⚡This Chain's Incentives Program is Attracting Capital

Investigating ZKsync's incentives program, local market tops and bull market peak signals

Read Time: ~5 minutes

⚡Snapshot

Frontier ideas for 2025

ZKsync’s 300M Ignite token incentives

Local market tops and what it means moving forward

Use the DeFi Chain Fees Dashboard to see what chains are seeing real activity

📖 Recommended Reads

The next wave of frontier innovations in crypto

⚡Everything is Fine with DeFAI

DeFAI sectors holding up & growing

⚡Solana tops charts across the board

The L1 leads or is the runner up in most metrics

⚡Local Tops: what makes the market go up and down

Flows, wealth compounding, and where we are now

⚡Azuki unveils ANIME tokenomics

50% community allocation

⚡North Dakota & New Hampshire introduce digital asset treasury legislation

“The state that is last to build Bitcoin reserves will lose” — New Hampshire Rep. Keith Ammon

⚡No-fluff toolkit for serious onchain traders

I built the Onchain Academy to be the resource I wish I had.

In less than 3 hours, you’ll be able to:

Track smart money flows before they trend

Spot undervalued gems using on-chain metrics

Find the next big airdrops using real data

Analyze protocols like a professional

Skip the expensive lessons. Get instant access to my complete framework →

🔢Onchain Analysis

ZKsync’s Incentives Attract Inflows

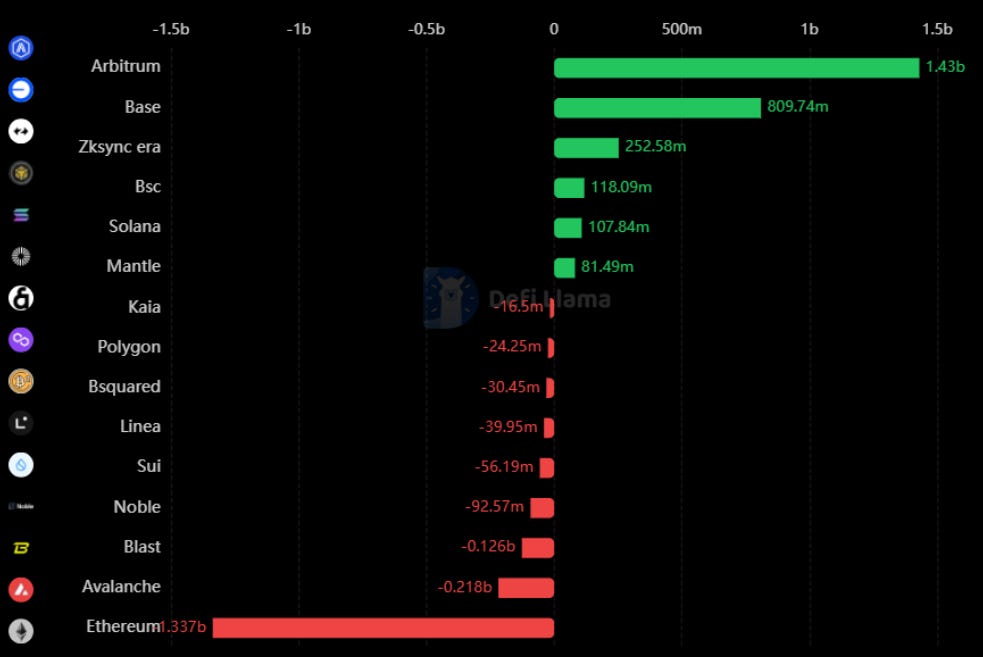

Over the last few months, we saw Solana, Base and Arbitrum dominate net flows. The picture looks different today - Arbitrum and Base still lead the way, but ZKsync saw $250M in net flows over the last 30 days.

ZKsync launched its Ignite incentive program, which is a 300M ZK token stream to DeFi users over 9 months. The tokens are rewarded to users who provide liquidity for token pairs, supply to lending markets and trade on specific protocols.

15 protocols are selected for Season 1 (Jan 6th-Mar 31st). Here’s the list of participating protocols and rewards.

The program is increasing onchain activity. Despite broad market drawdown, ZKsync’s 7D TVL is up over 50%.

ZKsync DEX volume is up 150% since October, but still down almost 90% from the airdrop frenzy peak in February 2024.

🚜Farm of the Week

ETH-USDC on Cetus

If you’re holding ETH, you can get over 200% APR providing liquidity on Cetus.

This pool earns rewards from trading fees and is also receiving additional mining rewards, paid out in SUI tokens.

How it Works

If you haven’t used Sui yet, you can create a Sui wallet using Suiet. Phantom is also integrating Sui into their wallet soon.

To begin providing liquidity, connect your wallet to Cetus and select a liquidity provision range. The ‘Active’ range is still quite wide, so we can do a Custom range.

If ETH falls 15% or rises 30%, you’ll be earning fees on swaps across the entirety of that price range. This asymmetric price range also means we’re providing more ETH than USDC, so we don’t have to tie up too much of our precious USDC.

Enter how much ETH-USDC you’d like to provide, and confirm - you’ll receive a prompt to confirm in your wallet. Once approved, you’re good to go.

You’ll earn fees when swaps are made within your liquidity provision range.

Risks

If price moves out of your liquidity range, you won’t earn fees. Keep an eye on prices and adjust if necessary.

The Ultimate Guide to AI Agents in Crypto

⚡AI Agents: What’s Next?

In last week’s Pro Call, we highlighted:

6 Solana airdrop opportunities

How to think about AI Agents

DeFAI upcoming projects

What the Trump admin means for crypto

The Dynamo DeFi Pro Call is a comprehensive research report I present live to Pro Members.

Along with the report, you’ll also get regular custom research from me, a private Discord with weekly community calls and member-only market videos.

🛠️Tool Spotlight

Bull Market Peak Signals from Coinglass

Bull Market Peak Signals is a dashboard tracking major data-based top signals.

The dashboard updates daily and compiles the result - currently, none of the top signals have been triggered.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Federal budget balance - January 13th

📊 December Core PPI Inflation data - January 14th

📊 December Core CPI Inflation data - January 15th

📊 Philly Fed Manufacturing Index - January 16th

📊 7 Fed Speaker Events this week

Token Unlocks: $2.6B Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓STRK (2.65%) - January 15th

🔓SEI (1.32%) - January 15th

🔓ARB (2.20%) - January 16th

🔓 PRIME (1.42%) - January 17th

🔓APE (2.16%) - January 17th

🔓QAI (4.79%) - January 18th

🔓ONDO (134.21%) - January 18th

🔓UXLINK (15.63%) - January 18th

🔓CLOUD (27.18%) - January 18th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Nosanna mainnet launch - January 14th (Source)

🚀 DRV launch - January 15th (Source)

🚀 Mintlayer v.1.0.0 launch - January 15th (Source)

🚀 Puffer season 2 launch - January 16th (Source)

🚀 Human AI private beta launch - January 16th (Source)

🚀 Raven quest mobile launch - January 16th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi

Great as always