⚡️Surprising Solana & Tron Metrics

Inside: Tron is ascending to new heights, Solana apps are dominating revenue again

Read Time: ~6 minutes

⚡Snapshot

Stablecoin market cap on Tron hits all-time high, Solana revenue is back

Introducing the Dynamo DeFi Crypto Fear & Greed Index Dashboard

Maximizing yield on USDC with Euler

📖 Recommended Reads

⚡AI prompt for quick & effective crypto research

Prompt template with instructions to level up your research

⚡FTX major repayments to begin May 30

BTC claims worth 20% of current price

⚡Blackrock CEO Larry Fink warns dollar at risk of losing world reserve currency status

And replaced by digital assets like Bitcoin

⚡You can still earn massively in this market

Perspective and highlights from Q1

⚡Altcoin investment products see inflows for the first time in 5 weeks

A conservative $226 inflows to digital asset products last week

⚡Secure Injective & Earn Rewards

We're thrilled to announce Dynamo DeFi now runs an Injective validator! As the only blockchain purpose-built for finance, Injective offers:

Lightning-fast, ultra-cheap transactions

Advanced infrastructure for DeFi, exchanges, lending, and tokenization

Multi-VM support including the most performant EVM layer

Deflationary tokenomics with weekly burn auctions

Injective is leading the tokenization initiative - major equities are already onchain.

Why stake with us?

Competitive commission rate

Trusted team with years of educational experience

Professional infrastructure with uptime guarantees

Exclusive ecosystem updates and content

Getting started is easy – stake directly through Keplr, Leap wallet, or Injective Hub in just a few clicks

Join our validator community and help build the future of onchain finance while earning attractive yields

🔢Onchain Analysis

Tron & Solana Protocols Top Revenue

Tether and Circle top the revenue charts on nearly any time frame. The slots below are what’s interesting.

Tron

Tron continues to grow and find PMF in the crypto payments category - its volume is made up of P2P stablecoin payments and transfers (Tron did $560b in transfers last month).

Stablecoin market cap on Tron just hit another all-time high.

Solana

After a few weeks out of the spotlight, Solana and ecosystem protocols are dominating the revenue charts again.

Pumpfun daily usage is down significantly since January but stabilizing at a much higher number of daily users than nearly any month last year.

While trading volume has also fallen from its peak, DEXs (Hyperliquid, PancakeSwap and Jupiter), Telegram trading bots, and wallets like Phantom are still processing hundreds of millions in volume each week.

Solana outpaced Ethereum in volume over the last 7 days - the first time that’s happened in 7 weeks.

At times, the market certainly feels like its “over”, but signs of life and growth are still abound. Things could certainly get dicey again in the short term and could stay that way for awhile. But the regulatory environment is getting friendlier every day, and builders are more focused on long-term success.

On a longer-term time horizon, we all know where this market is going.

🚜Farm of the Week

Farming Stablecoin Yield on Euler

Euler is a long-running DeFi lending application that just crossed the $1B TVL mark.

Two strategies here: First, simply deposit USDC for nearly 8% hands-free APY. There are plenty of stable yields available for different stable assets (see Ethena’s sUSDe at 13% APY plus Ethena points)

How it Works

These yields are available on ETH mainnet, so you don’t need to do any bridging. Berachain stable pools are earning even more (though many of them are smaller, look at total supply).

Just head to Euler, connect your wallet, and lend stables to start earning. Use this filter to search yourself.

