⚡What just happened to crypto?

Thoughts on the latest Bitcoin correction, missed top signals, and the outlook for the rest of 2025

Is it over?

I’ve been asked that question dozens of times over the past few days. And, honestly, I don’t blame people for asking it.

To recap:

Nearly $300b has been wiped off the crypto market cap in the past day.

Total crypto market cap is down over $800b from its peak in December.

Excluding the top 10, total crypto market cap is down 46% from its peak.

If you go back to my video outlining how I saw the bull market playing out back in early November, it was pretty accurate:

Pump following the election

Peak prior to Inauguration

Inauguration is sell-the news <- YOU ARE HERE

Resumption of secular uptrend later in 2025 after we get regulatory clarity in the US.

That being said, the depth of this altcoin sell-off has been steeper than I expected, particularly in projects with strong fundamentals. I didn’t expect so many projects to drop below their pre-election levels or to even approach their lows from 2024.

I attribute this more severe drop to a few factors:

The TRUMP memecoin caused us to pump further than we would have otherwise. This means that we have further to fall to correct to baseline.

Memecoins won as the predominant narrative. They just did. Whether you think that was justified or not. The biggest movers having no underlying value or utility means that new players were completely rinsed even more than they usually are. This prevented a flywheel from starting that allowed newly made capital to be reinvested. Instead money was made, taken out of the ecosystem and brought to the real world to buy assets.

Macro concerns are real. Signs that tech is rolling over. Government spending actually being cut. Tariffs. Many of these things are overdue and even have benefits long-term, but will cause short-term pain.

Slower action on the Strategic Bitcoin Reserve than the market consensus expected.

I also think many people, me included, were willing to overlook many top signals because we were expecting a wave of nation-state and institutional buying of Bitcoin. For the record, I still expect that to start at some point, but in the meantime, there’s a severe lack of catalysts.

Here are a few of the top signals that are more obvious in retrospect:

The President-Elect launching a memecoin and it going to tens of billions of dollars in a day.

Celebrities launching their own memecoins

Dozens of crypto ETFs being filed

Major financial news channels publishing multi hundred K Bitcoin predictions

AI Agents whose sole function was posting on Twitter running to massive valuations

DEX Volume spiking

Funding rates skyrocketing

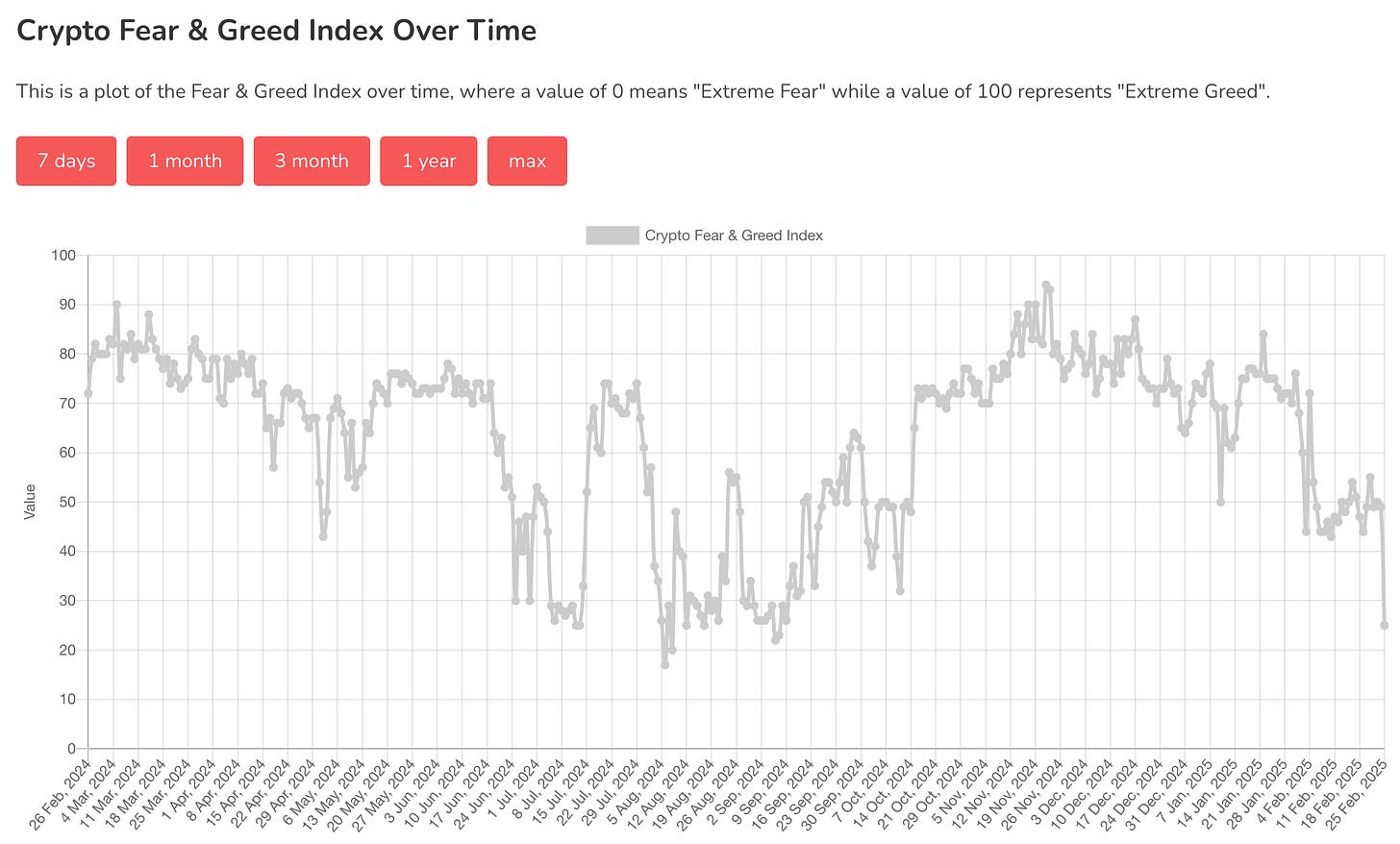

The Fear and Greed Index reaching its highest level since early 2021

That being said, this recent crash and the severity of it seems to have caught even many experienced investors flat-footed. So, if you lost money, I would incorporate this information into your trading system for the future, but don’t think too poorly of yourself. You’re in good company.

Still, I know the questions that are on everybody’s mind:

Where do we go from here? And what strategies should we be taking to the market from here?