⚡These protocols could bring trillions to crypto

Chainlink's CCIP, MakerDAO's master plan, RWAs, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

Quick note that I changed up the format this week. Based on popular feedback, I’ll now show the “Trends and Narratives” section first and “On-Chain Analysis” second.

📈Trends and Narratives

Is Chainlink the bridge to traditional markets?

Chainlink is back in the spotlight and attracting attention from some unlikely corners. Following Chainlink’s successful launch of their Cross-Chain Interoperability Protocol (CCIP) and SWIFT’s confirmation that they tested CCIP successfully, anticipation is mounting that traditional financial institutions will use Chainlink to tokenize assets.

In a July interview, Chainlink founder, Sergey Nazarov, described his vision as to create the “TCP/IP of finance.” If successful, this would mean that CCIP became the standard for TradFi and DeFi alike to exchange tokenized assets.

So far, there seems to be interest on the part of financial institutions. ChainLinkGod describes Chainlink’s presence at Sibos this year:

Chainlink’s timing on this is perfect, as “real world assets” begin to take center stage in DeFi (more on this below). Tokenizing the world’s financial assets will require secure standards and infrastructure. For now, at least, it seems that Chainlink has a fighting chance of being that infrastructure.

MakerDAO’s master plan takes shape

For the past few years, MakerDAO has been quietly building. Recently two of their new products have gained steam:

On-chain yield from US Treasuries

SubDAOs

Maker cofounder, Rune, describes SubDAOs as “small, fast, independent and specialized DAOs that can grow and experiment in parallel” and details all the new products they’re rolling out.

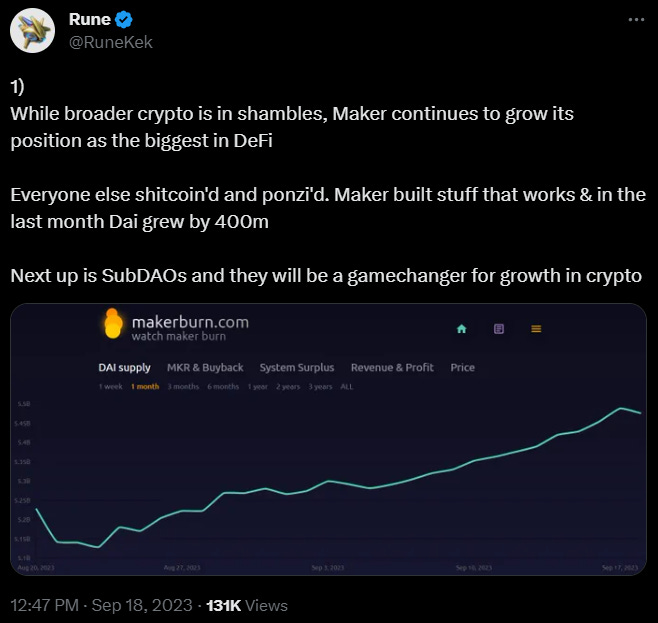

Enhanced yield on DAI through Spark Protocol, one of Maker’s SubDAOs, has also pushed the DAI supply higher recently. Thor Hartvigsen breaks down the numbers and revenue projections.

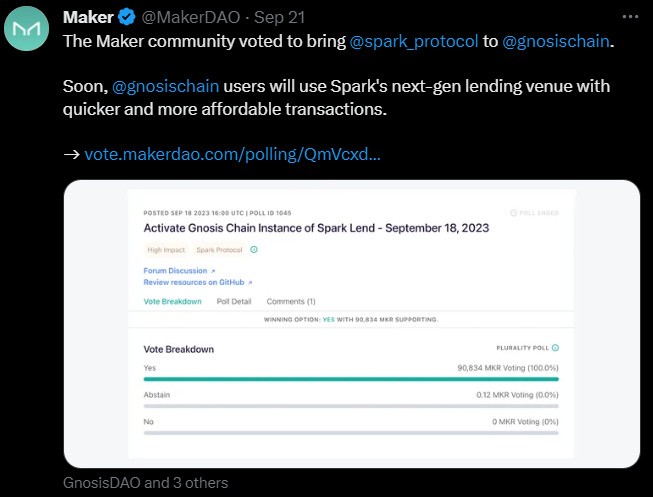

MakerDAO also began to go cross-chain this week, voting to deploy Spark Protocol on Gnosis Chain. This begins MakerDAO’s move from an Ethereum DeFi protocol to a core piece of DeFi infrastructure.

⚡Become a Better Crypto Investor

I’ve turned on paid subscriptions for this newsletter. The paid version of Dynamo DeFi, which I’ve dubbed Dynamo Research, will teach you to be a better crypto investor and give you deeper insight into which investments I’m personally looking at.

Premium subscribers get:

⚡NEW Discord to discuss on-chain data and trades. Based on feedback, I’ve commissioned a private Discord for paid newsletter subscribers. This should be ready within 1-2 weeks.

⚡Exclusive weekly newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more.

🔢On-Chain Analysis

Liquidity flows to Real World Assets

Tokenized real-world assets (RWAs) and infrastructure for them were among the top on-chain performers this week. Despite this sector already growing substantially year-to-date, it’s only scratched the surface of its total addressable market so far.

Some top performers this week:

Ondo Finance, a protocol for tokenizing US Treasuries, was up 20% in TVL this week.

TVL on Tangible, a protocol for issuing real estate backed stablecoins, was up 3% this week, although is still below its all-time high.

TVL on PearlFi, a DEX for RWAs, was up over 8% this week.

One subsector to watch closely here are protocols building infrastructure for RWAs (PearlFi (risky!), MakerDAO, Chainlink, and Avalanche for example). If RWAs succeed, then the picks-and-shovels plays that become industry standard will be big winners.

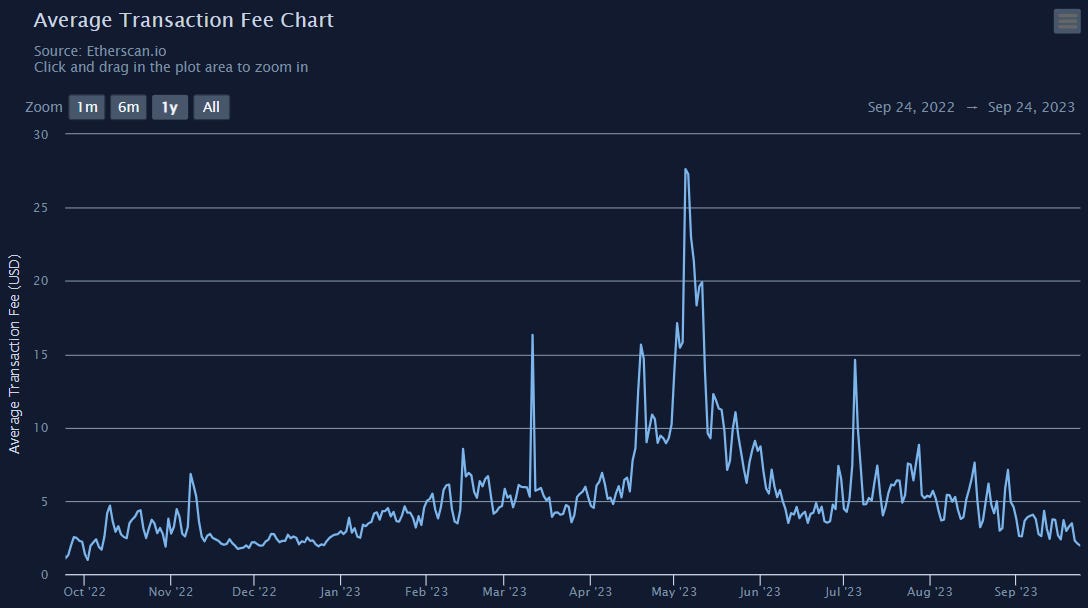

Ethereum fees hit yearly low

Ethereum daily fees hit their lowest point since December 2022 this week. This is a sign that on-chain activity continues to be slow; however, this doesn’t tell the entire story. Since last year, Ethereum Rollups have scaled significantly, now processing almost 6X as many transactions as Ethereum mainnet, up from 1.5X last December.

🛠️Tool Spotlight

Explore staking rates

For Proof of Stake tokens, native staking is the safest form of yield. If you’re researching the staking and inflation rates across various chains, StakingRewards.com breaks them down in an easy-to-use interface. This is also worth checking before depositing into a lending protocol or DEX. Make sure the extra smart contract risk is justified by extra yield.

📅Key Events This Week

Prepare for the Next Bull Market with Double Your DeFi This Fall

My friend The DeFi Edge and I are teaching another cohort of our Double Your DeFi course this November. This is an intensive course to transform your DeFi skills in 5 weeks.

I secured a $300 discount for the first 5 people that sign up from my email list.

Use the coupon code: DynamoDeFi

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi