⚡The TAO Takeover

Plus Bitcoin DeFi heats up, on-chain derivatives volume hits ATH, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

📈Trends and Narratives

The TAO Takeover

I mentioned Bittensor and it’s TAO token in this newsletter back in October and December. Today, TAO is hovering around $650 and has reached the top 25 coins by market cap. If you were on Crypto Twitter at all this week, you almost certainly saw a post about TAO.

Here is an intro to Bittensor - it’s well-written and is helpful for a foundational understanding of the project.

Additionally, as TAO further cements itself as the crypto x AI investment of choice (Van Eck called Bittensor “Bitcoin for Machine Intelligence” in a recent report - now THAT is a narrative), what would usually be a niche subgenre will continue to gain outsized amounts of attention.

TAO’s subnet architecture is coming together and projects have begun to build within the ecosystem.

As the TAO ecosystem grows, more projects looking to add or utilize AI models will be incentivized to join the ecosystem. TAO tokenomic architecture is designed to reward to the most efficient, reliable and valuable TAO subnets - as each subnet grows, they will all compete for emissions.

How to Capitalize

Gather a basic, foundational understanding of the problem Bittensor is working to solve. Why is it important to have a decentralized, collaborative AI network?

Watch projects that might be joining a TAO subnet (subnets range from data scraping to healthcare to blockchain insights, so there’s plenty of available use-case opportunities). Here are a few that I’m seeing:

Back in late 2020, many small projects had large token price appreciation because they were working to win Polkadot Parachain slots. The market is more sophisticated now but rest assured many projects will try to fly on the TAO hype and the overall crypto x AI narrative.

If you already own TAO tokens, you can liquid stake them on TensorPlex for over 17% APR, and receive a stTAO token that can be utilized across the Ethereum network.

Bitcoin DeFi Heats Up

In January, we discussed the Bitcoin DeFi ecosystem developing - it’s really starting to heat up.

B^2 Network and Merlin Chain (shown on DefiLlama as Merlins Seal, the name of the points incentive program leading up to the launch of the MERL governance token) are two Bitcoin Layer 2 protocols that, while new, have already attracted $1.3B TVL in a very short amount of time.

The ability of a single farm to cause Bitcoin TVL to leapfrog more established DeFi ecosystems, reaffirms the potential of Bitcoin DeFi. Only a small % of BTC needs to enter DeFi for Bitcoin to become one of the largest DeFi ecosystems.

Here is Merlin Chain’s rundown of the points program leading up to the MERL launch:

How to Capitalize

Participate in the Merlin’s Seal farm. Be mindful that this is already heavily farmed and carries risk.

Explore the Stacks ecosystem. Stacks is currently the leading Bitcoin L2 and will feature major performance improvements with its upcoming Nakamoto Upgrade.

Ordinals and BRC-20s. As the Bitcoin DeFi ecosystem develops, it becomes increasingly likely that tech improvements allow additional utility for BRC-20s and Ordinals.

⚡Learn More About Crypto with Dynamo DeFi Pro

The premium version of Dynamo DeFi gives you deeper insight into the crypto market.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Community calls & AMAs in Discord. 3X per month I’m holding community calls and AMAs in the Dynamo DeFi Discord.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

🔢On-Chain Analysis

On-Chain Derivatives Volume Hit ATH

On-chain derivatives volume hit a new ATH this week, crossing $40B for the first time ever. This is significantly higher than the peak in 2021, representing growth in the on-chain trading ecosystem. Derivatives trading platforms have consistently shown themselves to be one of the best business models in crypto; if this growth continues, it’s possible that perp DEXes could become one of the most profitable DeFi sectors.

NFT Lending TVL Surges

NFT Lending stood out as a breakout category this week, rising to over $270M in TVL. Despite challenges faced in the past by NFT lending markets, NFT Lending is intriguing as it:

Turns NFTs into yield-bearing assets

Unlocks NFTs bought for speculation for use as utility

Allows NFT-holders to unlock liquidity without selling

🛠️Tool Spotlight

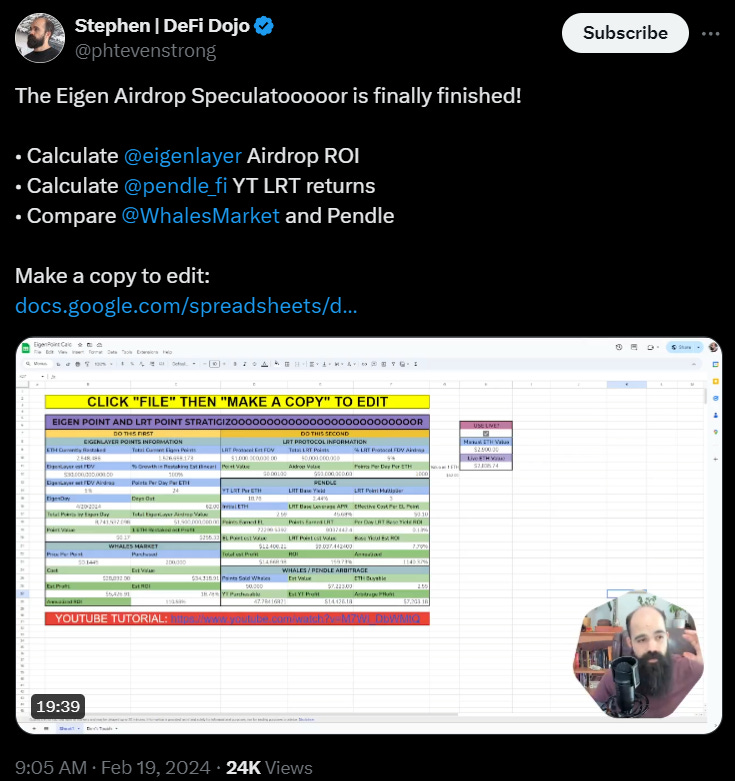

Tool to Track your EigenLayer Airdrop

Stephen, The Calculator Guy, came out with a new calculator to estimate your potential EigenLayer airdrop. If you’ve been restaking and liquid restaking ETH, this can be helpful to map different scenarios for what your points will end up being worth.

📅Key Events This Week

Macro Events

📊 FOMC member Bostic speaks - Feb 21st

📊 FOMC meeting minutes - Feb 21st

📊 FOMC member Jefferson speaks - Feb 22nd

📊 FOMC member Cook speaks- Feb 22nd

Token Unlocks

🔓 XETA (2%) - Feb 20th

🔓 BICO (0.8%) - Feb 22nd

🔓 AVAX (2.6%) - Feb 22nd

🔓 ID (4.29%) - Feb 22nd

🔓 DAO (0.5%) - Feb 24th

Launches

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Paradex open beta launch - Feb 19th (Source)

🚀 Metakinetic launch on fxHash - Feb 20th (Source)

🚀 Shido final testnet version + Hackathon - Feb 20th (Source)

🚀 $ALT token claim by $TIA holders commences - Feb 20th (Source)

🚀 Immutable new game playtest (Ascent of shards) - Feb 21st (Source)

🚀 Restake Finance $RSTK token staking- Feb 21st (Source)

🚀 Sharpnel’s STX1.1 launch- Feb 22nd (Source)

🚀 Acala $ACA token burn- Feb 23rd (Source)

Conferences

🤝 GS1GlobalForum2024 - Feb 19th to 22nd (Source)

🤝 Step2024 - Feb 21st to 22nd (Source)

🤝 NFT Paris in Paris - Feb 22nd (Source)

🤝 ETH Denver 2024 - Feb 23rd to Mar 3rd (Source)

🤝 NFTVerse in Paris - Feb 23rd (Source)

🤝 KC44 in Mexico - Feb 23rd (Source)

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi

🫡

Love the key events breakdown with token unlocks & burns. Excellent article as always.