⚡️This Token Raise Could Reshape the DeFi Landscape

Binance is taking over the backend, Cronje's innovative fundraise, perp DEX wars and more

Read Time: ~5 minutes

⚡In This Edition

Andre Cronje’s new project raises $200m with unique token mechanism

Perp DEX wars rage on

Binance rolls out CaaS (Crypto as a Service)

Top airdrop opportunities right now

⚡Metrics Snapshot

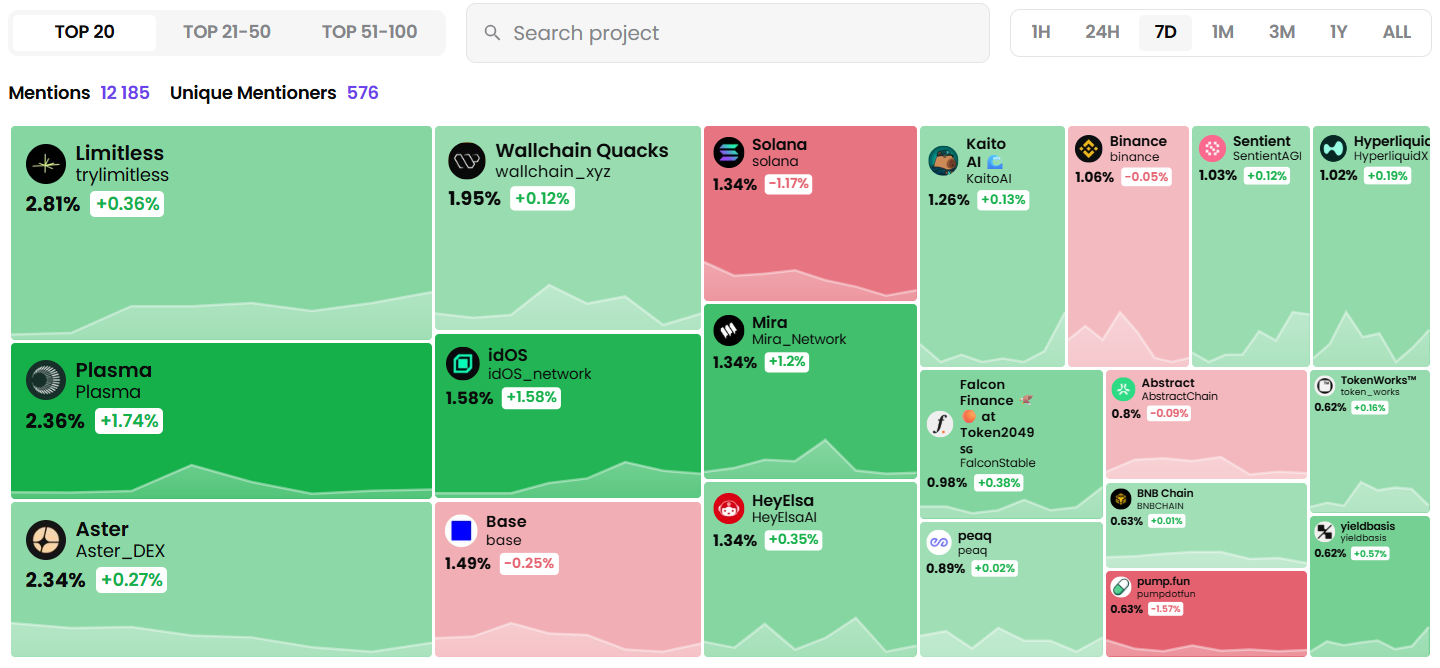

Top 100 Coins at a Glance (7d)

Fear & Greed Index: 50 (Neutral)

Narrative Mindshare (7d)

Historical Bitcoin Performance This Week (Week 38)

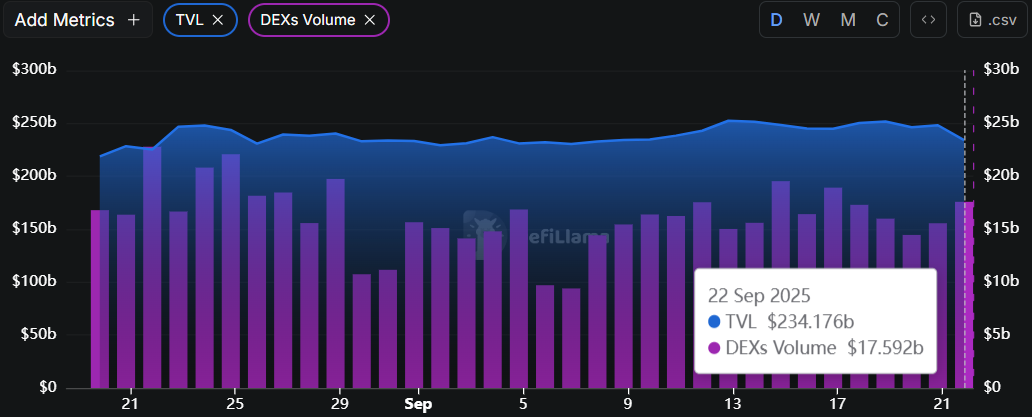

DeFi Market Metrics: Global TVL & DEX Volume

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. Andre Cronje’s Flying Tulip Raises $200M to Build Full-Stack DeFi Exchange

DeFi pioneer Andre Cronje is back with Flying Tulip, a protocol that aims to combine spot trading, lending, derivatives, stablecoins, and insurance in one onchain system.

The project just raised $200 million at a $1 billion valuation, with plans for another $800 million public raise.

The raise has a unique feature: all token buyers (private and public) are granted a put option via “onchain redemption rights,” letting them burn their tokens and reclaim their original principal at any time.

What This Means

Flying Tulip is a vertically integrated DeFi platform, architected with hard lessons from Yearn and Sonic. The perpetual put is a first-of-its-kind design, a welcome upgrade in capital protection and sustainable tokenomics. If successful, it could change how large DeFi raises are structured moving forward.

2. BitMine Now Holds 2.65M ETH, Eyes 5% of Total Supply

BitMine Immersion, the largest ETH DAT, now holds over 2.65 million ETH (more than 2% of total supply) and has a treasury worth $11.6 billion across ETH, BTC, cash, and venture positions. Their stated goal is to reach 5% of ETH’s total supply.

What This Means

This playbook has been successful for BitMine. Just last week, the company acquired 234k ETH. The company has another $400m in cash. BitMine’s thesis is that ETH will anchor the financial rails of AI, stablecoins and tokenization.

3. Binance Launches Crypto-as-a-Service for Traditional Finance

Binance is rolling out Crypto-as-a-Service (CaaS): a turnkey backend for banks, brokerages, and fintechs to offer crypto trading, custody, compliance, and settlement using Binance’s infrastructure.

Institutions keep their own branding and customer relationships, while getting plug-and-play access to Binance’s liquidity and global order book.

Features like internal order matching and segmented client dashboards look like a white-label Robinhood built on Binance rails.

What This Means

Binance is moving upstream; embedding itself into traditional finance as the backend for the next wave of crypto apps. If this gets real adoption, Binance’s moat will grow significantly.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡Underrated DeFiLlama dashboards to take your research to the next level

Yield overviews, custom dashboards, correlations matrix and more

⚡Our favorite airdrop opportunities checklist

Use these to potentially qualify for the biggest airdrops this year

⚡Hyperliquid Hypurr NFT collection goes live, hits $70k floor price

$45m in volume already traded

⚡Polymarket Ecosystem Landscape

Directory of builders on Polymarket including analytics, DeFi, trading & AI agents

NASDAQ-listed Predictive Oncology (POAI) launched a $344m ATH DAT

⚡Get the Pro Report

Each week, Patrick sends out a comprehensive DeFi report that includes:

Custom metrics & fundamentals of the strongest projects

Protocol revenue analysis

Aggregated cross-industry metrics

Market thoughts & onchain insights

Some of the Pro Report is free. You can give it a read right here.

To get the complete reports sent to your inbox each week (and much more), join Dynamo DeFi Pro.

🔢Onchain Analysis

Perp DEX Wars Rage On

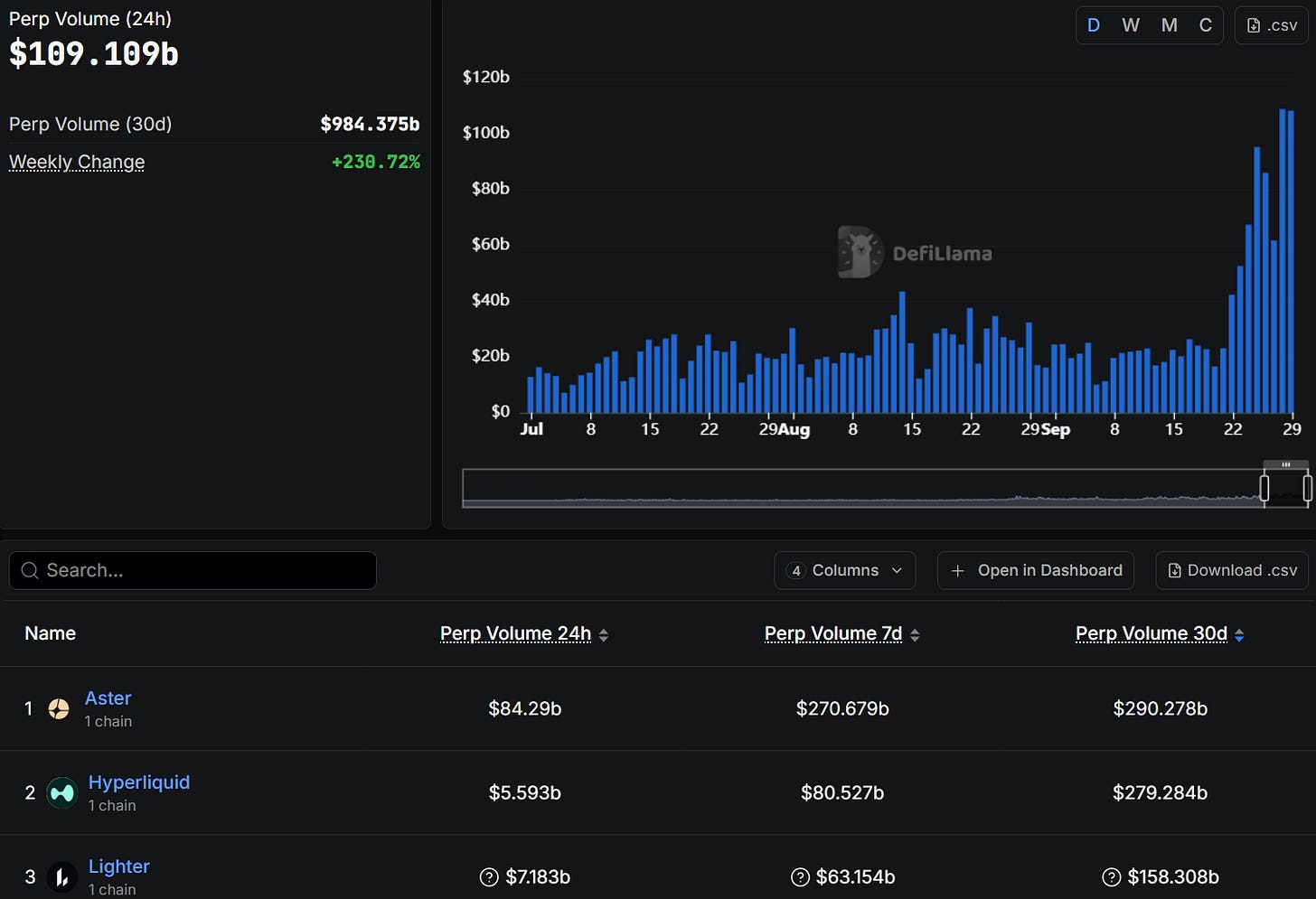

After a surge in volume, Aster has now flipped Hyperliquid on both 7d and 30d volume.

Total perp volume is at record highs over the last two days, 5x higher than justearlier this month.

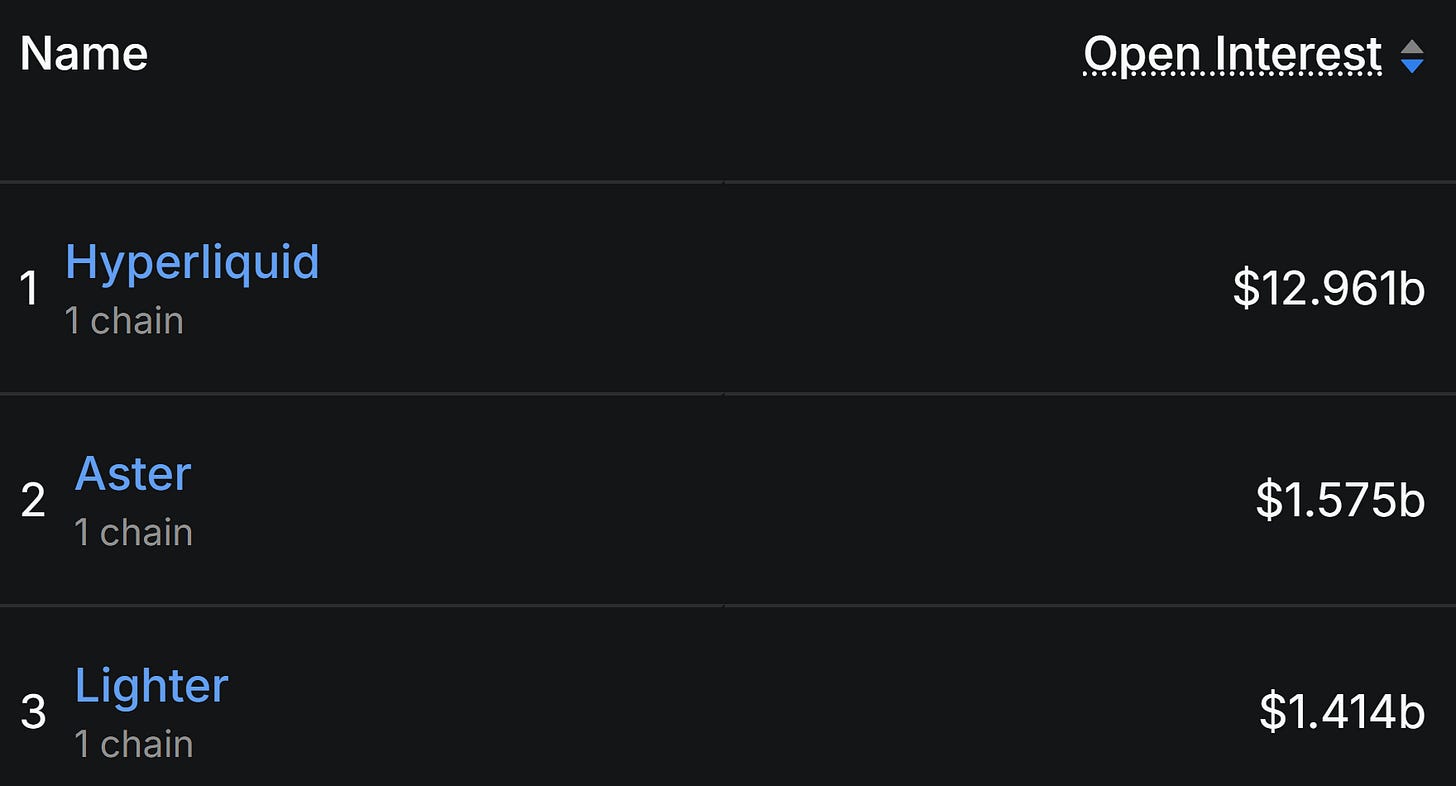

Open Interest, which measures liquidity as opposed to volume’s activity, is tougher to fake and also at an all-time high. Hyperliquid still dominates open interest by a wide margin.

The promise of upcoming airdrops on several platforms and Lighter’s fee-free trading are proving to be attractive to traders.

Hyperliquid has done well to keep traders on the platform, and Hyperliquid’s product is still great.

But the protocol is not immune to competition.

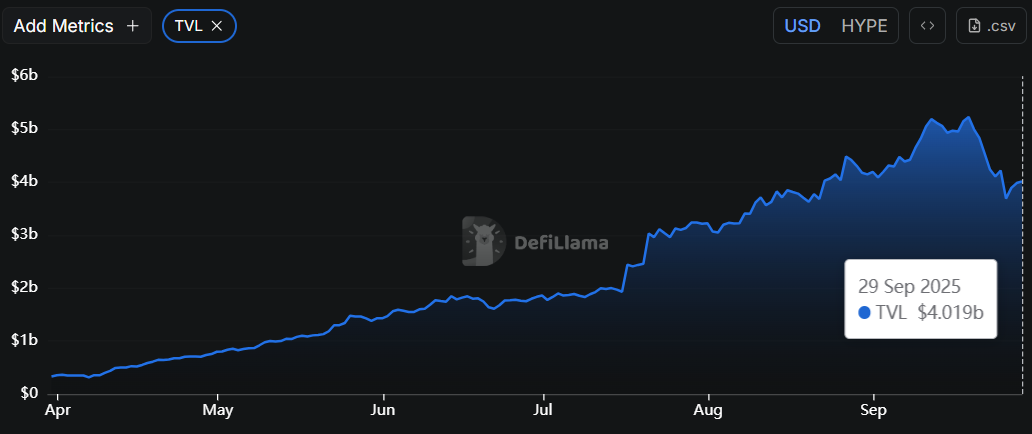

TVL on the Hyperliquid L1 has been up-only since April, with more projects being built within the Hyperliquid ecosystem and users speculating on ecosystem airdrops (here are the Hyperliquid airdrop opportunities that we like).

Over the last 10 days, TVL on Hyperliquid has fallen from $5.2b to $4b. That’s a quick 24% decrease. Money has been flowing out of Hyperliquid projects over the last week.

Hyperliquid’s product, tradfi acceptance and strong team make it a tough competitor to beat. Aster & Lighter know what users want: lower fees and airdrop. And they’re trying to steal as much market share as they can.

The question is, can they retain their newfound users in the long run? Or are they attracting temporary mercenary farmers?

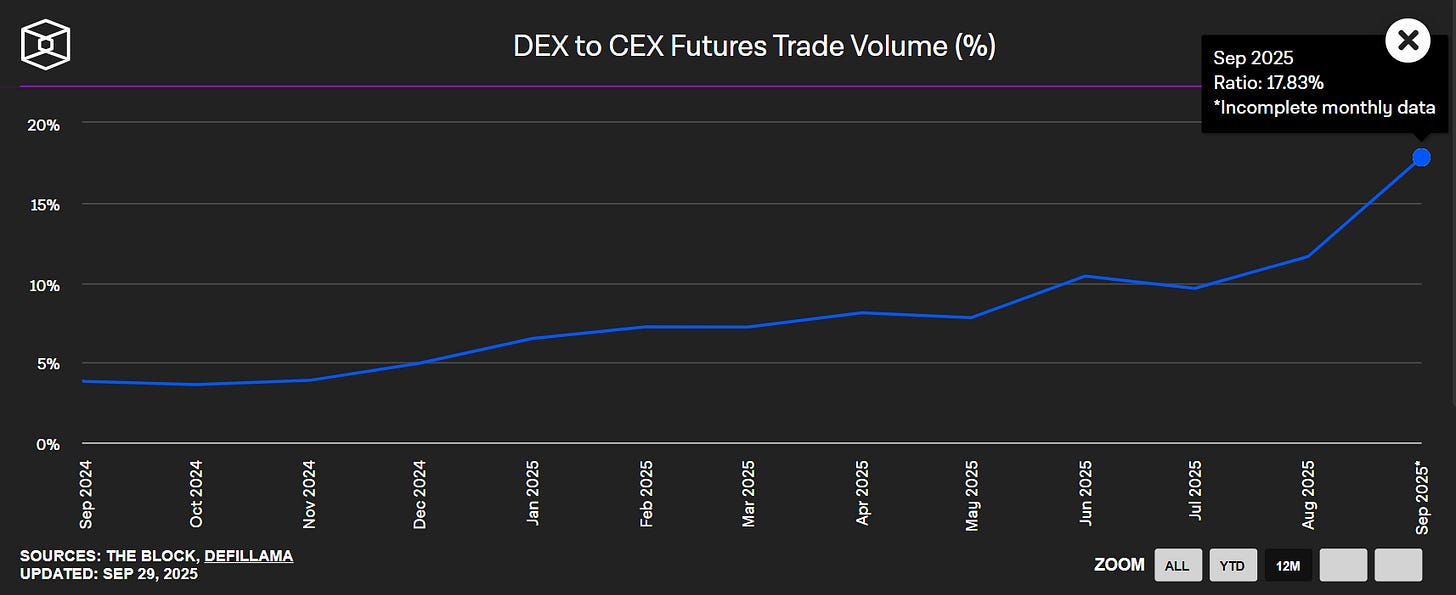

Either way, perp DEX volumes are increasingly growing against CEXs. This perp DEX battle shows how important perps are as a product. DEXs increasing their market share vs CEXs is a huge win for DeFi.

🚜Farm of the Week

16% Stablecoin Yield in One Click

New deposit incentives for lending PYUSD on Kamino mean 16% APY is up for grabs for PYUSD depositors.

How it Works

Kamino makes depositing very easy. Head to Kamino’s lending dashboard and deposit PYUSD to start earning APY immediately.

If you don’t have PYUSD, you can swap for it using Kamino’s Swap aggregator here.

Risk Level: Low

Risks

Smart Contract risk

Protocol Layer risk

Lending risk

⚡How to Lend & Borrow Crypto on Solana

🛠️Tool Spotlight

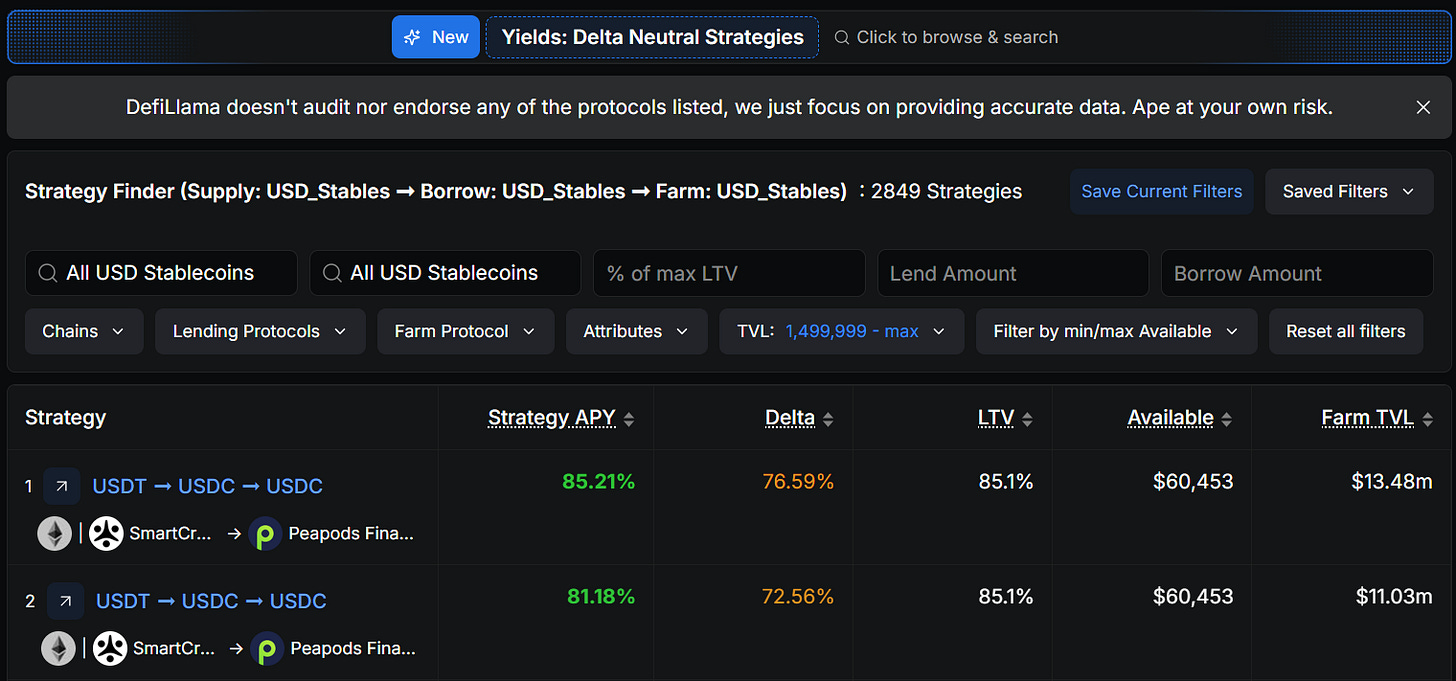

Find Delta-Neutral Yields on DeFiLlama’s Dashboard

If you’re looking for yield without price risk, you can search & filter delta-netural strategies across any chain and token of your choosing.

Search anything from stablecoins on Ethereum to LSTs on Solana, and set TVL minimums or select which specific protocols you’d like to search.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 August JOLTS Job Openings data - September 30th

📊 CB Consumer Confidence data - September 30th

📊 September ADP Nonfarm Employment data - October 1st

📊 September ISM Manufacturing PMI data - October 1st

📊 Initial Jobless Claims data - October 2nd

📊 September Jobs Report - October 3rd

Token Unlocks: $260m Unlocking This Week

🔓ZORA (4.65%) - September 29th

🔓OP (1.74%) - September 30th

🔓SUI (1.23%) - October 1st

🔓DYDX (0.58%) - October 1st

🔓EIGEN (6.7%) - October 1st

🔓IMX (1.26%) - October 3rd

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Onyxcoin gorilla testnet - September 30th (Source)

🚀 zkVerify mainnet - September 30th (Source)

🚀 DoubleZero mainnet - October 2nd (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi