⚡What Just Happened?

Plus crypto & global markets, stablecoin yields, and more

Estimated Read Time: ~5 minutes

⚡In Today’s Edition

WTF is happening across global markets

Best ETH yields megathread

Jump Trading & other entities dumping ETH

A tool to help you avoid malicious links and keep your funds safe

📖 Recommended Reads

⚡Market Bloodbath: Here’s what happened

Jon Wu provides context for global markets

⚡Japan’s Nikkei 225 posts largest drop since Black Monday 1987

South Korea markets halted

⚡Volatility Index briefly sees 550% spike

VIX levels not seen since 2020 and 2008

Curated selection of ETH yields from The Calculator Guy

⚡Number of Bitcoin whales holding 1,000+ BTC is rising

Stacy Muur gives us a dose of hopium

⚡Kraken launches Labs, an experiment in 3D data visualization

Kraken unveils a new way to look at onchain data

Dynamo DeFi Referrals

⚡Refer your friends to Dynamo DeFi. Get rewarded.

💵Earn rewards for supporting the newsletter - get a helpful infographic with the best crypto tools after just one referral.

💵Refer 3 friends and get a full month of Dynamo DeFi Pro (the best place to make more money in crypto & DeFi) completely free.

💵Refer 15 friends and you’ll get six months of Dynamo DeFi Pro on us!

Hit the button to see our referral page and copy the link there to share with anyone & start earning rewards.

🔢On-Chain Analysis

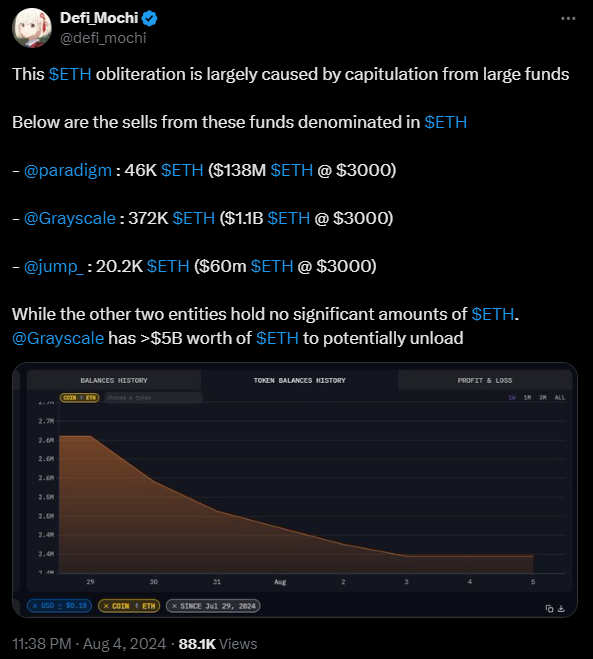

Is Jump Dumping ETH?

We know one thing for sure: Jump Trading, for the past few weeks, has been unstaking a lot of ETH - about $500M worth - and sending that ETH to exchanges.

The red circle on this chart is where Jump first began unstaking their Lido stETH.

Interestingly, Jump sent millions to exchanges this past weekend. Weekends are notorious for illiquid market conditions, so naturally there are questions surrounding the hastiness of the potential selling.

Current holdings suggest Jump is approaching the bottom of the barrel on their ETH holdings - about $6.5M of ETH left in Arkham’s tagged Jump wallet.

Paradigm also appears to be unwinding an ETH position.

🚜Farm of the Week

Stablecoin Yields on Drift Earn

Drift Protocol on Solana recently launched with several yield-bearing products including Insurance Fund Staking Vaults, Market Maker Vaults and even Super Staking.

How it Works

Earn 60% APR on USDC and over 100% APR on USDT using Drift’s Insurance Fund Vaults.

The yield comes from perp trading fees, borrowing APY and platform liquidations. Due to current volatility, these yields will likely change often.

The USDC vault is a favorite because it’s quite an impressive yield with over $15M in the vault. USDT yield is higher, but there’s less than $500k in the vault.

The rewards are paid out hourly in USDC.

Risks

Smart Contract Risk: Each vault operates through a smart contract, which could have vulnerabilities or bugs that might be exploited by attackers. To alleviate this risk, all of Drift’s contracts are heavily audited by top firms in the space.

Market Risk: In highly volatile markets, we could potentially see a high number of liquidations. If fees earned are unable to cover the losses from backstopping bankruptcies, stakers will be affected. Their stakes will be used to cover the bankruptcies, leading to losses on their end. However, Drift’s risk engine has been designed to alleviate this issue and has held up well in past situations.

Liquidity Risk: There’s a 13-day withdrawal period on IF Vaults, meaning that assets are locked and not immediately liquid should you wish to withdraw them. This could impact your decision to deposit and the size of deposits.

Top DeFi Yield Farms for August 2024

⚡Get Better at DeFi with Dynamo DeFi Pro

Take your crypto expertise to the next level with Dynamo DeFi Pro, the premium service designed to provide you insights into the on-chain economy and the knowledge to conduct your own in-depth research.

Dynamo DeFi Pro members get access to:

⚡Exclusive Discord Community - Engage in lively discussions on trading strategies, on-chain data and airdrop alpha. Learn more here.

⚡Live Community Calls & AMAs - Join 3X monthly live sessions with our community and get all your questions answered in real-time.

⚡Premium Newsletters & Curated Data Analysis - Receive actionable insights and special in-depth reports on tokens with strong fundamentals.

⚡In-Depth Pre-Recorded Videos - Watch comprehensive videos where I share my research process. View past videos here.

⚡Monthly Group Strategy Calls - Participate in exclusive monthly video calls to discuss market trends, the latest in crypto, and more. Access calls here.

Get ahead with Dynamo DeFi Pro, for just $11/month (less than the cost of lunch in most countries).

🛠️Tool Spotlight

Avoid Scams: Use DeFiLlama’s Directory

Today’s tool is simple, but one you’ll use every day.

Anyone who’s been scammed or had wallets drained knows it often happens by mistakenly clicking a malicious link. If you use Google to look up protocols, you are putting yourself in serious danger.

The easiest way to only use confirmed correct links is to use DeFiLlama’s Directory. Using the Directory means you can safely access thousands of protocols without creating bookmarks for each one.

Simply type in the protocol you’re looking for to pull up a trusted link.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

🗳️Prediction Pulse: Forecast the World Better

Prediction Pulse is a new newsletter launched by the Dynamo DeFi team about prediction markets.

On Tuesdays and Fridays, you get everything you need to know about the upcoming election, trending markets with the biggest moves, and our favorite prediction market picks to capitalize on🤝

Prediction markets, through which participants can place wagers on world events like elections, are one of the fastest growing crypto verticals. Join hundreds of subscribers and get critical updates on big markets.

📅Key Events This Week

Macro Events

📊15% of S&P 500 companies report earnings - All Week

📊S&P Global Services PMI data - August 5th

📊US 10-Year Note Auction - August 7th

📊Initial Jobless Claims data - August 8th

📊BOJ summary of opinions - August 8th

📊Atlanta Fed GDPNow data - August 8th

Token Unlocks

🔓TokenUnlocks: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓MODE (14.25%) - August 5th

🔓MAVIA (3.64%) - August 6th

🔓DYDX (0..68%) - August 6th

🔓HFT (3.11%) - August 7th

🔓GMT (2.09%) - August 7th

🔓ENS (0.94%) - August 8th

🔓IMX (2.11%) - August 9th

🔓FLR (5.61%) - August 9th

🔓XAI (6.91%) - August 9th

🔓WOO (0.71%) - August 10th

🔓IO (2.22%) - August 11th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 GRVT open beta testnet - August 5th (Source)

🚀 Conflux network upgrade - August 6th (Source)

🚀 Filecoin Waffle upgrade - August 6th (Source)

🚀 StarAtlas big airdrop - August 9th (Source)

🚀 Undeads game beta - August 10th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi