⚡Stablecoins and RWAs Boom as Market Tanks [Dynamo DeFi Pro Report]

On-chain insights and DeFi strategies

💡Dynamo’s Thoughts

Stablecoins and RWAs Boom as Market Tanks

Five years ago, DeFi was little more than a thought experiment. The idea of a global financial system without banks, borders, or permission seemed radical—if not delusional. DEXs pushed a few million in weekly volume. Total value locked across all protocols was under a billion. But while most wrote it off as a speculative blip, something real was taking shape.

Today, after a brutal market cycle, over $93 billion remains deposited in decentralized finance. DEXs have processed $23 billion in weekly volume for more than a year, peaking at $200 billion in January. This isn’t collapse—it’s a reset. The speculation drained out, but the infrastructure stayed. DeFi didn’t die. It matured.

The same thing is happening with stablecoins. In the past month alone, $9 billion has flowed into them—$1.6 billion in the past week, $1 billion in just a single day this week. For people in the U.S. or Europe, stablecoins might still feel like a niche tool for crypto trading. But in Argentina, people are paying a 30% premium just to get them. In Nigeria, 22%. In India, nearly 7%. For billions, they’re the only practical way to access US dollars—no banks, no bribes, no black markets.

This shift has gone mostly unnoticed in the West, but it’s becoming one of the most important macro trends of the decade. Dollar hegemony isn’t vanishing—it’s being replatformed. Stablecoins are spreading the dollar like never before, and the US government is waking up to it. Congress is exploring regulatory frameworks. Visa is integrating them. And strategists like Scott Bessent are openly talking about using stablecoins to entrench American financial dominance.

Meanwhile, real world assets—once an afterthought—are now the seventh-largest category on DefiLlama, outpacing restaking, CDPs, and basis trades. They’ve grown steadily while the rest of the market has chopped sideways. Quietly, they’re becoming one of the strongest product-market fits in DeFi, showing real traction while attention stays glued to memes and airdrops.

What we’re witnessing isn’t noise. It’s the base layer of a new financial system being built in the open. One chart at a time.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are growing?

Onchain Metrics

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

Onchain Milestones - Chains and protocols that hit on-chain milestones, such as breaking their ATH in TVL

🔭Market Outlook

Market Health

Total DeFi TVL

Down 8% YoY, sitting firmly in the range from March-November of last year.

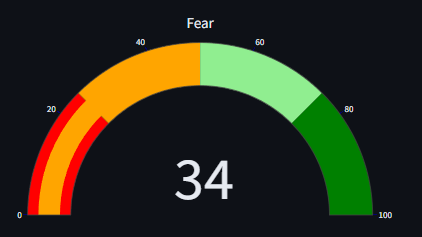

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here. Today’s value is 44, on the high end of the Fear category.

A month ago today, F&G index marked 10 - one of the lowest values ever and the lowest since July 2022.

Stablecoin Market Cap

Another all-time high, officially crossing $230b. Stablecoin market cap added almost $10b in the last 30 days.

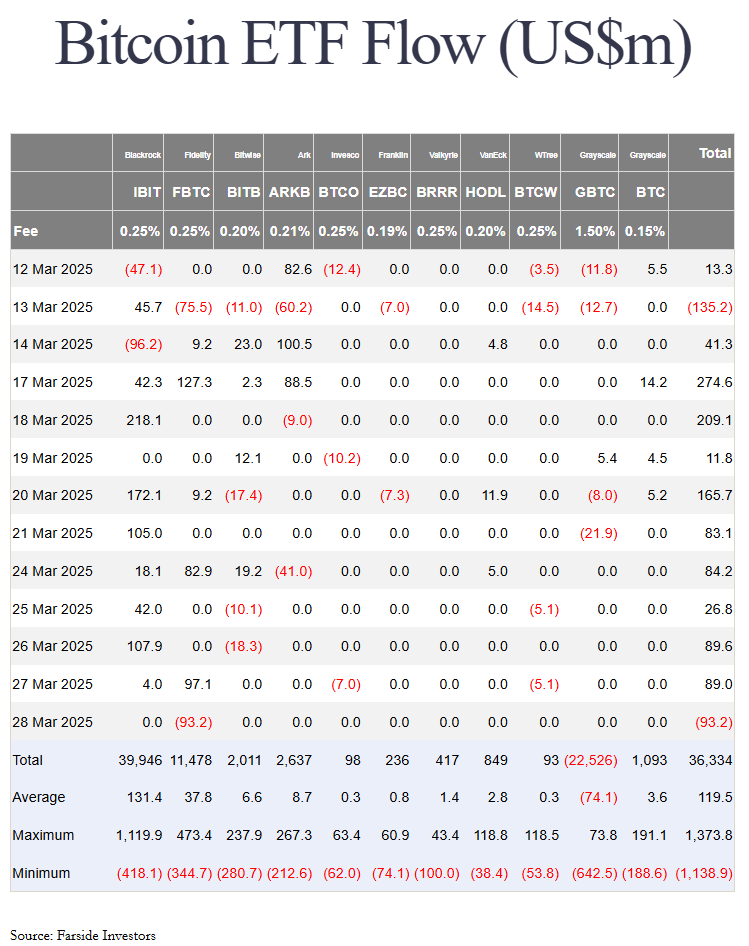

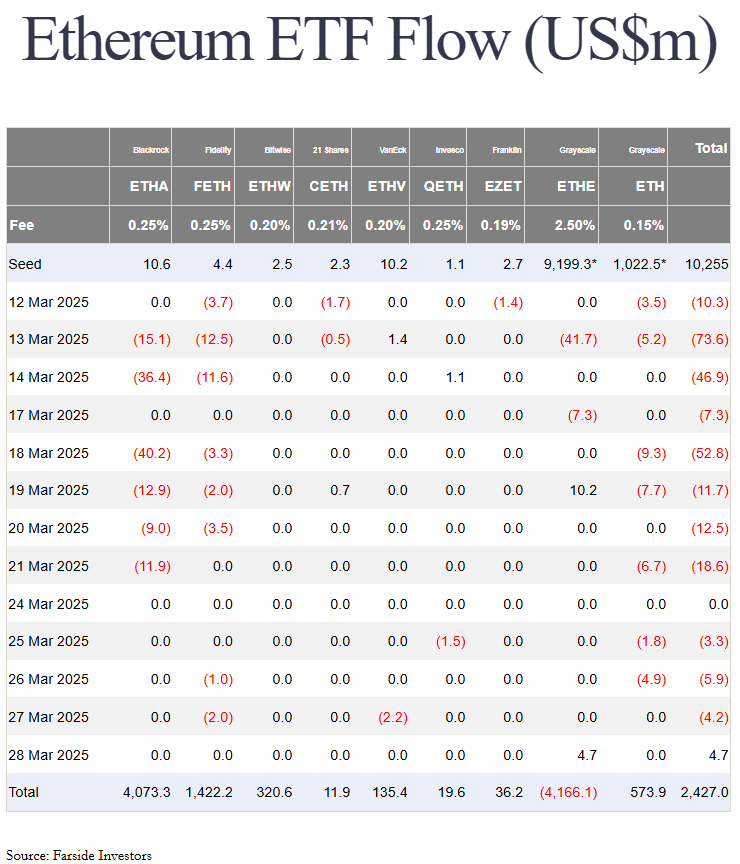

ETF Flows

After 5 straight weeks of outflows totaling over $5b, Bitcoin saw 10 straight days of inflows, before a single day of outflows on the 28th.

ETH ETF flows have been negative 11 out of the last 13 days, and is on its 6th straight week of outflows.

Since inception, Bitcoin ETFs accumulated $36.4b in net flows and Ethereum ETFs accumulated $2.42b.

IPOR Stablecoin Indeces

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity. The benchmark stablecoin rates have bounced from a downtrend after peaking in mid-December. The last time we saw USDC rates this low was September 2024.

For reference, here are last week’s numbers:

Category and Chain Trends

Category TVL Changes

With stablecoins all the rage, CDP projects like crvUSD, lvlUSD and others are growing in the CDP category. Lorenzo in the Restaked BTC category is seeing growth.

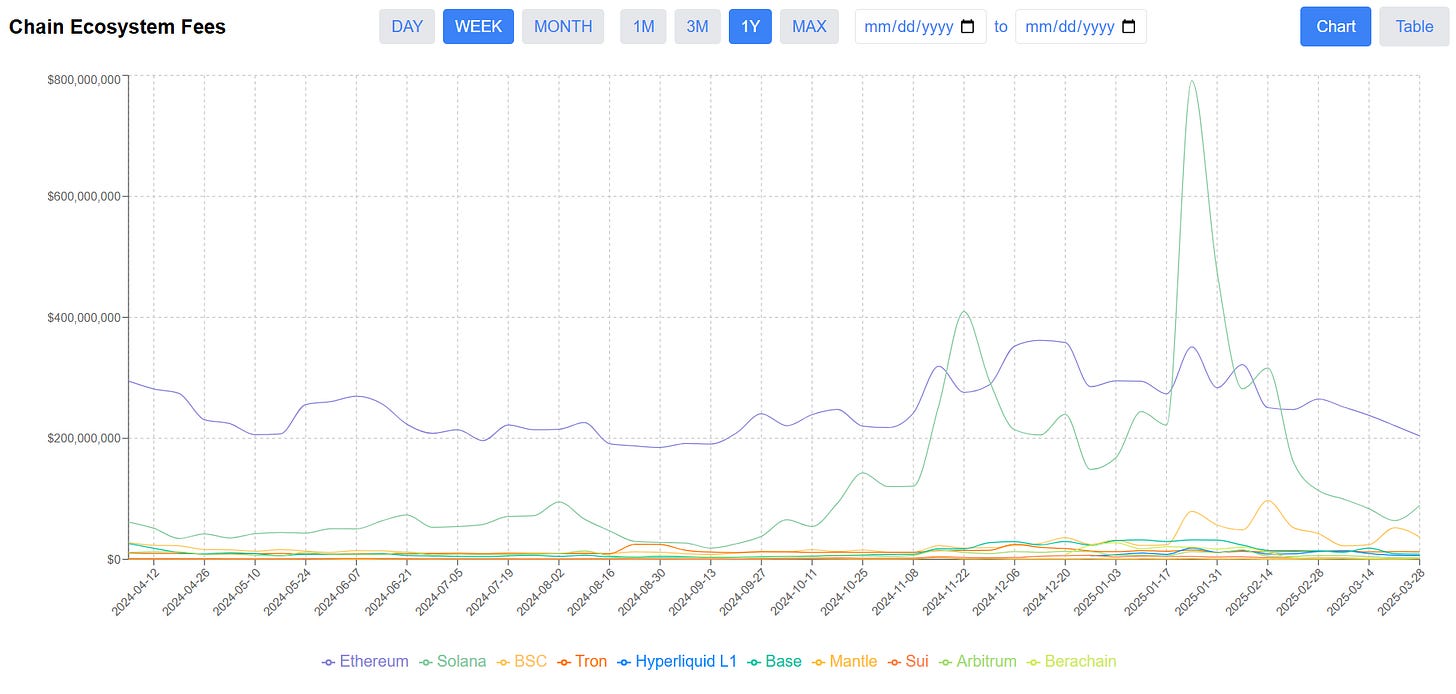

Chain GDP / Chain Ecosystem Fees

Chain GDP, which I’m now calling Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

Since this has been a custom metric up to this point, I built a dashboard myself to show this over time by chain: https://dashboard.dynamodefi.com/

Solana’s ecosystem fees have risen almost 40% WoW, and Berachain broke into the top 10 fee generators in the last 7 days.

Fastest Growing Chains ($100M+ TVL)

Hemi stands out this week as huge jumps in TVL from protocols joining the network pushed total TVL over $180m.

Soneium just crossed the $100m TVL mark, and each chain on this list saw WoW TVL growth of over 10%.

Fastest Growing Chains ($10M-100M TVL)

Swellchain grew 50% this week, and Cronos skEVM jumped 12.5% after Crypto.com announced upcoming partnerships with the Trump team.

📊Onchain Metrics

Onchain Highlights

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.