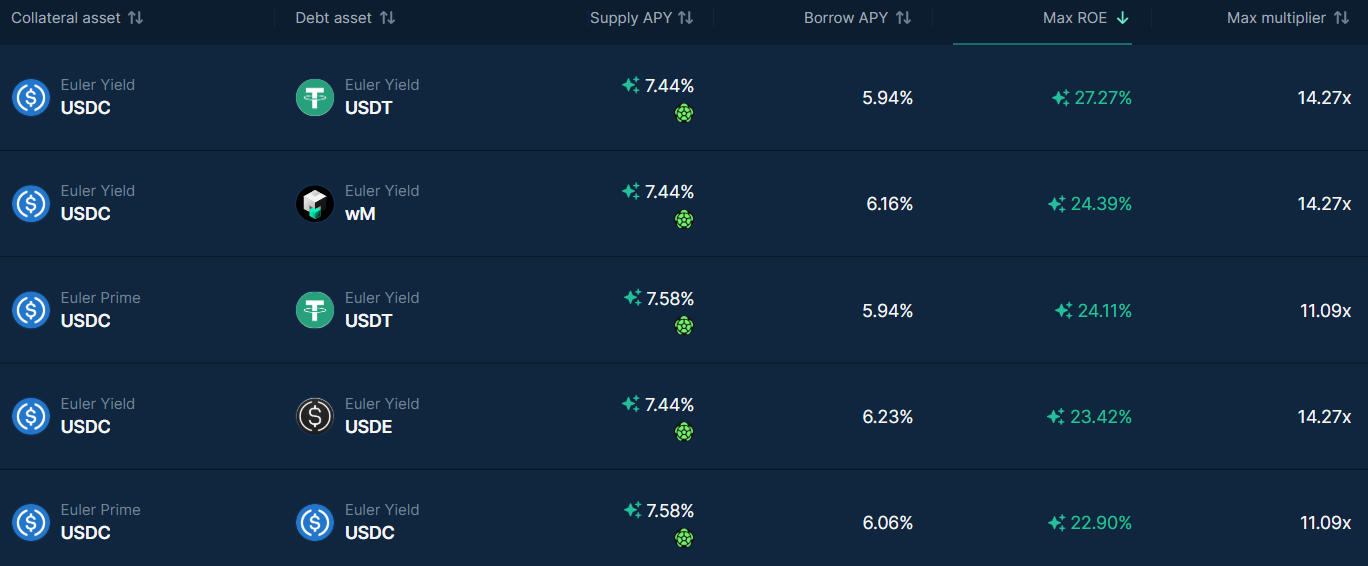

A second leg to this strategy is to borrow stablecoins against your supplied stables, rinse and repeat. This is called looping.

Through looping you can leverage the yield you’re receiving, because Euler incentives make borrowing against supply profitable - you’re just continuing to borrow, supply more, and borrow more.

Here are a few of these markets on ETH mainnet. This strategy turns a 7% yield into a 20%+ yield.

For more stablecoin yields, go to our top 10 stablecoin yields in April here.

Risks

Looping (leverage) risk

Stablecoin Mass Adoption Imminent

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

The Dynamo DeFi Crypto Fear & Greed Dashboard

Use our advanced dashboard to track crypto sentiment with more granular data.

The dashboard tracks daily Fear & Greed changes and has an interactive chart to distill what’s really going on under the market’s hood.

The Distribution tracker breaks down how much time the market spends in each category.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 ISM Manufacturing PMI data - April 1st

📊 JLOTS Job Openings data - April 1st

📊 Trump’s “Liberation Day” - April 2nd

📊 ADP Nonfarm Employment data - April 3rd

📊 March Jobs Report - April 4th

📊 Fed Chair Powell Speaks - April 4th

Token Unlocks: $750M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓OP (1.93%) - March 31st

🔓MAV (3.73%) - March 31st

🔓ZETA (6.05%) - April 1st

🔓SUI (2.03%) - April 1st

🔓ENA (0.77%) - April 2nd

🔓EIGEN (9.41%) - April 2nd

🔓BIGTIME (18.46%) - April 3rd

🔓W (47.42%) - April 3rd

🔓CETUS (1.23%) - April 3rd

🔓IMX (0.78%) - April 6th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Keeta network testnet release - March 31st (Source)

🚀 PinLink AI mainnet launch - March 31st (Source)

🚀 Botify v0.5 (MVP) release - March 31st (Source)

🚀 Pulsar v2.0 launch - March 31st (Source)

🚀dKargo testnet - March 31st (Source)

🚀Hedera testnet upgrade - April 1st (Source)

🚀StorX web3 authentication launch - April 1st (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi