This Skill Made DeFi Click for Me

Highlights from the World of Digital Assets

I struggled a lot with DeFi when I first started.

I was always a step behind narratives, buying coins after they had already pumped. I would see people get into DeFi projects early and wonder how they knew which projects would take off.

I distinctively remember BNB going from $50 to $300 in 2 weeks and the entire BSC ecosystem exploding...

How did people know that the Binance Smart Chain would take off when it did? How could I learn to predict that myself?

The answer: on-chain analysis.

On-chain analysis can tell you:

What whales are buying

Which chains people are bridging to

Which DeFi tokens have strong fundamentals

Tools like DefiLlama and Etherscan allow me to make decisions based on numbers and data.

Here are a couple strategies:

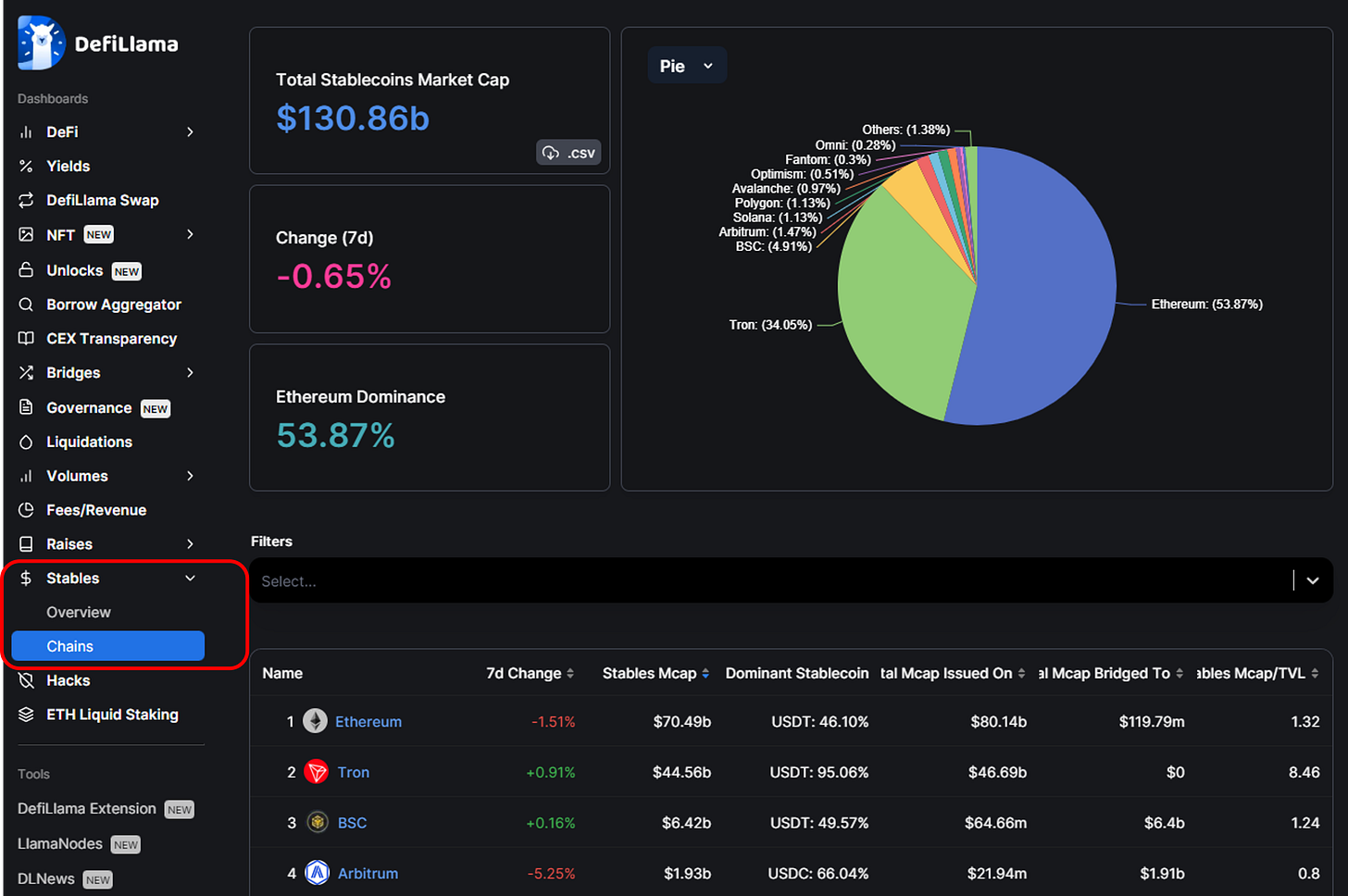

1. Tracking stablecoin flows on DefiLlama

It’s simple: new money is a sign of a growing, healthy ecosystem.

Since January, I’ve been heavily sharing information about the Arbitrum ecosystem. While everyone else was arguing about whether users were real or airdrop hunters, I focused on the numbers. And the numbers said that new money was entering the ecosystem.

To view stablecoin flows by chain go to DefiLlama > Stables > Chains

2. Tracking whale wallets

With blockchain scanners, it’s possible to identify wallets of whales and smart money and see what they’re holding. One simple strategy I use goes like this:

Find a coin that pumped recently. In this example, we’ll use KWENTA.

Look at top holders that bought it early. Using the page for KWENTA on the Optimism blockchain explorer, I found this address, which is one of the largest holders of KWENTA (NOTE: Be sure to confirm that they bought before the token pumped):

I then go to DeBank, to check that individual’s holdings across all chains. There, I see they hold RDNT and various NFTFi projects as well:

This isn’t enough to invest on its own. But it is enough to add these coins to a research list.

These two strategies just scratch the surface of what is possible with on-chain analysis. True mastery of on-chain analysis is what separates elite crypto analysts in my view.

That’s all for today. For more frequent content, follow me on Twitter, YouTube, and Instagram.

Until next time,

Patrick Scott

Dynamo DeFi