⚡The Perp DEX Wars Begin [Dynamo DeFi Pro Report]

Aster vs Hyperliquid vs Lighter vs EdgeX

💡Dynamo’s Thoughts

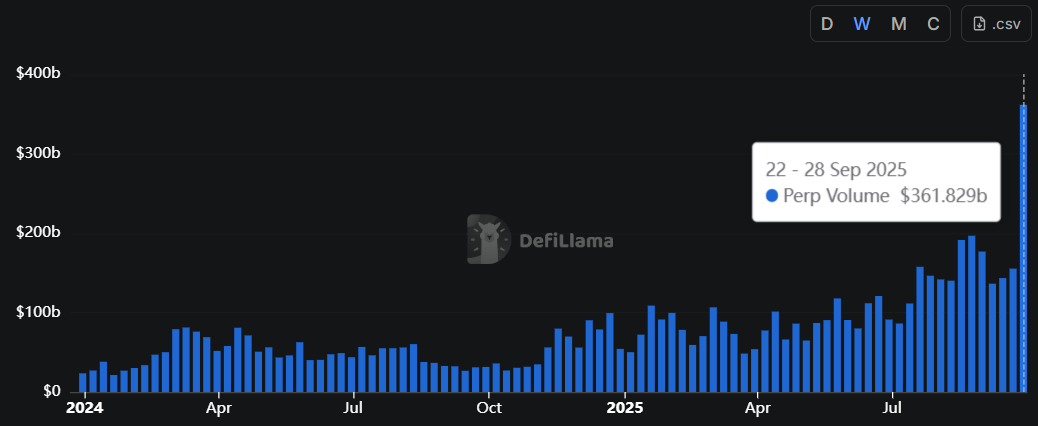

Aster flipped Hyperliquid in both 24hr & 7d perp volume this week. Lighter, with its fee-free trading, also had a great week.

The result of this intensifying competition: the single largest week of perp volume ever, nearly doubling the previous record.

Volume isn’t actually the best metric however, as it can be easily faked and is extremely volatile.

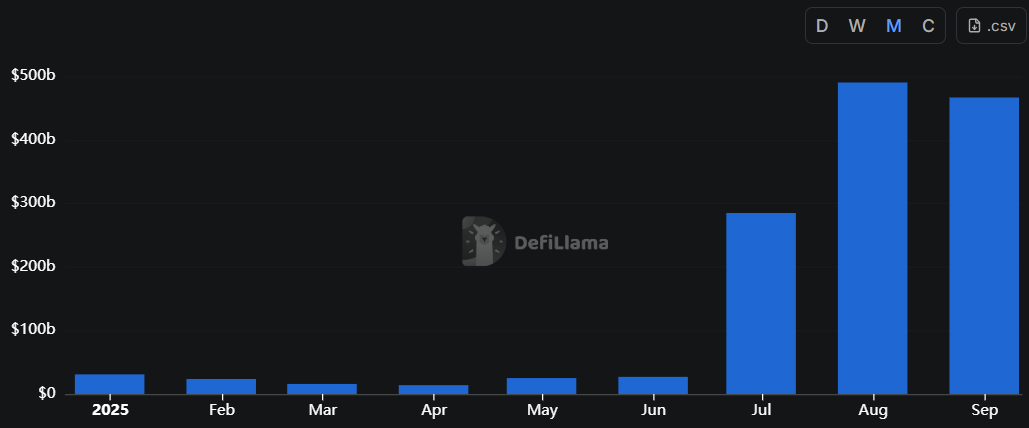

Open interest is a better metric, showing liquidity for traders. Total open interest has exploded over the last three months.

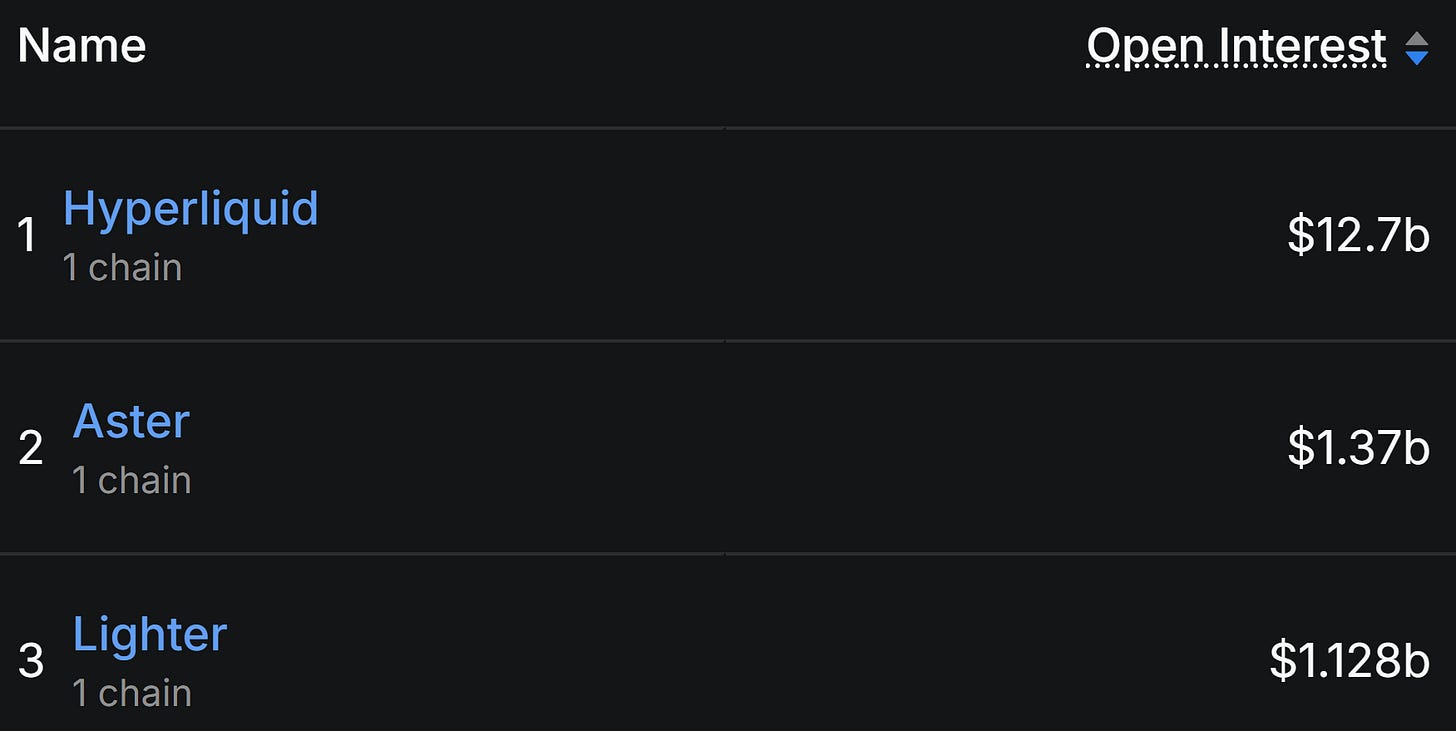

And in terms of open interest, Hyperliquid still remains supreme (although Aster and Lighter have grown significantly).

Aster, Lighter and EdgeX have quickly closed reached parity with Hyperliquid in terms of volume. Three questions remain:

Can these new upstarts maintain their volume?

Can they reach parity in terms of open interest too?

What will it ultimately take for the winner of the perp DEX wars to build a moat?

While Hyperliquid has a significant edge, I see one counterintuitive weak point: Hyperliquid has spent hundreds of millions of dollars buying back the HYPE token.

This was incredible as the HYPE token rose from single digits to over $50. Holders were happy, the price appreciation served as marketing for the platform, and Hyperliquid kept earning more and more money to repeat the positive feedback loop.

But now Hyperliquid is losing both market share and absolute volume.

Looking back, can you really say that buying back their token was the best way to spend over $500M?

Hyperliquid could have acquired an equities brokerage, a prediction market, a stablecoin issuer. Any of these would have made them more resilient against newer perp DEXs than a higher price on HYPE.

The Hyperliquid L1 saw a $600m drawdown in TVL this week, while competitors are all up.

There’s good news amidst all this: you don’t need to choose.

Investments aren’t sports teams. There’s nothing stopping you from farming multiple points programs or holding multiple perp DEX tokens.

Perp DEXs are a growing category and not a zero sum game. Moreover, there may not be a winner-takes-all game in the long term. Look at centralized exchanges: there is no “single best” option.

What to do then?

The numbers, despite their volatility, tell the story: there are still only a handful of perp DEXs in the upper echelons of the category. There’s no reason someone bullish on the sector can’t get exposure to multiple of them.

In a way, the Perp DEX wars are already over. And you, the investor/user won.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

If you’re looking for a more comprehensive overview of trends driving the market, check out our monthly Zoom call from this month:

🔭Market Outlook

We’ve heard your feedback from last week’s poll that you want more trending altcoins. We’ll be introducing several new newsletters each month:

Top 5 altcoins based on fundamentals that month. 3 will be free and 2 will be paywalled.

Portfolio updates. For paid subscribers, I’ll provide a monthly update on what I’m holding, based on fundamentals.

Market Health

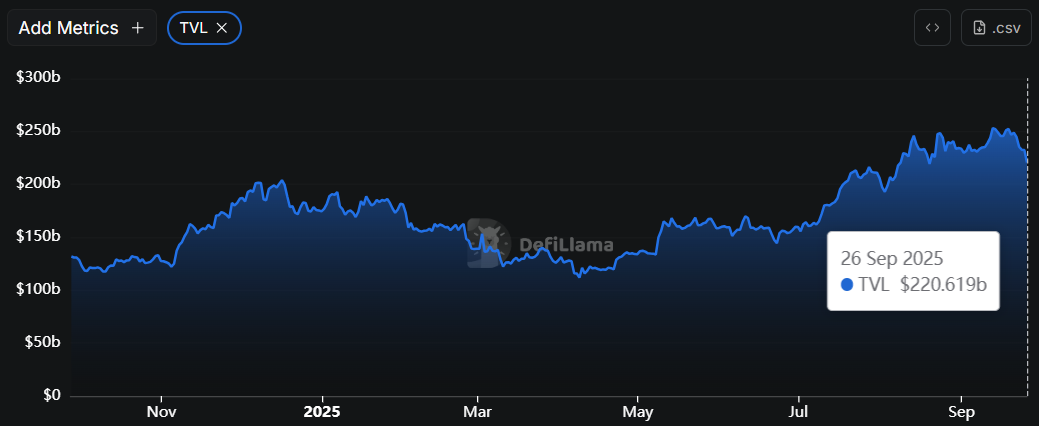

Total DeFi TVL

Total DeFi TVL fell this week to $220b from the $250b ATH two weeks ago.

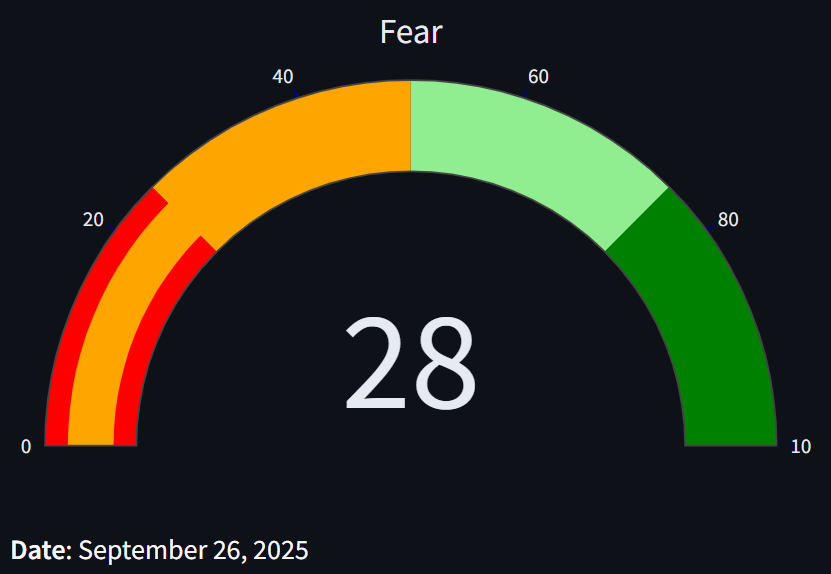

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here.

The index dropped sharply overnight to 28, the lowest reading since April.

Stablecoin Market Cap

Stablecoin growth marches on.

Stablecoins added $4b over the last week. Half of that growth belongs to USDT.

PayPal USD (PYUSD) market cap is up 43% this week, adding over $500m to its market cap. The payments giant announced a partnership with Spark to grow its stablecoin.

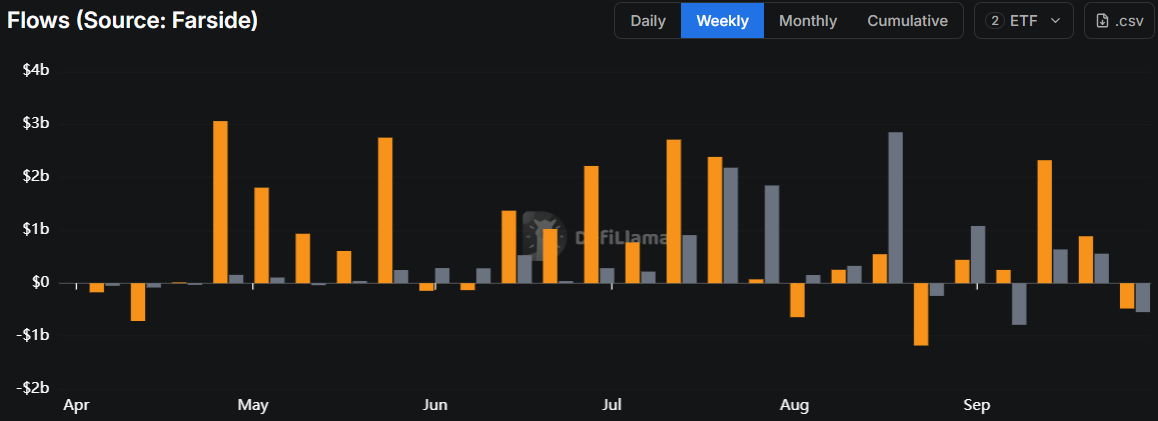

ETF Flows

Both BTC & ETH ETFs are currently experiencing outflow weeks, worth about the same amount: -$500m each.

The month of September is likely to shake out +$3b for BTC, -$150m for ETH.

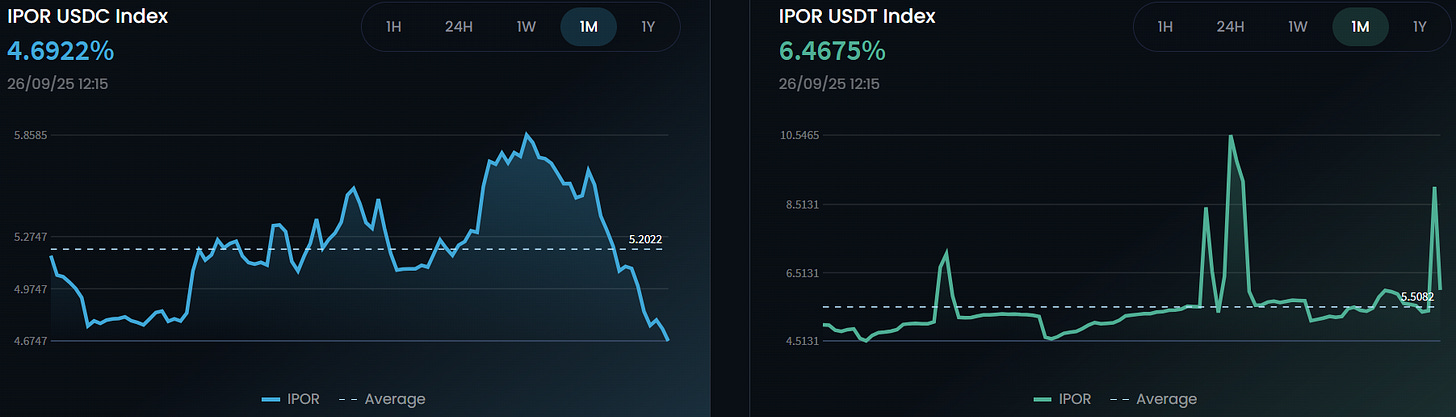

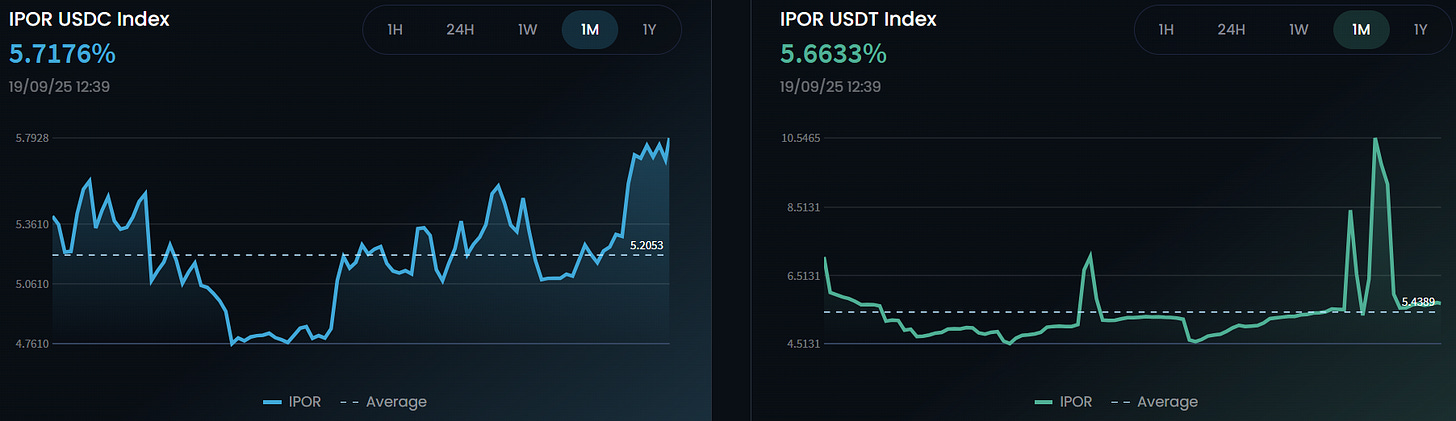

IPOR Stablecoin Indices

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

USDC rates hit their highest point since February but have since dropped off to below the monthly average. USDT rates remain more elevated and are currently above the yearly average of 5.77%

For reference, here are last week’s numbers:

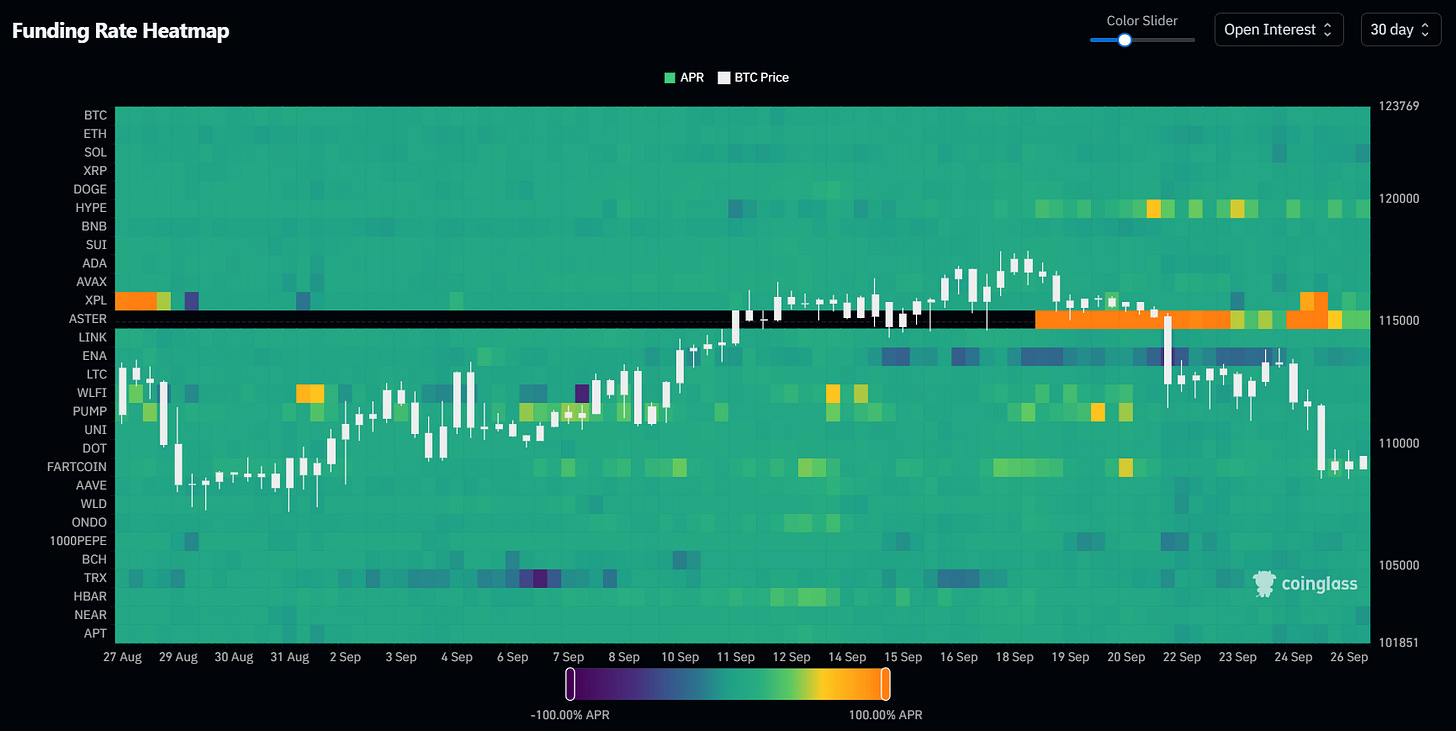

Funding Rate Heatmap

The Funding Rate Heatmap from Coinglass displays funding rates across some of the largest crypto assets.

Brighter colors indicate elevated funding rates for longs, and darker colors indicate low or negative funding rates (indicates large short positions).

Aster funding was red-hot for the last few days, but funding has dropped to a more reasonable 37% APY. XPL also experienced elevated rates, but only for a day.

SOL currently has slightly negative funding.

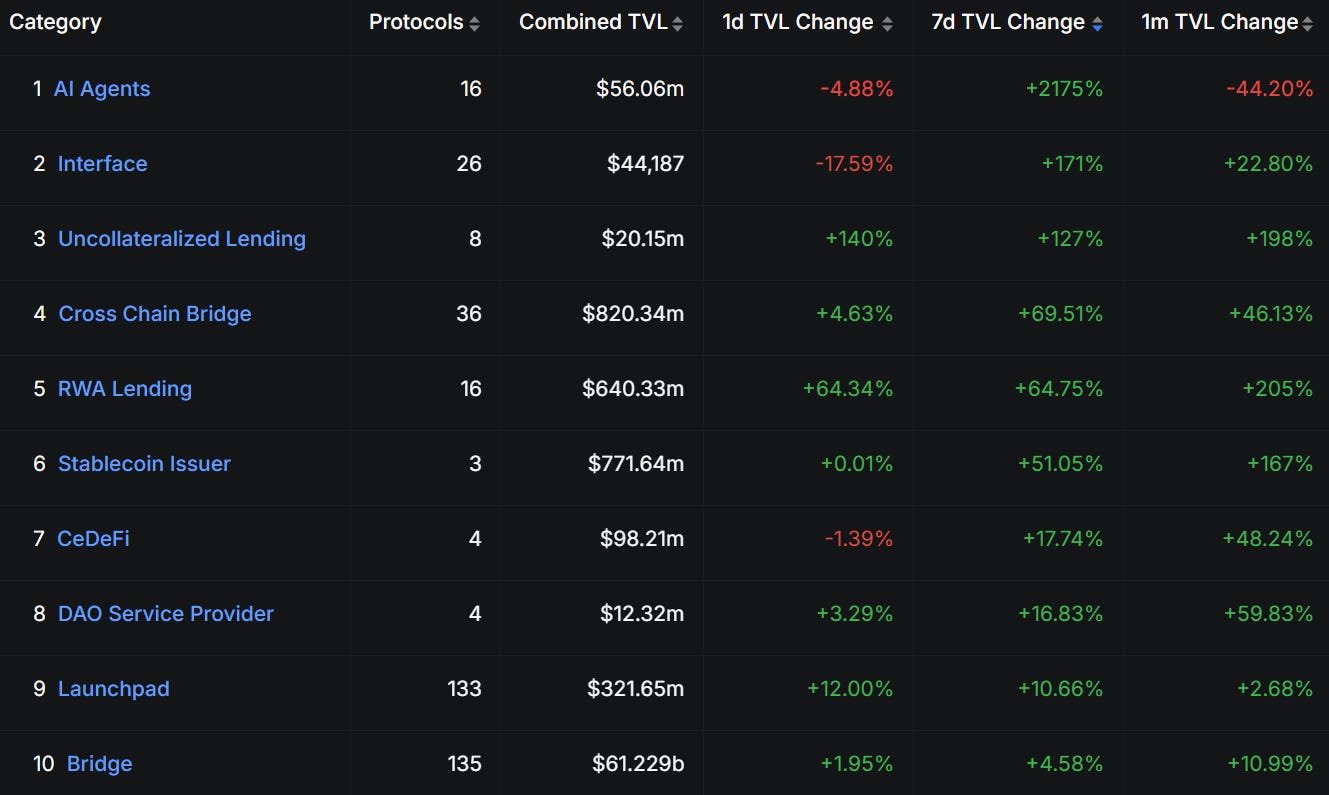

Category and Chain Trends

Category TVL Changes

RWA lending is continuing up in a straight line. USD AI, RWA Lending’s largest TVL contributor saw another big jump in TVL last week.

On the Stablecoin Issuer side, M^0 TVL added $250m in a week.

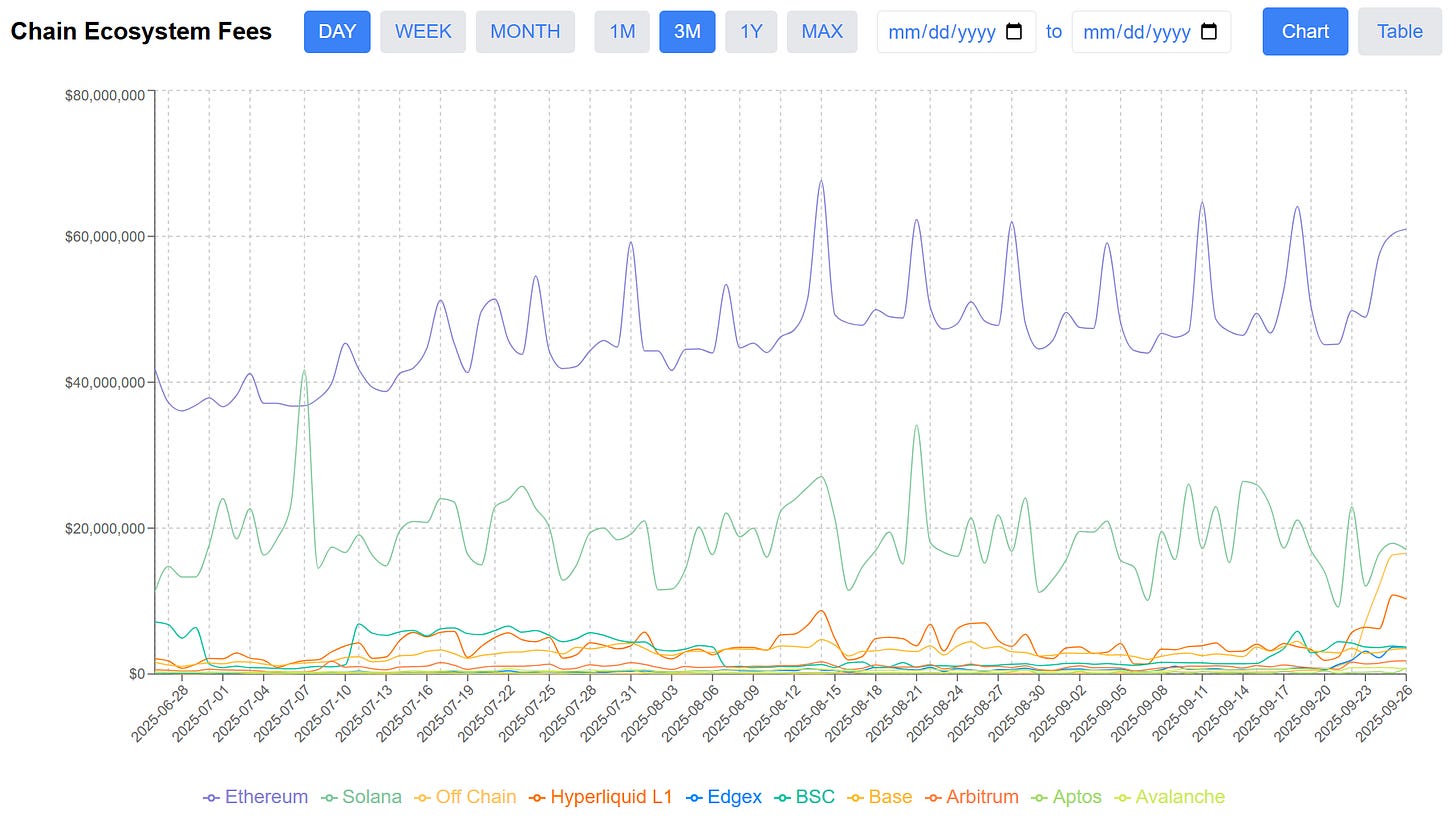

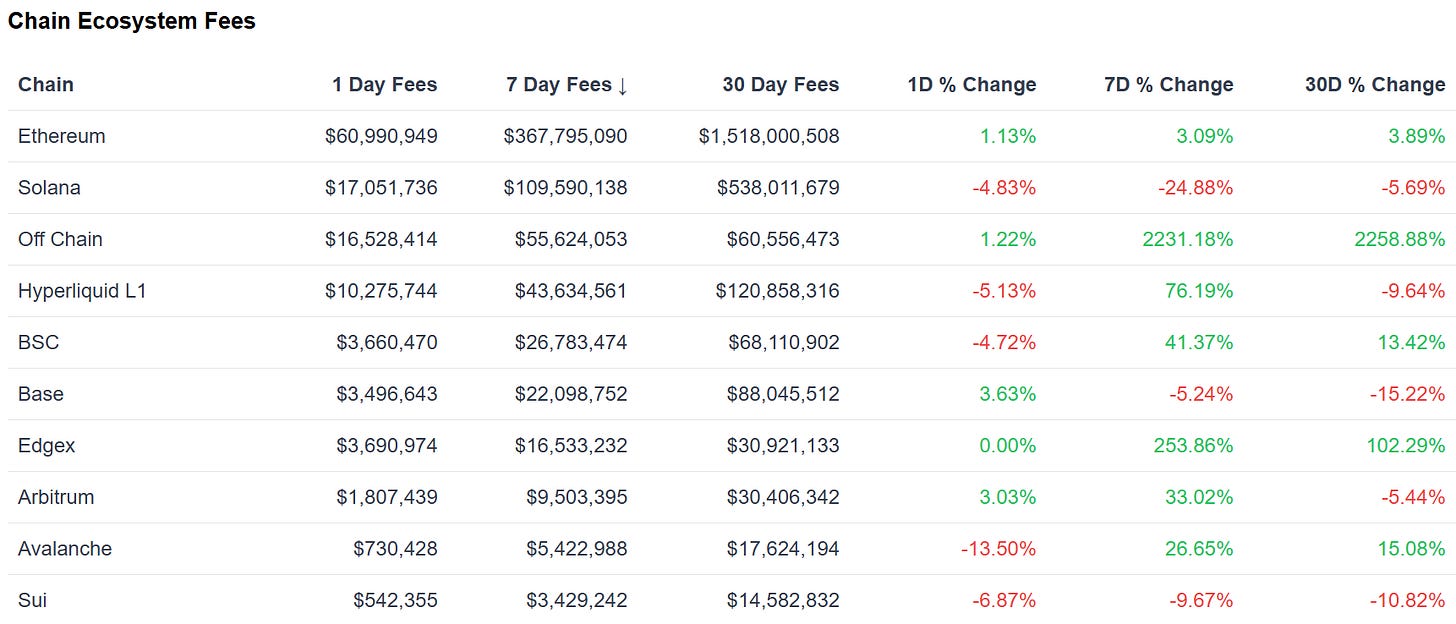

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

Off Chain ecosystem fees saw a massive spike this week, thanks to Aster earning $50m in fees.

EdgeX saw another large week of CEF, out-earning Arbitrum and Avalanche.

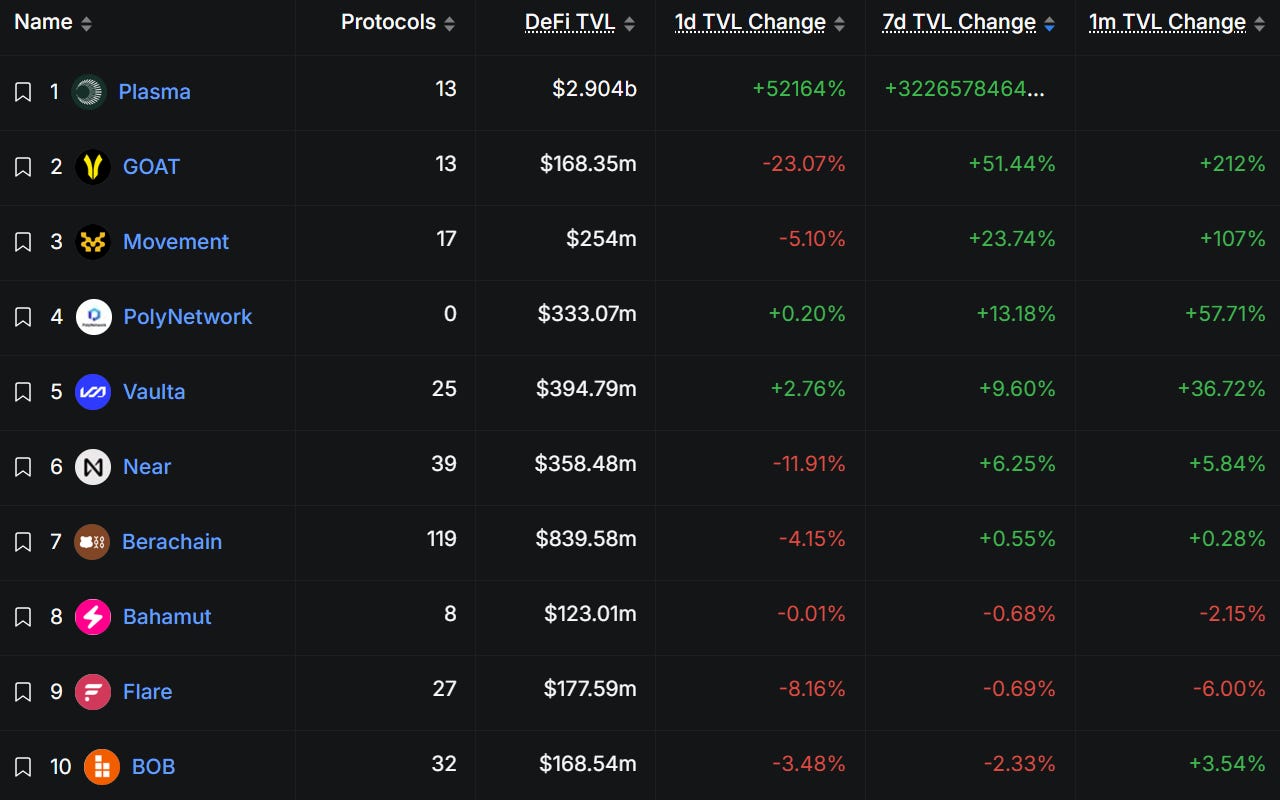

Fastest Growing Chains ($100M+ TVL)

Plasma’s launch came with nearly $3b in existing TVL - it’s already a top 10 chain ordered by TVL.

Last week, Goat and Movement were at the top of the growth list. This week, it’s the same story.

Only seven chains above $100m in TVL saw positive TVL growth this week.

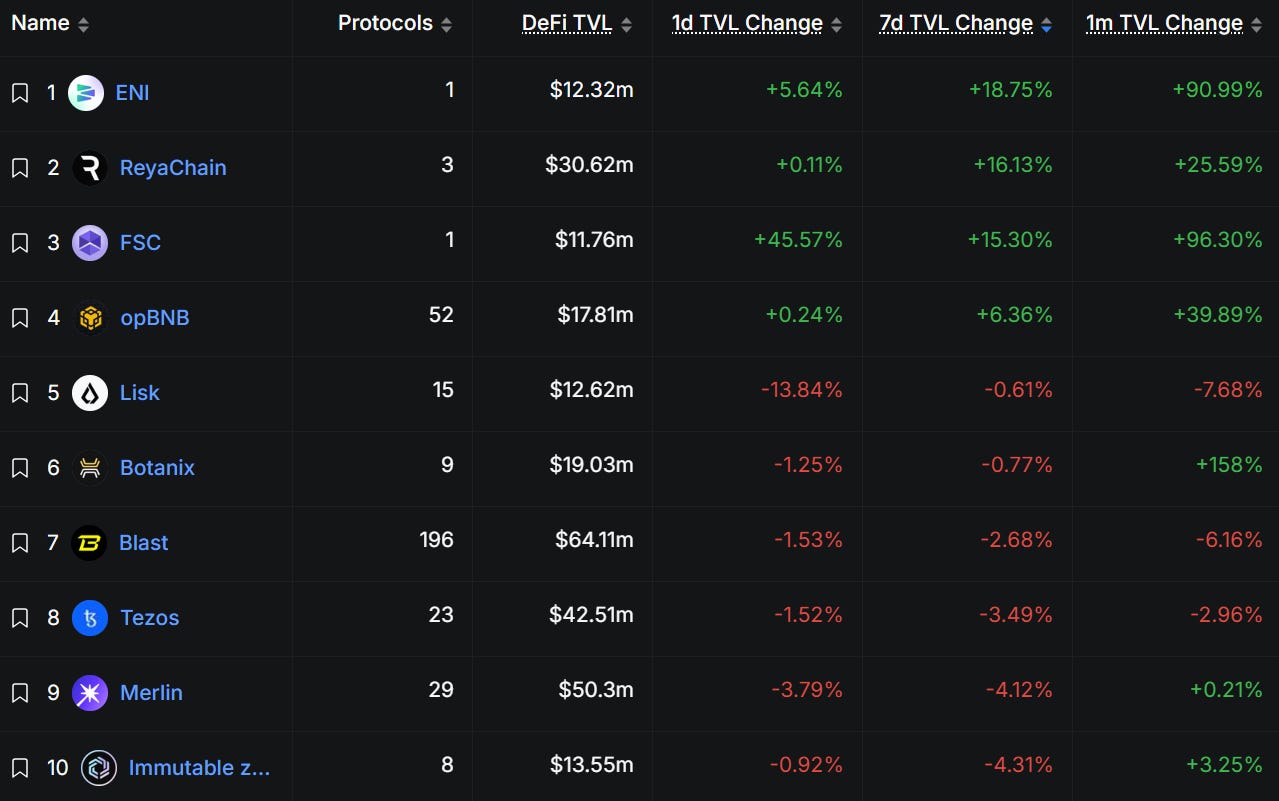

Fastest Growing Chains ($10M-$100M TVL)

Similar story for smaller chains. Only 4 saw TVL growth this week.

📊Onchain Metrics

Digital Asset Fundamentals

This section dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens.

Below you’ll find 3 visuals:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.