⚡The Solana Cycle Reaches a Fever Pitch

Bitcoin All-Time Highs and Solana DeFi in January: Boosted Yields, Airdrops, Restaking and Agents

Read Time: ~4 minutes

⚡Snapshot

Why the TRUMP memecoin is massive for Solana

Why crypto is going to miss Gary Gensler

Solana DeFi opportunities for January

10 Delphi predictions for 2025

📖 Recommended Reads

⚡Thoughts on the TRUMP memecoin and why it’s massively net positive for Solana

Memecoins aren’t the endgame, they’re the onboarding point

⚡The craziest weekend in crypto, visualized

10 charts to visualize the madness

⚡10 Delphi predictions for 2025

Bitcoin has more room to run, Solana is just getting started, and more

⚡VanEck files for Onchain Economy ETF

Actively managed ETF that invests in companies holding crypto

⚡Balaji: The Overton window has been smashed

Crypto equity is coming

⚡Why crypto is going to miss Gary Gensler

The crackdown ends, and so does the scapegoat

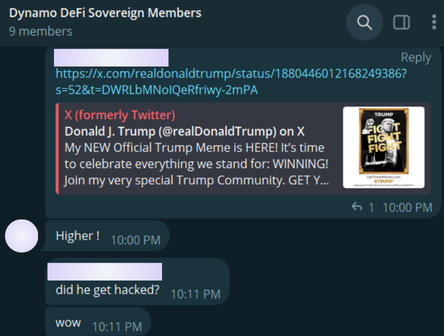

⚡How we found the TRUMP token under $5

Our Sovereign Members posted about the TRUMP token an hour after it launched. Some of them bought the token, some of them supplied liquidity on Meteora for hefty yield.

Being a Sovereign Member has other benefits as well, including a 1-on-1 strategy call and personalized access.

Upgrade to a Sovereign Member plan→

🔢Onchain Analysis

Solana Survives Stress Test

Friday evening at around 9PM EST, Solana began its most harsh test yet: the US President launching a memecoin.

Here’s what followed:

Solana saw its highest weekly TVL increase ever, hitting ATH

Solana TVL denominated in SOL hit nearly 100M

Solana facilitated the highest DEX volume week ever

Raydium, Jito & Solana raked in record fees

Solana Stablecoin Supply Increased by Over 50%

Solana has long struggled to attract stablecoins commensurate with its activity. That started to change this weekend, when stablecoin supply increased by over 50%. Note how on the chart the stablecoin supply line blends in with the vertical axis.

Phantom Wallet received up to 8M requests per minute - transactions failed and many users experienced chain congestion, but Solana did not go down like it has at times of increased activity in the past.

🚜Farm of the Week

SOL-USDC on Raydium

With all the volume this week, liquidity providers to the SOL-USDC pair are earning hefty APYs collecting fees.

How it Works

Head to the liquidity pool on Raydium.

The pool is quite simple. It’s full-range liquidity, so you don’t need to worry about the price falling outside of your range.

Simply add the amount of SOL and USDC tokens you’d like to provide, confirm the transaction in your wallet, and you’ll start earning.

Risks

Solana DeFi Opportunities January 2025

⚡No-fluff toolkit for serious onchain traders

I built the Onchain Academy to be the resource I wish I had when I started using DeFi.

In less than 3 hours, you’ll be able to:

Track smart money flows before they trend

Spot undervalued gems using on-chain metrics

Find the next big airdrops using real data

Analyze protocols like a professional

Skip the expensive lessons. Get instant access to my complete framework →

🛠️Tool Spotlight

DeFi Chain Fees Dashboard

The DeFi Chain Fees Dashboard, built by Dynamo DeFi, tracks and compares the “GDP” across different blockchains by measuring the fees users pay to interact with each chain. This includes not only fees spent on the chain itself, but also fees spent on apps on the chain, like DEXs. You can view fee data across multiple timeframes and compare how different chains stack up against each other.

The dashboard communicates which chains are seeing the most actual usage and economic activity, since fees represent real user demand and willingness to pay for blockchain services.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Inauguration of President Trump - January 20th

📊Bank holiday - January 20th

📊 Existing home sales - January 24th

Token Unlocks: $110M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓FTN (4.67%) - January 21st

🔓BICO (0.75%) - January 22nd

🔓IMX (1.43%) - January 24th

🔓ALT (10.39%) - January 25th

🔓TORN (0.92%) - January 26th

🔓AXL (1.39%) - January 26th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 CHIRP launch - January 20th (Source)

🚀 Dexcheck launch on base - January 20th (Source)

🚀 Taraxa V2 on mainnet - January 20th (Source)

🚀 HairDAO first onchain telehealth launch - January 20th (Source)

🚀 Peas leveraged volatility farming launch - January 20th (Source)

🚀 PinLink RWA-tokenized marketplace testnet launch - January 20th (Source)

🚀 Solblaze Bliq launch - January 21st (Source)

🚀 Mavia web marketplace exchange launch - January 21st (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi