September Is Supposed to Be Boring. Not This Year

Plus Whales Lead the Market: ETH & SOL Rotations Gain Attention

Read Time: ~5 minutes

It looks like the Fed might start cutting rates in September. There’s a Bitcoin whale rotating into Ethereum, and Tom Lee’s Fundstrat bought $800m in ETH just in the last week. Three heavyweight funds want to raise $1b to buy Solana.

September is usually a sleepy month for crypto assets. Are there enough catalysts to make this time different?

⚡In This Edition

Market Metrics at a Glance

What to know this week in crypto

Onchain Analysis

Farm of the Week

Macro events, new launches and token unlocks this week

DeFi tools & our favorite resources

⚡Metrics Snapshot

Top 100 Coins at a Glance

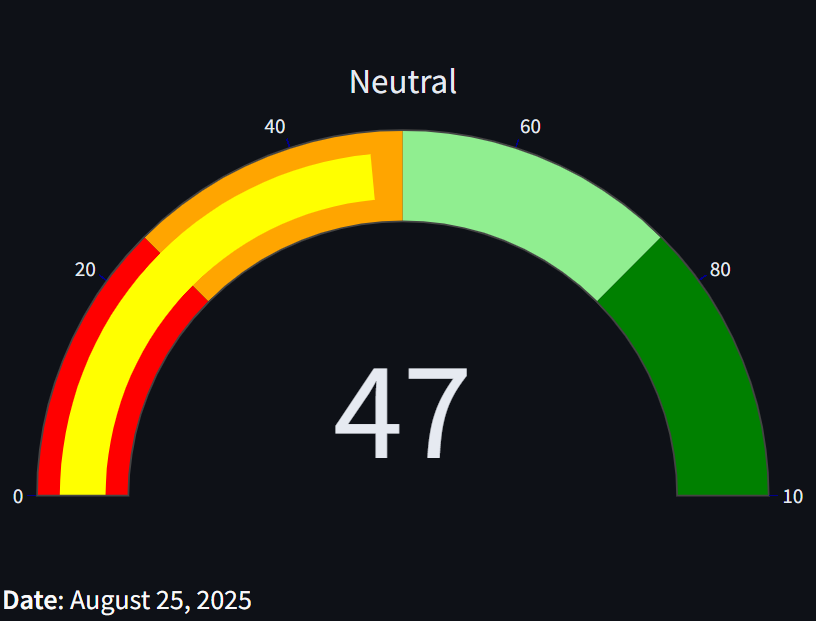

Fear & Greed Index: 47 (Neutral)

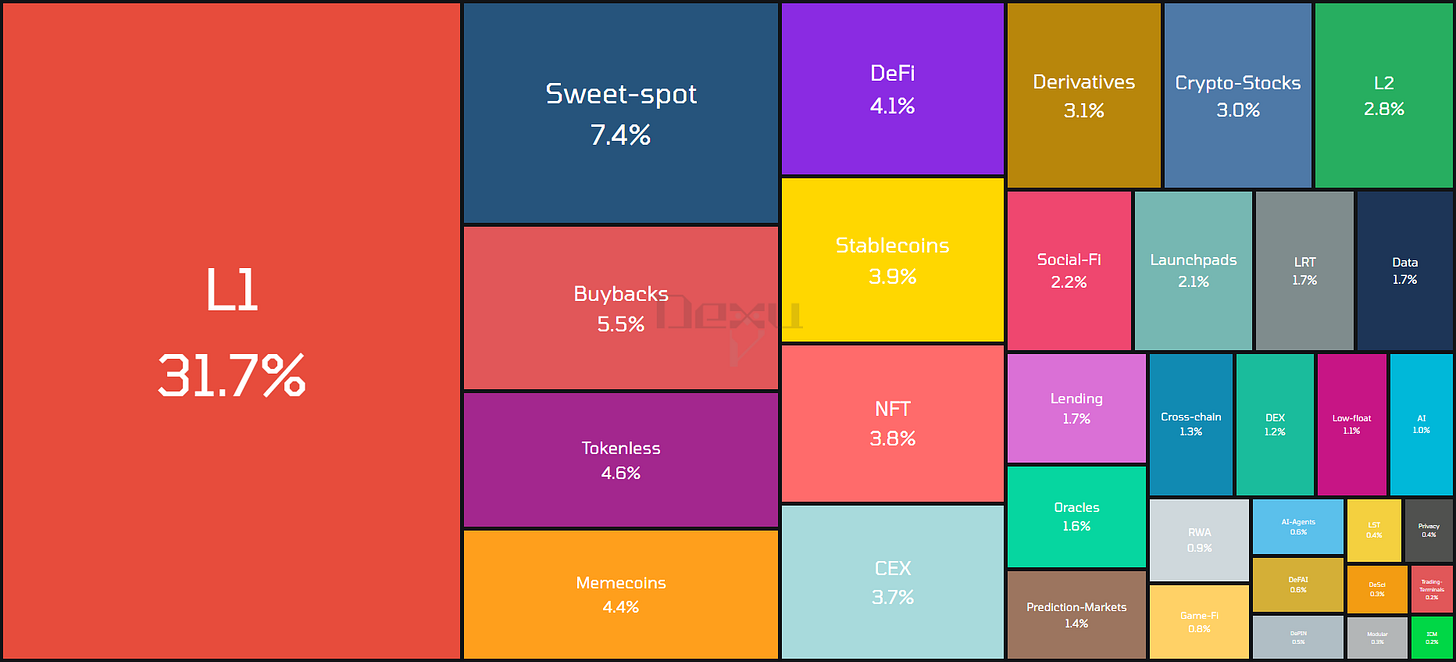

Narrative Mindshare (7d)

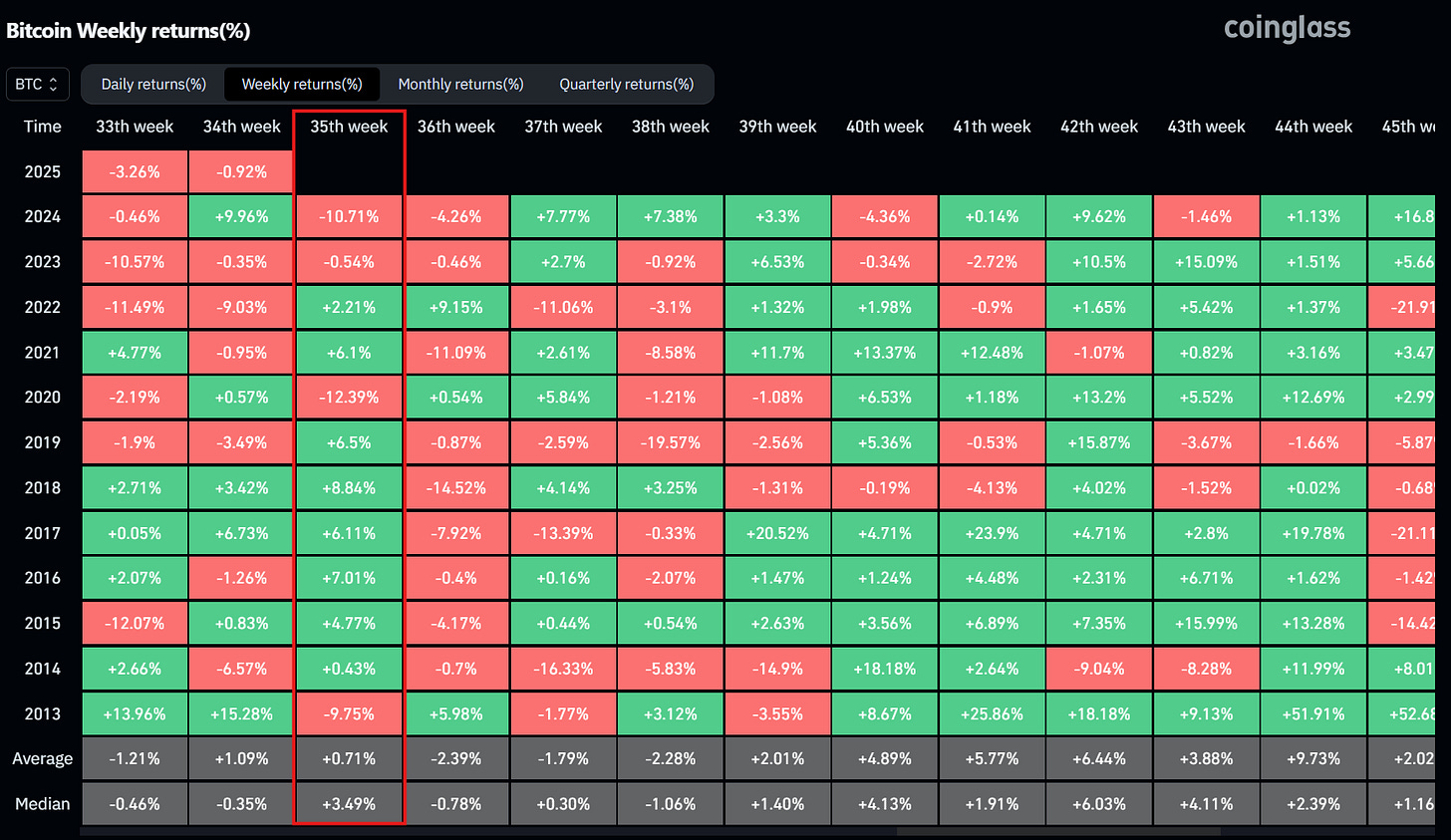

Historical Bitcoin Performance This Week

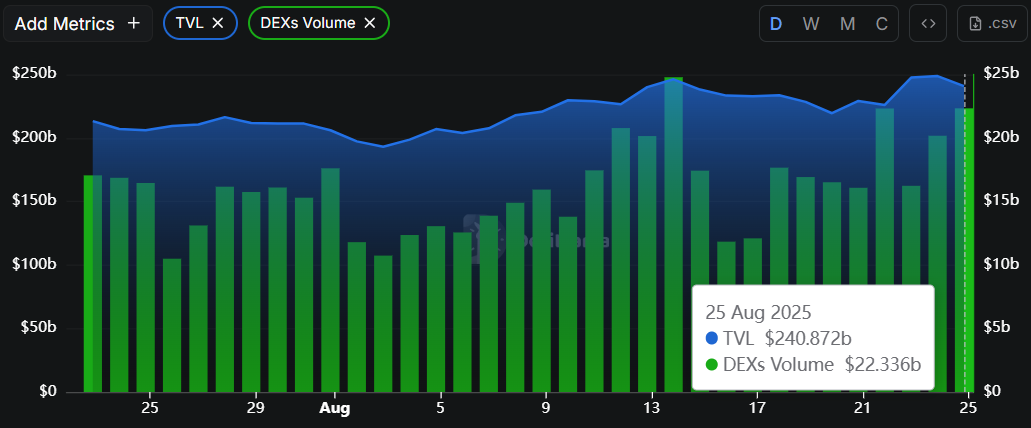

DeFi Market Metrics: Global TVL & DEX Volume

TVL MoM growth: +16%

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. Ethereum Breaks All-Time High

Almost four years after ETH’s last all-time high, the OG layer 1 token hit $4,900.

What This Means

Institutional buy pressure for Ethereum is strong. Entities accumulated nearly $20b in ETH, ETF flows have been strong and a Hyperliquid whale sold over $1B in BTC to buy ETH.

2. Galaxy, Jump & Multicoin Seek $1b to Buy Solana Token

VanEck filed for a jitoSOL staked ETF, DeFi Dev Corp announced a $125m raise to buy SOL, and three crypto heavyweights are raising funds to buy ~1% of Solana’s circulating market cap.

What This Means

This week, Solana was the recipient of several new avenues to capture large inflows. These avenues can take time to develop (especially an ETF listing), but Solana’s acceptance as a legitimate investment is growing.

3. Philippines Lawmaker Proposes 10K BTC strategic reserve

A Philippines lawmaker proposed a bill to establish a strategic Bitcoin reserve. The proposal was for the country’s central bank to buy 2,000 Bitcoin each year and hold the assets in cold storage for 20 years.

What This Means

2k BTC per year isn’t exactly a needle mover when Saylor is buying 3,000 BTC over the last few weeks, but expect similar proposals from more sovereign entities. While Scott Bessent said the US would not be acquiring more Bitcoin, El Salvador’s Bitcoin experiment has paid off big time.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡Four-Year Cycle Top vs Extended Cycle

Analysis on where we stand, and what to do about it

Updated Chainlink vision on how the world integrates into the onchain economy

⚡Get >10% yields on stablecoins without leverage

A non-leveraged stablecoin yield thread

Learn advanced yield strategies and how to find DeFi opportunities

⚡Digital asset investment products see largest weekly outflows since March

BTC & ETH saw $1.4b in combined outflows. BTC -$1b, ETH -$440m

⚡Get Crucial DeFi Metrics & Analysis

The Dynamo DeFi Pro newsletter helps you explore the intrinsic value behind different tokens. We dive deeper into the fundamentals behind digital assets with unique visuals, and revamped this recently to include a wide variety of custom metrics, such as:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

To get these insights delivered to you each week, become a Pro member.

🔢Onchain Analysis

Prop AMMs Pop Up

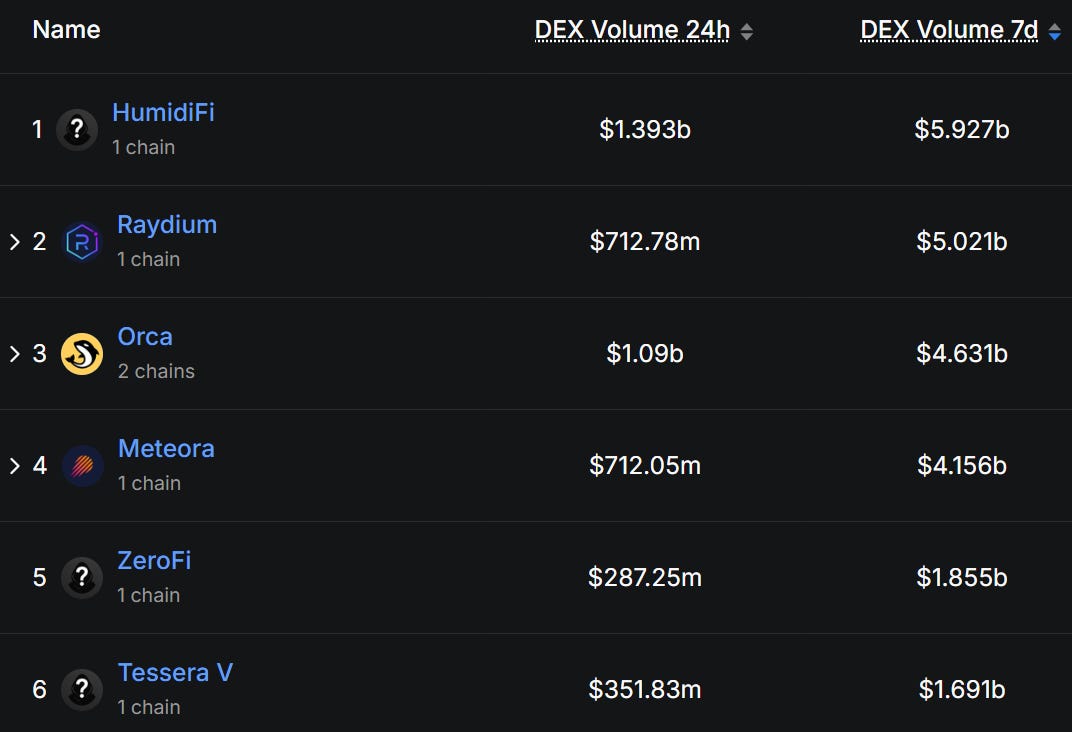

What are these protocols taking over Solana DEX volume?

And how did one of them become the 4th ranked DEX by total volume over the last week?

Prop AMMs, or proprietary automated market makers (also called dark pools), are specialized DEXs on Solana that use private liquidity vaults managed by a single market maker.

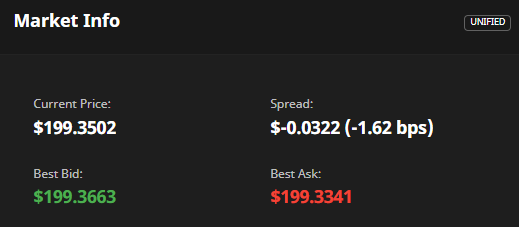

This setup reduces MEV risks and delivers tighter spreads compared to public AMMs like Raydium or Orca.

They lack frontends and route trades via aggregators like Jupiter for efficient, low-cost swaps on liquid pairs such as SOL-USDC.

These dark pools increase capital efficiency for traders. The addition of dark pools creates negative spreads for DEX aggregators, so when the aggregators are routing trades for traders, there’s more liquidity available at better prices.

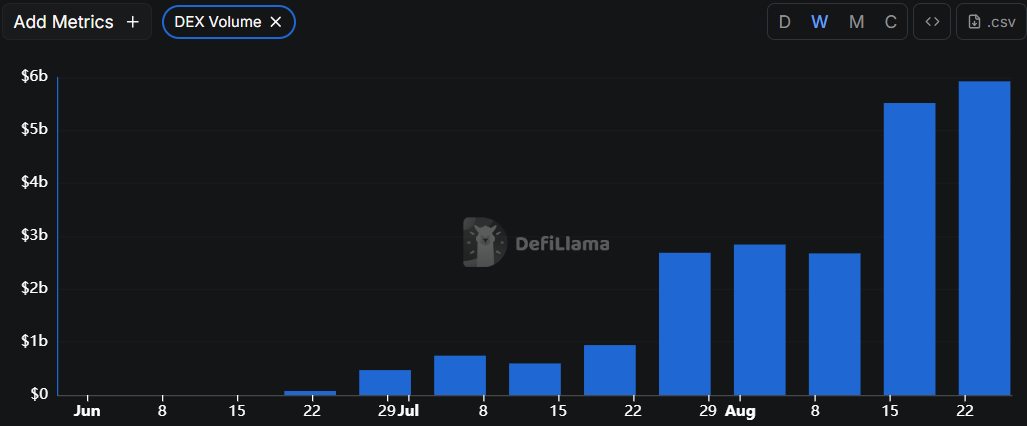

These dark pools now handle a significant chunk of Solana's DEX volume with almost $10B+ processed in the last week.

Prop AMMs lack flexibility for long-tail tokens. They are worse for memecoins and illiquid assets, which rely on permissionless pools for rapid launches and early price discovery. Traditional AMMs like Raydium still own this kind of market (a significant amount of volume on Solana is purely memecoin trading).

HumidiFi’s weekly volume shows the effectiveness of the model. DEX aggregators route trades to the best execution available, and that’s increasingly becoming dark pools.

Additional Prop AMMs on Solana include GoonFi, SolFi, Tessera V and ZeroFi.

🚜Farm of the Week

SyrupUSDC Multiply on Kamino

Kamino is Solana’s largest DeFi platform. The team recently launched Season 4 incentives. Instead of points, the rewards are KMNO tokens.

How it Works

Head to Kamino’s SyrupUSDC Multiply page, connect your wallet and deposit either USDG or SyrupUSDC. You can swap for either token on Kamino’s Swap page.

It’s not necessary to max out the Multiply feature. You can still earn almost 20% APY on the SyrupUSDC stablecoin by selecting 3x leverage.

The position is eligible for weekly USDG rewards.

While this is a stablecoin lending strategy, it’s still subject to liquidation if borrow rates increase dramatically for an extended period of time.

Risk Level: Medium

Risks

Smart Contract risk

Protocol Layer risk

Lending risk

Leverage Risk

⚡Creating a Portfolio of Undervalued Tokens

🛠️Tool Spotlight

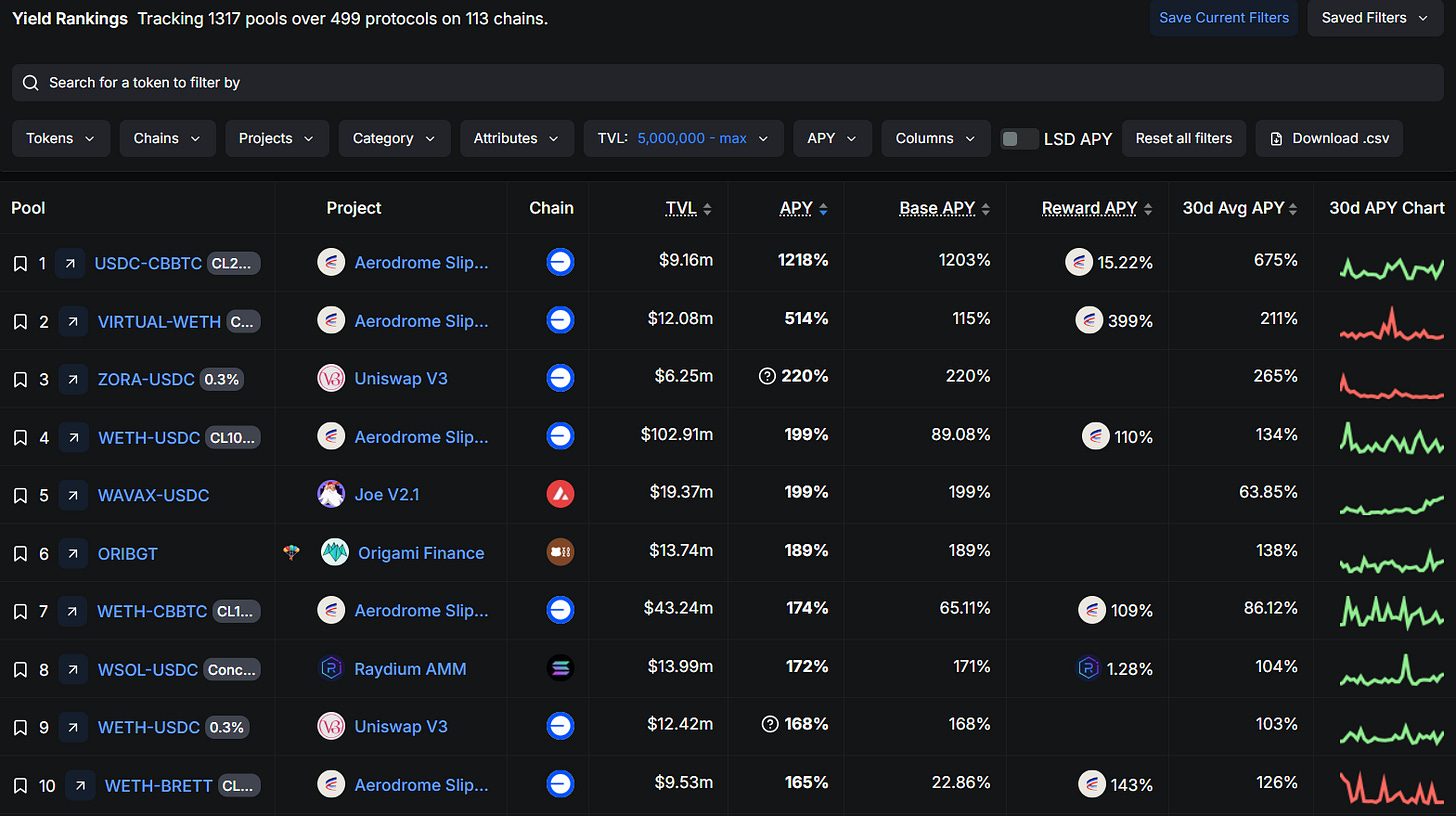

DeFiLlama Yields Dashboard

Find yields that are the right fit for you: filter by chain, token & yield type, sort by APY and set TVL minimums (or maximums)

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 July New Home Sales data - August 25th

📊 August Consumer Confidence data - August 26th

📊 Nvidia Reports Earnings - August 27th

📊 US Q2 2025 GDP data - August 28th

📊 MI Consumer Sentiment data - August 29th

📊 July PCE Inflation data - August 29th

Token Unlocks: $240m Unlocking This Week

🔓VELO (0.84%) - August 25th

🔓VENOM (2.34%) - August 25th

🔓AXL (1.51%) - August 27th

🔓TRIBL (2.03%) - August 27th

🔓RON (2.61%) - August 27th

🔓RED (14.2%) - August 29th

🔓OP (1.78%) - August 29th

🔓MAV (2.7%) - August 30th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Zircuit mainnet upgrade - August 25th (Source)

🚀 RecallAI trading competition commences - August 26th (Source)

🚀 Constellation DEX launch - August 27th (Source)

🚀 Vote for $S expansion into US and TradFi adoption ends - August 31st (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi