⚡️The 2 Questions That Matter Most in Today's Market

Plus: How to use DeFi metrics the right way, BTC ETF flows recap, and what's leading right now

Read Time: ~6 minutes

⚡Snapshot

How to use DeFi metrics the right way

2 questions to ask yourself and navigate this market

Taking advantage of SOL utilization on Kamino

A brand new way to understand token unlocks

📖 Recommended Reads

⚡Solana catalysts - what kicked off the recovery

Onchain activity picking up + positive catalysts

⚡Calls for higher BTC greatly outnumber bearish BTC calls

The market is feeling greedy again

⚡Crypto Twitter is not realistic

How you can be proud of progress every day

⚡Strategy announces $1.4b in Bitcoin purchases

Strategy’s holdings now exceed $52b

⚡Bitcoin ETFs see +$3b in inflows

Highest since November

⚡Are you reading the market correctly?

While most traders are paralyzed with uncertainty, Dynamo DeFi Pro gives you edge in today's challenging market with:

Exclusive onchain metrics that identify growing protocols

In-depth research on DeFi strategies and high-yield opportunities

Direct access to our analysts in the members-only Discord

Comprehensive education through our Onchain Academy course

"Patrick provides data-driven insights to DeFi in a trustworthy and fully disclosed manner, which is rare in this industry." - Michelle, Pro Member

Join the community of skilled investors navigating this market with confidence.

🔢Onchain Analysis

How to Capitalize on Crypto’s Reflexivity

Crypto (and by extension DeFi) is a highly reflexive asset class. Good times can lead to more good times, until the winds change and then the bad times can lead to more bad times.

Your job as a digital asset investor / Defi degen is to identify one of two things:

Is this reflexivity sustainable?

What is benefits the most from the current environment?

Here’s an example.

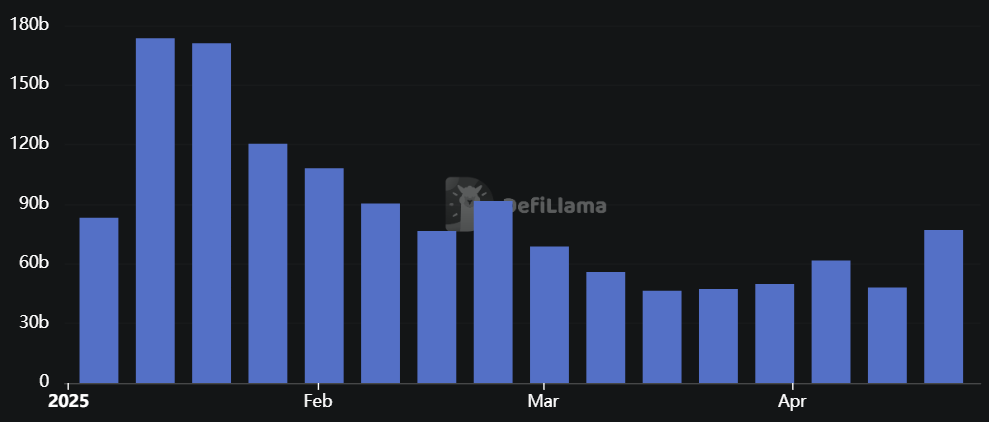

Q1 of 2025 was not very kind to digital assets.

Total DeFi TVL (including liquid staking) dropped from 194b to 114b, more than a 40% drop while Bitcoin held up much better, sustaining around a 30% drop.

But it wasn’t TVL dropping that had market sentiment in the gutter. the market reflexivity to the downside was extensive: a crosschain assault with blue chip tokens like Ethereum dropping 55% or more.

But in early April, the winds began to change. The market stopped dropping when bad news came out. Crypto would pump on good news, and hold up steady when equities were having a down day.

It wasn’t certain things had changed, but there was evidence that they had.

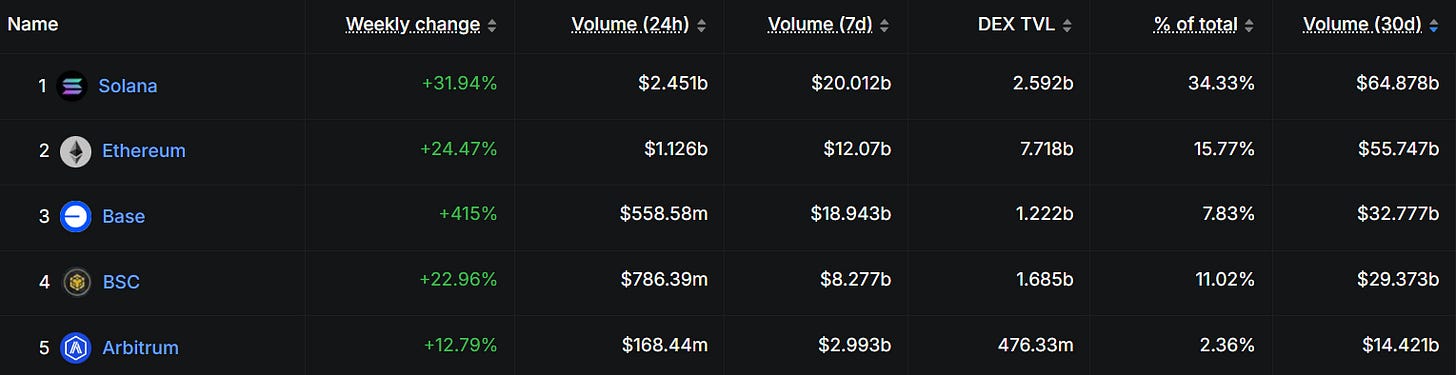

Highly volatile sectors like memes and smaller market cap projects started to move more to the upside - onchain degens came back, DEX volume to bottom and start to increase at the end of March and into April.

It wasn’t until weeks later that retail would catch on. Bitcoin ETFs had their 2nd highest week of inflows, totaling over $3b for the week (the second most ever).

This is part of reflexivity - the closest to the heartbeat of the market catches on first, followed by more and more people following and piling in.

That brings up an important question: is this upside sustainable? With ETF flows looking like they are, it would appear so. If the market gets squeamish at the first sign of trouble, that would put our sustainability assumption at risk.

If this upside is sustainable, what looks good here?

Given the “Digital Gold” narrative has been slowly bubbling up, Bitcoin is the only clear asset that can benefit from the current uncertain macro environment.

Given its strong revenue and token buybacks with that revenue, Hyperliquid is well-positioned with explosive demand growth in a bullish environment and a base floor of buying support in a bearish environment.

Solana’s Q1 was particularly brutal, but over the last month, as activity picks up, Solana is leading the way. Solana leads DEX volume on every time frame.

As long as this upside momentum continues, Bitcoin / Hyperliquid / Solana (and its ecosystem) should continue to do well.

🚜Farm of the Week

Taking Advantage of SOL Utilization on Kamino

Kamino is incentivizing SOL deposits in the Jito market - because the utilization rate is so high (lots of people borrowing against the deposit pool), deposits are highly rewarded.

This comes with risk, as increased borrowing and a sudden price decrease could lead to onchain liquidations (potentially making lending withdrawals more difficult).

How it Works

Earn over 70% by depositing SOL through the Jito market on Kamino - go to this pool, connect your wallet, and deposit SOL to start earning.

Obviously, this is not a market you want to borrow SOL from - you’re paying too high of an interest rate.

This rate will not likely stay for long, but to get some time with high yields can be beneficial for someone on the hunt for SOL yield.

Risks

Cap risk - if this pool fills up with yield chasers, it could be capped - meaning withdrawals could be limited for an epoch

How to Use DeFi Metrics the Right Way

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

See Token Unlocks in a Brand New Way

Use DeFiLlama’s new Token Unlocks Calendar to get a detailed view of upcoming token unlocks.

Get unlock details by month or week, and get a full calendar to better understand what unlocks are coming. You can see unlock frequency at a quick glance.

DeFiLlama also built a TreeMap to see unlocks by month for the rest of the year. Hover over any box to get specific unlock info.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 CB Consumer Confidence data - April 29th

📊 US Q1 GDP data - April 30th

📊 April Jobs Report - May 2nd

📊 25% of S&P 500 companies report earnings

Token Unlocks: $300m Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓OP (1.89%) - April 30th

🔓KMNO (16.98%) - April 30th

🔓REZ (19.57%) - April 30th

🔓STRK (1.23%) - April 30th

🔓MAV (3.15%) - April 30th

🔓ZETA (5.67%) - May 1st

🔓SUI (2.28%) - May 1st

🔓ENA (0.73%) - May 2nd

🔓MEME (7.91%) - May 3rd

🔓CETUS (1.17%) - May 3rd

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 BNB Lorentz testnet hardfork- April 29th (Source)

🚀 Engines of Fury season 1 launch - April 29th (Source)

🚀 Arcium testnet launch - April 30th (Source)

🚀 AgentTank public beta launch - April 30th (Source)

🚀ACS campaign launch - May 1st (Source)

🚀 YGG LoL Land launch on Abstract - May 2nd (Source)

🚀 CTF token burn - May 3rd (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi