⚡What I Learned Advising a Crypto Project

The difference between investing and building

For the past 10 months, I’ve been closely advising a DeFi project.

The project, Clip Finance, is an automatic yield optimizer, which is building infrastructure for multi-strategy vaults. As an advisor, I’ve been helping them to craft DeFi strategies and design marketing campaigns.

Although I’ve been investing in crypto in one form or another since 2017, this is the first time I’ve worked directly with a project.

Working with the Clip team transformed my perspective on the crypto market.

What is Clip? 📎

More about Clip for context:

Clip Finance is an automatic yield optimizer, which features vaults that use multiple DeFi strategies.

Clip recently joined the Chainlink Build program, in which Chainlink is helping them build and grow.

Clip is also launching an accompanying NFT project. To start, NFT-holders will receive all yield from locked governance tokens. Holders will compete in a gamified competition called the Yield Wars to earn highly boosted yields.

By the way, if you’re interested in Clip, the first way to get involved in the Clip ecosystem will be through their NFT mint.

What did I learn from working with Clip? 💡

I’m sharing all of this with you because contributing to a project changed how I invest. Here are a few key learnings:

Strong Teams Figure It Out

The past year had it’s share of challenges for the crypto market (an understatement). For new projects, this was an existential crisis.

Clip is bootstrapped. That means they didn’t have a massive war chest to weather the storm. But they did have something that was arguably better: a highly experienced team.

Clip has 3 co-founders:

Mikk - Founder of a tax and legal consultancy, where he registered over 70 crypto companies, founder of a tokenization platform, and founder of 2 affiliate marketing companies.

Artur - Co-founder and COO of Paxful, the largest peer-to-peer Bitcoin marketplace.

Alex - Built an AI startup to scout models, won first place in the Chainlink hackathon, and led the dev team for a DEX with $33M in TVL.

The market is going to throw things at your project that force you to deviate from the original roadmap. But if you have the right people on-board, challenges can turn into opportunities.

Key Takeaway: In the future, I’ll place more emphasis on the team behind projects.

Pivoting Based on Your Strengths is Good

In the past, I was skeptical of projects that pivoted.

Clip was originally conceived as a stablecoin yield optimizer that would facilitate mass adoption by allowing anyone in the world to easily access DeFi yields.

But as they built out the on-chain infrastructure for this, the team realized something: that infrastructure could be used for a lot more than just stablecoin yields:

LSTs

Multi-strategy vaults

Cross-chain vaults

They’re still launching the stablecoin vault as their MVP, but now their plan is use the on-chain Strategy Router they built as infrastructure for much more.

Key Takeaway: When projects pivot, look at whether the pivot fits with their core strengths and increases their value-potential long-term.

Build for Both Your Current and Future Customers

Like most of you, I’m extremely interested in what will bring mass adoption to crypto. Whether it be gaming or payments, the upside to onboarding millions of users will be enormous.

There’s one problem: with the UST, Celsius, and FTX collapses, most of the world is skeptical of crypto right now.

Because of that, your current customers are likely to be crypto native. Even if you’re building for millions in the future, today you still need to attract thousands of DeFi power-users.

Clip’s solution is to launch a gamified NFT competition called the Yield Wars.

This will be the first way to enter the Clip ecosystem and offer opportunities for both passive yield and highly boosted gamified yield. The NFTs work like this:

7% of the CLIP token supply will be airdropped to NFT-holders, 3% will be allocated to the Yield Wars prize pool, and 90% will be locked.

The locked tokens will earn yield from Clip’s stablecoin optimizer and 100% of that yield will go towards NFT stakers.

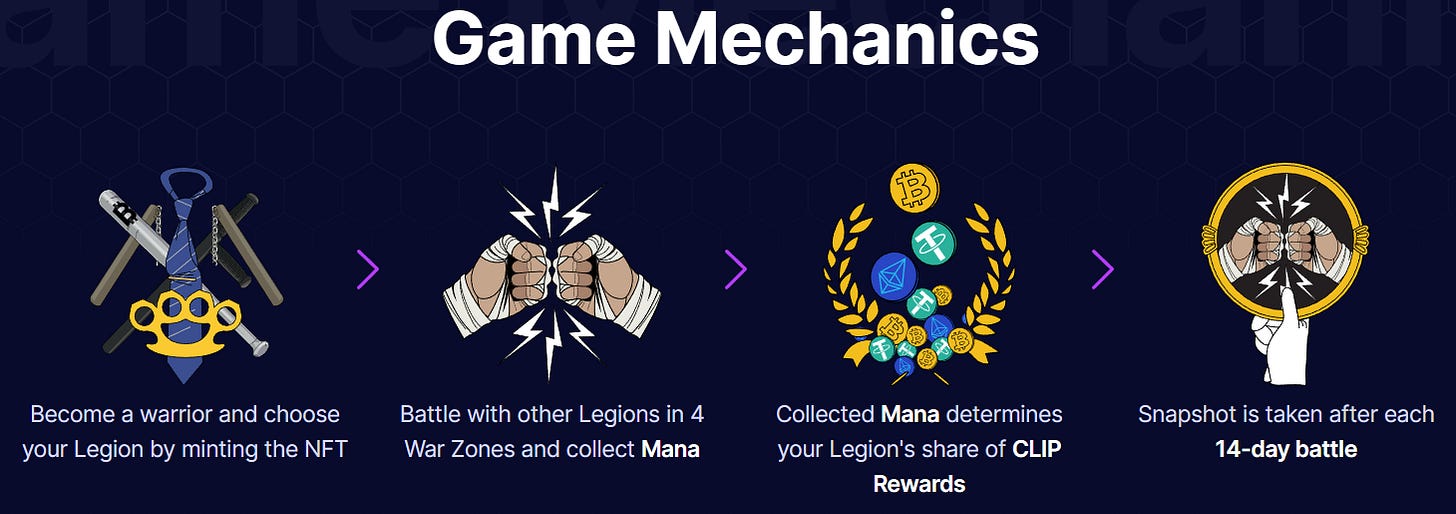

All Clip NFTs will earn yield, but to earn boosted yield you can join one of 10 “Legions” and complete tasks to collect Mana.

Every 14 days, the yield will be distributed, with Legions that collected more Mana receiving more yield.

What’s the point of this?

Stablecoin yield is great, but isn’t as exciting to the yield-chasing degens that make up much of the crypto market today

This gives those risk-seekers a way to participate in the ecosystem with high, boosted yields

Key Takeaway: In the future, I’ll look for projects that have a large total addressable market, while still appealing to today’s crypto users.

Hope you enjoyed this different sort of post.

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi

Thanks for sharing this patrick.

I also enjoyed your on-chain analysis guide