multiply on Kamino

JLP is a basket of majors and stablecoins used as a liquidity pool for Jupiter Perps.

JLP has proven to be a great index to hold. Kamino offers leverage on the token to increase exposure and earn additional yield while holding.

How it Works

Head to Kamino’s JLP Multiply page, connect your wallet and deposit either JLP or USDC.

It’s not necessary to max out the Multiply feature. 6x leverage is high, and it’s not worth getting liquidated. Anything below 3x leverage still earns significant yield and is a strong buffer against liquidation.

Risk Level: Medium

Risks

Smart Contract risk

Protocol Layer risk

Leverage Risk

⚡Creating a Portfolio of Undervalued Tokens

🛠️Tool Spotlight

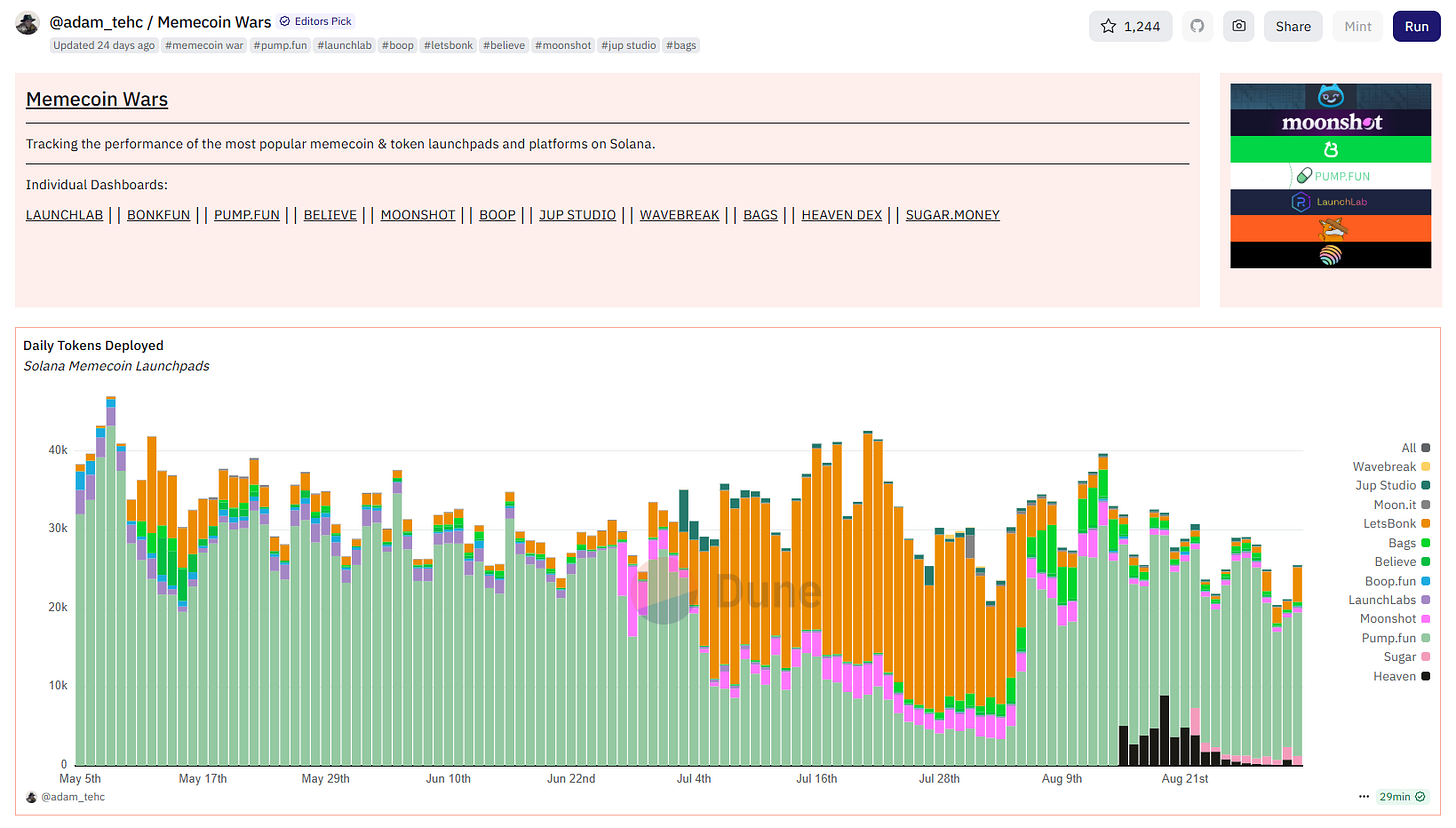

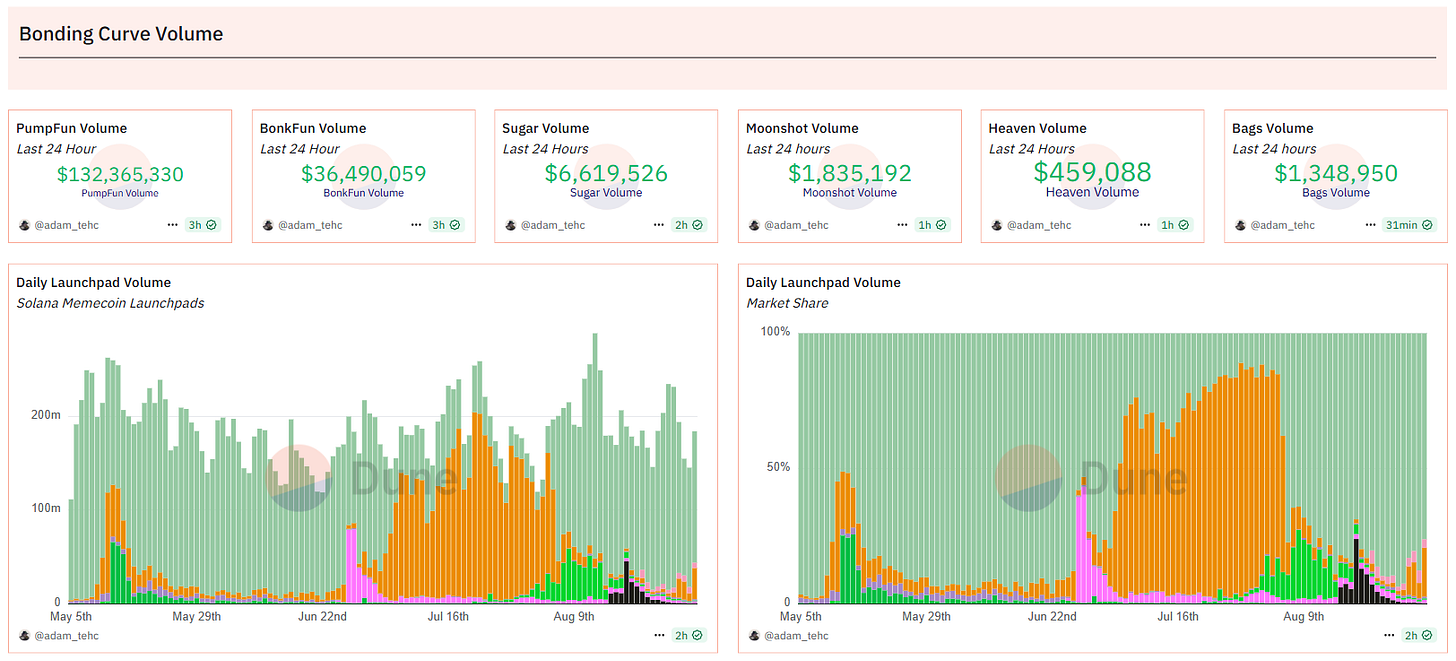

Memecoin Wars Dune Dashboard

The Memecoin Wars dashboard tracks all major memecoin & token launchpads on Solana.

The dashboard displays bonding curve volume, daily graduates, graduation rates and active addresses for all major launchpads.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 August ISM Manufacturing PMI data - September 2nd

📊 July JOLTS Jobs data - September 3rd

📊 August ADP Nonfarm Employment data - September 4th

📊 Initial Jobless Claims data - September 4th

📊 August Jobs Report - September 5th

Token Unlocks: $240m Unlocking This Week

🔓SUI (1.25%) - September 1st

🔓DYDX (0.59%) - September 1st

🔓ENA (0.64%) - September 2nd

🔓CETUS (1%) - September 2nd

🔓SD (1.17%) - September 4th

🔓IMX (1.27%) - September 5th

🔓GMT (1.14%) - September 7th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 $WLFI claim and listings - September 1st (Source)

🚀 Polkatrader gated launch - September 1st (Source)

🚀 Ondo global tokenization market launch - September 3rd (Source)

🚀 Tellor mainnet upgrade - September 3rd (Source)

🚀 Morpho optimizers deprecation - September 7th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi