⚡Top Solana Airdrops & DeFi Strategies Right Now

Plus the Trillion Dollar Crypto Opportunity

Estimated Read Time: ~4 minutes

⚡Snapshot

This week I share some promising Solana opportunities and how to capitalize on them. Overall, Solana’s ecosystem continues to shine as TVL crosses all-time highs. More data below. Also included is a way to track top holder activity in memecoins, and a bullish case for the fastest growing DeFi product in history.

📖 Recommended Reads

⚡Solana DeFi & Airdrop Strategies for October

Projects on my radar this month

⚡Coingecko Q3 Crypto Industry Report: Top 7 Highlights

How Bitcoin did against major asset classes, ETH layer 2 transactions, and the dominant chain for DEX trading

⚡Bitcoin has never made a new monthly low after this October day

October 12th is the historical beginning of Uptober: 10 years of analysis

0xGumshoe makes a SUI➡️SOL comparison, and lightcrypto talks material selling

⚡Ethena: the trillion dollar crypto opportunity

Bullish case for the fastest growing DeFi product in history

⚡Find the Next Big Thing in Crypto Before it Goes Mainstream

Get more upcoming airdrops & DeFi strategies on my YouTube channel.

🔢Onchain Analysis

Solana TVL Breaks All-Time High

It’s been a long road, but Solana finally broke the previous TVL ATH from November 2021 and is now approaching $12.3B.

Solana chain volume throughout 2024 dwarfs activity since the previous all-time high and all of 2022-23.

Last week, TVL denominated in SOL tokens crossed the previous all-time high set in June of 2022.

This is an indicator of strong chain growth. Solana’s fundamentals are improving: Solana’s TVL growth comes not solely from SOL token price appreciation but from more capital entering the Solana DeFi ecosystem.

There are now six protocols built on Solana with over $1B in TVL.

🚜Farm of the Week

🪂Jupiter Liquidity Provider (JLP) Pool

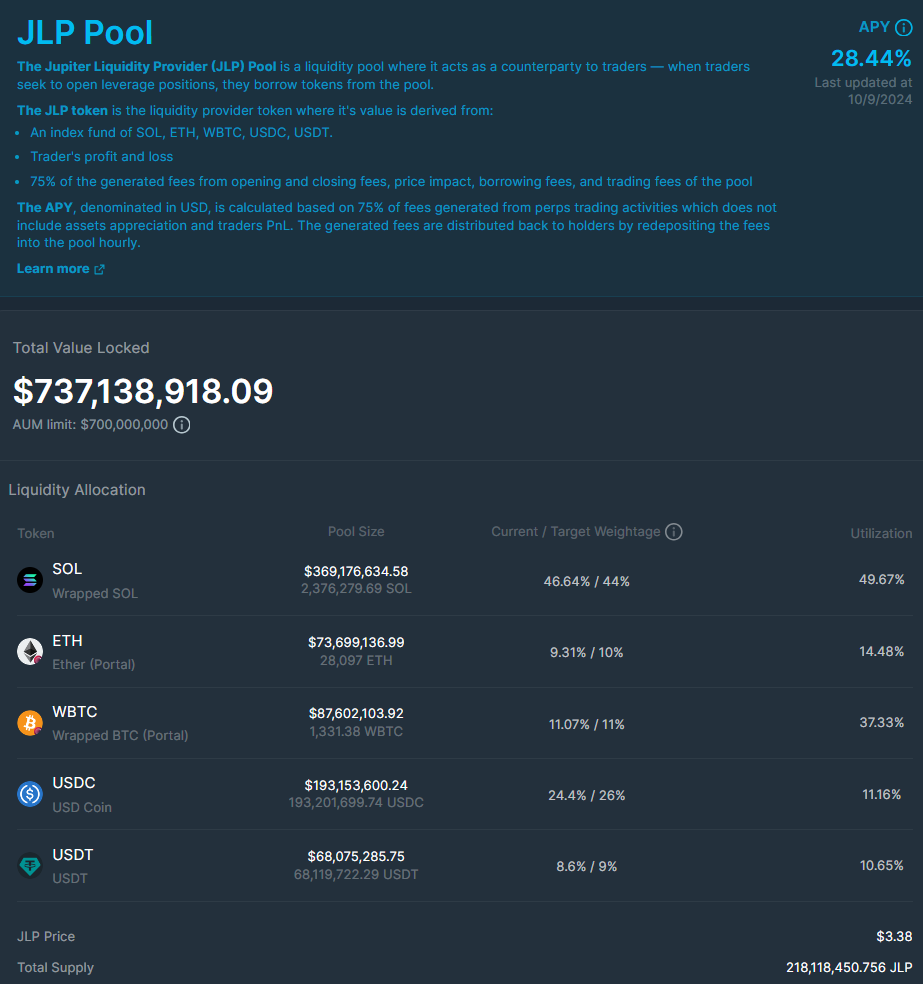

Jupiter is one of the hottest protocols in crypto. It’s an all-in-one stop for DeFi activity on Solana with over $1.3B in TVL. The JLP token is a yield-bearing liquidity pool powering Jupiter’s perp DEX.

How it Works

The JLP token is a combination of:

An index fund of SOL, ETH, WBTC, USDC & USDT - a great way to earn yield while maintaining exposure to upside from major tokens.

The total value of Jupiter Perp traders PnL

75% of Perp trading fees, leading to a yield for token holders

The yield fluctuates anywhere from 20% to over 100% APY, and changes depending on trading activity and trader performance.

To purchase JLP, simply swap for the JLP token on Jupiter Spot Swap.

🪂 Potential airdrop opportunity: Jupiter will be airdropping to their community members in the coming months (most likely January, dubbed “Jupuary” last year). There’s reason to believe JLP holders, in exchange for providing liquidity, will be rewarded.

For more Solana DeFi opportunities, check out my Solana DeFi Handbook.

Risks

Concerns surrounding WBTC’s recent ownership change

You’re betting against traders - if traders have a big win on leverage, winnings come from the liquidity pool.

How to Track Memecoin Top Holder Activity

⚡Get Real-Time DeFi Alerts

Be the first to know when a chain is growing or a protocol sees critical activity so you can act early.

Join the Dynamo DeFi Discord and get alerts sent straight to you.

🛠️Tool Spotlight

Find Trending Apps with DappRadar

DappRadar has a wide selection of dapps, DeFi projects, games & NFT collections paired with essential data - usage statistics, volume and more.

Use DappRadar to find top trending contracts, and head to the Rewards tab to find data on the latest airdrops: the estimated airdrop date, the likelihood of the airdrop, the actions required to qualify, and how many users are participating.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 OPEC Monthly Report - October 14th

📊 September Retail Sales data - October 17th

📊 Philly Fed Manufacturing data - October 17th

📊 September Housing Starts data - October 18th

📊 11 Fed Speaker events this week

📊 ~10% of S&P 500 companies report earnings

Token Unlocks

🔓TokenUnlocks: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓 CYBER (3.81%) - October 14th

🔓TAIKO (14.99%) - October 14th

🔓AXS (6.08%) - October 14th

🔓EIGEN (6.01%) - October 15th

🔓STRK (3.30%) - October 15th

🔓ARB (2.56%) - October 16th

🔓APE (2.31%) - October 17th

🔓PRIME (1.57%) - October 17th

🔓PIXEL (7.05%) - October 19th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Tectum partnership to launch stable coin- October 13th (Source)

🚀 Deep token launch on SUI- October 14th (Source)

🚀 Unichain roadmap release - October 14th (Source)

🚀 Dusk mainnet launch - October 15th (Source)

🚀 Trump token launch - October 15th (Source)

🚀 Monochrome first ETH ETF launch in Australia - October 16th (Source)

🚀 Zero1Labs cypher testnet launch - October 20th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi