USDC Depeg, DEX Volume All-Time High, and More

7 Highlights from the World of Digital Assets

This week was one for the crypto history books. USDC, long considered by many to be the safest stablecoin, depegged below 90 cents before recovering over several days. Here are the 7 most interesting things in digital assets I came across this week.

In this issue:

What happened to USDC?

DEX volume hits an all-time high

TUSD, DAI, LUSD, and USDT supplies explode

Silicon Valley Bank explained simply

Arthur Hayes Proposes NakaDollar Stablecoin

DefiLlama browser extension takes Etherscan to the next level

Thread of threads on finding alpha

What Happened to USDC?

It should be no surprise that the most notable events of the week surrounded the depeg of USDC and other stablecoins. This chart from CoinGecko is a stark reminder that in crypto anything can happen:

This is the best thread I’ve found that breaks down the entire situation start-to-finish, with a fair assessment of the different views on the depeg:

DEX Volume Hits All-Time High

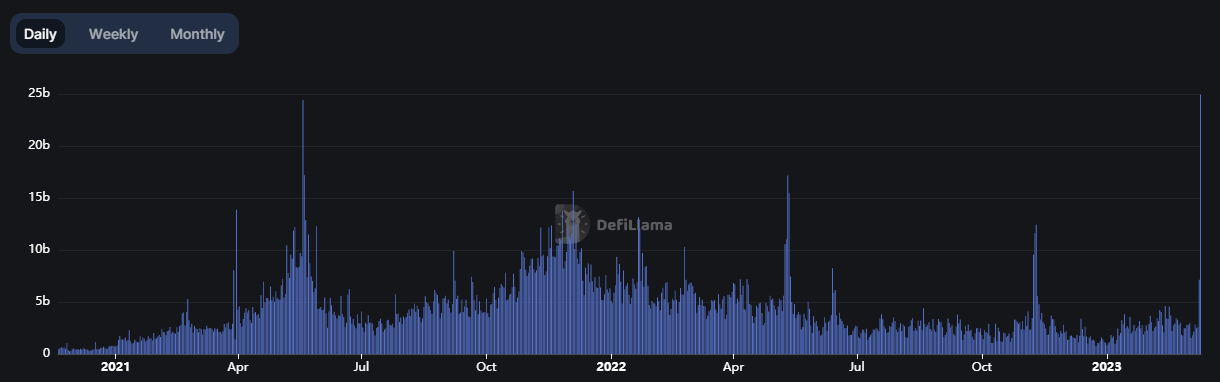

The day that USDC broke below 90 cents saw the highest DEX volume EVER, exceeding the FTX collapse, UST collapse, and May 2021 peak.

Curve in particular saw a massive volume spike, up 50X from a few days prior.

TUSD, DAI, LUSD, and USDT Supplies Explode

The USDC depeg along with concerns about its future viability pushed many investors to seek safety in other stablecoins. This pushed the supply of other stablecoins higher, with TUSD supply rocketing up 78%.

In a turn of events that would have shocked investors of the past, stablecoin holders fled to the safety of USDT. Total USDT circulating hit its highest point since May of 2022.

Silicon Valley Bank Explained Simply

I try to keep this newsletter focused on digital assets. But understanding the macro situation, especially as it relates to Silicon Valley Bank, is critical to understanding the crypto market this week.

This thread by Genevieve Roch-Decter explains how rising interest rates created a duration mismatch for SVB and other banks. Read this to understand why so many bank stocks are down over 50% in the past week.

Arthur Hayes Proposes NakaDollar Stablecoin

In response to increased regulation and fears of crypto off-ramps being shutdown, Arthur Hayes, founder of BitMex, proposed a crypto native stablecoin called NakaDollar.

Each NakaDollar would be backed by $1 of BTC and a 1X short on BTC to maintain a delta-neutral position. While this stablecoin would still rely on centralized exchanges, it could, in theory, reduce crypto’s dependence on traditional finance.

DefiLlama Browser Extension Takes Etherscan to the Next Level

The DefiLlama team continues to ship. This week they launched a browser extension that adds useful (and fun) tags to millions of Etherscan wallets. The extension also verifies real DeFi sites to help prevent scams.

Thread of Threads on Finding Alpha

DeFiMinty compiled 23 threads on how to find your own alpha. These threads teach everything from on-chain analysis to whale tracking to narrative prediction.

That’s all for this week. For more frequent content, follow me on Twitter, YouTube, and Instagram.

Until next time,

Patrick Scott

Dynamo DeFi