⚡️This DEX Quietly Dominated May

BSC & PancakeSwap posted record-breaking volume, fees, and payouts. Barely anyone noticed

Read Time: ~4 minutes

⚡Snapshot

The DEX & chain quietly crushing

74% yield on SOL

Bull case for Circle’s upcoming ICO

📖 Recommended Reads

Will the last 15 years of US asset purchases reverse?

⚡Is the “Bitcoin for Corporations” bubble over?

Why this is different than the average euphoria cycle

Who captures value in crypto?

⚡Bull Case for Circle’s Upcoming IPO

Potential path to $30b market cap

Season 3 claims portal now open

⚡Follow Dynamo DeFi on X

Get daily onchain updates & insights, the latest news and analytics.

🔢Onchain Analysis

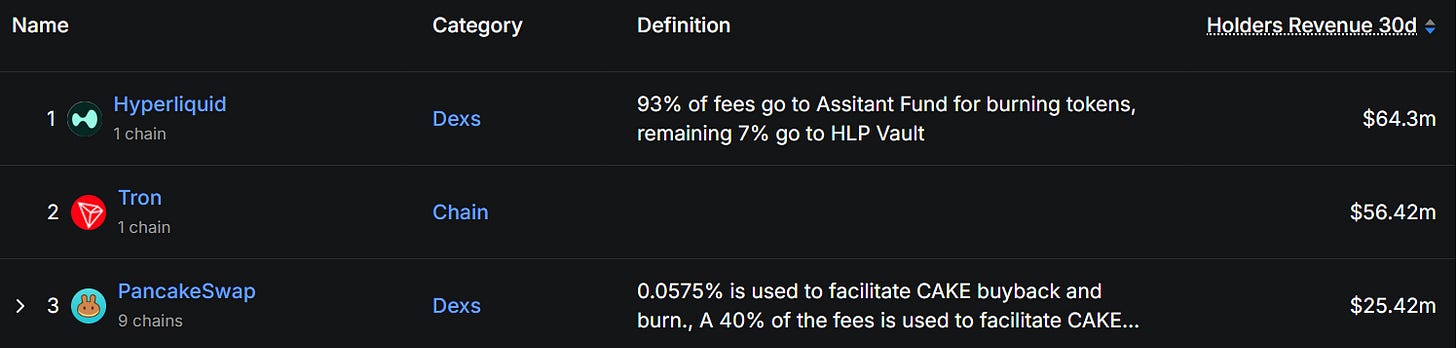

BSC & PancakeSwap Lead Record-Setting Month of Activity

May was a strong month for onchain activity. DEXs facilitated $475b of volume, the second highest month of volume ever.

Binance Smart Chain (BSC) had more volume over the last 30 days than Solana & Ethereum combined. BSC also has a stablecoin market cap of $10b, just shy of Solana’s $11b.

PancakeSwap, a BSC DEX with $1.6b in TVL, facilitated 93% of BSC’s volume, totaling $174b.

It should be noted that a sizable portion of PancakeSwap’s volume has been from the ZKJ token recently.

However, regardless of its source, this activity earned PancakeSwap $130m in fees over the last 30 days and $32m in revenue.

PancakeSwap fees earned are used to buyback and burn CAKE tokens. Thanks to PancakeSwap’s huge month, the DEX passed $25m to token holders.

With all the attention on Solana & Hyperliquid, this record-setting month for BSC & PancakeSwap flew under the radar.

🚜Farm of the Week

Earn 74% on SOL-USD Through Orca

With SOL’s recent volatility, liquidity providers are earning elevated yield. On Orca, a major Solana DEX, liquidity providers can earn 74% APY.

How it Works

Head to the pool on Orca, connect your wallet (you can use most major wallets) and deposit SOL & USDC by clicking Deposit.

The biggest risk of the range we selected in the screenshot above is the price of SOL dropping below 140, where this position would no longer earn yield.

Risks

Risk level: Medium

Impermanent loss - use the Impermanent Loss Calculator here

How to Analyze Crypto Fundamentals with DeFiLlama

⚡Get the Signals Before the Rest of Crypto Does

You don’t need more noise. You need timely data.

Pro members get real-time alerts on volume spikes, money flows, and chain activity before they trend.

Start Getting Real-Time Alerts →

🛠️Tool Spotlight

DefiLlama Metrics Dashboard

DefiLlama’s new metrics dashboard lets you rank protocols or chains by specific metrics.

Clicking on the banner shows popular metrics for thousands of chains or protocols, and ranks them for you.

Give it a try at defillama.com

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 May ISM Manufacturing PMI data - June 2nd

📊 Fed Chair Powell Speaks - June 2nd

📊 May ADP Nonfarm Employment data - June 4th

📊 Initial Jobless Claims data - June 5th

📊 May Jobs Report data - June 6th

Token Unlocks: $180m Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓ENA (0.7%) - June 2nd

🔓ORDERLY (47.62%) - June 2nd

🔓CETUS (1.15%) - June 2nd

🔓STADER (2.27%) - June 4th

🔓IMX (1.89%) - June 6th

🔓GMT (2.97%) - June 8th

🔓ENS (2.82%) - June 8th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 EDGEN airdrop - June 2nd (Source)

🚀 Yieldnest TGE- June 3rd (Source)

🚀 CoW protocol new mechanism release - June 3rd (Source)

🚀 Spectre AI screener (Beta) - June 6th (Source)

🚀 Fly TGE - June 6th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi