⚡ZK-Rollups Shine Amidst Volatility

Plus smart money tracking, ETH restaking, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

In this issue:

🔢On-Chain Metrics

📈Trends & Narratives

🛠️Tool Spotlight

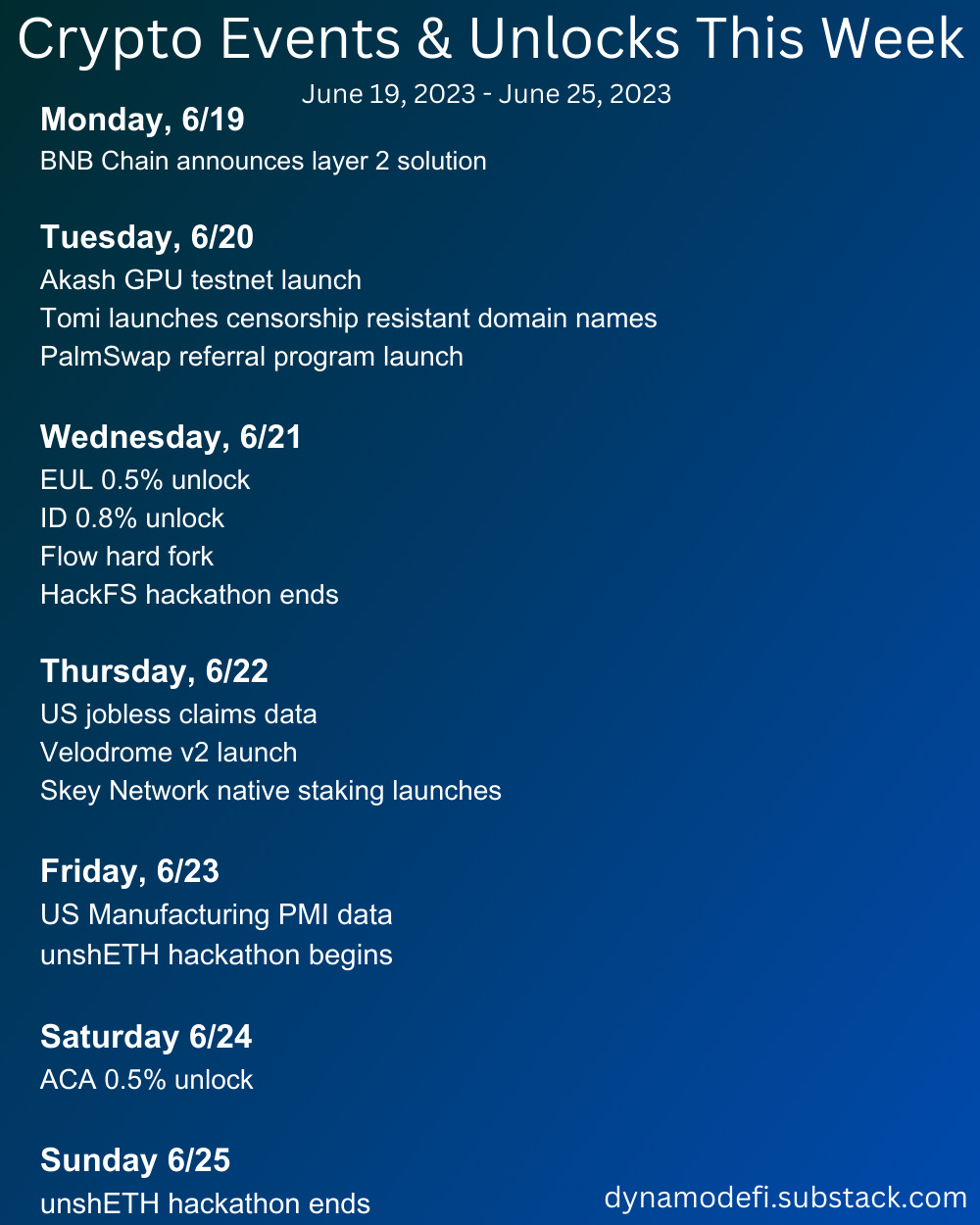

📅Key Events This Week

🔢On-Chain Metrics

Total DeFi TVL Flat This Week

Total DeFi TVL was flat this week, going from $61.13B to $60.71B, when you include liquid staking.

Among top chains, BNB Chain and Cronos lost the most TVL, while Solana gained the most.

Real World Asset TVL Continues to Boom

Real World Assets continued to attract total value locked. Of the 10 largest protocols in this category, 8 grew this week. These protocols are mostly a combination of tokenized real estate, US Treasury bonds, and gold.

ZK-Rollups Shine Amidst Market Volatility

Recent news hasn’t prevented investors from moving funds to ZK-rollups. ZK-Rollups have been heralded as the best tech for Ethereum layer 2 scaling. Right now, zkSync Era, Starknet, and Polygon zkEVM are the 3 leading ZK-rollups.

In the past month, zkSync Era TVL is up 35.3%, Starknet TVL is up 21.8%, and Polygon zkEVM TVL is up 185%.

Polygon zkEVM’s TVL increase is especially notable and consistent:

This increase in liquidity has coincided with a rise in active addresses. Starknet active addresses have been down in recent weeks, but Polygon zkEVM and zkSync Era have continued to see growth.

Many people correctly point out that some of this activity comes from airdrop hunters; however, as we saw in the case of Optimism and Arbitrum, airdrop incentives can be an effective way to bootstrap a chain’s ecosystem. And, in the case of both of those chains, their usage post-airdrop was higher than it was pre-airdrop.

📈Trends and Narratives

Blackrock Files for Bitcoin ETF

In a major win for Bitcoin adoption, Blackrock filed for a Bitcoin ETF this week. I view this as significant for 2 reasons:

A BlackRock ETF gives major credibility to Bitcoin and crypto as a legitimate investment vehicle.

Huge amounts of money is held in US retirement accounts. This allows those investors to easily get exposure to Bitcoin through a trusted company.

I expect this to increase structural demand for Bitcoin as people begin to DCA in through their retirement accounts.

For reference, BlackRock has only ever had 1 ETF rejected out of 576 applications. This bid is extremely credible and specifically addresses many of the issues that were identified in previous Bitcoin ETF applications.

Uniswap v4 Announced

Not long after Uniswap v3 became public domain, Uniswap v4 has been announced.

Uniswap v4 introduces “hooks”, which can be used to customize pools to support dynamic fees, to add on-chain limit orders, to act a “time weighted average market maker”, and more customizations.

It also introduces a new “singleton” contract, where all pools will live within a single contract, reducing the cost of pool creation by 99%.

Eigenlayer Brings Restaking to Ethereum

Eigenlayer launched to much anticipation this week. Eigenlayer allows Ethereum stakers to repurpose their staked ETH to earn extra yield by securing modules built on Eigenlayer as well. As liquid staking and Layer 2s cause the greater Ethereum ecosystem to bloom outwards, Eigenlayer supercharges ETH’s use as a yield-bearing asset.

Whether you are into airdrop hunting or not, this guide for a potential Eigenlayer airdrop is a great overview of the various things you can do on Eigenlayer now.

🛠️Tool Spotlight

Using Watchers Pro to Track Smart Money

Recently, I’ve been looking for tools to help with hunting whale wallets and smart money on-chain. One tool that I’ve come across is Watchers Pro by Scope Protocol. There’s both a free and paid version and even the free version has tons of useful features, such as a the top 20 tokens bought by smart money in the past 24 hours, a catalogue of VCs, and an easy interface to the find the top whales for specific coins.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi

Great stuff as always