⚡Two Chains Dominating Right Now

Determining if crypto is cooked, Bitcoin DeFi overview and an ETF flow surprise

Read Time: ~5 minutes

⚡Snapshot

Ready to put $7T onchain?

5th consecutive week of ETF inflows

Is crypto cooked? It’s not over yet

APY + points farming on Solana

📖 Recommended Reads

Despite current sentiment, there’s a lot to look forward to in 2025

⚡What’s interesting in BTC DeFi?

Complete ecosystem overview featuring 40+ projects

⚡How Arcdotfun’s AI agent framework compares to the competition

Delphi breaks down Arc’s unique architecture & advantages

⚡Elon Musk and Brian Armstrong propose putting all US spending onchain

What nearly $7T of spending would look like onchain

⚡Despite volatility, Bitcoin saw its 5th consecutive week of ETF inflows

ETH overshadowed BTC with $800M in inflows

⚡Thursday Pro Call: Real World Assets Coming Onchain

Institutions are rushing to put assets onchain - from US Treasury bonds to real estate.

This month's research presentation covers the complete RWA landscape:

Current state of institutional adoption

Breaking down top RWA protocols

Key infrastructure developments

Risk considerations that matter

Join us THURSDAY February 13th (5:30PM EST) for an extensive breakdown of the RWA market and where to find the best opportunities.

Pro Members: Bring a friend, RSVP coming your way tomorrow.

Sovereign Members: Submit questions ahead of time for dedicated research slides

Can't make it live? Join Pro now for instant access to the recording + slides →

🔢Onchain Analysis

Chains Leading 30d TVL Growth

Solana

Despite Solana’s plunge in price from $280+ to below $200, TVL is still up 12% over the last 30 days.

TVL denominated in SOL tokens continues it’s trend upward, and is sitting at all-time highs.

Major Solana protocols like Jito, Kamino & Jupiter are seeing TVL growth across multiple timeframes.

Raydium and Solayer are the only protocols in the top 10 with reductions in TVL over the last month.

A better measure for Raydium (top DEX on Solana) is fees & revenue. Over the last 7 days Raydium earned more fees than nearly any other dApp on Solana.

Sonic

Sonic’s recent hyped launch, airdrop incentives program and flurry of daily announcements & partnerships on X are attracting capital to the chain.

Over the past 30 days, TVL on Sonic doubled and the chain entered the top 20 on DefiLlama.

Many protocols on Sonic are branching out from other chains, but native Sonic protocols like SwapX, Shadow and Rings are growing rapidly.

While Bitcoin continues to trade around $100k, fundamentals are improving on certain chains - if you know where to look.

🚜Farm of the Week

Liquid Restake JitoSOL for Yield & Points

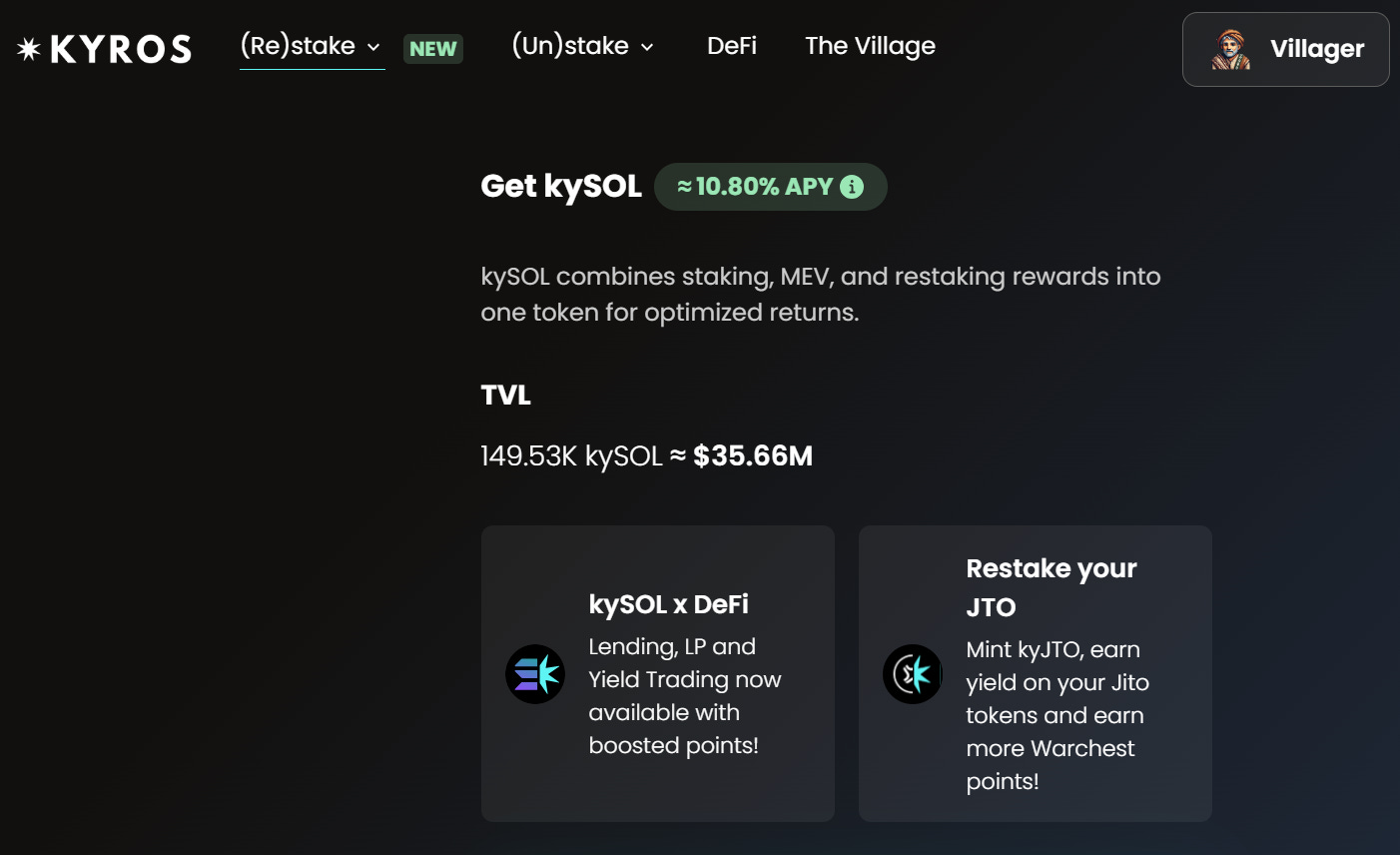

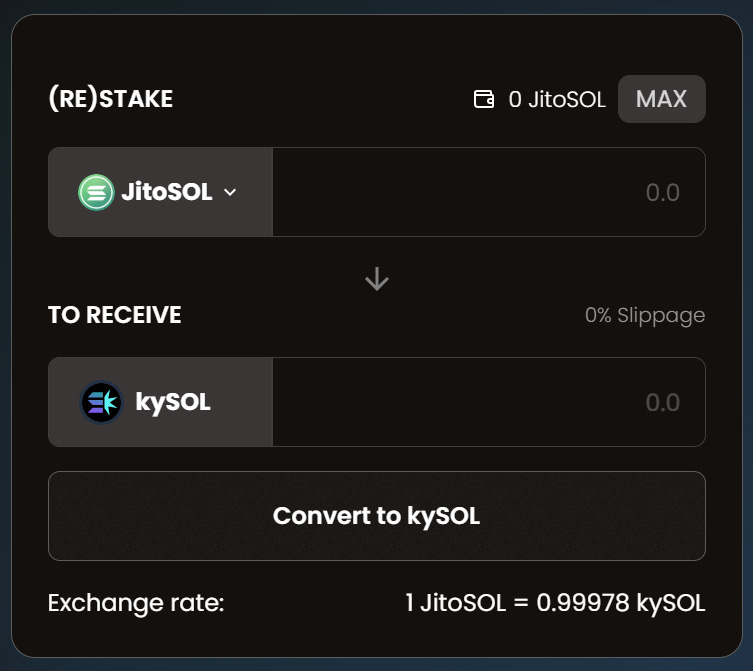

Kyros, a liquid restaking platform on Solana, is offering nearly 11% yield on JitoSOL and a thoughtful rewards program.

How it Works

It only requires a few clicks. Head to Kyros and connect your wallet in the top right corner. Enter the amount of JitoSOL you’d like to provide and click Convert to restake your JitoSOL.

If you don’t have JitoSOL, you can provide SOL instead.

After converting, you’ll begin earning yield and also begin your journey into the realm of Kyros.

The goal is to level up your character, and there are specific quests designed to help you do that.

Some of the quests include using kySOL in Solana DeFi, which earns points directly in addition to leveling up your character.

Risks

Is Crypto Cooked? It Still Isn’t Over

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

Curate Your DeFi Hub with LlamaFeed

LlamaFeed is a customizable hub for onchain activity - get prices, exchange volumes, upcoming unlocks, Polymarkets and claimable airdrops.

You can shuffle & resize the information feeds to suit your preferences, and each feed is interactive, so you can go straight to the source.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Trump's reciprocal tariff announcement - February 10/11th

📊 Fed chair Powell testifies - February 11/12th

📊 US CPI data - February 12th

📊 US PPI data - February 13th

📊 20% of S&P 500 companies report earnings

Token Unlocks: $300M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓APT (1.97%) - February 10th

🔓AXS (0.51%) - February 11th

🔓DYDX (0.57%) - February 11th

🔓IO (2.38%) - February 11th

🔓ATH (10.21%) - February 12th

🔓UXP (1.65%) - February 12th

🔓CYBER (2.94%) - February 12th

🔓PSP (0.83%) - February 14th

🔓APE (0.73%) - February 14th

🔓SAND (8.41%) - February 14th

🔓XCN (0.91%) - February 15th

🔓SEI (1.25%) - February 15th

🔓STRK (2.48%) - February 15th

🔓ARB (2.13%) - February 16th

🔓ZETA (1.36%) - February 16th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Injective protocol to launch on-chain S&P 500 index - February 10th (Source)

🚀 Vaiot DDRS module 2 beta launch - February 12th (Source)

🚀 Lumia prism mainnet - February 15th (Source)

🚀 Layer1X staking feature launch - February 15th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi