⚡Will Gaming and Real World Assets Drive Mass Adoption?

Plus BTC flows to hodlers, a tool to track narratives, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week.

📈Trends and Narratives

Gaming to Lead Crypto Mass Adoption?

The crypto gaming space has been one of the best-performing subsectors of crypto recently. Although this isn’t my usual focus, I find it interesting for a few reasons:

Gaming is already a fast-growing sector OUTSIDE of crypto

There is already proven demand for paying large premiums for rare video game assets

Crypto gaming is small, even in the context of crypto

Digital assets make a lot more sense in a digital world

Miles Deutscher discussed the thesis behind this opportunity more:

This analyst, MTS, outlined top GameFi tokens in this post. This is a great starting point for your research, to see what some of the top projects out there are:

Part 2 of crypto gaming tokens:

Real World Assets Bringing the Next Trillion Dollars to DeFi?

I could see a barbell strategy of crypto gaming and real world assets as the mass adoption portfolio. Two use-cases that couldn’t be more different: gaming bets on completely digital worlds and real world assets bets on tokenization of assets that aren’t digital.

Still, both are gaining traction. And both promise to make it possible to build real businesses on-chain, bringing consistent revenues into crypto that don’t rely on speculation.

Infrastructure improvements over the past 3 years make a lot of applications that were theoretical in the past, possible now.

This thread by Hitesh goes through some top RWA tokens:

⚡Monthly Dynamo DeFi Premium Call this Wednesday

The paid version of Dynamo DeFi, called Dynamo Research, gives you deeper insight into the crypto market.

Each month, this includes a call to discuss ongoing narratives and trends in the crypto market. This month’s call is this Wednesday at 5pm EST. Find more details here:

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

🔢On-Chain Analysis

Percent of BTC Held for more than 1 Year breaks 70%

The percent of BTC held long-term has been steadily growing this year. In late November, it broke 70% for the first time ever, a sign that BTC is moving into strong hands and being taken off the market:

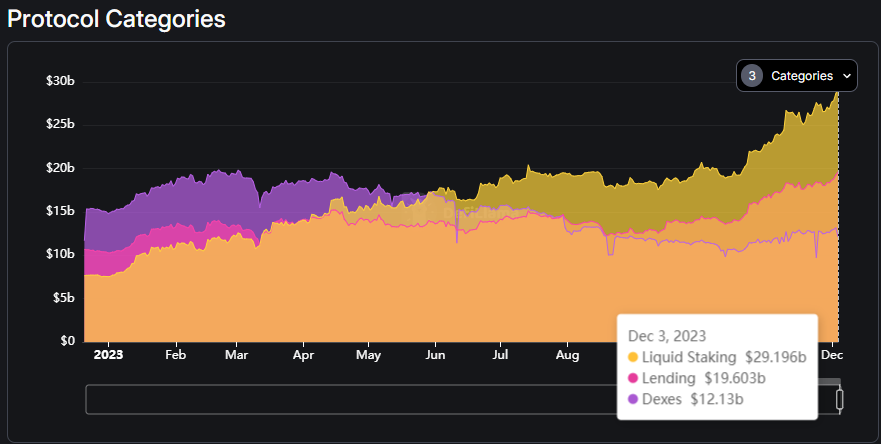

Liquid Staking Extends Lead as Largest DeFi Category

Liquid Staking has continued to outperform other DeFi categories. From less TVL than DEXes and Lending at the start of this year to 140% more TVL than DEXes now.

There are no signs of this slowing down as staking shows a comparatively good risk/reward to providing DEX liquidity. One major thing to watch is whether market activity picking up makes DEX APRs attractive enough for investors to look there.

🛠️Tool Spotlight

Crypto Koryo’s Narrative Dashboard

We love tracking narratives in this newsletter. This dashboard, created by the, always skilled, Crypto Koryo tracks performance of a wide range of narratives to help you keep track of what’s leading the market.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi