⚡What to Watch After BTC's Big Move [Dynamo DeFi Pro Report]

Plus a new framework for assessing digital asset fundamentals

💡Dynamo’s Thoughts

Bitcoin Makes a New High: What Comes with it?

First, let’s review how we got here:

The Big Beautiful Bill passed. That’s trillions of dollars in government spending, raising the probability of additional market liquidity, a historical driver of Bitcoin price.

With Bitcoin’s several rejections from all-time high breakouts, it appears there were some complacent shorts sitting just above ATHs. When Bitcoin broke out, shorts had to close or get liquidated, adding fuel to the fire.

The market brushed off Trump’s recent tariff updates, pushing back any sort of Liberation Day part 2 scenario. Removing a potential negative catalyst can be just as powerful as a positive catalyst. It helps that the market recovered so swiftly after the last round of tariffs.

What comes next now that Bitcoin is back at ATHs?

ETH is back at ~$3k. There was a clear institutional sentiment shift in April. We’ve been posting about it on X; ETH ETF flows were as strong and consistent as they’ve ever been. Cumulative holdings of ETH by ETFs doubled over the last several months.

It’s been a difficult road for ETH, and this reversal is likely to continue given the digital asset treasury narrative. By the way, Fidelity is going with the narrative that smart contract chains are like economies, a point we’ve made in this newsletter for over a year now. In fact, Fidelity created a variation of the GDP calculation to apply to digital assets, focusing not just on consumption, but also government spending (grants and security), imports (bridges and stablecoins), and investment (DeFi deposits).

The digital assets that TradFi institutions are allegedly referring to as “The Big Four” are:

BTC

ETH

XRP

SOL

Whether you like them or not, expect these assets to receive spot ETFs and gather momentum. Our perspective is that a well-balanced crypto portfolio has some allocation to one or more of “The Big Four” and an allocation smaller altcoins with strong fundamentals. Check out our Digital Asset Fundamentals section below to see how we’re looking at fundamentals for chains and protocols now.

Lastly, the onchain tokenization race has begun. Robinhood, Kraken and several onchain protocols (although Helix on Injective was doing it before it was cool) announced onchain stock trading. RWA protocols like Maple and Plume are seeing strong metric growth.

This feels like a “slowly, then all at once” moment but the culmination for each of these pieces of the puzzle have been in the works for quite some time.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

🔭Market Outlook

Market Health

Total DeFi TVL

Up 40% YoY and at the highest level in over seven months.

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here. Today’s value is 79, veering into the Extreme Greed category.

Stablecoin Market Cap

Another all-time high (are you surprised?), crossing $256b. Stablecoin market cap added almost $7b in the last 30 days - half of that came from USDT.

ETF Flows

We are on our 4th consecutive positive inflow month for both BTC & ETH ETFs.

In the last 12 weeks, ETH ETFs saw one net outflow week and BTC saw two.

Cumulative holdings for both ETFs are at all-time highs.

IPOR Stablecoin Indeces

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

Rates for both USDT & USDC are below 1Y averages, signaling a healthy onchain lending market.

Category and Chain Trends

Category TVL Changes

Leading this week’s growth are several small categories, but CDP Managers (DeFi Saver and Summer.fi) and Cross Chain Bridges are seeing strong TVL growth. Both categories are generally onchain fee generators and saw positive revenue over the last month.

While not in the top 10 in 7d growth, the largest onchain categories (Lending, Liquid Staking, Restaking) all saw double-digit TVL growth this week.

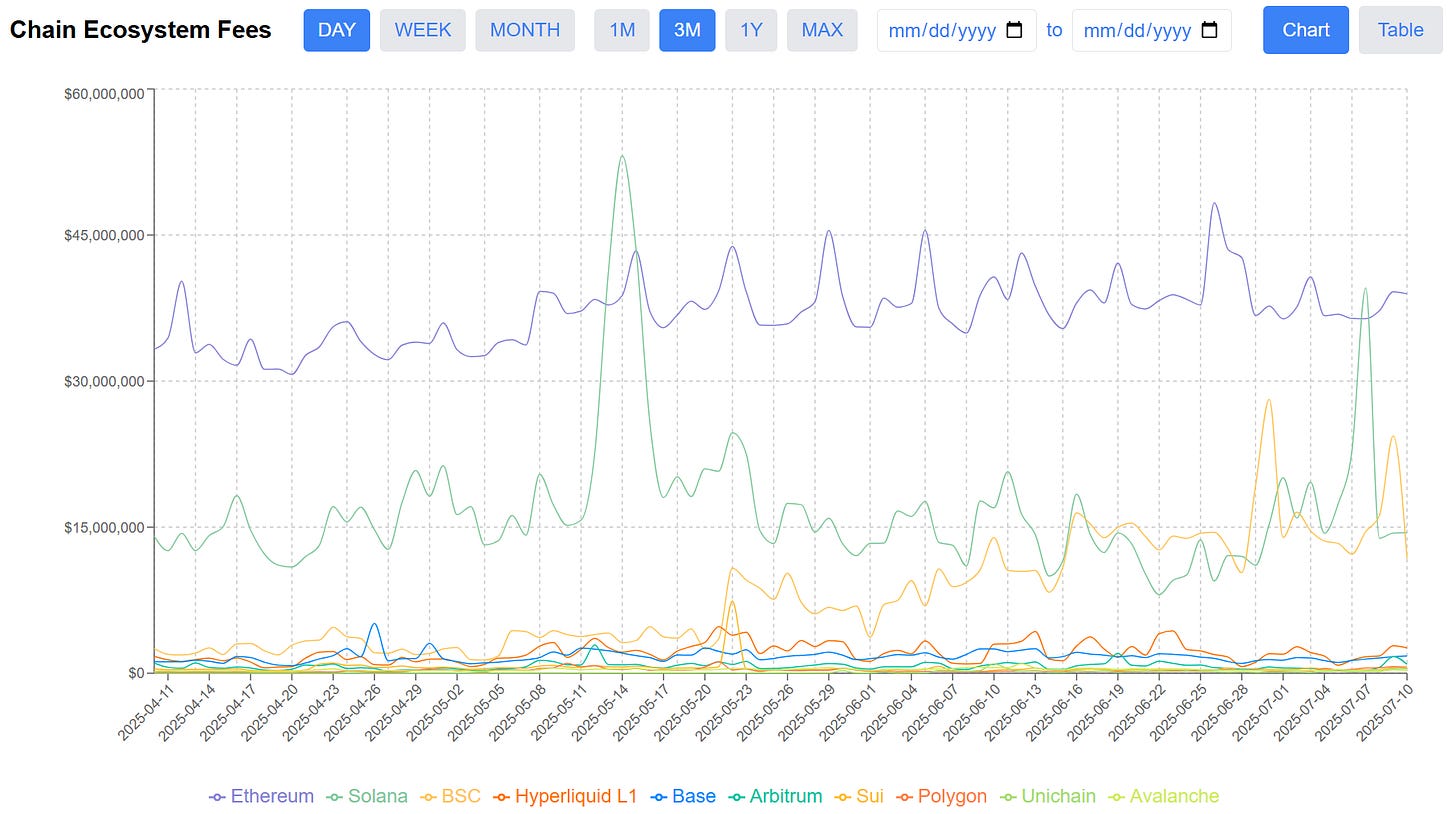

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard myself to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

BSC & Solana saw CEF growth recently - BSC had several days of matching or out-earning Solana, and Solana briefly flipped ETH in Chain Ecosystem Fees.

Arbitrum, Polygon and Unichain also saw growth this week.

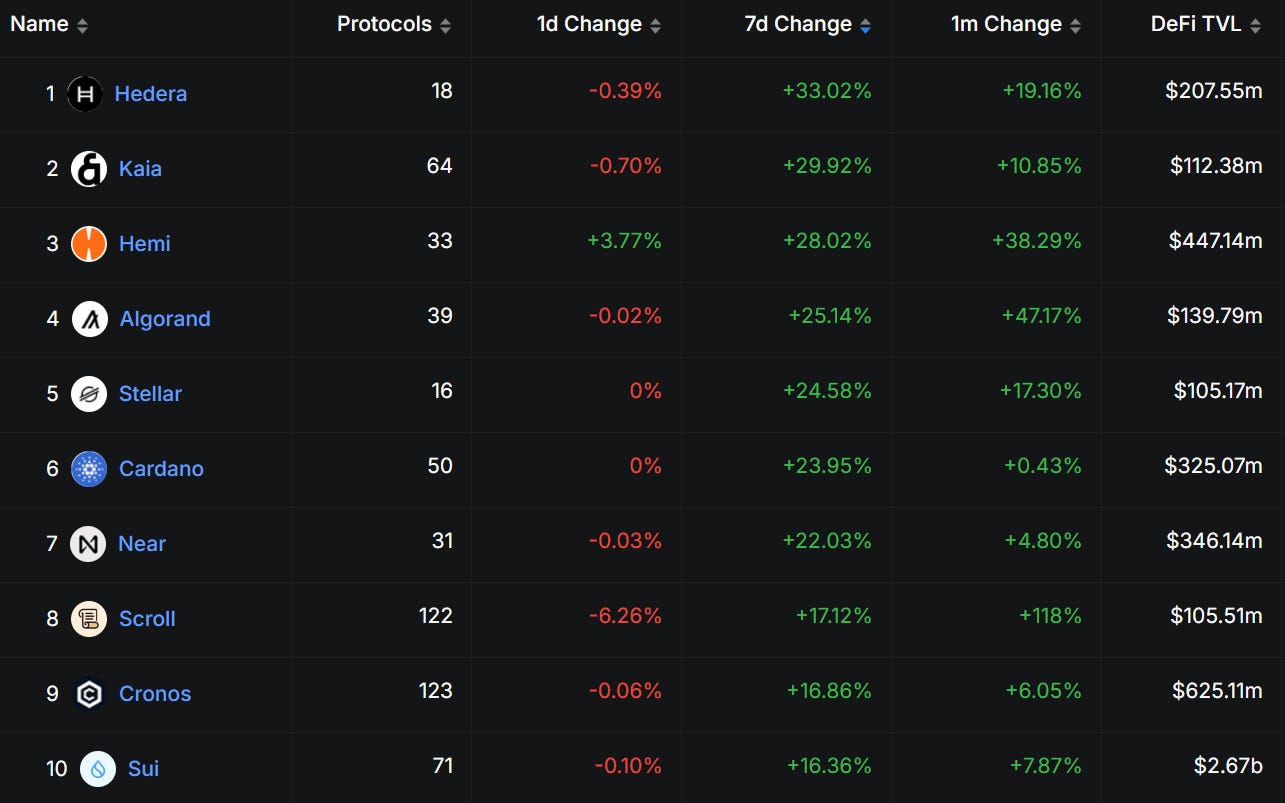

Fastest Growing Chains ($100M+ TVL)

Hedera Hashgraph leads TVL growth this week. Several older protocols like Algorand, Stellar and Cardano are up over 20%.

Fastest Growing Chains ($10M-100M TVL)

Story protocol is the highlight with TVL growth over 75% over the last month.

📊Onchain Metrics

Digital Asset Fundamentals

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.